Professional Documents

Culture Documents

Non-Current Liabilities

Non-Current Liabilities

Uploaded by

armor.coverOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non-Current Liabilities

Non-Current Liabilities

Uploaded by

armor.coverCopyright:

Available Formats

CFA Program Level I for November 2024 $ & '

( $

K Home ) # Non-Current Liabilities 3 4 7 6

Lessons Table of Contents Confidence Levels Notes Bookmarks Highlights Non-Current Liabilities

u Study Plan

k Lessons

g Flashcards

r Practice NON-CURRENT LIABILITIES

v Mock Exams

Learning Outcome

j Game Center explain the financial reporting and disclosures related to non-current liabilities

e Discussions All liabilities that are not classified as current are considered to be non-current or long-term. Exhibit 8 and

Exhibit 9 present balance sheet excerpts for SAP Group and Apple Inc. showing the line items for the

B Search

companies’ non-current liabilities.

Both companies’ balance sheets show non-current unearned revenue (deferred income for SAP Group and

deferred revenue for Apple). These amounts represent unearned revenue relating to goods and services

expected to be delivered in periods beyond 12 months following the reporting period. The sections that

follow focus on two common types of non-current (long-term) liabilities: long-term financial liabilities and

deferred tax liabilities.

Exhibit 8: SAP Group Consolidated Statements of Financial Position

(Excerpt: Non-Current Liabilities Detail) (in millions of euros)

As of 31 December

2017 2016

Assets

Total current assets 11,930 11,564

Total non-current assets 30,567 32,713

Total assets 42,497 44,277

Financial liabilities (current) 1,561 1,813

Total current liabilities 10,210 9,674

Trade and other payables 119 127

Tax liabilities 470 365

Financial liabilities 5,034 6,481

Other non-financial liabilities 503 461

Provisions 303 217

Deferred tax liabilities 240 411

Deferred income 79 143

Total non-current liabilities 6,747 8,205

Total liabilities 16,958 17,880

Total equity 25,540 26,397

Total equity and liabilities EUR42,497 EUR44,277

Source: SAP Group 2017 annual report.

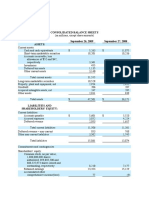

Exhibit 9: Apple Inc. Consolidated Balance Sheet (Excerpt: Non-

Current Liabilities Detail)* (in millions of US dollars)

Assets 30 September 2017 24 September 2016

Total current assets 128,645 106,869

[All other assets] 246,674 214,817

Total assets 375,319 321,686

Liabilities and shareholders’ equity

Total current liabilities 100,814 79,006

Deferred revenue, non-current 2,836 2,930

Long-term debt 97,207 75,427

Other non-current liabilities 40,415 36,074

[Total non-current liabilities] 140,458 114,431

Total liabilities 241,272 193,437

Total shareholders’ equity 134,047 128,249

Total liabilities and shareholders’ equity 375,319 321,686

Note: The italicized subtotals presented in this excerpt are not explicitly shown on the face of the financial statement as prepared by the

company.

Source: Apple Inc. 2017 annual report (Form 10K).

Long-Term Financial Liabilities

Typical long-term financial liabilities include loans (i.e., borrowings from banks) and notes or bonds payable

(i.e., fixed-income securities issued to investors). Liabilities such as loans payable and bonds payable are

usually reported at amortized cost on the balance sheet. At maturity, the amortized cost of the bond

(carrying amount) will be equal to the face value of the bond. For example, if a company issues

USD10,000,000 of bonds at par value, the bonds are reported as a long-term liability of USD10 million. The

carrying amount (amortized cost) from the date of issue to the date of maturity remains at USD10 million. As

another example, if a company issues USD10,000,000 of bonds at a price of 97.50 percent of par value (a

discount to par), the bonds are reported as a liability of USD9,750,000 at issue date. Over the bond’s life,

the discount of USD250,000 is amortized so that the bond will be reported as a liability of USD10,000,000 at

maturity. Similarly, any bond premium would be amortized for bonds issued at a price in excess of par value.

In certain cases, liabilities such as bonds issued by a company are reported at fair value. Those cases

include financial liabilities held for trading, derivatives that are a liability to the company, and some non-

derivative instruments, such as those which are hedged by derivatives.

SAP’s balance sheet in Exhibit 8 shows EUR5,034 million in financial liabilities, and the notes disclose that

these liabilities are mostly for bonds payable. Apple’s balance sheet in Exhibit 9 shows USD97,207 million in

long-term debt, and the notes disclose that this debt includes floating- and fixed-rate notes with varying

maturities.

Deferred Tax Liabilities

Deferred tax liabilities result from temporary timing differences between a company’s income as reported

for tax purposes (taxable income) and income as reported for financial statement purposes (reported

income). Deferred tax liabilities result when taxable income, and the actual income tax payable in a period

based on it, is less than the reported financial statement income before taxes and the income tax expense

based on it. Deferred tax liabilities are defined as the amounts of income taxes payable in future periods in

respect of taxable temporary differences.8 In contrast, in the previous discussion of unearned revenue,

inclusion of revenue in taxable income in an earlier period created a deferred tax asset (essentially prepaid

tax).

Rate Your Confidence

Deferred tax liabilities typically arise when some expenses are included in taxable income in earlier periods

than for financial statement net income. This results in taxable income being less than income before taxes High

in the earlier periods. As a result, taxes payable based on taxable income are less than income tax expense

based on accounting income before taxes. The difference between taxes payable and income tax expense Medium

results in a deferred tax liability—for example, when companies use accelerated depreciation methods for

Low

tax purposes and straight-line depreciation methods for financial statement purposes. Deferred tax liabilities

also arise when some income is included in taxable income in later periods—for example, when a

company’s subsidiary has profits that have not yet been distributed and thus have not yet been taxed. Continue !

SAP’s balance sheet in Exhibit 8 shows EUR240 million of deferred tax liabilities. Apple’s balance sheet in Category

Exhibit 9 does not show a separate line item for deferred tax liabilities; however, note disclosures indicate Analyzing Balance Sheets

that most of the USD40,415 million of other non-current liabilities reported on Apple’s balance sheet

represents deferred tax liabilities, which totaled USD31,504 million. r Related Questions:

Practice questions related to

Non-current liabilities will be explored in greater detail in a later learning module. this topic

Discuss " Filter #

Discussion

No messages to display

© 2024 CFA Institute. All Rights Reserved.

You might also like

- McGraw Hill Connect Question Bank Assignment 2Document2 pagesMcGraw Hill Connect Question Bank Assignment 2Jayann Danielle MadrazoNo ratings yet

- Solution Manual For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument39 pagesSolution Manual For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikMariaPetersonewjkf100% (84)

- Template Tax Provision Calculation 2021Document3 pagesTemplate Tax Provision Calculation 2021Chiara AnindaNo ratings yet

- Chapter 8: Ias 12 Income Taxes: QuestionsDocument7 pagesChapter 8: Ias 12 Income Taxes: Questionsmary100% (3)

- HD Consolidated Financials PDFDocument6 pagesHD Consolidated Financials PDFDWNo ratings yet

- Karora FS Q1 2021Document16 pagesKarora FS Q1 2021Predrag MarkovicNo ratings yet

- Colleagues CoDocument7 pagesColleagues CoKeahlyn BoticarioNo ratings yet

- Bitfarms Q4 2021 FS FinalDocument46 pagesBitfarms Q4 2021 FS FinalAlexandru IonescuNo ratings yet

- Karora Resources FS Q3 2021Document19 pagesKarora Resources FS Q3 2021prenges prengesNo ratings yet

- LPDP Financial Statements 2016Document4 pagesLPDP Financial Statements 2016Putriesti MandasariNo ratings yet

- Invested Capital Formula Excel TemplateDocument24 pagesInvested Capital Formula Excel TemplateMichael OdiemboNo ratings yet

- You Exec - Financial Statements FreeDocument13 pagesYou Exec - Financial Statements Freesk.propsearchNo ratings yet

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- Consolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Document45 pagesConsolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Fernando SeminarioNo ratings yet

- T Systems (Report)Document219 pagesT Systems (Report)Prachi SaklaniNo ratings yet

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocument2 pagesConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNo ratings yet

- Annual Report of INFOSYS LimitedDocument16 pagesAnnual Report of INFOSYS LimitedAman SinghNo ratings yet

- KRR FS Q1Document17 pagesKRR FS Q1prenges prengesNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Name of The Student: Student ID: Course: CRN: Instructor's Name: DateDocument14 pagesName of The Student: Student ID: Course: CRN: Instructor's Name: DateM shayan JavedNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Disclosure No. 507 2019 Audited Financial Statements As of December 31 2018 PDFDocument159 pagesDisclosure No. 507 2019 Audited Financial Statements As of December 31 2018 PDFJopel BasNo ratings yet

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocument5 pagesReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNo ratings yet

- Optiva Inc. Q2 2022 Financial Statements FinalDocument19 pagesOptiva Inc. Q2 2022 Financial Statements FinaldivyaNo ratings yet

- Way Finders Brands Limited: Balance Sheet As at 31 March 2017Document2 pagesWay Finders Brands Limited: Balance Sheet As at 31 March 2017Shoaib ShaikhNo ratings yet

- Practice Problems 2Document10 pagesPractice Problems 2Luigi NocitaNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Consolidated Balance SheetDocument1 pageConsolidated Balance SheetSukhmanNo ratings yet

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedDocument60 pagesPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiNo ratings yet

- Chapter 7 Problem 7Document3 pagesChapter 7 Problem 7Pamela PerezNo ratings yet

- 001 Apple-Quarterly-Balance-Sheet-1Document1 page001 Apple-Quarterly-Balance-Sheet-1hullegulkadNo ratings yet

- File 9 - Gabriel Resources Yukon - Financial Statements YE 2017Document34 pagesFile 9 - Gabriel Resources Yukon - Financial Statements YE 2017futurepatent20No ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- Syed Ali Mujtaba 14777 AfSDocument3 pagesSyed Ali Mujtaba 14777 AfSsyed ali mujtabaNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31, 2022Document307 pagesAnnual Financial Statements of Volkswagen AG As of December 31, 2022Karen NinaNo ratings yet

- Fy 17Document33 pagesFy 17vivekgandhi7k7No ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- External Financing Needed QuestionDocument1 pageExternal Financing Needed QuestionShaolin105No ratings yet

- Packaging Company FinancialsDocument7 pagesPackaging Company Financialstmir_1No ratings yet

- Financial Statements For The Half-Year ENDED 31 MAY 2022: Snowfit Group BerhadDocument12 pagesFinancial Statements For The Half-Year ENDED 31 MAY 2022: Snowfit Group BerhadJeff WongNo ratings yet

- Activity-13 GreenDocument3 pagesActivity-13 GreenLaura KissNo ratings yet

- DL 200219 Jahresabschluss Ag IsDocument198 pagesDL 200219 Jahresabschluss Ag Isdhruv jainNo ratings yet

- Coca ColaDocument10 pagesCoca ColaJelyn JagolinoNo ratings yet

- Practice Solution 2Document4 pagesPractice Solution 2Luigi NocitaNo ratings yet

- Particulars 2Document2 pagesParticulars 2AshwinNo ratings yet

- 2017 Year End FinancialsDocument37 pages2017 Year End FinancialsFryan GreenhousegasNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- MISODocument26 pagesMISOOka IndraNo ratings yet

- 2022 Full Year Balance SheetDocument2 pages2022 Full Year Balance Sheetmathewalina225No ratings yet

- The Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDocument3 pagesThe Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDeloresNo ratings yet

- Choose The Best Answer Out of The Available Options For Each QuestionDocument2 pagesChoose The Best Answer Out of The Available Options For Each QuestionSambhav TripathiNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- Sample 10KDocument29 pagesSample 10KabhishekNo ratings yet

- 6 Supplementary Accounting StatementDocument11 pages6 Supplementary Accounting StatementNithinMannepalliNo ratings yet

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- Paul R. Castro ACIEM - CastoDocument51 pagesPaul R. Castro ACIEM - CastoJhon NarvaezNo ratings yet

- Colleagues Co. Statement of Financial Statements December 31, 20X1Document6 pagesColleagues Co. Statement of Financial Statements December 31, 20X1Keahlyn BoticarioNo ratings yet

- Class Problem: 2Document7 pagesClass Problem: 2Riad FaisalNo ratings yet

- 4801-Article Text-19217-1-10-20110701Document8 pages4801-Article Text-19217-1-10-20110701David BriggsNo ratings yet

- Bài tập chủ đề 6Document7 pagesBài tập chủ đề 6thanhtrucNo ratings yet

- Bav T2Document122 pagesBav T2AviralNo ratings yet

- Practical Accounting 1Document18 pagesPractical Accounting 1Unknown WandererNo ratings yet

- IAS 12 - Bai TapDocument15 pagesIAS 12 - Bai TapHuỳnh Minh Gia HàoNo ratings yet

- Hanlon Heitzman 2010Document53 pagesHanlon Heitzman 2010vita cahyanaNo ratings yet

- Chapter 7 - Forecasting Financial StatementsDocument23 pagesChapter 7 - Forecasting Financial Statementsamanthi gunarathna95No ratings yet

- Homework Week 7Document147 pagesHomework Week 7Marjorie PalmaNo ratings yet

- Intermediate 3 Blend. (AutoRecovered)Document72 pagesIntermediate 3 Blend. (AutoRecovered)Cherwin bentulanNo ratings yet

- PAS 12 - Income Tax - AssignmentDocument8 pagesPAS 12 - Income Tax - Assignmentviva nazarenoNo ratings yet

- Materi - INCOME TAX ACCOUNTING - 26march2021Document18 pagesMateri - INCOME TAX ACCOUNTING - 26march2021Septian Dwi AnggoroNo ratings yet

- Psab LK TW Ii 2022Document114 pagesPsab LK TW Ii 2022Sitti HardiyantiNo ratings yet

- Income Taxes, Unusual Income Tax Items, and Investments in StocksDocument68 pagesIncome Taxes, Unusual Income Tax Items, and Investments in StocksPutri Amelia Kusuma TaheryNo ratings yet

- FAR04-13 - Income TaxesDocument6 pagesFAR04-13 - Income TaxesAi NatangcopNo ratings yet

- Ias 12Document69 pagesIas 12Md SaifulNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- Problems 1Document37 pagesProblems 1ace zero50% (6)

- Consolidated Financial Statements - Ownership Patterns and Income TaxesDocument33 pagesConsolidated Financial Statements - Ownership Patterns and Income Taxeslukring20100% (1)

- FR 知识点串讲(二)Document25 pagesFR 知识点串讲(二)周于No ratings yet

- Sfas 109-EeDocument132 pagesSfas 109-EekyougiNo ratings yet

- Chapter 3 - Overview of Accounting AnalysisDocument21 pagesChapter 3 - Overview of Accounting AnalysisYong Ren100% (1)

- PT Panca Mitra Multiperdana - TBK - 31 Mar 22Document101 pagesPT Panca Mitra Multiperdana - TBK - 31 Mar 22ThunderMiloNo ratings yet

- Mock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: RatingDocument14 pagesMock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: RatingMichelle Ann Langbis VinoyaNo ratings yet

- MINI CASE 3-Deferred Tax - A201 - StudentDocument3 pagesMINI CASE 3-Deferred Tax - A201 - Studentdini sofiaNo ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Ch19 Income TaxDocument7 pagesCh19 Income TaxVioni HanifaNo ratings yet

- MFRS 112 042015 PDFDocument44 pagesMFRS 112 042015 PDFAisyah JaafarNo ratings yet