Professional Documents

Culture Documents

IJCRT2308407

IJCRT2308407

Uploaded by

tijihe3605Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IJCRT2308407

IJCRT2308407

Uploaded by

tijihe3605Copyright:

Available Formats

www.ijcrt.

org © 2023 IJCRT | Volume 11, Issue 8 August 2023 | ISSN: 2320-2882

A COMPARATIVE STUDY ON IOCL, HPCL

AND BPCL

1

Mr.B.ARUNKUMAR, 2 Dr.V.RAJALAKSHMI

1

Assistant Professor, 2 Assistant Professor

1

Department of Commerce, 2Department of Commerce

1

Sri Krishna Adithya College of Arts and Science, Coimbatore, India, 2 Rathinam College of Arts and

Science, Coimbatore, India

Abstract: The study is made to know the common and different elements in the major Public Sector Oil

Companies who are in retail business during the financial year 2020 -21. Also the study dealt in the market

share of the respective companies and products dealt by the above corporates.

Index Terms - Comparative Study, Revenue, Oil Companies, Public sector.

INTRODUCTION

The major Indian Public Limited Oil Companies, Hindustan Petroleum, Bharat Petroleum, and Indian Oil has

something in common. All of them are Indian downstream oil firms. As of March 21, 2022, they are the only

downstream companies that are mentioned. Petroleum products, among which gasoline and diesel are two

that we are more familiar with, are sold by downstream companies.

The government of India controls these businesses in large part, which is another thing that unites them. They

are all Maharatna PSUs as well. Of the three, Indian Oil continues to hold the largest market share. The

availability of common industry-specific characteristics makes comparing businesses within the same sector

simpler. Here is a thorough analysis of India's top three oil marketing companies (OMCs).

IJCRT2308407 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org d807

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 8 August 2023 | ISSN: 2320-2882

Ownership Pattern

The Central Government's Ministry of Petroleum and Natural Gas owns a majority of the three OMCs. While

BPCL has drawn the most interest from mutual fund companies among its rivals,

HPCL has had the largest investment from overseas portfolio investors. IOCL has received the most public

investment out of the three companies.

Product Portfolios

The product portfolios of all the three companies are more or less the same.

IOCL

Natural gas Petrol and diesel Jet fuel

Industrial fuel Kerosene Bitumen

Petrochemicals Crude oil Lubricants

Greases.

IOCL operates 1,059 CNG stations in the country in addition to a gas pipeline network of 1,100+ kilometers.

The corporation has a group refining capacity of 80.55 MMTPA and operates an oil pipeline network of

15,000+ kilometers.

IJCRT2308407 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org d808

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 8 August 2023 | ISSN: 2320-2882

BPCL on the other hand produces and sells:

LPG Automotive LPG

Petrochemicals like benzene, toluene, naphtha, aviation fuel, diesel, petrol, kerosene, fuel oil.

The company also produces bitumen, sulfur, and lube oil base stock.

HPCL’s product list comprises fuel oil, naphtha, sulfur, lubricants and greases, gasoline, diesel, polyethylene,

polypropylene, and sulfur.

Number of petrol pumps

IOCL has the highest number of petrol pumps in the country. However, it has entered into an agreement with

Malaysia’s Petronas and may sell some of their petrol pumps. BPCL and HPCL are neck-to-neck with almost

a similar number of petrol pumps in the country.

IOCL 32,303

BPCL 18,766

HPCL 18,776

Throughput

The entire amount of crude oil utilized as a raw material and fed into the production of petrochemical goods

is known as refinery throughput.

The highest throughput was reported by IOCL in FY 2020–21 at 76 MMTPA, followed by BPCL at 26,4

MMTPA and HPCL at 16,42 MMTPA.

The greatest market sales during that time were recorded by IPCL at over 81 MMTPA, followed closely by

BPCL and HPCL with 38.7 MMTPA and 36.6 MMTPA, respectively.

Crude Oil Throughput

Revenue breakup

Petroleum products accounted for Rs 4,93,127 crore of IOCL's total revenue in the fiscal year (2021-2022).

It has the largest market share among its listed competitors, which can account for the highest revenue. In the

same year, IPCL received an additional Rs 19,169 crore in revenue from the sale of petrochemicals.

On the other side, BPCL claimed that its downstream petroleum business brought in Rs 3,04,197 crore in

revenue while hydrocarbon exploration and production contributed Rs 68 crore in FY 20-21.

In FY 20-21, HPCL recorded downstream petroleum income of Rs 2,70,333 crore and additional revenue of

Rs 244 crore from other companies.

IJCRT2308407 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org d809

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 8 August 2023 | ISSN: 2320-2882

Considering IOCL's size and scope, it can boast larger revenue, income, and PAT than its two competitors. In

FY 20-21, IOCL recorded a PAT of Rs 21,762 crore, followed by BPCL at Rs 19,041 crore and HPCL at Rs

10,662 crore.

However, it's important to notice that IOCL and BPCL are comparable in terms of PAT despite having a

significant disparity between their sales and total income. Even more intriguing is the fact that BPCL has the

highest EPS among its competitors, at Rs 96.44 per share. Third place goes to IOCL with an EPS of Rs 23.57,

while HPCL comes in at Rs 70.57 per share.

Gross Refining Margin

When comparing OMCs, it's necessary to take Gross Refining Margin, or GRM, into account. GRM is the

amount of money a corporation makes while turning a barrel of crude oil into fuel.

IOCL recorded the highest GRM at $5.64 per barrel for the fiscal year 2020–21, followed by BPCL and

HPCL.

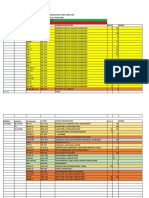

Ratios

Due to the high capital requirements of the oil and gas sector, all three companies' debt-to-equity ratios are a

little on the high side. As a result, BPCL, followed by IOCL and HPCL, has the lowest debt-to-equity ratio

among its two competitors.

IJCRT2308407 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org d810

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 8 August 2023 | ISSN: 2320-2882

Performance Ratios

About the companies

Indian Oil Corporation Limited (IOCL)

IOCL is a public business, with the Indian government owning the bulk of the stock. The largest

government-owned oil corporation in India is IOCL, and among its range of goods and services

include the exploration and production of petrochemicals, crude oil, and natural gas.

It focuses on oil extraction, refinement, pipeline transportation, and petrochemical product marketing.

It has a total annual refining capacity of 80.7 million tonnes and runs 11 of India's 23 refineries.

It operates through its subsidiaries in Sri Lanka, Mauritius, and the Middle East.

Bharat Petroleum Corporation Limited (BPCL)

Another state-owned oil company is BPCL. The company was founded in British India in 1891 as

Rangoon Oil and Exploration Company to investigate the possibility of oil in North Eastern India. It

was incorporated in 1952.

One of the country's oldest oil companies has two refineries, one each in Mumbai and Kochi.

While Petronet LNG imports and distributes LNG in the nation, Indraprastha Gas Limited (IGL), a

subsidiary of BPCL, distributes gas in Delhi-NCR.

Hindustan Petroleum Corporation Limited (HPCL)

A division of ONGC, the government-owned oil and gas company.

It operates two refineries, one in Mumbai and the other in Visakhapatnam, in India.

It holds an interest in Mangalore Refinery and Petrochemicals Limited (MRPL) that is close to 17%.

It is constructing a new refinery in Barmer, Rajasthan. Additionally, HPCL owns and runs the largest

lubricant facility in India, which generates 40% of all lubricants used in the nation.

Conclusion

In terms of size, volume, and the quantity of crude oil it handles, IOCL is the biggest OMC. However, as of

March 2022, the market might be assigning larger valuations to HPCL and BPCL, the other two biggest oil

marketing companies in the nation. With a vast network of gas stations and gasoline pumps across the entire

nation, all three are government-controlled and significantly contribute to the growth and development of the

country.

IJCRT2308407 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org d811

You might also like

- BPCL Supply Chain MGT ProjectDocument27 pagesBPCL Supply Chain MGT Projectdeepti12sharma100% (3)

- Bargaining Power of Suppliers and Airline IndustryDocument29 pagesBargaining Power of Suppliers and Airline IndustryPurnendu Singh100% (14)

- United International University: Assignment-01 Course Code: MGT 3229 Assignment TitleDocument3 pagesUnited International University: Assignment-01 Course Code: MGT 3229 Assignment TitleReaij SuvoNo ratings yet

- Overview of Oil and Gas SectorDocument8 pagesOverview of Oil and Gas SectorMudit KothariNo ratings yet

- Company Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsDocument12 pagesCompany Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsAnkit PandaNo ratings yet

- Summer Internship: TopicDocument48 pagesSummer Internship: TopicwaseemjuttNo ratings yet

- Oil and Gas Industry in IndiaDocument7 pagesOil and Gas Industry in IndiaShashank Lista De0% (1)

- Analysis of Oil Sector (Deepak Gaurav Laxmanan AbhishekS VishwathanDocument16 pagesAnalysis of Oil Sector (Deepak Gaurav Laxmanan AbhishekS VishwathanAbhishek SundaramNo ratings yet

- Project Report On HRDocument93 pagesProject Report On HRSwapnil PanpatilNo ratings yet

- Aditi Pant Internship ReportDocument14 pagesAditi Pant Internship ReportDR.B.REVATHYNo ratings yet

- Strengths: Brand EquitiesDocument6 pagesStrengths: Brand EquitiesSHETTY VIRAJNo ratings yet

- Functional Strategy and Its AlignmentDocument7 pagesFunctional Strategy and Its AlignmentDebasishNo ratings yet

- Mba Marketing Bharatgas ProjectDocument68 pagesMba Marketing Bharatgas ProjectNitin GuptaNo ratings yet

- Indian Oil CorporationDocument5 pagesIndian Oil CorporationNarendra PatilNo ratings yet

- GAIL India CompanyAnalysis923492384Document11 pagesGAIL India CompanyAnalysis923492384yaiyajieNo ratings yet

- Udbhav - Harsha GSM INDUSTRY ANALYSISDocument28 pagesUdbhav - Harsha GSM INDUSTRY ANALYSISchatgptplus1008No ratings yet

- Chennai Petroleum Corporation Limited: Oil and Gas IndustryDocument12 pagesChennai Petroleum Corporation Limited: Oil and Gas IndustryPrashik MendheNo ratings yet

- Project Report: Submitted To: Submitted byDocument31 pagesProject Report: Submitted To: Submitted byKunwar PrinceNo ratings yet

- Industry Report Project DraftDocument5 pagesIndustry Report Project DraftSai Kiran ReddyNo ratings yet

- Business Opportunities in Indian Oil and Gas SectorDocument24 pagesBusiness Opportunities in Indian Oil and Gas SectorgggggghhNo ratings yet

- Factors Affecting Competition in Upstream and Downstream Oil and Gas Sector in India: A Historical Analysis of Policy and Fiscal FrameworkDocument14 pagesFactors Affecting Competition in Upstream and Downstream Oil and Gas Sector in India: A Historical Analysis of Policy and Fiscal FrameworkDrishti TiwariNo ratings yet

- Equity Research On Oil & Gas SectorDocument47 pagesEquity Research On Oil & Gas Sectorjignay90% (10)

- Oil and Gas Exploration: Abhishek Rohit Gunjan Isha Shah Anupam KumariDocument21 pagesOil and Gas Exploration: Abhishek Rohit Gunjan Isha Shah Anupam KumariAbhee ThegreatNo ratings yet

- A Mini Project Report of Indian Oil CorporationDocument20 pagesA Mini Project Report of Indian Oil CorporationPotlamarri Sumanth0% (1)

- IOCL Complete ReportDocument43 pagesIOCL Complete ReportSanjiv KumarNo ratings yet

- Indian Oil CorporationDocument41 pagesIndian Oil CorporationTage NobinNo ratings yet

- HPCL ProjectDocument96 pagesHPCL Projectbose3508No ratings yet

- Indian Oil Corporation LTDDocument8 pagesIndian Oil Corporation LTDRituraj RanjanNo ratings yet

- Strategic Management: Report On Indian Oil Corporation LTDDocument19 pagesStrategic Management: Report On Indian Oil Corporation LTDANAMIKA ROYNo ratings yet

- Project On Indian OilDocument102 pagesProject On Indian Oiljignas cyberNo ratings yet

- Petrochemical Industry and Its Relative Performance To The EconomyDocument8 pagesPetrochemical Industry and Its Relative Performance To The EconomySomlina MukherjeeNo ratings yet

- Indian Petrolium Industry EsseyDocument15 pagesIndian Petrolium Industry EsseyShashank BansalNo ratings yet

- Future Prospects of Energy Firms in India: Financial Management AssignmentDocument13 pagesFuture Prospects of Energy Firms in India: Financial Management AssignmentKenanNo ratings yet

- Industry ProfileDocument15 pagesIndustry ProfileHaritha HaribabuNo ratings yet

- Bharat Petroleum Corporation LTDDocument12 pagesBharat Petroleum Corporation LTDJaffar AnasNo ratings yet

- A Study On Financial Analysis of Indian Oil Corporation LimitedDocument29 pagesA Study On Financial Analysis of Indian Oil Corporation LimitedMayank KumarNo ratings yet

- An Empirical Analysis of Financial Performance of Selected Oil Exploration and Production Companies in IndiaDocument6 pagesAn Empirical Analysis of Financial Performance of Selected Oil Exploration and Production Companies in Indiagamification576No ratings yet

- Oil and Gas Company Profile PDFDocument2 pagesOil and Gas Company Profile PDFChandrashekharCSKNo ratings yet

- Oil and Gas Company ProfileDocument2 pagesOil and Gas Company ProfileChandrashekharCSKNo ratings yet

- Indian Oil Corporation Organisational StructureDocument25 pagesIndian Oil Corporation Organisational StructureDheeraj Chandan0% (1)

- Final ProjectDocument47 pagesFinal ProjectKshitij MishraNo ratings yet

- About HPCL 2018Document14 pagesAbout HPCL 2018rqnNo ratings yet

- Vishwa Vishwani Institute of Systems and MangementDocument30 pagesVishwa Vishwani Institute of Systems and MangementNishant ShindeNo ratings yet

- Ongc Growth StrategyDocument10 pagesOngc Growth StrategydhavalmevadaNo ratings yet

- Overview of The FirmDocument5 pagesOverview of The FirmPrince PriyadarshiNo ratings yet

- Oil & Gas: June 2018Document41 pagesOil & Gas: June 2018Kiran KagitapuNo ratings yet

- Mudranki FileDocument78 pagesMudranki Filedrashyagarg7No ratings yet

- Oil India Ongc ComparisionDocument35 pagesOil India Ongc ComparisionAlakshendra Pratap TheophilusNo ratings yet

- Channel Conflict-Lubricant Markets-Petroleum IndustryDocument12 pagesChannel Conflict-Lubricant Markets-Petroleum IndustryNikhil100% (1)

- ONGC CSR Final NikhilDocument66 pagesONGC CSR Final Nikhilenrique_sumit100% (1)

- Profile of Chairman: SitemapDocument5 pagesProfile of Chairman: SitemaphellotoyashNo ratings yet

- A Report On Institutional Training Undergone at Oil and Natural Gas Corporation (Ongc)Document55 pagesA Report On Institutional Training Undergone at Oil and Natural Gas Corporation (Ongc)muthurajNo ratings yet

- Chapter 2 FinalDocument10 pagesChapter 2 FinalFemin PeterNo ratings yet

- Business Diversification Strategies of Energy Companies in India A Study of OilDocument27 pagesBusiness Diversification Strategies of Energy Companies in India A Study of Oiladiti pathakNo ratings yet

- Oil and Natural Gas Corporation Limited - Company ProfileDocument4 pagesOil and Natural Gas Corporation Limited - Company Profilejose luis pachecoNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Waste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesFrom EverandWaste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesRating: 5 out of 5 stars5/5 (1)

- EU China Energy Magazine 2023 April Issue: 2023, #3From EverandEU China Energy Magazine 2023 April Issue: 2023, #3No ratings yet

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesFrom EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo ratings yet

- Oil companies and the energy transitionFrom EverandOil companies and the energy transitionNo ratings yet

- Bahan OM PTKDocument7 pagesBahan OM PTKYayan Adrianova Eka Tuah yayanadrianova.2020No ratings yet

- Towards An Economic Approach To Sustainable Forest DevelopmentDocument36 pagesTowards An Economic Approach To Sustainable Forest DevelopmentRalph QuejadaNo ratings yet

- Oil & Gas Pipeline Opportunities 2020-22Document21 pagesOil & Gas Pipeline Opportunities 2020-22NORTECH TRINITYNo ratings yet

- A New Beginning: January 2022Document6 pagesA New Beginning: January 2022Nafia AzhariyaNo ratings yet

- Pricing Emulsions 01 04 2024Document1 pagePricing Emulsions 01 04 2024snehalmiko6452No ratings yet

- Ram Prasad Mainali, Toya Nath Joshi, Sagar Kafle, Yagya Prasad Giri, Santosh MarahattaDocument2 pagesRam Prasad Mainali, Toya Nath Joshi, Sagar Kafle, Yagya Prasad Giri, Santosh MarahattaToyanath JoshiNo ratings yet

- Gemma Generalcatalogue2019floorDocument117 pagesGemma Generalcatalogue2019floorahmed elkafafyNo ratings yet

- Proposal Entrepreneur Week 2021 Gear Up!: Organised by Entrepreneur ClubDocument4 pagesProposal Entrepreneur Week 2021 Gear Up!: Organised by Entrepreneur ClubDarmmini Mini100% (1)

- Agmark (Agricultural Marketing)Document13 pagesAgmark (Agricultural Marketing)Ankit SharmaNo ratings yet

- 2020 June Examinations TimetableDocument40 pages2020 June Examinations TimetablekingNo ratings yet

- BF-311 Ms YetiDocument1 pageBF-311 Ms YetiHesti PrawatiNo ratings yet

- PRICING OPTIONS FINAL Revised 13 OctoberDocument24 pagesPRICING OPTIONS FINAL Revised 13 OctoberEl GwekwerereNo ratings yet

- A Project Report On Poultry Trade at New DelhiDocument69 pagesA Project Report On Poultry Trade at New Delhinawaljain100% (2)

- BPCL Ethanol Booklet 2023Document22 pagesBPCL Ethanol Booklet 2023Subhankar SubuNo ratings yet

- GridExport May 7 2024 21 12 8Document335 pagesGridExport May 7 2024 21 12 8dapper011No ratings yet

- Makrolon ET - Resins For Extrusion and ThermoformingDocument8 pagesMakrolon ET - Resins For Extrusion and ThermoformingDiegoTierradentroNo ratings yet

- Process CostingDocument13 pagesProcess CostingRajendran KajananthanNo ratings yet

- The Viability of Liverpool Retail India LTD PresentationDocument32 pagesThe Viability of Liverpool Retail India LTD PresentationNikita SanghviNo ratings yet

- PMC CGDDocument27 pagesPMC CGDRaman KumarNo ratings yet

- ICON Casebook 2023-24 - Volume 13 (B)Document193 pagesICON Casebook 2023-24 - Volume 13 (B)ShubhamNo ratings yet

- A-103 Lim, Chun HwanDocument16 pagesA-103 Lim, Chun HwanDede RochmanNo ratings yet

- Farm RecordsDocument3 pagesFarm RecordsDr.Kavita ChopdeNo ratings yet

- Cost Accounting Quizzer No. 1: Basic ConceptsDocument11 pagesCost Accounting Quizzer No. 1: Basic ConceptsLuming100% (1)

- Amount Received From Online Hence No Need To Pay at BankDocument2 pagesAmount Received From Online Hence No Need To Pay at BankBasskar RawNo ratings yet

- DetolDocument18 pagesDetolWaseem AhmadNo ratings yet

- Case Ih Tractor Spx4410 Patriot Sprayer Troubleshooting Manual 87265680Document22 pagesCase Ih Tractor Spx4410 Patriot Sprayer Troubleshooting Manual 87265680xycedfsf100% (51)

- Next 6 Month Time Table For RBI Grade B 2024Document15 pagesNext 6 Month Time Table For RBI Grade B 2024Amit SangwanNo ratings yet

- The Role of Cooperative Agency in Promoting Agricultural Co-Operatives in A Country (A Case of in Gog Woreda, Southern Gambella, Ethiopia)Document16 pagesThe Role of Cooperative Agency in Promoting Agricultural Co-Operatives in A Country (A Case of in Gog Woreda, Southern Gambella, Ethiopia)Bekele Guta GemeneNo ratings yet