Professional Documents

Culture Documents

GSTR3B 29aaacm9875e1z1 042024

GSTR3B 29aaacm9875e1z1 042024

Uploaded by

jainp3882Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B 29aaacm9875e1z1 042024

GSTR3B 29aaacm9875e1z1 042024

Uploaded by

jainp3882Copyright:

Available Formats

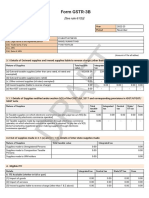

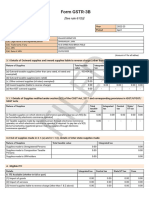

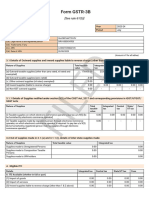

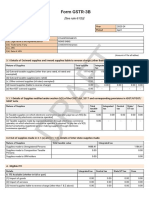

Form GSTR-3B

[See rule 61(5)]

Year 2024-25

Period April

GSTIN of the supplier 29AAACM9875E1Z1

2(a). Legal name of the registered person MRO TEK REALTY LIMITED

2(b). Trade name, if any MRO TEK REALTY LIMITED

2(c). ARN

2(d). Date of ARN

(Amount in ₹ for all tables)

T

3.1 Details of Outward supplies and inward supplies liable to reverse charge (other than those covered by Table 3.1.1)

Nature of Supplies Total taxable Integrated Central State/UT Cess

value tax tax tax

(a) Outward taxable supplies (other than zero rated, nil rated and 22997427.84 2656926.14 739842.94 739842.94 0.00

exempted)

(b) Outward taxable supplies (zero rated)

AF

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

301000.00

0.00

0.00

0.00

-

-

0.00

0.00

-

-

27090.00

-

-

-

27090.00

-

0.00

-

0.00

-

3.1.1 Details of Supplies notified under section 9(5) of the CGST Act, 2017 and corresponding provisions in IGST/UTGST/

SGST Acts

Nature of Supplies Total Integrated Central State/ Cess

taxable tax tax UT tax

DR

value

(i) Taxable supplies on which electronic commerce operator pays tax u/s 9(5) [to 0.00 0.00 0.00 0.00 0.00

be furnished by electronic commerce operator]

(ii) Taxable supplies made by registered person through electronic commerce 0.00 - - - -

operator, on which electronic commerce operator is required to pay tax u/s 9(5)

[to be furnished by registered person making supplies through electronic

commerce operator]

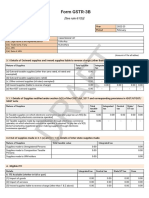

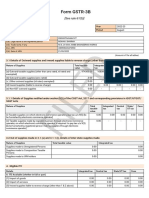

3.2 Out of supplies made in 3.1 (a) and 3.1.1 (i), details of inter-state supplies made

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

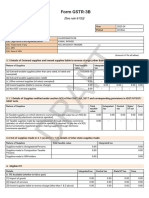

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 1513072.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 27090.00 27090.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 1223223.13 273077.97 273077.97 0.00

B. ITC Reversed

(1) As per rules 38,42 & 43 of CGST Rules and section 17(5) 0.00 0.00 0.00 0.00

(2) Others 970165.00 45002.00 45002.00 0.00

C. Net ITC available (A-B) 1766130.13 255165.97 255165.97 0.00

(D) Other Details 0.00 97830.00 97830.00 0.00

(1) ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax 0.00 97830.00 97830.00 0.00

period

(2) Ineligible ITC under section 16(4) & ITC restricted due to PoS rules 0.00 0.00 0.00 0.00

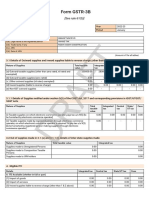

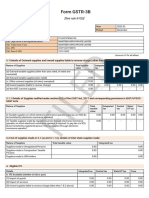

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

T

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

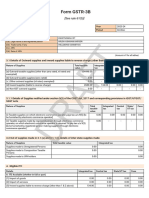

5.1 Interest and Late fee for previous tax period

Details

System computed

Interest

Interest Paid

Late fee

Integrated tax

-

-

AF 0.00

Central tax

-

0.00

0.00

State/UT tax

-

0.00

0.00

Cess

-

-

0.00

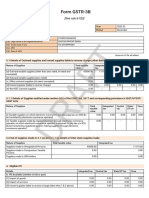

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid Late fee

payable cash in cash paid in cash

DR

Integrated tax Central tax State/UT tax Cess

(A) Other than reverse charge

Integrated 2656926.14 0.00 0.00 0.00 - 0.00 0.00 -

tax

Central tax 739842.94 0.00 0.00 - - 0.00 0.00 0.00

State/UT tax 739842.94 0.00 - 0.00 - 0.00 0.00 0.00

Cess 0.00 - - - 0.00 0.00 0.00 -

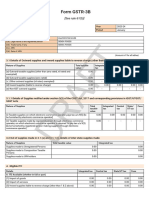

(B) Reverse charge

Integrated 0.00 - - - - 0.00 - -

tax

Central tax 27090.00 - - - - 0.00 - -

State/UT tax 27090.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

You might also like

- Template Tax Provision Calculation 2021Document3 pagesTemplate Tax Provision Calculation 2021Chiara AnindaNo ratings yet

- GSTR3B 27aaccc9192q1zu 032024Document2 pagesGSTR3B 27aaccc9192q1zu 032024sarang chawareNo ratings yet

- GSTR3B 07abwpt4073b1zb 112022Document2 pagesGSTR3B 07abwpt4073b1zb 112022Deepak JainNo ratings yet

- GSTR3B 23azopr4397n1ze 122023Document2 pagesGSTR3B 23azopr4397n1ze 122023vikas guptaNo ratings yet

- GSTR3B 21djipb1419l1zk 042024Document3 pagesGSTR3B 21djipb1419l1zk 042024satyabratadebanath2000No ratings yet

- GSTR3B 33auapv1142j1zs 112023Document3 pagesGSTR3B 33auapv1142j1zs 112023crmfinance.tnNo ratings yet

- GSTR3B 07biypk7555f1zl 032023Document3 pagesGSTR3B 07biypk7555f1zl 032023Shubham JindalNo ratings yet

- GSTR3B 29alwpc1359h2zp 012024Document3 pagesGSTR3B 29alwpc1359h2zp 012024crmfinance.tnNo ratings yet

- GSTR3B 27abqpk3088b1zj 012024Document2 pagesGSTR3B 27abqpk3088b1zj 012024krishnatawari20No ratings yet

- GSTR3B 29andpa2214j2zd 032024Document2 pagesGSTR3B 29andpa2214j2zd 032024praveen praveenNo ratings yet

- GSTR3B 33abppc1495f1zs 052023Document3 pagesGSTR3B 33abppc1495f1zs 052023Arun Nahendran SNo ratings yet

- $RRXOAKSDocument3 pages$RRXOAKSakxerox47No ratings yet

- GSTR3B 29dippk5985j1z7 122023Document2 pagesGSTR3B 29dippk5985j1z7 122023Arush KapoorNo ratings yet

- Nov 22Document3 pagesNov 22Aman JaiswalNo ratings yet

- GSTR3B 21fwdpr3557p1zy 042024.Document3 pagesGSTR3B 21fwdpr3557p1zy 042024.satyabratadebanath2000No ratings yet

- GSTR3B 09aaopj3054f1zo 042022Document3 pagesGSTR3B 09aaopj3054f1zo 042022Suhail KhanNo ratings yet

- GSTR3B 33auapv1142j1zs 062023Document3 pagesGSTR3B 33auapv1142j1zs 062023crmfinance.tnNo ratings yet

- GSTR3B 29alqpm0868b1zu 042022Document3 pagesGSTR3B 29alqpm0868b1zu 042022ThangaiSiddharthNo ratings yet

- GSTR3B 09BWDPS4346H1Z7 062022Document3 pagesGSTR3B 09BWDPS4346H1Z7 062022birpal singhNo ratings yet

- GSTR3B 36albpm0896j1zt 022023Document3 pagesGSTR3B 36albpm0896j1zt 022023nagesh abbaramainaNo ratings yet

- GSTR3B 36eqcpm7575n1z0 052024Document2 pagesGSTR3B 36eqcpm7575n1z0 052024n41987029No ratings yet

- GSTR3B 37aptpr5444p2zp 042024Document2 pagesGSTR3B 37aptpr5444p2zp 042024CA Shiva Shankar ReddyNo ratings yet

- GSTR3B 36acbfs4677g1zv 112023Document3 pagesGSTR3B 36acbfs4677g1zv 112023Srilakshmi MNo ratings yet

- GSTR3B 36acbfs4677g1zv 042023Document3 pagesGSTR3B 36acbfs4677g1zv 042023Srilakshmi MNo ratings yet

- GSTR3B 36acbfs4677g1zv 072023Document3 pagesGSTR3B 36acbfs4677g1zv 072023Srilakshmi MNo ratings yet

- GSTR3B 19bxipr2995f1zt 022023Document2 pagesGSTR3B 19bxipr2995f1zt 022023Booky TrendsNo ratings yet

- GSTR3B 08bkqpt4567e1zi 012023-1Document2 pagesGSTR3B 08bkqpt4567e1zi 012023-1Prakash KumawatNo ratings yet

- GSTR3B 27DSRPS9946D2ZS 122022Document2 pagesGSTR3B 27DSRPS9946D2ZS 122022Robin PathakNo ratings yet

- GSTR3B 10caepk0695k1zs 032024Document2 pagesGSTR3B 10caepk0695k1zs 032024Pankaj SinghNo ratings yet

- GSTR3B 07acppd4729a1zv 032024Document2 pagesGSTR3B 07acppd4729a1zv 032024vishuverma49130No ratings yet

- GSTR3B 07HMSPS9294B1Z5 042023Document2 pagesGSTR3B 07HMSPS9294B1Z5 042023Ajay rawatNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 07afhpj8662d1zd 092022Document2 pagesGSTR3B 07afhpj8662d1zd 092022Deepak JainNo ratings yet

- GSTR3B 03aabcn2864p1z7 082023Document2 pagesGSTR3B 03aabcn2864p1z7 082023Sumit K JhaNo ratings yet

- GSTR3B 29dxrpb1185a1zj 092021Document2 pagesGSTR3B 29dxrpb1185a1zj 092021Sainath ReddyNo ratings yet

- GSTR3B 09bfkps8730k1zo 032024Document3 pagesGSTR3B 09bfkps8730k1zo 032024Amit AcharyaNo ratings yet

- GSTR3B 19awjpr1906k1z3 092023Document2 pagesGSTR3B 19awjpr1906k1z3 092023ashiskarmakar93taxNo ratings yet

- GSTR3B 09BWDPS4346H1Z7 082022Document3 pagesGSTR3B 09BWDPS4346H1Z7 082022birpal singhNo ratings yet

- GSTR3B 21fwdpr3557p1zy 042024Document3 pagesGSTR3B 21fwdpr3557p1zy 042024satyabratadebanath2000No ratings yet

- GSTR3B 07afqpj3676j1zv 122023Document2 pagesGSTR3B 07afqpj3676j1zv 122023navjyotifurnitureNo ratings yet

- GSTRDocument6 pagesGSTRmohnishsainiNo ratings yet

- GSTR3B 09aaopj3054f1zo 072023Document3 pagesGSTR3B 09aaopj3054f1zo 072023Suhail KhanNo ratings yet

- GSTR3B 10jespk0829a1zs 042023Document3 pagesGSTR3B 10jespk0829a1zs 042023Pratik RajNo ratings yet

- GSTR3B 22agtpb0526h2zr 092022Document3 pagesGSTR3B 22agtpb0526h2zr 092022Alok KeswaniNo ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 19BBSPR1755D1Z8 062023Document2 pagesGSTR3B 19BBSPR1755D1Z8 062023b2bservices007No ratings yet

- GSTR3B 29alwpc1359h2zp 052023Document3 pagesGSTR3B 29alwpc1359h2zp 052023crmfinance.tnNo ratings yet

- GSTR3B 24czcpa4819a1z3 102023Document2 pagesGSTR3B 24czcpa4819a1z3 102023yadavdurgen276No ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B 09aaeci2181f2zn 062022Document2 pagesGSTR3B 09aaeci2181f2zn 062022Pushan SrivastavaNo ratings yet

- GSTR3B 01bcupl5374b1zo 062023Document3 pagesGSTR3B 01bcupl5374b1zo 062023imt caNo ratings yet

- GSTR3B 33auapv1142j1zs 102023Document3 pagesGSTR3B 33auapv1142j1zs 102023crmfinance.tnNo ratings yet

- Aqa5462f2r 112023Document2 pagesAqa5462f2r 112023Sivaraja GopinathanNo ratings yet

- GSTR3B 29avrpa8118r1zp 122023Document3 pagesGSTR3B 29avrpa8118r1zp 122023zeeshanNo ratings yet

- GSTR3B 33afcfs7231n1zr 012024Document2 pagesGSTR3B 33afcfs7231n1zr 012024saravanakumarNo ratings yet

- GSTR3B 29alwpc1359h2zp 042023Document3 pagesGSTR3B 29alwpc1359h2zp 042023crmfinance.tnNo ratings yet

- GSTR3B 21ahhpn3658h1zd 042021Document2 pagesGSTR3B 21ahhpn3658h1zd 042021GOOGLE NETNo ratings yet

- 3B Pa5462f2zr 122023Document2 pages3B Pa5462f2zr 122023Sivaraja GopinathanNo ratings yet

- GSTR3B 24FDSPM9863D1ZX 092022Document3 pagesGSTR3B 24FDSPM9863D1ZX 092022Atmos GamingNo ratings yet

- UK Personal Income TaxDocument7 pagesUK Personal Income TaxHoa ĐàoNo ratings yet

- Additional TaxDocument3 pagesAdditional TaxMel ManatadNo ratings yet

- Economics SyllabusDocument16 pagesEconomics Syllabuskumarpawan95373No ratings yet

- Business Mathematics 4TH Quarter Week 3Document4 pagesBusiness Mathematics 4TH Quarter Week 3John Calvin GerolaoNo ratings yet

- Salary Sheet TemplateDocument2 pagesSalary Sheet TemplateYaz YaraNo ratings yet

- Payslip: Unam Pharmaceautical (M) SDN BHDDocument2 pagesPayslip: Unam Pharmaceautical (M) SDN BHDFake PopcornNo ratings yet

- Direct Tax NotesDocument65 pagesDirect Tax NotesJeevan T RNo ratings yet

- Taxpayers Account Management Program (Tamp)Document8 pagesTaxpayers Account Management Program (Tamp)mark liezerNo ratings yet

- Deduction From Gross Total IncomeDocument23 pagesDeduction From Gross Total IncomeSaranya RathinavelNo ratings yet

- Unit 22: Government and Taxation (Handout)Document7 pagesUnit 22: Government and Taxation (Handout)Hannah KhuongNo ratings yet

- Matla Kriel November Payroll 2022Document2 pagesMatla Kriel November Payroll 2022Tshikani JoyNo ratings yet

- Twin Deficits HypothesisDocument3 pagesTwin Deficits HypothesisinnovatorinnovatorNo ratings yet

- BillbharwadDocument1 pageBillbharwadAmpere MISNo ratings yet

- Financial PlanDocument1 pageFinancial PlanAngel CuerdoNo ratings yet

- 13 - Chapter - VDocument38 pages13 - Chapter - VDigpal MoryaNo ratings yet

- 1904 Bir FormDocument2 pages1904 Bir Formal bentulanNo ratings yet

- Governtment AccountingDocument2 pagesGoverntment Accountingjessica amorosoNo ratings yet

- Effect of Government Spending On The Nigerian EducationDocument10 pagesEffect of Government Spending On The Nigerian EducationEditor IJTSRDNo ratings yet

- Concepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1Document73 pagesConcepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1hiedi100% (43)

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- EconomicsDocument9 pagesEconomicsOladosu Afeez OlawaleNo ratings yet

- Different Types of AllowancesDocument4 pagesDifferent Types of AllowancesYoga Guru100% (1)

- Pooja ElectricalDocument1 pagePooja ElectricalSSK IndustriesNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument17 pagesU.S. Individual Income Tax Return: Filing StatusCristian BurnNo ratings yet

- Financial AidDocument7 pagesFinancial AidAnna PeterNo ratings yet

- Allowances Under Income Tax Act1961Document12 pagesAllowances Under Income Tax Act1961Sahil14JNo ratings yet

- Taxation of Churches in Zimbabwe - AssignmentDocument2 pagesTaxation of Churches in Zimbabwe - AssignmentWELLINGTONNo ratings yet

- Solved Carlos Opens A Dry Cleaning Store During The Year He PDFDocument1 pageSolved Carlos Opens A Dry Cleaning Store During The Year He PDFAnbu jaromiaNo ratings yet

- Ccv2 News: Need To Know StuffDocument2 pagesCcv2 News: Need To Know StuffjoeNo ratings yet