Professional Documents

Culture Documents

Capital - Fixed and Working

Capital - Fixed and Working

Uploaded by

prasadkasak750 ratings0% found this document useful (0 votes)

2 views2 pagesWide topics

Original Title

Capital- fixed and working

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWide topics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesCapital - Fixed and Working

Capital - Fixed and Working

Uploaded by

prasadkasak75Wide topics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

CAPITAL- FIXED AND WORKING

Definition of Business finance:- Importance of Business finance:- Sources of Business finance:-

Business finance refers to the money and 1. can meet its liabilities in time 1. Sole proprietorship- Owner’s capital,

credit employed in business firms. It is 2. take advantage of operations retained profits, loans from relatives,

that aspect of business which is concerned 3. increases efficiency friends, banks, financial institutions,

with the arrangement of cash and credit 4. carry on its business smoothly credit from suppliers

so that business firms may, at all times, 5. can replace its plant and machinery in 2. Partnership- Owned capital

have the means to carry out their time contributed by partners, Retained

operation smoothly. 6. can face recession, trade cycles and profits, Loan from commercial banks

Nature of Business finance:- other crises and financial institutions, Short term

1. Includes all types of capital or 7. enjoy goodwill or reputation loans from suppliers

funds used in business. 8. bridge gap b/w production and sales 3. Joint stock company- Issue of shares,

2. Needed in all types of business – 9. to pay wages, salaries on time Retained profits, Bonds and

large or small, manufacturing or 10. determines size and scale of debentures, Long term loans and

trading etc operations Short term loans financial institutions

and commercial bank

Financial planning:- Importance of financial planning:- Factors affecting capital structure:-

Financial planning is the process of 1. Helps a business enterprise to Capital Structure means the proportion of

estimating the financial requirements of avoid the problems of shortage owner’s fund and borrowed fund in the total

an organisation, choosing the sources of and surplus of funds fund of the business. The ratio between equity

funds and deciding how the funds are to 2. Serves as a guide in developing a (owned funds) and debt (borrowed funds) is

be utilised. sound capital structure so as to called capital gearing or financial leverage. High

Features- maximise returns to shareholders gearing or trading on thin equity means

1. involves deciding when, how and why of 3. Planning helps in effective proportion of debt is high; Low gearing or

financial activities. utilisation of funds and wastage trading on thick equity means proportion of

2. is future oriented and involves of capital is eliminated. equity is high.

forecasting. 4. Provides policies and procedures

3. involves deciding objectives, policies, for coordinating i. Trading on Equity (Financial Leverage):

procedures, methods and programs 5. Enables the management to When a company uses borrowed funds

concerning funds. exercise effective control over in the regular conduct of business

the financial activities along with equity capital it is said to be

6. Prepare for facing business trading on equity.

WORKING CAPITAL:- shocks and surprises in future. ii. Exercise of Control: If the promoters of

Means the capital invested in working the company want to retain control in

assets or current assets. Required for the their own hands, they may not issue

day-to-day operations of an enterprise. FIXED CAPITAL:- additional equity shares to the public.

also known as circulating capital or Refers to the funds required for acquisition iii. Need for Flexibility: Debentures and

revolving capital because it is invested, of fixed assets. meant for generating preference shares can be paid off

recovered and reinvested repeatedly. income. used permanently for business whenever the company feels

operations. Also known as ‘block capital’ necessary. But equity shares cannot be

Gross working capital= book value of because it is blocked up in fixed assets for paid off during the life-time of a

current assets the life time of the enterprise company.

Net working capital= current assets- iv. Nature of Business: enjoying regular

current liabilities Factors affecting fixed capital:- and liberal earnings, e.g., public

i. Nature of Business: utilities can afford to have high capital

Types of working capital:- Manufacturing enterprises gearing (more loans).

permanent temporary require heavy investment in fixed v. Cost of Financing: Normally, the cost of

WC WC assets such as land and buildings debt is lower than that of equity.

inital Seasonal and plant and machinery. But vi. Period of financing: permanent

WC WC trading concerns require less investment equity shares are the

Regular Special investment in fixed capital. appropriate choice. Debentures and

WC WC

ii. Size of the Business: A large- preference shares are preferable for

sized enterprise requires a medium-term finance.

Factors affecting working capital:- greater amount of fixed capital vii. Capital Market Condition: During

i. Nature of Business: than a small scale firm boom investors are willing to take risk

Manufacturing firms require iii. Nature of Products: . A company and invest in equity shares. But in a

more working capital but public manufacturing capital goods will bearish market, or down swing

utility undertakings require less require a large amount of fixed investors prefer safe investment.

working capital as they do not capital And a firm producing viii. Statutory Requirements: The

have to maintain inventory. consumer products will need Companies Act and SEBI guidelines

ii. Size of Business: Firms carrying small amount of fixed capital must be observed while raising funds

on large-scale operations and iv. Method of Production: capital- from the public. Thus, state regulations

undertaking high volume of intensive techniques of regarding the issue of securities have

production require more working production such as automatic a bearing on capital structure.

capital than small-scale firms. machinery requires higher

iii. Manufacturing Cycle: Longer is amount of capital as compared

the time gap between the to a company employing labour-

purchase of raw materials and intensive

production of finished goods, v. Diversity of Product Lines: A

higher is the need for working multi-product company

capital. manufacturing diversified

iv. Rapidity of Turnover: When the products requires more fixed

turnover is rapid, the amount of capital than a firm manufacturing

working capital required is small a single product.

and vice versa vi. Mode of Acquiring Fixed Assets:

v. Terms of Purchase and Sale: Firm purchasing fixed assets on

business firm requires cash down basis requires huge

comparatively small amount of amount of fixed capital. On lease

working capital if it buys on or hire purchase will need less

credit and sells in cash, whereas, fixed capital.

if it purchases in cash and sells vii. Intangible Assets: The amount

on credit, larger amount of invested in acquiring goodwill,

working capital will be required. patents, copyrights, etc., also

vi. Credit Policy: liberal credit policy influence the amount of fixed

needs more working capital capital needed for business.

,whereas , smaller working

capital is needed in case of a

tight credit policy.

vii. Operating Efficiency: Better

utilisation of resources leads to

reduction in costs and improves

profitability so need for working

capital is reduced.

viii. Goodwill of Business: good

reputation requires a less

amount of working capital as can

easily and quickly obtain short-

term loans from banks.

You might also like

- Robert Kiyosaki The Real Book of Real EstateDocument256 pagesRobert Kiyosaki The Real Book of Real EstateJonnyCane91% (11)

- Project On Study of Working Capital Management in Reliance Industries Ltd.Document96 pagesProject On Study of Working Capital Management in Reliance Industries Ltd.Shibayan Acharya62% (13)

- Lecture Notes of Working Capital ManagementDocument9 pagesLecture Notes of Working Capital Managementমোঃ আশিকুর রহমান শিবলু100% (1)

- Zara Case PresentationDocument50 pagesZara Case PresentationFahlevi Dzulfikar100% (1)

- Working Capital ProjectDocument28 pagesWorking Capital ProjectPankaj PanjwaniNo ratings yet

- CHAPTER - 6 FinancingDocument19 pagesCHAPTER - 6 FinancingtemesgenNo ratings yet

- MEFA - IV and V UnitsDocument30 pagesMEFA - IV and V UnitsMOHAMMAD AZEEMANo ratings yet

- EntrepMind Finals ReviewerDocument5 pagesEntrepMind Finals ReviewerShanley Vanna EscalonaNo ratings yet

- SummaryDocument50 pagesSummarythamtayyNo ratings yet

- CHAPTER - 6 FinancingDocument19 pagesCHAPTER - 6 FinancingTesfahun TegegnNo ratings yet

- Financial Management in AgribusinessDocument10 pagesFinancial Management in AgribusinessNidhi NairNo ratings yet

- To Keep Inventory at Sufficiently HighDocument2 pagesTo Keep Inventory at Sufficiently HighMokhlesurNo ratings yet

- O Variations in Accounting Methods o TimingDocument8 pagesO Variations in Accounting Methods o TimingAeris StrongNo ratings yet

- Working Capital IntroductionDocument18 pagesWorking Capital IntroductionShanmuka SreenivasNo ratings yet

- D.M. Academy Classes: Accountancy & Business Studies by - Legacy GuptaDocument12 pagesD.M. Academy Classes: Accountancy & Business Studies by - Legacy Guptalegacy guptaNo ratings yet

- Unit-Iv Capital and Capital BudgetingDocument16 pagesUnit-Iv Capital and Capital BudgetingSubhas BeraNo ratings yet

- C2 BOYS PPT 1 & 2 LessonDocument55 pagesC2 BOYS PPT 1 & 2 Lesson02infinity JiggleNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalSwati KunwarNo ratings yet

- SP Chapter 1 NotesDocument7 pagesSP Chapter 1 NotesShivani KambliNo ratings yet

- HSC Finance NotesDocument12 pagesHSC Finance NotesKevin KidigaNo ratings yet

- Finance PDFDocument6 pagesFinance PDFBritney valladaresNo ratings yet

- Working CapitalDocument13 pagesWorking Capitalfrancis MagobaNo ratings yet

- Finance For Non Finance - Intro To Financial ManagementDocument45 pagesFinance For Non Finance - Intro To Financial Managementintan deanidaNo ratings yet

- Business EnvironmentDocument14 pagesBusiness EnvironmentBensonOTJr.No ratings yet

- Cash Management and Working Capital ReviewerDocument2 pagesCash Management and Working Capital ReviewerAeris StrongNo ratings yet

- Abm 4 Module 7 8Document4 pagesAbm 4 Module 7 8Argene AbellanosaNo ratings yet

- Shyam Prakash Project - Feb 12 2022Document71 pagesShyam Prakash Project - Feb 12 2022Sairam DasariNo ratings yet

- Lesson 01Document12 pagesLesson 01nityanandroyNo ratings yet

- Unit 5Document25 pagesUnit 5sheetal gudseNo ratings yet

- Working Capital ManagementDocument26 pagesWorking Capital ManagementAjay Singh PanwarNo ratings yet

- FM Unit 5Document14 pagesFM Unit 5Rizwana BegumNo ratings yet

- Vijay WC ConceptDocument26 pagesVijay WC ConceptVijay PkNo ratings yet

- Electric VehicleDocument22 pagesElectric VehicleanjufrancoNo ratings yet

- Q.Discuss The Various Sources of Financing Working Capital. (OR) Q. Explain The Sources of Financing of Current AssetsDocument5 pagesQ.Discuss The Various Sources of Financing Working Capital. (OR) Q. Explain The Sources of Financing of Current AssetsSiva SankariNo ratings yet

- Unit 7Document18 pagesUnit 7ShubhamkumarsharmaNo ratings yet

- Module 1-1Document6 pagesModule 1-1shejal naikNo ratings yet

- Unit-4 Working Capital Management: Sy Bba Sem-3Document25 pagesUnit-4 Working Capital Management: Sy Bba Sem-3Hitesh TejwaniNo ratings yet

- Unit-5 Working Capital ManagementDocument24 pagesUnit-5 Working Capital Managementdevil hNo ratings yet

- Introduction of The TopicDocument13 pagesIntroduction of The TopicBharat ManochaNo ratings yet

- Chapter-1 Objective of The StudyDocument52 pagesChapter-1 Objective of The StudyShilpi JainNo ratings yet

- Business Finance Notes Finals TermDocument3 pagesBusiness Finance Notes Finals TermMary Antonette VeronaNo ratings yet

- Topic 3: Finance - : 1. Role of Financial ManagementDocument14 pagesTopic 3: Finance - : 1. Role of Financial ManagementCarla SassineNo ratings yet

- 2 Financial RequirementsDocument30 pages2 Financial RequirementsRohan GuptaNo ratings yet

- Conceptual Framework 1Document10 pagesConceptual Framework 1sampad DasNo ratings yet

- Management of Working CapitalDocument9 pagesManagement of Working CapitalKushal KaushikNo ratings yet

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocument4 pagesCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseNo ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument21 pagesWORKING CAPITAL - Meaning of Working CapitalDinesh KumarNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementSuresh Dhanapal100% (1)

- Chapter 1Document13 pagesChapter 1rishikeshkhanpara2989No ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument53 pagesWORKING CAPITAL - Meaning of Working CapitalvipinramtekeNo ratings yet

- Working Capital LEC 1Document6 pagesWorking Capital LEC 1Mohammad Minhaz Hossain RiyadNo ratings yet

- Working Capital LEC 1Document6 pagesWorking Capital LEC 1Mohammad Minhaz Hossain RiyadNo ratings yet

- FIN 613 Working Capital Management Lecture-01Document6 pagesFIN 613 Working Capital Management Lecture-01Mohammad Minhaz Hossain RiyadNo ratings yet

- Project Report - Working Capital ManagementDocument45 pagesProject Report - Working Capital ManagementSumit mukherjeeNo ratings yet

- Working Capital Management ThingsDocument9 pagesWorking Capital Management ThingsNeel ManushNo ratings yet

- WCM - Unit 1 & 2Document14 pagesWCM - Unit 1 & 2Nayan kakiNo ratings yet

- 01.introduction To Corporate FinancetextbookDocument13 pages01.introduction To Corporate FinancetextbookgayatrinilakhNo ratings yet

- Financing Venture Group6Document29 pagesFinancing Venture Group6Albert Malabad Jr.No ratings yet

- Fixed Capital Working CapitalDocument26 pagesFixed Capital Working CapitalShweta TrivediNo ratings yet

- IAS 37 - SummaryDocument4 pagesIAS 37 - SummaryRenz Francis LimNo ratings yet

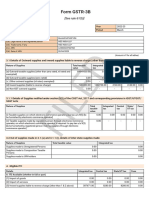

- GSTR3B 06aakfh0743f1zn 032023Document3 pagesGSTR3B 06aakfh0743f1zn 032023hecllp.ggnNo ratings yet

- Vertical AnalysisDocument5 pagesVertical AnalysisADRIANO, Glecy C.No ratings yet

- Ebm 3Document38 pagesEbm 3Mehak AsimNo ratings yet

- International Monetary Asymmetries and The Central BankDocument31 pagesInternational Monetary Asymmetries and The Central BankJuan Carlos Lara GallegoNo ratings yet

- PBM Scholarship Circular Form Spring 22 10032022Document5 pagesPBM Scholarship Circular Form Spring 22 10032022Rose MarryNo ratings yet

- Industry ProfileDocument26 pagesIndustry ProfileVish SolankiNo ratings yet

- CHARTDocument1 pageCHARTAyreesh Mey SpntNo ratings yet

- 21B Release Notes - New Features, Defects, and Known IssuesDocument56 pages21B Release Notes - New Features, Defects, and Known IssuesSrinivasa Rao AsuruNo ratings yet

- Walt Disney DissertationDocument5 pagesWalt Disney DissertationBuyACollegePaperOnlineBillings100% (1)

- BANCO DE ORO V EquitableDocument6 pagesBANCO DE ORO V Equitablejolly verbatimNo ratings yet

- Coping With Risk in Agriculture2015Document291 pagesCoping With Risk in Agriculture2015marcoNo ratings yet

- Financial AspectDocument16 pagesFinancial AspectJezeree DichosoNo ratings yet

- Zobel Vs City of ManilaDocument11 pagesZobel Vs City of ManilaSyElfredGNo ratings yet

- Auditor CV TemplateDocument2 pagesAuditor CV TemplateDaniel B Boy Nkrumah100% (2)

- Marketing FunctionsDocument15 pagesMarketing FunctionsKrishna ReddyNo ratings yet

- 2425 Can Mex 005967Document2 pages2425 Can Mex 005967edugonvas12No ratings yet

- Prac I InvestmentsDocument16 pagesPrac I InvestmentsJohn PasquitoNo ratings yet

- Caiib FM ModaDocument64 pagesCaiib FM ModaPrachi JoshiNo ratings yet

- Tutorial 1.1Document23 pagesTutorial 1.1Xiuqin LiNo ratings yet

- Review The Corporate Level Strategies The Organization CurrentlyDocument6 pagesReview The Corporate Level Strategies The Organization CurrentlyIndika JayaweeraNo ratings yet

- 1 Q-Attachment-2Document4 pages1 Q-Attachment-2AndresNo ratings yet

- Managerial Applications of StatisticsDocument10 pagesManagerial Applications of StatisticsSai Aditya100% (1)

- MBA711 - Answers To All Chapter 7 ProblemsDocument21 pagesMBA711 - Answers To All Chapter 7 Problemsshweta shuklaNo ratings yet

- Camel Rating (Framework) of Four BanksDocument94 pagesCamel Rating (Framework) of Four Bankslovels_agrawal631387% (23)

- Prof. Batungbakal - OBLIGATIONS AND CONTRACTS PRE-WEEK 2019Document21 pagesProf. Batungbakal - OBLIGATIONS AND CONTRACTS PRE-WEEK 2019Raquel Doquenia100% (1)

- OBHR 202 - W05 Exercise Compensation Management CaseDocument6 pagesOBHR 202 - W05 Exercise Compensation Management CaseDinaHengNo ratings yet

- Mike Wileman - LinkedInDocument2 pagesMike Wileman - LinkedInDonna SteenkampNo ratings yet