Professional Documents

Culture Documents

Mcqs 103 Business Accounting

Mcqs 103 Business Accounting

Uploaded by

MOLALIGNCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mcqs 103 Business Accounting

Mcqs 103 Business Accounting

Uploaded by

MOLALIGNCopyright:

Available Formats

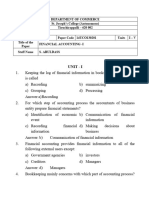

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

Question Bank - Multiple Choice Questions (MCQs)

Unit 1: Financial Accounting

1) Accounting furnishes data on

a) Income and cost for the managers

b) Financial conditions of the institutions

c) Company’s tax liability for a particular year

d) All the above

2) Long term assets having no physical existence but, possessing a value are called

a) Intangible assets

b) Fixed assets

c) Current assets

d) Investments

3) The assets that can be easily converted into cash within a short period, i.e., 1 year or less are known as

a) Current assets

b) Fixed assets

c) Intangible assets

d) Investments

4) The debts which are to be repaid within a short period (a year or less) are referred to as,

a) Current Liabilities

b) Fixed liabilities

c) Contingent liabilities

d) All the above

5) Accounting provides information on

a) Cost and income for managers

b) Company’s tax liability for a particular year

c) Financial conditions of an institution

d) All of the above

6) The following is not a type of liability

a) Short term

b) Current

c) Fixed

d) Contingent

7) Any written evidence in support of a business transaction is called

a) Journal

b) Ledger

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

c) Ledger posting

d) Voucher

8) The accounts that records expenses, gains and losses are

a) Personal accounts

b) Real accounts

c) Nominal accounts

d) None of the above

9) Real accounts records

a) Dealings with creditors or debtors

b) Dealings in commodities

c) Gains and losses

d) All of the above

10) Which accounting concept satisfy the valuation criteria?

a) Going concern, Realisation, Cost

b) Going concern, Cost, Dual aspect

c) Cost, Dual aspect, Conservatism

d) Realisation, Conservatism, Going concern.

11) A trader has made a sale of Rs.75,500 out of which cash sales amounted to Rs.25,500. He showed trade

receivables on 31-3-2014 at Rs.25,500. Which concept is followed by him?

a) Going concern

b) Cost

c) Accrual

d) Money measurement

12) A trader purchases goods for Rs. 2500000, of these 70% of goods were sold during the year. At the end

of 31st December 2009, the market value of such goods were Rs. 500000. But the trader recorded in his

books for Rs. 750000. Which of the following concept is violated.

a) Money measurement

b) Conservatism

c) Consistency

d) None of these

13) The proprietor of the business is treated as creditor for the capital introduced by him due to_____

concept.

a) Money measurement

b) Cost

c) Entity

d) Dual aspect

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

14) Fixed assets are held by business for _____.

a) Converting into cash

b) Generating revenue

c) Resale

d) None of the above

15) Which of the following is not a Real Account?

a) Cash A/c

b) Investments A/c

c) Outstanding rent A/c

d) Purchases A/c

16) Small items like, pencils, pens, files, etc. are written off within a year according to _____ concept.

a) Materiality

b) consistency

c) Conservatism

d) Realisation

17) Business enterprise is separate from its owner according to _____ concept.

a) Money measurement concept

b) Matching concept

c) Entity concept

d) Dual aspect concept

18) Debit the receiver & credit the giver is _____ account.

a) Personal

b) Real

c) Nominal

d) All the above

19) Cash a/c is a ______.

a) Real a/c

b) Nominal

c) Personal

d) None

20) As per the Matching concept, Revenue – ? = Profit

a) Expenses

b) Liabilities

c) Losses

d) Assets

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

21) Which of the following is not a nominal Account?

a) Outstanding salaries Account

b) Salaries account

c) Interest paid

d) Commission received

22) Historical cost concept requires the valuation of an asset at

a) Original cost

b) Replacement value

c) Net realizable value

d) Market value

23) Profit and loss is calculated at the stage of

a) Recording

b) Posting

c) Classifying

d) Summarising

24) The rule debit all expenses and losses and credit all income and gains relates to

a) Personal account

b) Real account

c) Nominal accounts

d) All

25) Which of the following is not the main objective of accounting?

a) Systematic recording of transactions

b) Ascertaining profit or loss

c) Ascertainment of financial position

d) Solving tax disputes with tax authorities

26) The comparison of financial statement of one year with that of another is possible only when -------------

---concept is followed

a) Going concern

b) Accrual

c) Consistency

d) Materiality

27) For every debit there will be an equal credit according to

a) Matching concept

b) Cost concept

c) Money measurement concept

d) Dual aspect concept

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

28) A trader calculated his profit as Rs.150000 on 31/03/2014. It is an

a) Transaction

b) Event

c) Transaction as well as event

d) Neither transaction nor event

29) Which of the following is a Real A/c?

a) Building A/c

b) Capital A/c

c) Shyam A/c

d) Rent A/c

30) Cost concept basically recognises ____.

a) Fair Market value

b) Historical cost

c) Realisable value

d) Replacement cost

31) Which of the following is not an internal user of management information?

a) Creditor

b) Department manager

c) Controller

d) Treasurer

32) Double entry system is used in which type of accounting?

a) Cost

b) Financial

c) Management

d) All

33) An accounting that deals with the accounting and reporting of information to management regarding the

detail information is

a) Financial accounting

b) Management accounting

c) Cost accounting

d) Real Accounting

34) Identify which is wrong rule

a) Nominal account- debit all expenses & losses

b) Real account- credit what comes in

c) Nominal account- credit all incomes & gains

d) Personal account- debit the receiver

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

35) Financial accounting is concerned with –

a) Recording of business expenses and revenue

b) Recording of costs of products and services

c) Recording of day to day business transactions

d) None of the above

36) The nature of financial accounting is:

a) Historical

b) Forward looking

c) Analytical

d) Social

37) The main object of cost accounting is:

a) To record day to day transactions of the business

b) To reveal managerial efficiency

c) To ascertain true cost of products and services

d) To determine tender price

38) Accounting principles are generally based upon:

a) Practicability

b) Subjectivity

c) Convenience in recording

d) None of the above

39) The system of recording based on dual aspect concept is called:

a) Double account system

b) Double entry system

c) Single entry system

d) All the above

40) P & L a/c is prepared for a period of one year by following:

a) Consistency concept

b) Conservatism concept

c) Accounting period concept

d) Cost Concept

41) All those to whom business owes money are:

a) Debtors

b) Investors

c) Creditors

d) Shareholders concept

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

42) Bookkeeping is a/an……………………of correctly recording of business transition.

a) Art and Science

b) Art

c) Science

d) Art or Science

43) The purpose of financial accounts is reporting to

a) Management only

b) Government only

c) Investor only

d) All of these

44) Accounting principles are divided into two types. These are ---

a) Accounting Concepts

b) Accounting Conventions

c) Accounting Standards

d) Accounting Concepts & Accounting Conventions

45) Which one of the following items would fall under the definition of a liability?

a) Cash

b) Debtor

c) Owner’s equity

d) None of these

46) A statement containing the various ledgers balances on particular date

a) Compound Journal

b) Ledger

c) Trial balance

d) None of the above

47) The transferring of debit and credit items from journal to the respective accounts in the ledger is called

as

a) Ledger

b) Posting

c) Forward journal

d) None of these one of these

48) The basic sequence in the accounting process can best be described as:

a) Transaction, journal entry, source document, ledger account, trial balance.

b) Source document, transaction, ledger account, journal entry, trial balance.

c) Transaction, source document, journal entry, trial balance, ledger account.

d) Transaction, source document, journal entry, ledger account, trial balance.

PROF. KAVITA PAREEK www.dacc.edu.in

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45

Subject: Business Accounting (103) CLASS: FYBBA (Sem – I) (2019 PATTERN)

49) Debit the receiver credit the giver rule for

a) Real a/c

b) Personal a/c

c) Nominal a/c

d) None of these

50) What comes in is to be debited, what goes out is to be credited.

a) Rules of Personal

b) Rules of Real

c) Rules of Nominal

d) All of these

Answer Key:

1-d 2-a 3- a 4-a 5–d 6-a 7-d 8-c 9-b 10 - a

11 - c 12 - b 13 - c 14 - b 15 – c 16 - a 17 - c 18 - a 19 - a 20 - a

21 - a 22 - a 23 - d 24 - c 25 – d 26 - c 27 - d 28 - b 29 - a 30 - b

31 - a 32 - b 33 - b 34 - b 35 – c 36 - a 37 - c 38 - a 39 - b 40 - c

41 - c 42 - b 43 - d 44 - d 45 – c 46 - c 47 - b 48 - d 49 - b 50 - b

PROF. KAVITA PAREEK www.dacc.edu.in

You might also like

- Acccob2 Portfolio: An Analysis/Reflection of The 2020 Financial Statements of San Miguel CorpDocument5 pagesAcccob2 Portfolio: An Analysis/Reflection of The 2020 Financial Statements of San Miguel CorpMichael Allen RodrigoNo ratings yet

- Final McqsDocument43 pagesFinal McqsShoaib Kareem100% (4)

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- MCQ For Accounting of Business ManagementDocument7 pagesMCQ For Accounting of Business ManagementRohan Gurav100% (3)

- EPM Multiple Choice Questions 7 PDFDocument21 pagesEPM Multiple Choice Questions 7 PDFSittie Hashima MangotaraNo ratings yet

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocument20 pages2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNo ratings yet

- Corp Gov CasesDocument23 pagesCorp Gov CasesClive MakumbeNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial AccountingDocument34 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial AccountingMonojit kunduNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial Statement of Corporate OrganisationsDocument37 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial Statement of Corporate Organisationsrocky singhNo ratings yet

- Afm MCQDocument10 pagesAfm MCQSarannya PillaiNo ratings yet

- Basic Accounting MCQs With AnswersDocument7 pagesBasic Accounting MCQs With AnswersShahid NaikNo ratings yet

- MCQ - 202 - Corporate Accounting - SEM IDocument34 pagesMCQ - 202 - Corporate Accounting - SEM ISARAVANAVEL VELNo ratings yet

- FINC512 Assignement QuestionsDocument37 pagesFINC512 Assignement QuestionsNaina Malhotra0% (1)

- Accounts MCQDocument41 pagesAccounts MCQHaripriya VNo ratings yet

- 14UCO130201Document29 pages14UCO130201Fawaz FazilNo ratings yet

- Practice MCQ Set Accounting-1 & 2Document77 pagesPractice MCQ Set Accounting-1 & 2Ram100% (1)

- 2020 - BCA 2 Sem Finanancial AccountingDocument13 pages2020 - BCA 2 Sem Finanancial AccountingLeah DesharNo ratings yet

- Financial Accounting MCQs - Senior Auditor Bs-16Document34 pagesFinancial Accounting MCQs - Senior Auditor Bs-16Faizan Ch0% (1)

- Final McqsDocument42 pagesFinal McqsShoaib KareemNo ratings yet

- Mcqs On AccountspdfDocument37 pagesMcqs On AccountspdfEkta SharmaNo ratings yet

- Fundamentals of AccountancylongtestDocument6 pagesFundamentals of AccountancylongtestEmarilyn BayotNo ratings yet

- Cfas Mock Test PDFDocument71 pagesCfas Mock Test PDFRose Dumadaug50% (2)

- 11th-Accountancy-Book-Back-One-Mark-Study-Materials-English-Medium - 2 PDFDocument6 pages11th-Accountancy-Book-Back-One-Mark-Study-Materials-English-Medium - 2 PDFSuresh GNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument11 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionSherlock HolmesNo ratings yet

- Financial Accounting - MCQ'S For PracticeDocument8 pagesFinancial Accounting - MCQ'S For Practiceprathampawar5912No ratings yet

- Ss2 Objective Type CDocument5 pagesSs2 Objective Type CUkoh OwoidohoNo ratings yet

- Accounting Principles & Procedures MCQs (Set-II) For All Competitive ExamsDocument10 pagesAccounting Principles & Procedures MCQs (Set-II) For All Competitive ExamsKhan ZuhaNo ratings yet

- Updated MCQ Booklet SO Part-IDocument573 pagesUpdated MCQ Booklet SO Part-IpunithupcharNo ratings yet

- Accounting Principles & Procedures MCQs (Set-II) For All Competitive ExamsDocument10 pagesAccounting Principles & Procedures MCQs (Set-II) For All Competitive ExamsBaloch BalochNo ratings yet

- PRATIMA MBA-1 Mang. Account - 120811Document36 pagesPRATIMA MBA-1 Mang. Account - 120811Mavani snehaNo ratings yet

- MH-N Knowledge: Accounts and Finance MCQ'SDocument17 pagesMH-N Knowledge: Accounts and Finance MCQ'SMuhammad HamidNo ratings yet

- Accounts GRP 1 BitsDocument40 pagesAccounts GRP 1 BitskalyanikamineniNo ratings yet

- Model Question Paper AccountingDocument8 pagesModel Question Paper AccountingHanith CgNo ratings yet

- Paper - 5: Financial Accounting Bit QuestionsDocument40 pagesPaper - 5: Financial Accounting Bit QuestionsDalwinder Singh100% (1)

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiArroNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Accounts p1Document5 pagesAccounts p1arkNo ratings yet

- Summer Assignment Accountancy XIDocument5 pagesSummer Assignment Accountancy XIKhushal ChordiaNo ratings yet

- 1st Year Accounts Solved MCQs by Bismillah AcademyDocument37 pages1st Year Accounts Solved MCQs by Bismillah AcademyFayyazNo ratings yet

- MCQ Financial AccountingDocument78 pagesMCQ Financial AccountingRange RoverNo ratings yet

- Accountancy MCQDocument93 pagesAccountancy MCQabnadeemmalik111No ratings yet

- Basic Accounting 295 QuestionsDocument25 pagesBasic Accounting 295 QuestionsMaria NewmanNo ratings yet

- 1ST Exam Fabm1Document3 pages1ST Exam Fabm1rose gabonNo ratings yet

- 1st Quiz in Financial Accounting by Valix CHP 1-7Document10 pages1st Quiz in Financial Accounting by Valix CHP 1-7Macalalad Yi-ShioonNo ratings yet

- Commerece Question Paper - KalvikuralDocument10 pagesCommerece Question Paper - KalvikuralRajaNo ratings yet

- Cma Inter MCQ Booklet Financial Accounting Paper 5Document175 pagesCma Inter MCQ Booklet Financial Accounting Paper 5DGGI BPL Group1No ratings yet

- Unit 1Document10 pagesUnit 1Abhinav AnandNo ratings yet

- Kerala +1 Accountancy Focus Area Question Bank - Introduction To AccountingDocument6 pagesKerala +1 Accountancy Focus Area Question Bank - Introduction To AccountinghadiyxxNo ratings yet

- MCQDocument20 pagesMCQSujeet GuptaNo ratings yet

- Part - I Section - A Instructions:: From Question Number 1 To 18, Attempt Any 15 QuestionsDocument16 pagesPart - I Section - A Instructions:: From Question Number 1 To 18, Attempt Any 15 QuestionsVANSH KARELNo ratings yet

- BCA MAcc Question BankDocument14 pagesBCA MAcc Question BankpratimapatikaNo ratings yet

- Accounting McqsDocument37 pagesAccounting McqsMuhammad KashifNo ratings yet

- Accountancy XIDocument8 pagesAccountancy XIGurmehar Kaur100% (1)

- I M.com Cost May 21Document3 pagesI M.com Cost May 21VISHAGAN MNo ratings yet

- Enterprise Performance Management MCQDocument20 pagesEnterprise Performance Management MCQNikhil Bhalerao50% (2)

- Instruction: Choose The Correct Answer and Write Your Answer Choice On The Space ProvidedDocument3 pagesInstruction: Choose The Correct Answer and Write Your Answer Choice On The Space Providedsamuel debebeNo ratings yet

- Class 11 BSTDocument4 pagesClass 11 BSTnizamkhan9616No ratings yet

- BBA 407 GUIDE BOOK Smu 4rth SemDocument81 pagesBBA 407 GUIDE BOOK Smu 4rth SemlalsinghNo ratings yet

- 101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Document3,032 pages101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Adwait BowlekarNo ratings yet

- EPM Multiple Choice Questions 7Document21 pagesEPM Multiple Choice Questions 7lalith kumarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Cost Management Accounting Exit ExamDocument7 pagesCost Management Accounting Exit ExamMOLALIGNNo ratings yet

- Addis Thesis FinalDocument96 pagesAddis Thesis FinalMOLALIGNNo ratings yet

- Cost Accounting I Module AUC MT Final 1 - Finall (1) HandoutDocument71 pagesCost Accounting I Module AUC MT Final 1 - Finall (1) HandoutMOLALIGNNo ratings yet

- 497-163 Final Exam A-1Document9 pages497-163 Final Exam A-1MOLALIGNNo ratings yet

- Final EXAM FOR COST II (1) For 2023Document2 pagesFinal EXAM FOR COST II (1) For 2023MOLALIGNNo ratings yet

- Advanced Accounting Lupisan 3aDocument14 pagesAdvanced Accounting Lupisan 3aDaniel Tadeja0% (1)

- Instant download pdf Advanced Accounting 12th Edition Beams Solutions Manual full chapterDocument53 pagesInstant download pdf Advanced Accounting 12th Edition Beams Solutions Manual full chapterulfylaires100% (6)

- Infosys Accounting PoliciesDocument13 pagesInfosys Accounting PoliciesNawazish KhanNo ratings yet

- Millennium Sports ClubDocument27 pagesMillennium Sports ClubtruesoulwhispersNo ratings yet

- CFS Test - 1 Set-A 13-2-2022Document2 pagesCFS Test - 1 Set-A 13-2-2022Hitesh SemwalNo ratings yet

- Full Name: Mai Thị Loan Class: 12KT201: Accounting ExercisesDocument9 pagesFull Name: Mai Thị Loan Class: 12KT201: Accounting Exercisesthanhyu13No ratings yet

- Hemas Holdings PLCDocument244 pagesHemas Holdings PLCManindi BasnayakeNo ratings yet

- Jungheinrich Epc Spare Parts List Et v4!37!506!10!2023Document43 pagesJungheinrich Epc Spare Parts List Et v4!37!506!10!2023geraldfleming230990yka100% (133)

- Ibbi 2Document232 pagesIbbi 2Muruga Das100% (3)

- Concept of Financial AnalysisDocument20 pagesConcept of Financial AnalysisJonathan 24No ratings yet

- Information Sheet No. 1.3 1Document7 pagesInformation Sheet No. 1.3 1Lav Casal CorpuzNo ratings yet

- Zomato FSDocument5 pagesZomato FSVinay JajuNo ratings yet

- 02 Activity 2Document3 pages02 Activity 2Hakken RyoNo ratings yet

- Accounting All ChaptersDocument155 pagesAccounting All ChaptersHasnain Ahmad KhanNo ratings yet

- Chapter 9 - Investment PropertyDocument14 pagesChapter 9 - Investment Propertyweddiemae villariza100% (1)

- Total Business StudiesDocument16 pagesTotal Business StudiesNhi NguyễnNo ratings yet

- Newfmtb2 1Document28 pagesNewfmtb2 1fasdsadsaNo ratings yet

- Antropologia - La - Cultura - 1 - 46 MartinezDocument46 pagesAntropologia - La - Cultura - 1 - 46 MartinezEmma y Edu KesternichNo ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Presentation ON: Financial Study of PC JewellerDocument10 pagesPresentation ON: Financial Study of PC Jewellershashwat jainNo ratings yet

- Bookkeeping and Accounting CycleDocument9 pagesBookkeeping and Accounting CycleIhda Rachmatina Season IINo ratings yet

- Intangible Asset: An: Identifiable Non-Monetary Asset Without Physical SubstanceDocument6 pagesIntangible Asset: An: Identifiable Non-Monetary Asset Without Physical SubstanceGianrie Gwyneth CabigonNo ratings yet

- 4Document2 pages4clarizelNo ratings yet

- QuickBook 2010 NotesDocument89 pagesQuickBook 2010 NotesKhan MohammadNo ratings yet

- 2013 Jollibee's Consolidated Statement of Financial PositionDocument86 pages2013 Jollibee's Consolidated Statement of Financial PositionRose Jean Raniel Oropa63% (16)

- CH 4 Work Sheet2Document54 pagesCH 4 Work Sheet2Yasin Arafat ShuvoNo ratings yet

- Mock Question Paper 2023 AAADocument9 pagesMock Question Paper 2023 AAAArukNo ratings yet