Professional Documents

Culture Documents

Nestle ST Ratio

Nestle ST Ratio

Uploaded by

neha.talele22.st0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

nestle st ratio

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesNestle ST Ratio

Nestle ST Ratio

Uploaded by

neha.talele22.stCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

This data can be easily copy pasted into a Microsoft Excel sheet PRINT

Nestle India Previous Years »

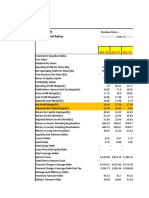

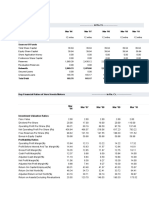

Key Financial Ratios ------------------- in Rs. Cr. -------------------

Mar '24 Dec '23 Dec '22 Dec '21 Dec '20

Investment Valuation Ratios

Face Value 1.00 10.00 10.00 10.00 10.00

Dividend Per Share -- 167.00 220.00 200.00 200.00

Operating Profit Per Share (Rs) 60.36 463.70 385.06 372.51 332.05

Net Operating Profit Per Share (Rs) 253.00 1,983.64 1,752.51 1,525.62 1,384.63

Free Reserves Per Share (Rs) -- -- -- -- --

Bonus in Equity Capital -- -- 76.13 76.13 76.13

Profitability Ratios

Operating Profit Margin(%) 23.85 23.37 21.97 24.41 23.98

Profit Before Interest And Tax Margin(%) 21.52 21.00 19.47 21.58 20.97

Gross Profit Margin(%) 21.65 21.13 19.58 21.76 21.20

Cash Profit Margin(%) 18.19 17.83 16.43 18.68 18.17

Adjusted Cash Margin(%) 18.19 17.83 16.43 18.68 18.17

Net Profit Margin(%) 16.12 15.67 14.14 14.58 15.59

Adjusted Net Profit Margin(%) 16.02 15.57 14.06 14.46 15.43

Return On Capital Employed(%) 161.03 133.26 137.01 156.78 144.92

Return On Net Worth(%) 117.71 96.95 97.20 102.89 103.12

Adjusted Return on Net Worth(%) 117.58 97.14 97.20 114.24 103.12

Return on Assets Excluding Revaluations 34.65 320.76 255.06 216.20 209.44

Return on Assets Including Revaluations 34.65 320.76 255.06 216.20 209.44

Return on Long Term Funds(%) 161.30 133.48 137.19 157.26 145.14

Liquidity And Solvency Ratios

Current Ratio 0.68 0.69 0.74 0.69 0.62

Quick Ratio 0.39 0.42 0.44 0.43 0.37

Debt Equity Ratio 0.01 0.01 0.01 0.02 0.02

Long Term Debt Equity Ratio 0.01 0.01 0.01 0.01 0.02

Debt Coverage Ratios

Interest Cover 37.32 34.90 22.06 16.51 18.13

Total Debt to Owners Fund 0.01 0.01 0.01 0.02 0.02

Financial Charges Coverage Ratio 41.02 38.50 24.67 18.45 20.39

Financial Charges Coverage Ratio Post

31.73 29.73 19.07 13.60 15.94

Tax

Management Efficiency Ratios

Inventory Turnover Ratio 11.68 10.21 8.76 9.31 9.42

Debtors Turnover Ratio 99.09 96.97 94.62 89.09 92.30

Investments Turnover Ratio 7.23 6.12 6.79 6.94 6.50

Fixed Assets Turnover Ratio 4.69 4.21 3.19 2.87 3.34

Total Assets Turnover Ratio 7.23 6.12 6.79 6.94 6.50

Asset Turnover Ratio 8.32 6.81 7.33 7.05 6.63

Average Raw Material Holding -- -- -- -- --

Average Finished Goods Held -- -- -- -- --

Number of Days In Working Capital -59.09 -76.10 -73.51 -88.07 -66.54

Profit & Loss Account Ratios

Material Cost Composition 44.08 44.29 47.78 43.80 43.43

Imported Composition of Raw Materials

-- -- -- -- --

Consumed

Selling Distribution Cost Composition -- -- 4.11 5.19 5.71

Expenses as Composition of Total Sales -- -- 4.09 4.34 4.84

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit -- -- 84.69 89.90 90.74

Dividend Payout Ratio Cash Profit -- -- 72.47 76.06 77.04

Earning Retention Ratio 100.00 100.00 15.31 19.03 9.26

Cash Earning Retention Ratio 100.00 100.00 27.53 30.43 22.96

AdjustedCash Flow Times 0.01 0.01 0.01 0.01 0.01

Source : Dion Global Solutions Limited

You might also like

- New Mail (30) 2 PDFDocument6 pagesNew Mail (30) 2 PDFWilliam SimonNo ratings yet

- 319 Question BankDocument142 pages319 Question BankElla67% (3)

- Xerox Case StudyDocument10 pagesXerox Case StudyMojiNo ratings yet

- Report 08 - 05 - 2020 10 - 49 - 33 CATDocument2 pagesReport 08 - 05 - 2020 10 - 49 - 33 CATManthan VananiNo ratings yet

- Housing Ratio PDFDocument2 pagesHousing Ratio PDFAbdul Khaliq ChoudharyNo ratings yet

- RatiosDocument2 pagesRatiosAbhay Kumar SinghNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Financial Ratio Latest 5 YrsDocument2 pagesFinancial Ratio Latest 5 YrsAryan BagdekarNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- Bosch 5confrDocument2 pagesBosch 5confrSsNo ratings yet

- Moneycontrol PDFDocument6 pagesMoneycontrol PDFMANIVISHVARJOON BOOMINATHANNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosTejaswiniNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- RatiosDocument2 pagesRatiosPRATHAMNo ratings yet

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financialsuffhbb99No ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- TCS Ratio AnalysisDocument2 pagesTCS Ratio AnalysisLogesh SureshNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsHarsh PuseNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- Larsen & Toubro InfotechDocument2 pagesLarsen & Toubro InfotechPriyaPrasadNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- Industry Analysis RatioDocument79 pagesIndustry Analysis Ratiopratz1996No ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Backend - Bajaj Auto - Dupont & Z ScoreDocument17 pagesBackend - Bajaj Auto - Dupont & Z ScoreYuvraj BholaNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsUday KumarNo ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Ratios of BajajDocument2 pagesRatios of BajajSunil KumarNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Axis RatioDocument5 pagesAxis RatiopradipsinhNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Bajaj Finserv: Previous YearsDocument2 pagesBajaj Finserv: Previous Yearsrohansparten01No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet

- Balance Sheet: Sources of FundsDocument5 pagesBalance Sheet: Sources of FundsTarun VijaykarNo ratings yet

- JaypeeDocument2 pagesJaypeeKintali VinodNo ratings yet

- Finacial Ratio Mar 21Document9 pagesFinacial Ratio Mar 21VishNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- Financial RatioDocument16 pagesFinancial RatioSantanu ModiNo ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- Excel Brittaniya 2Document3 pagesExcel Brittaniya 2Adnan LakdawalaNo ratings yet

- Rotaract Club Treasurer TutorialDocument15 pagesRotaract Club Treasurer TutorialNaelElMenshawy100% (1)

- Foreign Tax Credit - Worked Example From IRASDocument1 pageForeign Tax Credit - Worked Example From IRASItorin DigitalNo ratings yet

- Departmental Interpretation and Practice Notes No. 16 (Revised)Document12 pagesDepartmental Interpretation and Practice Notes No. 16 (Revised)Difanny KooNo ratings yet

- Merger and Acquisition in Steel IndustryDocument83 pagesMerger and Acquisition in Steel Industryarabinda_kar8696% (24)

- Final Report - BhoomitDocument70 pagesFinal Report - BhoomitShubham SuryavanshiNo ratings yet

- Top Glove 2020, 2021Document3 pagesTop Glove 2020, 2021nabil izzatNo ratings yet

- Guyana Budget Speech 2021Document80 pagesGuyana Budget Speech 2021stabroeknews100% (1)

- Comprehensive Reviewer On AppraiserDocument15 pagesComprehensive Reviewer On AppraiserBelteshazzarL.CabacangNo ratings yet

- Negotiable Instruments ActDocument23 pagesNegotiable Instruments ActNarendran Kamal'iyan100% (1)

- Fsa 3000Document1 pageFsa 3000Ngọc NguyễnNo ratings yet

- AL Financial Management May Jun 2016Document4 pagesAL Financial Management May Jun 2016hyp siinNo ratings yet

- Analysing Profitability of Opening A Subway Sandwiches Franchise in StockbridgeDocument23 pagesAnalysing Profitability of Opening A Subway Sandwiches Franchise in StockbridgeMonali PardeshiNo ratings yet

- BE FUNDING - Client AgreementDocument9 pagesBE FUNDING - Client AgreementJuan Camilo Davila GomezNo ratings yet

- Valuation GoodwilllDocument22 pagesValuation GoodwilllShubashPoojariNo ratings yet

- Beams11 - Ppt16-Partnership Formation Cyber PDFDocument25 pagesBeams11 - Ppt16-Partnership Formation Cyber PDFCYNTHIA ARYA PRANATANo ratings yet

- India Completing Inv UniverseDocument16 pagesIndia Completing Inv UniverseKushal ManupatiNo ratings yet

- E BankingDocument19 pagesE BankingramyaNo ratings yet

- Impact of Covid 19 On HDFC Bank SubmiteDocument38 pagesImpact of Covid 19 On HDFC Bank SubmiteKedar Gaikwad Patil100% (1)

- Common Guidelines For Priority Sector AdvancesDocument43 pagesCommon Guidelines For Priority Sector AdvancesKeval PatelNo ratings yet

- Fabm Module4Document50 pagesFabm Module4Paulo VisitacionNo ratings yet

- Final Account Theory Students' GroupDocument4 pagesFinal Account Theory Students' GroupI-51 GAURAV RANALKARNo ratings yet

- Municipal Commercial Paper Master Note FormDocument2 pagesMunicipal Commercial Paper Master Note FormOneNationNo ratings yet

- MBI7211 - Sserumaga James and Hamdi Omar OsmanDocument4 pagesMBI7211 - Sserumaga James and Hamdi Omar Osmanjonas sserumagaNo ratings yet

- CV - Nelson-CompressedDocument2 pagesCV - Nelson-CompressedmarksolomonighoNo ratings yet

- Digital OptionsDocument6 pagesDigital OptionsAparnaNo ratings yet

- CBN Rule Book Volume 3Document1,243 pagesCBN Rule Book Volume 3Justus OhakanuNo ratings yet