Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsBBA MCIS Financial Control and Ratio Analysis

BBA MCIS Financial Control and Ratio Analysis

Uploaded by

Akshara DesaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Day Trading Options Scalping Premiums by TradeswithramaDocument200 pagesDay Trading Options Scalping Premiums by TradeswithramaTraianNo ratings yet

- MAT112 - Past Year Bank Discount Promissory NotesDocument5 pagesMAT112 - Past Year Bank Discount Promissory Notesatiqahcantik100% (1)

- HBR Guide to Performance Management (HBR Guide Series)From EverandHBR Guide to Performance Management (HBR Guide Series)No ratings yet

- Performance Management: Measure and Improve The Effectiveness of Your EmployeesFrom EverandPerformance Management: Measure and Improve The Effectiveness of Your EmployeesRating: 4 out of 5 stars4/5 (4)

- Fundamental Analysis of Bandhan BankDocument41 pagesFundamental Analysis of Bandhan BankAbhishekNo ratings yet

- Financial Statement Analysis in CCL - Bhawna SinghDocument78 pagesFinancial Statement Analysis in CCL - Bhawna SinghTahir Hussain100% (2)

- BBA MCIS Management Control System Structure and ProcessDocument21 pagesBBA MCIS Management Control System Structure and ProcessAkshara DesaiNo ratings yet

- BBA MCIS Key Variables and Financial Goal SettingDocument10 pagesBBA MCIS Key Variables and Financial Goal SettingAkshara DesaiNo ratings yet

- BBA MCIS Control Process Responsibility BudgetingDocument38 pagesBBA MCIS Control Process Responsibility BudgetingAkshara DesaiNo ratings yet

- Alok Industries Final Report 2010-11.Document117 pagesAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- Comparative Financial Ratio Analysis With Special Reference To BhelDocument62 pagesComparative Financial Ratio Analysis With Special Reference To BhelVinodKatkarNo ratings yet

- Comparative Financial Ratio Analysis With Special Reference To BhelDocument62 pagesComparative Financial Ratio Analysis With Special Reference To BhelPooja ManoharNo ratings yet

- Financial Statement Analysis of ICICI Bank': A Study OnDocument79 pagesFinancial Statement Analysis of ICICI Bank': A Study OnAjay SanthNo ratings yet

- Ratio AnalysisDocument21 pagesRatio Analysisagamjain.bNo ratings yet

- "Financial Analysis OF HDFC Bank: Summer Project Training Report OnDocument83 pages"Financial Analysis OF HDFC Bank: Summer Project Training Report OnLancy SonkarNo ratings yet

- Ratio AnalysisDocument86 pagesRatio AnalysisSyed MohammedNo ratings yet

- ABHISHEK - Research ProjectDocument67 pagesABHISHEK - Research Projecthieranknotes BbaNo ratings yet

- HDFC Ratio Analysis StudyDocument27 pagesHDFC Ratio Analysis StudyShine BrightNo ratings yet

- BBA MCIS Ethics in Management Control SystemDocument28 pagesBBA MCIS Ethics in Management Control SystemAkshara DesaiNo ratings yet

- Tittle Pages of ProjectDocument8 pagesTittle Pages of ProjectVijay GbNo ratings yet

- PROJECT REPORT ASHISH MBA ADocument65 pagesPROJECT REPORT ASHISH MBA Aks841932No ratings yet

- Heritage 1Document32 pagesHeritage 1Tanvir KhanNo ratings yet

- Project Report On Verka by Manisha KaurDocument101 pagesProject Report On Verka by Manisha KaurAlisha RaiNo ratings yet

- Synopsis HDFCDocument4 pagesSynopsis HDFCNeel GuptaNo ratings yet

- Financial Statement and Ratio AnalysisDocument56 pagesFinancial Statement and Ratio Analysisuznahid4No ratings yet

- 08 Chapter 5Document36 pages08 Chapter 5Kiran VinnuNo ratings yet

- BBA MCIS Project Operation and Management ControlDocument14 pagesBBA MCIS Project Operation and Management ControlAkshara DesaiNo ratings yet

- Farhod Finance FinalDocument61 pagesFarhod Finance FinalAmeya PatilNo ratings yet

- REPORTDocument35 pagesREPORTdeekshadeewan456No ratings yet

- Financial Performance Analysis of Accor GroupDocument99 pagesFinancial Performance Analysis of Accor GroupsalmanNo ratings yet

- Summer Internship Presentation 1-1Document12 pagesSummer Internship Presentation 1-1Hardik KothiyalNo ratings yet

- 6th Sem Project 1Document87 pages6th Sem Project 1GauravsNo ratings yet

- Project Report On BhelDocument97 pagesProject Report On BhelBrijesh KumarNo ratings yet

- Bu Shivani Report 4Document31 pagesBu Shivani Report 4Shivani AgarwalNo ratings yet

- BBA MCIS Strategies, Goals and ObjectivesDocument11 pagesBBA MCIS Strategies, Goals and ObjectivesAkshara DesaiNo ratings yet

- 303am 62.EPRA Journals-4113Document6 pages303am 62.EPRA Journals-4113Amogh AroraNo ratings yet

- Pengukuran Kinerja Perusahaan Dengan Menerapkan Pendekatan Balanced ScorecardDocument9 pagesPengukuran Kinerja Perusahaan Dengan Menerapkan Pendekatan Balanced ScorecardevitriNo ratings yet

- FINANCE (FINAL) Term Project by Ankit Bhandari (Document60 pagesFINANCE (FINAL) Term Project by Ankit Bhandari (AnkitNo ratings yet

- Financial Statements MIS and Financial KPIsDocument67 pagesFinancial Statements MIS and Financial KPIsDevanand TayadeNo ratings yet

- SuneetaDocument84 pagesSuneetaLancy SonkarNo ratings yet

- Tybms Black BookDocument52 pagesTybms Black Bookmanasmhatre765No ratings yet

- Summer Project ReportDocument55 pagesSummer Project ReportsunilpratihariNo ratings yet

- Analysis of Financial Statements by Raviraj ChalakDocument9 pagesAnalysis of Financial Statements by Raviraj ChalakRaviraj Chalak MNSNo ratings yet

- Work in Progress SIP 3Document32 pagesWork in Progress SIP 3Yash GargNo ratings yet

- PDF & RenditionDocument56 pagesPDF & Renditionpachpind jayeshNo ratings yet

- Project Report ON: "Working Capital Management" in "Bharat Heavy Electrical Limited" HEERP - VaranasiDocument80 pagesProject Report ON: "Working Capital Management" in "Bharat Heavy Electrical Limited" HEERP - VaranasiAbhishek KapoorNo ratings yet

- 3 8 12 Prof. Kalpesh GeldaDocument5 pages3 8 12 Prof. Kalpesh GeldaSaurabh UpadhyayNo ratings yet

- Management - Chapter 13Document15 pagesManagement - Chapter 13yeshaNo ratings yet

- Chapter One Introduction of Report: 1.1 Background of The StudyDocument67 pagesChapter One Introduction of Report: 1.1 Background of The StudySadman Abrar RaiyanNo ratings yet

- Mr. Ashu Kshitij Vats Assistant Professor 03290188821Document34 pagesMr. Ashu Kshitij Vats Assistant Professor 03290188821Hello BrotherNo ratings yet

- Project ODYSSIA NewDocument96 pagesProject ODYSSIA Newmanesh100% (2)

- New Global Vision College: Fundamentals of Human Resource Management Group AssignmentDocument36 pagesNew Global Vision College: Fundamentals of Human Resource Management Group AssignmentFafiNo ratings yet

- O Lakshmi Prasanna: With Reference ToDocument76 pagesO Lakshmi Prasanna: With Reference ToInthiyaz KothapalleNo ratings yet

- Yash SIP ReportDocument40 pagesYash SIP ReportAbhijeet ShindeNo ratings yet

- Shradha Walia - 2019Document3 pagesShradha Walia - 2019Clash ClashhNo ratings yet

- A Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project ReportDocument69 pagesA Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project Reportsatish pawarNo ratings yet

- Performance Apprasial in HalDocument101 pagesPerformance Apprasial in HalSuraj DubeyNo ratings yet

- Mohiuddin Sir PDFDocument8 pagesMohiuddin Sir PDFShourav KunduNo ratings yet

- Asheesh Rao Project Update 13Document57 pagesAsheesh Rao Project Update 13abhi2612pNo ratings yet

- Vaibhav Sahare - Welspun - EnterprisesDocument53 pagesVaibhav Sahare - Welspun - EnterprisesnarkozionsNo ratings yet

- Aniruddh Thakur, B-06, Fsa, Indus TowerDocument47 pagesAniruddh Thakur, B-06, Fsa, Indus TowerAniruddh Singh ThakurNo ratings yet

- TCS - Financial AnalysisDocument18 pagesTCS - Financial AnalysisElectra Zin you yu ccNo ratings yet

- Advantages vs. Disadvantages of Debt FinancingDocument3 pagesAdvantages vs. Disadvantages of Debt FinancingAlberto NicholsNo ratings yet

- Order Information Premium Bandai UsaDocument1 pageOrder Information Premium Bandai UsaDiego Yáñez JiménezNo ratings yet

- Investment Guide Market Outlook Year End 2022 enDocument52 pagesInvestment Guide Market Outlook Year End 2022 enAurora Ferreira GonzalezNo ratings yet

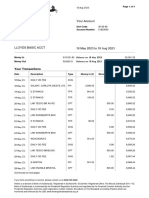

- Lloyds StatementDocument4 pagesLloyds Statementkatsergey12No ratings yet

- Strategic Growth Plus Annuity: Effective: Premium Bonus: 10% AUGUST 8, 2022Document2 pagesStrategic Growth Plus Annuity: Effective: Premium Bonus: 10% AUGUST 8, 2022JoseAliceaNo ratings yet

- Ibt Finals ReviewerDocument16 pagesIbt Finals ReviewerCALERO CATHERINE CNo ratings yet

- Café Do PontoDocument17 pagesCafé Do PontoYsNo ratings yet

- Monetary Authority of Singapore - Interest Rates of Banks and Finance CompaniesDocument4 pagesMonetary Authority of Singapore - Interest Rates of Banks and Finance CompaniesMunif MuhammadNo ratings yet

- Cola Wars AssignmentDocument1 pageCola Wars AssignmentHammad AliNo ratings yet

- Chapter 1: Company Profile 1.1. Introduction CompanyDocument7 pagesChapter 1: Company Profile 1.1. Introduction Companypink pinkNo ratings yet

- Message From Chairman: Achyut Prasad Prasai ChairmanDocument152 pagesMessage From Chairman: Achyut Prasad Prasai ChairmanDipesh NepalNo ratings yet

- Joseph Carlson Fact Sheet Start DecemberDocument1 pageJoseph Carlson Fact Sheet Start DecemberWahyudi AnugrahNo ratings yet

- ECONOMIC-DEVELOPMENTDocument20 pagesECONOMIC-DEVELOPMENTAra Mae WañaNo ratings yet

- Busn 8 8th Edition Kelly Test BankDocument47 pagesBusn 8 8th Edition Kelly Test BankAnthonyJacksonekdpb100% (15)

- 1.1 Engineering Economy FundamentalsDocument21 pages1.1 Engineering Economy Fundamentalsyookarina8No ratings yet

- Responsibility Accounting and Profitability RatiosDocument13 pagesResponsibility Accounting and Profitability RatiosKhrystal AbrioNo ratings yet

- Strategic Plan of UnileverDocument14 pagesStrategic Plan of Unileverkaka kynNo ratings yet

- 1st PaperDocument46 pages1st PaperDagmawi TesfayeNo ratings yet

- Standardised Approach To Valuation of Investment Portfolio of Alternative Investment Funds (AIFs)Document4 pagesStandardised Approach To Valuation of Investment Portfolio of Alternative Investment Funds (AIFs)Ishani MukherjeeNo ratings yet

- Report Myland MarketingDocument11 pagesReport Myland MarketingJinoda subodhaniNo ratings yet

- Session 3Document40 pagesSession 3kennethtxcNo ratings yet

- Kgalbato Professional ResumeDocument1 pageKgalbato Professional Resumeapi-404607062No ratings yet

- UnlockedDocument21 pagesUnlockedAbdul HannanNo ratings yet

- CUHK FINA4110 Assignment2Document5 pagesCUHK FINA4110 Assignment2MOON TVNo ratings yet

- Amazon Digital MarketingDocument11 pagesAmazon Digital MarketingVaibhavNo ratings yet

- NEW HUF Declaration Attachments - Final PDFDocument3 pagesNEW HUF Declaration Attachments - Final PDFVineetNo ratings yet

- Banking Regulation in GhanaDocument54 pagesBanking Regulation in GhanaprincegiftNo ratings yet

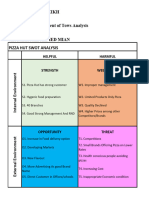

- Tows Assignment Sohaib Pizza Hut FinalDocument2 pagesTows Assignment Sohaib Pizza Hut Finalسعد احمد خاںNo ratings yet

BBA MCIS Financial Control and Ratio Analysis

BBA MCIS Financial Control and Ratio Analysis

Uploaded by

Akshara Desai0 ratings0% found this document useful (0 votes)

1 views13 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views13 pagesBBA MCIS Financial Control and Ratio Analysis

BBA MCIS Financial Control and Ratio Analysis

Uploaded by

Akshara DesaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 13

Financial Management II

Financial Control and Ratio Analysis

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

A basic limitation of the traditional financial

statements comprising the balance sheet and the

profit and loss account is that they do not give all

the information related to the financial operations

of a firm.

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

Nevertheless, they provide some extremely useful

information to the extent that the balance sheet

mirrors the financial position on a particular date

in terms of the structure of assets, liabilities and

owners’ equity, and so on.

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

The profit and loss account shows the results of

operations during a certain period of time in

terms of revenues obtained and the cost incurred

during the year.

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

Steps in the Financial Statement Analysis:

The first task of a financial analyst is to select the

information relevant to the decision under

consideration from the total information

contained in the financial statements.

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

Steps in the Financial Statement Analysis:

The second step is to arrange the information in a

way to highlight significant relationships.

The final step is interpretation and drawing of

inferences and conclusions.

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

Steps in the Financial Statement Analysis:

In brief, financial analysis is the process of

selection, relation and evaluation

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Statement Analysis

Ratio Analysis:

• Liquidity

• Activity/Turnover/Efficiency

• Solvency

• Profitability

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Liquidity Ratios:

Liquidity ratio: Stock - inventory

Tells about short-term liquidity position of the company.

• Current ratio = Total current assets/Total current liabilities

• Quick ratio = (Total current assets- stock)/Total current

liabilities

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Turnover Ratios:

Turnover/activity or efficiency ratio: Tells how efficiently

firm is utilizing the assets or stock to convert them into

sales.

• Stock turnover ratio: Sales/Stock

• Total assets turnover ratio: Sales/Total assets

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Solvency Ratios:

Solvency ratio: ability of the firm to meet long term

liabilities (repayment of loans).

• Debt ratio: long-term debt/total assets

• Interest coverage ratio: EBIT/Interest

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Profitability Ratios:

Profitability ratio: Tells about the financial soundness of the

firm.

Two types: with respect to sales and to capital (or assets)

• Net profit margin: Net Profit/Sales (%)

• ROA: Net profit/Total assets (%)

• Return to shareholders’ capital: Net profit/Equity share

capital

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

Financial Control and Ratio Analysis

Thank You

Dr. Ajay Prasad Adepu, Assistant Professor ICFAI Business

School (IBS) Hyderabad

You might also like

- Day Trading Options Scalping Premiums by TradeswithramaDocument200 pagesDay Trading Options Scalping Premiums by TradeswithramaTraianNo ratings yet

- MAT112 - Past Year Bank Discount Promissory NotesDocument5 pagesMAT112 - Past Year Bank Discount Promissory Notesatiqahcantik100% (1)

- HBR Guide to Performance Management (HBR Guide Series)From EverandHBR Guide to Performance Management (HBR Guide Series)No ratings yet

- Performance Management: Measure and Improve The Effectiveness of Your EmployeesFrom EverandPerformance Management: Measure and Improve The Effectiveness of Your EmployeesRating: 4 out of 5 stars4/5 (4)

- Fundamental Analysis of Bandhan BankDocument41 pagesFundamental Analysis of Bandhan BankAbhishekNo ratings yet

- Financial Statement Analysis in CCL - Bhawna SinghDocument78 pagesFinancial Statement Analysis in CCL - Bhawna SinghTahir Hussain100% (2)

- BBA MCIS Management Control System Structure and ProcessDocument21 pagesBBA MCIS Management Control System Structure and ProcessAkshara DesaiNo ratings yet

- BBA MCIS Key Variables and Financial Goal SettingDocument10 pagesBBA MCIS Key Variables and Financial Goal SettingAkshara DesaiNo ratings yet

- BBA MCIS Control Process Responsibility BudgetingDocument38 pagesBBA MCIS Control Process Responsibility BudgetingAkshara DesaiNo ratings yet

- Alok Industries Final Report 2010-11.Document117 pagesAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- Comparative Financial Ratio Analysis With Special Reference To BhelDocument62 pagesComparative Financial Ratio Analysis With Special Reference To BhelVinodKatkarNo ratings yet

- Comparative Financial Ratio Analysis With Special Reference To BhelDocument62 pagesComparative Financial Ratio Analysis With Special Reference To BhelPooja ManoharNo ratings yet

- Financial Statement Analysis of ICICI Bank': A Study OnDocument79 pagesFinancial Statement Analysis of ICICI Bank': A Study OnAjay SanthNo ratings yet

- Ratio AnalysisDocument21 pagesRatio Analysisagamjain.bNo ratings yet

- "Financial Analysis OF HDFC Bank: Summer Project Training Report OnDocument83 pages"Financial Analysis OF HDFC Bank: Summer Project Training Report OnLancy SonkarNo ratings yet

- Ratio AnalysisDocument86 pagesRatio AnalysisSyed MohammedNo ratings yet

- ABHISHEK - Research ProjectDocument67 pagesABHISHEK - Research Projecthieranknotes BbaNo ratings yet

- HDFC Ratio Analysis StudyDocument27 pagesHDFC Ratio Analysis StudyShine BrightNo ratings yet

- BBA MCIS Ethics in Management Control SystemDocument28 pagesBBA MCIS Ethics in Management Control SystemAkshara DesaiNo ratings yet

- Tittle Pages of ProjectDocument8 pagesTittle Pages of ProjectVijay GbNo ratings yet

- PROJECT REPORT ASHISH MBA ADocument65 pagesPROJECT REPORT ASHISH MBA Aks841932No ratings yet

- Heritage 1Document32 pagesHeritage 1Tanvir KhanNo ratings yet

- Project Report On Verka by Manisha KaurDocument101 pagesProject Report On Verka by Manisha KaurAlisha RaiNo ratings yet

- Synopsis HDFCDocument4 pagesSynopsis HDFCNeel GuptaNo ratings yet

- Financial Statement and Ratio AnalysisDocument56 pagesFinancial Statement and Ratio Analysisuznahid4No ratings yet

- 08 Chapter 5Document36 pages08 Chapter 5Kiran VinnuNo ratings yet

- BBA MCIS Project Operation and Management ControlDocument14 pagesBBA MCIS Project Operation and Management ControlAkshara DesaiNo ratings yet

- Farhod Finance FinalDocument61 pagesFarhod Finance FinalAmeya PatilNo ratings yet

- REPORTDocument35 pagesREPORTdeekshadeewan456No ratings yet

- Financial Performance Analysis of Accor GroupDocument99 pagesFinancial Performance Analysis of Accor GroupsalmanNo ratings yet

- Summer Internship Presentation 1-1Document12 pagesSummer Internship Presentation 1-1Hardik KothiyalNo ratings yet

- 6th Sem Project 1Document87 pages6th Sem Project 1GauravsNo ratings yet

- Project Report On BhelDocument97 pagesProject Report On BhelBrijesh KumarNo ratings yet

- Bu Shivani Report 4Document31 pagesBu Shivani Report 4Shivani AgarwalNo ratings yet

- BBA MCIS Strategies, Goals and ObjectivesDocument11 pagesBBA MCIS Strategies, Goals and ObjectivesAkshara DesaiNo ratings yet

- 303am 62.EPRA Journals-4113Document6 pages303am 62.EPRA Journals-4113Amogh AroraNo ratings yet

- Pengukuran Kinerja Perusahaan Dengan Menerapkan Pendekatan Balanced ScorecardDocument9 pagesPengukuran Kinerja Perusahaan Dengan Menerapkan Pendekatan Balanced ScorecardevitriNo ratings yet

- FINANCE (FINAL) Term Project by Ankit Bhandari (Document60 pagesFINANCE (FINAL) Term Project by Ankit Bhandari (AnkitNo ratings yet

- Financial Statements MIS and Financial KPIsDocument67 pagesFinancial Statements MIS and Financial KPIsDevanand TayadeNo ratings yet

- SuneetaDocument84 pagesSuneetaLancy SonkarNo ratings yet

- Tybms Black BookDocument52 pagesTybms Black Bookmanasmhatre765No ratings yet

- Summer Project ReportDocument55 pagesSummer Project ReportsunilpratihariNo ratings yet

- Analysis of Financial Statements by Raviraj ChalakDocument9 pagesAnalysis of Financial Statements by Raviraj ChalakRaviraj Chalak MNSNo ratings yet

- Work in Progress SIP 3Document32 pagesWork in Progress SIP 3Yash GargNo ratings yet

- PDF & RenditionDocument56 pagesPDF & Renditionpachpind jayeshNo ratings yet

- Project Report ON: "Working Capital Management" in "Bharat Heavy Electrical Limited" HEERP - VaranasiDocument80 pagesProject Report ON: "Working Capital Management" in "Bharat Heavy Electrical Limited" HEERP - VaranasiAbhishek KapoorNo ratings yet

- 3 8 12 Prof. Kalpesh GeldaDocument5 pages3 8 12 Prof. Kalpesh GeldaSaurabh UpadhyayNo ratings yet

- Management - Chapter 13Document15 pagesManagement - Chapter 13yeshaNo ratings yet

- Chapter One Introduction of Report: 1.1 Background of The StudyDocument67 pagesChapter One Introduction of Report: 1.1 Background of The StudySadman Abrar RaiyanNo ratings yet

- Mr. Ashu Kshitij Vats Assistant Professor 03290188821Document34 pagesMr. Ashu Kshitij Vats Assistant Professor 03290188821Hello BrotherNo ratings yet

- Project ODYSSIA NewDocument96 pagesProject ODYSSIA Newmanesh100% (2)

- New Global Vision College: Fundamentals of Human Resource Management Group AssignmentDocument36 pagesNew Global Vision College: Fundamentals of Human Resource Management Group AssignmentFafiNo ratings yet

- O Lakshmi Prasanna: With Reference ToDocument76 pagesO Lakshmi Prasanna: With Reference ToInthiyaz KothapalleNo ratings yet

- Yash SIP ReportDocument40 pagesYash SIP ReportAbhijeet ShindeNo ratings yet

- Shradha Walia - 2019Document3 pagesShradha Walia - 2019Clash ClashhNo ratings yet

- A Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project ReportDocument69 pagesA Project Report On Financial Ratios at B.D.K. Ltd. Hubli Project Reportsatish pawarNo ratings yet

- Performance Apprasial in HalDocument101 pagesPerformance Apprasial in HalSuraj DubeyNo ratings yet

- Mohiuddin Sir PDFDocument8 pagesMohiuddin Sir PDFShourav KunduNo ratings yet

- Asheesh Rao Project Update 13Document57 pagesAsheesh Rao Project Update 13abhi2612pNo ratings yet

- Vaibhav Sahare - Welspun - EnterprisesDocument53 pagesVaibhav Sahare - Welspun - EnterprisesnarkozionsNo ratings yet

- Aniruddh Thakur, B-06, Fsa, Indus TowerDocument47 pagesAniruddh Thakur, B-06, Fsa, Indus TowerAniruddh Singh ThakurNo ratings yet

- TCS - Financial AnalysisDocument18 pagesTCS - Financial AnalysisElectra Zin you yu ccNo ratings yet

- Advantages vs. Disadvantages of Debt FinancingDocument3 pagesAdvantages vs. Disadvantages of Debt FinancingAlberto NicholsNo ratings yet

- Order Information Premium Bandai UsaDocument1 pageOrder Information Premium Bandai UsaDiego Yáñez JiménezNo ratings yet

- Investment Guide Market Outlook Year End 2022 enDocument52 pagesInvestment Guide Market Outlook Year End 2022 enAurora Ferreira GonzalezNo ratings yet

- Lloyds StatementDocument4 pagesLloyds Statementkatsergey12No ratings yet

- Strategic Growth Plus Annuity: Effective: Premium Bonus: 10% AUGUST 8, 2022Document2 pagesStrategic Growth Plus Annuity: Effective: Premium Bonus: 10% AUGUST 8, 2022JoseAliceaNo ratings yet

- Ibt Finals ReviewerDocument16 pagesIbt Finals ReviewerCALERO CATHERINE CNo ratings yet

- Café Do PontoDocument17 pagesCafé Do PontoYsNo ratings yet

- Monetary Authority of Singapore - Interest Rates of Banks and Finance CompaniesDocument4 pagesMonetary Authority of Singapore - Interest Rates of Banks and Finance CompaniesMunif MuhammadNo ratings yet

- Cola Wars AssignmentDocument1 pageCola Wars AssignmentHammad AliNo ratings yet

- Chapter 1: Company Profile 1.1. Introduction CompanyDocument7 pagesChapter 1: Company Profile 1.1. Introduction Companypink pinkNo ratings yet

- Message From Chairman: Achyut Prasad Prasai ChairmanDocument152 pagesMessage From Chairman: Achyut Prasad Prasai ChairmanDipesh NepalNo ratings yet

- Joseph Carlson Fact Sheet Start DecemberDocument1 pageJoseph Carlson Fact Sheet Start DecemberWahyudi AnugrahNo ratings yet

- ECONOMIC-DEVELOPMENTDocument20 pagesECONOMIC-DEVELOPMENTAra Mae WañaNo ratings yet

- Busn 8 8th Edition Kelly Test BankDocument47 pagesBusn 8 8th Edition Kelly Test BankAnthonyJacksonekdpb100% (15)

- 1.1 Engineering Economy FundamentalsDocument21 pages1.1 Engineering Economy Fundamentalsyookarina8No ratings yet

- Responsibility Accounting and Profitability RatiosDocument13 pagesResponsibility Accounting and Profitability RatiosKhrystal AbrioNo ratings yet

- Strategic Plan of UnileverDocument14 pagesStrategic Plan of Unileverkaka kynNo ratings yet

- 1st PaperDocument46 pages1st PaperDagmawi TesfayeNo ratings yet

- Standardised Approach To Valuation of Investment Portfolio of Alternative Investment Funds (AIFs)Document4 pagesStandardised Approach To Valuation of Investment Portfolio of Alternative Investment Funds (AIFs)Ishani MukherjeeNo ratings yet

- Report Myland MarketingDocument11 pagesReport Myland MarketingJinoda subodhaniNo ratings yet

- Session 3Document40 pagesSession 3kennethtxcNo ratings yet

- Kgalbato Professional ResumeDocument1 pageKgalbato Professional Resumeapi-404607062No ratings yet

- UnlockedDocument21 pagesUnlockedAbdul HannanNo ratings yet

- CUHK FINA4110 Assignment2Document5 pagesCUHK FINA4110 Assignment2MOON TVNo ratings yet

- Amazon Digital MarketingDocument11 pagesAmazon Digital MarketingVaibhavNo ratings yet

- NEW HUF Declaration Attachments - Final PDFDocument3 pagesNEW HUF Declaration Attachments - Final PDFVineetNo ratings yet

- Banking Regulation in GhanaDocument54 pagesBanking Regulation in GhanaprincegiftNo ratings yet

- Tows Assignment Sohaib Pizza Hut FinalDocument2 pagesTows Assignment Sohaib Pizza Hut Finalسعد احمد خاںNo ratings yet