Professional Documents

Culture Documents

Prajay 16 6 08 PL

Prajay 16 6 08 PL

Uploaded by

api-3862995Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Licence Details Upto June 2015Document74 pagesLicence Details Upto June 2015piudevaNo ratings yet

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995No ratings yet

- Hdfcbank 25-8-08 PLDocument5 pagesHdfcbank 25-8-08 PLapi-3862995100% (1)

- Technicals 19062008 AlsDocument3 pagesTechnicals 19062008 Alsapi-3862995No ratings yet

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995No ratings yet

- TU544 HDFC LTD 080624Document7 pagesTU544 HDFC LTD 080624api-3862995No ratings yet

- Enil 25 8 08 PLDocument12 pagesEnil 25 8 08 PLapi-3862995No ratings yet

- Varun Shipping LKP SharesDocument3 pagesVarun Shipping LKP Sharesapi-3862995No ratings yet

- Market StrategyDocument3 pagesMarket Strategyapi-3862995No ratings yet

- India DailyDocument15 pagesIndia Dailyapi-3862995No ratings yet

- Plastics+ RNDocument4 pagesPlastics+ RNapi-3862995No ratings yet

- Technicals 18062008 AlsDocument4 pagesTechnicals 18062008 Alsapi-3862995No ratings yet

- Eagle+Eye June19 (E)Document4 pagesEagle+Eye June19 (E)api-3862995No ratings yet

- TU534 IDBI LTD 080616Document6 pagesTU534 IDBI LTD 080616api-3862995100% (1)

- Sector+ Update+ +160608+ +centrumDocument4 pagesSector+ Update+ +160608+ +centrumapi-3862995No ratings yet

- TU533 Tech Mahindra Limited 080616Document5 pagesTU533 Tech Mahindra Limited 080616api-3862995100% (1)

- Inox RU4QFY2008 110608Document4 pagesInox RU4QFY2008 110608api-3862995No ratings yet

- Pipes+ +Sector+Update+170608Document4 pagesPipes+ +Sector+Update+170608api-3862995No ratings yet

- Saregama 16-6-08 PLDocument3 pagesSaregama 16-6-08 PLapi-3862995No ratings yet

- Mukand+ Note+ +160608+ +centrumDocument6 pagesMukand+ Note+ +160608+ +centrumapi-3862995No ratings yet

- Jindal Saw Limited Event UpdateDocument6 pagesJindal Saw Limited Event Updateapi-3862995No ratings yet

- Bombay Stock ExchangeDocument16 pagesBombay Stock ExchangeabhasaNo ratings yet

- The Business Guardian 1708Document8 pagesThe Business Guardian 1708mohamedNo ratings yet

- Hasiyaa InnovationDocument11 pagesHasiyaa InnovationSudhar SanNo ratings yet

- New Suncity ArcadeDocument10 pagesNew Suncity ArcadePulkit DhuriaNo ratings yet

- Bombay Stock Exchange (BSE)Document15 pagesBombay Stock Exchange (BSE)Kumar DoddamaniNo ratings yet

- Interdependency Between Indian and US Market Indices: A Granger Causality ApproachDocument6 pagesInterdependency Between Indian and US Market Indices: A Granger Causality ApproachBOHR International Journal of Finance and Market Research (BIJFMR)No ratings yet

- Gurgaon Circle Rate 2017-2018Document14 pagesGurgaon Circle Rate 2017-2018Pawan SharmaNo ratings yet

- Indian Election - Do They Change Market Trends or Otherwise ?Document70 pagesIndian Election - Do They Change Market Trends or Otherwise ?karthik goelNo ratings yet

- NSE Nifty 50 Quarterly Financial Analysis With EPSDocument1 pageNSE Nifty 50 Quarterly Financial Analysis With EPSRajeev NaikNo ratings yet

- CISS For Cold Storage - Chhattisgarh State Year-Wise DataDocument3 pagesCISS For Cold Storage - Chhattisgarh State Year-Wise DataAshokNo ratings yet

- Advertising L&TDocument80 pagesAdvertising L&TsaiyuvatechNo ratings yet

- DP FatsDocument57 pagesDP Fatspokeman693No ratings yet

- Alert For TCI Rsi Sell 15 MIN ChartinkDocument29 pagesAlert For TCI Rsi Sell 15 MIN ChartinkYeshwanth RamakrishnaNo ratings yet

- Ketan Parekh Scam FinalDocument20 pagesKetan Parekh Scam FinalMohit3107No ratings yet

- 1396010413162Document7 pages1396010413162Shailendra Dwiwedi100% (1)

- Sbi Ifsc CodeDocument1,141 pagesSbi Ifsc CodeManoj K C0% (1)

- Volume Avg More Than 20, Technical Analysis ScannerDocument2 pagesVolume Avg More Than 20, Technical Analysis ScannerH3muPlayzGamez YTNo ratings yet

- Project On Volatility in Indian Stock MarketDocument41 pagesProject On Volatility in Indian Stock MarketPoonam Singh80% (5)

- Fuzzy Lookup ScripDocument65 pagesFuzzy Lookup ScripNeha MalhotraNo ratings yet

- Toih 2020 04 08 PDFDocument14 pagesToih 2020 04 08 PDFrafihydNo ratings yet

- HaiDocument20 pagesHaikuku's entertainmentNo ratings yet

- The Structural and Secular Bull Story Time Forintrospection: IndiaDocument21 pagesThe Structural and Secular Bull Story Time Forintrospection: IndiadddNo ratings yet

- India Market Outlook 2024Document18 pagesIndia Market Outlook 2024arpit2mutha2No ratings yet

- Stock Market NotesDocument1 pageStock Market NotesmanishNo ratings yet

- Commercial List of ProjectsDocument2 pagesCommercial List of ProjectsVikram RaviNo ratings yet

- Smart: Sensex - 20000 & Nifty - 6000 ConqueredDocument12 pagesSmart: Sensex - 20000 & Nifty - 6000 ConqueredSai VaasavNo ratings yet

- Stock Market: Aditya Mohan BBA 3"B"Document11 pagesStock Market: Aditya Mohan BBA 3"B"rajivNo ratings yet

- Module 4Document19 pagesModule 4vaseem aktharcpNo ratings yet

- Archives - Safal NiveshakDocument17 pagesArchives - Safal NiveshakladmohanNo ratings yet

Prajay 16 6 08 PL

Prajay 16 6 08 PL

Uploaded by

api-3862995Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prajay 16 6 08 PL

Prajay 16 6 08 PL

Uploaded by

api-3862995Copyright:

Available Formats

PL Mega Corporate Month

Prajay Engineers Syndicate

Big plans continue

June 16, 2008 Increased development potential: Prajay Engineers’ total land bank has

increased to 45 million sq.ft. from 32 million sq.ft. on account of

enhanced FSI on some of its properties. There is additional potential of

Rating Under Review increasing this by another 5-8 million sq.ft. over the next couple of

Price Rs139 months. Most of the increased development potential has been on

Target Price Under Review account of increased FSI on existing properties. Consequentially, the

Implied Upside NA project execution period has also gone up from five years to seven years.

Sensex 15,190 Rollout plans: The company is planning to undertake development on 20

(Prices as on June 13, 2008) million sq.ft. in FY09. Of this, 16 million sq.ft. is residential and

remaining four million sq.ft. is retail, commercial and IT park. In FY09,

the company is targeting to deliver around 3.85 million sq.ft. as against

Trading Data 2.35 million sq.ft. in FY08. This would largely be from the Vizag property

Market Cap. (Rs bn) 5.6 and Prajay Enclave.

Shares o/s (m) 40.2 Fund raising: Prajay plans to raise US$50m through a QIP issue. This

Free Float 83.6% funding is important and sufficient to execute its development plans.

Avg. Daily Vol (‘000) 93.2 Delay in flow of funds could result in delay in rolling out its plans as well.

Avg. Daily Value (Rs m) 23.9 While the company is open to project level funding also, it would prefer

to dilute at the entity level as this brings in greater flexibility in

deployment of funds. While corporate debt is always an option, it has

become increasingly difficult to syndicate debt.

Major Shareholders Valuations: Prajay has a development potential of 45 million sq.ft. to be

Promoters 16.4% developed over the next seven years, which we think is a key challenge

Foreign 71.0% to the company to execute, as project funding is difficult given the

present economic scenario. At the CMP of Rs139, the stock trades at 3.1x

Domestic Inst. NA

FY08E EPS of Rs44.8. Rating is currently under review.

Public & Others 12.6%

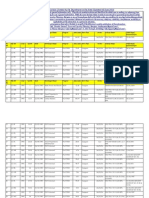

Key financials (Y/e March) FY05 FY06 FY07 FY08E

Revenue (Rs m) 233 730 2,096 4,606

Growth (%) 31.0 213.8 187.1 119.7

Stock Performance

EBITDA (Rs m) 74 310 990 2,495

(%) 1M 6M 12M PAT (Rs m) 44 227 772 1,801

Absolute (41.2) (62.8) (42.9) EPS (Rs) 5.7 15.3 35.7 44.8

Growth (%) 843.8 167.0 133.6 25.6

Relative (30.0) (40.1) (52.3)

Net DPS (Rs) 1.2 2.0 2.0 2.5

Source: Company Data; PL Research

Price Performance (RIC: PRJE.BO, BB: PES IN) Profitability & valuation FY05 FY06 FY07 FY08E

(Rs) EBITDA margin (%) 31.9 42.5 47.2 54.2

470 RoE (%) 38.7 64.7 50.0 39.3

420 RoCE (%) 21.7 29.4 22.1 22.7

370 EV / sales (x) 5.2 3.7 3.1 2.0

320 EV / EBITDA (x) 16.3 8.8 6.6 3.7

270 PE (x) 24.3 9.1 3.9 3.1

220 P / BV (x) 8.3 3.6 1.2 0.8

170 Net dividend yield (%) 0.9 1.4 1.4 1.8

120 Source: Company Data; PL Research

Apr-08

Dec-07

Feb-08

Jun-07

Aug-07

Oct-07

Jun-08

Kejal Mehta Subramaniam Yadav

KejalMehta@PLIndia.com SubramaniamYadav@PLIndia.com

Source: Bloomberg +91-22-6632 2246 +91-22-6632 2241

PL Mega Corporate Month

Prajay Engineers Syndicate

Management representatives:

Mr. Ravinder Reddy, COO

Q: Are you sufficiently funded to undertake this

Q: Have there been any land bank additions in the development?

recent past?

A: The company has plans to raise US$50m through a

A: The total land bank has increased to 45 million sq.ft. QIP issue. This funding is important and sufficient to

from 32 million sq.ft. on account of enhanced FSI on execute the development plans. Delay in access to

some of its properties. There is additional potential of funds could entail some delay in rollout plans as well.

increasing this by another 5-8 million sq.ft. over the While the company is open to project level funding as

next couple of months. Most of the increased well, they would prefer to dilute at the entity level as

development potential has been on account of this brings in greater flexibility in deployment of funds.

increased FSI on existing properties. We have tied-up with Lehman for our Virgin County

project, and for our Waterfront City project we have

Consequentially, the project execution period has also tied for debt with HSBC.

gone up from five years to seven years. Out of this land

bank, 70% would be residential and remaining retail, This is important in light of the fact that individual

commercial and hotels; and a major chunk of the 70% projects could witness some delays in rollout on

residential is mid-income housing accounting for around account of delayed clearances, etc.

60-70% and the remaining in premium and luxury.

Q: How has real estate demand been in Hyderabad

Q: How much has been developed in FY08, and going over the last couple of months and what is the

forward how is development going to be rolled out? outlook on real estate prices?

A: The company is planning to undertake development A: There has been a dip in residential transaction

on 20 million sq.ft. in FY09. Of this, 16 million sq.ft. is volumes vis-à-vis last six months, although it has

in residential and remaining four million sq.ft. is in improved a bit as compared to last six month, but still

retail, commercial and IT park. much lower than the peak offtake a year ago.

In FY09, the company is targeting to deliver around Lower volumes have been particularly in the high end

3.85 million sq.ft. as against 2.35 million sq.ft. in FY08. luxury segment where volumes in some cases have been

This would largely be from the Vizag property and lower by almost 70% as against mid-income housing,

Prajay Enclave. where volumes have fallen by 10-15%.

Q: What are the key projects that would be launched However, prices have not declined in the period. In the

in the current year? recent past there have been some signs of pick-up in

demand across residential properties, but transaction

A: Some of the key projects to be launched include volumes are still lower than what was witnessed a year

Prajay Windsor Park, which is a 1.3 million sq.ft. ago.

project, Prajay Waterfront City, which is a 3.3 million

sq.ft. residential project, and Prajay Virgin County, Q: Has your cost of construction been impacted on

which is a 6.25 million sq.ft. mixed development account of increased input prices?

project. Apart from this, the company also plans to

launch a couple of retail and commercial projects, A: On YoY basis the cost of construction has increased

which include Prajay Technopark and Prajay Megapolis. by 15-20% depending on the type of project.

June 16, 2008 2

PL Mega Corporate Month

Prajay Engineers Syndicate

Q: What is your cost of construction?

A: It varies from segment to segment, for mid-segment

it’s around Rs800-850, for upper mid-segment it’s

Rs1,000-1,100, for premium it’s around Rs1,250-1,400,

for luxury it’s Rs1,750-2,000 and for retail space it’s

Rs1,700-2,000.

Q: What is the ramp-up plan for the hotel business?

A: Currently, Prajay has 100 rooms operational in two

properties. However, the company eventually plans to

ramp this up to 2,200 rooms in the next 3-4 years.

Currently, there are about 1,000 hotel rooms that are

in various stages of construction. The new hotel

properties would be under management contract with

reputed hotel chains.

June 16, 2008 3

PL Mega Corporate Month

Prajay Engineers Syndicate

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India.

Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

PL’s Recommendation Nomenclature

BUY : > 15% Outperformance to BSE Sensex Outperformer (OP) : 5 to 15% Outperformance to Sensex

Market Performer (MP) : -5 to 5% of Sensex Movement Underperformer (UP) : -5 to -15% of Underperformace to Sensex

Sell : <-15% Relative to Sensex

Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information

and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken

as an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or

completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information,

statements and opinion given, made available or expressed herein or for any omission therein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The

suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent

expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or

engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication.

We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

June 16, 2008 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Licence Details Upto June 2015Document74 pagesLicence Details Upto June 2015piudevaNo ratings yet

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995No ratings yet

- Hdfcbank 25-8-08 PLDocument5 pagesHdfcbank 25-8-08 PLapi-3862995100% (1)

- Technicals 19062008 AlsDocument3 pagesTechnicals 19062008 Alsapi-3862995No ratings yet

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995No ratings yet

- TU544 HDFC LTD 080624Document7 pagesTU544 HDFC LTD 080624api-3862995No ratings yet

- Enil 25 8 08 PLDocument12 pagesEnil 25 8 08 PLapi-3862995No ratings yet

- Varun Shipping LKP SharesDocument3 pagesVarun Shipping LKP Sharesapi-3862995No ratings yet

- Market StrategyDocument3 pagesMarket Strategyapi-3862995No ratings yet

- India DailyDocument15 pagesIndia Dailyapi-3862995No ratings yet

- Plastics+ RNDocument4 pagesPlastics+ RNapi-3862995No ratings yet

- Technicals 18062008 AlsDocument4 pagesTechnicals 18062008 Alsapi-3862995No ratings yet

- Eagle+Eye June19 (E)Document4 pagesEagle+Eye June19 (E)api-3862995No ratings yet

- TU534 IDBI LTD 080616Document6 pagesTU534 IDBI LTD 080616api-3862995100% (1)

- Sector+ Update+ +160608+ +centrumDocument4 pagesSector+ Update+ +160608+ +centrumapi-3862995No ratings yet

- TU533 Tech Mahindra Limited 080616Document5 pagesTU533 Tech Mahindra Limited 080616api-3862995100% (1)

- Inox RU4QFY2008 110608Document4 pagesInox RU4QFY2008 110608api-3862995No ratings yet

- Pipes+ +Sector+Update+170608Document4 pagesPipes+ +Sector+Update+170608api-3862995No ratings yet

- Saregama 16-6-08 PLDocument3 pagesSaregama 16-6-08 PLapi-3862995No ratings yet

- Mukand+ Note+ +160608+ +centrumDocument6 pagesMukand+ Note+ +160608+ +centrumapi-3862995No ratings yet

- Jindal Saw Limited Event UpdateDocument6 pagesJindal Saw Limited Event Updateapi-3862995No ratings yet

- Bombay Stock ExchangeDocument16 pagesBombay Stock ExchangeabhasaNo ratings yet

- The Business Guardian 1708Document8 pagesThe Business Guardian 1708mohamedNo ratings yet

- Hasiyaa InnovationDocument11 pagesHasiyaa InnovationSudhar SanNo ratings yet

- New Suncity ArcadeDocument10 pagesNew Suncity ArcadePulkit DhuriaNo ratings yet

- Bombay Stock Exchange (BSE)Document15 pagesBombay Stock Exchange (BSE)Kumar DoddamaniNo ratings yet

- Interdependency Between Indian and US Market Indices: A Granger Causality ApproachDocument6 pagesInterdependency Between Indian and US Market Indices: A Granger Causality ApproachBOHR International Journal of Finance and Market Research (BIJFMR)No ratings yet

- Gurgaon Circle Rate 2017-2018Document14 pagesGurgaon Circle Rate 2017-2018Pawan SharmaNo ratings yet

- Indian Election - Do They Change Market Trends or Otherwise ?Document70 pagesIndian Election - Do They Change Market Trends or Otherwise ?karthik goelNo ratings yet

- NSE Nifty 50 Quarterly Financial Analysis With EPSDocument1 pageNSE Nifty 50 Quarterly Financial Analysis With EPSRajeev NaikNo ratings yet

- CISS For Cold Storage - Chhattisgarh State Year-Wise DataDocument3 pagesCISS For Cold Storage - Chhattisgarh State Year-Wise DataAshokNo ratings yet

- Advertising L&TDocument80 pagesAdvertising L&TsaiyuvatechNo ratings yet

- DP FatsDocument57 pagesDP Fatspokeman693No ratings yet

- Alert For TCI Rsi Sell 15 MIN ChartinkDocument29 pagesAlert For TCI Rsi Sell 15 MIN ChartinkYeshwanth RamakrishnaNo ratings yet

- Ketan Parekh Scam FinalDocument20 pagesKetan Parekh Scam FinalMohit3107No ratings yet

- 1396010413162Document7 pages1396010413162Shailendra Dwiwedi100% (1)

- Sbi Ifsc CodeDocument1,141 pagesSbi Ifsc CodeManoj K C0% (1)

- Volume Avg More Than 20, Technical Analysis ScannerDocument2 pagesVolume Avg More Than 20, Technical Analysis ScannerH3muPlayzGamez YTNo ratings yet

- Project On Volatility in Indian Stock MarketDocument41 pagesProject On Volatility in Indian Stock MarketPoonam Singh80% (5)

- Fuzzy Lookup ScripDocument65 pagesFuzzy Lookup ScripNeha MalhotraNo ratings yet

- Toih 2020 04 08 PDFDocument14 pagesToih 2020 04 08 PDFrafihydNo ratings yet

- HaiDocument20 pagesHaikuku's entertainmentNo ratings yet

- The Structural and Secular Bull Story Time Forintrospection: IndiaDocument21 pagesThe Structural and Secular Bull Story Time Forintrospection: IndiadddNo ratings yet

- India Market Outlook 2024Document18 pagesIndia Market Outlook 2024arpit2mutha2No ratings yet

- Stock Market NotesDocument1 pageStock Market NotesmanishNo ratings yet

- Commercial List of ProjectsDocument2 pagesCommercial List of ProjectsVikram RaviNo ratings yet

- Smart: Sensex - 20000 & Nifty - 6000 ConqueredDocument12 pagesSmart: Sensex - 20000 & Nifty - 6000 ConqueredSai VaasavNo ratings yet

- Stock Market: Aditya Mohan BBA 3"B"Document11 pagesStock Market: Aditya Mohan BBA 3"B"rajivNo ratings yet

- Module 4Document19 pagesModule 4vaseem aktharcpNo ratings yet

- Archives - Safal NiveshakDocument17 pagesArchives - Safal NiveshakladmohanNo ratings yet