Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsTax Calculation FY 2024 25 OldRegime

Tax Calculation FY 2024 25 OldRegime

Uploaded by

mohangboxCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Core Java KBADocument6 pagesCore Java KBAmohangboxNo ratings yet

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaNo ratings yet

- ZTE-F670L (WIFI Name Password Change Procedure) v.7Document10 pagesZTE-F670L (WIFI Name Password Change Procedure) v.7mohangbox100% (2)

- 02a Create Defect ReportDocument29 pages02a Create Defect ReportmohangboxNo ratings yet

- Assignment 6.2 LiquidationDocument7 pagesAssignment 6.2 LiquidationAnna Mae Nebres100% (1)

- Evi16 104953Document2 pagesEvi16 104953Al QadriNo ratings yet

- Trial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing BalanceDocument4 pagesTrial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing Balancesushilo_2No ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- Pro-Forma Income Statement & Percentage of Sales For Year 2020Document9 pagesPro-Forma Income Statement & Percentage of Sales For Year 2020Rehan ShariarNo ratings yet

- FinmanDocument4 pagesFinmanAngel ToribioNo ratings yet

- Tea Project - Cma - Cashbudged - Mini TeaDocument18 pagesTea Project - Cma - Cashbudged - Mini Teabijoy dasNo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Evi12 104945Document1 pageEvi12 104945Al QadriNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Cab Case StudyDocument7 pagesCab Case StudyPriyanka GoenkaNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Sachin DaneshwariDocument2 pagesSachin DaneshwariADARSH PATTARNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- 2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount ExceedingDocument2 pages2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount Exceedingsarwar raziNo ratings yet

- Irma12 104932Document1 pageIrma12 104932Al QadriNo ratings yet

- PR 117 Part 2Document9 pagesPR 117 Part 2viswadevassociates.tvmNo ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- Evi13 104949Document2 pagesEvi13 104949Al QadriNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Projected Financials - RAM Resorts and Hotels CorporationDocument12 pagesProjected Financials - RAM Resorts and Hotels CorporationCharlene Tiong100% (1)

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Nama: Muh Hisyam NPM: 1961201063 Kelas: Manajemen 4C Mata Kuliah: Analisa Laporan Keuangan Diketahui: Neraca Dan Laporan Laba Rugi PT. XYZDocument2 pagesNama: Muh Hisyam NPM: 1961201063 Kelas: Manajemen 4C Mata Kuliah: Analisa Laporan Keuangan Diketahui: Neraca Dan Laporan Laba Rugi PT. XYZMuh HisyamNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- PR 53Document8 pagesPR 53viswadevassociates.tvmNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- PR 53Document8 pagesPR 53viswadevassociates.tvmNo ratings yet

- FM 2 AssignmentDocument4 pagesFM 2 AssignmentTestNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- BodieDocument8 pagesBodieLinh NguyenNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Balance General 2Document1 pageBalance General 2Esmeralda BernaNo ratings yet

- AE 111 Midterm Summative Assessment 3 SolutionsDocument12 pagesAE 111 Midterm Summative Assessment 3 SolutionsDjunah ArellanoNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Sre San Fabian 2022Document6 pagesSre San Fabian 2022San Fabian DILGNo ratings yet

- Balance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsDocument4 pagesBalance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsCA Saurav Kumar AgrawalNo ratings yet

- AssignmentDocument10 pagesAssignmentczymonNo ratings yet

- 14Document1 page14Iqbal RamadhanNo ratings yet

- 4 3Document3 pages4 3ANDI TE'A MARI SIMBALANo ratings yet

- FinancialsDocument6 pagesFinancialsharshithamandalapuNo ratings yet

- Ambey Trading CorporationDocument9 pagesAmbey Trading Corporationgbv bbbNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Mid Term BAV - 12 Oct 2017 - SolutionDocument2 pagesMid Term BAV - 12 Oct 2017 - SolutionMAYANK JAINNo ratings yet

- Figures and Illustrations - Financial RatiosDocument19 pagesFigures and Illustrations - Financial RatioscamillaNo ratings yet

- Evi15 104951Document2 pagesEvi15 104951Al QadriNo ratings yet

- Irma15 104936Document2 pagesIrma15 104936Al QadriNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- CHE THI KAL DTCP Plot 11 PlotLayout ApprovedDocument20 pagesCHE THI KAL DTCP Plot 11 PlotLayout ApprovedmohangboxNo ratings yet

- PlotLayout-TRY THU UPP 183 242Document1 pagePlotLayout-TRY THU UPP 183 242mohangboxNo ratings yet

- TRY THU UPP DTCP Regularisation Plot 242-ApprovedDocument3 pagesTRY THU UPP DTCP Regularisation Plot 242-ApprovedmohangboxNo ratings yet

- ALM NewDocument7 pagesALM NewmohangboxNo ratings yet

- TRY THU UPP DTCP Regularisation Plot 183-ApprovedDocument3 pagesTRY THU UPP DTCP Regularisation Plot 183-ApprovedmohangboxNo ratings yet

- NMKL NMKL PER DTCP Regularisation Plot 06-ApprovedDocument2 pagesNMKL NMKL PER DTCP Regularisation Plot 06-ApprovedmohangboxNo ratings yet

- Generative AI Refresher - E0Document3 pagesGenerative AI Refresher - E0mohangboxNo ratings yet

- Selenium Basics UPDATEDDocument27 pagesSelenium Basics UPDATEDmohangboxNo ratings yet

- DTCP 12 2015 MLPA SunShine PH 2Document1 pageDTCP 12 2015 MLPA SunShine PH 2mohangboxNo ratings yet

- Maven 65 FailedDocument5 pagesMaven 65 FailedmohangboxNo ratings yet

- HP ALM QuestionsDocument2 pagesHP ALM QuestionsmohangboxNo ratings yet

- 04 RAID Test Planning Strategizing Case Study - SpecialistDocument10 pages04 RAID Test Planning Strategizing Case Study - SpecialistmohangboxNo ratings yet

- 03 RAID Test Planning Strategizing - IntroductionDocument27 pages03 RAID Test Planning Strategizing - IntroductionmohangboxNo ratings yet

- Critical Thinking Essentials Applying Critical Thinking SkillsDocument7 pagesCritical Thinking Essentials Applying Critical Thinking SkillsmohangboxNo ratings yet

- Test Planning and Strategizing: Quality GatesDocument50 pagesTest Planning and Strategizing: Quality GatesmohangboxNo ratings yet

Tax Calculation FY 2024 25 OldRegime

Tax Calculation FY 2024 25 OldRegime

Uploaded by

mohangbox0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesTax Calculation FY 2024 25 OldRegime

Tax Calculation FY 2024 25 OldRegime

Uploaded by

mohangboxCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

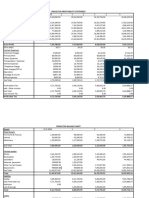

Income Tax Calculator -FY 2024-25

Old Regime Calcualtion, Age <60

Total CTC

All other deductions

Annual total Gross

Std Deduction

Taxable Income

Balance

S. N Min Max Slap % Limit

1 0 250,000 0% 250,000

2 250,000 500,000 5% 250,000

3 500,000 1,000,000 20% 500,000

4 1,000,000 100,000,000 30% 99,000,000

Education cess

Total Tax

Tax Paid

Remaining Months

Balance Tax per Month

Items Submit To be approved Approved To Be Filed

80C 150,000 150,000 126,960 150,000

HRA 204,000 204,000 0 204,000

80CCD(1) 50,000 50,000 0 50,000

80D 0 0 0 75,000

LTA 0 0 145,000

EV 0 0 145,000

Loan Interest 0 190,000

Any other 0 0

Total 404,000 404,000 126,960 959,000

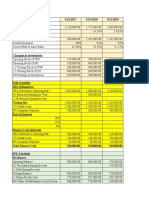

FY 2024-25

60

2,300,000

392,767

1,907,233

50,000

1,857,233

1,453,233

Calculation

0

12,500

100,000

135,970

9,939

258,409

28,737

11

20,879

For Calculation

404,000

You might also like

- Core Java KBADocument6 pagesCore Java KBAmohangboxNo ratings yet

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaNo ratings yet

- ZTE-F670L (WIFI Name Password Change Procedure) v.7Document10 pagesZTE-F670L (WIFI Name Password Change Procedure) v.7mohangbox100% (2)

- 02a Create Defect ReportDocument29 pages02a Create Defect ReportmohangboxNo ratings yet

- Assignment 6.2 LiquidationDocument7 pagesAssignment 6.2 LiquidationAnna Mae Nebres100% (1)

- Evi16 104953Document2 pagesEvi16 104953Al QadriNo ratings yet

- Trial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing BalanceDocument4 pagesTrial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing Balancesushilo_2No ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- Pro-Forma Income Statement & Percentage of Sales For Year 2020Document9 pagesPro-Forma Income Statement & Percentage of Sales For Year 2020Rehan ShariarNo ratings yet

- FinmanDocument4 pagesFinmanAngel ToribioNo ratings yet

- Tea Project - Cma - Cashbudged - Mini TeaDocument18 pagesTea Project - Cma - Cashbudged - Mini Teabijoy dasNo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Evi12 104945Document1 pageEvi12 104945Al QadriNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Cab Case StudyDocument7 pagesCab Case StudyPriyanka GoenkaNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Sachin DaneshwariDocument2 pagesSachin DaneshwariADARSH PATTARNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- 2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount ExceedingDocument2 pages2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount Exceedingsarwar raziNo ratings yet

- Irma12 104932Document1 pageIrma12 104932Al QadriNo ratings yet

- PR 117 Part 2Document9 pagesPR 117 Part 2viswadevassociates.tvmNo ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- Evi13 104949Document2 pagesEvi13 104949Al QadriNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Projected Financials - RAM Resorts and Hotels CorporationDocument12 pagesProjected Financials - RAM Resorts and Hotels CorporationCharlene Tiong100% (1)

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Nama: Muh Hisyam NPM: 1961201063 Kelas: Manajemen 4C Mata Kuliah: Analisa Laporan Keuangan Diketahui: Neraca Dan Laporan Laba Rugi PT. XYZDocument2 pagesNama: Muh Hisyam NPM: 1961201063 Kelas: Manajemen 4C Mata Kuliah: Analisa Laporan Keuangan Diketahui: Neraca Dan Laporan Laba Rugi PT. XYZMuh HisyamNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- PR 53Document8 pagesPR 53viswadevassociates.tvmNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- PR 53Document8 pagesPR 53viswadevassociates.tvmNo ratings yet

- FM 2 AssignmentDocument4 pagesFM 2 AssignmentTestNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- BodieDocument8 pagesBodieLinh NguyenNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Balance General 2Document1 pageBalance General 2Esmeralda BernaNo ratings yet

- AE 111 Midterm Summative Assessment 3 SolutionsDocument12 pagesAE 111 Midterm Summative Assessment 3 SolutionsDjunah ArellanoNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Sre San Fabian 2022Document6 pagesSre San Fabian 2022San Fabian DILGNo ratings yet

- Balance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsDocument4 pagesBalance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsCA Saurav Kumar AgrawalNo ratings yet

- AssignmentDocument10 pagesAssignmentczymonNo ratings yet

- 14Document1 page14Iqbal RamadhanNo ratings yet

- 4 3Document3 pages4 3ANDI TE'A MARI SIMBALANo ratings yet

- FinancialsDocument6 pagesFinancialsharshithamandalapuNo ratings yet

- Ambey Trading CorporationDocument9 pagesAmbey Trading Corporationgbv bbbNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Mid Term BAV - 12 Oct 2017 - SolutionDocument2 pagesMid Term BAV - 12 Oct 2017 - SolutionMAYANK JAINNo ratings yet

- Figures and Illustrations - Financial RatiosDocument19 pagesFigures and Illustrations - Financial RatioscamillaNo ratings yet

- Evi15 104951Document2 pagesEvi15 104951Al QadriNo ratings yet

- Irma15 104936Document2 pagesIrma15 104936Al QadriNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- CHE THI KAL DTCP Plot 11 PlotLayout ApprovedDocument20 pagesCHE THI KAL DTCP Plot 11 PlotLayout ApprovedmohangboxNo ratings yet

- PlotLayout-TRY THU UPP 183 242Document1 pagePlotLayout-TRY THU UPP 183 242mohangboxNo ratings yet

- TRY THU UPP DTCP Regularisation Plot 242-ApprovedDocument3 pagesTRY THU UPP DTCP Regularisation Plot 242-ApprovedmohangboxNo ratings yet

- ALM NewDocument7 pagesALM NewmohangboxNo ratings yet

- TRY THU UPP DTCP Regularisation Plot 183-ApprovedDocument3 pagesTRY THU UPP DTCP Regularisation Plot 183-ApprovedmohangboxNo ratings yet

- NMKL NMKL PER DTCP Regularisation Plot 06-ApprovedDocument2 pagesNMKL NMKL PER DTCP Regularisation Plot 06-ApprovedmohangboxNo ratings yet

- Generative AI Refresher - E0Document3 pagesGenerative AI Refresher - E0mohangboxNo ratings yet

- Selenium Basics UPDATEDDocument27 pagesSelenium Basics UPDATEDmohangboxNo ratings yet

- DTCP 12 2015 MLPA SunShine PH 2Document1 pageDTCP 12 2015 MLPA SunShine PH 2mohangboxNo ratings yet

- Maven 65 FailedDocument5 pagesMaven 65 FailedmohangboxNo ratings yet

- HP ALM QuestionsDocument2 pagesHP ALM QuestionsmohangboxNo ratings yet

- 04 RAID Test Planning Strategizing Case Study - SpecialistDocument10 pages04 RAID Test Planning Strategizing Case Study - SpecialistmohangboxNo ratings yet

- 03 RAID Test Planning Strategizing - IntroductionDocument27 pages03 RAID Test Planning Strategizing - IntroductionmohangboxNo ratings yet

- Critical Thinking Essentials Applying Critical Thinking SkillsDocument7 pagesCritical Thinking Essentials Applying Critical Thinking SkillsmohangboxNo ratings yet

- Test Planning and Strategizing: Quality GatesDocument50 pagesTest Planning and Strategizing: Quality GatesmohangboxNo ratings yet