Professional Documents

Culture Documents

Session 03 Advance Candlestick Patterns

Session 03 Advance Candlestick Patterns

Uploaded by

Zulfiqar AliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session 03 Advance Candlestick Patterns

Session 03 Advance Candlestick Patterns

Uploaded by

Zulfiqar AliCopyright:

Available Formats

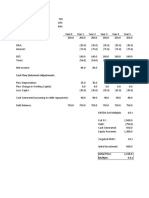

Sr.

No Topic Page No

1 Other Candlestick Patterns 1

2 Magic of Candlestick patterns 6

*********************

Copyright: Maan Trading Academy, Rajkot Page No: 1 Date:12082023 Rev01

Other Candlestick Patterns:

Tweezer: The tweezer candlestick pattern consists of two identical candles (can be

neutral, solid green or red candlestick). It has more significant if found on the top or

bottom of the trend.

Three white soldiers: is made of three solid green bullish candles.

Indicates strong up trend. The candlesticks should have big bodies and

very small (or no) wicks.

Three black crows: is made of three solid Red bearish candles.

Indicates strong down trend. The candlesticks should have big bodies

and very small (or no) wicks.

Copyright: Maan Trading Academy, Rajkot Page No: 2 Date:12082023 Rev01

Harami candlestick pattern: The bullish Harami candlestick formation is a

trend reversal pattern that occurs at the end of a downward trend and signals a

buying opportunity.

The name “Harami” comes from Japanese and means pregnant since the

formation is similar in appearance to a pregnant woman. There are two types

of Harami candle patterns, the bullish and bearish Harami candlestick pattern.

Bullish Harami candlestick pattern consists of a long bearish candlestick,

followed by a bullish candlestick with a small body. Second candle is totally

inside of the first candle.

Bearish Harami candlestick pattern consists of a long Bullish candlestick,

followed by a Bearish candlestick with a small body. Second candle is totally

inside of the first candle.

Copyright: Maan Trading Academy, Rajkot Page No: 3 Date:12082023 Rev01

A Marubozu is a single candlestick pattern has big body with small or no wicks.

It signals a strong price action as buyers or sellers dominate the session.

Marubozu is Japanese word used for Dominance, also means shaved head or

bald head, which is shown in the formation of the Marubozu candle pattern that

has no shadows.

Copyright: Maan Trading Academy, Rajkot Page No: 4 Date:12082023 Rev01

Dark Cloud Cover: is bearish two candlestick pattern. In this pattern, the first

candle must be green (bullish) and the second candle has to be red (bearish). The

second red candle must open higher than the first green candle and cover at list

50 % body of first Green bullish candle. And it is good if we found in uptrend on

the top for bearish reversal pattern.

Hanging man on the Top has a small real body and a long lower shadow

(Hammer on the top). It has more significant if found on the top of the

trend. It is a bearish reversal pattern

Shooting star pattern is a single candlestick that appears on the top

after upward trends. It is a bearish reversal pattern has a small real body

and a long upper shadow (Inverted Hammer on the top).

Hammer at bottom is single candlestick that appears on the Bottom

after downward trends. It is a bullish reversal pattern has a small real

body and a long lower shadow (Hammer at bottom).

Copyright: Maan Trading Academy, Rajkot Page No: 5 Date:12082023 Rev01

Magic of Candlestick Patterns:

When we combine candlestick patterns, it can form another one, which

gives you clarity to what is going on in the markets. This approach

allows for a more comprehensive analysis of price action and enhances

the understanding of potential trend reversals or continuations.

After combining two or three candlesticks, we found majority of bullish

candles are like Hammer, while majority of bearish candles are inverted

hammer or Shooting Star.

Copyright: Maan Trading Academy, Rajkot Page No: 6 Date:12082023 Rev01

Copyright: Maan Trading Academy, Rajkot Page No: 7 Date:12082023 Rev01

Copyright: Maan Trading Academy, Rajkot Page No: 8 Date:12082023 Rev01

You might also like

- Trading FaceDocument52 pagesTrading Facecryss savin92% (24)

- Candlestick BookDocument22 pagesCandlestick BookPrabhu Mohan100% (20)

- Candlestick Chart PatternsDocument60 pagesCandlestick Chart Patternskrunal solanki100% (5)

- Scalping is Fun! 2: Part 2: Practical examplesFrom EverandScalping is Fun! 2: Part 2: Practical examplesRating: 4.5 out of 5 stars4.5/5 (28)

- CandleStick Patterns ListDocument23 pagesCandleStick Patterns ListZaid Ahmed50% (2)

- West Bengal Housing Department No. 23099-HODocument18 pagesWest Bengal Housing Department No. 23099-HOSubraNo ratings yet

- Candle Stick PatternDocument47 pagesCandle Stick PatternAtanu Pandit100% (1)

- 21 Easy Candlestick PatternsDocument24 pages21 Easy Candlestick Patternsharry1520100% (3)

- Forex Trading 1-2: Book 1: Practical examples,Book 2: How Do I Rate my Trading Results?From EverandForex Trading 1-2: Book 1: Practical examples,Book 2: How Do I Rate my Trading Results?Rating: 5 out of 5 stars5/5 (5)

- Standard Purchase Agreement For Real Estate - BPDocument2 pagesStandard Purchase Agreement For Real Estate - BPMJ Aramburo100% (1)

- SESSION 3 ADVANCE CNDLESTICKDocument8 pagesSESSION 3 ADVANCE CNDLESTICKrivacshahNo ratings yet

- Session 02 Candle Stick PatternsDocument9 pagesSession 02 Candle Stick PatternsZulfiqar AliNo ratings yet

- SESSION 2 CANDLE STICKDocument9 pagesSESSION 2 CANDLE STICKrivacshahNo ratings yet

- Candlestick PatternsDocument12 pagesCandlestick PatternsSameer100% (2)

- Candlestick: Technical AnalysisDocument15 pagesCandlestick: Technical AnalysisHrushikesh S.K.100% (1)

- Candlelstick Patten EnglishDocument37 pagesCandlelstick Patten EnglishPub Lolzzz0% (1)

- Candlestick PatternsDocument10 pagesCandlestick PatternsSourav GargNo ratings yet

- CandleDocument45 pagesCandleMohammad GalibNo ratings yet

- RR25072016Document4 pagesRR25072016rajagopalakrishnanNo ratings yet

- CLASS 6 Candle Sticks and Candlesticks PatternsDocument12 pagesCLASS 6 Candle Sticks and Candlesticks PatternsUmar Hussaini100% (1)

- Ninjacators CandlestickPatternSpotter ManualDocument34 pagesNinjacators CandlestickPatternSpotter ManualiantraderNo ratings yet

- All 35 Candlestick Chart Patterns in The Stock Market ExplainedDocument35 pagesAll 35 Candlestick Chart Patterns in The Stock Market Explained9cvxkh4wtkNo ratings yet

- Candlesticks Signals and Patterns PDFDocument149 pagesCandlesticks Signals and Patterns PDFSLIME GAMING100% (6)

- 35 Powerful Candlestick Patterns For Day Trading Finschool by 5paisaDocument1 page35 Powerful Candlestick Patterns For Day Trading Finschool by 5paisadaniilo.fotografiaNo ratings yet

- Candlelstick English Wealth Multiplier - Google Docs 2023 31 08 03 59 1Document39 pagesCandlelstick English Wealth Multiplier - Google Docs 2023 31 08 03 59 1Sunny KhetarpalNo ratings yet

- Galaxy Waves First ChipterDocument37 pagesGalaxy Waves First ChipterEisa IshaqzaiNo ratings yet

- All PatternsDocument157 pagesAll PatternsaramannaNo ratings yet

- Candlelstick 30901982 2024 03 26 22 20Document37 pagesCandlelstick 30901982 2024 03 26 22 20vasanthshm123No ratings yet

- Candlelstick EnglishDocument37 pagesCandlelstick EnglishSatish NaikNo ratings yet

- Candlestick & Chart Pattern explanationDocument54 pagesCandlestick & Chart Pattern explanationchandraprakashsaxena134No ratings yet

- Bullish Reversal Candlestick PatternsDocument42 pagesBullish Reversal Candlestick PatternsMaham BaqaiNo ratings yet

- Candlestick PatternsDocument14 pagesCandlestick Patternsmuse marni100% (3)

- Candlestick BookDocument22 pagesCandlestick Bookrajveer40475% (4)

- Candlestick Patterns Explained With ExamplesDocument68 pagesCandlestick Patterns Explained With ExamplesMatthew EnglandNo ratings yet

- 5 Secrets of Candle SticksDocument26 pages5 Secrets of Candle Sticksraviduseja88No ratings yet

- 30 Important Candlestick Patterns and How Are They ReadDocument20 pages30 Important Candlestick Patterns and How Are They Readkegonif419No ratings yet

- Technical AnalysisDocument4 pagesTechnical AnalysisTOSHAK SHARMANo ratings yet

- Candle SticksDocument9 pagesCandle SticksDurganandan JanaNo ratings yet

- How To Trade With CandlesticksDocument10 pagesHow To Trade With CandlesticksBhavesh ShahNo ratings yet

- Equal Open and Close, Doji PatternsDocument24 pagesEqual Open and Close, Doji PatternsalokNo ratings yet

- Candlestick PatternsDocument13 pagesCandlestick Patternsvineetrao2003No ratings yet

- Eight Best CandlesDocument4 pagesEight Best CandlesJonathan DominguezNo ratings yet

- Candle Nals: Sticks SigDocument22 pagesCandle Nals: Sticks SigBursa Valutara0% (1)

- Use of Candlestick Charts Use of Candlestick ChartsDocument10 pagesUse of Candlestick Charts Use of Candlestick ChartssrirubanNo ratings yet

- Secrets of Candlestick Patterns - The Secrets of The Top 12 - Bhandari, Bhuwan - 2022Document27 pagesSecrets of Candlestick Patterns - The Secrets of The Top 12 - Bhandari, Bhuwan - 2022Rajesh7358No ratings yet

- 10 Price Action Candlestick Patterns You Must KnowDocument30 pages10 Price Action Candlestick Patterns You Must KnowHadji Hrothgar100% (1)

- 10 Price Action Candlestick Patterns You Must Know: StrategyDocument22 pages10 Price Action Candlestick Patterns You Must Know: StrategykotiNo ratings yet

- Candlestick PaternsDocument12 pagesCandlestick Paternsdarshan wareNo ratings yet

- What Are The Candlesticks ChartsDocument18 pagesWhat Are The Candlesticks ChartsadamobirkNo ratings yet

- Candle Book John GhattiDocument19 pagesCandle Book John GhattiMarvin AjavonNo ratings yet

- En 16 Candlestick Patterns You Must Know and How To Read ThemDocument17 pagesEn 16 Candlestick Patterns You Must Know and How To Read Themibragazza01No ratings yet

- Overview Candlesticks PDFDocument2 pagesOverview Candlesticks PDFHasrul RezaNo ratings yet

- TWG Candlestick PatternDocument19 pagesTWG Candlestick Patternoshristi13No ratings yet

- Hammer & Hanging Man - PrintedDocument16 pagesHammer & Hanging Man - PrintedMian Umar Rafiq0% (1)

- Profitable Candlestick PatternsDocument13 pagesProfitable Candlestick PatternsVicaas VSNo ratings yet

- SodaPDF Converted Beginners Guide To Trading, Candlesticks PatternsDocument21 pagesSodaPDF Converted Beginners Guide To Trading, Candlesticks PatternsgopalatheophilusNo ratings yet

- Summary of Steve Nison's Japanese Candlestick Charting TechniquesFrom EverandSummary of Steve Nison's Japanese Candlestick Charting TechniquesRating: 4 out of 5 stars4/5 (1)

- Forex Trading: The $250,000 Candlestick Patterns StrategyFrom EverandForex Trading: The $250,000 Candlestick Patterns StrategyRating: 5 out of 5 stars5/5 (3)

- Chapter 1 - Marketing - Creating Customer Value and Engagement PDFDocument25 pagesChapter 1 - Marketing - Creating Customer Value and Engagement PDFmaalouf nicolasNo ratings yet

- Financial Econometrics Modeling Market Microstructure, Factor Models and Financial Risk MeasuresDocument281 pagesFinancial Econometrics Modeling Market Microstructure, Factor Models and Financial Risk MeasuresTayyaba ShahNo ratings yet

- Economics 2 0525 Cameroon General Certificate of Education BoardDocument3 pagesEconomics 2 0525 Cameroon General Certificate of Education BoardTheodore YimoNo ratings yet

- Account Statement: NSDL Payments BankDocument3 pagesAccount Statement: NSDL Payments BankPunam PanditNo ratings yet

- THW5 London Hilton-1Document2 pagesTHW5 London Hilton-1junho yoonNo ratings yet

- CB & STPDocument20 pagesCB & STPPruthviraj RathoreNo ratings yet

- Myths of GlobalizationDocument8 pagesMyths of GlobalizationCheskaNo ratings yet

- Fall of BPL ReportDocument18 pagesFall of BPL ReportUday HiremathNo ratings yet

- International Business Trade SeatworkDocument2 pagesInternational Business Trade SeatworkMaia Carmela JoseNo ratings yet

- Modern History USA 1919-1941 NotesDocument13 pagesModern History USA 1919-1941 NotesOliver Al-MasriNo ratings yet

- Insights Mind Maps: Golden Quadrilateral ProjectDocument2 pagesInsights Mind Maps: Golden Quadrilateral Projectashish kumarNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsJb De GuzmanNo ratings yet

- Eco 310Document3 pagesEco 310LAIZA MARIE MANALONo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Depreciation ExerciseDocument7 pagesDepreciation ExerciseMuskan LohariwalNo ratings yet

- Saln CherryDocument3 pagesSaln CherryMARISSA MAMARILNo ratings yet

- Short Cases: Business Process ReengineeringDocument9 pagesShort Cases: Business Process ReengineeringNOSHEEN MEHFOOZNo ratings yet

- The Role of Supplier Base Rationalisation in Operational Performance in The Retail Sector in ZimbabweDocument10 pagesThe Role of Supplier Base Rationalisation in Operational Performance in The Retail Sector in ZimbabweJorge Alejandro Patron ChicanaNo ratings yet

- Small Business Loans: A Practical Guide To Business CreditDocument15 pagesSmall Business Loans: A Practical Guide To Business CreditwilllNo ratings yet

- Rizki Permana Eka PutraDocument32 pagesRizki Permana Eka Putrakhoirunnisa ramadhanNo ratings yet

- Introduction To Capital BudgetingDocument20 pagesIntroduction To Capital BudgetingMary R. R. PanesNo ratings yet

- Penn World Table, Version 9.1: When Using These Data, Please Refer To The Following PaperDocument20 pagesPenn World Table, Version 9.1: When Using These Data, Please Refer To The Following PaperGloria Angelica ROJAS PENANo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- ANSWER KEY (Mid-Term Quiz 1)Document1 pageANSWER KEY (Mid-Term Quiz 1)JoyluxxiNo ratings yet

- Guide Question AccountingDocument24 pagesGuide Question AccountingJUARE MaxineNo ratings yet

- Deepak Bhai - Repaired - FINALDocument107 pagesDeepak Bhai - Repaired - FINALNehaNo ratings yet

- Corporations CH 12 Lecture 1Document18 pagesCorporations CH 12 Lecture 1Faisal SiddiquiNo ratings yet

- Ofw Application FormDocument1 pageOfw Application FormJan Carlos SuykoNo ratings yet