Professional Documents

Culture Documents

Law Reviewer

Law Reviewer

Uploaded by

키지아0 ratings0% found this document useful (0 votes)

3 views1 pageLAW REVIEWER

Original Title

LAW REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLAW REVIEWER

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageLaw Reviewer

Law Reviewer

Uploaded by

키지아LAW REVIEWER

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Definition of Monetary Instrument 5.

Foreign bank accounts – physically taking small

amounts of cash abroad, below the customs

declaration threshold, lodging in foreign bank

(1) coins or currency of legal tender of the accounts, then sending back to the country of origin.

Philippines, or of any other country;

6. Aborted transactions – funds are lodged with a

(2) drafts, checks and notes; lawyer or accountant to hold in their client account

to settle a proposed transaction. After a short time,

(3) securities or negotiable instruments, bonds, the transaction is aborted. Funds are repaid to the

commercial papers, deposit certificates, trust client from an unimpeachable source.

certificates, custodial receipts or deposit substitute

instruments, trading orders, transaction tickets and

confirmations of sale or investments and money

Meaning of Layering

market instruments; and

(4) other similar instruments where title thereto

passes to another by endorsement, assignment or Layering is essentially the use of placement and

delivery. extraction

over and over again, using varying amounts each

time,

Three Stages of Money Laundering

to make tracing transactions as hard as possible

There are usually two or three phases to the

laundering:

• Placement

• Layering

• Integration / Extraction

Examples of Placement

1. Cash businesses – adding the cash gained from

crime to the legitimate takings. This works best in

business with little or no variable costs, such as car

parks, strip clubs, tanning studios, car washes, and

casinos.

2. False invoicing – putting through dummy

invoices to match cash lodged, making it look like

payment in settlement of the false invoice

3. Smurfing – lodging small amounts of money

below the AML reporting threshold to bank

accounts or credit cards, then using these to pay

expenses etc.

4. Trusts and offshore companies – useful for hiding

the identity of the real beneficial owners.

You might also like

- Acams Cams6 en C Flashcards v1.13Document51 pagesAcams Cams6 en C Flashcards v1.13shettyNo ratings yet

- Certificate of Agreement For Coverage of Student LoanDocument4 pagesCertificate of Agreement For Coverage of Student LoanJohn BaileyNo ratings yet

- AC216 Unit 4 Assignment 5 - Amortization MorganDocument2 pagesAC216 Unit 4 Assignment 5 - Amortization MorganEliana Morgan100% (1)

- Chapter 8 Deposit FunctionDocument5 pagesChapter 8 Deposit FunctionMariel Crista Celda MaravillosaNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Tokeny Solutions ONBOARDDocument2 pagesTokeny Solutions ONBOARDJosephine BonjourNo ratings yet

- Project Report On Credit Risk ManagementDocument56 pagesProject Report On Credit Risk ManagementGayatriThotakura80% (30)

- As Amended by R.A. No. 9194 & R.A. No. 10167Document4 pagesAs Amended by R.A. No. 9194 & R.A. No. 10167CJ IbaleNo ratings yet

- Red Flags For BanksDocument12 pagesRed Flags For BanksNour Allah tabibNo ratings yet

- Amla Notes 2.0Document4 pagesAmla Notes 2.0ARON QUINONESNo ratings yet

- Sec. 1. Covered Persons:: A. Anti-Money Laundering/Counter-Terrorism Financing - R.A. No. 10365Document6 pagesSec. 1. Covered Persons:: A. Anti-Money Laundering/Counter-Terrorism Financing - R.A. No. 10365Aaron Gabriel SantosNo ratings yet

- Money LaunderingDocument2 pagesMoney LaunderingFaik AhmedNo ratings yet

- Revised Anti (Updated)Document41 pagesRevised Anti (Updated)Marilyn OhoylanNo ratings yet

- Money Laundering ActDocument4 pagesMoney Laundering ActpadminiNo ratings yet

- CMASTR GuidanceNote Version 1Document5 pagesCMASTR GuidanceNote Version 1Sematimba AndrewNo ratings yet

- Money Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaDocument15 pagesMoney Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaHarshael SawantNo ratings yet

- CL2022 - 29 Annex ADocument38 pagesCL2022 - 29 Annex AElyssa MendozaNo ratings yet

- Amla 2Document32 pagesAmla 2Mariel MontonNo ratings yet

- Introduction - Money Laundering: Money Laundering Is The Illegal Process of Concealing TheDocument19 pagesIntroduction - Money Laundering: Money Laundering Is The Illegal Process of Concealing Thesrishti tripathiNo ratings yet

- Report On Money LaunderingDocument3 pagesReport On Money LaunderingAJAY AGARWALNo ratings yet

- Anti-Money Laundering Law NotesDocument9 pagesAnti-Money Laundering Law NotesWinna Yu OroncilloNo ratings yet

- DFDocument2 pagesDFWander LarsNo ratings yet

- Money LaunderingDocument38 pagesMoney Launderingchinmayee khareNo ratings yet

- Anti-Money Laundering ActDocument75 pagesAnti-Money Laundering ActAkiko AbadNo ratings yet

- Control Over Cash - For LayoutDocument10 pagesControl Over Cash - For LayoutMariel RascoNo ratings yet

- NIL THEORY - Doc 2Document7 pagesNIL THEORY - Doc 2nikoleNo ratings yet

- Notes On AMLADocument2 pagesNotes On AMLAMQA lawNo ratings yet

- Financial Services Law Main ExamDocument12 pagesFinancial Services Law Main Exammutavacecilia36No ratings yet

- Amla PDFDocument10 pagesAmla PDFCes CamelloNo ratings yet

- Amla-Anti-Money Laundering Act of 2001Document3 pagesAmla-Anti-Money Laundering Act of 2001Leny Joy DupoNo ratings yet

- Amla - Aco-Ppt - 7.11.19Document13 pagesAmla - Aco-Ppt - 7.11.19Rey Jan N. VillavicencioNo ratings yet

- Summary of Cash and Cash EquivalentsDocument4 pagesSummary of Cash and Cash EquivalentsMhico Mateo100% (1)

- Anti-Money Laundering Act BackgroundDocument45 pagesAnti-Money Laundering Act BackgroundKeith Joshua GabiasonNo ratings yet

- Prevention of FraudsDocument9 pagesPrevention of FraudsS KunalNo ratings yet

- Prevention of FraudsDocument9 pagesPrevention of FraudsS KunalNo ratings yet

- Cpat Reviewer - AmlaDocument3 pagesCpat Reviewer - AmlaZaaavnn Vannnnn100% (1)

- A Securities TradeDocument3 pagesA Securities TradeNikhil SawantNo ratings yet

- Finmar Chap 3 4 - 111011Document6 pagesFinmar Chap 3 4 - 111011Jasmine GabianaNo ratings yet

- Amended Report......Document27 pagesAmended Report......KrisLarrNo ratings yet

- SRC: Exempt Securities, Exempt Transactions, and Mandatory Tender OfferDocument7 pagesSRC: Exempt Securities, Exempt Transactions, and Mandatory Tender OfferDeus DulayNo ratings yet

- 2011012138COM15109GE14Unit 1st Depository Concept and Importance, SEBI and Its Regulatory RoledepositoryDocument32 pages2011012138COM15109GE14Unit 1st Depository Concept and Importance, SEBI and Its Regulatory RoledepositoryLone AryanNo ratings yet

- Param Palana - FMM PPT - Half Yearly - 12 Com ADocument7 pagesParam Palana - FMM PPT - Half Yearly - 12 Com AParam PalanaNo ratings yet

- Lecturer 2 (I) - Money LaunderingDocument28 pagesLecturer 2 (I) - Money LaunderingkhooNo ratings yet

- Law On Capital MarketsDocument68 pagesLaw On Capital Markets011anaNo ratings yet

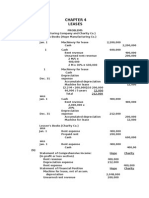

- Chapter 4 CashDocument9 pagesChapter 4 CashTsegaye BelayNo ratings yet

- BUS LAW 103 AssignmentDocument4 pagesBUS LAW 103 AssignmentAireyNo ratings yet

- TF Accounting For Cryptocurrencies 0922Document6 pagesTF Accounting For Cryptocurrencies 0922v vidishaNo ratings yet

- Amla Codal 9160 9194 10167 10365Document17 pagesAmla Codal 9160 9194 10167 10365Aijeleth Shahar G AwacayNo ratings yet

- The Money Laundering Cycle Can Be Broken Down Into Three Distinct StagesDocument2 pagesThe Money Laundering Cycle Can Be Broken Down Into Three Distinct StagesMd.Sakil AhmedNo ratings yet

- Aml Policy enDocument13 pagesAml Policy enTalents cachésNo ratings yet

- Anti Money Laundering ActDocument11 pagesAnti Money Laundering ActFanalex BalwayNo ratings yet

- Financial AssetsDocument43 pagesFinancial Assetsanna paulaNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- CDD Final 2014Document30 pagesCDD Final 2014Henry DunaNo ratings yet

- LSC 2310 - Capital Markets Law - NotesDocument40 pagesLSC 2310 - Capital Markets Law - NotesEugene KwizeraNo ratings yet

- The Anti-Money Laundering Act (R.A. No. 9160, As Amended by R.A. No. 9194, R.A. No. 10167 and R.A. No. 10365) Policy of The LawDocument5 pagesThe Anti-Money Laundering Act (R.A. No. 9160, As Amended by R.A. No. 9194, R.A. No. 10167 and R.A. No. 10365) Policy of The Lawjosiah9_5100% (2)

- International Business New 11Document66 pagesInternational Business New 11tubenaweambroseNo ratings yet

- SRCDocument17 pagesSRCNieves GalvezNo ratings yet

- IntroductionToCommercialBank PDFDocument4 pagesIntroductionToCommercialBank PDFnurulkhairunnajahNo ratings yet

- Fa - I Chapter 6Document13 pagesFa - I Chapter 6Hussen AbdulkadirNo ratings yet

- Ra 9160 Anti-Money Laundering Act: University of San Carlos College of LawDocument7 pagesRa 9160 Anti-Money Laundering Act: University of San Carlos College of LawValerie WNo ratings yet

- Chapter 8 Deposit FunctionDocument5 pagesChapter 8 Deposit FunctionMariel Crista Celda MaravillosaNo ratings yet

- ACAMS CAMS6 EN C Flashcards Printable v1.15Document51 pagesACAMS CAMS6 EN C Flashcards Printable v1.15abhishekrai11111990No ratings yet

- READPHILHIS ReviewerDocument27 pagesREADPHILHIS Reviewer키지아No ratings yet

- Pas and PfrsDocument1 pagePas and Pfrs키지아No ratings yet

- Chap 11Document5 pagesChap 11키지아No ratings yet

- Midterm Reviewer Part 1Document15 pagesMidterm Reviewer Part 1키지아No ratings yet

- GBERMIC Midterms ReviewerDocument18 pagesGBERMIC Midterms Reviewer키지아No ratings yet

- Chap 10Document11 pagesChap 10키지아No ratings yet

- QUIZ and JOURNAL 1Document1 pageQUIZ and JOURNAL 1키지아No ratings yet

- Accounting For MaterialsDocument2 pagesAccounting For Materials키지아No ratings yet

- QUIZ and JOURNAL 2Document1 pageQUIZ and JOURNAL 2키지아No ratings yet

- Truth TableDocument1 pageTruth Table키지아No ratings yet

- CFAS Post TestDocument2 pagesCFAS Post Test키지아No ratings yet

- FIFODocument4 pagesFIFO키지아No ratings yet

- Notes MATHMWDocument4 pagesNotes MATHMW키지아No ratings yet

- Accounting Process BBBBDocument8 pagesAccounting Process BBBB키지아No ratings yet

- 16Document2 pages16키지아No ratings yet

- ProblemsDocument3 pagesProblems키지아No ratings yet

- EulerDocument2 pagesEuler키지아No ratings yet

- 11Document2 pages11키지아No ratings yet

- Define Related PartyDocument1 pageDefine Related Party키지아No ratings yet

- Xcfas ReviewerDocument10 pagesXcfas Reviewer키지아No ratings yet

- 15Document3 pages15키지아No ratings yet

- 12Document1 page12키지아No ratings yet

- PeDocument2 pagesPe키지아No ratings yet

- Notes UTSDocument6 pagesNotes UTS키지아No ratings yet

- ReviewerDocument5 pagesReviewerJeline E LansanganNo ratings yet

- Importance of The Study of EconomicsDocument2 pagesImportance of The Study of EconomicsSyed Fawad Ali ShahNo ratings yet

- SmartFX BrochureDocument10 pagesSmartFX BrochureAkhil HussainNo ratings yet

- VN Top500Document43 pagesVN Top500Vioh NguyenNo ratings yet

- Chapter Two The Financial System2 - Eco551Document25 pagesChapter Two The Financial System2 - Eco551Hafiz akbarNo ratings yet

- Cambridge University Press University of Washington School of Business AdministrationDocument17 pagesCambridge University Press University of Washington School of Business AdministrationShia ZenNo ratings yet

- Chapter 1 BAC 100 PDFDocument32 pagesChapter 1 BAC 100 PDFacademianotes75% (4)

- FEMA RegulationsDocument38 pagesFEMA RegulationsRamakrishnan AnantapadmanabhanNo ratings yet

- Pengaruh Hutang Dan Ekuitas Terhadap Profitabilitas Pada Perusahaan Aneka Industri Yang Terdaftar Di Bursa Efek IndonesiaDocument11 pagesPengaruh Hutang Dan Ekuitas Terhadap Profitabilitas Pada Perusahaan Aneka Industri Yang Terdaftar Di Bursa Efek IndonesiaTitin SuhartiniNo ratings yet

- ABC Vacuum Tube Catalog CombinedDocument15 pagesABC Vacuum Tube Catalog CombinedVincent J. CataldiNo ratings yet

- Philippines - (Complainant: United States) : Taxes On Distilled SpiritsDocument20 pagesPhilippines - (Complainant: United States) : Taxes On Distilled SpiritsMa Gabriellen Quijada-TabuñagNo ratings yet

- Dividend PolicyDocument24 pagesDividend PolicySandhyadarshan Dash100% (1)

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNo ratings yet

- 1.0 Executive Summary:: Integrated Marketing CommunicationDocument28 pages1.0 Executive Summary:: Integrated Marketing CommunicationAnubhov Jobair100% (1)

- Comparative Study of NSE & BSEDocument96 pagesComparative Study of NSE & BSEAhetesham RazaNo ratings yet

- Auditing Notes - Chapter 1 OutlineDocument25 pagesAuditing Notes - Chapter 1 OutlinechaseNo ratings yet

- By Laws Sapang EsDocument11 pagesBy Laws Sapang EsIrish JuanNo ratings yet

- C & M A (MGT402) : Semester S 2018Document3 pagesC & M A (MGT402) : Semester S 2018Syed Ali HaiderNo ratings yet

- Chapter 10 SolutionsDocument5 pagesChapter 10 Solutionsbilal khanNo ratings yet

- Module 11 - Personal FinanceDocument48 pagesModule 11 - Personal FinanceJaffrey JoyNo ratings yet

- Coping With Risk in Agriculture2015Document291 pagesCoping With Risk in Agriculture2015marcoNo ratings yet

- 24 The GraduateDocument2 pages24 The GraduateW.J. ZondagNo ratings yet

- PURA - Hardworking Human - 2020Document32 pagesPURA - Hardworking Human - 2020Ganesh Deshmukh100% (1)

- Primary Sources BooksDocument16 pagesPrimary Sources Booksapi-198969071No ratings yet

- CH 4 - Strategic and Tactical Compensation IssuesDocument19 pagesCH 4 - Strategic and Tactical Compensation IssuestahseenthedevilNo ratings yet