Professional Documents

Culture Documents

Wage and Tax Statement: Page 1 / 4

Wage and Tax Statement: Page 1 / 4

Uploaded by

4kbzdsfw8kOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wage and Tax Statement: Page 1 / 4

Wage and Tax Statement: Page 1 / 4

Uploaded by

4kbzdsfw8kCopyright:

Available Formats

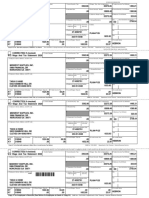

a Employee's social security number

638771614 OMB No. 15450008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

843009663 446.00 0.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Twenty Pho Hour LLC 325.71 27.65

11951 International Drive

Unit B2

Orlando, Florida 32821

d Control number 5 Medicare wages and tips 6 Medicare tax withheld

446.00 6.47

e/f Employee's name, address, and ZIP code

SANTIAGO TOMAS FOJANINI

5475 Vineland Rd

Kissimme, FL 32811

7 Social security tips 8 Allocated tips 9 Advanced EIC payment

120.29 0.00 0.00

10 Dependent care benefits 11 Nonqualified plans See instructions for box 12

0.00 0.00 12a Code

12b Code 12c Code 12d Code

13 Statutory employee Retirement plan Thirdparty sick pay 14 Other

15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Department of the Treasury—Internal Revenue Service

Form W2 Wage and Tax Statement 2023

Copy B To Be Filed with Employee's FEDERAL Tax Return.

This information is being furnished to the Internal Revenue Service.

This information is being furnished to the Internal Revenue Service.

If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

a Employee's social security number

638771614 OMB No. 15450008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

843009663 446.00 0.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Twenty Pho Hour LLC 325.71 27.65

11951 International Drive

Unit B2

Orlando, Florida 32821

d Control number 5 Medicare wages and tips 6 Medicare tax withheld

446.00 6.47

e/f Employee's name, address, and ZIP code

SANTIAGO TOMAS FOJANINI

5475 Vineland Rd

Kissimme, FL 32811

7 Social security tips 8 Allocated tips 9 Advanced EIC payment

120.29 0.00 0.00

10 Dependent care benefits 11 Nonqualified plans See instructions for box 12

0.00 0.00 12a Code

12b Code 12c Code 12d Code

13 Statutory employee Retirement plan Thirdparty sick pay 14 Other

Powered by eStratex.com 1/31/2024 11:09 PM Page 1 / 4

15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax

This information is being furnished to the Internal Revenue Service.

If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

a Employee's social security number

638771614 OMB No. 15450008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

843009663 446.00 0.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Twenty Pho Hour LLC 325.71 27.65

11951 International Drive

Unit B2

Orlando, Florida 32821

d Control number 5 Medicare wages and tips 6 Medicare tax withheld

446.00 6.47

e/f Employee's name, address, and ZIP code

SANTIAGO TOMAS FOJANINI

5475 Vineland Rd

Kissimme, FL 32811

7 Social security tips 8 Allocated tips 9 Advanced EIC payment

120.29 0.00 0.00

10 Dependent care benefits 11 Nonqualified plans See instructions for box 12

0.00 0.00 12a Code

12b Code 12c Code 12d Code

13 Statutory employee Retirement plan Thirdparty sick pay 14 Other

15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Department of the Treasury—Internal Revenue Service

Form W2 Wage and Tax Statement 2023

Copy C For Employee's Record.

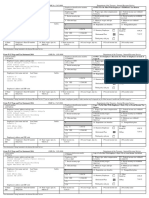

a Employee's social security number

638771614 OMB No. 15450008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

843009663 446.00 0.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Twenty Pho Hour LLC 325.71 27.65

11951 International Drive

Unit B2

Orlando, Florida 32821

d Control number 5 Medicare wages and tips 6 Medicare tax withheld

446.00 6.47

e/f Employee's name, address, and ZIP code

SANTIAGO TOMAS FOJANINI

5475 Vineland Rd

Kissimme, FL 32811

7 Social security tips 8 Allocated tips 9 Advanced EIC payment

120.29 0.00 0.00

10 Dependent care benefits 11 Nonqualified plans See instructions for box 12

0.00 0.00 12a Code

12b Code 12c Code 12d Code

13 Statutory employee Retirement plan Thirdparty sick pay 14 Other

15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax

Powered by eStratex.com 1/31/2024 11:09 PM Page 2 / 4

a Employee's social security number

638771614 OMB No. 15450008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

843009663 446.00 0.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Twenty Pho Hour LLC 325.71 27.65

11951 International Drive

Unit B2

Orlando, Florida 32821

d Control number 5 Medicare wages and tips 6 Medicare tax withheld

446.00 6.47

e/f Employee's name, address, and ZIP code

SANTIAGO TOMAS FOJANINI

5475 Vineland Rd

Kissimme, FL 32811

7 Social security tips 8 Allocated tips 9 Advanced EIC payment

120.29 0.00 0.00

10 Dependent care benefits 11 Nonqualified plans See instructions for box 12

0.00 0.00 12a Code

12b Code 12c Code 12d Code

13 Statutory employee Retirement plan Thirdparty sick pay 14 Other

15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Department of the Treasury—Internal Revenue Service

Form W2 Wage and Tax Statement 2023

Copy 2To Be Filed With

Employee's State, City, or

Local Income Tax Return.

Powered by eStratex.com 1/31/2024 11:09 PM Page 3 / 4

Powered by eStratex.com 1/31/2024 11:09 PM Page 4 / 4

You might also like

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- Petitioner MemorialDocument43 pagesPetitioner MemorialAditya Bhatnagar50% (2)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- Community-Based Monitoring System: Household Profile QuestionnaireDocument12 pagesCommunity-Based Monitoring System: Household Profile QuestionnaireDAden Nabong100% (1)

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Nike Sweatshops Case StudyDocument5 pagesNike Sweatshops Case StudyPranavKhuranaNo ratings yet

- Workk Safely CompileDocument167 pagesWorkk Safely CompileBarbara AlvesNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 4blon majorsNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- W2 Hyatt PLaceDocument5 pagesW2 Hyatt PLaceJuan Diego Velandia DuarteNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- US Internal Revenue Service: fw2 - 2000Document12 pagesUS Internal Revenue Service: fw2 - 2000IRSNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- James Melvin Anderson W2Document1 pageJames Melvin Anderson W2matheus.alcantara014No ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- US Internal Revenue Service: Fw2vi - 2000Document10 pagesUS Internal Revenue Service: Fw2vi - 2000IRSNo ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- US Internal Revenue Service: Fw2vi - 1995Document10 pagesUS Internal Revenue Service: Fw2vi - 1995IRSNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Returnjenner.domasNo ratings yet

- Paredes Abreu - W2 2021Document1 pageParedes Abreu - W2 2021Sarah ParedesNo ratings yet

- New Age w-2 Forms ExcelDocument42 pagesNew Age w-2 Forms Excelapi-429923183No ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- US Internal Revenue Service: Fw2as - 1992Document10 pagesUS Internal Revenue Service: Fw2as - 1992IRSNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- 2 41923892Document1 page2 41923892spurlock90No ratings yet

- w2 hh83UtqU4WlQsBEvVnOTDocument1 pagew2 hh83UtqU4WlQsBEvVnOTDutchavelli5thNo ratings yet

- Bill W2Document2 pagesBill W2ISSA AWADHNo ratings yet

- W2 - 2022 Ryan OnealDocument1 pageW2 - 2022 Ryan Onealjhonsmith900012No ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- US Internal Revenue Service: Fw2as - 2000Document10 pagesUS Internal Revenue Service: Fw2as - 2000IRSNo ratings yet

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- US Internal Revenue Service: Fw2gu - 2000Document10 pagesUS Internal Revenue Service: Fw2gu - 2000IRSNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Beneficial Interpretation in Welfare Legislation: Study of Judicial Decisions in IndiaDocument7 pagesBeneficial Interpretation in Welfare Legislation: Study of Judicial Decisions in IndiaVeena Kulkarni DalaviNo ratings yet

- Maynes v. OrieroDocument1 pageMaynes v. OrieroMark Anthony ReyesNo ratings yet

- Newsletter - July 2022Document12 pagesNewsletter - July 2022Maz Izman BudimanNo ratings yet

- An Assignment On SWOT Analysis of WaltonDocument11 pagesAn Assignment On SWOT Analysis of Waltonashrafurrahman119No ratings yet

- MRP Mohammed Ali ShaikhDocument59 pagesMRP Mohammed Ali ShaikhAli ShaikhNo ratings yet

- Groupd4-Hrm Staffing, Its Steps and Process-Flores, Jirah Rose C.Document18 pagesGroupd4-Hrm Staffing, Its Steps and Process-Flores, Jirah Rose C.jirah rose floresNo ratings yet

- Casual Labor SOPDocument2 pagesCasual Labor SOPAinaNo ratings yet

- Offer of Employment: Dao Sriwasopa +64 21 175 8903 orDocument18 pagesOffer of Employment: Dao Sriwasopa +64 21 175 8903 orBoss ZoldicksNo ratings yet

- Air India (Contracted Company Infivation PVT LTD) : Tax InvoiceDocument1 pageAir India (Contracted Company Infivation PVT LTD) : Tax InvoiceHari RamNo ratings yet

- Duties & Responsibilities of Front Office Staff:Front Office ManagerDocument2 pagesDuties & Responsibilities of Front Office Staff:Front Office ManagerKenneth YasisNo ratings yet

- Employee Management SystemDocument4 pagesEmployee Management SystemkanchangawndeNo ratings yet

- BDBB4103 Introductory Human Resource Development - Jan 22Document17 pagesBDBB4103 Introductory Human Resource Development - Jan 22SOBANAH A/P CHANDRAN STUDENTNo ratings yet

- Labor Law Case Digest 1Document56 pagesLabor Law Case Digest 1ARNOLD GUTIERREZNo ratings yet

- Academics: Participated in Blood Donation Event Organized by DSA, LPU, PhagwaraDocument2 pagesAcademics: Participated in Blood Donation Event Organized by DSA, LPU, PhagwaraShaksher Singh PundhirNo ratings yet

- Industrial Unrest: by Varun BandiDocument6 pagesIndustrial Unrest: by Varun BandivrnbandiNo ratings yet

- 584Document9 pages584Nur Illahi'No ratings yet

- Recume, CVDocument3 pagesRecume, CVkunjan2165No ratings yet

- W 2Document6 pagesW 2prads1259No ratings yet

- GEC 131 Purposive Comm WorksheetDocument5 pagesGEC 131 Purposive Comm WorksheetJohara Bayabao100% (1)

- Trainees Record BookDocument4 pagesTrainees Record BookFrinces MarvidaNo ratings yet

- Making The Link Between Work Life Balance Practices and Organizational Performance (LSERO Version)Document52 pagesMaking The Link Between Work Life Balance Practices and Organizational Performance (LSERO Version)NoorunnishaNo ratings yet

- Priyanka - Activitas - HR AnalyticsDocument90 pagesPriyanka - Activitas - HR AnalyticsPriyankaNo ratings yet

- A Guide To FundraisingDocument14 pagesA Guide To FundraisingBratimir Nešić100% (1)

- Eparwa Vs Liceo (2006) G.R. 150402 DigestDocument3 pagesEparwa Vs Liceo (2006) G.R. 150402 DigestBetson Cajayon100% (1)

- Residents Don 'T Just Look Miserable. They Really Are: EditorialDocument3 pagesResidents Don 'T Just Look Miserable. They Really Are: EditorialBeny RiliantoNo ratings yet

- Comparison of Codes and Earlier Labour Laws 2Document9 pagesComparison of Codes and Earlier Labour Laws 2Srikanth KrishnamurthyNo ratings yet