Professional Documents

Culture Documents

2021 2023 gr12 Economics p1 Essays Final

2021 2023 gr12 Economics p1 Essays Final

Uploaded by

leratothandolove2Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 2023 gr12 Economics p1 Essays Final

2021 2023 gr12 Economics p1 Essays Final

Uploaded by

leratothandolove2Copyright:

Available Formats

lOMoARcPSD|37906377

2021-2023 GR12 Economics P1 Essays Final

Economics (Thohoyandou Secondary School)

Scan to open on Studocu

Studocu is not sponsored or endorsed by any college or university

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

MADIBENG AND MOSES KOTANE

SUB-DISTRICTS

GRADE 12

ECONOMICS P1ESSAYS

COMPILED BY: MKHIZE P. A (ECONOMICS SES: N.W)

EMAIL ADDRESS: kingbhebhe808@gmail.com

This manual consists of 35 pages.

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

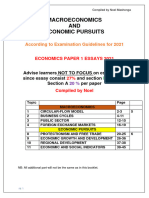

2021-2023 PAPER 1 & 2 ESSAYS PER TOPIC AND PER QUESTIONS WITHOUT

ADDITIONAL PARTS

PAPER ONE

QUESTION 5: MACRO-ECONOMICS

TOPIC NO. ESSAY LAST YEAR

ASSESSED

CIRCULAR FLOW 1. Discuss in detail the role of various DBE Nov 2020

markets within the FOUR-SECTOR

model.

BUSINESS 2. Discuss in detail the features DBE Nov 2018

CYCLES underpinning the business cycle

forecasting.

3. Discuss in detail the new economic DBE Nov- 2021

paradigm in smoothing-out business (To be studied

cycles. for section B

ONLY in 2022)

PUBLIC SECTOR 4. Discuss in detail the main objectives DBE May- 2021

of the public sector in the economy.

5. Discuss in detail the reasons for DBE May-2022

public sector failure.

FOREIN 6. Discuss in detail the reasons for * NOT YET

EXCHANGE international trade. ASSESSED

MARKET

PAPER ONE

QUESTION 6: ECONOMIC PURSUITS

TOPIC NO. ESSAY LAST YEAR

ASSESSED

PROTECTIONISM 1. Examine South Africa's export DBE Nov-2019

& FREE TRADE promotion trade policy.

2. Discuss the arguments in favour of DBE Nov-2021

protectionism. (To be studied

for section B

ONLY in 2022)

ECONOMIC 3. Discuss in detail the demand-side DBE May 2022

GROWTH & approach in promoting economic

DEVELOPMENT growth and development in South

Africa.

4. Discuss in detail the South African * NOT YET

growth and development policies and ASSESSED

strategic initiatives

REGIONAL 5. Discuss in detail South Africa’s DBE NOV 2019

DEVELOPMENT initiatives (endeavours) in regional

development

ECONOMIC & 6. Discuss the various economic DBE May-2021

SOCIAL indicators in detail.

INDICATORS 7. Discuss the various social indicators DBE May- 2019

in detail.

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

PAPER ONE ESSAYS

QUESTION 5: MACRO-ECONOMICS

1. Discuss the role of markets in the circular flow.

INTRODUCTION

• Markets coordinate economic activities and determine prices for goods and

services

• The circular flow model is a simplified representation of the interaction

between the participants of the economy

MAIN PART

Goods/Product/Output markets

• These are markets for consumer goods and services.

In economics a distinction is made between goods and services:

• Goods are defined as any tangible items such as food, clothing and cars that

satisfy some human wants or need

• Buying and selling of goods that are produced in markets, include:

- Capital goods market for trading of buildings and machinery

- Consumer goods market for trading of durable consumer goods, semi-

durable consumer goods and non-durable consumer goods.

• Services are defined as non-tangible actions and includes wholesale and

retail, transport and financial markets

• Flows of private and public goods and services are real flows and they are

accompanied by counter flows of expenditures and taxes on the product

market

Factors/Resources/Input markets

• Factors of production are bought and sold in the factor market

• The factor market includes the labour, property and financial markets

• Factor services are real flows and they are accompanied by counter flows of

income on the factor market.

Financial markets

• They are not directly involved in production of goods and services, but act as

a link between households, the business sector and other participants with

surplus funds

• Banks, insurance companies and pension funds form part of the financial

market

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Money markets

• In the money market, short-term loans and very short-term funds (less than 3

years) are saved and borrowed by consumers and business enterprises

• Products sold in this market are bank debentures, treasury bills and

government bonds

• The SARB is the key institution in the money market

Capital markets

• In the capital market long-term funds (3 years or longer) are borrowed and

saved by consumers and business enterprises

• The Johannesburg Security Exchange is a key institution in the capital market

• Products sold in this market are mortgage bonds and shares

Foreign exchange markets

• On the foreign exchange market businesses buy/sell foreign currencies to pay

for imported goods and services

• These transactions occur in banks and consists of an electronic money

transfer from one account to another

• The most important foreign exchange markets are in London/New York/Tokyo

• The SA rand is traded freely in these markets when a person buys travellers'

cheques to travel abroad

• Imports and exports are real flows and they are accompanied by counter

flows of expenditure and revenue on the foreign exchange market

(Accept any other correct relevant response) (Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

Markets are critically important institutions in our economic system because they regulate

the market, to safeguard price stability and general business confidence. (2)

2. Discuss in detail the new economic paradigm in smoothing-out business cycles.

INTRODUCTION

• The new economic paradigm suggests that it is possible to implement measures to promote

economic growth and reduce unemployment without provoking inflation.

• The new economic paradigm is embedded in both demand-side and supply-side policies.

(Accept any other relevant introduction) (Max 2)

BODY: MAIN PART

Demand-side policies:

• Traditional monetary and fiscal policies focus on aggregate demand.

Monetary policy:

• When the level of economic activity is depressed the SARB can use expansionary

measures to stimulate economic activities.

• An expansionary monetary policy is implemented when the economy is in recession in

order to stimulate economic activities.

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

• Interest rates can be reduced to make borrowing cheaper and encourage spending by

households and businesses.

• The increased spending increases the level of economic activity. Investment will increase

and more factors of production will be employed.

• Higher levels of production and income and expenditure will be achieved.

• If the supply of goods and services does not increase in line with increase in demand,

inflation will increase.

Fiscal policy:

• When the level of economic activity is low the minister of finance can use expansionary

fiscal measures to stimulate growth and reduce unemployment.

• An expansionary fiscal policy can be implemented when the economy is in recession in

order to stimulate economic activities.

• An increase in government expenditure will increase aggregate demand.

• When there is an increase in injection in the economy, production which will result in a

higher employment of factors of production.

• The result will be higher income and higher expenditure.

• Taxes can be reduced, which will lead to an increase in disposable income.

• This will increase consumer spending and investments, stimulating aggregate demand

Inflation:

❖ When the demand increases, the supply will react in the same way.

❖ If the supply does not react to an increase in demand, prices will increase (a new

equilibrium).

❖ Aggregate demand and supply are in equilibrium where AD = AS at point C, and again

where AD1 = AS1 at point E.

❖ When the demand increases, the supply will react in the same way.

❖ Fig (a) below illustrates that if AD1 increases and AS does not respond, the new

equilibrium will be at point F. Therefore, real production will increase and prices will also

increase. Inflation will prevail.

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Unemployment:

❖ Demand-side policies are effective in stimulating economic growth.

❖ The demand for labour will increase due to economic growth, and that leads to reduced

unemployment.

❖ A decrease in unemployment results in an increase in inflation because more people are

employed, which causes an increase in demand for labour.

❖ This relationship between unemployment and inflation is illustrated using the Phillips

curve.

• The Phillips curve shows the relationship between unemployment and inflation.

• PC shows the initial situation, where at point C the PC curve intersects x/axis i.e. natural

rate of unemployment is 14%.

• If unemployment falls to D i.e. 9% causes wages to increase, thus inverse relationship

between unemployment and inflation.

• Supply-side measures that can relocate the Phillips curve to shift to the left, due to

improved education, effective training and fewer restrictions on immigration of skilled

workers,

• Demand-side policies are effective in stimulating economic growth.

• Economic growth can lead to an increase in demand for labour.

• As a result, more people will be employed and unemployment will decrease.

• As unemployment decreases inflation is likely to increase.

Supply-side policies:

• A demand-side approach does not render desirable outcome because growth has to be

cut due to problems in inflation.

• Aggregate supply needs to be managed as well by focusing on increased flexibility of

supply components.

• If the cost of increasing production is completely flexible, a greater output can be

supplied at any given price level.

• The governments can arrange things in the economy in a way that is cooperative to

changes in demand.

• Reduction of costs allows greater output to be supplied at any given price level.

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Government measures that can reduce costs

• Infrastructural services like communication, transport and energy costs.

• Administrative costs like inspections and regulations add to overall costs.

• Cash incentives such as subsidies lower the production cost.

• Compensation to exporters to encourage increased production aimed at foreign

markets.

Measures to improve efficiency of inputs:

• Lower rates of personal income tax are incentives for high productivity and increase

aggregate supply.

• Capital consumption by replacing capital goods on a regular basis that will create

opportunities for businesses to keep up with technological development.

• Human resources development where the quality of labour can be improved by improving

health care, education and training which will increase the efficiency of businesses.

• Free advisory services to promote opportunities to export and establish business

activities in foreign countries which includes weather forecasts, veterinary services and

research.

Measures to improve efficiency of markets:

• Deregulation where laws and regulations are removed to make markets free.

• Competition is encouraged to establish new businesses, invite foreign direct investment

and remove power imbalances.

• Levelling the economic playing fields because private businesses cannot compete with

public enterprises due to legislative protection. (Max 26)

(Accept any other correct relevant response) (Allocate a maximum of 8 marks for mere

listing of facts / examples)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

It is critically important for the government to focus on both demand-side and supply-side

measures to ensure stability in the economy.

(Accept any other correct higher order, relevant conclusion) (Max 2)

3. Discuss ALL the features underpinning forecasting of business cycles, excluding the

economic indicators.

INTRODUCTION

• There are a number of techniques available to help economists to forecast business cycles

like economic indicators

• A business cycle can be described as successive periods of contraction and expansion of

economic activities

• The pattern of expansion and contraction of aggregate economic activity, measured as real

Gross Domestic Product, displays around its overall trend

• The process of making predictions about changing conditions of future events that may

significantly affect the economy

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

BODY: MAIN PART

Extrapolation

• Past data is used, where predictions are made about the future based on assumptions

related to trends

• Extrapolation means to estimate something unknown from the facts and information that is

known

• Extending a trend into the future may provide information on what is likely to happen

• If a business cycle has passed through a trough and entered into a boom phase, forecasters

may predict that the economy will grow in the months to follow

• Extrapolation techniques are sometimes used to predict future share prices

• The trend of the curve must be followed to complement the completed section

• Take a calculated decision to continue beyond the level of a resistance point

Amplitude

• It is the difference between the value of total output between peak and trough measured from

the trend line to the peak and trough

• Amplitude reflects the intensity of the upswing and downswing in economic activity

• The amplitude shows two things: -

❖ The power of the underlying forces, e.g., interest rates, exports or consumer spending

❖ A large amplitude during the upswing signifies strong underlying forces – which result

in longer cycles

❖ The extent of change: the larger the amplitude, the more extreme the changes that

may occur

❖ During an upswing, unemployment may decrease from 20% to 10% (a decrease of

50%) / inflation may increase from 3% to 6% (i.e. 100%) / a surplus on the current

account (BOP) can change from a surplus to a deficit.

Trend

❖ The trend indicates the general direction in which the indexes that were used in the

business cycle, moves.

❖ When the economy is growing, there is an upward trend, but when the economy is

decreasing, there is a downward trend.

❖ The trend will change when the time series data change their behaviour patterns

of the past.

❖ Resistance points indicates forces in the economy preventing it from repeating the

performance – unfavourable forces need to change or be removed for growth to

exceed previous tendencies.

❖ It normally has a positive slope because the production capacity of the economy

increases over time.

❖ Channels are formed when output growth reaches successive higher turning

points (upward channel).

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Length

❖ Length is measured from peak to peak or from trough to trough.

❖ Longer cycles show strength and shorter cycles show weakness with regard to

economic activities.

❖ Cycles may overshoot with the effect that some composite indicators increase to

beyond its normal level.

Moving averages

❖ This method is repeatedly calculating a series of different average values along a

time series to produce a smooth curve

❖ It is used to analyse the changes in a series of data over a certain period of time

❖ To eliminate the effect of sharp fluctuations in the business cycle, economists use

moving averages to smooth out the business cycle so that it looks more like a

straight of slightly curved line(Accept any other correct relevant response) (A

maximum of 8 marks may be allocated for mere listing of facts/examples)

(Candidates would receive 2 marks if they indicated the amplitude, length and

trend line on a graph)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

Policy makers should closely watch all these indicators because external factors are very

significant for South African business cycles.

Different methods can be used in forecasting like the quantitative method that is based on

mathematical models or qualitative methods being used in long term forecasting.

(Accept any other correct relevant higher order response) (Max. 2)

4. Discuss in detail the objectives of the public sector.

INTRODUCTION

The government responds to market failure by establishing and maintaining state-owned

enterprises to provide public goods and services.

(Accept any other correct relevant response) (Max 2)

BODY: MAIN PART

1. ECONOMIC GROWTH

• An increase in the production of goods and services by the economy.

• It is measured in terms of an increase in the real gross domestic product.

• Real GDP is the value of goods produced in the country after the effects of inflation have

been taken into account.

• For economic development to occur, the economic growth rate must be higher than the

population growth rate.

• A high economic growth rate also means there will be fewer people who are dependent

on the state to satisfy their basic needs.

• The state tries to ensure that there is continual growth in this capacity because it leads to

an improvement in the standard of living.

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

2. FULL EMPLOYMENT

• Attaining high levels of employment is one of the most important economic objectives for

all governments.

• Full employment means that all persons who would like to work and who are looking for

work, should be able to find work or create work for themselves.

• The unemployment rate increased over the past few years and above 30% after Covid-

19 pandemic.

• Informal sector activities must be promoted because it is an area where employment

increases.

• In the short-run, the state accelerates employment creation through direct employment

schemes, targeted subsidies and expansionary macroeconomic packages.

• Over the medium term the state support labour-intensive activities in the agricultural and

light manufacturing sectors.

• Over the longer run, as full employment is achieved, the state supports knowledge-

intensive and capital-intensive sectors to remain competitive.

3. EXCHANGE RATE STABILITY / BALANCE OF PAYMENTS (BoP) EQUILIBRIUM

• Depreciation and appreciation of a currency create uncertainty for producers and traders

and should therefore be limited.

• Government uses its monetary and fiscal policies to ensure that the exchange rate

remains relatively stable for as long as possible.

• BoP equilibrium influences the flow of goods, services and capital in a country.

• Exchange rate stability has a strong impact on the inflation rate and other

macroeconomic variables.

• The choice and management of an exchange rate system forms a critical aspect of

economic management to protect and encourage competitiveness, macroeconomic

stability and growth.

• More money inflows into a country result in a surplus on the Balance of Payments

account.

• The SARB changed the Exchange rate from a Managed floating to a Free-floating

exchange rate.

• Promoting domestic production will increase exports.

4. PRICE STABILITY

• Market economies produce better results in terms of economic growth and employment

when prices are relatively stable.

• In South Africa relative price stability means that the inflation rate remains within the

inflation target of 3–6%.

• Interest Rates, based on the Repo Rate are the main instruments used to achieve price

stability.

• The benefit of the inflation target is a greater degree of transparency in monetary policy.

• If inflation exceeds the upper limit of the range, the Reserve Bank must consider

increasing the interest rate to cool down the heated economy.

10

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

5. ECONOMIC EQUITY

• A redistribution of income and wealth is essential in market economies.

• There are sections of society that earn a large amount of money while others earn very

little.

• Progressive income tax and tax on profits, wealth and expenditure are used to finance free

social services.

• Basic education, primary healthcare, basic economic services and cash grants to poor and

other vulnerable people, will enhance economic equity.

(Accept any other correct relevant response) (Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

The state plays a significant role in achieving the macroeconomic objectives by guiding the

economy through the national budget.

(Accept any other correct relevant higher order conclusion) (Max 2)

5. Discuss in detail the reasons for public sector failure.

INTRODUCTION

• Public sector failure occurs when the government fails to manage the economy and the

resources under its control optimally.

• Public sector failure can be regarded as a failure of government to achieve its objectives.

(Accept any other correct relevant introduction.) (Max 2)

BODY: MAIN PART

Management failure

• Ignorance leads to the implementation of conflicting or wrong policies.

• Incompetence in the public sector may be due to improper qualifications, lack of training,

experience and an attitude of apathy.

• Lack of skills may lead to wrong decisions and low productivity.

• Corruption exists when government official exploits their positions for personal gain.

• Taking bribes, committing fraud, nepotism, behaving dishonestly and committing

discrimination.

• Allowing rent-seeking, which is behaviour that improves the welfare of someone at the

expense of the welfare of others.

Apathy

• Government officials show little or no interest in delivering an efficient service to the

public.

• It is not always easy to hold the public sector officials accountable because of the huge

workforce in various departments.

• Corruption and poor service delivery are some of the symptoms of apathy

• People employed by the state do not always serve the interests of the public.

11

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

• Public sector officials seek to maximise their salaries, status and power and are not

required to produce a profit and loss statement.

• Poor accountability is the result of low motivation, poor training, and lack of competence.

Lack of motivation

• Frontline workers rarely receive incentives for successful service delivery but are only

monitored on inputs and following procedures and processes.

• Lack of motivation leads to limited services, high cost and low-quality service delivery

• There is no measurement of effectiveness or productivity and few rewards for

outstanding performance and penalties for poor performance.

• There are not enough systems in place to evaluate the services that government

employees give.

Bureaucracy

• Bureaucracy makes policies take long to be implemented or it is not implemented

successfully. for example, official rules and procedures.

• Bureaucrats tend to obey rules and procedures without judgements.

• Government officials tend to be more interested in obeying rules than the efficient

delivery of goods and services to the people.

• Bureaucrats can manipulate policies to benefit themselves at the expense of the people

Politicians

• Politicians tend to promote policies and spend money on projects as long as they get

votes in return.

• These policies might involve an inefficient allocation of resources.

• Politicians can also serve their own interests through corruption, personal and hidden

agendas and suspicious motives.

Structural weaknesses

• Objectives are not met, such as full employment and houses for all are not realistic and

attainable objectives.

• Too aggressive redistribution of income and wealth may cause the government not to

reach their macroeconomic objectives.

Special interest groups

• Groups such as labour unions and business groups can also cause government failure.

• Trade unions can influence the government to pass certain laws to favour their members.

• Business groups can influence the government to provide them with profitable contracts

and favourable regulations.

• Businesses may influence the government to distribute resources so that they can benefit

at the expense of the country.

A maximum of 8 marks may be allocated for headings/examples. (Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

South Africa requires a creative and competitive private sector with new technologies that can

help entrepreneurs to enter industries where the state dominates.

(Accept any other relevant higher order conclusion.) (Max 2)

12

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

6. Discuss, in detail, the reasons for international trade.

INTRODUCTION

There are many reasons for international trade. Countries may have a surplus of

some goods and a shortage of other goods, and they will trade in order to correct

these imbalances.

Trade that takes place between different countries of the world .

(Accept any other correct relevant answer) (Max 2)

BODY: MAIN PART

DEMAND REASONS

The size of the population

• If there is an increase in population growth, it causes an increase in demand,

as more people’s needs must be satisfied.

• Local suppliers may not be able to satisfy this demand.

Income levels

• Changes in income cause a change in the demand for goods and services.

• Consumable income for example may increase due to a decrease in tax, or

increased employment of factors of production which may lead to increased

consumption expenditure.

• Higher income creates more needs, wants, and subsequently greater

demand for a greater variety of goods even if it necessary to get the goods

from abroad

• An increase in the per capita income of people results in more disposable

income that can be spent on local goods and services, some of which may

then have to be imported

Change in the wealth of the population

• An increase in the wealth of the population leads to greater demand for

goods.

• People have access to loans and can spend more on luxury goods, many of

which are produced in other countries.

Preferences and taste

• Not all the goods wanted are produced in a country

• Consumer preferences and taste play a decisive role in demand of goods

from foreign countries

• If consumers in China have a preference for tea and consumers in America

have a preference for coffee, the relative prices of tea and coffee will differ

between these countries

• This is influenced by international migration in terms of religion and lifestyles

The difference in consumption patterns

• This is determined by the level of economic development in the country.

e.g. a poorly developed country will have a high demand for basic goods and

services but a lower demand for luxury goods.

13

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

SUPPLY REASONS

Natural resources

• These resources are not evenly distributed across all countries of the world.

• They vary from country to country and can only be exploited in places where

these resources exist.

• South Africa is well endowed with different natural resources but less well

endowed with skilled labour and capital.

• whilst Japan and Ireland have relative abundance of skilled labour but they

lack natural resources

Climatic conditions

• These conditions make it possible for some countries to produce certain

goods at a lower price than other countries. E.g. Brazil is the biggest producer

of coffee

• Countries have different climatic conditions and are therefore able to produce

different products.

Labour resources

• Labour differs from country to country in terms of skills, knowledge, training,

quality, quantity and cost between them.

• Some countries have highly skilled, well-paid workers and high productivity

levels. E.g. Switzerland

Technological resources

• The development levels and innovation processes of countries will always

differ and as a result other countries may have them in abundance while

others may not.

• Countries like Germany, the United States, are able to use capital that

embodies high levels of technology while other countries do not have access

to the latest technology.

• These countries that have high technological labour force are able to produce

certain goods and services at a low unit cost. E.g., US and Germany

Specialisation

• The production of certain goods and services allows some countries to

produce them at a lower cost than others. E.g. Japan produces electronic

goods and sells these at a lower price

• International trade enables countries to specialize in the production of goods

and services in which they have a comparative advantage.

• Most of such surplus production gets exported to other countries and the

revenue earned from these exports can be used to finance imports.

Capital

• Some countries need to modernize their industries and economies with

advanced machinery, equipment and plant but cannot manufacture this

equipment because they lack capital to do so.

• This has then increased the need for international trade.

(Accept any other correct relevant answer) (Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

While the Russia-Ukraine conflict is ongoing, the South African government has to

look at other ways of strengthening its infrastructure to take advantage of future

gains in commodity trade✓✓

(Accept any other correct and relevant higher order response) (Max. 2)

14

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

QUESTION 6 ESSAYS

1. Examine South Africa's export promotion trade policy.

INTRODUCTION

• Export promotion involves providing incentives to encourage local businesses to produce

goods for export.

• When government pay incentives to encourage the production of goods that can be

exported.

(Accept any other correct relevant response) (Max 2)

BODY: MAIN PART

Methods of export promotion:

• Incentives:

− Involves a programme administered by EMIA, aiming to compensate exporters for

costs incurred in developing export markets for South Africa.

− Also participation in National Pavilion exhibitions, where government ministers

conclude future trade agreements for business.

− Providing support in credit facilities, such as government assisting businesses to get

low interest loans by signing surety on certain loan agreements.

− The DTI is providing Business Intelligence by providing market research as well as

export opportunities overseas

− Technical advice and expertise is provided by the DTI on matters such as product

specification, advertising and marketing.

- To provide insurance contracts for export transactions.

Other grants

- Tax concessions on earnings from exports

- Tax concessions on capital investments to produced export goods

− Implementing Export-Processing Zones (EPZs) to attract export investment firms to

such zones by offering tax exemptions and less labour restrictions.

− The government supplies information on export markets in order to stimulate exports.

− Other examples are research on new markets, concessions on transport charges,

export credit.

• Subsidies:

− Incentives to encourage exporters to increase the amount of their production

− It includes direct and indirect subsidies:

o Direct subsidies: Cash payments to exporters

o Indirect subsidies: Refunds on import tariffs and general tax rebates

• Trade neutrality:

− Subsidies, equal in size to import duties, are paid − Neutrality can be achieved through

trade liberalisation.

− Experience growth in exports if cost-raising effects of protection are neutralized by

Subsidies.

15

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Reasons for export promotion:

• Exports helps to pay for the goods we need to import, and thus improves the BOP/it

earns foreign exchange.

• Export promotion can provide the financial assistance required by domestic efficient firms

to become more competitive.

• Export promotion can also lead to an increase in South Africa’s trade globally.

• It stimulates industrial development, which is very important for economic growth and

development in the country.

• The country achieves significant export-led economic growth.

• Export promotion enlarges the production capacity of the country because more

manufacturing industries are established.

• Export markets are much bigger than local markets and to capture them many greater

volumes need to be produced.

• More workers will be employed due to the increased volumes produced.

• Prices will be reduced due to larger volumes of goods being produced.

Advantages

• No limitations of size of scale since world market is very large.

• Production is based on cost and efficiency organized according to comparative

advantages.

• Increased domestic production leads to growth in exports and imports (supply foreign

exchange to pay for necessary imports).

• Exchange rates would be realistic no exchange control or quantitative limitations

exists.

• Increased employment opportunities, which could improve income and skills.

• The increased size of domestic businesses and the increase in the number of

producers will result in increased competition, more efficient output, lower prices and

larger variety of goods/inflation could be reduced.

Disadvantages of export promotion

• The real cost of production is hidden:

− It reduces the total costs by subsidies and incentives.

− The real cost of production is concealed by the subsidies.

− The product may thus never be able to compete in the open market.

• Lack of competition:

− Incentives and subsidies reduce prices and force competitors who may be able

to create sustainable and profitable businesses out of the market

− Total potential trade is therefore reduced with subsidies rather than without

Subsidies.

• Increased tariffs and quotas:

− Overseas countries may retaliate with tariffs and even quotas when similar

goods are sold domestically below their real cost of production.

16

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

− Powerful overseas businesses can afford to offer similar products at much lower

prices.

− Compared to their production, the subsidised business's domestic market may

be so small that it will destroy the business who received the subsidy

• Protection of labour-intensive industries:

− Developed countries often maintain high levels of effective protection for their

industries that produce labour-intensive goods in which developing countries

already have or can achieve comparative advantage.

− Export promotion results in the protection of labour-intensive industries by

developed countries.

− Increased exports could be seen as dumping, which enables foreign firms to

obtain a larger market share and force local producers out of the market.

(Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

World economies grow and develop on better international relations with other countries by

applying different trade policies such as import substitution and free trade.

(Accept any other correct relevant response) (Max 2)

2. Discuss the arguments in favour of protectionism.

INTRODUCTION

A trade policy whereby state implements measures to protect local industries against unfair

competition from abroad. (Max 2)

(Accept any other correct relevant response)

BODY: MAIN PART

Industrial development

• Some developing countries are suitable for establishing certain kinds of industries

• Free trade makes it impossible to compete with well-established older countries, due to

the first few years of existence of an industry being the most difficult.

• Older industries use unfair methods of price-cutting and dumping – therefore young

industries need protection until properly established.

• Protection will prevent competition, because it is difficult to do away with, once applied.

Infant industries

• It is difficult for a young industry to survive, due to their average costs being higher than

well-established foreign competitors.

• If they are given protection in their early years, they may grow and take advantage of

economies of scale/lower their average costs/become competitive.

Stable wage levels and high standard of living

• A country with high wages has a view that standard of living will be undermined if

cheaper goods are imported from countries with low wages.

• In reality, high wages are paid to workers with high productivity.

17

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Increased employment

• Local industries cannot find profitable markets, may stop production and cause

unemployment.

• Protection will result in less unemployment.

Economic self-sufficiency and strategic key industries

• War causes cut off, or friction between countries, depression, shifts in demand, all factors

that are vital to be self-supporting.

• Protection is granted especially to key industries to ensure survival.

Maintaining domestic employment, to reduce unemployment and provide more job

opportunities.

• Countries with high levels of unemployment are pressured to stimulate employment

creation.

• Protectionism policies are used to stimulate industrialisation.

• Domestic employment is encouraged through imposing import restrictions.

• Domestic employment creation at the expense of other countries is known as “Beggar thy

neighbour” policies.

Prevent dumping

• Countries selling goods in a foreign country at lower prices than cost of production in

home country.

• Dumping is used to capture new markets and forces financially weaker industries out of

competition.

• Foreign enterprises may engage in dumping because government subsidies permit them

to sell goods at very low prices or below cost or because they are seeking to raise profits

through price discrimination.

• The initial reason for exporting products at a low price may be to dispose of accumulated

stocks of goods.

• In the short term, consumers in the importing country will benefit.

• However, their long-term objective may be to drive out domestic producers and gain a

strong market position.

• In this case consumers are likely to lose out as a result of the reduction in choice and the

higher prices that the exporters will be able to charge.

• Protectionism prevents foreign industries from dumping their surpluses and out of season

goods at low prices, which may be harmful to home industries.

Stabilising exchange rates and balance of payments.

• Traders buy on cheapest markets and sell on most expensive ones.

• Countries export primary products and import manufactured goods causing a disrupted

balance of payments and exchange rates.

• Prices of imports increase through tariffs and quotas.

• A stable exchange rate and BoP increases government revenue/prevents harmful goods

from entering the country/develop greater technical skills.

18

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Protection of natural resources.

• Free trade will exhaust resources because the world shares.

• Protection ensures that industries survive.

Ensures greater economic stability

• Over-specialisation is a result of free trade and is harmful in times of war and friction

(more guns than food).

• Protection prevents over-specialisation, thereby creating a more differentiated economy

and greater stability.

• It also promotes secondary industries and the welfare of people dependent on protected

industries.

• If imports are greater than exports, a country may introduce import controls such as

customs duty and quotas eliminate the deficit on the balance of payments.

• Developing countries rely on the export of primary products. Selling processed goods is

more beneficial to a country as more foreign exchange can be earned.

• Protection ensures the processing of primary goods until completion.

(Accept any other correct relevant response) (Max 26)

(Allocate a maximum of 8 marks for mere listing of facts/examples)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

The policy of restriction of international trade (protectionism) with the aim of preventing

unemployment or capital losses in industries threatened by imports, might not affect the internal

distribution of income sufficiently or improve the country's terms of trade, because it is not

based on international monopoly power and expert knowledge.

(Accept any other correct, higher order, relevant response) (Max 2)

3. Discuss in detail the demand-side approach in promoting economic growth and

development in South Africa.

INTRODUCTION

The demand-side approach involves discretionary changes in monetary and fiscal policies with

the aim of changing the level of aggregate demand and therefore output.

(Accept any other correct relevant introduction.) (Max 2)

BODY: MAIN PART

MONETARY POLICY

• The SARB is co-responsible for formulating and implementing South Africa's monetary

policy.

• Its primary goal is to protect the value of the currency by stabilising prices in terms of

inflation targets.

19

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

It uses mainly three monetary policy instruments:

1. Interest rate changes

• These are used to influence credit creation by making credit more expensive or

cheaper.

• Interest rate changes are also used to stabilise the exchange rate by encouraging

capital inflows or outflows in order to take care of a deficit or a surplus on the current

account of the balance of payments.

2. Open market transactions

• To restrict bank credit, the SARB sells securities.

• When banks buy these securities, money flows from the banks to the SARB.

• The banks then have less money to lend and cannot extend as much credit as before.

• To encourage credit creation, the SARB buys securities in the open market.

• Money then flows into the banking system.

• The banks use the money to create credit.

3. Moral suasion

• The SARB consults with banks and persuades them to act in a manner that is desirable

in terms of the economic conditions that prevail at the time.

• The persuasion is often linked to transactions of the SARB in the money market.

• The SARB can call on banks to be less lenient when they are too generous in extending

credit.

• Government securities may be sold on open markets to drain excess liquidity so that

banks have less money to lend.

4. Cash reserves requirement

• The SARB may increase the balance that commercials are required to maintain in order

to increase money creation.

• This will increase money supply and stimulate aggregate demand thereby encouraging

businesses to produce more.

5. Exchange rate policy.

• The SARB uses the free-floating exchange rate system to allow forces of demand and

supply to determine the exchange rate.

• This allows local prices to be linked to international prices.

• Exchange rates adjust themselves with minimum government intervention.

FISCAL POLICY

• The National Treasury is responsible for the formulation and implementation of fiscal

policy in South Africa.

• The main purpose of fiscal policy in South Africa is to stimulate macroeconomic growth

and employment, and to ensure a desirable redistribution of income (economic equity).

• The stability objective, in terms of prices and exchange rates, is left for the most part to

monetary policy.

• Government compiles and times its expenditure and taxation in a way that enhances its

chances of achieving its macroeconomic objectives.

1. Progressive personal income tax

• Higher-income earners are taxed at higher rates than lower-income earners.

• The taxes are used to finance social development.

• The poor benefit more than those with higher incomes. Examples are the social wage

and social allowances such as pensions.

20

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

2. Wealth taxes

• Properties such as houses, offices and factory buildings in urban areas are taxed

annually.

• Transfer duties are paid when properties are bought.

• Securities (shares and bonds) are taxed when they are traded.

• Capital gains tax (CGT) is levied on gains earned on the sale of capital goods, such as

properties and shares.

• Estate duties are levied on the estates of deceased persons.

• Taxes are used to finance development expenditures which benefit the poor more than

those who are not poor.

3. Cash benefits

• Old-age pensions, disability grants, child support grants and unemployment insurance

are important cash grants.

4. Benefits in kind

• These include the provision of healthcare, education and school meals, protection,

municipal services and infrastructure.

• Where user-fees are charged, poor people and low-income earners benefit more than

others because they pay nothing or less than higher-income earners.

• Limited quantities of free electricity and water are provided.

5. Other redistributions

• Some macroeconomic policies have advantages that favour poor and low income

earners.

• Public work programmes, for example, provide employment and Strategic Investment

projects (SIPs) provide employment subsidies and a number of other cash and financial

benefits to SMMEs.

• Previously disadvantaged persons receive preference.

6. Land restitution and land redistribution

• The purpose of land restitution is to return land (or pay cash compensation) to those who

lost their land because of discriminatory laws.

• Land redistribution focuses on land for residential (town) and productive (farm) use.

• The aim is to redistribute 30% of the country's agricultural land to previously

disadvantaged persons.

• The money for these redress and redistribution programmes is provided for in the main

budget.

7. Property subsidies

• Subsidies help beneficiaries to acquire ownership of fixed residential property.

• The government's housing subsidy scheme provides funding options to all eligible

persons earning less than R3 500 per month.

• The money for this scheme comes from the main budget.

A maximum of 8 marks may be allocated for headings/examples (Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

21

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

• To achieve economic development, economic growth rate should exceed population

growth rate.

(Accept any other relevant higher-order conclusion.) (Max 2)

4. Discuss in detail the South African growth and development policies and strategic

initiatives.

INTRODUCTION

Almost 30% of the South African population is poor, therefore poverty is a serious policy matter

for the government.

Any other relevant definition. (Max. 2)

1. Reconstruction and Development policy (RDP)

• The policy implemented in 1994 in South Africa to redress inequalities of the

past.

• The RDP programme became the original route map for economic growth and

development of the country.

• The introduction of the RDP programme shot the economy from negative four

per cent (-4%) to about 3%.

• The housing infrastructure of the majority of the people started to improve.

• More electrification of the rural communities was put in place

2. Growth, Employment and Redistribution Programme (GEAR)

• It was launched in 1996 and abandoned in 2001.

• It was built on the strategic vision set out in the RDP.

• It improved the economy from a 3% point growth to 6%.

• The resultant growth in the economy trickled down to more social welfare of

the communities.

• The trade deficit of the country decreased.

• It was also committed government to specific macro-objectives/targets.

• Continue service delivery to the poor, and to increase spending on this.

• Improve infrastructure to improve service delivery.

• Stabilise inflation through monetary policy.

• Reduce national budget deficit through a more effective fiscal policy.

3. National Skills Development Strategy (NSDS)

• This policy provides the framework for skills development in the workplace.

• JIPSA is a short- to medium term mechanism to fast track the objectives of the NSDS

• and to prioritise the acquisition of skills necessary for accelerated and shared growth

Three processes for implementation:

❖ It focuses on productive citizens

❖ Focuses on equity

❖ quality training and skills development in workplace

❖ Focuses on institutional learning

22

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

4. Accelerated and Shared Growth Initiative for South Africa (AsgiSA)

• It was launched in 2006.

• It was committed to halve unemployment and poverty by 2014.

• Improve economic development.

• Overcome constraints to economic growth.

Why did AsgiSA fail?

❖ AsgiSA failed because it did not achieve its goal of halving unemployment and

poverty by 2014 because:

➢ an average growth rate of 6% has not been achieved although certain

economic sectors were targeted.

➢ stable exchange rate was not achieved.

➢ shortfall in skills development.

➢ good governance (public administration) was not achieved.

➢ a massive investment in infrastructure was an important strategy of

government, although a massive degrading of roads is evident.

➢ focus on building small businesses to bridge the gap between the formal

and informal economies did not solve unemployment .

5. Joint Initiative on Priority Skills Acquisition (JIPSA)

• It is the skills empowerment arm of AsgiSA.

• The initiative was launched in 2006 to address the country’s chronic problem areas:

unemployment and the skills shortage.

6. Expanded Public Works Programme (EPWP)

• It is a nationwide government intervention to create employment using labour-intensive

methods.

• and to give people the skills they can use to find jobs when their work in the EPWP is

done.

7. The New Growth Path (NGP

It aims to:

❖ enhance growth

❖ create employment

❖ and greater equity

❖ It was announced in October 2010 and the main focus was to create 5 million jobs over

the next 10 years.

Key areas where jobs can be created:

❖ Infrastructure expansion with investments in five key physical and social

infrastructure areas, namely energy, transport, communication, water and housing.

❖ The agricultural value chain by addressing the high costs of fertilisers and other

inputs and by promoting processing and export marketing.

❖ The mining value chain by increasing mineral extraction, improving infrastructure

and skills development and supporting the beneficiation on the final manufacture of

consumers and capital goods whereby minerals are processed into higher value

products locally rather than exporting raw minerals to be processed thus creating

employment and generating wealth

23

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

❖ The green economy by expanding construction and production of technologies for

solar energy, wind energy and biofuels.

❖ Manufacturing sectors through innovation, strong skills development, reduced input

costs and increased research and development investment.

❖ Tourism and certain high level services.

8. National Development Plan (NDP)

Aims to eliminate poverty and reduce inequality by 2030.

Goals are:

❖ To reduce poverty

❖ Economic growth/grow an inclusive economy – build capabilities.

❖ Economic transformation/enhancing the capability of the state and leaders working

together to solve complex problems.

❖ Job creation/reduce unemployment to 14 % by 2020 and 6% by 2030.

❖ Uniting all South Africans around a common programme to achieve prosperity and

equity.

❖ Promoting active citizenry strengthen development, democracy and accountability.

❖ Faster economic growth, high investment and greater labour absorption.

❖ Focusing on key capabilities of people and the state.

❖ Building a capable and developmental state.

❖ Encouraging strong leadership throughout society to work together to solve problems.

The process in the implementation of the plan includes the following:

❖ The NDP and its proposal will need to be implemented in the right order over the next 17

years, it will shape the budget allocation during the period.

❖ Government has already started a process to align the long-term plans of the

departments with the NDP and to identify areas where policy change is required for

smooth implementation.

❖ Government will also engage with all sectors to understand how they are contributing to

the implementation process.

❖ The President and the Deputy President will be the lead champions of the plan with the

cabinet, in government and throughout the country, Premiers and Mayors will be active

champions of the plan with their offices driving implementation at provincial and

municipal levels.

❖ The plan identifies the task of improving the quality of public services as critical to

achieving transformation.

❖ Planning and implementation should be informed by evidence-based monitoring and

evaluation.

Critical actions:

❖ A social compact to reduce poverty and inequality and raise employment and investment.

❖ A strategy to address poverty and its impacts by broadening access to employment,

strengthening the social wage, improving public transport and raising rural incomes.

❖ Steps by the state to professionalise the public service, strengthen accountability,

improve coordination and prosecute corruption.

❖ Boost private investment in labour-intensive areas, competitiveness and exports with

adjustments to lower the risk of hiring younger workers.

❖ An education accountability chain with lines of responsibility from state to classroom

24

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

❖ Phase in national health insurance, with a focus on upgrading public health facilities,

producing more health professionals and reducing the relative cost of health care.

❖ Public infrastructure investment at 10% of GDP financed through tariffs, public-private

partnerships, taxes and loans and focused on transport, energy and water.

❖ Interventions to ensure environmental sustainability and resilience to future shocks.

❖ New spatial norms and standards – densifying cities, improving transport, locating jobs

where people live, upgrading informal settlements and fixing housing market gaps.

❖ Reduce crime by strengthening criminal justice and improving community environments

9. Small Business Development Promotion Programme

• It acquires and improves business management skills.

• Help to broaden the employment base.

• SMMEs receive a tax-free cash grant for investment in industries.

• New or expanding businesses will receive the grant for three years, after which the

company is expected to be self-sustaining.

• Provision of business advise and related services.

• They access platforms which provide the business infrastructure support and a regulatory

environment that enable entrepreneurs to thrive.

• They access platforms which provide the business infrastructure support and a regulatory

environment that enable entrepreneurs to thrive.

10. Black Economic Empowerment Programmes

• BEE is a measure to redress inequalities of the past. Motivate your answer.

• There are many previously disadvantaged people participating in the economy of the

country than before.

• The focus of the BEE policy instrument is: to eradicate inequality, stimulate further

economic growth, create employment and to Broaden the economic base.

• There is more participation and competition in the market /business environment.

• IPAP will play a positive role in black economic empowerment by: focusing on many

sectors (clothing, textiles, motor, tourist) which gives an opportunity to the

disadvantaged to partake actively in the economy

• Supporting new BEE business ventures through giving advice and give them access to

finance.

• Providing skills development programmes to BEE entrepreneurs especially in the labour-

intensive industries

• However, there are still many previously disadvantaged people who are excluded from

economic participation.

• In some industries there is still a shortage of previously disadvantaged role players.

• BEE should focus on ALL the sectors and levels of the economy.

• The government should establish more charters/agreements between the Department of

Trade and Industry (DTI) and industries in private sector.

• BBBEE faces the following challenges:

❖ the majority of people do not have finances to buy shares to participate in the

ownership / shareholding of companies.

❖ rural and local communities do not all have access to economic opportunities.

❖ corruption in the awarding of contracts, resulted in few people benefitting from

BBBEE.

❖ fronting resulted in many people failing to benefit from the policy.

25

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

❖ a lack of skills and necessary knowledge led to many black women and youth

not being able to occupy top management strategic positions in companies.

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

It is debatable whether the new strategies implemented will be successful in addressing the

various economic objectives because past policies have failed to meet their targets, e.g. Asgisa

(Max. 2)

Accept any other relevant higher order conclusion.

5. Discuss in detail South Africa's initiatives (endeavours) in regional development.

INTRODUCTION

• Regional development refers to policies which are aimed at increasing the economic

livelihood of specific areas or regions.

(Any other correct relevant introduction) (Max 2)

BODY: MAIN PART

SPATIAL DEVELOPMENT INITIATIVES(SDI):

• SDI is a policy to promote sustainable industrial development in areas where poverty and

unemployment are at their highest.

• It can be defined as a link between important economic hubs and regions in a country.

• The intention was to grow the SDI's mostly through private sector investment.

• The state was to enhance inward investment through the granting of incentives.

• The Public Private Partnerships, promotes the economic potential of underdeveloped

areas.

• In a PPP a private business may provide the capital to build the factory and to buy raw

materials and employ labour, while the government provides the capital for the

infrastructure e.g. roads and water.

• There are 2 types of PPPs which are compensated differently: unitary payments and

user-fees.

• The SDI involves an interdepartmental investment strategy that the DTI and the

Department of Transport (DOT) lead.

• Government’s industrial policy strives towards balance between openness and in

promoting local competitiveness by opening up the domestic economy to international

competition.

• DTI is driving force behind industrial and spatial development.

• Relies on networking with other central provincial government departments, IDC,

parastatals (like Telkom, Eskom and Transnet) and research institutions to plan and

monitor development.

• Key policy remains sustainable industrial development in areas where poverty and

unemployment are at their highest.

• SDI’s focus on high-level support on areas where socio-economic conditions require

concentrated government assistance and inherent economic potential exists.

• SDI goal to fast-track investment and maximize synergies between various types of

investments.

26

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Objectives of Spatial Development Initiatives

• Develop physical infrastructure such as roads and harbours.

• Stimulate economic activities in the underdeveloped areas.

• Create employment and stimulate economic growth in the underdeveloped areas.

• Develop inherent economic potential in the underdeveloped areas.

• Attract private sector and foreign direct investment (FDI).

• Establish Public Private Partnerships (PPP)

INDUSTRIAL DEVELOPMENT ZONES (IDZs)

• They are purpose-built industrial estates, physically enclosed and linked to a port or

airport.

• They are in duty-free import areas.

• This strategy was aimed at making exports internationally competitive.

• They focus on creating jobs and promoting exports.

• Goods produced in these zones should be exported to foreign countries.

• As services are provided from outside, the economy in the areas should be stimulated.

• An IDZ offers a world-class infrastructure, enjoys a zero rate of VAT on supplies from

South African sources and reduced taxation on some products.

• IDZs were located to benefit:

- investing companies through support

- access to transport for exporting purposes

- products produced for export by wavering import duties

- skills training for employees by providing subsidies

• Each IDZ is designed to:

- provide location for establishment of strategic investments

- promote and develop links between domestic and zone-based industries

- enable exploitation of resource-intensive industries

(Accept any other correct relevant response) (Max 26)

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION

Economic decentralisation would guarantee that greater emphasis of the development of the

country and comprehensive use of resources are used effectively for the improvement of the

well-being of the country.

(Accept any other correct relevant higher order response) (Max 2)

27

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

6. Discuss the various economic indicators in detail.

INTRODUCTION

Governments use different statistical data to predict economic trends and formulate suitable

developmental strategies toward influencing the direction that the economy should take /

Economic indicators are used to establish the performance of an economy in terms of the

basic economic objectives (Accept any other relevant response) (Max. 2)

BODY: MAIN PART

1. THE INFLATION RATE

Inflation can be described as an increase in the general level of prices in an economy that is

sustained over a period of time.

SARB aims to keep the inflation rate stable between 3 and 6%.

The following instruments measure inflation:

Consumer prices/CPI

• This is the weighted average of the prices of a general basket of goods and services likely to

be bought by consumers.

Production prices /PPI

• Measures prices of locally produced goods when they leave the factory and imported

goods when they enter the country.

• Serves as an indicator to predict consumer inflation (CPI).

2. FOREIGN TRADE INDICATORS

The terms of trade

• Changes in terms of trade serve as indicator of changes that may spill over into the

balance of payments and may lead to a deficit.

• Terms of trade will deteriorate, if a greater volume of exports must be produced to

keep export earnings constant.

The exchange rate

• Changes in an exchange rate affect the prices for imports and prices of exports.

• A depreciation of the rand against the dollar will result in US goods and services

becoming more expensive domestically and earnings from exports to the US increasing.

3. EMPLOYMENT

The economically active population (EAP / labour force)

• The official employment ages in South Africa are between 15 and 65 who are willing to

work and it includes workers in the formal sector, informal sector, employers, self-

employed persons and unemployed persons.

Employment rate.

• The number of employed persons expressed as percentage of the EAP gives the

employment rate.

• The South African employment rate was 70,9% during 2019 and is not accompanied by a

similar growth in employment numbers.

28

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

Unemployment rate

• The unemployment rate is expressed as the percentage of unemployed persons out of the

total number of people willing and able to work.

• In South Africa the official unemployment rate was 29,1 % in 2019 and is the most important

cause of poverty.

4. PRODUCTIVITY INDICATORS

Labour productivity

• Watched most closely, particularly in relation to real wage increases.

• In South Africa productivity increased less than labour remuneration.

• Labour productivity is measured by dividing the real GDP by the number of workers

employed.

Remuneration per worker

• If productivity increases are lower than the real wage increases, inflationary pressures will

occur.

• The relationship between productivity and wages is crucial for employers survive in vigorous

markets and workers to survive on their salaries.

(Accept analysis of other kind of productivity)

5. INTEREST RATES

Repo rate

• Repo rate is the rate at which the SARB provides loans to commercial banks.

• effective utilization of the decisions made on the change of the repo rate by the Monetary

Policy Committee (MPC).

• When the MPC lower the repo rate, banks should likewise reduce their interest rates in

order to produce increased consumption spending by consumers.

• When the MPC increases its repo rate, banks would increase their interest rates and this

would have a negative effect or decline in the consumption spending by consumers.

• If interest rates increase, debt of households and businesses increase and repayment of

debt becomes larger too.

• It may signal that a downturn in the business may occur and thus the welfare of

consumers becomes affected

6. MONEY SUPPLY

• Money supply is of critical importance to give early warning of likely changes in inflation

• The SARB is currently focusing on targeting inflation rather than the money supply

• South African Reserve Bank defines money in different categories:

❖ M1 - coins and notes

❖ M2 - equal to M1 plus all short- and medium-term deposits.

❖ M3 - equal to M2 plus all long-term deposits of domestic private sector with

monetary institutions.

BODY: ADDITIONAL PART (NOT TO BE PREDICTED)

CONCLUSION The use of economic indicators is important because analysts use the

data to interpret current or future investment possibilities. (Max 2)

29

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

7. Discuss social indicators in detail

1. DEMOGRAPHICS

Demographics refers to data collected relating to the composition of the population of a country,

such as size, race, age, sex, income, geographic distribution, language, education, occupation,

religion, birth rate, fertility rate, life expectancy at birth, infant mortality rate, death rate.

Demographics consist of population growth and life expectancy.

Population growth

• Currently the South Africa's population is approximately 60.6 million.

• Census is done every few years in order to determine the population growth.

• The population growth rate is an important indicator to the government in terms of the

number of social services that are needed.

• The size and the change in the population indicate the future labour force and the needed

infrastructure.

• The Human Development Index represents an intention to define human well-being more

broadly. It provides a combined measure of three basic dimensions of human

development: health, education and income.

Life expectancy

• Life expectancy refers to the number of years that an individual is expected to live.

• It reflects the average age at which people in the country die.

• In South Africa life expectancy is low due to AIDS or other pandemics.

• Other demographic indicators include migration rates, population density, mortality rates

and birth rates.

• Assurance companies are interested in life expectancy reductions because it has an

impact on premiums and service delivery.

2. Nutrition and health indicators

Nutrition and health: These are two related social indicators.

• Nutrition: This is an important indicator for the well-being of infants and young children two

important conditions of nutrition in child malnutrition and overweight which are both

particularly important for children under the age of five years of age:

- Child malnutrition:

❖ Malnutrition is expressed in two ways, namely weight for age (underweight) and

height for weight (stunted or dwarfism).

❖ the proportion of children who are underweight is the most important indicator of

malnutrition.

❖ it is important to monitor malnutrition and weight because being overweight

increases the risk of death and inhibits cognitive development in children.

30

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

- Overweight children (obesity):

❖ the prevalence of overweight children is growing concern in South Africa.

❖ there is an association between obesity in children and the high prevalence of

diabetes, respiratory diseases, high blood pressure, and psychological and

orthopaedic disorders.

❖ being overweight can lead to numerous adverse health conditions which affect

people's ability to work and take care of themselves, obesity is a killer.

❖ governments often legislate that health supplements such as vitamin A be added

to basic food stuffs such as bread while the health department also encourage

breast feeding.

❖ malnutrition and obesity in children are indicators taken into account when

deciding on feeding schemes and their extent

• HEALTH: A number of indicators are used both nationally and internationally to monitor

the health of a population

❖ Infant mortality: This is measured in terms of the number of infants who die before

reaching one year of age per thousand live births in a given year. In South Africa in

2010, it was at 34% per thousand.

❖ Under five mortality: This is measured in terms of the probability that a new born

baby will die before reaching the age of five years, if subject to present age-specific

mortality rates. The probability is expressed is a number per thousand and in South

Africa it was at 50 per thousand in 2010.

❖ Spending on health: This is measured in terms of the amount of public and private

expenditure on healthcare as a percentage of GDP. In 2009 South Africa's

expenditure was 8,4% compared to the 6,6% in the Sub-Saharan Africa and 5,3%

in the North Africa.

❖ Access to safe and drinking water: This is measure in terms of the percentage of

the population that a reasonable access to safe and drinking water (treated or

uncontaminated) - in 2009 91% of the South African population had access

compared to 60% in Sub Saharan Africa and 92% of North Africa.

❖ Access to sanitation facilities: This is measured in terms of the percentage of a

population with at least adequate sanitation facilities that can effectively prevent

human/animal/and insect contact. In 2009, 77% of the South African population had

access to improved sanitation, compared to 31% in sub-Saharan Africa and 89% in

North Africa. A healthy population saves on medical and other costs, produces

income and contributes to a stronger economy.

3. EDUCATION

• People’s standard of living is directly related to their level of education.

• Five or Six years of schooling is essential for the achievement of sustainable literacy and

numeracy skills.

• Public expenditure percentage. This shows the percentage of public expenditure that is

directed towards education.

• Secondary enrolment percentage. This shows the percentage of the designated age

group attending secondary education.

❖ In high-income countries, learners of a younger age attend secondary education.

• Primary completion. This shows the percentage of the designated age group that

completed primary education. It serves as indication for efficiency.

31

Downloaded by Lerato Thando Love (leratothandolove2@gmail.com)

lOMoARcPSD|37906377

• Youth literacy rate. This shows the percentage of the designated age group (15 - 24

years) that are literate. It serves as indication for the outcome of the education system.

4. SERVICES

• Services are vital to enhance people's lifestyles and level of economic and social

development In South Africa, in terms of the Constitution's requirements of human

dignity and social justice.

• The following are identified:

❖ Electricity: The national Electricity Regulator reports that 84% of households has

access to electricity in 2020 despite the loadshedding challenges.