Professional Documents

Culture Documents

Consumer Banking BBA

Consumer Banking BBA

Uploaded by

vani3826Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Banking BBA

Consumer Banking BBA

Uploaded by

vani3826Copyright:

Available Formats

Fundamentals of Consumer Banking

Course Description

This course is the study of the provision of products and services to meet the financial needs of

individuals with a steady and verifiable income flow. This course starts with a survey of

consumer banking, consumer banking products from deposits, and credit cards to mortgage, auto,

house and personal loans, risk assessment related to these loans and followed by an investigation

of mobile / internet banking services, customer asset management system; call centers

effectiveness, and the real-life case study.

Course Objectives and Learning Outcomes

Upon completion of the course you will gain:

Basic Understanding of Consumer Banking, Banking Business Model

Emerging Issues in Consumer Banking

The Nature and Importance of Credit Risk- Largest Source of Bank Losses

Risk Analysis and Critical Success Factors

An opportunity to undertake some additional/complimentary learning which could help them

succeed in their work/professional lives, i.e. choosing any occupation/carrier in general or

Banking/Finance in particular

Course Contents:

Consumer Banking (Over view of consumer banking in terms of Micro and macro level), Bank

Business & Operating Model (BOM): An Extended Context. Consumer, Consumer Rights &

Protection, Essentials of Valid Offer, Revocation of Offer, Acceptance Definition, Essentials of

Valid Acceptance, Revocation of Acceptance, Communication of Offer, Acceptance and

Revocation, Key Issues in CB Consumer’s Perspective , Emerging Issues in Retail Banking,

Structure of Bank Credit Risk An Overview, Consumer Financing in Pakistan An Overview,

Auto Financing/Leasing in Pakistan, Bank Schedule of Charges (Creation and calculation of

charges), Case Study: Consumer Financing in Pakistan Issues, Challenges and way Forward

Study / Report, Code of Consumer Banking Practice: Institute of banker Pakistan, Growth

Strategy in Retail Banking, Capturing Consumer Finance Opportunities in, Emerging Markets,

Market-Based Approach for Poverty Reduction (Micro Finance in Pakistan) , SBP prudential

regulations in terms of consumer Banking, Review of Bank credit risk criterions, SBP Risk

Management Guidelines, Housing/Mortgage Finance in Pakistan , Report on : Global Perspective

on Managing Mortgage Profitability Retail Banks at a Crossroad in 2009 Principal Findings,SBP

Operational Guidelines for Credit Cards Business in Pakistan, Building, Consumer Trust in Retail

Payments, Compaction in Consumer banking and strategies for survival

Text/Reference Books:

1. The consumer Banking Regulatory by Price Water house cooper.

2. State Bank of Pakistan (Website for prudential Regulation).

3. Consumer Banking Handouts (Virtual University).

4. Consumer banking by Sefton Anthony Solo man.

You might also like

- DIY Credit Repair GuideDocument21 pagesDIY Credit Repair GuideAnthony VinsonNo ratings yet

- Assignment 1 - Financial Accounting 1A Introduction To Accounting Financial Accounting 1Document4 pagesAssignment 1 - Financial Accounting 1A Introduction To Accounting Financial Accounting 1aldrid100% (1)

- Project On Retail BankingDocument74 pagesProject On Retail BankingManasvi Darshan Tolia80% (5)

- Bloomberg Market Concepts PDFDocument12 pagesBloomberg Market Concepts PDFMehul Rathi0% (1)

- Kaleidoscopic View of BankingDocument89 pagesKaleidoscopic View of BankingRahul D'abreoNo ratings yet

- Products and Services Provided by BanksDocument61 pagesProducts and Services Provided by BanksVinay GovilkarNo ratings yet

- Resume - Shailesh BudhiaDocument2 pagesResume - Shailesh BudhiaShadab Khan100% (1)

- Spark Python Course APPLY Project Problem StatementDocument3 pagesSpark Python Course APPLY Project Problem StatementDeepakNo ratings yet

- Overview of Banking: ObjectiveDocument3 pagesOverview of Banking: ObjectivePratik SawalaniNo ratings yet

- Excutive SummaryDocument42 pagesExcutive SummaryRiya TomarNo ratings yet

- Retail Banking in Suko Bank SNDDocument43 pagesRetail Banking in Suko Bank SNDhasanNo ratings yet

- Corporate BankingDocument122 pagesCorporate Bankingrohan2788No ratings yet

- Analysis On Deposits Schemes of Indusind BankDocument76 pagesAnalysis On Deposits Schemes of Indusind BankKarthik GsNo ratings yet

- Retail Banking - PDF Syallabus Bba PDFDocument2 pagesRetail Banking - PDF Syallabus Bba PDFAnonymous So5qPSn100% (1)

- Consumer Financing in Pakistan Issues & Challenges - PROJECTDocument88 pagesConsumer Financing in Pakistan Issues & Challenges - PROJECTFarman Memon100% (1)

- Impact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanDocument5 pagesImpact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanthNo ratings yet

- Synopsis Cannra BankDocument3 pagesSynopsis Cannra BankGagan KauraNo ratings yet

- Session Plan - Banking - Class of 2022Document6 pagesSession Plan - Banking - Class of 2022ZeusNo ratings yet

- Retail Banking (Scope)Document2 pagesRetail Banking (Scope)anant21198633% (3)

- Emerging Trends in Retail BankingDocument6 pagesEmerging Trends in Retail Bankinganandsree12345100% (3)

- Black BookDocument23 pagesBlack BookMukesh ManwaniNo ratings yet

- 2.10 Retail BankingDocument14 pages2.10 Retail BankingSrinivas RaoNo ratings yet

- Commercial BankingDocument2 pagesCommercial BankingGajendra JaiswalNo ratings yet

- JB Genaral BankingDocument40 pagesJB Genaral BankingKajol HossainNo ratings yet

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesDocument6 pagesMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenNo ratings yet

- Universal Banking LatestDocument189 pagesUniversal Banking LatestSony Bhagchandani50% (2)

- Relationship Banking AssignmentDocument17 pagesRelationship Banking AssignmentIftekharul Alam ChyNo ratings yet

- Research Opportunities and Challenges of Buy Now Pay Later Service For Commercial Banks in VietnamDocument23 pagesResearch Opportunities and Challenges of Buy Now Pay Later Service For Commercial Banks in Vietnamk60.2112280025No ratings yet

- GP CoreDocument133 pagesGP CoreDivya GanesanNo ratings yet

- ReportDocument13 pagesReportmirzaNo ratings yet

- RB Chapter 1 - Introduction To Retail BankingDocument7 pagesRB Chapter 1 - Introduction To Retail BankingHarish YadavNo ratings yet

- Practice Banking SyllabusDocument2 pagesPractice Banking SyllabusSrinivas GowdaNo ratings yet

- A Study On Services Quality of SBI In: P.RoselinDocument4 pagesA Study On Services Quality of SBI In: P.RoselinSanchit ParnamiNo ratings yet

- Introduction and Design of The Study: Chapter - IDocument12 pagesIntroduction and Design of The Study: Chapter - IDrSankar CNo ratings yet

- Certificate: A Project Report On "Retail Banking"Document27 pagesCertificate: A Project Report On "Retail Banking"Parag MogarkarNo ratings yet

- Credit Risk Management AT Punjab National BankDocument4 pagesCredit Risk Management AT Punjab National BankSahil SethiNo ratings yet

- Images - Download - Jbfsir - Jbfsir - December - 2011 - (Complete) - 2 Deepak Gupta A Comparative Study of Customer Friendly ServicesDocument12 pagesImages - Download - Jbfsir - Jbfsir - December - 2011 - (Complete) - 2 Deepak Gupta A Comparative Study of Customer Friendly ServicesAmit RajputNo ratings yet

- Final Project Report SimranDocument42 pagesFinal Project Report SimransimranNo ratings yet

- A2Document16 pagesA2Varsha VarshaNo ratings yet

- Cib CoursesDocument10 pagesCib CoursesEnusah AbdulaiNo ratings yet

- Ba8c3banking and Financial InstitutionsDocument1 pageBa8c3banking and Financial InstitutionsAyush ChhabraNo ratings yet

- Nitish India Banking 00923009001533Document68 pagesNitish India Banking 00923009001533Ghulam AbbasNo ratings yet

- Synopsis 1Document16 pagesSynopsis 1Vipul GuptaNo ratings yet

- Chapter - 1Document8 pagesChapter - 1rajkumariNo ratings yet

- Reflection Note4 1711031 MayankDocument5 pagesReflection Note4 1711031 MayankMK UNo ratings yet

- Rohit Final P-1Document113 pagesRohit Final P-1SpUnky RohitNo ratings yet

- Bank Marketing: Dr. Ram SinghDocument34 pagesBank Marketing: Dr. Ram SinghDrRam Singh KambojNo ratings yet

- MBA 468 2 Credits Objective: F 3 - Management of Banks and Financial InstitutionsDocument3 pagesMBA 468 2 Credits Objective: F 3 - Management of Banks and Financial Institutions05550No ratings yet

- Project On Retail BankingDocument74 pagesProject On Retail Bankingshreyshaw21No ratings yet

- ChapterDocument60 pagesChapterPrabin ChaudharyNo ratings yet

- Consumer Banking A Tool of Poverty Reduction & Socioeconomic DevelopmentDocument4 pagesConsumer Banking A Tool of Poverty Reduction & Socioeconomic DevelopmentsadiquehakimNo ratings yet

- Customer Satisfaction Analysis of Bank Products in The Light of Survey ResearchDocument13 pagesCustomer Satisfaction Analysis of Bank Products in The Light of Survey ResearchTwinkle JaiswalNo ratings yet

- Retail and Wholesale Banking in IndiaDocument12 pagesRetail and Wholesale Banking in Indiau2indiaNo ratings yet

- Uday BlackbookDocument61 pagesUday BlackbookRavi VishwakarmaNo ratings yet

- The Impact of Credit Cards On HDFC Bank Customers in Shimoga - An Evaluative StudyDocument9 pagesThe Impact of Credit Cards On HDFC Bank Customers in Shimoga - An Evaluative StudyankitNo ratings yet

- Comm ReportDocument5 pagesComm ReportvarunsalwanNo ratings yet

- Research Paper On BanksDocument5 pagesResearch Paper On Banksfvdra0st100% (1)

- Bank Operations Management Course OutlineDocument2 pagesBank Operations Management Course Outlinevani3826No ratings yet

- Banking Operations and ManagementDocument6 pagesBanking Operations and ManagementAdeel SajjadNo ratings yet

- Slide 3 - Retail Banking OperationsDocument73 pagesSlide 3 - Retail Banking OperationsRashi JainNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Islamic Banking in Indonesia: New Perspectives on Monetary and Financial IssuesFrom EverandIslamic Banking in Indonesia: New Perspectives on Monetary and Financial IssuesNo ratings yet

- Bam-657 Supply Chain Risk Management Spring 2024Document8 pagesBam-657 Supply Chain Risk Management Spring 2024vani3826No ratings yet

- Course Outline IR & CA Spring 2023Document9 pagesCourse Outline IR & CA Spring 2023vani3826No ratings yet

- BAM-625 International Trade and Foreign Exchange BBADocument7 pagesBAM-625 International Trade and Foreign Exchange BBAvani3826No ratings yet

- Bank Operations Management Course OutlineDocument2 pagesBank Operations Management Course Outlinevani3826No ratings yet

- Bam-404 - HRMDocument13 pagesBam-404 - HRMvani3826No ratings yet

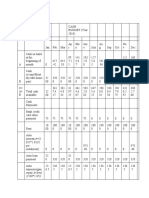

- B. StatDocument5 pagesB. Statvani3826No ratings yet

- Table of Content: Sr. No Content Page No. 1 Executve Summary 2 3 Profile of The Organization 4 Research Methodology 5 6 7Document11 pagesTable of Content: Sr. No Content Page No. 1 Executve Summary 2 3 Profile of The Organization 4 Research Methodology 5 6 7Přẳshẳɳţ PẳţīłNo ratings yet

- TTMF Mortgage Application PDFDocument4 pagesTTMF Mortgage Application PDFLorenzo BurnleyNo ratings yet

- Understanding Money ManagementDocument4 pagesUnderstanding Money ManagementJulie Ann ZafraNo ratings yet

- Small Business Chart of Accounts: Account Name Code Financial Statement Group Sub-Group NormallyDocument3 pagesSmall Business Chart of Accounts: Account Name Code Financial Statement Group Sub-Group NormallyShajib AhmedNo ratings yet

- BJVJGDocument5 pagesBJVJGAvinash AcharyaNo ratings yet

- Working Capital: Apl Apollo Tubes LTDDocument17 pagesWorking Capital: Apl Apollo Tubes LTDNimish MishraNo ratings yet

- Banking Ope Art IonsDocument26 pagesBanking Ope Art IonsChinmay KhetanNo ratings yet

- GPT TextDocument24 pagesGPT TextRahul JhaNo ratings yet

- Test 5Document6 pagesTest 5shahabNo ratings yet

- Dufló, E. - The Economic Lives of The PoorDocument44 pagesDufló, E. - The Economic Lives of The PoorvalentinNo ratings yet

- Honda Auto Receivables 2021-3 Owner Trust Honda Auto Receivables 2021-3 Owner TrustDocument15 pagesHonda Auto Receivables 2021-3 Owner Trust Honda Auto Receivables 2021-3 Owner Trustsprite2lNo ratings yet

- Credit and Collection - Chapter 4 & 5 PDFDocument21 pagesCredit and Collection - Chapter 4 & 5 PDFDhez Madrid100% (1)

- Cash BudgetDocument9 pagesCash BudgetColter SodjaNo ratings yet

- Shriram City Union Finance - Shriramcity - inDocument5 pagesShriram City Union Finance - Shriramcity - inRamesh GaonkarNo ratings yet

- Unraveling The Financial Crisis of 2008Document6 pagesUnraveling The Financial Crisis of 2008Pooja Ujjwal JainNo ratings yet

- Tax BmbeDocument7 pagesTax BmbeRuiz, CherryjaneNo ratings yet

- Financial Statements of Companies - DPP 01 II Udesh Fastrack Accounting (Group 1)Document8 pagesFinancial Statements of Companies - DPP 01 II Udesh Fastrack Accounting (Group 1)ajay singhNo ratings yet

- The Oxford Handbook of Banking Third Edition Allen N Berger Full ChapterDocument67 pagesThe Oxford Handbook of Banking Third Edition Allen N Berger Full Chaptergeorge.wang839100% (12)

- Bank of India Indonesia TBK - Dec 31 2018 - Final ReleasedDocument136 pagesBank of India Indonesia TBK - Dec 31 2018 - Final Releasedemilinda putriNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial Planningsabarais100% (3)

- EMI Prepayment CalculatorDocument17 pagesEMI Prepayment CalculatorKhaja ShaikNo ratings yet

- Law Chapter 10 Power Point Teacher VersionDocument22 pagesLaw Chapter 10 Power Point Teacher VersionDavidNo ratings yet

- Chapter 18 Working Capital Management - CompressDocument27 pagesChapter 18 Working Capital Management - CompressAshiv MungurNo ratings yet

- Focus On Personal Finance 5th Edition Kapoor Solutions ManualDocument24 pagesFocus On Personal Finance 5th Edition Kapoor Solutions Manualdrkarenboltonddsqjtgwxzmbr100% (32)

- Eastwest Bank AfDocument2 pagesEastwest Bank AfKeanu Menil MoldezNo ratings yet