Professional Documents

Culture Documents

15 H Form (Pre-Filled)

15 H Form (Pre-Filled)

Uploaded by

pareshrankaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

15 H Form (Pre-Filled)

15 H Form (Pre-Filled)

Uploaded by

pareshrankaCopyright:

Available Formats

PAN : AKIPR9803N

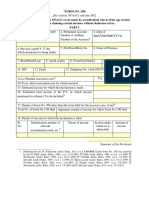

FORM No. 15H

[See Section 197A(1C)and Rule 29C]

Declaration under section 197a(1C) to be made by an individual who is of the age of sixty years or more

claiming certain incomes without deduction of tax.

PART-I

1. Name of Assessee (Declarant) DIPTI 2. Permanent Account Number or Aadhaar Number of 3. Date of Birth2 (DD/MM/YYYY) 26/06/1962

CHANDRAKANT RAWAL the Assessee1 AKIPR9803N

4. Previous Year(P.Y)3 5. Flat/Door/Block No. FLAT NO 7 SHANKAR NIWAS 6. Name of Premises PRABHAT COLONY TPS 5

(for which declaration is being made) 1ST FLOOR SANTACRUZ EAST

2024-2025

7. Road/Street/Lane 8. Area/Locality 9. Town/City/District MUMBAI 10. State MAHARASHTRA

11. PIN 400055 12. Email RADIPTI@GMAIL.COM 13. Telephone No. (with STD Code) and Mobile No.

919819174456

4

14. (a) Whether assessed to tax

Yes No

❒ ❒

(b) If Yes, latest assessment year for which assessed.

15. Estimated Income for which this declaration is 16. Estimated Total Income of the PY in which income

made mentioned in column 15 to be included.5

17. Details of Form No.15H other than this form filed for the previous year,if any6

Total No.of Form No.15H filed Aggregate amount of income for which Form No.15H

filed.

18. Details of income for which the declaration is filed

Sl. Identification number of Nature of Income Section under which Amount of income

No relevant investment/account tax is deductible

7

,etc.

© HDFC BANK LTD

CUST ID: 249404343

1 © FD NO : 50300871061832 Interest 194A

2 © FD NO : 50300884896206 Interest 194A

3 © FD NO : 50300818309247 Interest 194A

4 © FD NO : 50300818314846 Interest 194A

5 © FD NO : 50300818307063 Interest 194A

6 © FD NO : 50300954322976 Interest 194A

7 © FD NO : 50300901582670 Interest 194A

8 © RD NO : 50400321160095 Interest 194A

......................................................

Signature of declarant

Mandatory : To be filled by the Branch

Checklist for Form 15H (For individual >= 60 years)

I have checked and confirm the below Tick ( ✔ or ✕ )

Customer is >= 60 years (if < 60 years than fill form 15 G)

PAN No. is updated in Bank Records against the Cust Id of customer

Copy of PAN Card attached ( if not updated in the system)

Customer has signed in six places (indicated by)

Fields marked © are mandatory to be filled

Name of the Emp _____________________ Emp. Code _______________

Emp. Sign ___________________________ Date ____________________

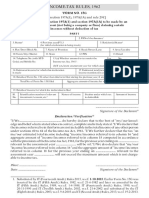

Declaration / Verification 8

I ................................................. do hereby declare that I am resident in India within the meaning of section 6 of the Income-tax Act, 1961. I also hereby declare that

to the best of my knowledge and belief what is stated above is correct, complete and is truly stated and that the incomes referred to in this form are not includible in

the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. I further declare that the tax on my estimated total income including

*income/ incomes referred to in column 15 *and aggregate amount of *income/ incomes referred to in column 17 computed in accordance with the provisions of the

Income-tax Act, 1961, for the previous year ending on 31st Mar 2025 relevant to the assessment year 2025-2026 will be nil.

Place: ..................................................

Date: ..................................................

Signature of declarant

PART II

[To be filled by the person responsible for paying the income referred to in column 15 of part 1]

1. Name of the person responsible for paying 2. Unique Identification No.9

3. Pan of the person responsible for paying 4. Complete Address 5. TAN of the person responsible for paying

AAACH2702H HDFC Bank House, Senapati Bapat Marg, MUMH03189E

Lower Parel, Mumbai, Maharashtra -

400013

6. Email 7. Telephone No. (with STD Code) and 8. Amount of Income Paid10

support@hdfcbank.com Mobile No.

9. Date on which Declaration is received (DD/MM/YYYY) 10. Date on which the income has been paid/ credited

(DD/MM/YYYY)

....................................................................

Signature of the person responsible for

Place: ............................................. paying the income referred to in

Date: ............................................. column 15 of part 1

Notes:

*Delete whichever is not applicable

1

As per provisions of section section 206AA(2), the declaration under section 197A(1C) shall be invalid if the declarant fails to furnish his valid

Permanent Account Number (PAN).

2

Declaration can be furnished by a resident individual who is of the age 60 years or more at any time during the previous year.

3

The financial year to which the income pertains.

4

Please mention "Yes" if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year out of six assessment years

preceding the year in which the declaration is filed.

5

Please mention the amount of estimated total income of the previous year for which the declaration is filed including the amount of income for which

this declaration is made.

6

In case any declaration(s) in Form No. 15H is filed before filing this declaration during the previous year, mention the total numer of such Form No.

15H filed along with the aggregate amount of income for which said declaration(s) have been filed.

7

Mention the distinctive number of shares, account number of term deposit, recurring deposit, Naitonal Savings Scheme, life insurance policy number,

employee code, etc.

8

Before signing the declaration/ verification, the declarant should satisfy himself that the information furnished in this form is true, correct and complete

in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961 and

on conviction be punishable-

(i) In a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which shall not be less than six months but

which may extend to seven years and with fine;

(ii) In any other case, rigorous imprisonment which shall not be less than three months but which may extend to two yeards and with fine.

9

The person responsible for paying the income referred to in column 15 of Part I shall allot a unique identification number to all the Form No. 15H

received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the

Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No. 15G during the same

quarter, please allot separate series of serial number for Form No. 15H and Form No. 15G.

10

The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the

nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or paid during the

previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax after allowing for deduction(s)

under Chapter VI-A, if any, or set off of loss, if any, under the head "income from house property" for which the declarant is eligible. For deciding the

eligibility, he is required to verify income or the aggregate amount of incomes, as the case may be, reported by the declarant in columns 15 and 17.

11

Provided that such person shall accept the declaration in a case where income of the assessee, who is eligible for rebate of income-tax under section

87A, is higher than the income for which declaration can be accepted as per this note, but his tax liability shall be nil after taking into account the

rebate available to him under the said section 87A.

You might also like

- Kobelco Excavator Error CodesDocument7 pagesKobelco Excavator Error CodesMaryam86% (57)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- 15 G Form (Pre-Filled)Document3 pages15 G Form (Pre-Filled)Ravi JammulaNo ratings yet

- 15 H Form (Pre-Filled)Document2 pages15 H Form (Pre-Filled)sethiashok766No ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)royprithvi37No ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Form No. 15G: Declaration/VerificationDocument2 pagesForm No. 15G: Declaration/VerificationMadhu MohanNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- Tata Consumer ANNEXURE - 2 FORM 15HDocument5 pagesTata Consumer ANNEXURE - 2 FORM 15HAnbarasu MookiahpandianNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- 2024 07 1 13 10 18 15GH - AcknowledgeDocument2 pages2024 07 1 13 10 18 15GH - AcknowledgeKajal SamaniNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- "FORM NO. 15G": (See Section 197A (1), 197A (1A) and Rule 29C)Document2 pages"FORM NO. 15G": (See Section 197A (1), 197A (1A) and Rule 29C)JAY SAINo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- Income-Tax Rules, 1962Document3 pagesIncome-Tax Rules, 1962Jalpa TrivediNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Shashank KSNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Form-15GDocument2 pagesForm-15GvikramNo ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- Form 15h Revised1Document2 pagesForm 15h Revised1rajprince26460No ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordMahesh RathodNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Form 15G 03 May 2024Document2 pagesForm 15G 03 May 2024ravaldigish62No ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsumeet khannaNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- UntitledDocument1 pageUntitledGeethu KadariNo ratings yet

- Form 15 HDocument2 pagesForm 15 HPravin KaleNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Book Review by SH Mukesh GaurDocument17 pagesBook Review by SH Mukesh GaurAnant JainNo ratings yet

- Merit List MBA Scholarship 2020 March 1 PDFDocument11 pagesMerit List MBA Scholarship 2020 March 1 PDFPrakash SitaulaNo ratings yet

- Datasheet KA7500BDocument8 pagesDatasheet KA7500BFady HachemNo ratings yet

- Sulong Karunungan Scholarship Program (Sulkar-Sp) : Annex "A"Document1 pageSulong Karunungan Scholarship Program (Sulkar-Sp) : Annex "A"maevelene dedalNo ratings yet

- KIP7770 KService ManualDocument659 pagesKIP7770 KService Manualjoe100% (1)

- The Physical DomainDocument9 pagesThe Physical DomainPatricia RiveraNo ratings yet

- Role of Mid-Day Meal SchemeDocument3 pagesRole of Mid-Day Meal SchemekishorebharathNo ratings yet

- Info Pompe Pistonase PDFDocument44 pagesInfo Pompe Pistonase PDFMarin GarazNo ratings yet

- DWIN LCD Display With ApplicationDocument23 pagesDWIN LCD Display With ApplicationcihanNo ratings yet

- Host Reactions To BiomaterialsDocument40 pagesHost Reactions To BiomaterialsSidekkNo ratings yet

- Mipi-Tutorial PDF CompressedDocument13 pagesMipi-Tutorial PDF CompressedGeorgeNo ratings yet

- American Scientific Research Journal For Engineering, Technology, and Sciences (Asrjets), Vol 6, No 1 (2013), Issn (Print) 2313-44106Document2 pagesAmerican Scientific Research Journal For Engineering, Technology, and Sciences (Asrjets), Vol 6, No 1 (2013), Issn (Print) 2313-44106atilaelciNo ratings yet

- Belzona High Performance Linings For Storage Tanks: Guide Only Contact Belzona For Specific Chemicals Zero WastageDocument2 pagesBelzona High Performance Linings For Storage Tanks: Guide Only Contact Belzona For Specific Chemicals Zero WastagepgltuNo ratings yet

- April 19, 2004 Group B1Document19 pagesApril 19, 2004 Group B1jimeetshh100% (2)

- Kisi-Kisi Soal Pas Kelas XDocument14 pagesKisi-Kisi Soal Pas Kelas XRionaNo ratings yet

- What Is A Bijamantra?: Aghori - It 1Document20 pagesWhat Is A Bijamantra?: Aghori - It 1er arNo ratings yet

- Shortcuts For Krita: HelloDocument66 pagesShortcuts For Krita: HellogronolivNo ratings yet

- Dissertation Conflit Israelo PalestinienDocument7 pagesDissertation Conflit Israelo PalestinienPaySomeoneToWriteAPaperForMeUK100% (2)

- 3-Parallel Lines and TransversalsDocument6 pages3-Parallel Lines and Transversalsshela26No ratings yet

- Lesson 9 Tax Planning and StrategyDocument31 pagesLesson 9 Tax Planning and StrategyakpanyapNo ratings yet

- Reassembly: 1. Assemble Piston and Connecting RodDocument7 pagesReassembly: 1. Assemble Piston and Connecting Roddawitmesfin9No ratings yet

- STR-DA1200ES v1.1 PDFDocument125 pagesSTR-DA1200ES v1.1 PDFGomoiu BogdanNo ratings yet

- Transforming Small Local Business To Widely Recognized BrandsDocument6 pagesTransforming Small Local Business To Widely Recognized BrandsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Guidelines On The Evaluation of Organic Agriculture ProposalsDocument37 pagesGuidelines On The Evaluation of Organic Agriculture ProposalsJefferson RillortaNo ratings yet

- ACTION Plan For NAT ReviewDocument3 pagesACTION Plan For NAT ReviewIvy NiñezaNo ratings yet

- Bond EnthalpyDocument4 pagesBond EnthalpyLan NguyenNo ratings yet

- TCS NQT Part4Document5 pagesTCS NQT Part4djustinlivingstonNo ratings yet

- 0-Mayper 1991 An Analysis of Municipal Budget Variances-1Document24 pages0-Mayper 1991 An Analysis of Municipal Budget Variances-1ani100% (1)

- Norsok Materials GuideDocument37 pagesNorsok Materials GuideYomara Samantha Hernandez LaureanoNo ratings yet