Professional Documents

Culture Documents

Amacr 2

Amacr 2

Uploaded by

nyandasteven2050Copyright:

Available Formats

You might also like

- Scientific Glass ExcelDocument13 pagesScientific Glass ExcelSakshi ShardaNo ratings yet

- AP Macro Cheat SheetDocument23 pagesAP Macro Cheat SheetGabriel Jimenez100% (7)

- AP Macro Cheat Sheet Good To Have For The ExamDocument24 pagesAP Macro Cheat Sheet Good To Have For The ExamLilith PersephoneNo ratings yet

- AP Macroeconomics - Models & Graphs Study GuideDocument22 pagesAP Macroeconomics - Models & Graphs Study GuideLynn Hollenbeck Breindel100% (2)

- Yarn Faults: Types Causes RemediesDocument20 pagesYarn Faults: Types Causes Remediesஹரி கிருஷ்ணன் வாசு71% (7)

- Questions Macroeconomics (With Answers) : 2 Money and InflationDocument3 pagesQuestions Macroeconomics (With Answers) : 2 Money and InflationMuhazzam MaazNo ratings yet

- Answer Macroeconomics: 2 Money and InflationDocument3 pagesAnswer Macroeconomics: 2 Money and InflationsamNo ratings yet

- Part IIIDocument47 pagesPart IIICoutinhoNo ratings yet

- Lecture 8 Monetary and Fiscal PolicyDocument25 pagesLecture 8 Monetary and Fiscal PolicyThao Nguyen TranNo ratings yet

- The Influence of Monetary On Aggregate DemandDocument14 pagesThe Influence of Monetary On Aggregate DemandNgọc ÁnhNo ratings yet

- Chapter 12 Review QuestionsDocument21 pagesChapter 12 Review QuestionsBrahim BelkadiNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument41 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandPutri Aprilia ManembuNo ratings yet

- Chapter 9 InflationDocument25 pagesChapter 9 InflationĐỉnh Kout NamNo ratings yet

- ETP Econ Lecture Note 34 Winter 2012Document31 pagesETP Econ Lecture Note 34 Winter 2012Shubhika PantNo ratings yet

- 2.5 Economic Growth: DefinitionsDocument4 pages2.5 Economic Growth: DefinitionsAryan KalyanamNo ratings yet

- Copy of AP MACRO - GRAPHS GUIDEDocument2 pagesCopy of AP MACRO - GRAPHS GUIDEM KNo ratings yet

- Liquidity Preference TheoryDocument34 pagesLiquidity Preference Theorygoldenguy90100% (2)

- 09 - Fiscal and Monetary PoliciesDocument59 pages09 - Fiscal and Monetary PoliciesMinh PhươngNo ratings yet

- Putting The Market Togethere: Aggregate Demand and Aggregate SupplyDocument21 pagesPutting The Market Togethere: Aggregate Demand and Aggregate SupplyKatherine Asis NatinoNo ratings yet

- Lecture 6 Money Growth and InflationDocument41 pagesLecture 6 Money Growth and InflationLê Thiên Giang 2KT-19No ratings yet

- Macroeconomics I: Aggregate Demand II: Applying The IS-LM ModelDocument27 pagesMacroeconomics I: Aggregate Demand II: Applying The IS-LM Model우상백No ratings yet

- Macro 2 Chap 3Document46 pagesMacro 2 Chap 3ngant21401cNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument25 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandWening RestiyaniNo ratings yet

- Chapter 3Document49 pagesChapter 3Trang ĐoànNo ratings yet

- 9 - Monetary and Fiscal PolicyDocument40 pages9 - Monetary and Fiscal PolicyChi NguyenNo ratings yet

- InflationDocument25 pagesInflationAarti YadavNo ratings yet

- Monetary PolicyDocument11 pagesMonetary PolicydrezatullahhaqmalNo ratings yet

- Macro Economics: Assignment 04Document11 pagesMacro Economics: Assignment 04Areesha NafeesNo ratings yet

- Fiscal and Monetary PolicyDocument34 pagesFiscal and Monetary Policyvenkataswamynath channa100% (4)

- Lecture 8 Relationship Between Money and Goods MarketDocument27 pagesLecture 8 Relationship Between Money and Goods MarketAvinash PrashadNo ratings yet

- Fundamentals of Economics Chapter 6Document15 pagesFundamentals of Economics Chapter 6faraz aijazNo ratings yet

- Macro Session On AD-AS ModelDocument53 pagesMacro Session On AD-AS Modelsaty16No ratings yet

- 5 - General Equilibrium and AD-As ModelDocument55 pages5 - General Equilibrium and AD-As ModelMendese KamalaNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument38 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandLuthfia ZulfaNo ratings yet

- 05) Money MarketDocument56 pages05) Money MarketNaina GoyalNo ratings yet

- Session 12 Fiscal PolicyDocument36 pagesSession 12 Fiscal PolicySourabh AgrawalNo ratings yet

- Short-Run Economic Fluctuations: Economic Activity Fluctuates From Year To YearDocument49 pagesShort-Run Economic Fluctuations: Economic Activity Fluctuates From Year To YearDinda Cici AuliaNo ratings yet

- Mock 2 Paper 2 AnswerDocument5 pagesMock 2 Paper 2 AnswerL MyNo ratings yet

- Macro Lecture ch16 Fiscal and Monetary PolicyDocument33 pagesMacro Lecture ch16 Fiscal and Monetary PolicyKatherine Sauer100% (1)

- 2.2.1 The Characteristics of ADDocument25 pages2.2.1 The Characteristics of AD18kchohanNo ratings yet

- Chapter 7. Exchange Rate Determination PDFDocument65 pagesChapter 7. Exchange Rate Determination PDFKim NgânNo ratings yet

- Money Growth and InflationDocument30 pagesMoney Growth and InflationopshoraNo ratings yet

- Macroeconomics Chapter 34cDocument8 pagesMacroeconomics Chapter 34cThiha Kaung SettNo ratings yet

- 6 - Aggregate Demand and SupplyDocument62 pages6 - Aggregate Demand and SupplyMạnh Nguyễn VănNo ratings yet

- Interest Rates PresentationDocument29 pagesInterest Rates PresentationFitri RajabNo ratings yet

- Lecture 7 - Money Growth and InflationDocument35 pagesLecture 7 - Money Growth and InflationY Nguyen Ngoc Nhu QTKD-1TC-18No ratings yet

- Screenshot 2024-03-05 at 8.09.02 PMDocument1 pageScreenshot 2024-03-05 at 8.09.02 PMemmanuelkakayayaNo ratings yet

- Chapter 14 (Principle of Economic)Document42 pagesChapter 14 (Principle of Economic)izatul akmal maisarahNo ratings yet

- Interest RatesDocument62 pagesInterest RatesclementNo ratings yet

- Aggregate Demand Aggregate SupplyDocument26 pagesAggregate Demand Aggregate Supplycompudoc11No ratings yet

- PDF For SEBI Economics ISLMDocument41 pagesPDF For SEBI Economics ISLMSaraswathi Putra KamalNo ratings yet

- Money Growth and Inflation: Week 7Document22 pagesMoney Growth and Inflation: Week 7Dewi Ushriyah UlyaNo ratings yet

- Low .BDocument13 pagesLow .Bsteven msusaNo ratings yet

- Consumer Price IndexDocument8 pagesConsumer Price IndexNguyễn Long VũNo ratings yet

- Fiscal Policy Lecture - PGP 26Document23 pagesFiscal Policy Lecture - PGP 26Parth BhatiaNo ratings yet

- Unit2 Study GuideDocument3 pagesUnit2 Study Guide高瑞韩No ratings yet

- Chapter 8Document29 pagesChapter 8Tafirenyika SundeNo ratings yet

- Fiscal PolicyDocument25 pagesFiscal PolicyAlexNo ratings yet

- ICERDocument13 pagesICEROussama ChaoukiNo ratings yet

- Chap 34Document76 pagesChap 34Jia Wei MiaoNo ratings yet

- Notes - Introduction To Hearing ImpairmentDocument66 pagesNotes - Introduction To Hearing Impairmentnyandasteven2050No ratings yet

- Non Exchange RevenueDocument44 pagesNon Exchange Revenuenyandasteven2050No ratings yet

- MacroeconomicsDocument308 pagesMacroeconomicsnyandasteven2050No ratings yet

- Public Sector Finances SourcesDocument21 pagesPublic Sector Finances Sourcesnyandasteven2050No ratings yet

- LAW of Contract 1 2023Document9 pagesLAW of Contract 1 2023nyandasteven2050No ratings yet

- Custom Hand Grips For RevolverDocument13 pagesCustom Hand Grips For RevolverfrankieitalianNo ratings yet

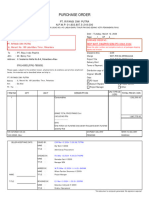

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument2 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionTUff LabNo ratings yet

- 18 International Capital BudgetingDocument49 pages18 International Capital BudgetingBrijesh Chauhan100% (1)

- Gini Coefficient: Jump To Navigation Jump To SearchDocument3 pagesGini Coefficient: Jump To Navigation Jump To SearchTeodoro Miguel Carlos IsraelNo ratings yet

- Infant and Child Mortality: Mothers and Infants, As Well As The Effectiveness ofDocument3 pagesInfant and Child Mortality: Mothers and Infants, As Well As The Effectiveness ofhendraNo ratings yet

- The Role of The Service Sector in The Indian Economy: Dr.D.AmuthaDocument10 pagesThe Role of The Service Sector in The Indian Economy: Dr.D.AmuthaHitesh ManglaniNo ratings yet

- Pol 223 Main TextDocument147 pagesPol 223 Main TextDaramola Olanipekun EzekielNo ratings yet

- SAP Revenue Accounting and Reporting in SAP S 4HANA 2020 1637339074Document48 pagesSAP Revenue Accounting and Reporting in SAP S 4HANA 2020 1637339074Fatima Zohra BoughlalNo ratings yet

- Principle Acct. Ii - Chapter FourDocument22 pagesPrinciple Acct. Ii - Chapter Fourbereket nigussieNo ratings yet

- Test Bank For Fundamentals of Economics 6th Edition William BoyesDocument36 pagesTest Bank For Fundamentals of Economics 6th Edition William Boyesforeliftperiople.ttyox100% (47)

- Some Et Any ExercicesDocument1 pageSome Et Any ExercicesJean-Loïc HANNAISNo ratings yet

- Duplicated RecordsDocument12 pagesDuplicated RecordsOğuzhan DaşkayaNo ratings yet

- Full Economics 10Th Edition Boyes Test Bank Online PDF All ChapterDocument64 pagesFull Economics 10Th Edition Boyes Test Bank Online PDF All Chaptermauraanaviolat284100% (6)

- Struktur Organisasi BTN KCS Makassar TMT Januari 2022Document1 pageStruktur Organisasi BTN KCS Makassar TMT Januari 2022sriwahyuningsih7656No ratings yet

- AP Macro WorkbookDocument346 pagesAP Macro WorkbookLynn Hollenbeck Breindel100% (5)

- DAFTAR PUSTAKA FATA TerbaruDocument2 pagesDAFTAR PUSTAKA FATA TerbaruFata JualanNo ratings yet

- MayaSavings SoA 2023AUGDocument1 pageMayaSavings SoA 2023AUGChrissandra BolarNo ratings yet

- Invoice 20211130121017 CBN30105841121Document1 pageInvoice 20211130121017 CBN30105841121Fadhil RachmanNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions ManualDocument26 pagesMacroeconomics 12th Edition Michael Parkin Solutions ManualDanielCarterrdcz100% (56)

- PO 062 PT. Riau Indo PasifikDocument4 pagesPO 062 PT. Riau Indo PasifikhkbpsimpangpadangduriNo ratings yet

- Demand ForecastingDocument26 pagesDemand Forecastingnuraini9332No ratings yet

- Las Melc 3 QTR 3 English 8 Odbulaong 1Document5 pagesLas Melc 3 QTR 3 English 8 Odbulaong 1Celso Abel Jr. PontillasNo ratings yet

- ECO558Document26 pagesECO558Nur Adriana binti Abdul AzizNo ratings yet

- AppliedEconomics Q3 M3 Market-StructureDocument25 pagesAppliedEconomics Q3 M3 Market-Structure•LAZY SHEEP•No ratings yet

- Module For Managerial Accounting-Job Order CostingDocument17 pagesModule For Managerial Accounting-Job Order CostingMary De JesusNo ratings yet

- 'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexDocument26 pages'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexSurendra SharmaNo ratings yet

- Test Bank For Managerial Economics Applications Strategies and Tactics 13th EditionDocument6 pagesTest Bank For Managerial Economics Applications Strategies and Tactics 13th EditionJamesJohnsonqxcej100% (28)

- SS 80-100 1072Document1 pageSS 80-100 1072Rodrigo SantosNo ratings yet

Amacr 2

Amacr 2

Uploaded by

nyandasteven2050Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amacr 2

Amacr 2

Uploaded by

nyandasteven2050Copyright:

Available Formats

Answer Macroeconomics

2 Money and inflation

01 Money 1

Functions of money:

Medium of exchange

Unit of account

Store of value

02 Money 2

/ Motives for holding money:

Transactions motive / dependent on income

Precautionary motive / dependent on income

Speculative motive / dependent on interest rates

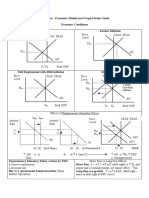

03 Money market

Interest rates (r)

Supply 2 Supply 1

r2

r1

Demand

Money

Interest rates rise.

AMACR2.DOC Page 1 (of 3) 2 Money and inflation 09/06/2016

04 Money market, GDP and inflation

Interest rates (r) Price level (PL) Aggregate supply

Supply 1 Supply 2

r1 PL 2

PL 1 Aggregate

demand 2

Demand

Aggregate demand 1

Money GDP

1 2

Money supply rises Interest rates fall Aggregate demand (investment) rises

GDP and the price level rise

05 Money creation 1

1 1 1

Money = 5000 * 1 - (1 - r) = 5000 * r = 5000 * 0.2 = 25000

06 Money creation 2

Cash ratio rises: Money multiplier decreases.

Reserve ratio falls: Money multiplier increases.

07 Inflation 1

Shoeleather costs (= costs of holding less cash)

Menu costs (= costs of changing prices)

In the case of unexpected inflation:

Arbitrary change in the redistribution of income and wealth

People with nominal assets (liabilities) lose (gain).

AMACR2.DOC Page 2 (of 3) 2 Money and inflation 09/06/2016

08 Inflation 2

Price level (PL)

Aggregate supply 2

Aggregate

supply 1

PL 2

PL 1

GDP

The price level rises, GDP falls (Stagflation).

09 Price level

108.2 - 105.0

Increase in prices = 105.0 * 100 = 3.05 %

10 Quantity theory of money

M*V=Q*P

If velocity of money and real output (full employment) are constant, a rise in the money

supply will cause an increase in the price level.

Back to questions. Click here!

AMACR2.DOC Page 3 (of 3) 2 Money and inflation 09/06/2016

You might also like

- Scientific Glass ExcelDocument13 pagesScientific Glass ExcelSakshi ShardaNo ratings yet

- AP Macro Cheat SheetDocument23 pagesAP Macro Cheat SheetGabriel Jimenez100% (7)

- AP Macro Cheat Sheet Good To Have For The ExamDocument24 pagesAP Macro Cheat Sheet Good To Have For The ExamLilith PersephoneNo ratings yet

- AP Macroeconomics - Models & Graphs Study GuideDocument22 pagesAP Macroeconomics - Models & Graphs Study GuideLynn Hollenbeck Breindel100% (2)

- Yarn Faults: Types Causes RemediesDocument20 pagesYarn Faults: Types Causes Remediesஹரி கிருஷ்ணன் வாசு71% (7)

- Questions Macroeconomics (With Answers) : 2 Money and InflationDocument3 pagesQuestions Macroeconomics (With Answers) : 2 Money and InflationMuhazzam MaazNo ratings yet

- Answer Macroeconomics: 2 Money and InflationDocument3 pagesAnswer Macroeconomics: 2 Money and InflationsamNo ratings yet

- Part IIIDocument47 pagesPart IIICoutinhoNo ratings yet

- Lecture 8 Monetary and Fiscal PolicyDocument25 pagesLecture 8 Monetary and Fiscal PolicyThao Nguyen TranNo ratings yet

- The Influence of Monetary On Aggregate DemandDocument14 pagesThe Influence of Monetary On Aggregate DemandNgọc ÁnhNo ratings yet

- Chapter 12 Review QuestionsDocument21 pagesChapter 12 Review QuestionsBrahim BelkadiNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument41 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandPutri Aprilia ManembuNo ratings yet

- Chapter 9 InflationDocument25 pagesChapter 9 InflationĐỉnh Kout NamNo ratings yet

- ETP Econ Lecture Note 34 Winter 2012Document31 pagesETP Econ Lecture Note 34 Winter 2012Shubhika PantNo ratings yet

- 2.5 Economic Growth: DefinitionsDocument4 pages2.5 Economic Growth: DefinitionsAryan KalyanamNo ratings yet

- Copy of AP MACRO - GRAPHS GUIDEDocument2 pagesCopy of AP MACRO - GRAPHS GUIDEM KNo ratings yet

- Liquidity Preference TheoryDocument34 pagesLiquidity Preference Theorygoldenguy90100% (2)

- 09 - Fiscal and Monetary PoliciesDocument59 pages09 - Fiscal and Monetary PoliciesMinh PhươngNo ratings yet

- Putting The Market Togethere: Aggregate Demand and Aggregate SupplyDocument21 pagesPutting The Market Togethere: Aggregate Demand and Aggregate SupplyKatherine Asis NatinoNo ratings yet

- Lecture 6 Money Growth and InflationDocument41 pagesLecture 6 Money Growth and InflationLê Thiên Giang 2KT-19No ratings yet

- Macroeconomics I: Aggregate Demand II: Applying The IS-LM ModelDocument27 pagesMacroeconomics I: Aggregate Demand II: Applying The IS-LM Model우상백No ratings yet

- Macro 2 Chap 3Document46 pagesMacro 2 Chap 3ngant21401cNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument25 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandWening RestiyaniNo ratings yet

- Chapter 3Document49 pagesChapter 3Trang ĐoànNo ratings yet

- 9 - Monetary and Fiscal PolicyDocument40 pages9 - Monetary and Fiscal PolicyChi NguyenNo ratings yet

- InflationDocument25 pagesInflationAarti YadavNo ratings yet

- Monetary PolicyDocument11 pagesMonetary PolicydrezatullahhaqmalNo ratings yet

- Macro Economics: Assignment 04Document11 pagesMacro Economics: Assignment 04Areesha NafeesNo ratings yet

- Fiscal and Monetary PolicyDocument34 pagesFiscal and Monetary Policyvenkataswamynath channa100% (4)

- Lecture 8 Relationship Between Money and Goods MarketDocument27 pagesLecture 8 Relationship Between Money and Goods MarketAvinash PrashadNo ratings yet

- Fundamentals of Economics Chapter 6Document15 pagesFundamentals of Economics Chapter 6faraz aijazNo ratings yet

- Macro Session On AD-AS ModelDocument53 pagesMacro Session On AD-AS Modelsaty16No ratings yet

- 5 - General Equilibrium and AD-As ModelDocument55 pages5 - General Equilibrium and AD-As ModelMendese KamalaNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument38 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandLuthfia ZulfaNo ratings yet

- 05) Money MarketDocument56 pages05) Money MarketNaina GoyalNo ratings yet

- Session 12 Fiscal PolicyDocument36 pagesSession 12 Fiscal PolicySourabh AgrawalNo ratings yet

- Short-Run Economic Fluctuations: Economic Activity Fluctuates From Year To YearDocument49 pagesShort-Run Economic Fluctuations: Economic Activity Fluctuates From Year To YearDinda Cici AuliaNo ratings yet

- Mock 2 Paper 2 AnswerDocument5 pagesMock 2 Paper 2 AnswerL MyNo ratings yet

- Macro Lecture ch16 Fiscal and Monetary PolicyDocument33 pagesMacro Lecture ch16 Fiscal and Monetary PolicyKatherine Sauer100% (1)

- 2.2.1 The Characteristics of ADDocument25 pages2.2.1 The Characteristics of AD18kchohanNo ratings yet

- Chapter 7. Exchange Rate Determination PDFDocument65 pagesChapter 7. Exchange Rate Determination PDFKim NgânNo ratings yet

- Money Growth and InflationDocument30 pagesMoney Growth and InflationopshoraNo ratings yet

- Macroeconomics Chapter 34cDocument8 pagesMacroeconomics Chapter 34cThiha Kaung SettNo ratings yet

- 6 - Aggregate Demand and SupplyDocument62 pages6 - Aggregate Demand and SupplyMạnh Nguyễn VănNo ratings yet

- Interest Rates PresentationDocument29 pagesInterest Rates PresentationFitri RajabNo ratings yet

- Lecture 7 - Money Growth and InflationDocument35 pagesLecture 7 - Money Growth and InflationY Nguyen Ngoc Nhu QTKD-1TC-18No ratings yet

- Screenshot 2024-03-05 at 8.09.02 PMDocument1 pageScreenshot 2024-03-05 at 8.09.02 PMemmanuelkakayayaNo ratings yet

- Chapter 14 (Principle of Economic)Document42 pagesChapter 14 (Principle of Economic)izatul akmal maisarahNo ratings yet

- Interest RatesDocument62 pagesInterest RatesclementNo ratings yet

- Aggregate Demand Aggregate SupplyDocument26 pagesAggregate Demand Aggregate Supplycompudoc11No ratings yet

- PDF For SEBI Economics ISLMDocument41 pagesPDF For SEBI Economics ISLMSaraswathi Putra KamalNo ratings yet

- Money Growth and Inflation: Week 7Document22 pagesMoney Growth and Inflation: Week 7Dewi Ushriyah UlyaNo ratings yet

- Low .BDocument13 pagesLow .Bsteven msusaNo ratings yet

- Consumer Price IndexDocument8 pagesConsumer Price IndexNguyễn Long VũNo ratings yet

- Fiscal Policy Lecture - PGP 26Document23 pagesFiscal Policy Lecture - PGP 26Parth BhatiaNo ratings yet

- Unit2 Study GuideDocument3 pagesUnit2 Study Guide高瑞韩No ratings yet

- Chapter 8Document29 pagesChapter 8Tafirenyika SundeNo ratings yet

- Fiscal PolicyDocument25 pagesFiscal PolicyAlexNo ratings yet

- ICERDocument13 pagesICEROussama ChaoukiNo ratings yet

- Chap 34Document76 pagesChap 34Jia Wei MiaoNo ratings yet

- Notes - Introduction To Hearing ImpairmentDocument66 pagesNotes - Introduction To Hearing Impairmentnyandasteven2050No ratings yet

- Non Exchange RevenueDocument44 pagesNon Exchange Revenuenyandasteven2050No ratings yet

- MacroeconomicsDocument308 pagesMacroeconomicsnyandasteven2050No ratings yet

- Public Sector Finances SourcesDocument21 pagesPublic Sector Finances Sourcesnyandasteven2050No ratings yet

- LAW of Contract 1 2023Document9 pagesLAW of Contract 1 2023nyandasteven2050No ratings yet

- Custom Hand Grips For RevolverDocument13 pagesCustom Hand Grips For RevolverfrankieitalianNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument2 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionTUff LabNo ratings yet

- 18 International Capital BudgetingDocument49 pages18 International Capital BudgetingBrijesh Chauhan100% (1)

- Gini Coefficient: Jump To Navigation Jump To SearchDocument3 pagesGini Coefficient: Jump To Navigation Jump To SearchTeodoro Miguel Carlos IsraelNo ratings yet

- Infant and Child Mortality: Mothers and Infants, As Well As The Effectiveness ofDocument3 pagesInfant and Child Mortality: Mothers and Infants, As Well As The Effectiveness ofhendraNo ratings yet

- The Role of The Service Sector in The Indian Economy: Dr.D.AmuthaDocument10 pagesThe Role of The Service Sector in The Indian Economy: Dr.D.AmuthaHitesh ManglaniNo ratings yet

- Pol 223 Main TextDocument147 pagesPol 223 Main TextDaramola Olanipekun EzekielNo ratings yet

- SAP Revenue Accounting and Reporting in SAP S 4HANA 2020 1637339074Document48 pagesSAP Revenue Accounting and Reporting in SAP S 4HANA 2020 1637339074Fatima Zohra BoughlalNo ratings yet

- Principle Acct. Ii - Chapter FourDocument22 pagesPrinciple Acct. Ii - Chapter Fourbereket nigussieNo ratings yet

- Test Bank For Fundamentals of Economics 6th Edition William BoyesDocument36 pagesTest Bank For Fundamentals of Economics 6th Edition William Boyesforeliftperiople.ttyox100% (47)

- Some Et Any ExercicesDocument1 pageSome Et Any ExercicesJean-Loïc HANNAISNo ratings yet

- Duplicated RecordsDocument12 pagesDuplicated RecordsOğuzhan DaşkayaNo ratings yet

- Full Economics 10Th Edition Boyes Test Bank Online PDF All ChapterDocument64 pagesFull Economics 10Th Edition Boyes Test Bank Online PDF All Chaptermauraanaviolat284100% (6)

- Struktur Organisasi BTN KCS Makassar TMT Januari 2022Document1 pageStruktur Organisasi BTN KCS Makassar TMT Januari 2022sriwahyuningsih7656No ratings yet

- AP Macro WorkbookDocument346 pagesAP Macro WorkbookLynn Hollenbeck Breindel100% (5)

- DAFTAR PUSTAKA FATA TerbaruDocument2 pagesDAFTAR PUSTAKA FATA TerbaruFata JualanNo ratings yet

- MayaSavings SoA 2023AUGDocument1 pageMayaSavings SoA 2023AUGChrissandra BolarNo ratings yet

- Invoice 20211130121017 CBN30105841121Document1 pageInvoice 20211130121017 CBN30105841121Fadhil RachmanNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions ManualDocument26 pagesMacroeconomics 12th Edition Michael Parkin Solutions ManualDanielCarterrdcz100% (56)

- PO 062 PT. Riau Indo PasifikDocument4 pagesPO 062 PT. Riau Indo PasifikhkbpsimpangpadangduriNo ratings yet

- Demand ForecastingDocument26 pagesDemand Forecastingnuraini9332No ratings yet

- Las Melc 3 QTR 3 English 8 Odbulaong 1Document5 pagesLas Melc 3 QTR 3 English 8 Odbulaong 1Celso Abel Jr. PontillasNo ratings yet

- ECO558Document26 pagesECO558Nur Adriana binti Abdul AzizNo ratings yet

- AppliedEconomics Q3 M3 Market-StructureDocument25 pagesAppliedEconomics Q3 M3 Market-Structure•LAZY SHEEP•No ratings yet

- Module For Managerial Accounting-Job Order CostingDocument17 pagesModule For Managerial Accounting-Job Order CostingMary De JesusNo ratings yet

- 'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexDocument26 pages'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexSurendra SharmaNo ratings yet

- Test Bank For Managerial Economics Applications Strategies and Tactics 13th EditionDocument6 pagesTest Bank For Managerial Economics Applications Strategies and Tactics 13th EditionJamesJohnsonqxcej100% (28)

- SS 80-100 1072Document1 pageSS 80-100 1072Rodrigo SantosNo ratings yet