Professional Documents

Culture Documents

3 GL Ab KV P2 MQ J7 KH RT CL3 BC Qa 3 M6 E1 Ui SWHHSCKMZ

3 GL Ab KV P2 MQ J7 KH RT CL3 BC Qa 3 M6 E1 Ui SWHHSCKMZ

Uploaded by

niken angelinaCopyright:

Available Formats

You might also like

- University of Botswana-Eco 212 Assignment 2022-2023Document3 pagesUniversity of Botswana-Eco 212 Assignment 2022-2023Tinotenda Dube100% (1)

- Final GCRDocument54 pagesFinal GCRAniket Patel0% (1)

- WP-1 3Document27 pagesWP-1 3subhi1980No ratings yet

- Analysis of Regional Economic Development in The Regency/Municipality at South Sulawesi Province in IndonesiaDocument10 pagesAnalysis of Regional Economic Development in The Regency/Municipality at South Sulawesi Province in Indonesiaayu wulanNo ratings yet

- ThakurDocument30 pagesThakurSudha KumaraveluNo ratings yet

- Tax Potential As An Indicator of Sustainable Development of The RegionDocument5 pagesTax Potential As An Indicator of Sustainable Development of The RegionKhuyên TrầnNo ratings yet

- zz1030 01Document25 pageszz1030 01LENANo ratings yet

- Interactive Relationship Among Urban Expansion EcoDocument31 pagesInteractive Relationship Among Urban Expansion Ecoramanpreet kaurNo ratings yet

- Approaches To Economic GeographyDocument4 pagesApproaches To Economic GeographyTuliNo ratings yet

- Lesson 5 A World of RegionsDocument20 pagesLesson 5 A World of RegionsJamivia Shayne MacasayonNo ratings yet

- China's Economic Development Stage and Its Patio-Temporal Evolution: A Prefectural-Level AnalysisDocument19 pagesChina's Economic Development Stage and Its Patio-Temporal Evolution: A Prefectural-Level AnalysisCatherine CacundanganNo ratings yet

- An Integrated Fuzzy AHP and Fuzzy TOPSIS ApproachDocument21 pagesAn Integrated Fuzzy AHP and Fuzzy TOPSIS ApproachRosie APDVNo ratings yet

- Michael DunfordDocument23 pagesMichael DunfordEmil TengwarNo ratings yet

- Forum #5Document3 pagesForum #5Novamae gavinoNo ratings yet

- Administratie Si Management PublicDocument14 pagesAdministratie Si Management PublicВиталий НиценкоNo ratings yet

- Sustainability 10 01194 v2 PDFDocument20 pagesSustainability 10 01194 v2 PDFRajendra LamsalNo ratings yet

- 190 625 1 PBDocument7 pages190 625 1 PBDaphne CasanovaNo ratings yet

- Purewal-Haini2021 Article Re-examiningTheEffectOfFinanciDocument23 pagesPurewal-Haini2021 Article Re-examiningTheEffectOfFinancihajarNo ratings yet

- Transportation and Regional Economic Development: Analysis of Spatial Spillovers in China Provincial RegionsDocument22 pagesTransportation and Regional Economic Development: Analysis of Spatial Spillovers in China Provincial RegionsBINGWEN RaúlNo ratings yet

- SSP, Antwerpen & Local GovernmentDocument2 pagesSSP, Antwerpen & Local GovernmentDwi Retno MulyaningrumNo ratings yet

- Jing - Influence of Fiscal Decentralization On The Economic Growth of Public Welfare and Poverty Between Regions of Province of PapuaDocument8 pagesJing - Influence of Fiscal Decentralization On The Economic Growth of Public Welfare and Poverty Between Regions of Province of PapuaNova TambunanNo ratings yet

- CH1, CH2 1Document46 pagesCH1, CH2 1USAMA RAJANo ratings yet

- GIS and Regional Economic Development Planning: Chen Fei Du Daosheng Jiang JingtongDocument8 pagesGIS and Regional Economic Development Planning: Chen Fei Du Daosheng Jiang JingtongJuragan MudaNo ratings yet

- Investigation of The Social Factors of Development of Society, VariosDocument7 pagesInvestigation of The Social Factors of Development of Society, Variosfernando aldeaNo ratings yet

- A Success of Economic Policy: An Analysis of The Impact of Western Development On Life Expectancy in Chinese Western RegionsDocument8 pagesA Success of Economic Policy: An Analysis of The Impact of Western Development On Life Expectancy in Chinese Western RegionsIjahss JournalNo ratings yet

- Identifikasi Sektor Unggulan Di Provinsi Maluku: Darwis AminDocument20 pagesIdentifikasi Sektor Unggulan Di Provinsi Maluku: Darwis AminPCR WMKNo ratings yet

- Information 11 00420Document16 pagesInformation 11 00420Francis PunoNo ratings yet

- Dimensions in Regional DevelopmentDocument9 pagesDimensions in Regional DevelopmentJhony Mencari SiJantunghatiNo ratings yet

- SSRN Id3127280Document61 pagesSSRN Id3127280SD RanaNo ratings yet

- Land 09 00324 v2 PDFDocument50 pagesLand 09 00324 v2 PDFShikha AggarwalNo ratings yet

- Buget Utilization ResearchDocument11 pagesBuget Utilization ResearchhailemariamNo ratings yet

- Economic GeographyDocument3 pagesEconomic Geographymahisuman108No ratings yet

- Dezvoltare Sustenabila in Zonele RuraleDocument20 pagesDezvoltare Sustenabila in Zonele RuraleAdrian BuțaNo ratings yet

- Sustainability 12 02423Document19 pagesSustainability 12 02423Mavy KylineNo ratings yet

- Sustainability 08 00759 v2Document14 pagesSustainability 08 00759 v2Nur AzizahNo ratings yet

- Integrating Spatial Statistics and Gis ForDocument16 pagesIntegrating Spatial Statistics and Gis ForKenneth UgaldeNo ratings yet

- Fiscal Decentralization, Commitment and Regional InequalityDocument29 pagesFiscal Decentralization, Commitment and Regional InequalityJoseLuisTangaraNo ratings yet

- Determinants of Regional Development in The Context of The Globalization ProcessDocument9 pagesDeterminants of Regional Development in The Context of The Globalization Process582d9c24No ratings yet

- s11156 019 00822 7Document25 pagess11156 019 00822 7sabinanth63No ratings yet

- The Spatial Effects of Fiscal Decentralization OnDocument21 pagesThe Spatial Effects of Fiscal Decentralization OnNana NogaNo ratings yet

- Analysis of Economic Development Disparities Between Districts in North SumatraDocument7 pagesAnalysis of Economic Development Disparities Between Districts in North Sumatrakar1999No ratings yet

- Regional PlanDocument12 pagesRegional PlanRahul ChoudharyNo ratings yet

- Agasisti & Bertoletti 2020 Higher Education and Economic GrowthDocument18 pagesAgasisti & Bertoletti 2020 Higher Education and Economic GrowthmamamamiiiiNo ratings yet

- Sustainability 08 01323 PDFDocument18 pagesSustainability 08 01323 PDFAlexandru BarnaNo ratings yet

- Sustainability 12 04202Document21 pagesSustainability 12 04202sangoi_vipulNo ratings yet

- c808 C Base PaperDocument28 pagesc808 C Base Papershahzad ahmedNo ratings yet

- Economic Geography Part 4Document1 pageEconomic Geography Part 4manish.cdmaNo ratings yet

- Analisis Perrgeseran Struktur Ekonomi Dan Pola Pertumbuhan Ekonomi Kota ParepareDocument12 pagesAnalisis Perrgeseran Struktur Ekonomi Dan Pola Pertumbuhan Ekonomi Kota ParepareEgiNo ratings yet

- Regional Development Fueled by Entrepreneurial Ventures Providing Kibs - Case Study On RomaniaDocument18 pagesRegional Development Fueled by Entrepreneurial Ventures Providing Kibs - Case Study On Romaniamanagement_seminarNo ratings yet

- Evaluation of Rural DevelopmentDocument22 pagesEvaluation of Rural DevelopmentiordachitararesNo ratings yet

- 18mag41c U1Document9 pages18mag41c U1Suhail WaniNo ratings yet

- The Role of The Demographic Transition in The Process of UrbanizationDocument23 pagesThe Role of The Demographic Transition in The Process of UrbanizationlessujmNo ratings yet

- BiH Statistical RegionsDocument16 pagesBiH Statistical RegionsGoran MutabdzijaNo ratings yet

- Financial Determinants of Public Investment Strategic ManagementDocument11 pagesFinancial Determinants of Public Investment Strategic ManagementredalouziriNo ratings yet

- The Greater Mekong Sub-RegionDocument8 pagesThe Greater Mekong Sub-RegionThar Thantsin Jao NaiNo ratings yet

- Onumah, Simpson The Accounting Discipline and The Government Budgeting ConceptDocument18 pagesOnumah, Simpson The Accounting Discipline and The Government Budgeting ConceptInternational Consortium on Governmental Financial Management100% (1)

- Regional Development Theory Peter Nijkamp: VU University, Amsterdam, The NetherlandsDocument12 pagesRegional Development Theory Peter Nijkamp: VU University, Amsterdam, The NetherlandsJesus Villaflor Jr.No ratings yet

- Financial Development and Economic Growth: Theory and A Survey of EvidenceDocument29 pagesFinancial Development and Economic Growth: Theory and A Survey of EvidenceFeleke TerefeNo ratings yet

- JRFM 12 00143Document13 pagesJRFM 12 00143Nguyễn Thiên PhúNo ratings yet

- State Transformation and Uneven Developm PDFDocument39 pagesState Transformation and Uneven Developm PDFJames XgunNo ratings yet

- Improving Indonesia Regional ConnectivityDocument17 pagesImproving Indonesia Regional ConnectivitywisnuNo ratings yet

- China-Central Asia's Regiocentric Strategies of Integration and Geoeconomics PerspectivesFrom EverandChina-Central Asia's Regiocentric Strategies of Integration and Geoeconomics PerspectivesNo ratings yet

- Economic Growthand Unemployment Rate An Empirical Studyof IndianDocument9 pagesEconomic Growthand Unemployment Rate An Empirical Studyof IndianAnonymousNo ratings yet

- Gujarat, SMEDocument20 pagesGujarat, SMEDeepak Pareek100% (1)

- Data, Development, and Growth: Steven WeberDocument27 pagesData, Development, and Growth: Steven WeberganeshNo ratings yet

- Macro Module 1 1Document126 pagesMacro Module 1 1Haileluel WondimnehNo ratings yet

- Indian Economy 2 NotesDocument5 pagesIndian Economy 2 NotesMuskan YadavNo ratings yet

- Dollar and Kraay (2003) Institutions, Trade and GrowthDocument30 pagesDollar and Kraay (2003) Institutions, Trade and GrowthPaula-Raluca SocaciuNo ratings yet

- Pakistan Statistical Year Book, 2016Document514 pagesPakistan Statistical Year Book, 2016Eman WahidNo ratings yet

- Service Marketing MixDocument4 pagesService Marketing MixYee Sook YingNo ratings yet

- IMT AssignmentDocument21 pagesIMT AssignmentAbdulla MunfizNo ratings yet

- CR 17319Document82 pagesCR 17319nicodelrioNo ratings yet

- Truly Admin Payroll 2021Document50 pagesTruly Admin Payroll 2021Truly ClarissaNo ratings yet

- Tourism Survival KitDocument17 pagesTourism Survival Kitterramoonlight91No ratings yet

- Introduction To International Business PDFDocument141 pagesIntroduction To International Business PDFIIDT BA-3 Tirupathi67% (3)

- Fmi Proyeccion Abril22Document199 pagesFmi Proyeccion Abril22César Fabricio Sánchez CarranzaNo ratings yet

- Deutsche Bank ResearchDocument12 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- Geography: Test SeriesDocument11 pagesGeography: Test SeriesIhtisham Ul HaqNo ratings yet

- GDP As A Measure of Economic WelfareDocument12 pagesGDP As A Measure of Economic WelfareАндрей ГоловинNo ratings yet

- InflationDocument17 pagesInflationNeethu MohanNo ratings yet

- KOF - Globalisation Index - RevisitedDocument53 pagesKOF - Globalisation Index - Revisitedpreksha adeNo ratings yet

- Best Performing Cities 2021Document75 pagesBest Performing Cities 2021Adam ForgieNo ratings yet

- Imperatives For Modelling and Forecasting Petroleum Products Demand For NigeriaDocument14 pagesImperatives For Modelling and Forecasting Petroleum Products Demand For NigeriaLintang CandraNo ratings yet

- Hendricks Econ 102 McqsDocument107 pagesHendricks Econ 102 McqsNguyễn Hoàng ThơNo ratings yet

- Potential Theme Park Development in MyanmarDocument18 pagesPotential Theme Park Development in MyanmarWonwhee Kim100% (1)

- Investigating The Impact of Agriculture and Industrial Sector On Economic Growth of IndiaDocument13 pagesInvestigating The Impact of Agriculture and Industrial Sector On Economic Growth of IndiaAadhityaNo ratings yet

- Overview of Phil AgriDocument10 pagesOverview of Phil AgriJenny Lumain100% (3)

- Financial Intermediaries in India: - John Gurley and Edward Shaw Money in A Theory of Finance, 1960Document15 pagesFinancial Intermediaries in India: - John Gurley and Edward Shaw Money in A Theory of Finance, 1960anantNo ratings yet

- Landscaping+the+Repair+and+Reuse+Economy+in+Kenya+-+Final+Report March+2022Document76 pagesLandscaping+the+Repair+and+Reuse+Economy+in+Kenya+-+Final+Report March+2022patiencewanjuguNo ratings yet

- Sustainability, Resource Efficiency and CompetitivenessDocument37 pagesSustainability, Resource Efficiency and CompetitivenessIbssiNo ratings yet

3 GL Ab KV P2 MQ J7 KH RT CL3 BC Qa 3 M6 E1 Ui SWHHSCKMZ

3 GL Ab KV P2 MQ J7 KH RT CL3 BC Qa 3 M6 E1 Ui SWHHSCKMZ

Uploaded by

niken angelinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 GL Ab KV P2 MQ J7 KH RT CL3 BC Qa 3 M6 E1 Ui SWHHSCKMZ

3 GL Ab KV P2 MQ J7 KH RT CL3 BC Qa 3 M6 E1 Ui SWHHSCKMZ

Uploaded by

niken angelinaCopyright:

Available Formats

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

Analysis on Geographical Factors of Regional

Economic Development Difference

Hongshou Chen

Business School, Graduate University of Mongolia, Ulaanbaatar, Mongolia

Hongshou2006@126.com

Abstract: Since the reform and opening up, many regions in China have different locations, resources,

policy support and other factors, resulting in large differences in economic and financial development

between regions. In order to better analyze the mechanism of interaction between geographic factors

and economic growth, construct economic growth indicators, regional financial development

indicators, and control variable indicators respectively, establish a panel data fixed-effect model, and

further propose relevant policy recommendations to reduce regional and economic growth. Inequality,

thus providing a theoretical reference for the coordinated development of the regional economy.

Keywords: Regional economy, Economic development, Regional differences, Economic growth

1. Introduction

Over the past 40 years of China's reform and opening up, due to the large differences in location,

transportation infrastructure, policy support, etc., there are significant differences in economic and

financial development between regions. It is very important to fully understand the difference in

geographical influence between China's economic development and economic development. It can help

us how to build an economic and financial system that meets the actual needs of local social and

economic development according to regional development differences, and to a certain extent promote

the high-quality development of the local economy . In the research on the analysis of the influence of

geographic factors on regional economic development differences, many scholars have conducted

research on them, and achieved good results. For example, Li Shuangyan and others, from the

perspective of R&D investment, believe that the development of inclusive finance in the western region

has an impact on regional green total factor productivity. Play a driving role and increase the

innovation vitality of enterprises through R&D investment. [1] Hu Yao believes that the formation of a

financial center is conducive to the rapid accumulation of various economic resources (such as

industrial agglomeration, technological incubation, investment and financing services, etc.), through

the multiplier effect, transformation and upgrading of the industrial structure, and thus promote

regional economic growth. It can be seen that the research on the financial geographic factors of

regional economic development differences is of great significance to China's economic development.

Based on the new economic system geography and the science of regional integration development,

this article considers China's regional economic development and regional integration development

from the perspective of financial geographic differences, and further explain the impact of financial

geographic differences on the economic development of Chinese counties[2].

2. Research on Financial Geography Influencing Factors of Regional Economic Development

Differences

2.1 Theoretical Research on Economic Geography and Regional Economic Growth

(1) Selection of economic geographic indicators

1) Density

Density refers to the density of economic activity per unit area and the relative scale of economic

activity settlement per unit area. It is a record of the economic output and income level of a piece of

land [3]. Therefore, density can always be measured by GDP per unit area. In addition, since population

density is always closely related to economic activities, and people are the creators and customers of

Published by Francis Academic Press, UK

-13-

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

financial services, density can also be measured by the number of people in each region.

2) Distance

Different disciplines have different interpretations of the concept. Among them, the mathematical

concept believes that distance is the length of two objects in space or time (that is, the straight-line

distance between two points), while geography believes that distance is two The spatial trajectory of

the interaction of objects (that is, a spatial relationship). The location of transportation infrastructure,

the support of financial policies and the convenience of location are all important factors that affect the

distance between regions.

3) Split

Segmentation refers to factors that affect the flow of commodities, capital, population, and

knowledge of a country or regional organization, including obstacles to economic activities caused by

currency, convention, commercial protection, and language differences. Therefore, improving the

barriers to economic and human mobility and promoting inter-regional trade can enable a region to

produce greater social and economic benefits.

(2) Applicability of economic geographic indicators

In macroeconomic research, the partial comparison method is a traditional and widely used research

method, which can be divided into two categories: one is the longitudinal comparison method. The

longitudinal comparison method compares the similarities and differences in the field distribution of

the same research topic in different periods, and then examines the migration process and the law of

occurrence and development, providing a basis for scientific prediction. The second is the horizontal

comparison method. The horizontal comparison method refers to comparing different research

materials at the same time, intervening in the cross-section of the research materials, and providing an

effective analysis method for understanding the regional differences of the economic system. Vertical

comparison method and horizontal comparison method are two different parts of problem analysis, they

can be used alone or in combination.

2.2 Geographical Factors of Regional Economic Development

(1) Research on Economic Geography and New Economic Geography

Economic geography, also known as "location theory", is a discipline that studies the interaction

between human economic activities and the geographical environment. Traditional economic

geography adheres to the traditional location theory, that is, under the premise of perfect competition

and constant returns to scale, it emphasizes that geographical factors only have an impact on the initial

stage of location selection. However, new economic geography has a more obvious difference from the

former, and the main performance is In the following two aspects: One is the so-called "new" in new

economic geography, that is, the analysis of "spatial" elements introduced in economic analysis.

The scope of the study is mainly focused on one-dimensional point-like or linear regions, rather

than true two-dimensional or even three-dimensional spatial analysis. The extent to which the new

economic geography study of policy performance in relation to region-specific developments is less

well explained will be reduced. Second, new economic geography conducts indiscriminate analysis of

different levels of geographic space such as cities, regions and countries, which is bound to reduce the

credibility of model construction.

Through theoretical research, it can be seen that simply using the new economic geography theory

to construct a model to analyze the development of regional economy will inevitably ignore the

influence of important factors such as politics, society, and culture. This may lead to deviations in the

results. However, the new economic geography does Constructive ideas were put forward on some

aspects of economic analysis. For example, in the process of social and economic development, the

spatial distribution of economic activities is of great significance to the formulation of regional policies,

and there is indeed an imbalance in economic development in geography and space. At the same time,

in view of the hypothesis setting when the model is constructed, the new economic geography will be

more effective in analyzing the regional economic problems of developing countries.

(2) Linear regression analysis for policy and geographic factors

The influence of geographical factors is reflected by comparing the level of economic development

between different regions. Over the past 40 years of reform and opening up, according to the

Published by Francis Academic Press, UK

-14-

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

differences in natural resources, transportation infrastructure conditions, economic and scientific and

technological development levels between regions, as early as 1986, the state divided China into three

major economic belts: the eastern, central and western regions to clarify the role of each region in

national economic and social development, and to facilitate the government to formulate unique

economic development plans for different regions, so as to fully utilize regional advantages and

promote Division of labor and coordination and coordination of social and economic development will

ultimately achieve common prosperity in all regions. However, with the continuous growth of the

national economic development level, the economic development gap between regions has become

increasingly obvious. Therefore, establishing a simple model to analyze the level of regional economic

development in different economic zones can not only verify whether financial geographic factors have

a significant impact on inter-regional economic development, but it can also be more obvious whether

financial geographic factors will have an impact on regional economic and social development. .

2.3 Research on Countermeasures for Regional Economic Development and Promotion

(1) Establish a diversified regional financial institution system

In recent years, China has continuously optimized its business environment and deepened its

commercial system, and has greatly released the dividends of reforms, especially private enterprises.

The total amount has increased significantly (to 10.598 million in 2012 and 14.369 million in 2017),

accounting for all enterprises The proportion of the quantity reached 79.4%. The large number of small

and medium-sized enterprises and regional socio-economic levels have obvious differences. The

construction of a diversified regional financial system can not only meet the needs of diverse financial

services (such as the introduction of basic financial services for the elderly, simplify the financing

thresholds for small and medium-sized enterprises, etc.), but also Through the development of strong

local financial institutions, to streamline local planning and raise local development funds, to give full

play to the benefits of local financial leverage services (such as strengthening the structure of Internet

financial products, patent pledge financing loans, etc.), promote full competition in the regional market,

and increase finance Effective market supply.

(2) Cultivate growth poles for regional financial development

Regional coordinated development has always been the focus of close attention of the Party Central

Committee and the people. Doing a good job in regional coordinated development can not only inject a

steady stream of new impetus into the high-quality development of the regional economy, but also take

a new approach to regional economic development with a reasonable division of labor and

complementary advantages. Way. From the 2017 Central Economic Work Conference first mentioning

the three goals of regional coordinated development (i.e. equalized basic public services, balanced

infrastructure transportation facilities, and equivalent people’s living standards), to the 2019 Central

Region Rise Work Symposium, After General Secretary Xi Jinping inspects the Xiongan New Area in

2021, "coordinated regional development" will always be the main theme of high-quality economic

development at present and in the future. Looking forward to the reform and opening up, regional

coordinated development has entered vertical and horizontal and in-depth development. With the

continuous increase of development strategies such as "Western Development" and "East-West

Cooperation", regional coordinated development has entered a new normal. However, due to resource

endowments and location The situation is quite different, and there is still a long way to go to achieve

balanced development of the east, west, south and north (the GDP of the eastern region in 2020 is about

2.46 times that of the western region). The central region has a convenient public transportation

infrastructure and rapid economic growth (the average annual economic growth of the central region

has reached 8.6% in the past 5 years, and the growth rate ranks first among the four major regions in

China), laying a foundation for the realization of a domestic and international dual cycle in the central

region With a solid economic foundation, in view of this, the central region should adjust the credit

structure in a timely manner by establishing a financial supervision system that matches powers and

responsibilities, and accurately flow green finance and technology funds to key areas and weak links,

and promote high-quality and coordinated development in the central region.

(3) Construct an open information exchange mechanism

Local governments should continuously optimize the business environment, provide the public with

public policy information services covering the entire process in terms of basic social services,

government information disclosure, and basic medical and health care, and use the reform of the

commercial system as a starting point to promote regional economies. The development and deepening

Published by Francis Academic Press, UK

-15-

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

of cooperation. At the same time, under the policy guidance of local governments, various financial

management institutions have deepened the implementation rules for industrial development, using

finance as a lever (such as focusing on supporting the financing needs of strategic industrial clusters,

accurately supporting the development of advantageous industries in poor areas, and assisting the

transformation and upgrading of modern manufacturing. Etc.) Leveraging the high-quality

development of the regional economy, and delivering financial “live water” for accelerating the

coordinated development of the region. In addition, the government and financial institutions can

continue to promote local investment promotion policies and high-quality business environment

through various information channels such as the Internet and the media. In addition, government

agencies need to manage the normal operation of financial products (such as overdue financial

management information, sales of false financial product information, etc.) to maintain normal product

supervision, and conduct major investigations (such as notifications) of financial violations by

stakeholders. Anti-monopoly case punishment information, illegal disclosure of important information,

etc.), protect market rules and promote the sound operation of securities transactions.

2.4 Regional Economic Improvement Measurement Algorithm

Use the theory of urban primacy to fully analyze the urban scale system structure, and put forward

feasible regional economic policies for coordinated regional development. [4] The primacy calculation

method is:

p1

S (1)

p2

Among them, S is the primacy degree, and p1 and p2 are the population numbers of cities A and B

in the region, respectively. The original calculation index S is used to analyze the city's primacy degree.

For a more comprehensive and intuitive comparison, the results of the other two algorithms are also

listed. The formula is expressed as:

p1

S1 (2)

p2 p3 ...... pn

Among them, p2,p3,pn refers to the population of the 2nd to nth cities.

3. Experimental Research on Geographical Influencing Factors of Regional Economic

Development Differences

3.1 The Purpose of the Experiment

This article mainly uses financial-related ratios, relative ratios of deposits and loans (LSR), and the

number of financial institutions to analyze the overall status of regional financial differentiation, and

tries to get the current status and magnitude of financial differences in eastern, central, western and

northeastern regions of my country. [5]

3.2 Experimental Method

Due to the lack of statistical data on financial assets and M2 in various regions in my country, it is

impossible to directly use Gorbachev’s indicators to describe differences in financial development.

However, in my country’s financial market, indirect financing occupies a major position, and most of

the financial assets are concentrated in banks. Deposits and loans are most of the assets of banks, so

most scholars directly use bank deposits and loans instead of total financial assets to approximate the

financial development status. The revised financial correlation ratio is: FIR=(S+L)/GDP, where FIR is

For financial-related ratios, GDP is the gross product of each region, S is the deposit amount of

financial institutions, and L is the loan amount of financial institutions.

Among them, the ratio of loan balance to deposit balance (LSR) is an indicator to measure the

efficiency of regional financial development, that is, the efficiency of financial institutions in

converting savings into loans.

Published by Francis Academic Press, UK

-16-

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

4. Experimental Analysis of Geographical Influencing Factors of Regional Economic Development

Differences

4.1 Financial Related Ratio (FIR)

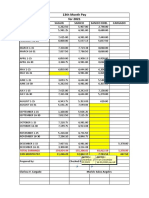

The results of the experimental survey of my country's financial-related ratios are shown in Table 1.

Table 1: Comparison of FIR across the country and by region at the end of 2019-2020

Area 2019 2020

East 3.17 3.07

Central 2.11 2.16

West 2.46 2.49

Northeast 2.09 2.11

Nationwide 2.78 2.79

2020 2019

Nationwide 2.79

2.78

Northeast 2.11

2.09

Area

West 2.49

2.46

Central 2.16

2.11

East 3.07

3.17

0 0.5 1 1.5 2 2.5 3 3.5 4

Financial correlation rate

Figure 1: FIR Comparison Chart of China and Regions at the End of 2019-2020

As shown in Figure 1, as of the end of 2020, the financial correlation rate in the eastern region was

3.07. The median income in the central region is 2.16, the lowest among the four regions. The currency

stability rate in the western region is second only to the eastern region, which shows that the economic

growth rate in the western region is acceptable. The relative value of the three regions in the northeast

is 2.11, second only to the western region. The FIR sequence is: Eastern Region>Western

Region>Northeast Region>Central Region. Through the definition of relevant departments, this article

believes that the eastern, western, northeastern, and central regions have all improved well in terms of

cost, scale, and ability to provide services. The inflation rate alone cannot measure a region’s economic

growth well. level.

4.2 Relative Ratio of Deposit and Loan Balance (LSR)

The ratio of loan balance to deposit balance (LSR) is a measure of the efficiency of regional

financial development, that is, the efficiency of financial institutions in converting savings into loans.

The survey results are shown in Table 2.

Table 2: Comparison of LSRs across the country and in various regions at the end of 2019-2020

Area 2019 2020

East 0.73 0.74

Central 0.65 0.67

West 0.72 0.72

Northeast 0.74 0.75

Nationwide 0.73 0.75

Published by Francis Academic Press, UK

-17-

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

2019 2020

0.9

0.8 0.73 0.74 0.72 0.72 0.74 0.75 0.73 0.75

0.7 0.65 0.67

0.6

LSR value

0.5

0.4

0.3

0.2

0.1

0

East Central West Northeast Nationwide

Area

Figure 2: Comparison of LSRs across the country and in various regions at the end of 2019-2020

As shown in Figure 2, it can be seen that LSR actually describes the efficiency of financial

institutions in converting savings into loans, which belongs to the efficiency of financial intermediaries.

Taking into account the small size of the securities market in each region of my country, the ratio of the

loan balance to the deposit balance in each region can generally reflect the efficiency level of a region's

financial development. As of the end of 2020, the LSR of the northeastern region was 0.75, leading the

country, and financial institutions had the highest efficiency in converting savings into loans; the LSR

of the eastern region was 0.74, slightly weaker than that of the northeastern region: the LSR of the

western region was 0.72, weak In the eastern and northeastern regions; the central region has the lowest

LSR level of 0.67. The order of LSR is: Northeast Region>Eastern Region>Western Region>Central

Region. Through the definition of LSR, we can know that in the Northeast, Eastern, Western, and

Central regions, the efficiency of financial institutions in converting savings into loans is gradually

decreasing.

5. Conclusions

From the above analysis of the results, it can be seen that there are differences in regional economic

development due to factors such as location, natural resources, and transportation infrastructure.

However, in recent years, with the continuous advancement of China's coordinated regional

development strategy and the pace of building a moderately prosperous society in an all-round way,

absolute poverty in various regions has been basically eliminated, but the uneven regional development,

the increase in income of low-income groups and the construction of a long-term poverty reduction

system still need to be further deepened. From a macro perspective, the economic development

potential and quality of the eastern region is better than that of the western region. Therefore, to

maximize the benefits of financial and fiscal funds, and to be guided by implementation effects, to

evaluate the effectiveness of policies in a timely manner based on the results, and to concentrate limited

financial resources in key industries or fields of regional economic development can effectively make

up for the shortcomings of regional economic development. So that the fruits of reform and

development benefit all people. [6]

References

[1] S. Y. Li, X. Tan, & H. H. Si, “Financial Inclusion and Green Total Factor Productivity: Based on

the Perspective of R&D Input,” Journal of Contemporary Economic Science, no. (6), 2021.

[2] Y. Hu, “The Impact of Financial Geography on Local Economic Development,” Journal of

Changchun Finance College, no. (1): pp. 16-19, 2016.

[3] W. Jin, C. Zhou, T. Liu, & et al., “Exploring the factors affecting regional land development

patterns at different developmental stages: Evidence from 289 Chinese cities,” no. 91(AUG.): pp.

193-201, 2019.

[4] B. Chen, & J. Zhang, “Research on Urban Architecture in Hubei Province Based on Urban

Primacy Theory,” Journal of Scientific and Technological Progress and Countermeasures, no. (12): pp.

Published by Francis Academic Press, UK

-18-

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 1: 13-19, DOI: 10.25236/AJBM.2022.040103

50-53, 2009.

[5] S. L. Chen, “Analysis of Regional Financial Development Differentiation in China,” Journal of

Economic Forum, no. (6), pp. 83-86, 2017.

[6] W. Z. Liu, H. J, Li, & Z. L. Xie, “Financial Agglomeration and Regional Economic Growth in the

Guangdong-Hong Kong-Macao Greater Bay Area,” Journal of Special Economic Zone Economy, no.

(1): pp. 14-18, 2021.

Published by Francis Academic Press, UK

-19-

You might also like

- University of Botswana-Eco 212 Assignment 2022-2023Document3 pagesUniversity of Botswana-Eco 212 Assignment 2022-2023Tinotenda Dube100% (1)

- Final GCRDocument54 pagesFinal GCRAniket Patel0% (1)

- WP-1 3Document27 pagesWP-1 3subhi1980No ratings yet

- Analysis of Regional Economic Development in The Regency/Municipality at South Sulawesi Province in IndonesiaDocument10 pagesAnalysis of Regional Economic Development in The Regency/Municipality at South Sulawesi Province in Indonesiaayu wulanNo ratings yet

- ThakurDocument30 pagesThakurSudha KumaraveluNo ratings yet

- Tax Potential As An Indicator of Sustainable Development of The RegionDocument5 pagesTax Potential As An Indicator of Sustainable Development of The RegionKhuyên TrầnNo ratings yet

- zz1030 01Document25 pageszz1030 01LENANo ratings yet

- Interactive Relationship Among Urban Expansion EcoDocument31 pagesInteractive Relationship Among Urban Expansion Ecoramanpreet kaurNo ratings yet

- Approaches To Economic GeographyDocument4 pagesApproaches To Economic GeographyTuliNo ratings yet

- Lesson 5 A World of RegionsDocument20 pagesLesson 5 A World of RegionsJamivia Shayne MacasayonNo ratings yet

- China's Economic Development Stage and Its Patio-Temporal Evolution: A Prefectural-Level AnalysisDocument19 pagesChina's Economic Development Stage and Its Patio-Temporal Evolution: A Prefectural-Level AnalysisCatherine CacundanganNo ratings yet

- An Integrated Fuzzy AHP and Fuzzy TOPSIS ApproachDocument21 pagesAn Integrated Fuzzy AHP and Fuzzy TOPSIS ApproachRosie APDVNo ratings yet

- Michael DunfordDocument23 pagesMichael DunfordEmil TengwarNo ratings yet

- Forum #5Document3 pagesForum #5Novamae gavinoNo ratings yet

- Administratie Si Management PublicDocument14 pagesAdministratie Si Management PublicВиталий НиценкоNo ratings yet

- Sustainability 10 01194 v2 PDFDocument20 pagesSustainability 10 01194 v2 PDFRajendra LamsalNo ratings yet

- 190 625 1 PBDocument7 pages190 625 1 PBDaphne CasanovaNo ratings yet

- Purewal-Haini2021 Article Re-examiningTheEffectOfFinanciDocument23 pagesPurewal-Haini2021 Article Re-examiningTheEffectOfFinancihajarNo ratings yet

- Transportation and Regional Economic Development: Analysis of Spatial Spillovers in China Provincial RegionsDocument22 pagesTransportation and Regional Economic Development: Analysis of Spatial Spillovers in China Provincial RegionsBINGWEN RaúlNo ratings yet

- SSP, Antwerpen & Local GovernmentDocument2 pagesSSP, Antwerpen & Local GovernmentDwi Retno MulyaningrumNo ratings yet

- Jing - Influence of Fiscal Decentralization On The Economic Growth of Public Welfare and Poverty Between Regions of Province of PapuaDocument8 pagesJing - Influence of Fiscal Decentralization On The Economic Growth of Public Welfare and Poverty Between Regions of Province of PapuaNova TambunanNo ratings yet

- CH1, CH2 1Document46 pagesCH1, CH2 1USAMA RAJANo ratings yet

- GIS and Regional Economic Development Planning: Chen Fei Du Daosheng Jiang JingtongDocument8 pagesGIS and Regional Economic Development Planning: Chen Fei Du Daosheng Jiang JingtongJuragan MudaNo ratings yet

- Investigation of The Social Factors of Development of Society, VariosDocument7 pagesInvestigation of The Social Factors of Development of Society, Variosfernando aldeaNo ratings yet

- A Success of Economic Policy: An Analysis of The Impact of Western Development On Life Expectancy in Chinese Western RegionsDocument8 pagesA Success of Economic Policy: An Analysis of The Impact of Western Development On Life Expectancy in Chinese Western RegionsIjahss JournalNo ratings yet

- Identifikasi Sektor Unggulan Di Provinsi Maluku: Darwis AminDocument20 pagesIdentifikasi Sektor Unggulan Di Provinsi Maluku: Darwis AminPCR WMKNo ratings yet

- Information 11 00420Document16 pagesInformation 11 00420Francis PunoNo ratings yet

- Dimensions in Regional DevelopmentDocument9 pagesDimensions in Regional DevelopmentJhony Mencari SiJantunghatiNo ratings yet

- SSRN Id3127280Document61 pagesSSRN Id3127280SD RanaNo ratings yet

- Land 09 00324 v2 PDFDocument50 pagesLand 09 00324 v2 PDFShikha AggarwalNo ratings yet

- Buget Utilization ResearchDocument11 pagesBuget Utilization ResearchhailemariamNo ratings yet

- Economic GeographyDocument3 pagesEconomic Geographymahisuman108No ratings yet

- Dezvoltare Sustenabila in Zonele RuraleDocument20 pagesDezvoltare Sustenabila in Zonele RuraleAdrian BuțaNo ratings yet

- Sustainability 12 02423Document19 pagesSustainability 12 02423Mavy KylineNo ratings yet

- Sustainability 08 00759 v2Document14 pagesSustainability 08 00759 v2Nur AzizahNo ratings yet

- Integrating Spatial Statistics and Gis ForDocument16 pagesIntegrating Spatial Statistics and Gis ForKenneth UgaldeNo ratings yet

- Fiscal Decentralization, Commitment and Regional InequalityDocument29 pagesFiscal Decentralization, Commitment and Regional InequalityJoseLuisTangaraNo ratings yet

- Determinants of Regional Development in The Context of The Globalization ProcessDocument9 pagesDeterminants of Regional Development in The Context of The Globalization Process582d9c24No ratings yet

- s11156 019 00822 7Document25 pagess11156 019 00822 7sabinanth63No ratings yet

- The Spatial Effects of Fiscal Decentralization OnDocument21 pagesThe Spatial Effects of Fiscal Decentralization OnNana NogaNo ratings yet

- Analysis of Economic Development Disparities Between Districts in North SumatraDocument7 pagesAnalysis of Economic Development Disparities Between Districts in North Sumatrakar1999No ratings yet

- Regional PlanDocument12 pagesRegional PlanRahul ChoudharyNo ratings yet

- Agasisti & Bertoletti 2020 Higher Education and Economic GrowthDocument18 pagesAgasisti & Bertoletti 2020 Higher Education and Economic GrowthmamamamiiiiNo ratings yet

- Sustainability 08 01323 PDFDocument18 pagesSustainability 08 01323 PDFAlexandru BarnaNo ratings yet

- Sustainability 12 04202Document21 pagesSustainability 12 04202sangoi_vipulNo ratings yet

- c808 C Base PaperDocument28 pagesc808 C Base Papershahzad ahmedNo ratings yet

- Economic Geography Part 4Document1 pageEconomic Geography Part 4manish.cdmaNo ratings yet

- Analisis Perrgeseran Struktur Ekonomi Dan Pola Pertumbuhan Ekonomi Kota ParepareDocument12 pagesAnalisis Perrgeseran Struktur Ekonomi Dan Pola Pertumbuhan Ekonomi Kota ParepareEgiNo ratings yet

- Regional Development Fueled by Entrepreneurial Ventures Providing Kibs - Case Study On RomaniaDocument18 pagesRegional Development Fueled by Entrepreneurial Ventures Providing Kibs - Case Study On Romaniamanagement_seminarNo ratings yet

- Evaluation of Rural DevelopmentDocument22 pagesEvaluation of Rural DevelopmentiordachitararesNo ratings yet

- 18mag41c U1Document9 pages18mag41c U1Suhail WaniNo ratings yet

- The Role of The Demographic Transition in The Process of UrbanizationDocument23 pagesThe Role of The Demographic Transition in The Process of UrbanizationlessujmNo ratings yet

- BiH Statistical RegionsDocument16 pagesBiH Statistical RegionsGoran MutabdzijaNo ratings yet

- Financial Determinants of Public Investment Strategic ManagementDocument11 pagesFinancial Determinants of Public Investment Strategic ManagementredalouziriNo ratings yet

- The Greater Mekong Sub-RegionDocument8 pagesThe Greater Mekong Sub-RegionThar Thantsin Jao NaiNo ratings yet

- Onumah, Simpson The Accounting Discipline and The Government Budgeting ConceptDocument18 pagesOnumah, Simpson The Accounting Discipline and The Government Budgeting ConceptInternational Consortium on Governmental Financial Management100% (1)

- Regional Development Theory Peter Nijkamp: VU University, Amsterdam, The NetherlandsDocument12 pagesRegional Development Theory Peter Nijkamp: VU University, Amsterdam, The NetherlandsJesus Villaflor Jr.No ratings yet

- Financial Development and Economic Growth: Theory and A Survey of EvidenceDocument29 pagesFinancial Development and Economic Growth: Theory and A Survey of EvidenceFeleke TerefeNo ratings yet

- JRFM 12 00143Document13 pagesJRFM 12 00143Nguyễn Thiên PhúNo ratings yet

- State Transformation and Uneven Developm PDFDocument39 pagesState Transformation and Uneven Developm PDFJames XgunNo ratings yet

- Improving Indonesia Regional ConnectivityDocument17 pagesImproving Indonesia Regional ConnectivitywisnuNo ratings yet

- China-Central Asia's Regiocentric Strategies of Integration and Geoeconomics PerspectivesFrom EverandChina-Central Asia's Regiocentric Strategies of Integration and Geoeconomics PerspectivesNo ratings yet

- Economic Growthand Unemployment Rate An Empirical Studyof IndianDocument9 pagesEconomic Growthand Unemployment Rate An Empirical Studyof IndianAnonymousNo ratings yet

- Gujarat, SMEDocument20 pagesGujarat, SMEDeepak Pareek100% (1)

- Data, Development, and Growth: Steven WeberDocument27 pagesData, Development, and Growth: Steven WeberganeshNo ratings yet

- Macro Module 1 1Document126 pagesMacro Module 1 1Haileluel WondimnehNo ratings yet

- Indian Economy 2 NotesDocument5 pagesIndian Economy 2 NotesMuskan YadavNo ratings yet

- Dollar and Kraay (2003) Institutions, Trade and GrowthDocument30 pagesDollar and Kraay (2003) Institutions, Trade and GrowthPaula-Raluca SocaciuNo ratings yet

- Pakistan Statistical Year Book, 2016Document514 pagesPakistan Statistical Year Book, 2016Eman WahidNo ratings yet

- Service Marketing MixDocument4 pagesService Marketing MixYee Sook YingNo ratings yet

- IMT AssignmentDocument21 pagesIMT AssignmentAbdulla MunfizNo ratings yet

- CR 17319Document82 pagesCR 17319nicodelrioNo ratings yet

- Truly Admin Payroll 2021Document50 pagesTruly Admin Payroll 2021Truly ClarissaNo ratings yet

- Tourism Survival KitDocument17 pagesTourism Survival Kitterramoonlight91No ratings yet

- Introduction To International Business PDFDocument141 pagesIntroduction To International Business PDFIIDT BA-3 Tirupathi67% (3)

- Fmi Proyeccion Abril22Document199 pagesFmi Proyeccion Abril22César Fabricio Sánchez CarranzaNo ratings yet

- Deutsche Bank ResearchDocument12 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- Geography: Test SeriesDocument11 pagesGeography: Test SeriesIhtisham Ul HaqNo ratings yet

- GDP As A Measure of Economic WelfareDocument12 pagesGDP As A Measure of Economic WelfareАндрей ГоловинNo ratings yet

- InflationDocument17 pagesInflationNeethu MohanNo ratings yet

- KOF - Globalisation Index - RevisitedDocument53 pagesKOF - Globalisation Index - Revisitedpreksha adeNo ratings yet

- Best Performing Cities 2021Document75 pagesBest Performing Cities 2021Adam ForgieNo ratings yet

- Imperatives For Modelling and Forecasting Petroleum Products Demand For NigeriaDocument14 pagesImperatives For Modelling and Forecasting Petroleum Products Demand For NigeriaLintang CandraNo ratings yet

- Hendricks Econ 102 McqsDocument107 pagesHendricks Econ 102 McqsNguyễn Hoàng ThơNo ratings yet

- Potential Theme Park Development in MyanmarDocument18 pagesPotential Theme Park Development in MyanmarWonwhee Kim100% (1)

- Investigating The Impact of Agriculture and Industrial Sector On Economic Growth of IndiaDocument13 pagesInvestigating The Impact of Agriculture and Industrial Sector On Economic Growth of IndiaAadhityaNo ratings yet

- Overview of Phil AgriDocument10 pagesOverview of Phil AgriJenny Lumain100% (3)

- Financial Intermediaries in India: - John Gurley and Edward Shaw Money in A Theory of Finance, 1960Document15 pagesFinancial Intermediaries in India: - John Gurley and Edward Shaw Money in A Theory of Finance, 1960anantNo ratings yet

- Landscaping+the+Repair+and+Reuse+Economy+in+Kenya+-+Final+Report March+2022Document76 pagesLandscaping+the+Repair+and+Reuse+Economy+in+Kenya+-+Final+Report March+2022patiencewanjuguNo ratings yet

- Sustainability, Resource Efficiency and CompetitivenessDocument37 pagesSustainability, Resource Efficiency and CompetitivenessIbssiNo ratings yet