Professional Documents

Culture Documents

December 2009

December 2009

Uploaded by

akshay kausaleCopyright:

Available Formats

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- December1 2010Document1 pageDecember1 2010akshay kausaleNo ratings yet

- June 2010.Document1 pageJune 2010.akshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- December 2011.Document1 pageDecember 2011.akshay kausaleNo ratings yet

- September 2011.Document1 pageSeptember 2011.akshay kausaleNo ratings yet

- June 11Document1 pageJune 11akshay kausaleNo ratings yet

- Dec 08Document1 pageDec 08akshay kausaleNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- AlokIndustries q1Document2 pagesAlokIndustries q1Abhijeet PimpalgaonkarNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Castrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Document3 pagesCastrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Sona DuttaNo ratings yet

- Sep 08Document1 pageSep 08akshay kausaleNo ratings yet

- Pages From 19annual - ReportDocument1 pagePages From 19annual - ReportrahulNo ratings yet

- Financial Results 310324 PDFDocument14 pagesFinancial Results 310324 PDFvikramgandhi89No ratings yet

- FR 09112023Document10 pagesFR 09112023vikramgandhi89No ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- Summer Internship ProjectDocument16 pagesSummer Internship ProjectpalakNo ratings yet

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- 2nd Quarterly Announcement As at 31 July 2017Document15 pages2nd Quarterly Announcement As at 31 July 2017YouJianNo ratings yet

- Jeans Knit Pvt. LTD.: 21/E, Peenya II Phase, Peenya Industrial Area, Bangalore-560058, IndiaDocument10 pagesJeans Knit Pvt. LTD.: 21/E, Peenya II Phase, Peenya Industrial Area, Bangalore-560058, IndiaAmit SrivastavaNo ratings yet

- Audited Financial Result 2019 2020Document22 pagesAudited Financial Result 2019 2020Avrajit SarkarNo ratings yet

- Director ReportDocument3 pagesDirector ReportZeeshan AzizNo ratings yet

- GR-I-Crew-II-2018-Bajaj FinanceDocument51 pagesGR-I-Crew-II-2018-Bajaj FinanceMUKESH KUMARNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniNo ratings yet

- Q4FY19 Press TableDocument9 pagesQ4FY19 Press TableSumit SharmaNo ratings yet

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Document15 pagesNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77No ratings yet

- Results Q1 10-11Document1 pageResults Q1 10-11my_debdasNo ratings yet

- For Fixed AssetsDocument27 pagesFor Fixed AssetsaryalsajaniNo ratings yet

- HCL Q3 FY 14 - ResultsDocument3 pagesHCL Q3 FY 14 - ResultsPrice Action Trading SurajNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- Project ReportDocument19 pagesProject ReportCA DïvYã PrÁkàsh JäîswãlNo ratings yet

- Gita AgricultureDocument20 pagesGita AgriculturemrigendrarimalNo ratings yet

- Financial Result CIPLA 2023 24Document26 pagesFinancial Result CIPLA 2023 24chatwithshariqNo ratings yet

- BEMLDocument7 pagesBEMLdurgesh varunNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Seminar On Accounting Theory and Practice AssignmentDocument13 pagesSeminar On Accounting Theory and Practice AssignmentDEEPALI ANANDNo ratings yet

- Financial Statement AnalysisDocument1,179 pagesFinancial Statement AnalysisSYEDWASIQABBAS RIZVINo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Ger S G, Eejeeb Y We S,: Crjsi"Document5 pagesGer S G, Eejeeb Y We S,: Crjsi"Suraj KediaNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- pdf (4)Document11 pagespdf (4)akshay kausaleNo ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- Investor Presentation - Q4FY23Document24 pagesInvestor Presentation - Q4FY23akshay kausaleNo ratings yet

- KIL Result June-2022Document3 pagesKIL Result June-2022akshay kausaleNo ratings yet

- Thermax Subsidiary Annual Report 19 20Document417 pagesThermax Subsidiary Annual Report 19 20akshay kausaleNo ratings yet

- Thermax Subsidiary AR 2023 24 7 2023 FinalDocument676 pagesThermax Subsidiary AR 2023 24 7 2023 Finalakshay kausaleNo ratings yet

- Sem - III CA II AtktDocument4 pagesSem - III CA II Atktabp1677No ratings yet

- Cengage Learning Accounting 27th Edition-Copy RemovedDocument4 pagesCengage Learning Accounting 27th Edition-Copy Removedkaya waffles12No ratings yet

- NPO - Income &expenditureDocument47 pagesNPO - Income &expenditureAhmad NawazNo ratings yet

- Module 9: Business ImplementationDocument27 pagesModule 9: Business ImplementationPrincess Enrian Quintana Polinar100% (1)

- 9706 m19 Ms 32Document22 pages9706 m19 Ms 32Ryan Xavier M. BiscochoNo ratings yet

- MSIN0004 AFB Sample Exam Paper Term 1 2022-23Document9 pagesMSIN0004 AFB Sample Exam Paper Term 1 2022-23Erika MajorosNo ratings yet

- CA Inter RTP Nov 2018 Small PDFDocument281 pagesCA Inter RTP Nov 2018 Small PDFSANKAR SIVANNo ratings yet

- Sample ML 2011 Format DepedDocument33 pagesSample ML 2011 Format DepedRevelles NayoNo ratings yet

- Class Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsDocument22 pagesClass Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsjashanjeetNo ratings yet

- Provisions, Contingent Liabilities and Contingent AssetsDocument36 pagesProvisions, Contingent Liabilities and Contingent Assetspks009No ratings yet

- 20 Tax Return Tips CanadaDocument28 pages20 Tax Return Tips CanadaWill PastonsNo ratings yet

- Final ABC InventoryDocument83 pagesFinal ABC Inventoryactive1cafeNo ratings yet

- Medical Store Business PlanDocument17 pagesMedical Store Business PlanBrave King100% (3)

- Morning Star BakeryDocument24 pagesMorning Star BakeryKelvin WidjajaNo ratings yet

- Chapter10. Finance ThutmDocument25 pagesChapter10. Finance ThutmĐức LộcNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Financial Management in Construction: For Third Year Cotm Student by Abinet GDocument18 pagesFinancial Management in Construction: For Third Year Cotm Student by Abinet GYosiNo ratings yet

- Standards of Professional Conduct and Etiquette For Lawyer IndiaDocument30 pagesStandards of Professional Conduct and Etiquette For Lawyer IndiaTanaya ThakurNo ratings yet

- Ind - Chapter 8xxDocument34 pagesInd - Chapter 8xxMbadilishaji DuniaNo ratings yet

- Leases: International Accounting Standards (IAS 17)Document13 pagesLeases: International Accounting Standards (IAS 17)ashfakkadriNo ratings yet

- Finals Lecture Discussion On Special JournalsDocument36 pagesFinals Lecture Discussion On Special JournalsGarpt Kudasai100% (1)

- AfarDocument6 pagesAfarRolando PasamonteNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual DownloadDocument65 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual DownloadMay Madrigal100% (23)

- ApplicationExercise7 ProfitabilityReportDocument6 pagesApplicationExercise7 ProfitabilityReportDuong BuiNo ratings yet

- May 2020 Corporate Reporting (Paper 3.1)Document28 pagesMay 2020 Corporate Reporting (Paper 3.1)FrankNo ratings yet

- LATIHAN1Document15 pagesLATIHAN1iqbal HilmawanNo ratings yet

- Fundamentals of Accounting 2 Draft PDFDocument123 pagesFundamentals of Accounting 2 Draft PDFCzaeshel Edades100% (5)

- Final Accounts Adjust 1Document12 pagesFinal Accounts Adjust 1Gundarapu RamachandraNo ratings yet

- Mitsui OSK Lines Vs Orient Ship AgencyDocument108 pagesMitsui OSK Lines Vs Orient Ship Agencyvallury chaitanya RaoNo ratings yet

- ADocument57 pagesAAliaJustineIlagan100% (1)

December 2009

December 2009

Uploaded by

akshay kausaleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

December 2009

December 2009

Uploaded by

akshay kausaleCopyright:

Available Formats

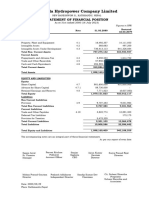

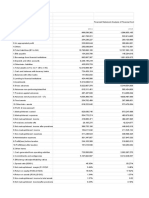

KANANI INDUSTRIES LIMITED

R.O. : G-6, PRASAD CHAMBERS, TATA ROAD NO.2, OPERA HOUSE, MUMBAI- 400 004.

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 31ST DECEMBER, 2009

(Rs. in lacs)

Quarter Quarter Nine Months Nine Months Year

Ended on Ended on Ended on Ended on Ended on

Particulars 31.12.2009 31.12.2008 31.12.2009 31.12.2008 31.03.2009

Unaudited Unaudited Unaudited Unaudited Audited

1. Income

a. Sales/ Income from Operation 2,300.17 744.07 6,324.23 4,098.77 5,426.58

b. Other Operating Income - - - - 24.88

c. Currency Fluctuation (2.65) - (54.94) - -

Total Income 2,297.52 744.07 6,269.29 4,098.77 5,451.46

2. Expenditure

a. (Increase)/Decrease in Stock (37.35) - (37.35) - -

b. Raw Material Consumption & Purchases 2,102.98 655.66 5,739.43 3,429.70 4,549.11

c. Staff Cost 9.46 7.44 25.74 21.07 11.35

d. Depreciation 3.72 1.57 11.10 2.79 9.13

e. Other Expenses 14.95 5.23 27.51 20.55 42.08

Total Expenses 2,093.76 669.90 5,766.43 3,474.11 4,611.67

3. Profit from Operations before Other Income,

Interest and Exceptional Items 203.76 74.17 502.86 624.66 839.79

4. Other Income - - - - -

5. Profit before Interest and Exceptional Items 203.76 74.17 502.86 624.66 839.79

6. Interest & Finance Charges (3.25) - 42.65 - 7.31

7. Profit after Interest but before Exceptional Items 207.01 74.17 460.21 624.66 832.48

8. Exceptional Items - - - - -

9. Profit from Ordinary Activities before tax 207.01 74.17 460.21 624.66 832.48

10. Provision for Current tax - 0.02 - 0.08 0.04

11. Profit after tax 207.01 74.15 460.21 624.58 832.45

12. Paid up Equity Capital(Face Value of Rs.10)

(Rs.5/- w.e.f. 10/12/2009) 899.40 299.80 899.40 299.80 299.80

13. Reserves (excluding revaluation reserves) - - - - 1,411.21

14. Basic & Diluted EPS (Not annualised)

* on face value of Rs.5/- per share * 1.15 2.47 * 2.56 20.83 27.77

15. Public Shareholding

- No. of Shares 4,527,120 754,520 4,527,120 754,520 754,520

- % of Shares 25.17 25.17 25.17 25.17 25.17

16. Promoters and promoter group shareholding

a. Pledged / Encumbered

- Number of shares - - - - -

- Percentage of shares as a % of total

Promoter and promoter group holding. - - - - -

- Percentage of shares as a % of total Share

Capital of the company. - - - - -

b. Non-Encumbered

- Number of shares 13,460,880 2,243,480 13,460,880 2,243,480 2,243,480

- Percentage of shares as a % of total -

Promoter and promoter group holding. 100.00 100.00 100.00 100.00 100.00

- Percentage of shares as a % of total Share 74.83 74.83 74.83 74.83 74.83

Capital of the company.

NOTES :

1. The above financial results were approved by the Board of Directors at their Meeting held on 18th January, 2010.

2. The Statutory Auditors have carried out Limited Review as required under clause 41 of the Listing Agreement.

3. The equity shares of company were sub-divided from denomination of Rs.10/- per share to Rs.5/- per share as per resolution

passed through Postal Ballot dated 10th December,2009. Conseuqently no. of shares were increased from 89,94,000 equity

shares of Rs. 10/- to 1,79,88,000 equtiy shares of Rs.5/- each.

4. Previous period figures have been regrouped/rearranged wherever necessary .

5 The Company has only one segment i.e. Studded Diamond Jewellery.

6 No. of complaints of the investor

Pending at the beginning of the quarter Nil

Received during the quarter 2

Dispose off during the quarter 2

Lying unresolved at the end of the quarter Nil

For & On behalf of Board of Directors

Place : Mumbai

Date : January 18, 2010

(HARSHIL P. KANANI)

Managing Director

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- December1 2010Document1 pageDecember1 2010akshay kausaleNo ratings yet

- June 2010.Document1 pageJune 2010.akshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- December 2011.Document1 pageDecember 2011.akshay kausaleNo ratings yet

- September 2011.Document1 pageSeptember 2011.akshay kausaleNo ratings yet

- June 11Document1 pageJune 11akshay kausaleNo ratings yet

- Dec 08Document1 pageDec 08akshay kausaleNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- AlokIndustries q1Document2 pagesAlokIndustries q1Abhijeet PimpalgaonkarNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Castrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Document3 pagesCastrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Sona DuttaNo ratings yet

- Sep 08Document1 pageSep 08akshay kausaleNo ratings yet

- Pages From 19annual - ReportDocument1 pagePages From 19annual - ReportrahulNo ratings yet

- Financial Results 310324 PDFDocument14 pagesFinancial Results 310324 PDFvikramgandhi89No ratings yet

- FR 09112023Document10 pagesFR 09112023vikramgandhi89No ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- Summer Internship ProjectDocument16 pagesSummer Internship ProjectpalakNo ratings yet

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- 2nd Quarterly Announcement As at 31 July 2017Document15 pages2nd Quarterly Announcement As at 31 July 2017YouJianNo ratings yet

- Jeans Knit Pvt. LTD.: 21/E, Peenya II Phase, Peenya Industrial Area, Bangalore-560058, IndiaDocument10 pagesJeans Knit Pvt. LTD.: 21/E, Peenya II Phase, Peenya Industrial Area, Bangalore-560058, IndiaAmit SrivastavaNo ratings yet

- Audited Financial Result 2019 2020Document22 pagesAudited Financial Result 2019 2020Avrajit SarkarNo ratings yet

- Director ReportDocument3 pagesDirector ReportZeeshan AzizNo ratings yet

- GR-I-Crew-II-2018-Bajaj FinanceDocument51 pagesGR-I-Crew-II-2018-Bajaj FinanceMUKESH KUMARNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniNo ratings yet

- Q4FY19 Press TableDocument9 pagesQ4FY19 Press TableSumit SharmaNo ratings yet

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Document15 pagesNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77No ratings yet

- Results Q1 10-11Document1 pageResults Q1 10-11my_debdasNo ratings yet

- For Fixed AssetsDocument27 pagesFor Fixed AssetsaryalsajaniNo ratings yet

- HCL Q3 FY 14 - ResultsDocument3 pagesHCL Q3 FY 14 - ResultsPrice Action Trading SurajNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- Project ReportDocument19 pagesProject ReportCA DïvYã PrÁkàsh JäîswãlNo ratings yet

- Gita AgricultureDocument20 pagesGita AgriculturemrigendrarimalNo ratings yet

- Financial Result CIPLA 2023 24Document26 pagesFinancial Result CIPLA 2023 24chatwithshariqNo ratings yet

- BEMLDocument7 pagesBEMLdurgesh varunNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Seminar On Accounting Theory and Practice AssignmentDocument13 pagesSeminar On Accounting Theory and Practice AssignmentDEEPALI ANANDNo ratings yet

- Financial Statement AnalysisDocument1,179 pagesFinancial Statement AnalysisSYEDWASIQABBAS RIZVINo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Ger S G, Eejeeb Y We S,: Crjsi"Document5 pagesGer S G, Eejeeb Y We S,: Crjsi"Suraj KediaNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- pdf (4)Document11 pagespdf (4)akshay kausaleNo ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- Investor Presentation - Q4FY23Document24 pagesInvestor Presentation - Q4FY23akshay kausaleNo ratings yet

- KIL Result June-2022Document3 pagesKIL Result June-2022akshay kausaleNo ratings yet

- Thermax Subsidiary Annual Report 19 20Document417 pagesThermax Subsidiary Annual Report 19 20akshay kausaleNo ratings yet

- Thermax Subsidiary AR 2023 24 7 2023 FinalDocument676 pagesThermax Subsidiary AR 2023 24 7 2023 Finalakshay kausaleNo ratings yet

- Sem - III CA II AtktDocument4 pagesSem - III CA II Atktabp1677No ratings yet

- Cengage Learning Accounting 27th Edition-Copy RemovedDocument4 pagesCengage Learning Accounting 27th Edition-Copy Removedkaya waffles12No ratings yet

- NPO - Income &expenditureDocument47 pagesNPO - Income &expenditureAhmad NawazNo ratings yet

- Module 9: Business ImplementationDocument27 pagesModule 9: Business ImplementationPrincess Enrian Quintana Polinar100% (1)

- 9706 m19 Ms 32Document22 pages9706 m19 Ms 32Ryan Xavier M. BiscochoNo ratings yet

- MSIN0004 AFB Sample Exam Paper Term 1 2022-23Document9 pagesMSIN0004 AFB Sample Exam Paper Term 1 2022-23Erika MajorosNo ratings yet

- CA Inter RTP Nov 2018 Small PDFDocument281 pagesCA Inter RTP Nov 2018 Small PDFSANKAR SIVANNo ratings yet

- Sample ML 2011 Format DepedDocument33 pagesSample ML 2011 Format DepedRevelles NayoNo ratings yet

- Class Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsDocument22 pagesClass Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsjashanjeetNo ratings yet

- Provisions, Contingent Liabilities and Contingent AssetsDocument36 pagesProvisions, Contingent Liabilities and Contingent Assetspks009No ratings yet

- 20 Tax Return Tips CanadaDocument28 pages20 Tax Return Tips CanadaWill PastonsNo ratings yet

- Final ABC InventoryDocument83 pagesFinal ABC Inventoryactive1cafeNo ratings yet

- Medical Store Business PlanDocument17 pagesMedical Store Business PlanBrave King100% (3)

- Morning Star BakeryDocument24 pagesMorning Star BakeryKelvin WidjajaNo ratings yet

- Chapter10. Finance ThutmDocument25 pagesChapter10. Finance ThutmĐức LộcNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Financial Management in Construction: For Third Year Cotm Student by Abinet GDocument18 pagesFinancial Management in Construction: For Third Year Cotm Student by Abinet GYosiNo ratings yet

- Standards of Professional Conduct and Etiquette For Lawyer IndiaDocument30 pagesStandards of Professional Conduct and Etiquette For Lawyer IndiaTanaya ThakurNo ratings yet

- Ind - Chapter 8xxDocument34 pagesInd - Chapter 8xxMbadilishaji DuniaNo ratings yet

- Leases: International Accounting Standards (IAS 17)Document13 pagesLeases: International Accounting Standards (IAS 17)ashfakkadriNo ratings yet

- Finals Lecture Discussion On Special JournalsDocument36 pagesFinals Lecture Discussion On Special JournalsGarpt Kudasai100% (1)

- AfarDocument6 pagesAfarRolando PasamonteNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual DownloadDocument65 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual DownloadMay Madrigal100% (23)

- ApplicationExercise7 ProfitabilityReportDocument6 pagesApplicationExercise7 ProfitabilityReportDuong BuiNo ratings yet

- May 2020 Corporate Reporting (Paper 3.1)Document28 pagesMay 2020 Corporate Reporting (Paper 3.1)FrankNo ratings yet

- LATIHAN1Document15 pagesLATIHAN1iqbal HilmawanNo ratings yet

- Fundamentals of Accounting 2 Draft PDFDocument123 pagesFundamentals of Accounting 2 Draft PDFCzaeshel Edades100% (5)

- Final Accounts Adjust 1Document12 pagesFinal Accounts Adjust 1Gundarapu RamachandraNo ratings yet

- Mitsui OSK Lines Vs Orient Ship AgencyDocument108 pagesMitsui OSK Lines Vs Orient Ship Agencyvallury chaitanya RaoNo ratings yet

- ADocument57 pagesAAliaJustineIlagan100% (1)