Professional Documents

Culture Documents

Form GST ASMT - 10 (See Rule 99 (1) )

Form GST ASMT - 10 (See Rule 99 (1) )

Uploaded by

meritta2002Copyright:

Available Formats

You might also like

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- GSTDocument75 pagesGSTHarsh Parasiya50% (2)

- GeetaramDocument2 pagesGeetarammeritta2002No ratings yet

- Geeta DineshDocument3 pagesGeeta Dineshmeritta2002No ratings yet

- Ca Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Document2 pagesCa Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Gaurav GuptaNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Hemang 1Document2 pagesHemang 1meritta2002No ratings yet

- HariomDocument2 pagesHariommeritta2002No ratings yet

- Balasubramaniam AppealDocument23 pagesBalasubramaniam AppealSambasivam GanesanNo ratings yet

- File GSTR-10 Final Return Before 30 - 06 - 2023 To Avail GST AmnestyDocument13 pagesFile GSTR-10 Final Return Before 30 - 06 - 2023 To Avail GST AmnestySubhash VishwakarmaNo ratings yet

- Case Study On Cinderella Flora Farms PVT LTDDocument1 pageCase Study On Cinderella Flora Farms PVT LTDTosniwal and AssociatesNo ratings yet

- Blaw Workshop ThirupathiDocument2 pagesBlaw Workshop Thirupathigraceamulyavempati142No ratings yet

- 784 Settlement of Arrears of Tax Interest Penalty or Late Fee For The Period Ending On or Before 30.06.2017Document38 pages784 Settlement of Arrears of Tax Interest Penalty or Late Fee For The Period Ending On or Before 30.06.2017santosh pandeyNo ratings yet

- O-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-IDocument2 pagesO-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-Id69451559No ratings yet

- 3.declaration - Erc 1-Annex 2-SepDocument1 page3.declaration - Erc 1-Annex 2-SepAmardeep Singh JadejaNo ratings yet

- 19 - Appendix-XIX (Page 260-304)Document45 pages19 - Appendix-XIX (Page 260-304)manishmanishhk12No ratings yet

- RBS July, 2009Document5 pagesRBS July, 2009pmNo ratings yet

- Taxguru - In-How To Write A Reply To Show Cause Notice Under GSTDocument4 pagesTaxguru - In-How To Write A Reply To Show Cause Notice Under GSTMSFNo ratings yet

- Renewal Premium Acknowledgement: Collecting Branch: E-Mail: Phone: Transaction No.: Date (Time) : Servicing BranchDocument0 pagesRenewal Premium Acknowledgement: Collecting Branch: E-Mail: Phone: Transaction No.: Date (Time) : Servicing BranchramhulNo ratings yet

- Abhinav - Tiwari Ilovepdf CompressedDocument3 pagesAbhinav - Tiwari Ilovepdf Compressedraaju.chillNo ratings yet

- LICI 13052024164522 GST Penalty AssamDocument1 pageLICI 13052024164522 GST Penalty AssamSonu GargNo ratings yet

- Sunil TradersDocument1 pageSunil Tradersmeritta2002No ratings yet

- 15 1 2019 Important Advance Ruling HC DecisionsDocument41 pages15 1 2019 Important Advance Ruling HC Decisionsdalip.singhNo ratings yet

- Circular CGST 95Document3 pagesCircular CGST 95Venkataramana NippaniNo ratings yet

- Bharat Sanchar Nigam Limited: BSNL Cdma BillDocument1 pageBharat Sanchar Nigam Limited: BSNL Cdma BillKartikPatidarNo ratings yet

- Ref - No. 302905-1085791-3: Prem Shankar SinghDocument3 pagesRef - No. 302905-1085791-3: Prem Shankar SinghRahul JainNo ratings yet

- G O RT NoDocument2 pagesG O RT NoGunda SrikanthNo ratings yet

- Analysis and Acceptance of GST in IndiaDocument19 pagesAnalysis and Acceptance of GST in IndiashubhamNo ratings yet

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaNo ratings yet

- Blueprint of Drafting WRT GST Replies To Notices 1716394755Document35 pagesBlueprint of Drafting WRT GST Replies To Notices 1716394755souvik boralNo ratings yet

- CA Sushil KR Goyal: Due DatesDocument4 pagesCA Sushil KR Goyal: Due DatesKunalKumarNo ratings yet

- Paper-18 Supplementary 180221Document109 pagesPaper-18 Supplementary 180221Srihari SrinivasNo ratings yet

- Revised Commerce Indirect TaxexDocument4 pagesRevised Commerce Indirect Taxexlipsa PriyadarshiniNo ratings yet

- Sri Ram Tech Asmt-10 Cto Sec 2021-22-9Document1 pageSri Ram Tech Asmt-10 Cto Sec 2021-22-9Sunil KumarNo ratings yet

- NIlfilingfacilityof Composition TaxpayersthroughsmsDocument2 pagesNIlfilingfacilityof Composition TaxpayersthroughsmsAshwin KumarNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Ae Circulars Office OrdersDocument10 pagesAe Circulars Office OrdersNaveen YadavNo ratings yet

- FORM-GST-RFD-08 Notice For Rejection of Application For RefundDocument2 pagesFORM-GST-RFD-08 Notice For Rejection of Application For RefundMK KodiaNo ratings yet

- Gmail - DOCUMENT VERIFICATION OF PROBATIONARY OFFICERS ON 27.10.2020Document8 pagesGmail - DOCUMENT VERIFICATION OF PROBATIONARY OFFICERS ON 27.10.2020shelharNo ratings yet

- Jun Jio PhoneDocument1 pageJun Jio Phonesid850No ratings yet

- Loksabhaquestions Annex 178 AU1973Document1 pageLoksabhaquestions Annex 178 AU1973Ajay RottiNo ratings yet

- GST ChallanDocument2 pagesGST Challanakash kaushikNo ratings yet

- GST Compliance Booklet Grant Thornton Bharat 1657896868Document56 pagesGST Compliance Booklet Grant Thornton Bharat 1657896868Gopal SutharNo ratings yet

- Roll No C 17 Prakash Ochwanni Sem XDocument10 pagesRoll No C 17 Prakash Ochwanni Sem XPRAKASH OCHWANINo ratings yet

- VIJAY1Document1 pageVIJAY1khodapawan7No ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Lien DraftKdaDvDocument12 pagesLien DraftKdaDvankush goyalNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- SR Notice ZD0902241645864 20240217024021Document1 pageSR Notice ZD0902241645864 20240217024021gktr342caNo ratings yet

- Compliance Calander FY23-24 - UJADocument5 pagesCompliance Calander FY23-24 - UJAagrawal.rahul.00No ratings yet

- Adjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Document7 pagesAdjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Shyam SunderNo ratings yet

- Invoice PBT0922A00352890Document1 pageInvoice PBT0922A00352890Yusuf AnsariNo ratings yet

- DoPT O.M. Dated 18.11.2022 - Guidelines For Framingamendmentrelaxation of Recruitment RulesDocument7 pagesDoPT O.M. Dated 18.11.2022 - Guidelines For Framingamendmentrelaxation of Recruitment RulesSk VermaNo ratings yet

- Finance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017Document3 pagesFinance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017RenugopalNo ratings yet

- Pakistan Institute of Public Finance Accountants: Summer Exam-2021Document2 pagesPakistan Institute of Public Finance Accountants: Summer Exam-2021ArifNo ratings yet

- GST INDEX BY AMAN GUPTA - MergedreorderDocument38 pagesGST INDEX BY AMAN GUPTA - MergedreorderPRASHANT PANDEYNo ratings yet

Form GST ASMT - 10 (See Rule 99 (1) )

Form GST ASMT - 10 (See Rule 99 (1) )

Uploaded by

meritta2002Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form GST ASMT - 10 (See Rule 99 (1) )

Form GST ASMT - 10 (See Rule 99 (1) )

Uploaded by

meritta2002Copyright:

Available Formats

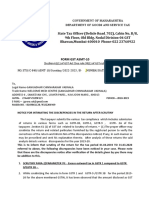

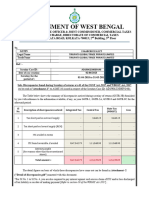

Government of India

उप/सहायक आयु का कायालयक ीय व ु एवं सेवा

कर & क ीय उ ाद शु , म ल –VII

Office of the Deputy/Assistant Commissioner

CGST & C Ex, Division VII,

Mumbai Central CGST Commissionerate

8th Floor, Piramal Chambers, Jijibhoy Lane, Lalbaug, Parel, Mumbai, Maharashtra -

400012

Form GST ASMT - 10 [See rule 99(1)]

Date: 22/05/2024

To,

GSTIN: 27AARFS3739B1ZZ

Name : SIS IMPORTS

Address : 1ST FLOOR, 101, ASHFORD CHAMBERS,

L. J. ROAD, MAHIM WEST, Mumbai, Maharashtra, 400016

Tax period - F.Y. – 2019-20

Notice for intimating discrepancies in the return after scrutiny

This is in continuation to the ASMT 10 dated 22.11.2023 issued to you.

Tax Liability as per 3.1(a) +3.1(b) GSTR-3B is Rs. 51896525: Tax Liability as per

4A+4C+5+6+7A(1)+ 78(1)+11A+118 (with amendments) of GSTR-1 is Rs. 5,69,85,084.

Interest u/s 50 on cash component of Rs 15,28,503/- on account of delayed filing of

GSTR-3B Return for March 2020 filed on 24.06.2020 maybe informed urgently.

You are hereby directed to explain the reasons for the aforesaid discrepancies within 3

days of receipt of this notice in ASMT 11 form.

If no explanation is received by the aforesaid date, it will be presumed that you have

nothing to say in the matter and proceedings in accordance with law will be initiated against you

without making any further reference to you in this regard.

(Meritta Suni)

Superintendent, R-V, Dn.VII,

CGST & CX, Mumbai Central

You might also like

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- GSTDocument75 pagesGSTHarsh Parasiya50% (2)

- GeetaramDocument2 pagesGeetarammeritta2002No ratings yet

- Geeta DineshDocument3 pagesGeeta Dineshmeritta2002No ratings yet

- Ca Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Document2 pagesCa Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Gaurav GuptaNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Hemang 1Document2 pagesHemang 1meritta2002No ratings yet

- HariomDocument2 pagesHariommeritta2002No ratings yet

- Balasubramaniam AppealDocument23 pagesBalasubramaniam AppealSambasivam GanesanNo ratings yet

- File GSTR-10 Final Return Before 30 - 06 - 2023 To Avail GST AmnestyDocument13 pagesFile GSTR-10 Final Return Before 30 - 06 - 2023 To Avail GST AmnestySubhash VishwakarmaNo ratings yet

- Case Study On Cinderella Flora Farms PVT LTDDocument1 pageCase Study On Cinderella Flora Farms PVT LTDTosniwal and AssociatesNo ratings yet

- Blaw Workshop ThirupathiDocument2 pagesBlaw Workshop Thirupathigraceamulyavempati142No ratings yet

- 784 Settlement of Arrears of Tax Interest Penalty or Late Fee For The Period Ending On or Before 30.06.2017Document38 pages784 Settlement of Arrears of Tax Interest Penalty or Late Fee For The Period Ending On or Before 30.06.2017santosh pandeyNo ratings yet

- O-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-IDocument2 pagesO-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-Id69451559No ratings yet

- 3.declaration - Erc 1-Annex 2-SepDocument1 page3.declaration - Erc 1-Annex 2-SepAmardeep Singh JadejaNo ratings yet

- 19 - Appendix-XIX (Page 260-304)Document45 pages19 - Appendix-XIX (Page 260-304)manishmanishhk12No ratings yet

- RBS July, 2009Document5 pagesRBS July, 2009pmNo ratings yet

- Taxguru - In-How To Write A Reply To Show Cause Notice Under GSTDocument4 pagesTaxguru - In-How To Write A Reply To Show Cause Notice Under GSTMSFNo ratings yet

- Renewal Premium Acknowledgement: Collecting Branch: E-Mail: Phone: Transaction No.: Date (Time) : Servicing BranchDocument0 pagesRenewal Premium Acknowledgement: Collecting Branch: E-Mail: Phone: Transaction No.: Date (Time) : Servicing BranchramhulNo ratings yet

- Abhinav - Tiwari Ilovepdf CompressedDocument3 pagesAbhinav - Tiwari Ilovepdf Compressedraaju.chillNo ratings yet

- LICI 13052024164522 GST Penalty AssamDocument1 pageLICI 13052024164522 GST Penalty AssamSonu GargNo ratings yet

- Sunil TradersDocument1 pageSunil Tradersmeritta2002No ratings yet

- 15 1 2019 Important Advance Ruling HC DecisionsDocument41 pages15 1 2019 Important Advance Ruling HC Decisionsdalip.singhNo ratings yet

- Circular CGST 95Document3 pagesCircular CGST 95Venkataramana NippaniNo ratings yet

- Bharat Sanchar Nigam Limited: BSNL Cdma BillDocument1 pageBharat Sanchar Nigam Limited: BSNL Cdma BillKartikPatidarNo ratings yet

- Ref - No. 302905-1085791-3: Prem Shankar SinghDocument3 pagesRef - No. 302905-1085791-3: Prem Shankar SinghRahul JainNo ratings yet

- G O RT NoDocument2 pagesG O RT NoGunda SrikanthNo ratings yet

- Analysis and Acceptance of GST in IndiaDocument19 pagesAnalysis and Acceptance of GST in IndiashubhamNo ratings yet

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaNo ratings yet

- Blueprint of Drafting WRT GST Replies To Notices 1716394755Document35 pagesBlueprint of Drafting WRT GST Replies To Notices 1716394755souvik boralNo ratings yet

- CA Sushil KR Goyal: Due DatesDocument4 pagesCA Sushil KR Goyal: Due DatesKunalKumarNo ratings yet

- Paper-18 Supplementary 180221Document109 pagesPaper-18 Supplementary 180221Srihari SrinivasNo ratings yet

- Revised Commerce Indirect TaxexDocument4 pagesRevised Commerce Indirect Taxexlipsa PriyadarshiniNo ratings yet

- Sri Ram Tech Asmt-10 Cto Sec 2021-22-9Document1 pageSri Ram Tech Asmt-10 Cto Sec 2021-22-9Sunil KumarNo ratings yet

- NIlfilingfacilityof Composition TaxpayersthroughsmsDocument2 pagesNIlfilingfacilityof Composition TaxpayersthroughsmsAshwin KumarNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Ae Circulars Office OrdersDocument10 pagesAe Circulars Office OrdersNaveen YadavNo ratings yet

- FORM-GST-RFD-08 Notice For Rejection of Application For RefundDocument2 pagesFORM-GST-RFD-08 Notice For Rejection of Application For RefundMK KodiaNo ratings yet

- Gmail - DOCUMENT VERIFICATION OF PROBATIONARY OFFICERS ON 27.10.2020Document8 pagesGmail - DOCUMENT VERIFICATION OF PROBATIONARY OFFICERS ON 27.10.2020shelharNo ratings yet

- Jun Jio PhoneDocument1 pageJun Jio Phonesid850No ratings yet

- Loksabhaquestions Annex 178 AU1973Document1 pageLoksabhaquestions Annex 178 AU1973Ajay RottiNo ratings yet

- GST ChallanDocument2 pagesGST Challanakash kaushikNo ratings yet

- GST Compliance Booklet Grant Thornton Bharat 1657896868Document56 pagesGST Compliance Booklet Grant Thornton Bharat 1657896868Gopal SutharNo ratings yet

- Roll No C 17 Prakash Ochwanni Sem XDocument10 pagesRoll No C 17 Prakash Ochwanni Sem XPRAKASH OCHWANINo ratings yet

- VIJAY1Document1 pageVIJAY1khodapawan7No ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Lien DraftKdaDvDocument12 pagesLien DraftKdaDvankush goyalNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- SR Notice ZD0902241645864 20240217024021Document1 pageSR Notice ZD0902241645864 20240217024021gktr342caNo ratings yet

- Compliance Calander FY23-24 - UJADocument5 pagesCompliance Calander FY23-24 - UJAagrawal.rahul.00No ratings yet

- Adjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Document7 pagesAdjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Shyam SunderNo ratings yet

- Invoice PBT0922A00352890Document1 pageInvoice PBT0922A00352890Yusuf AnsariNo ratings yet

- DoPT O.M. Dated 18.11.2022 - Guidelines For Framingamendmentrelaxation of Recruitment RulesDocument7 pagesDoPT O.M. Dated 18.11.2022 - Guidelines For Framingamendmentrelaxation of Recruitment RulesSk VermaNo ratings yet

- Finance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017Document3 pagesFinance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017RenugopalNo ratings yet

- Pakistan Institute of Public Finance Accountants: Summer Exam-2021Document2 pagesPakistan Institute of Public Finance Accountants: Summer Exam-2021ArifNo ratings yet

- GST INDEX BY AMAN GUPTA - MergedreorderDocument38 pagesGST INDEX BY AMAN GUPTA - MergedreorderPRASHANT PANDEYNo ratings yet