Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsA Note On Asm

A Note On Asm

Uploaded by

khushboo.easycreditCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- APES 310 Audit ProgramDocument13 pagesAPES 310 Audit ProgramShamir Gupta100% (1)

- Credit Appraisal Process of BanksDocument25 pagesCredit Appraisal Process of Banksbhavikashetty75% (4)

- Audit Programme and Checklists For Completion of Audit Audit ProgrammeDocument26 pagesAudit Programme and Checklists For Completion of Audit Audit ProgrammejafarNo ratings yet

- BFP Flowchart For Fire Safety Inspection Certificate Fsic For New Business PermitDocument1 pageBFP Flowchart For Fire Safety Inspection Certificate Fsic For New Business PermitRomel RagasaNo ratings yet

- Bank Maker Checker N Approver WorkflowDocument23 pagesBank Maker Checker N Approver WorkflowSubhashNo ratings yet

- Cash and Liquidity ManagementDocument13 pagesCash and Liquidity ManagementashkoolNo ratings yet

- ABSA August 2016 StatementDocument4 pagesABSA August 2016 StatementTafadzwa Manjengwa0% (1)

- Mahesh CVDocument4 pagesMahesh CVRj GuptaNo ratings yet

- Offer For Appointment As Agency For Specialised Monitoring Asm 07 07Document16 pagesOffer For Appointment As Agency For Specialised Monitoring Asm 07 07cfeaakashtiwariNo ratings yet

- HBL ReportDocument34 pagesHBL ReportMansoor ArifNo ratings yet

- Audit Assignment Case 3Document11 pagesAudit Assignment Case 3Yee HooiNo ratings yet

- Damodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkDocument20 pagesDamodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkradhakrishnaNo ratings yet

- Credit Monitoring: R.KanchanamalaDocument53 pagesCredit Monitoring: R.Kanchanamalamithilesh tabhaneNo ratings yet

- Damodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkDocument19 pagesDamodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkradhakrishnaNo ratings yet

- Assignment No3 (Auditting and Assurance)Document6 pagesAssignment No3 (Auditting and Assurance)NIYOMUGENGA EdmondNo ratings yet

- Final KAMDocument20 pagesFinal KAMSarah SharonNo ratings yet

- Working Capital Finance-Recommendations of Various Committees.Document33 pagesWorking Capital Finance-Recommendations of Various Committees.Ranaque JahanNo ratings yet

- Annx-2-Con Audit Policy 2012-13Document55 pagesAnnx-2-Con Audit Policy 2012-13as14jnNo ratings yet

- UCO BANK - Empanelment of Concurrent Auditors 2015-16-3d52232154Document15 pagesUCO BANK - Empanelment of Concurrent Auditors 2015-16-3d52232154Puneet MittalNo ratings yet

- Report of The Board of Directors On Corporate GovernanceDocument6 pagesReport of The Board of Directors On Corporate GovernanceglorydharmarajNo ratings yet

- Concurrent Audit: Dr. Saroj UpadhyayDocument40 pagesConcurrent Audit: Dr. Saroj Upadhyayharsh143352No ratings yet

- Assessment of Working Capital Finance 95MIKGBVDocument31 pagesAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- CB CheatDocument365 pagesCB Cheatrajeshraj0112No ratings yet

- The Institute of Chartered Accountants of India Syllabus For Professional Competence Examination (PCE)Document9 pagesThe Institute of Chartered Accountants of India Syllabus For Professional Competence Examination (PCE)Tanoy DewanjeeNo ratings yet

- Topic 3 - Part 2 - Regulatory Approach of An Accounting TheoryDocument40 pagesTopic 3 - Part 2 - Regulatory Approach of An Accounting TheoryMOHAMMAD ASYRAF NAZRI SAKRINo ratings yet

- Licensing Guidelines - 2016Document14 pagesLicensing Guidelines - 2016SEBASTIÁNNo ratings yet

- Monitoring & Follow Up of Advances: H S Sharma, Guest Faculty, IIBFDocument51 pagesMonitoring & Follow Up of Advances: H S Sharma, Guest Faculty, IIBFBhaskara Sita Ramayya PNo ratings yet

- IGNOU - Acounting Course PDFDocument22 pagesIGNOU - Acounting Course PDFPulkit SinghNo ratings yet

- Strategic Credit Management - IntroductionDocument14 pagesStrategic Credit Management - IntroductionDr VIRUPAKSHA GOUD G50% (2)

- Concurrent Audit ProcessDocument7 pagesConcurrent Audit Processsukumar basuNo ratings yet

- UCO BANK Audit and InspectionDocument16 pagesUCO BANK Audit and Inspectionganpati megabuilderNo ratings yet

- Credit AppraisalDocument49 pagesCredit AppraisalRam Vishrojwar50% (2)

- Guidelines For InspectionDocument132 pagesGuidelines For InspectiondineshmarginalNo ratings yet

- Para Banking by Management Fund ADocument32 pagesPara Banking by Management Fund AArijit BhadraNo ratings yet

- Para Banking by Management Fund ADocument32 pagesPara Banking by Management Fund ADeepika GargNo ratings yet

- Project On Audit of BankDocument45 pagesProject On Audit of BankCyril Chettiar90% (10)

- A Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaDocument6 pagesA Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaCA Lokesh MaheshwariNo ratings yet

- Credit Report On MCBDocument16 pagesCredit Report On MCBuzmabhatti34No ratings yet

- Security Analysis AND Portfolio Management Assignment 2Document9 pagesSecurity Analysis AND Portfolio Management Assignment 2Ankur SharmaNo ratings yet

- Aau3711 Module With Past Year Exam SummaryDocument117 pagesAau3711 Module With Past Year Exam SummaryRosliana RazabNo ratings yet

- PCC - Auditing - RTP - Nov 2008Document31 pagesPCC - Auditing - RTP - Nov 2008Omnia HassanNo ratings yet

- Mba III Strategic Credit Management (14mbafm306) NotesDocument85 pagesMba III Strategic Credit Management (14mbafm306) NotesZoheb Ali K100% (3)

- 3.pre AcceptanceDocument7 pages3.pre AcceptanceJaskaran SinghNo ratings yet

- 15 - Audit of BanksDocument21 pages15 - Audit of BanksBelgium PropertiesNo ratings yet

- Audit Smart Notea PDFDocument324 pagesAudit Smart Notea PDFTheLatentGamer100% (1)

- Cra RegulationsDocument12 pagesCra RegulationsPooja MiglaniNo ratings yet

- Pre-Sanction Credit ProcessDocument14 pagesPre-Sanction Credit ProcessSumit Kumar Sharma100% (2)

- Assessment of Working Capital LimitDocument4 pagesAssessment of Working Capital LimitKeshav Malpani100% (8)

- Securities and Exchange Board of India: CircularDocument5 pagesSecurities and Exchange Board of India: CircularSwapnil JagatiNo ratings yet

- Audit of ReceivableDocument26 pagesAudit of ReceivableHannah AngNo ratings yet

- Accepting/continuing An Audit EngagementDocument11 pagesAccepting/continuing An Audit EngagementI'j Chut MoHammadNo ratings yet

- S.S.T. College of Arts and Commerce ULHASNAGAR - 421 004Document23 pagesS.S.T. College of Arts and Commerce ULHASNAGAR - 421 004MohammedAhmedRazaNo ratings yet

- Naresh Chandra Committee Report On Corporate Audit andDocument20 pagesNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNo ratings yet

- Policy For Selection and Appointment of Statutory Central Auditors (Scas) For The Year 2022-23Document15 pagesPolicy For Selection and Appointment of Statutory Central Auditors (Scas) For The Year 2022-23Anand LuharNo ratings yet

- Key Audit Matters HULDocument8 pagesKey Audit Matters HULSarah SharonNo ratings yet

- Chap-6-Verification of Assets and LiabilitiesDocument48 pagesChap-6-Verification of Assets and LiabilitiesAkash GuptaNo ratings yet

- 4Document6 pages4shresthanightingaleNo ratings yet

- 07 - Acceptance & Continuance of The Audit EngagementDocument57 pages07 - Acceptance & Continuance of The Audit EngagementHaythem TrabelsiNo ratings yet

- AUDITING AND ASSURANCE SPECLIZED INDUSTRIES - 25 Sep 2023v2Document20 pagesAUDITING AND ASSURANCE SPECLIZED INDUSTRIES - 25 Sep 2023v2Renelyn FiloteoNo ratings yet

- Appraisal of The ProposalDocument10 pagesAppraisal of The ProposalroutraykhushbooNo ratings yet

- Notes 1 Notes 1: Principles of Auditing (University of Embu) Principles of Auditing (University of Embu)Document12 pagesNotes 1 Notes 1: Principles of Auditing (University of Embu) Principles of Auditing (University of Embu)ABID ANAYATNo ratings yet

- BanksDocument58 pagesBanksgraceNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Table of 1 US Dollar To Indian Rupee Exchange Rate: Table of 1 US Dollar To Indian Rupee Exchange RateDocument11 pagesTable of 1 US Dollar To Indian Rupee Exchange Rate: Table of 1 US Dollar To Indian Rupee Exchange RateSanket DubeyNo ratings yet

- New World v. NYK Fil JapanDocument2 pagesNew World v. NYK Fil JapanMarionnie SabadoNo ratings yet

- Member Statement: Questions?Document8 pagesMember Statement: Questions?Michael CarsonNo ratings yet

- Cenovnik Proizvoda I Usluga Za Stanovnistvo I Registrovana Poljoprivredna GazdinstvaDocument26 pagesCenovnik Proizvoda I Usluga Za Stanovnistvo I Registrovana Poljoprivredna Gazdinstvaqyr52rvk2bNo ratings yet

- FAQDocument58 pagesFAQvivekluvinNo ratings yet

- BOA Statement 2 PDFDocument7 pagesBOA Statement 2 PDFmdyafi8084No ratings yet

- Ujas2 12902580Document9 pagesUjas2 12902580Sami JattNo ratings yet

- Account Deposit Protection enDocument2 pagesAccount Deposit Protection enBrigitte HigazieNo ratings yet

- Savings Account Statement: Capitec B AnkDocument4 pagesSavings Account Statement: Capitec B AnkJon LwaziNo ratings yet

- Amit KumarDocument43 pagesAmit KumarAmit SharmaNo ratings yet

- NEO-Super (NEOX) WhitepaperDocument18 pagesNEO-Super (NEOX) WhitepaperP. H. MadoreNo ratings yet

- Account Current Question BankDocument2 pagesAccount Current Question BankQuestionscastle Friend0% (1)

- Kami Export - Alexander Sookram - 2019-2020 Complete The Accounting Cycle - GLDocument3 pagesKami Export - Alexander Sookram - 2019-2020 Complete The Accounting Cycle - GLJake OttNo ratings yet

- A Study On The Role of Bajaj Finserv in Consumer Durable FinanceeDocument58 pagesA Study On The Role of Bajaj Finserv in Consumer Durable Financeeshwetha17% (6)

- Faq Guidelines 2Document20 pagesFaq Guidelines 2Haroon AbidNo ratings yet

- Strategic Management: Jpmorgan Chase & CoDocument16 pagesStrategic Management: Jpmorgan Chase & CoBea Garcia100% (1)

- Islamic Capital Market Malaysia PDFDocument35 pagesIslamic Capital Market Malaysia PDFSyahrul EffendeeNo ratings yet

- ForfeitingDocument34 pagesForfeitingvandana_daki3941No ratings yet

- IDBI ProjectDocument46 pagesIDBI Projectfardeenansari 646No ratings yet

- PCI DSS v3 AOC ServiceProvidersDocument10 pagesPCI DSS v3 AOC ServiceProvidersGeorgiana MateescuNo ratings yet

- Morning Sheet TemplateDocument4 pagesMorning Sheet TemplatedkokkeNo ratings yet

- Fido-Dec13 2019 PDFDocument4 pagesFido-Dec13 2019 PDFalex mac dougallNo ratings yet

- Xi Accounting Set 2Document6 pagesXi Accounting Set 2aashirwad2076No ratings yet

- Death Claimant StatementDocument4 pagesDeath Claimant Statementcet.ranchi7024No ratings yet

- Introduction To Small BusinessDocument27 pagesIntroduction To Small BusinessPandu RangaraoNo ratings yet

- Week 5 - Topic OverviewDocument13 pagesWeek 5 - Topic Overviewjoy mbasoNo ratings yet

A Note On Asm

A Note On Asm

Uploaded by

khushboo.easycredit0 ratings0% found this document useful (0 votes)

0 views3 pagesOriginal Title

A NOTE ON ASM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views3 pagesA Note On Asm

A Note On Asm

Uploaded by

khushboo.easycreditCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

A NOTE ON ASM- AGENCY FOR SPECIALISED MONITORING

What is ASM in audit?

ASM means Agency for Specialised Monitoring. Banks are supposed to

monitor their borrower's financial operations. Now Chartered

Accountants are appointed as Agents of the Bank for specialised

monitoring of the financial operations of the borrower, largely to track

any misuse /diversion of funds.

What is ASM report bank?

A critical strategy in reducing NPAs, ASM audits involve extensive

analysis of a company's transactions, operations, and financial health.

Auditors spend weeks going through ledgers, bank statements, project

reports and other information to prepare their quarterly report.

APPLICABILITY OF ASM AUDIT-

ASM will be applicable for all debtors where exposure is above INR 250

Crore. The Scope of work shall include: Concurrent Review and

Monitoring Procedures (for Working Capital)

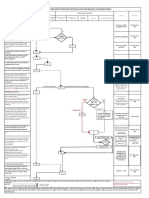

The process for selection involves the following steps:

1. Invitation for application by IBA

2. Submission of application with supporting documents by ASMs

3. Successful Payment of stipulated application fees by the ASMs

4. Scrutiny of the application and eligibility by the Working Group

constituted by IBA

5. Raising of queries by the Working Group members and response by

applicants.

6. Finalisation of eligible agencies for empanelment

7. Payment of stipulated Empanelment fees by the ASMs

8. Approval of the panel by the Manging Committee of IBA

9. Publication of the approved list of empanelled ASMs

MANISH MAHAVIR & CO

CHARTERED ACCOUNTANTS

9830248684

A NOTE ON ASM- AGENCY FOR SPECIALISED MONITORING

10. Sharing of the approved panel with member banks

SCOPE OF ASM AUDIT-

The broad scope of ASM Audit work involves the following activities:

Stock & Receivable Audit

Cash flow Monitoring

LC/BG Audit

Sales/Purchase Monitoring

End Use of Funds/Siphoning of Funds

Verification of group company transactions at arms length

Validation of Drawing Power as per Banks’ sanctioned terms

LIE Work for Term Loans/Projects

Review of project progress vis-a-vis scheduled milestones, Capacity

Utilisation, asset book size, quality and diversification.

Verification of re-valuation of assets if any

Verification of routing of project revenue and expenses through

designated bank accounts

Verification of project expenses, payments to creditors and advances

to suppliers

Review of unbilled revenue and WIP and justifiable reasons for the

same

Litigations/Contingent Liabilities including letters of comfort

Pre-disbursement verification of some specific high value transactions

as the Banks may deem necessary

External Ratings, statutory and regulatory compliances, insurance

cover.

Assessment of Quarterly Key Financial Indicators/Movement in stock

exchanges

Movement in promoter holding in the company from time to time

and percentage holding pledged to financial institutions and banks to

raise capital

MANISH MAHAVIR & CO

CHARTERED ACCOUNTANTS

9830248684

A NOTE ON ASM- AGENCY FOR SPECIALISED MONITORING

Any other Key Areas Review (KAR) which the Banks find necessary

to be monitored

MANISH MAHAVIR & CO

CHARTERED ACCOUNTANTS

9830248684

You might also like

- APES 310 Audit ProgramDocument13 pagesAPES 310 Audit ProgramShamir Gupta100% (1)

- Credit Appraisal Process of BanksDocument25 pagesCredit Appraisal Process of Banksbhavikashetty75% (4)

- Audit Programme and Checklists For Completion of Audit Audit ProgrammeDocument26 pagesAudit Programme and Checklists For Completion of Audit Audit ProgrammejafarNo ratings yet

- BFP Flowchart For Fire Safety Inspection Certificate Fsic For New Business PermitDocument1 pageBFP Flowchart For Fire Safety Inspection Certificate Fsic For New Business PermitRomel RagasaNo ratings yet

- Bank Maker Checker N Approver WorkflowDocument23 pagesBank Maker Checker N Approver WorkflowSubhashNo ratings yet

- Cash and Liquidity ManagementDocument13 pagesCash and Liquidity ManagementashkoolNo ratings yet

- ABSA August 2016 StatementDocument4 pagesABSA August 2016 StatementTafadzwa Manjengwa0% (1)

- Mahesh CVDocument4 pagesMahesh CVRj GuptaNo ratings yet

- Offer For Appointment As Agency For Specialised Monitoring Asm 07 07Document16 pagesOffer For Appointment As Agency For Specialised Monitoring Asm 07 07cfeaakashtiwariNo ratings yet

- HBL ReportDocument34 pagesHBL ReportMansoor ArifNo ratings yet

- Audit Assignment Case 3Document11 pagesAudit Assignment Case 3Yee HooiNo ratings yet

- Damodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkDocument20 pagesDamodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkradhakrishnaNo ratings yet

- Credit Monitoring: R.KanchanamalaDocument53 pagesCredit Monitoring: R.Kanchanamalamithilesh tabhaneNo ratings yet

- Damodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkDocument19 pagesDamodaram Sanjivayya National Law University Vishakapatnam: Bank Audit - A Statutory FrameworkradhakrishnaNo ratings yet

- Assignment No3 (Auditting and Assurance)Document6 pagesAssignment No3 (Auditting and Assurance)NIYOMUGENGA EdmondNo ratings yet

- Final KAMDocument20 pagesFinal KAMSarah SharonNo ratings yet

- Working Capital Finance-Recommendations of Various Committees.Document33 pagesWorking Capital Finance-Recommendations of Various Committees.Ranaque JahanNo ratings yet

- Annx-2-Con Audit Policy 2012-13Document55 pagesAnnx-2-Con Audit Policy 2012-13as14jnNo ratings yet

- UCO BANK - Empanelment of Concurrent Auditors 2015-16-3d52232154Document15 pagesUCO BANK - Empanelment of Concurrent Auditors 2015-16-3d52232154Puneet MittalNo ratings yet

- Report of The Board of Directors On Corporate GovernanceDocument6 pagesReport of The Board of Directors On Corporate GovernanceglorydharmarajNo ratings yet

- Concurrent Audit: Dr. Saroj UpadhyayDocument40 pagesConcurrent Audit: Dr. Saroj Upadhyayharsh143352No ratings yet

- Assessment of Working Capital Finance 95MIKGBVDocument31 pagesAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- CB CheatDocument365 pagesCB Cheatrajeshraj0112No ratings yet

- The Institute of Chartered Accountants of India Syllabus For Professional Competence Examination (PCE)Document9 pagesThe Institute of Chartered Accountants of India Syllabus For Professional Competence Examination (PCE)Tanoy DewanjeeNo ratings yet

- Topic 3 - Part 2 - Regulatory Approach of An Accounting TheoryDocument40 pagesTopic 3 - Part 2 - Regulatory Approach of An Accounting TheoryMOHAMMAD ASYRAF NAZRI SAKRINo ratings yet

- Licensing Guidelines - 2016Document14 pagesLicensing Guidelines - 2016SEBASTIÁNNo ratings yet

- Monitoring & Follow Up of Advances: H S Sharma, Guest Faculty, IIBFDocument51 pagesMonitoring & Follow Up of Advances: H S Sharma, Guest Faculty, IIBFBhaskara Sita Ramayya PNo ratings yet

- IGNOU - Acounting Course PDFDocument22 pagesIGNOU - Acounting Course PDFPulkit SinghNo ratings yet

- Strategic Credit Management - IntroductionDocument14 pagesStrategic Credit Management - IntroductionDr VIRUPAKSHA GOUD G50% (2)

- Concurrent Audit ProcessDocument7 pagesConcurrent Audit Processsukumar basuNo ratings yet

- UCO BANK Audit and InspectionDocument16 pagesUCO BANK Audit and Inspectionganpati megabuilderNo ratings yet

- Credit AppraisalDocument49 pagesCredit AppraisalRam Vishrojwar50% (2)

- Guidelines For InspectionDocument132 pagesGuidelines For InspectiondineshmarginalNo ratings yet

- Para Banking by Management Fund ADocument32 pagesPara Banking by Management Fund AArijit BhadraNo ratings yet

- Para Banking by Management Fund ADocument32 pagesPara Banking by Management Fund ADeepika GargNo ratings yet

- Project On Audit of BankDocument45 pagesProject On Audit of BankCyril Chettiar90% (10)

- A Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaDocument6 pagesA Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaCA Lokesh MaheshwariNo ratings yet

- Credit Report On MCBDocument16 pagesCredit Report On MCBuzmabhatti34No ratings yet

- Security Analysis AND Portfolio Management Assignment 2Document9 pagesSecurity Analysis AND Portfolio Management Assignment 2Ankur SharmaNo ratings yet

- Aau3711 Module With Past Year Exam SummaryDocument117 pagesAau3711 Module With Past Year Exam SummaryRosliana RazabNo ratings yet

- PCC - Auditing - RTP - Nov 2008Document31 pagesPCC - Auditing - RTP - Nov 2008Omnia HassanNo ratings yet

- Mba III Strategic Credit Management (14mbafm306) NotesDocument85 pagesMba III Strategic Credit Management (14mbafm306) NotesZoheb Ali K100% (3)

- 3.pre AcceptanceDocument7 pages3.pre AcceptanceJaskaran SinghNo ratings yet

- 15 - Audit of BanksDocument21 pages15 - Audit of BanksBelgium PropertiesNo ratings yet

- Audit Smart Notea PDFDocument324 pagesAudit Smart Notea PDFTheLatentGamer100% (1)

- Cra RegulationsDocument12 pagesCra RegulationsPooja MiglaniNo ratings yet

- Pre-Sanction Credit ProcessDocument14 pagesPre-Sanction Credit ProcessSumit Kumar Sharma100% (2)

- Assessment of Working Capital LimitDocument4 pagesAssessment of Working Capital LimitKeshav Malpani100% (8)

- Securities and Exchange Board of India: CircularDocument5 pagesSecurities and Exchange Board of India: CircularSwapnil JagatiNo ratings yet

- Audit of ReceivableDocument26 pagesAudit of ReceivableHannah AngNo ratings yet

- Accepting/continuing An Audit EngagementDocument11 pagesAccepting/continuing An Audit EngagementI'j Chut MoHammadNo ratings yet

- S.S.T. College of Arts and Commerce ULHASNAGAR - 421 004Document23 pagesS.S.T. College of Arts and Commerce ULHASNAGAR - 421 004MohammedAhmedRazaNo ratings yet

- Naresh Chandra Committee Report On Corporate Audit andDocument20 pagesNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNo ratings yet

- Policy For Selection and Appointment of Statutory Central Auditors (Scas) For The Year 2022-23Document15 pagesPolicy For Selection and Appointment of Statutory Central Auditors (Scas) For The Year 2022-23Anand LuharNo ratings yet

- Key Audit Matters HULDocument8 pagesKey Audit Matters HULSarah SharonNo ratings yet

- Chap-6-Verification of Assets and LiabilitiesDocument48 pagesChap-6-Verification of Assets and LiabilitiesAkash GuptaNo ratings yet

- 4Document6 pages4shresthanightingaleNo ratings yet

- 07 - Acceptance & Continuance of The Audit EngagementDocument57 pages07 - Acceptance & Continuance of The Audit EngagementHaythem TrabelsiNo ratings yet

- AUDITING AND ASSURANCE SPECLIZED INDUSTRIES - 25 Sep 2023v2Document20 pagesAUDITING AND ASSURANCE SPECLIZED INDUSTRIES - 25 Sep 2023v2Renelyn FiloteoNo ratings yet

- Appraisal of The ProposalDocument10 pagesAppraisal of The ProposalroutraykhushbooNo ratings yet

- Notes 1 Notes 1: Principles of Auditing (University of Embu) Principles of Auditing (University of Embu)Document12 pagesNotes 1 Notes 1: Principles of Auditing (University of Embu) Principles of Auditing (University of Embu)ABID ANAYATNo ratings yet

- BanksDocument58 pagesBanksgraceNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Table of 1 US Dollar To Indian Rupee Exchange Rate: Table of 1 US Dollar To Indian Rupee Exchange RateDocument11 pagesTable of 1 US Dollar To Indian Rupee Exchange Rate: Table of 1 US Dollar To Indian Rupee Exchange RateSanket DubeyNo ratings yet

- New World v. NYK Fil JapanDocument2 pagesNew World v. NYK Fil JapanMarionnie SabadoNo ratings yet

- Member Statement: Questions?Document8 pagesMember Statement: Questions?Michael CarsonNo ratings yet

- Cenovnik Proizvoda I Usluga Za Stanovnistvo I Registrovana Poljoprivredna GazdinstvaDocument26 pagesCenovnik Proizvoda I Usluga Za Stanovnistvo I Registrovana Poljoprivredna Gazdinstvaqyr52rvk2bNo ratings yet

- FAQDocument58 pagesFAQvivekluvinNo ratings yet

- BOA Statement 2 PDFDocument7 pagesBOA Statement 2 PDFmdyafi8084No ratings yet

- Ujas2 12902580Document9 pagesUjas2 12902580Sami JattNo ratings yet

- Account Deposit Protection enDocument2 pagesAccount Deposit Protection enBrigitte HigazieNo ratings yet

- Savings Account Statement: Capitec B AnkDocument4 pagesSavings Account Statement: Capitec B AnkJon LwaziNo ratings yet

- Amit KumarDocument43 pagesAmit KumarAmit SharmaNo ratings yet

- NEO-Super (NEOX) WhitepaperDocument18 pagesNEO-Super (NEOX) WhitepaperP. H. MadoreNo ratings yet

- Account Current Question BankDocument2 pagesAccount Current Question BankQuestionscastle Friend0% (1)

- Kami Export - Alexander Sookram - 2019-2020 Complete The Accounting Cycle - GLDocument3 pagesKami Export - Alexander Sookram - 2019-2020 Complete The Accounting Cycle - GLJake OttNo ratings yet

- A Study On The Role of Bajaj Finserv in Consumer Durable FinanceeDocument58 pagesA Study On The Role of Bajaj Finserv in Consumer Durable Financeeshwetha17% (6)

- Faq Guidelines 2Document20 pagesFaq Guidelines 2Haroon AbidNo ratings yet

- Strategic Management: Jpmorgan Chase & CoDocument16 pagesStrategic Management: Jpmorgan Chase & CoBea Garcia100% (1)

- Islamic Capital Market Malaysia PDFDocument35 pagesIslamic Capital Market Malaysia PDFSyahrul EffendeeNo ratings yet

- ForfeitingDocument34 pagesForfeitingvandana_daki3941No ratings yet

- IDBI ProjectDocument46 pagesIDBI Projectfardeenansari 646No ratings yet

- PCI DSS v3 AOC ServiceProvidersDocument10 pagesPCI DSS v3 AOC ServiceProvidersGeorgiana MateescuNo ratings yet

- Morning Sheet TemplateDocument4 pagesMorning Sheet TemplatedkokkeNo ratings yet

- Fido-Dec13 2019 PDFDocument4 pagesFido-Dec13 2019 PDFalex mac dougallNo ratings yet

- Xi Accounting Set 2Document6 pagesXi Accounting Set 2aashirwad2076No ratings yet

- Death Claimant StatementDocument4 pagesDeath Claimant Statementcet.ranchi7024No ratings yet

- Introduction To Small BusinessDocument27 pagesIntroduction To Small BusinessPandu RangaraoNo ratings yet

- Week 5 - Topic OverviewDocument13 pagesWeek 5 - Topic Overviewjoy mbasoNo ratings yet