Professional Documents

Culture Documents

December1 2010

December1 2010

Uploaded by

akshay kausaleCopyright:

Available Formats

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Retaining Wall DetailDocument9 pagesRetaining Wall DetailRonald KahoraNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- 5th Sem Food Production Notes PDFDocument82 pages5th Sem Food Production Notes PDFayush83% (18)

- List of International Electrotechnical Commission Standards - Wikipedia PDFDocument263 pagesList of International Electrotechnical Commission Standards - Wikipedia PDFShivaNo ratings yet

- December 2011.Document1 pageDecember 2011.akshay kausaleNo ratings yet

- December 2009Document1 pageDecember 2009akshay kausaleNo ratings yet

- September 2011.Document1 pageSeptember 2011.akshay kausaleNo ratings yet

- June 11Document1 pageJune 11akshay kausaleNo ratings yet

- June 2010.Document1 pageJune 2010.akshay kausaleNo ratings yet

- June 09Document1 pageJune 09akshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- AlokIndustries q1Document2 pagesAlokIndustries q1Abhijeet PimpalgaonkarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- Summer Internship ProjectDocument16 pagesSummer Internship ProjectpalakNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dec 08Document1 pageDec 08akshay kausaleNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- Performance Evaluation and Ratio Analysis - Meghna Cement - R1Document11 pagesPerformance Evaluation and Ratio Analysis - Meghna Cement - R1Sayed Abu Sufyan100% (2)

- STL 30.09 2010Document1 pageSTL 30.09 2010Amol PatilNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Document16 pagesFinancial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Arun SharmaNo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Panasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalDocument12 pagesPanasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Cipla - Unaudited Fin Result For The Quarter Ended 30th June 2010Document4 pagesCipla - Unaudited Fin Result For The Quarter Ended 30th June 2010thelostbardNo ratings yet

- HCL Q3 FY 14 - ResultsDocument3 pagesHCL Q3 FY 14 - ResultsPrice Action Trading SurajNo ratings yet

- I. Operating Statement: (To Be Filled by The Dealing Group From Balance Sheet / Projections)Document18 pagesI. Operating Statement: (To Be Filled by The Dealing Group From Balance Sheet / Projections)CA DïvYã PrÁkàsh JäîswãlNo ratings yet

- Maruti Vs Tata - EXCELDocument15 pagesMaruti Vs Tata - EXCELParth MalikNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- For Fixed AssetsDocument27 pagesFor Fixed AssetsaryalsajaniNo ratings yet

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsDocument7 pagesBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsNagendra PrasadNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Project ReportDocument19 pagesProject ReportCA DïvYã PrÁkàsh JäîswãlNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- KIL Result June-2022Document3 pagesKIL Result June-2022akshay kausaleNo ratings yet

- Investor Presentation - Q4FY23Document24 pagesInvestor Presentation - Q4FY23akshay kausaleNo ratings yet

- Thermax Subsidiary AR 2023 24 7 2023 FinalDocument676 pagesThermax Subsidiary AR 2023 24 7 2023 Finalakshay kausaleNo ratings yet

- Thermax Subsidiary Annual Report 19 20Document417 pagesThermax Subsidiary Annual Report 19 20akshay kausaleNo ratings yet

- 4 Single Phase Uncontrolled Full-Wave RectifiersDocument12 pages4 Single Phase Uncontrolled Full-Wave RectifiersLuthfan AzizanNo ratings yet

- Statellite Communication NotesDocument50 pagesStatellite Communication Notessathish14singhNo ratings yet

- 770G Preventive Maintenance ListDocument4 pages770G Preventive Maintenance ListLuis LadinoNo ratings yet

- Leap PDFDocument5 pagesLeap PDFMiguel Angel MartinNo ratings yet

- Safety Data Sheet: Butyl AcrylateDocument8 pagesSafety Data Sheet: Butyl AcrylateAsifa Ihya NurdinaNo ratings yet

- Modal VerbsDocument4 pagesModal VerbsabrantesdeborakellyNo ratings yet

- Emu8086 TutorialDocument9 pagesEmu8086 Tutoriallordsuggs0% (1)

- Research Paper On Logic GatesDocument5 pagesResearch Paper On Logic Gatesafedoeike100% (1)

- Delivery Note FormDocument5 pagesDelivery Note FormMelster LoctonaganNo ratings yet

- H&MT - Lesson 4. One Dimensional Steady State Conduction Through Plane and Composite Walls, Tubes and Spheres With Heat Generation PDFDocument14 pagesH&MT - Lesson 4. One Dimensional Steady State Conduction Through Plane and Composite Walls, Tubes and Spheres With Heat Generation PDFadimeghaNo ratings yet

- DTS 4132.timeserver: Swiss Time SystemsDocument6 pagesDTS 4132.timeserver: Swiss Time SystemsnisarahmedgfecNo ratings yet

- Baghouse Filter Modular Pulse Jet Type: Operation and ApplicationDocument5 pagesBaghouse Filter Modular Pulse Jet Type: Operation and ApplicationBudy AndikaNo ratings yet

- B. Sc. Nursing Course (4 Years) : Entrance Examination 2022 (CET-2022)Document6 pagesB. Sc. Nursing Course (4 Years) : Entrance Examination 2022 (CET-2022)Tannu PalNo ratings yet

- Module Title Construction Technology I Module Code Credits Prerequisites Module Aim(s)Document2 pagesModule Title Construction Technology I Module Code Credits Prerequisites Module Aim(s)LokuliyanaNNo ratings yet

- Tutorial ExampleDocument2 pagesTutorial Exampleapi-3812977100% (1)

- Iso Metric 32Document2 pagesIso Metric 32rahul caddNo ratings yet

- Railway Braking PDFDocument6 pagesRailway Braking PDFTANYA AGARWALNo ratings yet

- Spons GuideDocument12 pagesSpons GuideMelyssa Dawn GullonNo ratings yet

- First Order Ordinary Differential Equations (1 Order - ODE)Document3 pagesFirst Order Ordinary Differential Equations (1 Order - ODE)Naga MerahNo ratings yet

- Case Study: Red BullDocument3 pagesCase Study: Red BullAbhinav VashisthaNo ratings yet

- Negotiable Instruments LawDocument186 pagesNegotiable Instruments LawJosca Villamor BasilanNo ratings yet

- Inner Product SpaceDocument3 pagesInner Product SpaceDharmendra KumarNo ratings yet

- Pharmaceuticals Industry in IndiaDocument4 pagesPharmaceuticals Industry in IndiachetnaNo ratings yet

- Order Flow Trading Setups 1 2Document50 pagesOrder Flow Trading Setups 1 2RajoNo ratings yet

- Alternative AsswssmentDocument9 pagesAlternative AsswssmenthindNo ratings yet

- 35usca PDFDocument212 pages35usca PDFRaven BennettNo ratings yet

- SENPLUSDocument178 pagesSENPLUSNateshNo ratings yet

December1 2010

December1 2010

Uploaded by

akshay kausaleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

December1 2010

December1 2010

Uploaded by

akshay kausaleCopyright:

Available Formats

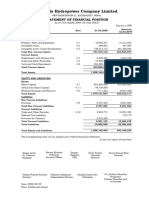

KANANI INDUSTRIES LIMITED

R.O. : G-6, PRASAD CHAMBERS, TATA ROAD, OPERA HOUSE, MUMBAI- 400 004.

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER/YEAR ENDED 31ST DECEMBER, 2010

(` in lacs)

Quarter Quarter Nine Months Nine Months Year

Ended on Ended on Ended on Ended on Ended on

Particulars 31.12.2010 31.12.2009 31.12.2010 31.12.2009 31.03.2010

Unaudited Unaudited Unaudited Unaudited Audited

1. Income

a. Sales/ Income from Operation 3,827.69 2,300.17 12,257.94 6,324.23 8,683.86

b. Other Operating Income - - - - -

c. Currency Fluctuation 9.34 (2.65) 26.13 (54.94) (44.08)

Total Income 3,837.02 2,297.52 12,284.07 6,269.29 8,639.78

2. Expenditure

a. (Increase)/Decrease in Stock (0.16) (37.35) 59.35 (37.35) (59.51)

b. Raw Material Consumption & Purchases 3,507.77 2,102.98 10,336.95 5,739.43 7,774.42

c. Staff Cost 13.66 9.46 39.96 25.74 37.02

d. Depreciation 3.39 3.72 10.17 11.10 14.84

e. Other Expenses 55.09 14.95 76.49 27.51 65.09

Total Expenses 3,579.75 2,093.76 10,522.92 5,766.43 7,831.86

3. Profit from Operations before Other Income, Interest and

Exceptional Items 257.27 203.76 1,761.15 502.86 807.92

4. Other Income - - - - -

5. Profit before Interest and Exceptional Items 257.27 203.76 1,761.15 502.86 807.92

6. Interest & Finance Charges 5.94 (3.25) 27.55 42.65 53.18

7. Profit after Interest but before Exceptional Items 251.33 207.01 1,733.60 460.21 754.74

8. Exceptional Items - - - - -

9. Profit from Ordinary Activities before tax 251.33 207.01 1,733.60 460.21 754.74

10. Provision for Current tax - - - - -

11. Profit after tax 251.33 207.01 1,733.60 460.21 754.74

12. Paid up Equity Capital(Face Value of `5) 899.40 899.40 899.40 899.40 899.40

13. Reserves excluding revaluation reserves (As per Balance

Sheet of Previous accounting year) 1,461.12

14. Basic & Diluted EPS (Not annualised) 1.40 1.15 9.64 2.56 4.20

15. Public Shareholding

- No. of Shares 4,527,120 4,527,120 4,527,120 4,527,120 4,527,120

- % of Shares 25.17 25.17 25.17 25.17 25.17

16. Promoters and promoter group shareholding

a. Pledged / Encumbered

- Number of shares - - - - -

- Percentage of shares as a % of total Promoter

and promoter group holding. - - - - -

- Percentage of shares as a % of total Share

Capital of the company. - - - - -

b. Non-Encumbered

- Number of shares 13,460,880 13,460,880 13,460,880 13,460,880 13,460,880

- Percentage of shares as a % of total Promoter

and promoter group holding. 100.00 100.00 100.00 100.00 100.00

- Percentage of shares as a % of total Share

Capital of the company. 74.83 74.83 74.83 74.83 74.83

NOTES :

1. Previous period figures have been regrouped/rearranged wherever necessary .

2. The above statement of unaudited financial results were taken on record at the meeting of the Board of Directors held on 28th

January, 2011.

3. The Company has only one segment i.e. Studded Diamond Jewellery.

4. The Statutory Auditors have carried out Limited Review as required under Clause 41 of the Listing Agreement.

5. The Company has not received any Investor's Compliants during the period under review.

For & On behalf of Board of Directors

Sd/-

Place : Mumbai (MR. HARSHIL P. KANANI)

Date : 28/01/11 Managing Director

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Retaining Wall DetailDocument9 pagesRetaining Wall DetailRonald KahoraNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- 5th Sem Food Production Notes PDFDocument82 pages5th Sem Food Production Notes PDFayush83% (18)

- List of International Electrotechnical Commission Standards - Wikipedia PDFDocument263 pagesList of International Electrotechnical Commission Standards - Wikipedia PDFShivaNo ratings yet

- December 2011.Document1 pageDecember 2011.akshay kausaleNo ratings yet

- December 2009Document1 pageDecember 2009akshay kausaleNo ratings yet

- September 2011.Document1 pageSeptember 2011.akshay kausaleNo ratings yet

- June 11Document1 pageJune 11akshay kausaleNo ratings yet

- June 2010.Document1 pageJune 2010.akshay kausaleNo ratings yet

- June 09Document1 pageJune 09akshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- AlokIndustries q1Document2 pagesAlokIndustries q1Abhijeet PimpalgaonkarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- Summer Internship ProjectDocument16 pagesSummer Internship ProjectpalakNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dec 08Document1 pageDec 08akshay kausaleNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- Performance Evaluation and Ratio Analysis - Meghna Cement - R1Document11 pagesPerformance Evaluation and Ratio Analysis - Meghna Cement - R1Sayed Abu Sufyan100% (2)

- STL 30.09 2010Document1 pageSTL 30.09 2010Amol PatilNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Document16 pagesFinancial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Arun SharmaNo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Panasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalDocument12 pagesPanasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Cipla - Unaudited Fin Result For The Quarter Ended 30th June 2010Document4 pagesCipla - Unaudited Fin Result For The Quarter Ended 30th June 2010thelostbardNo ratings yet

- HCL Q3 FY 14 - ResultsDocument3 pagesHCL Q3 FY 14 - ResultsPrice Action Trading SurajNo ratings yet

- I. Operating Statement: (To Be Filled by The Dealing Group From Balance Sheet / Projections)Document18 pagesI. Operating Statement: (To Be Filled by The Dealing Group From Balance Sheet / Projections)CA DïvYã PrÁkàsh JäîswãlNo ratings yet

- Maruti Vs Tata - EXCELDocument15 pagesMaruti Vs Tata - EXCELParth MalikNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- For Fixed AssetsDocument27 pagesFor Fixed AssetsaryalsajaniNo ratings yet

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsDocument7 pagesBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsNagendra PrasadNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Project ReportDocument19 pagesProject ReportCA DïvYã PrÁkàsh JäîswãlNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- KIL Result June-2022Document3 pagesKIL Result June-2022akshay kausaleNo ratings yet

- Investor Presentation - Q4FY23Document24 pagesInvestor Presentation - Q4FY23akshay kausaleNo ratings yet

- Thermax Subsidiary AR 2023 24 7 2023 FinalDocument676 pagesThermax Subsidiary AR 2023 24 7 2023 Finalakshay kausaleNo ratings yet

- Thermax Subsidiary Annual Report 19 20Document417 pagesThermax Subsidiary Annual Report 19 20akshay kausaleNo ratings yet

- 4 Single Phase Uncontrolled Full-Wave RectifiersDocument12 pages4 Single Phase Uncontrolled Full-Wave RectifiersLuthfan AzizanNo ratings yet

- Statellite Communication NotesDocument50 pagesStatellite Communication Notessathish14singhNo ratings yet

- 770G Preventive Maintenance ListDocument4 pages770G Preventive Maintenance ListLuis LadinoNo ratings yet

- Leap PDFDocument5 pagesLeap PDFMiguel Angel MartinNo ratings yet

- Safety Data Sheet: Butyl AcrylateDocument8 pagesSafety Data Sheet: Butyl AcrylateAsifa Ihya NurdinaNo ratings yet

- Modal VerbsDocument4 pagesModal VerbsabrantesdeborakellyNo ratings yet

- Emu8086 TutorialDocument9 pagesEmu8086 Tutoriallordsuggs0% (1)

- Research Paper On Logic GatesDocument5 pagesResearch Paper On Logic Gatesafedoeike100% (1)

- Delivery Note FormDocument5 pagesDelivery Note FormMelster LoctonaganNo ratings yet

- H&MT - Lesson 4. One Dimensional Steady State Conduction Through Plane and Composite Walls, Tubes and Spheres With Heat Generation PDFDocument14 pagesH&MT - Lesson 4. One Dimensional Steady State Conduction Through Plane and Composite Walls, Tubes and Spheres With Heat Generation PDFadimeghaNo ratings yet

- DTS 4132.timeserver: Swiss Time SystemsDocument6 pagesDTS 4132.timeserver: Swiss Time SystemsnisarahmedgfecNo ratings yet

- Baghouse Filter Modular Pulse Jet Type: Operation and ApplicationDocument5 pagesBaghouse Filter Modular Pulse Jet Type: Operation and ApplicationBudy AndikaNo ratings yet

- B. Sc. Nursing Course (4 Years) : Entrance Examination 2022 (CET-2022)Document6 pagesB. Sc. Nursing Course (4 Years) : Entrance Examination 2022 (CET-2022)Tannu PalNo ratings yet

- Module Title Construction Technology I Module Code Credits Prerequisites Module Aim(s)Document2 pagesModule Title Construction Technology I Module Code Credits Prerequisites Module Aim(s)LokuliyanaNNo ratings yet

- Tutorial ExampleDocument2 pagesTutorial Exampleapi-3812977100% (1)

- Iso Metric 32Document2 pagesIso Metric 32rahul caddNo ratings yet

- Railway Braking PDFDocument6 pagesRailway Braking PDFTANYA AGARWALNo ratings yet

- Spons GuideDocument12 pagesSpons GuideMelyssa Dawn GullonNo ratings yet

- First Order Ordinary Differential Equations (1 Order - ODE)Document3 pagesFirst Order Ordinary Differential Equations (1 Order - ODE)Naga MerahNo ratings yet

- Case Study: Red BullDocument3 pagesCase Study: Red BullAbhinav VashisthaNo ratings yet

- Negotiable Instruments LawDocument186 pagesNegotiable Instruments LawJosca Villamor BasilanNo ratings yet

- Inner Product SpaceDocument3 pagesInner Product SpaceDharmendra KumarNo ratings yet

- Pharmaceuticals Industry in IndiaDocument4 pagesPharmaceuticals Industry in IndiachetnaNo ratings yet

- Order Flow Trading Setups 1 2Document50 pagesOrder Flow Trading Setups 1 2RajoNo ratings yet

- Alternative AsswssmentDocument9 pagesAlternative AsswssmenthindNo ratings yet

- 35usca PDFDocument212 pages35usca PDFRaven BennettNo ratings yet

- SENPLUSDocument178 pagesSENPLUSNateshNo ratings yet