Professional Documents

Culture Documents

Current Affairs

Current Affairs

Uploaded by

Kamal Danish0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

Download as odt, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesCurrent Affairs

Current Affairs

Uploaded by

Kamal DanishCopyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

Download as odt, pdf, or txt

You are on page 1of 2

Now, I want you to provide a comprehensive summary of the key points discussed in the above text

using headings and bullet points. Include information on historical aspects, major themes, and key

initiatives or case studies presented. Support your summary with concrete evidence, examples,

statistics, and literature references mentioned in the article.

Add a little more supportive details, especially some specifics.

Has De-Dollarization Begun?

Overview:

• Since the Bretton Woods system, the U.S. dollar has been a dominant global currency.

• It is widely used in international trade, finance, and as a reserve currency.

Factors Cementing Dollar's Dominance:

1. Bretton Woods Stability (1944):

• 44 countries pledged their currencies to the dollar.

• Stable framework reduced volatility and increased global trade.

• Easy convertibility of the dollar facilitated international transactions.

• The U.S. government agreed to convert the US dollar at the rate of $35 per ounce of

gold.

2. Post-1971 Challenges:

• Nixon suspended dollar convertibility to gold in 1971.

• Various interventions, Plaza Accord of 1985, and technological innovations stabilized

the dollar.

• The U.S. remained the largest economy and a stable source of dollars.

• Military power maintained credibility and trust in the predictive value of the dollar.

• The rapid transformation of international finance due to technological innovations

favored holding and trading US dollars.

3. Current Dollar Dominance:

• IMF (2021) reports over 60% of global foreign reserves in U.S. dollars.

• U.S. dollar used in 90% of all foreign exchange transactions worldwide.

• SWIFT system shows U.S. dollar used in 42-45% of total payments (2022-2023).

• Saudi Arabia agreed in 1974 to price oil in dollars, contributing to the dollar's

dominance in oil trade.

• More than 80% of the oil trade is settled in the U.S. dollar.

Challenges to Dollar Dominance:

1. Asian Monetary Fund Proposal:

• Japan's 1997 proposal revisited by China and Malaysia.

• Ongoing talks for the revival of the Asian Monetary Fund to reduce dependence on the

U.S. dollar.

2. BRICS Initiatives:

• Brazil, Russia, India, China, and South Africa working on a common currency.

• Potential financial accord by August 2023 to challenge American dominance.

• BRICS countries may emerge as a strong economic bloc.

• Russia and China actively seeking alternatives to the U.S. dollar.

3. String of Deals by China:

• Bilateral currency swap agreements with 41 countries (2009-2020).

• Yuan-dominated trade valued at 7.9 trillion yuan or 1.1 trillion US dollars in 2022.

• Brazil accepting yuan for trade and increasing its yuan-dominated foreign exchange

reserves.

• China challenging the petrodollar regime and conducting yuan-settled energy deals.

4. Petrodollar Threat:

• Saudi Arabia open to trading in currencies other than the dollar in 2023.

• China conducting negotiations with Middle Eastern and North American countries to

trade in local currency.

SWIFT as a Tool and China's Alternative:

• SWIFT used by the U.S. as a tool to maintain financial dominance.

• China's alternative: Cross-Border Interbank Payment System (CIPS) launched in 2015.

• CIPS reported 2.6 million transactions in 2021, a 58% increase from the previous year.

• However, CIPS lags behind SWIFT in total volume, with only 19 banks signing on to Phase 1.

China's Capacity for Transformation:

1. Obstacles for China:

• Lack of full convertibility of the renminbi.

• Capital controls limit renminbi's role in international transactions.

• China's financial markets, while advanced, lack the depth and liquidity of the U.S.

2. Internationalization Challenges:

• Size and strength of the U.S. economy.

• Depth and liquidity of U.S. financial markets.

• Historical dominance of the U.S. dollar since World War II.

You might also like

- Mattli - The Logic of Regional IntegrationDocument60 pagesMattli - The Logic of Regional IntegrationMihaela IojaNo ratings yet

- Unit 1 - IMSDocument28 pagesUnit 1 - IMSvintNo ratings yet

- The "Exorbitant Privilege" - A Theoretical ExpositionDocument25 pagesThe "Exorbitant Privilege" - A Theoretical ExpositionANIBAL LOPEZNo ratings yet

- International Monetary System: DR Sowmya SDocument22 pagesInternational Monetary System: DR Sowmya Svasu pradeepNo ratings yet

- UNIT 4 Organizaciones InternacionalesDocument14 pagesUNIT 4 Organizaciones Internacionalesevz86192No ratings yet

- 20th JuneDocument7 pages20th JuneGAMING BUZZNo ratings yet

- International Economics II - Chapter 5Document33 pagesInternational Economics II - Chapter 5seid sufiyanNo ratings yet

- International Trade SystemDocument52 pagesInternational Trade SystemViệt Nguyễn ĐăngNo ratings yet

- Presentation 1Document16 pagesPresentation 1vincentlikongweNo ratings yet

- International Monetary SystemDocument53 pagesInternational Monetary SystemIrfan ArshadNo ratings yet

- Bretton WoodsDocument13 pagesBretton WoodsAnkit BadnikarNo ratings yet

- Eun 10e International Financial Management PPT CH02 AccessibleDocument42 pagesEun 10e International Financial Management PPT CH02 AccessibleMaciel García FuentesNo ratings yet

- The International Monetary SystemDocument17 pagesThe International Monetary SystemNauman HabibNo ratings yet

- De DollarDocument2 pagesDe Dollaryashasreddy777No ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemPragya KasanaNo ratings yet

- Chapter 21Document25 pagesChapter 21Châu Anh TrịnhNo ratings yet

- The Bretton Woods System: Submitted by Ankit Badnikar Mba It Roll No-04Document13 pagesThe Bretton Woods System: Submitted by Ankit Badnikar Mba It Roll No-04Faiz Ur RehmanNo ratings yet

- 2020 11 9 10 The International Monetary SystemDocument31 pages2020 11 9 10 The International Monetary SystemAimae Inot MalinaoNo ratings yet

- Gagan Deep Singh Runner UpDocument10 pagesGagan Deep Singh Runner UpangelNo ratings yet

- Today's AgendaDocument40 pagesToday's AgendaThanh LaiNo ratings yet

- Contemporary WorldDocument6 pagesContemporary WorldRandom TutorialsNo ratings yet

- IPE LESSON 4 ENGLISHDocument60 pagesIPE LESSON 4 ENGLISHYến Nhi Phạm ThịNo ratings yet

- Int Monetary System PPT 1Document31 pagesInt Monetary System PPT 1Abhijeet Bhattacharya100% (1)

- International Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Solution ManualDocument11 pagesInternational Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Solution ManualJenniferNelsonfnoz100% (41)

- Final PPT International FianceDocument30 pagesFinal PPT International FianceGaurav AroraNo ratings yet

- ch03 ER SystemDocument30 pagesch03 ER SystemArun KumarNo ratings yet

- CHAP 4 - Global EconomyDocument57 pagesCHAP 4 - Global EconomySamantha Cleopas DemetrioNo ratings yet

- A Critique of The Bretton Woods System Other Important Economic OrganizationDocument12 pagesA Critique of The Bretton Woods System Other Important Economic OrganizationKenneth Dave Calucag AguilaNo ratings yet

- FM 412 - Lesson 1Document36 pagesFM 412 - Lesson 1Find DeviceNo ratings yet

- Money and Finance in The Global Economy: - The International Monetary SystemDocument59 pagesMoney and Finance in The Global Economy: - The International Monetary SystemAnkita AroraNo ratings yet

- John Maynard Keynes, The Bancor, and An International Money Clearing Unit (ICU) : From Bretton Woods To 21 Century International TradeDocument15 pagesJohn Maynard Keynes, The Bancor, and An International Money Clearing Unit (ICU) : From Bretton Woods To 21 Century International Traderajesht99No ratings yet

- Part 4 International Monetary SystemDocument78 pagesPart 4 International Monetary SystemMUSABYIMANA DeogratiasNo ratings yet

- International Financial ManagementDocument39 pagesInternational Financial Managementnikku2968No ratings yet

- Intl Mon SystemDocument33 pagesIntl Mon SystemSammy MosesNo ratings yet

- Topic 3B ST - International Monetary SystemDocument22 pagesTopic 3B ST - International Monetary SystemmumbiNo ratings yet

- Global Financial Crisis & A Single World Currency by Garry JacobsDocument30 pagesGlobal Financial Crisis & A Single World Currency by Garry Jacobstammy_fooNo ratings yet

- Balaam and Dillman 7 OutlineDocument4 pagesBalaam and Dillman 7 OutlinePaul AriolaNo ratings yet

- Contemporary World 3Document62 pagesContemporary World 3Adrian AndalNo ratings yet

- Aiswarya V V 4 DcmsDocument37 pagesAiswarya V V 4 DcmsRuksana BiazNo ratings yet

- Chap 06Document16 pagesChap 06N.S.RavikumarNo ratings yet

- Contemporary WorldDocument16 pagesContemporary WorldjamesmagdadaroNo ratings yet

- The International Monetary SystemDocument4 pagesThe International Monetary SystemGuia LeeNo ratings yet

- Mac 11& 12Document60 pagesMac 11& 12Shubham DasNo ratings yet

- The International Monetary SystemDocument25 pagesThe International Monetary SystemAnkit GoelNo ratings yet

- Week 4 EC 304Document9 pagesWeek 4 EC 304Mustafa KhanNo ratings yet

- Bretton Wood SystemDocument6 pagesBretton Wood SystemLegends FunanzaNo ratings yet

- International Monetary FundDocument6 pagesInternational Monetary FundAisar Ud DinNo ratings yet

- 2021 - Lecture - 2 - Evolution of IFSDocument18 pages2021 - Lecture - 2 - Evolution of IFSBogdan BNo ratings yet

- Evaluation of Imf & Ibrd 22 SlidesDocument22 pagesEvaluation of Imf & Ibrd 22 SlidesvmktptNo ratings yet

- Chap 9 - IBDocument36 pagesChap 9 - IBkamaruljamil4No ratings yet

- De Dollar Is at I On AnonymousDocument36 pagesDe Dollar Is at I On AnonymousTanmaye ShagotraNo ratings yet

- Review QuestionsDocument2 pagesReview QuestionsHads LunaNo ratings yet

- YUANDocument27 pagesYUANpratik_1989No ratings yet

- The International Monetary SystemDocument11 pagesThe International Monetary SystemScribdTranslationsNo ratings yet

- Int Monetary SysDocument54 pagesInt Monetary Sys杜易航No ratings yet

- Global Economy NotesDocument4 pagesGlobal Economy Notes2022-201417No ratings yet

- Fundamentos de La Comercialización: Chapter 11: The International Monetary SystemDocument21 pagesFundamentos de La Comercialización: Chapter 11: The International Monetary SystemElizabeth CantúNo ratings yet

- Tema 8 EpiDocument14 pagesTema 8 Epimaría graciaNo ratings yet

- Lecture 7 - 120324Document64 pagesLecture 7 - 120324Полина БаеваNo ratings yet

- Currency WarDocument25 pagesCurrency WarSumanta Kumar BiswalNo ratings yet

- Is The US 2012 Presidential Election Tipping Point for the fall of the Greenback?From EverandIs The US 2012 Presidential Election Tipping Point for the fall of the Greenback?No ratings yet

- "Big Ben" Strategy by Kristian KerrDocument4 pages"Big Ben" Strategy by Kristian Kerrapi-26247058100% (1)

- Computation With Dumping Duty (R.A 8752)Document11 pagesComputation With Dumping Duty (R.A 8752)Mariel BoncatoNo ratings yet

- Doha Development AgendaDocument7 pagesDoha Development Agendaumar hashmiNo ratings yet

- Kinds of TradeDocument1 pageKinds of TradeBianca TapangNo ratings yet

- March 2014Document3 pagesMarch 2014SarwarNo ratings yet

- International TradeDocument7 pagesInternational TradeReddy Haveri100% (1)

- Foreign Exchange Market in BangladeshDocument28 pagesForeign Exchange Market in BangladeshYeasir Malik85% (20)

- Foreign Exchange MonetaryDocument51 pagesForeign Exchange MonetarySuriya HoqueNo ratings yet

- CBP Form 434Document2 pagesCBP Form 434Heather SoraparuNo ratings yet

- KRW - South Korean Won: Top KRW Exchange RatesDocument2 pagesKRW - South Korean Won: Top KRW Exchange RatesFriktNo ratings yet

- Types of MoneyDocument4 pagesTypes of MoneyAlexandraNo ratings yet

- Notes - 2 Encode DecodeDocument4 pagesNotes - 2 Encode DecodeSiel BrengaNo ratings yet

- Virginia Co Has A Subsidiary in Hong Kong and inDocument1 pageVirginia Co Has A Subsidiary in Hong Kong and inAmit PandeyNo ratings yet

- SD FX Excel - Sample File: Option ClassesDocument11 pagesSD FX Excel - Sample File: Option ClassesFranc GrošeljNo ratings yet

- R20 International Trade and Capital Flows PDFDocument36 pagesR20 International Trade and Capital Flows PDFROSHNINo ratings yet

- Full Download Test Bank For International Financial Management 9th Edition Cheol Eun Bruce Resnick Tuugi Chuluun PDF Full ChapterDocument36 pagesFull Download Test Bank For International Financial Management 9th Edition Cheol Eun Bruce Resnick Tuugi Chuluun PDF Full Chapterjenniferterrygrqoekdfic100% (24)

- Tariff Classification: Information SheetDocument6 pagesTariff Classification: Information Sheetpaul molinaNo ratings yet

- Foreign Trade and Trade Policy: Group - 7Document16 pagesForeign Trade and Trade Policy: Group - 7Ashutosh BiswalNo ratings yet

- Forex TransactionsDocument3 pagesForex TransactionsDing CostaNo ratings yet

- Leec 106Document22 pagesLeec 106Addicted To CricketNo ratings yet

- Towards A Single Currency: A Brief History of EMUDocument6 pagesTowards A Single Currency: A Brief History of EMUSimona OanaNo ratings yet

- General Profile: CanadaDocument3 pagesGeneral Profile: CanadaDaniela CarauşNo ratings yet

- Assessing The Potential Impact of The African Continental Free Trade Area On Least Developed Countries A Case Study of EthiopiaDocument85 pagesAssessing The Potential Impact of The African Continental Free Trade Area On Least Developed Countries A Case Study of Ethiopiahabtamu100% (1)

- CHAPTER 14 Macroeconomics in An Open EconomyDocument7 pagesCHAPTER 14 Macroeconomics in An Open EconomyAdel HassanNo ratings yet

- Pros and Cons-RcepDocument1 pagePros and Cons-RcepSumeer BeriNo ratings yet

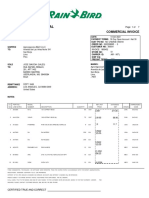

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Document7 pagesRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboNo ratings yet

- The Tanzania National Trade PolicyDocument2 pagesThe Tanzania National Trade PolicySam MasingaNo ratings yet

- IBM Question Bank PDFDocument25 pagesIBM Question Bank PDFpavandongreNo ratings yet