Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsMicrofinance

Microfinance

Uploaded by

Rifa EtyBal

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Micro Finance PPT FinalDocument37 pagesMicro Finance PPT FinalVaibhav Alawa100% (2)

- Confessions of a Microfinance Heretic: How Microlending Lost Its Way and Betrayed the PoorFrom EverandConfessions of a Microfinance Heretic: How Microlending Lost Its Way and Betrayed the PoorRating: 3.5 out of 5 stars3.5/5 (5)

- How To Open A Bank Account For An LLC OnlineDocument8 pagesHow To Open A Bank Account For An LLC OnlineStepford UniversityNo ratings yet

- Unit One Microfinance OverviewDocument15 pagesUnit One Microfinance OverviewCome-all NathNo ratings yet

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Strategic Management of Southeast Bank LimitedDocument32 pagesStrategic Management of Southeast Bank LimitediqbalNo ratings yet

- TRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDocument302 pagesTRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchNo ratings yet

- Ibt RevDocument4 pagesIbt RevKim SunooNo ratings yet

- Microfin Reviewer MDTDocument1 pageMicrofin Reviewer MDTKim SunooNo ratings yet

- Microfinance 8431683779625937Document25 pagesMicrofinance 8431683779625937AR47No ratings yet

- Microfinance - 1Document47 pagesMicrofinance - 1Balasingam PrahalathanNo ratings yet

- MicrofinanceDocument6 pagesMicrofinanceyasirseyyid100% (1)

- NavdeepDocument18 pagesNavdeepArshdeep SinghNo ratings yet

- Week34 Grameen ApproachDocument26 pagesWeek34 Grameen ApproachGilarie AlisonNo ratings yet

- Unit 1Document92 pagesUnit 1Amrit KaurNo ratings yet

- Research Study About The Role of MicrofinanceDocument4 pagesResearch Study About The Role of Microfinancedhanush rNo ratings yet

- 43 Micro CreditDocument16 pages43 Micro CreditAli Muhammad TunioNo ratings yet

- Microfinance (D)Document75 pagesMicrofinance (D)smithNo ratings yet

- Assignment of Financial InstitutionDocument9 pagesAssignment of Financial InstitutionKamalpreet_Mad_6500No ratings yet

- Microfinance PresentationDocument5 pagesMicrofinance Presentationnidhi1726No ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument72 pagesMicro-Finance Management & Critical Analysis in IndiaAtul MangaleNo ratings yet

- Micro-Finance/credit Institution: Its Principles, and Relevance in Liberia's Post-War ReconstructionDocument9 pagesMicro-Finance/credit Institution: Its Principles, and Relevance in Liberia's Post-War ReconstructionGleh Huston Appleton100% (4)

- Hastra: Information Technology SolutionsDocument14 pagesHastra: Information Technology SolutionsSarthak ParnamiNo ratings yet

- Microfinance: Creating Opportunities For The Poor? By: Susana KhavulDocument8 pagesMicrofinance: Creating Opportunities For The Poor? By: Susana KhavulMuhammad ShahidNo ratings yet

- A Study On Microfinance Sector in KarnatakaDocument84 pagesA Study On Microfinance Sector in KarnatakaPrashanth PB100% (3)

- Microfinance Principles and PracticeDocument17 pagesMicrofinance Principles and Practicejamesamani2001No ratings yet

- Barathan.S Ii Year MbaDocument20 pagesBarathan.S Ii Year Mbabarathan08No ratings yet

- Micro Finance AssignmentDocument4 pagesMicro Finance AssignmentLimasenla Moa100% (1)

- The History of MicrofinanceDocument8 pagesThe History of Microfinancevv9408922438No ratings yet

- Prelim Topic 2Document8 pagesPrelim Topic 2Sairah Camille ArandiaNo ratings yet

- MF Briefing Doc EnglishDocument8 pagesMF Briefing Doc EnglishButterfly DiaryNo ratings yet

- FIP 3Qtr2013Document8 pagesFIP 3Qtr2013Karol Mikhail Ra NakpilNo ratings yet

- The History of MicrofinanceDocument9 pagesThe History of MicrofinanceKhawaja Muzaffar Mehmood100% (1)

- Impact of Self-Help Groups On Socio-Economic Empowerment of Women: A Study in Uttrakhand StateDocument13 pagesImpact of Self-Help Groups On Socio-Economic Empowerment of Women: A Study in Uttrakhand StateUsha JadhavNo ratings yet

- MicrofinanceDocument77 pagesMicrofinancePramish SubediNo ratings yet

- Micro Finance and NGO'sDocument50 pagesMicro Finance and NGO'sMunish Dogra100% (1)

- MicrofinanceDocument65 pagesMicrofinanceRahul AksHNo ratings yet

- An Assignment On Microcredit in BangladeshDocument15 pagesAn Assignment On Microcredit in Bangladeshhimi.asifNo ratings yet

- Group#1 - MicrofinancersDocument14 pagesGroup#1 - MicrofinancersBianca MedrandaNo ratings yet

- Case Study On MicrofinanceDocument18 pagesCase Study On MicrofinanceTusharika RajpalNo ratings yet

- Various Islamic Microfinance Models and Its Effectiveness On Poverty AlleviationDocument19 pagesVarious Islamic Microfinance Models and Its Effectiveness On Poverty Alleviationasif.aza.coNo ratings yet

- Chapter Four: Micro-Financing InstitutionsDocument7 pagesChapter Four: Micro-Financing InstitutionsBekele DemissieNo ratings yet

- MicrofinanceDocument57 pagesMicrofinancepallavi gurav100% (1)

- Lecture - 02 Micro Credit & NGOs To Alleviate PovertyDocument25 pagesLecture - 02 Micro Credit & NGOs To Alleviate PovertyRaef AhmedNo ratings yet

- Unit-1 Over View: Microfinance Rural Banking and Development FinanceDocument46 pagesUnit-1 Over View: Microfinance Rural Banking and Development FinanceAMIT SINDHUNo ratings yet

- MicroDocument28 pagesMicro1k12No ratings yet

- Microfinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsDocument8 pagesMicrofinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsRohan_Kapoor_4806No ratings yet

- Microfinance and Poverty AlleviationDocument27 pagesMicrofinance and Poverty AlleviationIzma HussainNo ratings yet

- Microfinance Regulation in India. Microfinance ManagementDocument5 pagesMicrofinance Regulation in India. Microfinance ManagementRavindra SalviNo ratings yet

- Microfinance - IntroductionDocument7 pagesMicrofinance - Introductionbeena antuNo ratings yet

- The History of Microfinance PDFDocument8 pagesThe History of Microfinance PDFTheodorah Gaelle MadzyNo ratings yet

- Micro Finance Ravi Mathur Mms-FinDocument55 pagesMicro Finance Ravi Mathur Mms-FinSwati KakadNo ratings yet

- 1 What Is MicrofinanceDocument39 pages1 What Is MicrofinanceAbhishek GargNo ratings yet

- Chapter 1 NotesDocument15 pagesChapter 1 Notesthete.ashishNo ratings yet

- How Will The Goal Be Achieved?: MicrocreditDocument4 pagesHow Will The Goal Be Achieved?: MicrocreditthundergssNo ratings yet

- CH Allen EgsDocument5 pagesCH Allen EgsY N S Y SNo ratings yet

- Micro Finance: Chapter FourteenDocument17 pagesMicro Finance: Chapter FourteenNhon HoangNo ratings yet

- Please Read: A Personal Appeal From Wikipedia Author LilarojaDocument23 pagesPlease Read: A Personal Appeal From Wikipedia Author LilarojaavismlNo ratings yet

- Concept of Micro CreditDocument16 pagesConcept of Micro CreditSyed Wahidur RahmanNo ratings yet

- 05 Chapter-1 PDFDocument52 pages05 Chapter-1 PDFRohitNo ratings yet

- A Brief History of Credit ReviewerDocument2 pagesA Brief History of Credit ReviewerJAM CLNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- Small Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and BeyondFrom EverandSmall Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and BeyondNo ratings yet

- Financial Management: Week 10Document10 pagesFinancial Management: Week 10sanjeev parajuliNo ratings yet

- 22 Siga An V VillanuevaDocument1 page22 Siga An V VillanuevaPring SumNo ratings yet

- Sadia Banu 111Document4 pagesSadia Banu 111Pankhuri KaushikNo ratings yet

- Sbi New Health InsurSBI NEW HEALTH INSURANCE SCHEMEance SchemeDocument17 pagesSbi New Health InsurSBI NEW HEALTH INSURANCE SCHEMEance SchemefmsrypNo ratings yet

- Money and BankingDocument7 pagesMoney and Bankingaamiralishiasbackup1No ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- Group Assignment On Bangladesh BankDocument20 pagesGroup Assignment On Bangladesh BankAlphahin 17No ratings yet

- Capital FirstDocument92 pagesCapital FirstviswanathNo ratings yet

- How Visa Makes Money and Understaning Visa Business ModelDocument5 pagesHow Visa Makes Money and Understaning Visa Business ModelAchintya MittalNo ratings yet

- KrazyBee Services Private LimitedDocument9 pagesKrazyBee Services Private LimitedBalakrishnan IyerNo ratings yet

- Case Study Mki - BladesDocument3 pagesCase Study Mki - Bladeslily kusumawati100% (1)

- Indusind BankDocument85 pagesIndusind BankMamata Panadi50% (2)

- 1542438436593Document1 page1542438436593kushalNo ratings yet

- s17 Cash and Cash Conversion CycleDocument22 pagess17 Cash and Cash Conversion CycleKranti PrajapatiNo ratings yet

- Accounting Paper 3 Summer 03Document16 pagesAccounting Paper 3 Summer 03igcsepapersNo ratings yet

- M/Chip Functional Architecture For Debit and Credit: Applies To: SummaryDocument12 pagesM/Chip Functional Architecture For Debit and Credit: Applies To: SummaryAbiy MulugetaNo ratings yet

- Alm Review of LiteratureDocument17 pagesAlm Review of LiteratureSai ViswasNo ratings yet

- Transfer of Property Act 1882 CSDocument15 pagesTransfer of Property Act 1882 CSShubham Jain Modi100% (1)

- 1.industry Profile: 1. Primary FunctionDocument70 pages1.industry Profile: 1. Primary FunctionBhavanams Rao0% (1)

- HUDCO's ObjectivesDocument8 pagesHUDCO's ObjectivesAvishek GhosalNo ratings yet

- Difference Between Bill of Exchange and Cheque - CheckDocument2 pagesDifference Between Bill of Exchange and Cheque - Checkksumukh86No ratings yet

- 10.21.2017 Audit of ReceivablesDocument10 pages10.21.2017 Audit of ReceivablesPatOcampoNo ratings yet

- Accounting Equation ProblemDocument2 pagesAccounting Equation ProblemSenthil ArasuNo ratings yet

- Home LoanidbiDocument2 pagesHome LoanidbivinodmcaNo ratings yet

- Bahan Rakor HLP.Document21 pagesBahan Rakor HLP.Aprilo DielovaNo ratings yet

- Sample Group FIT Rate Agreement T CsDocument1 pageSample Group FIT Rate Agreement T CsBharatRajNo ratings yet

- Loan Products of The City Bank LimitedDocument7 pagesLoan Products of The City Bank LimitedQuazi AsaduzzamanNo ratings yet

Microfinance

Microfinance

Uploaded by

Rifa Ety0 ratings0% found this document useful (0 votes)

2 views12 pagesBal

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBal

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views12 pagesMicrofinance

Microfinance

Uploaded by

Rifa EtyBal

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

Microfinance • One-third of the world’s population lives

• Micro-finance has been defined as a on less than $3.10 per day.

provision of financial services that's Microcredit and Microfinance

available to low-income people. Microfinance refers to savings, insurance,

• This type of loan helps aspiring loans, transfer services, microcredit and other

entrepreneurs generate income, build financial products to customers who have low

assets, manage risks and meet their incomes.

household needs. • Microcredit is a small amount of money

• Microfinance has been around for provided to the client by the Bank or other

centuries in some form or another, and institutions.

even longer in Asia as a form of informal • The poor people have no physical

lending. What we know as microfinance collateral and have a higher risk in return

today was born sometime in the '70s in the payments of the borrowing money.

country of Bangladesh. • The term MF includes many financial

Microfinancing products for both the poor and the near-

• In the midst of a famine, Dr. Muhammad poor.

Yunus, professor of economics at the Microfinance Begins

University of Chittagong, was becoming • In 1973 an antipoverty organization in

disappointed with the abstract theories of Brazil called Accion noticed a high

economics prevalence of small, informal enterprises

(A theory in which a system is described w that often needed funds to expand their

ithout specifying a structure) that failed to business. It was in this context that the first

explain why so many poor people were microfinance loan was granted.

starving in Bangladesh.

• Within a few years, other institutions and

• In the village of Jobra, the professor individuals across the globe were also

discovered that a group of 42 females beginning to experiment with microcredit

made bamboo stools but did not have the and with other microfinance services.

money to purchase the raw materials for

• The Bangladesh Rural Advancement

the stools.

Committee (BRAC), a nonprofit

• As a result, the women fell into a cycle of organization in Bangladesh, was also an

debt among the local community's traders. early micro-lender.

Micro-finance • In 1976, similarly in Bangladesh, in the

• The traders would lend the women the village of Jobra, economist Muhammad

funds they needed with one condition: Yunus observed that if the poor were given

They would sell the stools at a price just access to credit they could pull themselves

hardly higher than what the raw materials out of poverty.

cost. • His first loan, a total of $27 to a group of

The $27 came from the entire borrowing villagers, was an early experiment in group

needs of the 42 women combined. Yunus lending.

lent them his own money, allowed them to

• By 1983 he had established the Grameen

sell their stools and got them out of their

Bank, one of the most prominent

debt cycle.

microfinance institutions today with one of • Microfinance has matured from funding

the strongest socially driven missions. exclusively micro business loans to

• Around the same time, the Indonesian providing savings, insurance, mortgages,

state-owned bank, Bank Rakyat Indonesia mobile banking, healthcare, and education.

(BRI), also began to experiment with not • The public has become increasingly aware

only microloans but also micro savings. of the industry, in part due to the success

• Accion, BRAC, BRI, and Grameen Bank of Yunus, who received the Nobel Peace

soon discovered something remarkable: Prize in 2006.

the poor could save money, and they could • More recently, in 2009 American

borrow money and reliably repay with President Barack Obama awarded him the

interest. Medal of Freedom, the highest American

• These institutions found ways to expand to civilian honor.

serve very large numbers of the poor Microcredit and Microfinance

without subsidies. • The Grameen methodology has enjoyed

• They treated financial services for the poor explosive growth and given hope to

like a business that could sustain itself, and millions of poor women and men seeking

in some cases even turn a profit. to generate income in order to rise out of

• Their initial successes proved that the poor poverty. Indeed the microfinance

often have the skills and drive to enhance management system has solved many of

their incomes and the well-being of their the structural problems of targeting and

families if they have access to finance or delivering financial services to poor

ways to save. people.

• The idea that the poor can lift themselves • The microcredit program in Bangladesh

out of poverty is at the heart of rightly began by targeting the rural poor,

microfinance. especially women, as a development

• Initially, many MFIs financed their intervention strategy.

operations through donors and grants, and • MC serves not only to meet financial

many today still rely on charitable needs but also contributes to other social

contributions. and institutional development issues such

• However, in the decades since the 1970s, as women’s empowerment, bringing the

hundreds of MFIs have matured to become rural poor into an institutional service

fully commercial enterprises that by network, and reducing the dependency on

charging interest and service fees cover informal money lenders.

their costs and earn profits. • The management system of microfinance

• MFIs that can fully cover their operational programs has evolved over time but

costs (and therefore do not need donations) commonly have the following features:

are called self-sufficient or sustainable, • Women are the main recipients of

suggesting that if run properly they can microfinance services though many MFIs now

serve the poor in perpetuity. have male members/clients;

• Microfinance reaches more than 200 • Group-based lending methodology is the

million clients through the branches of main system of delivery of microfinance services,

many thousands of institutions although commercial banks and a number of

MFIs offer loans to individual clients.

Groups not only meant a collection of • This diversification strategy is not only

members for administrative purposes but also helping portfolio growth and outreach but

meant group liability. In case of loan default by a also transforming NGO-MFIs as

member, the group would take responsibility for permanent financial service providers for

the repayment of the defaulted loan. both the poor and the near-poor (above

But now the group-based system provides poverty threshold), amongst both the rural

just a low-cost management structure, and urban populations.

without any responsibility of repayment; • NGO-MFIs have now become a new class

that is the responsibility of the individual of financial institution in Bangladesh

borrower. financial markets.

• However, groups do serve another • "Hard-core poor" describes one who does

practical purpose, as a filter for screening not have a sufficient income to meet even

individuals for membership; an energy intake of 1,805 calories (WFP,

• The microfinance sector in Bangladesh is 1997).

now dominated by NGOs offering • Persons defined as extremely poor if

microfinance services, collectively known living in households with a per capita

as NGO-MFIs, which offer financial income under US$1.90 PPP per day,

services as ‘private not-for-profit • Moderately poor if the household daily

businesses’ but try hard to achieve per capita income is US$1.90 PPP or

institutional and financial viability as soon higher but under US$3.10 PPP and

as possible; • Not poor if living on more than US$3.10

• Group lending is one approach to PPP per day.

combating all three problems: insufficient • 'Marginal Farmer' means

client information, lack of collateral, and a farmer cultivating (as owner or tenant or

high operating costs per transaction. share cropper) agricultural land up to 1

• The MFI lends funds to a group of people, hectare (2.5 acres).

often about five or six, though the groups • ‘Small Farmer' means

can grow quite large to even 20 or 30 a farmer cultivating (as owner or tenant or

individuals. share cropper) agricultural land of more

• The total amount loaned to the group is the than 1 hectare.

account figure on the MFI’s books, all • People living in ultra-poverty are

disbursed and repaid at the same time. confronted by a multitude of

• By pooling several clients into one loan interconnected and cyclical problems.

agreement, MFIs keep their costs per client • They have little or no land or productive

in check. assets and simultaneously struggle to cope

• It also helps the MFIs feel more with food shortages, poor health, social

comfortable about potential risks, because stigma, and a lack of basic services like

the groups self-select. In this way the clean water and sanitation.

group behaves as collateral. • They are mostly excluded from social

• MFIs are diversifying into other target services and healthcare, generally live in

segments, including near-poor groups, by remote areas disconnected from markets,

developing new financial products along and are often unable to work due to

with the traditional management system.

prolonged illnesses or disability in the • Grameen mainly served women as it found

family. that they generally repay loans on time,

• Conventional development programmes invest their money for productive

have not been able to cope with these purposes, and make expenditures to

complex, interrelated needs. improve the quality of life of family

• 12.9% of the population in Bangladesh members.

live below the global poverty line of • Grameen also believed that this increased

USD 1.90 per day. women’s agency over resources by

enhancing their traditional role as

household budget managers.

• BRAC rapidly evolved into the world’s

largest, most renowned and diverse not for

profit organization, offering holist

development solutions to millions of poor

people across the globe. Microcredit was

but one strand of BRAC’s multi-faceted

interventions to address poverty. BRAC

operating in seven countries including

Bangladesh, Pakistan, Tanzania, Uganda,

Sierra Leone, Liberia, and Myanmar.

• ASA pivoted to a sole focus on

• Four types of institutions involved in microcredit lending. The objective of this

micro-finance activities. shift was to overcome a dependence on

international donor agencies and become a

1) Grameen Bank (GB), a member owned

specialized microfinance organization that

specialized institution,

was financially self-sufficient. ASA soon

2) Around 1500 Non- Governmental became the most profitable MFI in

Organizations (NGO) like BRAC, Proshika, Bangladesh, generating annual net

ASA, BURO-Tangail, BEES, CODEC, SUS, surpluses since 1992.

TMSS, Action- Aid etc.

• BURO introduced partial savings

3) Commercial and Specialized banks like withdrawal in 1990, and moved to

Bangladesh Krishi Bank (BKB), Rajshahi Krishi completely open access saving system

Unnayan Bank (RAKUB) and unaffected by loan outstanding in 1998.

4) Government sponsored micro finance projects/ This led to a substantial increase in

Programs like BRDB, Swanirvar Bangladesh, deposits and net savings.

RD-12 and others which are run through several • BURO revolutionized the microcredit

ministries viz., Ministry of Women & Children landscape of Bangladesh by overcoming

Affairs, Ministry of Youth & Sports, Ministry of the industry’s obsession with credit alone

Social Welfare etc. and integrating savings into the range of

• The Grameen approach broke barriers of offerings for the clients.

availing credit for the poor by pioneering • BURO continues to lead much of the

the joint-liability lending model, offering innovation and broadening of the range of

collateral-free loans.

financial services offered by MFIs in the • Nationalized Commercial Banks (NCBs),

country. and Specialized Banks like BKB and

Influence and global expansion of RAKUB have been encouraged to provide

microfinance models of Bangladesh a considerable amount of their rural credit

• The biggest impact that came as a result to the poor without security.

of Grameen Bank’s early success was • Private Commercial Banks (PCBs) have

convincing the banks and other people that also started direct and linkage programs

the poor are bankable, they utilize their with NGOs.

loan and repay on time, performing better • More than a thousand of institutions are

in contrast to the wealthy borrowers of the operating microcredit programs, but only

bank. 10 large Microcredit Institutions (MFIs)

• The simple effectiveness of the model and Grameen Bank represent 87% of total

conceived by GB has inspired many NGOs savings of the sector and 81% of total

to emulate the model and offer similar outstanding loan of the sector.

financial services to the poor. • Through the financial services of

• Since its inception, Grameen Trust has microcredit, the poor people are engaging

provided assistance to 151 organizations in themselves in various income generating

41 countries. activities and around 30 million poor

• By 2020, BRAC had already been ranked people are directly benefited from

the #1 NGO in the world for the fifth microcredit programs.

consecutive time by NGO Advisor, an • Credit services of this sector can be

independent Geneva-based media categorized into six broad groups: i)

organization. general microcredit for small-scale self

• BRAC ranked as the top NGO for the first employment based activities, ii)

time in the Global Journal’s list of the 100 microenterprise loans, iii) loans for ultra

Best NGOs in the world in 2013. poor, iv) agricultural loans, v) seasonal

loans, and vi) loans for disaster

• ASA International currently has 1,961

management.

branches, over 2.4 million clients, and an

outstanding loan portfolio of USD 418.5 • At the end of June 2018, 805 licensed

million in thirteen countries outside MFIs and 128 provisional licensed MFIs

Bangladesh. provided microfinance services to 30.5

million people But, Grameen Bank is out

Categories of Microcredit Institutions

of the jurisdiction of MRA as it is operated

• All the programs are targeted at the under a distinct legislation- Grameen Bank

functionally landless rural poor. Ordinance, ‘83.

• All the MFIs provide mostly small, un- • The market scenario of NGO-MFIs in

collateralized one-year term loans to Bangladesh: The top two MFIs contribute

individuals belonging to jointly liable peer a more than 50 percent of total loan

groups, and they use similar on-site loan outstanding as well as savings of the

disbursement and weekly collection microfinance sector in Bangladesh.

methods by forming village organizations

• Two of the largest MFIs, viz., BRAC &

or centers.

ASA, are each serving over four million

borrowers. Two largest organizations have

control of over 50 percent in terms of both • Large MFIs: The sector has got a group of

clients and total financial portfolios. large MFIs whose memberships vary

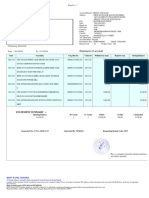

Institution-wise Cumulative Loan Disbursement between 50,000 to one million.

• All of them are PKSF partner MFIs except

BURO Bangladesh. Even within the group

two organizations, TMSS and BURO-B

separate them from the others and have

expanded into more than 40 districts with

their networks.

• Medium Size MFIs: Above two groups are

followed by organizations with 5-50,000

members (3 to 30 branches) which are

local or regional organizations mostly

Financial Services by MFIs

financed by PKSF.

• Sector Structure

• Small MFIs: MRA has a cut-off point of

• In terms of memberships / clients (and 1000 memberships, and Taka 4 million in

consequently portfolio size) the structure loans outstanding for receiving license.

of the microfinance sector is as follows: Several hundred such MFIs operate in the

• Three very large MFIs: Three very large country although the exact number is not

organizations – ASA, BRAC and Grameen known.

Bank- dominate the microfinance sector, • Very small MFIs: Smaller NGOs with very

each having more than 7 million limited resources for loan disbursement,

members/clients (ASA 7.28 million, use mostly savings; are still operating,

BRAC 8.15 and Grameen Bank 7.67 which may face extinction for not

million) all products combined. qualifying for license.

• These three MFIs have achieved • ASA has 2,932 branches, BRAC has 2,083

spectacular lateral expansion, that is, to branches, BURO Bangladesh has 790

include new clients in same or new branches and TMSS has 578 branches.

geographical areas by enhanced

• G. Bank has more than 8.81 mn members

management efficiency, standardized

constituting over 24% in 2015. ASA has more

management practices, products and

than 6.90 mn members and BRAC’s number

policies, and mobilizing financial

of members is 5.38 mn.

resources.

• Of the total loan amount disbursed, the

• The three combined has 8,547 branches,

MF-NGOs disbursed 37% followed by BRAC

19.16 million borrowers and loan

(23%), ASA (21%) and GB (18%).

outstanding of Taka 125,87 million at the

end of December 2015 (ASA Taka • The recovery rate of MF-NGOs in 2015 is

176,832 million (21.36%), BRAC Taka 98%, which is equal to ASA (98%) and

192,983 million (23.31%) and Grameen BRAC (98%). In this year, GB has the

Taka 149,227 million (18.03%). highest rate of recover of 100%.

• All 3 organizations have branch networks • The total net savings, GB has mobilized

throughout the country except in a few 44%, ASA: 16%, BRAC: 15% and the rest

remote char and coastal areas. MF-NGOs: 25%.

• GB is the single largest savings mobilizing •These insurance practices are loan

MFI as it has a good number of savings insurance, life insurance, live-stock

products. Besides, as a bank it can collect insurance, accidental & health insurance

deposits from the general public. and members’ welfare fund.

• Sources of loan funds: The major • The MFI insurance practice is approved by

contributors have been found to be the the MRA law, which was enacted in the

members’ savings, own fund, PKSF, Parliament and is very much legal.

banks, and surplus income. The other • The insurers have to pay a nominal fee.

sources were reserve fund, emergency There are organizations that do not even

fund, insurance fund, grants by donors, charge any fee at all. Such organizations

international NGOs, local NGOs and have developed a welfare fund from their

others. own earnings.

• Most common insurance practice is called

loan insurance. Most MFIs have loan

insurance. This insurance is applicable

generally for the duration of the loan.

• In most cases of loan insurance, the

spouses are covered.

Commercial Banks in Retail Microcredit

• Currently NCBs have largely abandoned

lending to group-based small loan

programs but have maintained their

original individual loan operations. In

addition, two of them (Sonali and Agrani)

and also one of the specialized banks,

BASIC Bank, have opted for wholesale

lending to NGO-MFIs.

• BKB and RAKUB follow individual

lending techniques for their own

operations and lend to groups organized by

NGOs/projects.

• Private Banks, with the exception of IBBL

which has a large and profitable retail

Grameen styled loan operations with more

Micro-insurance practices of MFIs than 589,000 clients in addition to its

normal individual banking operations,

• MFIs have 5 kinds of insurance practices

opted for wholesale lending to MFIs.

for their clients, which are very short-term

in nature. These practices have been • Foreign banks offer small loans to

devised by individual MFIs to ensure the individual borrowers mainly in urban

welfare and wellbeing of the clients in centers.

their distress situation. • Small loans (up to BDT 500,000) are

available from two types of formal

financial institutions: commercial banks • Launched in 1995 as pilot program styled

and two specialized banks, BKB and after the Grameen Bank model except that

RAKUB. Before the emergence of the the scheme used Islamic modes of

vibrant MFI sector, these banks were the investment. The program runs side by side

main sources of small loans, especially for with the commercial banking operation of

agriculture and trade. the bank and forms groups of women to

• Recently a number of PCBs have also provide small loans.

entered in this segment in urban centers. • As a bank it collects savings. But it shows

• The highest number of clients belongs to lot more flexibility than MFIs in terms of

BDT 5,000 to 50,000 category duration of loans: one to five years

representing 88% of borrowers and 55% of depending on the type of investments.

loan outstanding. Although the total • For example, housing loan is given for five

number of clients is high (8.3 million), a years. The rate of interest is 10% which is

significant number of them, especially half of BRAC and ASA.

those from the NCBs and specialized • Similar to MFIs, 92% of the members are

banks, are believed to be inactive due to women. Loan outstanding was Taka

high loan default. [Source: Bangladesh 3,204.13 million ($47.12 million) and

Bank] repayment rate was 99%.

• Of the total small clients, 91% comes from • Although RDS is offered from its 136

NCBs and the specialized banks. This has branches in 61 district IBBL has recruited

been due to their wide branch networks in a separate cadre of officials to run the

rural areas and mandate for disbursing program.

agricultural credit to small holders. • While NCBs left retail microcredit

• Private Banks are insignificant operators in operations and other PCBs opted for

this small business segment, limiting wholesale lending IBBL shows that a PCB

themselves in urban centers to serve large with proper management and motivation

clients. can profitably run microcredit operations

• Agricultural credits top the list of as well.

outstanding loans followed by trade. There GOB Owned MF programs and cooperative

are two other formal institutions, BSBL societies

and BRDB (state-owned), which are also

Non-Bank Government Departments and

active in this sector. But the disturbing Institutions

issue is the very low rate of recovery of

• 17 GOB ministries and departments were

agricultural credits.

engaged in either retail or wholesale

• All formal banks require collateral to microcredit operations for diverse groups

receive loans, especially for loans more of poor people. However, most of the

than BDT 50,000. projects collapsed or closed when donor

• One of the main reasons for emergence of funds (CIDA) ended.

MFIs in Bangladesh is the dismal failure • CDF reports that 13 GOB ministries and

of NCBs, BKB and RAKUB to reach the departments were still running microcredit

poor who need small loans but cannot program.

offer physical collateral.

Rural Development Scheme (RDS) of IBBL

• Bangladesh Rural Development Board • But many market-based cooperatives

(BRDB) manages the largest of such reportedly are doing (should it not be

operations as ‘projects’. extending in place of doing) microcredit to

• Consequently the portfolio quality, loan non-shareholders. But the quality and

recovery rates and financial viability are sustainability of such operations are not

very poor. known.

LGED – Cooperative Approach Interest Rate

• Several other government departments • The rate of interest of microcredit

such Local Government Engineering programs is expected to be higher than

Department and Water Development commercial bank’s lending rate due to

Board construct water control, irrigation small size of loan and high delivery cost

and drainage projects in different parts of but there is general public perception that

the country. MFIs charge ‘excessive’ interest on loan.

• Both agencies, mostly LGED, have formed • Grameen Bank used to charge 16%

hundreds of cooperative societies by (effective rate) same as commercial banks’

people living in the project command areas lending rate.

to take over the maintenance of water • But it then increased to 18% then to 20%

infrastructure. to reflect its cost of operations and cost of

• These cooperatives have undertaken fund.

savings and credit operation and even

borrowed from a fund created by LGED.

• However, an assessment of sample

cooperatives shows that the microcredit

operations are either not functioning

because of many management problems or

not viable due to tiny portfolio size.

• In few cases where the cooperatives run

irrigation projects (sell water for boro

cultivation) and provide seasonal

agricultural loan have shown success in

loan recovery.

Cooperative Societies in Microfinance • Incidentally Grameen’s rate of interest on

• No comprehensive study is available on loan is the second lowest and interest paid

microfinance programs run by cooperative on savings is highest in the sector. That

societies within their shareholders or for has been possible due its economies of

outside borrowers. scale and higher average loan size due to

long microcredit operations, longer than

• Although the cooperative law clearly

any other organizations (Grameen Bank

permits savings and lending programs

began as bank in 1983 and ASA started in

within the members (shareholders) of the

1990-91).

societies but not clear about whether they

can accept savings from and lend to non- Factors determine the rate of interest

members.

• Cost of funds: This is the weighted average • Sounds high compared to loans like

rate of cost of different sources of capital mortgages in developed countries, it is

such as grants, savings, concessional loan, comparable to many credit card rates.

and commercial loans. • Operating cost is the biggest component of

• In early 1990s many small NGOs used to MFI’s expenditure item comprising mainly

run their microcredit with savings by of salary expenses. In general the average

paying no or small interest and grants from salary in microfinance sector has gone up

donors. and the salary gap at the field level

• But now payment of interest on savings between large and medium/small MFIs has

has become universal, grants have dried also reduced due to increase in income,

up, most small MFIs borrow from PKSF recently due to inflationary pressure, and

and many MFIs borrow from commercial demand for skilled staff members.

banks at the rate of 12-15% interest. • Cost of risk or loan losses is covered by

• Grameen Bank fully depends on members keeping provision, which is, creating a

and public deposits and pay competitive reserve for future loss. PKSF ensures that

interests. loan-loss provisions are kept and MRA

• Unfortunately, administrative and recommends also creating such reserve.

processing costs are typically much higher Savings and Beyond

than at traditional commercial banks. • The income of poor people could not cover

• It is much more time consuming and traditional large costs, such as weddings

expensive to lend 5,000 small $200 and funerals, school fees for their children,

transactions than to lend out just one or investment opportunities like acquiring

commercial business loan worth the same a dairy cow to sell milk.

$1 million. • Many poor also often suffer significant

• That is because processing and unpredictable day-to-day fluctuations in

administrative costs are not directly income and might go without any income

dependent on the size of the loan. for days or weeks.

• It costs essentially the same to process a • Furthermore, the poor need savings in case

$100 loan as a $1000 one. Suppose a of emergencies, such as illness or natural

transaction costs the bank $25 either way. disasters.

• The interest rate would need to be 25% • The poor lack access to savings accounts

just to break even on the $100 loan but that allow for tiny, frequent deposits, are

only 2.5% for the $1000 loan. physically accessible, and easy to

Furthermore, MFI staff may need to travel withdraw funds from when needed.

to the borrowers, adding costs in terms of • Innovative MFIs like BRI have found

fuel and hourly wages. ways to provide accessible savings

• According to the Consultative Group to accounts that are also financially viable

Assist the Poor (CGAP), an independent from an institutional perspective.

policy and research center that focuses on • In recent years a substantial number of

the spread of financial services to the poor, MFIs are changing from being NGOs

globally the average annual interest rate (which lack legal status to take deposits) to

charged by an MFI in 2011 was 27%. being formally licensed banks.

• BRI by 2015 had grown to 43 million businesses operating throughout the

microsavings client accounts and boasted a country, which so far have been outside

microsavings deposit portfolio of $14 the MFIs traditional lending programs.

billion. (d) Microfinance for marginal and small farmers

• Its own borrowers’ savings have become (BDT 10,000-50,000): So far only a small

the bank’s primary source of funding, number of MFIs has ventured into this segment

allowing it to become completely self- by following group-based lending techniques

sufficient and independent. with limited outreach.

• BRI has taken microsavings to the next • Seasonal loans with shorter duration (3-9

level by also providing more than 22,000 months) are disbursed and collected in one

ATMs—including some mobile ones on installment, for example after harvest.

boats to reach remote areas—and more • MFIs cater mostly to women groups.

than 10,000 accessible branches Savings Products

throughout the many islands that make up

• Mandatory weekly savings with or without

Indonesia.

withdrawal facilities: All microcredit

Market, Product and Delivery System programs collect mandatory weekly

• The distinctive market segments in today’s savings as a condition for microcredit

Bangladesh microfinance sector are as provisions.

follows: • Additional savings account: BRAC allows

(a) Mainstream microcredit (BDT 5,000- opening up savings bank account where

30,000, approx USD 70-425): available members may transact according to their

financial service for the ‘moderately’ poor will.

following the Grameen model of group- • Time deposit: An amount of money kept for a

based lending. fixed time for higher interest for example by ASA

• This category includes the common and GB.

programs of NGO-MFIs serving the poor • Small regular savings to get a lump-sum

and moderately poor. after a fixed period: This type of savings

• The amount then invested in petty trades, has been most successfully introduced by

poultry and livestock, fisheries, numerous Grameen Bank.

small agro-processing activities and Credit Products Offered by MFIs

horticulture.

Microenterprise Loan Program

• The main focus remains on poor women.

• Another distinctive market segment being

• (b) Programs for the hardcore poor (BDT served by the MFIs. This has been due to

500-5,000): Have been adopted to redress several factors:

the problem of meeting the needs of the

• Demand from better performing

poorest for financial services.

(‘graduating’) borrowers for larger loans

• (c) Microenterprise program (BDT compared to loans normally given under

25,000-500,000): One relatively new ‘mainstream microcredit’;

frontier for the MFIs is loans for the

• Demand from small enterprises throughout

development of microenterprises managed

the country, which are not the members of

by ‘graduates’ from microfinance

microcredit groups but willing to take

programs as well as millions of informal

loans for running or expanding businesses;

• Small enterprises that do not qualify for • Small Enterprise Loan (SEL) of ASA is

receiving loans from commercial banks targeting microenterprises for ‘productive

but need capital; purposes’ (for example, manufacturing and

• MFIs are also actively seeking to expand processing), that is, ASA under this

portfolio (and income) by serving this program avoids traders.

group. • Small Business Loan program ASA lends

• Another reason for devising loan product to shop owners in rural market places to

for this group is that microenterprises finance inventory.

create wage employment for poor people • ME-PKSF funded NGOs: PKSF under a

in addition to self-employment for the separate lending window provides loans to

owners. its partner organizations to finance

Definition of Microenterprise microenterprises of ‘graduates’ of

• In Bangladeshi context, there is no microcredit programs.

uniformly understood definition for • The Micro Enterprise Development

microenterprise. The term is used to Initiative (MIDI) is a special credit

indicate that they are larger than income program of MIDAS Financing Limited,

generating activities financed by non-bank financial institution provides

microcredit programs. loans to small entrepreneurs, especially

Microenterprise among women.

• These are bigger than the millions of • Commercial banks: There has been a

family-managed income generating visible trend in the private and

activities financed by microfinance nationalized banks to try to reach out the

programs all over the country. microenterprises.

• Although there is no acceptable uniform • Leasing companies: Although leasing

definition, the following characteristics companies are not in a big way in this

may be used to develop a profile of such segment but increasingly some leasing

ventures: companies are getting involved in small

leases. They are the biggest borrowers of

• Employ less than 10 persons; employ

Bangladesh Bank managed SME Fund.

capital machineries in case of

manufacturing units; capital is between

Taka 20,000 to 1,000,000; sells within the

local as well as distant markets.

Brief Descriptions of Prominent Programs

• Grameen Bank: Grameen Bank provides

larger loan amount to microenterprises for

1 to 3 years.

• BRAC- Progoti: The Progoti program

(formally known as MELA) currently

serves two types of clients both in rural

and urban areas: ‘graduates’ of

microfinance program, and the non-poor

micro-entrepreneurs.

You might also like

- Micro Finance PPT FinalDocument37 pagesMicro Finance PPT FinalVaibhav Alawa100% (2)

- Confessions of a Microfinance Heretic: How Microlending Lost Its Way and Betrayed the PoorFrom EverandConfessions of a Microfinance Heretic: How Microlending Lost Its Way and Betrayed the PoorRating: 3.5 out of 5 stars3.5/5 (5)

- How To Open A Bank Account For An LLC OnlineDocument8 pagesHow To Open A Bank Account For An LLC OnlineStepford UniversityNo ratings yet

- Unit One Microfinance OverviewDocument15 pagesUnit One Microfinance OverviewCome-all NathNo ratings yet

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Strategic Management of Southeast Bank LimitedDocument32 pagesStrategic Management of Southeast Bank LimitediqbalNo ratings yet

- TRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDocument302 pagesTRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchNo ratings yet

- Ibt RevDocument4 pagesIbt RevKim SunooNo ratings yet

- Microfin Reviewer MDTDocument1 pageMicrofin Reviewer MDTKim SunooNo ratings yet

- Microfinance 8431683779625937Document25 pagesMicrofinance 8431683779625937AR47No ratings yet

- Microfinance - 1Document47 pagesMicrofinance - 1Balasingam PrahalathanNo ratings yet

- MicrofinanceDocument6 pagesMicrofinanceyasirseyyid100% (1)

- NavdeepDocument18 pagesNavdeepArshdeep SinghNo ratings yet

- Week34 Grameen ApproachDocument26 pagesWeek34 Grameen ApproachGilarie AlisonNo ratings yet

- Unit 1Document92 pagesUnit 1Amrit KaurNo ratings yet

- Research Study About The Role of MicrofinanceDocument4 pagesResearch Study About The Role of Microfinancedhanush rNo ratings yet

- 43 Micro CreditDocument16 pages43 Micro CreditAli Muhammad TunioNo ratings yet

- Microfinance (D)Document75 pagesMicrofinance (D)smithNo ratings yet

- Assignment of Financial InstitutionDocument9 pagesAssignment of Financial InstitutionKamalpreet_Mad_6500No ratings yet

- Microfinance PresentationDocument5 pagesMicrofinance Presentationnidhi1726No ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument72 pagesMicro-Finance Management & Critical Analysis in IndiaAtul MangaleNo ratings yet

- Micro-Finance/credit Institution: Its Principles, and Relevance in Liberia's Post-War ReconstructionDocument9 pagesMicro-Finance/credit Institution: Its Principles, and Relevance in Liberia's Post-War ReconstructionGleh Huston Appleton100% (4)

- Hastra: Information Technology SolutionsDocument14 pagesHastra: Information Technology SolutionsSarthak ParnamiNo ratings yet

- Microfinance: Creating Opportunities For The Poor? By: Susana KhavulDocument8 pagesMicrofinance: Creating Opportunities For The Poor? By: Susana KhavulMuhammad ShahidNo ratings yet

- A Study On Microfinance Sector in KarnatakaDocument84 pagesA Study On Microfinance Sector in KarnatakaPrashanth PB100% (3)

- Microfinance Principles and PracticeDocument17 pagesMicrofinance Principles and Practicejamesamani2001No ratings yet

- Barathan.S Ii Year MbaDocument20 pagesBarathan.S Ii Year Mbabarathan08No ratings yet

- Micro Finance AssignmentDocument4 pagesMicro Finance AssignmentLimasenla Moa100% (1)

- The History of MicrofinanceDocument8 pagesThe History of Microfinancevv9408922438No ratings yet

- Prelim Topic 2Document8 pagesPrelim Topic 2Sairah Camille ArandiaNo ratings yet

- MF Briefing Doc EnglishDocument8 pagesMF Briefing Doc EnglishButterfly DiaryNo ratings yet

- FIP 3Qtr2013Document8 pagesFIP 3Qtr2013Karol Mikhail Ra NakpilNo ratings yet

- The History of MicrofinanceDocument9 pagesThe History of MicrofinanceKhawaja Muzaffar Mehmood100% (1)

- Impact of Self-Help Groups On Socio-Economic Empowerment of Women: A Study in Uttrakhand StateDocument13 pagesImpact of Self-Help Groups On Socio-Economic Empowerment of Women: A Study in Uttrakhand StateUsha JadhavNo ratings yet

- MicrofinanceDocument77 pagesMicrofinancePramish SubediNo ratings yet

- Micro Finance and NGO'sDocument50 pagesMicro Finance and NGO'sMunish Dogra100% (1)

- MicrofinanceDocument65 pagesMicrofinanceRahul AksHNo ratings yet

- An Assignment On Microcredit in BangladeshDocument15 pagesAn Assignment On Microcredit in Bangladeshhimi.asifNo ratings yet

- Group#1 - MicrofinancersDocument14 pagesGroup#1 - MicrofinancersBianca MedrandaNo ratings yet

- Case Study On MicrofinanceDocument18 pagesCase Study On MicrofinanceTusharika RajpalNo ratings yet

- Various Islamic Microfinance Models and Its Effectiveness On Poverty AlleviationDocument19 pagesVarious Islamic Microfinance Models and Its Effectiveness On Poverty Alleviationasif.aza.coNo ratings yet

- Chapter Four: Micro-Financing InstitutionsDocument7 pagesChapter Four: Micro-Financing InstitutionsBekele DemissieNo ratings yet

- MicrofinanceDocument57 pagesMicrofinancepallavi gurav100% (1)

- Lecture - 02 Micro Credit & NGOs To Alleviate PovertyDocument25 pagesLecture - 02 Micro Credit & NGOs To Alleviate PovertyRaef AhmedNo ratings yet

- Unit-1 Over View: Microfinance Rural Banking and Development FinanceDocument46 pagesUnit-1 Over View: Microfinance Rural Banking and Development FinanceAMIT SINDHUNo ratings yet

- MicroDocument28 pagesMicro1k12No ratings yet

- Microfinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsDocument8 pagesMicrofinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsRohan_Kapoor_4806No ratings yet

- Microfinance and Poverty AlleviationDocument27 pagesMicrofinance and Poverty AlleviationIzma HussainNo ratings yet

- Microfinance Regulation in India. Microfinance ManagementDocument5 pagesMicrofinance Regulation in India. Microfinance ManagementRavindra SalviNo ratings yet

- Microfinance - IntroductionDocument7 pagesMicrofinance - Introductionbeena antuNo ratings yet

- The History of Microfinance PDFDocument8 pagesThe History of Microfinance PDFTheodorah Gaelle MadzyNo ratings yet

- Micro Finance Ravi Mathur Mms-FinDocument55 pagesMicro Finance Ravi Mathur Mms-FinSwati KakadNo ratings yet

- 1 What Is MicrofinanceDocument39 pages1 What Is MicrofinanceAbhishek GargNo ratings yet

- Chapter 1 NotesDocument15 pagesChapter 1 Notesthete.ashishNo ratings yet

- How Will The Goal Be Achieved?: MicrocreditDocument4 pagesHow Will The Goal Be Achieved?: MicrocreditthundergssNo ratings yet

- CH Allen EgsDocument5 pagesCH Allen EgsY N S Y SNo ratings yet

- Micro Finance: Chapter FourteenDocument17 pagesMicro Finance: Chapter FourteenNhon HoangNo ratings yet

- Please Read: A Personal Appeal From Wikipedia Author LilarojaDocument23 pagesPlease Read: A Personal Appeal From Wikipedia Author LilarojaavismlNo ratings yet

- Concept of Micro CreditDocument16 pagesConcept of Micro CreditSyed Wahidur RahmanNo ratings yet

- 05 Chapter-1 PDFDocument52 pages05 Chapter-1 PDFRohitNo ratings yet

- A Brief History of Credit ReviewerDocument2 pagesA Brief History of Credit ReviewerJAM CLNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- Small Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and BeyondFrom EverandSmall Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and BeyondNo ratings yet

- Financial Management: Week 10Document10 pagesFinancial Management: Week 10sanjeev parajuliNo ratings yet

- 22 Siga An V VillanuevaDocument1 page22 Siga An V VillanuevaPring SumNo ratings yet

- Sadia Banu 111Document4 pagesSadia Banu 111Pankhuri KaushikNo ratings yet

- Sbi New Health InsurSBI NEW HEALTH INSURANCE SCHEMEance SchemeDocument17 pagesSbi New Health InsurSBI NEW HEALTH INSURANCE SCHEMEance SchemefmsrypNo ratings yet

- Money and BankingDocument7 pagesMoney and Bankingaamiralishiasbackup1No ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- Group Assignment On Bangladesh BankDocument20 pagesGroup Assignment On Bangladesh BankAlphahin 17No ratings yet

- Capital FirstDocument92 pagesCapital FirstviswanathNo ratings yet

- How Visa Makes Money and Understaning Visa Business ModelDocument5 pagesHow Visa Makes Money and Understaning Visa Business ModelAchintya MittalNo ratings yet

- KrazyBee Services Private LimitedDocument9 pagesKrazyBee Services Private LimitedBalakrishnan IyerNo ratings yet

- Case Study Mki - BladesDocument3 pagesCase Study Mki - Bladeslily kusumawati100% (1)

- Indusind BankDocument85 pagesIndusind BankMamata Panadi50% (2)

- 1542438436593Document1 page1542438436593kushalNo ratings yet

- s17 Cash and Cash Conversion CycleDocument22 pagess17 Cash and Cash Conversion CycleKranti PrajapatiNo ratings yet

- Accounting Paper 3 Summer 03Document16 pagesAccounting Paper 3 Summer 03igcsepapersNo ratings yet

- M/Chip Functional Architecture For Debit and Credit: Applies To: SummaryDocument12 pagesM/Chip Functional Architecture For Debit and Credit: Applies To: SummaryAbiy MulugetaNo ratings yet

- Alm Review of LiteratureDocument17 pagesAlm Review of LiteratureSai ViswasNo ratings yet

- Transfer of Property Act 1882 CSDocument15 pagesTransfer of Property Act 1882 CSShubham Jain Modi100% (1)

- 1.industry Profile: 1. Primary FunctionDocument70 pages1.industry Profile: 1. Primary FunctionBhavanams Rao0% (1)

- HUDCO's ObjectivesDocument8 pagesHUDCO's ObjectivesAvishek GhosalNo ratings yet

- Difference Between Bill of Exchange and Cheque - CheckDocument2 pagesDifference Between Bill of Exchange and Cheque - Checkksumukh86No ratings yet

- 10.21.2017 Audit of ReceivablesDocument10 pages10.21.2017 Audit of ReceivablesPatOcampoNo ratings yet

- Accounting Equation ProblemDocument2 pagesAccounting Equation ProblemSenthil ArasuNo ratings yet

- Home LoanidbiDocument2 pagesHome LoanidbivinodmcaNo ratings yet

- Bahan Rakor HLP.Document21 pagesBahan Rakor HLP.Aprilo DielovaNo ratings yet

- Sample Group FIT Rate Agreement T CsDocument1 pageSample Group FIT Rate Agreement T CsBharatRajNo ratings yet

- Loan Products of The City Bank LimitedDocument7 pagesLoan Products of The City Bank LimitedQuazi AsaduzzamanNo ratings yet