Professional Documents

Culture Documents

Pursuant To The Practice Note No 4

Pursuant To The Practice Note No 4

Uploaded by

ahchee880 ratings0% found this document useful (0 votes)

2 views4 pagesOriginal Title

Pursuant to the Practice Note No 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views4 pagesPursuant To The Practice Note No 4

Pursuant To The Practice Note No 4

Uploaded by

ahchee88Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

Pursuant to the Practice Note No 4/2020.

This Practice Note is issued pursuant to the amendment of the Income Tax Act 1967 [Act 53] (ITA

1967) by the Finance Act 2019 [Act 823]. Effective from Year of Assessment 2020;

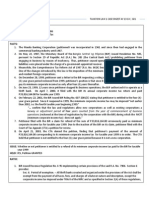

NO. ISSUES TAX TREATMENT

3. Company carrying on Where a Company carries out a business activities and incurring

a business but does expenses related to the business such as purchase of stock, payment

not have gross of salaries, rental of premises, promotional expenses or any other

income from business allowable expenses under subsection 33(1) of the ITA1967, but

sources due to current suffering loss due to not receiving any gross business income

year business losses. during the year, the Company is deemed to have gross income from

business sources equivalent to NIL.

Therefore, the Company is eligible for tax treatment under

paragraphs 2A, Part 1, Schedule 1 and subparagraph 19A (3),

Schedule 3 of ITA 1967.

Pursuant to the Practice Note No 4/2020.

This Practice Note is issued pursuant to the amendment of the Income Tax Act 1967 [Act 53] (ITA

1967) by the Finance Act 2019 [Act 823]. Effective from Year of Assessment 2020;

NO. ISSUES TAX TREATMENT

2. Company which does Where a Company other income such as rent and interest are not

not have gross assessed as income from the source of a business under paragraph

income from business 4(a) of the ITA1967, the Company is deemed to not have gross

sources but have income from a business source.

other incomes such as Therefore, the Company is not eligible for tax treatment under

rent and interest. paragraphs 2A, Part 1, Schedule 1 and subparagraph 19A (3),

Schedule 3 of ITA 1967.

Pursuant to the Practice Note No 4/2020.

This Practice Note is issued pursuant to the amendment of the Income Tax Act 1967 [Act 53] (ITA

1967) by the Finance Act 2019 [Act 823]. Effective from Year of Assessment 2020;

NO. ISSUES TAX TREATMENT

4. Company which does Where a Company that temporarily close its business operation but

not have gross still incurring expenses related to the business such as payment of

income from business salaries, utilities, maintenance, rental of premises or any other

source due to current allowable expenses under section 33(1) of the ITA 1967 is deemed

year business loss to have gross income from a business source equivalent to NIL.

caused by temporary Therefore, the Company is eligible for tax treatment under

closure of business paragraphs 2A, Part 1, Schedule 1 and subparagraph 19A (3),

operation. Schedule 3 of ITA 1967.

Pursuant to the Practice Note No 4/2020.

This Practice Note is issued pursuant to the amendment of the Income Tax Act 1967 [Act 53] (ITA

1967) by the Finance Act 2019 [Act 823]. Effective from Year of Assessment 2020;

NO. ISSUES TAX TREATMENT

1. Company is an Where a Company which is an investment holding company and is

Investment Holding subject to section 60F of the ITA 1967, a Company which is an

Company. investment holding not listed on Bursa Malaysia, is deemed to have

no gross income from a business source and is not eligible for tax

treatment under paragraphs 2A, Part 1, Schedule 1 and

subparagraph 19A (3), Schedule 3 of ITA 1967.

Refer to Public Ruling No. 5/2015 Investment Holding Company

for definition and criteria of an Investment Holding Company.

You might also like

- Jonasson v. Disney, RidleyDocument21 pagesJonasson v. Disney, RidleyTHRNo ratings yet

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- RR 9-98Document5 pagesRR 9-98matinikkiNo ratings yet

- Allocable Surplus and Available SurplusDocument1 pageAllocable Surplus and Available SurplusRukhsar Khatun0% (1)

- Chua v. Mesina Case DigestDocument2 pagesChua v. Mesina Case Digestroigtc100% (1)

- Report WritingDocument13 pagesReport WritingDeepak Kumar50% (2)

- Group Assignment: 1/ What Are Tax Changes For Individuals and Businesses After The Covid Pandemic 19?Document2 pagesGroup Assignment: 1/ What Are Tax Changes For Individuals and Businesses After The Covid Pandemic 19?Lan YenNo ratings yet

- Solicitor Exam Materials (Pages 185 To 515)Document331 pagesSolicitor Exam Materials (Pages 185 To 515)bobjones1111No ratings yet

- Mobil Phil vs. City Treas. of MakatiDocument6 pagesMobil Phil vs. City Treas. of MakatiDario G. TorresNo ratings yet

- June 2020 SP 1Document7 pagesJune 2020 SP 1Avinash ShettyNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- Guideline Answers: Professional ProgrammeDocument115 pagesGuideline Answers: Professional ProgrammeArham SoganiNo ratings yet

- TDS Under Sec 194A EtcDocument25 pagesTDS Under Sec 194A EtcGmd NizamNo ratings yet

- Mobil Philippines vs. City Treasurer of MakatiDocument5 pagesMobil Philippines vs. City Treasurer of MakatiCharisse Ayra ClamosaNo ratings yet

- OL 4 - BLT Study Text Suppliment 2021 - On New Tax AmmendmentsDocument28 pagesOL 4 - BLT Study Text Suppliment 2021 - On New Tax Ammendmentshte19031No ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument6 pagesPetitioner Vs Vs Respondent: Second DivisionPatty PerezNo ratings yet

- 02 Manila Banking Corporation v. CIRDocument2 pages02 Manila Banking Corporation v. CIRCheska VergaraNo ratings yet

- Income Tax Act, 1961 (ITA)Document3 pagesIncome Tax Act, 1961 (ITA)June HaydenNo ratings yet

- Suggested Answer To Q1Document6 pagesSuggested Answer To Q1KY LawNo ratings yet

- The Payment of Bonus Act 1965Document1 pageThe Payment of Bonus Act 1965k.salem@pmd-house.comNo ratings yet

- Reverse Charge Liability Under GST Not Paid in 2018-19Document3 pagesReverse Charge Liability Under GST Not Paid in 2018-19Finance KRIPPLNo ratings yet

- Reverse Charge Liability Under GST Not Paid in 2018-19 - Taxguru - inDocument3 pagesReverse Charge Liability Under GST Not Paid in 2018-19 - Taxguru - inFinance KRIPPLNo ratings yet

- Amendments FA 2018 Dec2019 PDFDocument14 pagesAmendments FA 2018 Dec2019 PDFYash GargNo ratings yet

- 2001 Bir RulingsDocument12 pages2001 Bir RulingsSarah Jeane CardonaNo ratings yet

- G.R. No. 168118 - MCITDocument5 pagesG.R. No. 168118 - MCITFord OsipNo ratings yet

- Instructions For Form 2220: Underpayment of Estimated Tax by CorporationsDocument4 pagesInstructions For Form 2220: Underpayment of Estimated Tax by CorporationsIRSNo ratings yet

- Manila Banking Corporation vs. CIR, GR No. 168118 Dated August 28, 2006Document6 pagesManila Banking Corporation vs. CIR, GR No. 168118 Dated August 28, 2006Abbey Agno PerezNo ratings yet

- 30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021Document6 pages30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021ashok babuNo ratings yet

- Minimum Alternate TaxDocument8 pagesMinimum Alternate Taxjainrahul234No ratings yet

- Commissioner of Internal Revenue v. Cebu Toyo Corp - TAXDocument1 pageCommissioner of Internal Revenue v. Cebu Toyo Corp - TAXejusdem generisNo ratings yet

- 1645195113green Joanna 407 AssignmentDocument6 pages1645195113green Joanna 407 AssignmentFawziyyah AgboolaNo ratings yet

- Heads of IncomeDocument7 pagesHeads of IncomeRACHITNo ratings yet

- 30851ipcc May Nov14 It Vol1 CP 9.unlockedDocument43 pages30851ipcc May Nov14 It Vol1 CP 9.unlockedavesatanas13No ratings yet

- P 6 1. Business Laws PDFDocument70 pagesP 6 1. Business Laws PDFSruthi RekhaNo ratings yet

- Clarification On Commencement and Cessation Rules and Business ReorganisationDocument11 pagesClarification On Commencement and Cessation Rules and Business ReorganisationdemolaojaomoNo ratings yet

- RR 13-2000 BIR Ruling 6-00Document1 pageRR 13-2000 BIR Ruling 6-00Angeli Soabas0% (1)

- Recent Amendments Companies Act 2013Document39 pagesRecent Amendments Companies Act 2013warner313No ratings yet

- 31188sm DTL Finalnew-May-Nov14 Cp28Document66 pages31188sm DTL Finalnew-May-Nov14 Cp28gvcNo ratings yet

- A Project On TaxationDocument48 pagesA Project On TaxationMuhammad AamirNo ratings yet

- Ammendements in Companies ActDocument39 pagesAmmendements in Companies ActVrkNo ratings yet

- Professional Programme (New Syllabus) Supplement FOR Advanced Tax LawDocument5 pagesProfessional Programme (New Syllabus) Supplement FOR Advanced Tax Lawmanjunath rNo ratings yet

- RMC 25-2011 SummaryDocument2 pagesRMC 25-2011 SummaryCinNo ratings yet

- Taxation Law 1 Case Digest Ay 13-14 - G01Document2 pagesTaxation Law 1 Case Digest Ay 13-14 - G01Kelsey Olivar MendozaNo ratings yet

- Circular Refund 137 7 2020Document3 pagesCircular Refund 137 7 2020Shirish JainNo ratings yet

- Paper-18 Supplementary 180221Document109 pagesPaper-18 Supplementary 180221Srihari SrinivasNo ratings yet

- Questions & Answers Direct Taxes Issues On Tds Under The Head SalaryDocument4 pagesQuestions & Answers Direct Taxes Issues On Tds Under The Head Salarycgvipin8639No ratings yet

- Nov 2019Document39 pagesNov 2019amitha g.sNo ratings yet

- Income Tax 2017 Edazdb1013Document50 pagesIncome Tax 2017 Edazdb1013Pradeep PatilNo ratings yet

- 19771ipcc It Vol1 Cp9Document40 pages19771ipcc It Vol1 Cp9Joseph SalidoNo ratings yet

- 74802bos60498-Cp7 (1) - UnlockedDocument136 pages74802bos60498-Cp7 (1) - Unlockedsinghalrachit27No ratings yet

- Issuance of Tax Invoice Credit Note Debit Note After 1st Sept 2018 CKSCP 080519Document14 pagesIssuance of Tax Invoice Credit Note Debit Note After 1st Sept 2018 CKSCP 080519Victoria ChNo ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet

- 29 Deductions GenerallyDocument17 pages29 Deductions GenerallyMasitala PhiriNo ratings yet

- Direct Tax Proposals 2019 (No. 2) - 1Document16 pagesDirect Tax Proposals 2019 (No. 2) - 1Namita Agarwal KediaNo ratings yet

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachNo ratings yet

- TDS Under Sec 194A EtcDocument26 pagesTDS Under Sec 194A EtcDivyaNo ratings yet

- Lesson 5 Taxation of Business and Investment IncomeDocument32 pagesLesson 5 Taxation of Business and Investment IncomeakpanyapNo ratings yet

- Cosmos Appliances FY 2018Document23 pagesCosmos Appliances FY 2018Bhavin SagarNo ratings yet

- State Land Investment Corporation v. Cir DigestDocument2 pagesState Land Investment Corporation v. Cir DigestAlan Gultia100% (1)

- E Dipn08Document17 pagesE Dipn08Lam Wing ManNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- CH 1 2 3 4-5-Professional EthicsDocument81 pagesCH 1 2 3 4-5-Professional EthicsAhmadin Bamud100% (1)

- Topic 3c. Law & MoralityDocument18 pagesTopic 3c. Law & MoralityYuvanesh Kumar100% (1)

- In Assignment: Submitted byDocument8 pagesIn Assignment: Submitted byrochel100% (1)

- A Beginner's Introduction To Cryptoeconomics - Binance AcademyDocument1 pageA Beginner's Introduction To Cryptoeconomics - Binance Academyrony chidiacNo ratings yet

- Indian Currency in Uae - Google SearchDocument2 pagesIndian Currency in Uae - Google SearchFATHIMA FATHIMANo ratings yet

- Law On Public Officers ReviewerDocument40 pagesLaw On Public Officers ReviewerArmstrong BosantogNo ratings yet

- Merchant Navy Code of Conduct 2013Document10 pagesMerchant Navy Code of Conduct 2013Le Bep100% (1)

- Reyes, Christian Emil B. - Week 11Document11 pagesReyes, Christian Emil B. - Week 11Christian Emil B. ReyesNo ratings yet

- Hyderabad: Property DescriptionDocument6 pagesHyderabad: Property DescriptionMuhammad Ahmad PeerNo ratings yet

- Zeitlyn Working PaperDocument11 pagesZeitlyn Working Paperparomita bhattacharjeeNo ratings yet

- Investor Doc 1649199Document382 pagesInvestor Doc 1649199Jijo VargheseNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document2 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)raheebhaiderchouhanNo ratings yet

- The Utmost Good Faith in Maritime Insurance The Na PDFDocument9 pagesThe Utmost Good Faith in Maritime Insurance The Na PDFAli RajaNo ratings yet

- NYC Neighborhood Overrun by Broad Daylight BrothelsDocument1 pageNYC Neighborhood Overrun by Broad Daylight BrothelsRamonita GarciaNo ratings yet

- Writ of Praecipe Vital Records Autograph and Fingerprint Scribd 1-27-2024 UpdatedDocument2 pagesWrit of Praecipe Vital Records Autograph and Fingerprint Scribd 1-27-2024 Updatedakil kemnebi easley elNo ratings yet

- T7 B20 Flights 175 and 93 Load Patterns FDR - Entire Contents - FBI Reports 222Document43 pagesT7 B20 Flights 175 and 93 Load Patterns FDR - Entire Contents - FBI Reports 2229/11 Document ArchiveNo ratings yet

- R40 InspectionDocument1 pageR40 InspectionaaanathanNo ratings yet

- 1 sp041122Document4 pages1 sp041122Samrat AshokNo ratings yet

- Case Analysis WorksheetDocument3 pagesCase Analysis WorksheetAndrei Jose Gil (SM21Gil, Andrei Jose C.)No ratings yet

- Forest Hills Golf and Country Club Inc. vs. Gardpro IncDocument1 pageForest Hills Golf and Country Club Inc. vs. Gardpro IncJeric M. CuencaNo ratings yet

- Quasha Ancheta Pena and Nolasco Law Office v. LCN Construction Corp - ESCRADocument21 pagesQuasha Ancheta Pena and Nolasco Law Office v. LCN Construction Corp - ESCRAMHERITZ LYN LIM MAYOLANo ratings yet

- Form - BIR Form 1905Document4 pagesForm - BIR Form 1905ibangpassword50% (2)

- ECDocument4 pagesECNAGA Tax ConsultancyNo ratings yet

- Ruto's Inauguration SpeechDocument24 pagesRuto's Inauguration SpeechLawrence TolloNo ratings yet

- Balatbat v. Arias y SanchezDocument6 pagesBalatbat v. Arias y Sanchezcarla_cariaga_2No ratings yet

- Diamond V ChakrabartyDocument7 pagesDiamond V ChakrabartyIndiraNo ratings yet

- The Scope and Structure of Specialized Commercial Court For Ethiopia - Lessons From AbroadDocument100 pagesThe Scope and Structure of Specialized Commercial Court For Ethiopia - Lessons From AbroadEbsa IsayasNo ratings yet