Professional Documents

Culture Documents

Tax Paper

Tax Paper

Uploaded by

noneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Paper

Tax Paper

Uploaded by

noneCopyright:

Available Formats

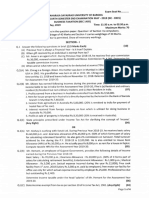

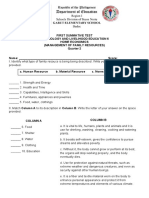

TER'S (OLLEGE (AUTONOMOUS) MUMBAI

END SEMESTER EXAMS

FRIDAY UID No.:

20h Oetober 2023 Duration: 2 Hours

SYBMS Maximum Marks: 60

Elements of Taxation Course Code: CMS0306

NOTE: 1) All questtions are compulsory. Refer to each Question for internal choice.

2) Figures to the right indicate maximum marks.

Q.1. What the tax treatnent for the different forms of salaries? (Marks 5)

Q.2.a. What are the available deductions from salary income? (Marks 3)

OR

2.b. What exemptions arc available for Retrcnchment Compensation under the Income 1ax

Act, 1961? (Marks 3)

Q.3. Mr. Ram who resides in Chennai, gets Rs. 3,00,000 as basic salary. He receives Rs. S0,000

per annum as HRA. Rent paid by him is Rs. 40,000 per annum. Find out the amount of taxable

(Marks 7)

HRA for the AY. 2022-23.

Q. 4.a. Which deductions are not allowed under section 58 ofthe Income Tax Act, 1961?

(Marks 5)

OR

Q. 4.b. During the previous ycar, Rajesh has reccived immovable property (market value Rs.

1,50,00,000) from his friend as his friend is settling abroad. The stamp duty value of such property

is Rs. 1,40,000. Check the taxability of this transaction in the hands of Rajesh. (Marks 5)

0.5. What the term Relative" means in context of Income from Other Source? (Marks 3)

Q.6. Briefly explain Company in which the public are substantially interested. (Marks 7)

0.7.a. Briefly describe the various kinds of income that can be deemed to accrue or arise in

India as per sec. 9 of the Income Tx Act, 1961. (Marks 8)

OR

Q7.b. X, a resident of Ajmer, receives Rs. 48,000 as basic salary during the previous year 2020

21. In addition, he gets Rs. 4,800 as dearness allowance forming part of basic salary, 7%

commission on sales made by him (sale made by X during the relevant previous year is Rs.

86,000) and Rs. 6,000 as house rent allowance. He, however, pays Rs. S,800 as house rent.

Determine the quantum of exempted house rent allowance. (Marks 8)

Q. 8. Briefly deseribe Indexed Cost of Acquisition. (Marks 7)

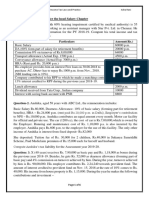

Q.9. Mr. Raja is Accounts head in M/s Rani Ltd. The following are the particulars:

(Marks l0)

Basic salary Rs. 65,000 p.m.

Rs. 22,000p.m. (30% is for retirement

Dearness allowance

benefits)

Bonus Rs. 17,000 p.m.

,2021 at a concessional

The company has provided him with an accommodation on Ist April

Mr. Raja occupied the house

rent. The house was taken on lease by Rani Ltd. for Rs. 12,000 p.m.

Mr. Raja.

from 1st November,2021. Rs. 4,800 p.m. is recovered from the salary of

birthday. He contributes 18% of his salary

Rani Ltd. gave him a gift voucher of Rs. 8,000 on his

company contributes the same

(Basic pay + DA) towards recognized provident fund and the

amount.

liters) provides to Mr.

Motor car owned by Rani Ltd. (cubic capacity of engine exceeds 1.60

personal use. Repair and

Raja from lst November 2021 which is used for both official and

The motor car was self-driven by

running expenses Rs. 50,000 were fully met by the company.

Mr. Raja.

in the hands of Mr. Raja for the

Compute the income chargeable to tax under the head "Salaries"

Assessment year 2022-23.

is the concept of destination

Q 10.a. What is Goods and Services Tax (GST) and what exactly

based tax on consumption? (Marks 5)

OR

under the Payment of

Q10.b. Sharad, an employee of BKC Ltd., receives Rs. 2,05,000 as gratuity

service for 35 years and 7

Gratuity Act, 1972. He retires on 10th September, 2020 after rendering

of gratuity

months. The last drawn salary was Rs. 2,700 per month. Calculate the amount

chargeable to tax. (Marks 5)

You might also like

- February Payslip 2023.pdf - 1-2Document1 pageFebruary Payslip 2023.pdf - 1-2Arbaz KhanNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- 012-Practice Questions - Income TaxDocument106 pages012-Practice Questions - Income Taxalizaidkhan29% (7)

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- 1 Business TaxationDocument4 pages1 Business TaxationchouhanjainilNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Nov DecIII V Sem 2020Document8 pagesNov DecIII V Sem 2020dweeps75No ratings yet

- 029 Practice Test 08 Taxation Test Solution Subjective Udesh RegularDocument8 pages029 Practice Test 08 Taxation Test Solution Subjective Udesh Regulardeathp006No ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- CS Professional DT IDT Most Expected Questions For DECEMBER 2023Document285 pagesCS Professional DT IDT Most Expected Questions For DECEMBER 2023Dhanush GunisettyNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- iNCOME TAX MODEL Q.PDocument3 pagesiNCOME TAX MODEL Q.PAndalNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Suppy PNo ratings yet

- Most Expected Top 50 GST Questions For CA Inter November 2023 ExamsDocument45 pagesMost Expected Top 50 GST Questions For CA Inter November 2023 ExamsmukhiapurvaNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Cim 8682 Taxation Question Paper (Ahemadabad)Document3 pagesCim 8682 Taxation Question Paper (Ahemadabad)Pomi ShiyaNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- MCQ - Income Under The Head Salary by CA Kishan KumarDocument16 pagesMCQ - Income Under The Head Salary by CA Kishan KumarGoutam ChakrabortyNo ratings yet

- Pakistan Institute of Public Finance Accountants: TaxationDocument3 pagesPakistan Institute of Public Finance Accountants: TaxationAzfar AliNo ratings yet

- Q IT Divyastra CH 13 - TDS & TCS - May 24 by CA Kishan KumarDocument8 pagesQ IT Divyastra CH 13 - TDS & TCS - May 24 by CA Kishan KumarDrishti SyalNo ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- Case Study-5 PDF - QuestionDocument2 pagesCase Study-5 PDF - QuestionAbhi rajouraNo ratings yet

- Most Expected GST Questions Part 1 by Ca Vivek GabaDocument25 pagesMost Expected GST Questions Part 1 by Ca Vivek GabaLakshman MurthyNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- MBA183F3: RamaiahDocument5 pagesMBA183F3: Ramaiahvijay shetNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- MBA Sem 1 Indirect Tax PaperDocument4 pagesMBA Sem 1 Indirect Tax PaperVedvati PetkarNo ratings yet

- Itcst Nov06Document27 pagesItcst Nov06api-3825774No ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Income Tax Compulsory Paper-3: AHK/KW/19/4101Document6 pagesIncome Tax Compulsory Paper-3: AHK/KW/19/4101Deepak ThomasNo ratings yet

- RA - M16UCM12 - B.Com. - 24.03.2021 - FNDocument4 pagesRA - M16UCM12 - B.Com. - 24.03.2021 - FNkavinilavan14072004No ratings yet

- Other Source P1, P2, P3Document3 pagesOther Source P1, P2, P3Suhani RathiNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- PFTP - Unit II - Income From Salary - Short SumsDocument3 pagesPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974No ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- IT Income From Other Sources Pt-2Document7 pagesIT Income From Other Sources Pt-2syedfareed596100% (1)

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Aditya Sharma - II Mid Term PaperDocument4 pagesAditya Sharma - II Mid Term PaperAditya SharmaNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Salary - PaperDocument5 pagesSalary - PaperVenkataRajuNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- 27 (B3 and B4) .IFP (8,9, 10) - 19.06.2023Document1 page27 (B3 and B4) .IFP (8,9, 10) - 19.06.2023jopah81118No ratings yet

- Sales and Tax Declaration Form 2020Document1 pageSales and Tax Declaration Form 2020k act100% (1)

- Drake State Refund As Taxable Worksheet (2018)Document1 pageDrake State Refund As Taxable Worksheet (2018)TaxGuyNo ratings yet

- Illustration 5Document2 pagesIllustration 5Bea Nicole BaltazarNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Salary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Document2 pagesSalary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Adheesh SanthoshNo ratings yet

- Danish Taxes and The Taxation System in DenmarkDocument3 pagesDanish Taxes and The Taxation System in Denmarkbhushan kumarNo ratings yet

- 18e Key Question Answers CH 4Document2 pages18e Key Question Answers CH 4Andrea RobinsonNo ratings yet

- BC 604, Income Tax Law & Practice, 2022Document12 pagesBC 604, Income Tax Law & Practice, 2022davusingh786No ratings yet

- Table 1 - Tax Table 01Document182 pagesTable 1 - Tax Table 01wellawalalasithNo ratings yet

- CIR Vs BAIER-NICKEL G.R. No. 153793 August 29, 2006Document2 pagesCIR Vs BAIER-NICKEL G.R. No. 153793 August 29, 2006Emil BautistaNo ratings yet

- Lecture 1 + 2 - Derivation of Perpetuity FormulaDocument1 pageLecture 1 + 2 - Derivation of Perpetuity Formulatran thanhNo ratings yet

- Citibank vs. CA, 280 SCRA 459Document1 pageCitibank vs. CA, 280 SCRA 459SURITA, FLOR DE MAE PNo ratings yet

- Fringe Benefits Tax: Income Taxation 7Th Edition (By: Valencia & Roxas) Suggested AnswersDocument8 pagesFringe Benefits Tax: Income Taxation 7Th Edition (By: Valencia & Roxas) Suggested AnswersJuan Frivaldo100% (2)

- TABL2751 T2 2021 Sample Quiz QuestionsDocument3 pagesTABL2751 T2 2021 Sample Quiz QuestionsPeper12345No ratings yet

- RPD-Taxation of House Property IncomeDocument2 pagesRPD-Taxation of House Property IncomedeshpanderpNo ratings yet

- Income Recognition, Measurement and Reporting and Taxpayer ClassificationsDocument27 pagesIncome Recognition, Measurement and Reporting and Taxpayer ClassificationsAries Queencel Bernante BocarNo ratings yet

- Tax Incidence On Partnership Fi RMDocument12 pagesTax Incidence On Partnership Fi RMTejas DesaiNo ratings yet

- Commercial Arithmetic 2 QDocument9 pagesCommercial Arithmetic 2 Qideal writersNo ratings yet

- Module 9 - Tax On Co-Ownership, EstatesDocument13 pagesModule 9 - Tax On Co-Ownership, EstatesAbegail Jenn Elis MulderNo ratings yet

- TaxationDocument11 pagesTaxationAnonymous ougAoiPZNo ratings yet

- First Summative Test-Tle He6Document6 pagesFirst Summative Test-Tle He6Jassim Magallanes100% (1)

- 1575 Tania Sultana (Taxation I)Document28 pages1575 Tania Sultana (Taxation I)Tania SultanaNo ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDocument2 pages6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Tax FormDocument1 pageTax FormTop Cooling fanNo ratings yet

- Computation 21 22Document1 pageComputation 21 22aarushi singhNo ratings yet