Professional Documents

Culture Documents

Detailed Computation AOLPA4035J 1926312 Old Regime 20230830114705

Detailed Computation AOLPA4035J 1926312 Old Regime 20230830114705

Uploaded by

Lalchand AliCopyright:

Available Formats

You might also like

- Robert C Martin - Tiszta KódDocument489 pagesRobert C Martin - Tiszta KódÁron Demcsik100% (4)

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- The Big List of Star Wars NPC Names - RPG ReadyDocument5 pagesThe Big List of Star Wars NPC Names - RPG ReadyMichael LorenzNo ratings yet

- Memorialon Behalf of State (Prosecution) - 7th RLC SAQUIB RIZVI MEMORIAL NATIONAL MOOT COURT COMPETITION 2015Document30 pagesMemorialon Behalf of State (Prosecution) - 7th RLC SAQUIB RIZVI MEMORIAL NATIONAL MOOT COURT COMPETITION 2015Pronoy Chatterji88% (32)

- Basic Details: Detailed Computation As Per OLD Tax RegimeDocument2 pagesBasic Details: Detailed Computation As Per OLD Tax RegimeVishal SharmaNo ratings yet

- Detailed Computation AUPPA6498M 1632537 Old Regime 20230731220306Document3 pagesDetailed Computation AUPPA6498M 1632537 Old Regime 20230731220306Acharya SubhashishNo ratings yet

- SATTUCOM21Document2 pagesSATTUCOM21Alok G ShindeNo ratings yet

- Detailed - Computation AOKPV2391B 2004634 New Regime 20240411191153Document8 pagesDetailed - Computation AOKPV2391B 2004634 New Regime 20240411191153vermaparas576No ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- Latha R (KT083) - PayslipDocument1 pageLatha R (KT083) - Paysliprangaswamy8194No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21No ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Payslip 59904 202401Document1 pagePayslip 59904 202401Sk Imran IslamNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- Report - 2024-05-06T070831.495Document2 pagesReport - 2024-05-06T070831.495EDWARD LUPASANo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (2)

- Nov2023Document2 pagesNov2023ManiNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Earning For The Month - April 2023: Jubilant Foodworks LTDDocument1 pageEarning For The Month - April 2023: Jubilant Foodworks LTDnishankithkumarNo ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- Jan PayslipDocument1 pageJan Payslipnegishilpa051No ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- Deloitte Consulting India Private LimitedDocument2 pagesDeloitte Consulting India Private LimitedChinni SreenivasNo ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- Payslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPayslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Oct2023Document2 pagesOct2023ManiNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- IRPF 2022 2021 Origi Imagem Declaracao07Document1 pageIRPF 2022 2021 Origi Imagem Declaracao07BVC RoleplayNo ratings yet

- Tax Computation 10 2021Document2 pagesTax Computation 10 2021prashanth kumarNo ratings yet

- April Pay SlipDocument1 pageApril Pay SlipBale MishraNo ratings yet

- SalaryDocument1 pageSalaryBale MishraNo ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Adecco India Private Limited: Payslip For The Month of October 2022Document1 pageAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNo ratings yet

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Document1 pageGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNo ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Computation Abhishek 2021-22Document2 pagesComputation Abhishek 2021-22vm4416122No ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- PayslipDocument1 pagePayslipSahil shahNo ratings yet

- Abdul Rahim Jan-2024Document1 pageAbdul Rahim Jan-2024mohdshahjada77No ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsvineethpowerstarNo ratings yet

- The GameDocument1 pageThe Gamechhabram137No ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsvineethpowerstarNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsabhigopal444No ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- SEP2023 STFC PaySlipDocument2 pagesSEP2023 STFC PaySlipJHP CreationsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Waste Disposal FormDocument2 pagesWaste Disposal FormSubbaiahNo ratings yet

- MA Edition Doha V5sentDocument82 pagesMA Edition Doha V5sentMohamed ElkammahNo ratings yet

- Chapter 1 - VLE Part 1Document36 pagesChapter 1 - VLE Part 1Roger FernandezNo ratings yet

- B Law 3 Negotiable Instruments LawDocument4 pagesB Law 3 Negotiable Instruments LawvaneknekNo ratings yet

- ISL 201 Assignment 2 SolutionDocument4 pagesISL 201 Assignment 2 SolutionAleem IqbalNo ratings yet

- Open Mic - QRadar Fundamentals of FlowsDocument28 pagesOpen Mic - QRadar Fundamentals of Flowshiehie272No ratings yet

- CA FINAL DT Amendment Book BY Durgesh SinghDocument115 pagesCA FINAL DT Amendment Book BY Durgesh SinghRaviteja GundabattulaNo ratings yet

- Bangladesh Telecommunication Industry-A Comprehensive Review 2019Document14 pagesBangladesh Telecommunication Industry-A Comprehensive Review 2019fullerineNo ratings yet

- Management of Financial Services (MB 924)Document14 pagesManagement of Financial Services (MB 924)anilkanwar111No ratings yet

- CJ 1010 Final EssayDocument8 pagesCJ 1010 Final Essayapi-316578880No ratings yet

- DM50-DM60 1Document2 pagesDM50-DM60 1RoxanaNo ratings yet

- A Study On The Social Status of Women in Ancient Assam: Minakhee PowrelDocument8 pagesA Study On The Social Status of Women in Ancient Assam: Minakhee PowrelManagement StudiesNo ratings yet

- Progress Report G7Document40 pagesProgress Report G7龚子栩No ratings yet

- Bullfighting LeafletDocument2 pagesBullfighting LeafletOur CompassNo ratings yet

- @25are Catholic Beliefs and Practices BiblicalDocument3 pages@25are Catholic Beliefs and Practices BiblicalJessie BechaydaNo ratings yet

- Breaking and EnteringDocument1 pageBreaking and EnteringTianaNo ratings yet

- St. Nicholas Day Student Version ColorDocument2 pagesSt. Nicholas Day Student Version ColorFilipkoNo ratings yet

- CDC Annual ESG Report TemplateDocument6 pagesCDC Annual ESG Report TemplateJean OlemouNo ratings yet

- Deddy Corbuzier: Chinese Indonesian Name Family NameDocument4 pagesDeddy Corbuzier: Chinese Indonesian Name Family NameLuthfan FauzanNo ratings yet

- AStudy Outilne of The Revised Corporation CodeDocument153 pagesAStudy Outilne of The Revised Corporation Codetesla67% (3)

- Maximo Asset Management 7.1 Rapid Engagement Guide PDFDocument112 pagesMaximo Asset Management 7.1 Rapid Engagement Guide PDFriad100% (1)

- ALI Bonds 2022 Issuance Due 2024, 2027, 2029Document291 pagesALI Bonds 2022 Issuance Due 2024, 2027, 2029Ram CervantesNo ratings yet

- Dizon V CTA G.R. No. 140944 April 30, 2008Document11 pagesDizon V CTA G.R. No. 140944 April 30, 2008Emil BautistaNo ratings yet

- Removable Media Policy v1.0Document9 pagesRemovable Media Policy v1.0RyuNo ratings yet

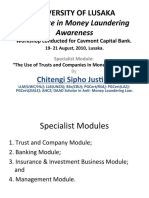

- The Use of Trusts and Corporations in Money LaunderingDocument15 pagesThe Use of Trusts and Corporations in Money LaunderingCHITENGI SIPHO JUSTINE, PhD Candidate- Law & PolicyNo ratings yet

- UT Daily Market Update 280911Document5 pagesUT Daily Market Update 280911jemliang_85No ratings yet

- Ranoco, Renz (Resume)Document3 pagesRanoco, Renz (Resume)Neil RanocoNo ratings yet

Detailed Computation AOLPA4035J 1926312 Old Regime 20230830114705

Detailed Computation AOLPA4035J 1926312 Old Regime 20230830114705

Uploaded by

Lalchand AliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Detailed Computation AOLPA4035J 1926312 Old Regime 20230830114705

Detailed Computation AOLPA4035J 1926312 Old Regime 20230830114705

Uploaded by

Lalchand AliCopyright:

Available Formats

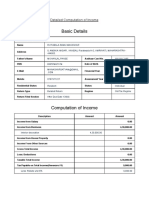

ITR #1926312

Detailed Computation as per Old Tax Regime

Basic Details

Personal Information

Name NIZAMUDDIN AHMED

VILL KURIHAMARI NALBARI ASSAM Kurihamari Bazar, Bhangnamari, NALBARI,

Address

ASSAM - 781126.

Father's Name ALAUDDIN AHMED Aadhaar Card No. **** **** 2729

PAN AOLPA4035J Date of Birth 01-01-1989

01-04-2022 to 31-03-

E-Mail toptfacts@gmail.com Financial Year

2023

01-04-2023 to 31-03-

Mobile 7002543431 Assessment Year

2024

Residential Status Resident Status Individual

Return Type Belated Return Regime Old Tax Regime

Return Filed Section After Due Date 139(4)

Computation of Income

Description Amount Amount

Income from Salary 0.00

Income from Business 1,86,598.00

Retail sale of other products n.e.c 1,86,598.00

Income from House Property 0.00

Income from Other Sources (Annexure #1) 14,584.00

Gross Total Income 2,01,182.00

Less: Deductions 0.00

Taxable Total Income 2,01,180.00

Tax Payable on Total Income 0.00

Less: Rebate u/s 87A 0.00

Tax2win.in Page 1 2023-08-30 11:47:05

ITR #1926312

Description Amount Amount

Tax Payable After Rebate 0.00

Add: Surcharge 0.00

Add: Health & Education Cess 0.00

Gross Tax Liability 0.00

Balance Tax After Relief 0.00

Less: Total Advance Tax Paid 0.00

Less: Total Self Assessment Tax Paid 0.00

Less: Total TDS Claimed 0.00

Less: Tax Collected at Source 0.00

Add: Interest u/s 234A 0.00

Add: Interest u/s 234B 0.00

Add: Interest u/s 234C 0.00

Add: Late Filing Fees u/s 234F 0.00

Balance Tax Payable 0.00

Details of Bank Accounts

Bank Name IFSC Code Account Number Selected for Refund?

State Bank of India SBIN0015304 37991736458 No

State Bank of India SBIN0015304 42159205697 Yes

Income from Other Sources

(Annexure #1)

Particulars Amount Amount

Other Taxable Income 14,584.00

Total Taxable Income 14,584.00

Tax2win.in Page 2 2023-08-30 11:47:05

ITR #1926312

Disclaimer: Your income tax return has been prepared and filed based on the data you provided. If any false or inaccurate deductions or

exemption claims were included, the responsibility rests solely with you. If you find discrepancies in the calculations or the tax return form,please

contact us at queryservice@tax2win.in within 48 hours for modifications. Post this period, Tax2win and its representatives will not beliable for

any discrepancies or issues. We act as an intermediary, processing your information for the tax department.

Tax2win.in Page 3 2023-08-30 11:47:05

You might also like

- Robert C Martin - Tiszta KódDocument489 pagesRobert C Martin - Tiszta KódÁron Demcsik100% (4)

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- The Big List of Star Wars NPC Names - RPG ReadyDocument5 pagesThe Big List of Star Wars NPC Names - RPG ReadyMichael LorenzNo ratings yet

- Memorialon Behalf of State (Prosecution) - 7th RLC SAQUIB RIZVI MEMORIAL NATIONAL MOOT COURT COMPETITION 2015Document30 pagesMemorialon Behalf of State (Prosecution) - 7th RLC SAQUIB RIZVI MEMORIAL NATIONAL MOOT COURT COMPETITION 2015Pronoy Chatterji88% (32)

- Basic Details: Detailed Computation As Per OLD Tax RegimeDocument2 pagesBasic Details: Detailed Computation As Per OLD Tax RegimeVishal SharmaNo ratings yet

- Detailed Computation AUPPA6498M 1632537 Old Regime 20230731220306Document3 pagesDetailed Computation AUPPA6498M 1632537 Old Regime 20230731220306Acharya SubhashishNo ratings yet

- SATTUCOM21Document2 pagesSATTUCOM21Alok G ShindeNo ratings yet

- Detailed - Computation AOKPV2391B 2004634 New Regime 20240411191153Document8 pagesDetailed - Computation AOKPV2391B 2004634 New Regime 20240411191153vermaparas576No ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- Latha R (KT083) - PayslipDocument1 pageLatha R (KT083) - Paysliprangaswamy8194No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21No ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Payslip 59904 202401Document1 pagePayslip 59904 202401Sk Imran IslamNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- Report - 2024-05-06T070831.495Document2 pagesReport - 2024-05-06T070831.495EDWARD LUPASANo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (2)

- Nov2023Document2 pagesNov2023ManiNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Earning For The Month - April 2023: Jubilant Foodworks LTDDocument1 pageEarning For The Month - April 2023: Jubilant Foodworks LTDnishankithkumarNo ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- Jan PayslipDocument1 pageJan Payslipnegishilpa051No ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- Deloitte Consulting India Private LimitedDocument2 pagesDeloitte Consulting India Private LimitedChinni SreenivasNo ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- Payslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPayslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Oct2023Document2 pagesOct2023ManiNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- IRPF 2022 2021 Origi Imagem Declaracao07Document1 pageIRPF 2022 2021 Origi Imagem Declaracao07BVC RoleplayNo ratings yet

- Tax Computation 10 2021Document2 pagesTax Computation 10 2021prashanth kumarNo ratings yet

- April Pay SlipDocument1 pageApril Pay SlipBale MishraNo ratings yet

- SalaryDocument1 pageSalaryBale MishraNo ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Adecco India Private Limited: Payslip For The Month of October 2022Document1 pageAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNo ratings yet

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Document1 pageGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNo ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Computation Abhishek 2021-22Document2 pagesComputation Abhishek 2021-22vm4416122No ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- PayslipDocument1 pagePayslipSahil shahNo ratings yet

- Abdul Rahim Jan-2024Document1 pageAbdul Rahim Jan-2024mohdshahjada77No ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsvineethpowerstarNo ratings yet

- The GameDocument1 pageThe Gamechhabram137No ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsvineethpowerstarNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsabhigopal444No ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- SEP2023 STFC PaySlipDocument2 pagesSEP2023 STFC PaySlipJHP CreationsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Waste Disposal FormDocument2 pagesWaste Disposal FormSubbaiahNo ratings yet

- MA Edition Doha V5sentDocument82 pagesMA Edition Doha V5sentMohamed ElkammahNo ratings yet

- Chapter 1 - VLE Part 1Document36 pagesChapter 1 - VLE Part 1Roger FernandezNo ratings yet

- B Law 3 Negotiable Instruments LawDocument4 pagesB Law 3 Negotiable Instruments LawvaneknekNo ratings yet

- ISL 201 Assignment 2 SolutionDocument4 pagesISL 201 Assignment 2 SolutionAleem IqbalNo ratings yet

- Open Mic - QRadar Fundamentals of FlowsDocument28 pagesOpen Mic - QRadar Fundamentals of Flowshiehie272No ratings yet

- CA FINAL DT Amendment Book BY Durgesh SinghDocument115 pagesCA FINAL DT Amendment Book BY Durgesh SinghRaviteja GundabattulaNo ratings yet

- Bangladesh Telecommunication Industry-A Comprehensive Review 2019Document14 pagesBangladesh Telecommunication Industry-A Comprehensive Review 2019fullerineNo ratings yet

- Management of Financial Services (MB 924)Document14 pagesManagement of Financial Services (MB 924)anilkanwar111No ratings yet

- CJ 1010 Final EssayDocument8 pagesCJ 1010 Final Essayapi-316578880No ratings yet

- DM50-DM60 1Document2 pagesDM50-DM60 1RoxanaNo ratings yet

- A Study On The Social Status of Women in Ancient Assam: Minakhee PowrelDocument8 pagesA Study On The Social Status of Women in Ancient Assam: Minakhee PowrelManagement StudiesNo ratings yet

- Progress Report G7Document40 pagesProgress Report G7龚子栩No ratings yet

- Bullfighting LeafletDocument2 pagesBullfighting LeafletOur CompassNo ratings yet

- @25are Catholic Beliefs and Practices BiblicalDocument3 pages@25are Catholic Beliefs and Practices BiblicalJessie BechaydaNo ratings yet

- Breaking and EnteringDocument1 pageBreaking and EnteringTianaNo ratings yet

- St. Nicholas Day Student Version ColorDocument2 pagesSt. Nicholas Day Student Version ColorFilipkoNo ratings yet

- CDC Annual ESG Report TemplateDocument6 pagesCDC Annual ESG Report TemplateJean OlemouNo ratings yet

- Deddy Corbuzier: Chinese Indonesian Name Family NameDocument4 pagesDeddy Corbuzier: Chinese Indonesian Name Family NameLuthfan FauzanNo ratings yet

- AStudy Outilne of The Revised Corporation CodeDocument153 pagesAStudy Outilne of The Revised Corporation Codetesla67% (3)

- Maximo Asset Management 7.1 Rapid Engagement Guide PDFDocument112 pagesMaximo Asset Management 7.1 Rapid Engagement Guide PDFriad100% (1)

- ALI Bonds 2022 Issuance Due 2024, 2027, 2029Document291 pagesALI Bonds 2022 Issuance Due 2024, 2027, 2029Ram CervantesNo ratings yet

- Dizon V CTA G.R. No. 140944 April 30, 2008Document11 pagesDizon V CTA G.R. No. 140944 April 30, 2008Emil BautistaNo ratings yet

- Removable Media Policy v1.0Document9 pagesRemovable Media Policy v1.0RyuNo ratings yet

- The Use of Trusts and Corporations in Money LaunderingDocument15 pagesThe Use of Trusts and Corporations in Money LaunderingCHITENGI SIPHO JUSTINE, PhD Candidate- Law & PolicyNo ratings yet

- UT Daily Market Update 280911Document5 pagesUT Daily Market Update 280911jemliang_85No ratings yet

- Ranoco, Renz (Resume)Document3 pagesRanoco, Renz (Resume)Neil RanocoNo ratings yet