Professional Documents

Culture Documents

Schoemakerand Russo 2014 Decision Making Palgrave Encyclopedia

Schoemakerand Russo 2014 Decision Making Palgrave Encyclopedia

Uploaded by

sozibulibmchrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schoemakerand Russo 2014 Decision Making Palgrave Encyclopedia

Schoemakerand Russo 2014 Decision Making Palgrave Encyclopedia

Uploaded by

sozibulibmchrCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/320042464

decision-making

Article · January 2014

DOI: 10.1057/9781137294678.0160

CITATIONS READS

10 157,976

1 author:

J. Edward Russo

Cornell University

98 PUBLICATIONS 8,666 CITATIONS

SEE PROFILE

All content following this page was uploaded by J. Edward Russo on 26 September 2017.

The user has requested enhancement of the downloaded file.

decision-making

Paul J. H. Schoemaker; J. Edward Russo

DOI: 10.1057/9781137294678.0160

Palgrave Macmillan

decision-making which may strain the adequacy of the heuristics

employed to achieve approximate rationality. Com-

Definition

Decision-making is the process whereby an individual,

plexity often creates unwelcome biases in the decision-

group or organization reaches conclusions about what making process. A well-known example is the sunk

future actions to pursue given a set of objectives and limits cost fallacy and the related phenomenon of escalating

on available resources. This process will be often iterative, commitment to existing courses of action (Schultze,

involving issue-framing, intelligence-gathering, coming to Pfeiffer and Schulz-Hardt, 2012). Psychologically,

conclusions and learning from experience. losses – especially those that are quantified and

recorded such as write-offs of major investments –

Abstract

This entry aims to connect behavioural research on

loom larger than comparable gains or opportunity

decision-making over a number of decades to the field of costs (Kahneman and Tversky, 1979). Also, as firms

Copyright material from www.palgraveconnect.com - licensed to Wilmington University - PalgraveConnect - 2015-07-14

strategic management. This intersection has not been as grow, strategic decisions are more likely to encounter

fully developed as it could be and hence presents rich internal political and organizational constraints that

opportunities for improving strategic decision-making in exclude creative perspectives while highlighting more

and by organizations. We shall cover both individual and routine ones. For example, the relevant competitors

organizational findings using our four-phased decision may be defined as just domestic ones (as the car

framework (Russo and Schoemaker, 2002), with special makers in Detroit once did). Or the time frame may be

links to the domain of strategic decisions. These include limited to just five years (when examining future

corporate strategic choices as well as adopting a strategic technological trends). Furthermore, which committee

approach to making tactical and even operational decisions

will evaluate various investments, in what sequence

in organizations.

and at what time may matter greatly (Bower, 1971).

Multiple views exist about strategic decision-making

Cognitive biases

in complex firms, from rational, top-down perspec-

The remainder of this entry will focus on cognitive

tives to incremental and power-based ones (see

sources of poor decision-making, while fully recog-

Schoemaker, 1993). The rational unitary actor model

nizing that many emotional factors influence the

posits that organizations carefully scan their environ-

decision process as well (Kets de Vries and Miller,

ment and objectively match external opportunities

1987; Weber and Johnson, 2009). We view the deci-

with internal strengths. By contrast, the organiza-

sion process as consisting of four key phases:

tional view emphasizes that even though these may

(1) framing, (2) intelligence-gathering, (3) choice and

be the intentions of individual actors, the design of

(4) learning from feedback. In addition, there is the

the organization (in terms of structure and process)

important meta-decision stage. It overarches the four

greatly influences what is perceived, encoded and

phases just mentioned, posing such questions as:

acted upon. The political view especially questions

(i) are we solving the right problem, (ii) who should be

the intended collective rationality of organizational

involved in the decision and (iii) which of the above

actors and frames them as coalitional in nature.

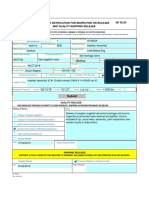

four phase(s) deserves the most attention? Figure 1

Stronger groups will often enhance their power and

charts this model of decision-making based on Russo

interests at the expense of the minority or even the

and Schoemaker (2002). The accounting and finance

firm’s overall well-being (Allison, 1971). Lastly, some

functions are traditionally strong in addressing the

scholars view the organization as entangled in its own

choice or ranking phase, while leaving idea generation

inner complexity, with limited coping routines and a

and framing more to other disciplines and functions,

high degree of context-sensitivity. The garbage can

such as marketing and strategy.

model (Cohen, March and Olsen, 1972) posits that

what happens and why in organizations depends

greatly on the vagaries of the moment, that is to say Framing

the actors involved, the timing of the decision, hidden It is useful to distinguish between decision frames and

agendas, information flows and other details in the thinking frames. Decision frames define the acts,

mosaic of organizational life. contingencies and outcomes as perceived by the

As firms become large and highly structured, they decision maker (Tversky and Kahneman, 1986).

must manage increasingly complex decision processes, Thinking frames concern the deeper cognitive

r Palgrave Publishers Ltd 1

10.1057/9781137294678.0160 - decision-making, Paul J. H. Schoemaker and J. Edward Russo

decision-making

Paul J. H. Schoemaker; J. Edward Russo

decision-making DOI: 10.1057/9781137294678.0160

Palgrave Macmillan

Learning Framing

from the

experience issues

The meta-decision

(deciding how to decide)

Coming to Gathering

Copyright material from www.palgraveconnect.com - licensed to Wilmington University - PalgraveConnect - 2015-07-14

conclusions intelligence

Source: Russo and Schoemaker (2002)

Figure 1 Phases of the decision process

structures, such as knowledge bases, scripts, schemata, knowledge, that is not knowing what we don’t know

cognitive maps and inference mechanisms that shape (Kahneman, Slovic and Tversky, 1982; Klayman et al.,

the decision frame. Key aspects of the decision frame 1999). This can be partly cured through repeated

are its boundaries (for example, region, time and feedback (e.g., in weather forecasting and bridge) or

market scope), reference points (for instance, required attempts to challenge key premises via reason gen-

rates of returns, performance benchmarks, relevant eration, fault trees or scenario construction (Russo

competitors) and metrics (such as return on invest- and Schoemaker, 1992). The overconfidence bias is

ment, market share and measures of product quality). especially likely to plague decisions for which little

Many firms use their own past performance, or data exist and in which judgement must necessarily

that of close competitors, as the relevant reference play a major role. The key is to know when to distrust

point for judging their success. Such myopic framing one’s intuitions and how to bring key assumptions to

plagued much UK industry in the 1970s as the surface (Mason and Mitroff, 1981), especially in

well as the automobile manufacturers in Detroit. small groups (Janis, 1982).

A more subtle framing issue in new technology Reliance on heuristics (that is, short-cuts that

decisions concerns the ‘don’t invest’ option, which simplify complex judgements) is unavoidable in

often assumes a continuation of current trends as its many cases. For instance, future market share or

reference point (Kaplan, 1986). This static view, interest rates may be predicted from current values.

however, ignores the actions of competitors which However, often such anchors drag the judgement,

will likely erode the status quo. Game theory, as well resulting in an underestimation of change (Tversky

as shifting the metaphor (e.g., towards biological and Kahneman, 1974) and hence conservatism. In

evolution), can help challenge such myopic frames. stable times, managerial heuristics (in such areas as

The failure to adopt a portfolio perspective is another pricing, hiring, forecasting) often strike an effi-

notable framing bias of the behavioural decision lit- cient balance between accuracy and information-

erature (see Thaler, 1980); each decision is addressed processing cost. During periods of discontinuity,

in isolation of others. many established rules of thumb become outdated

and dangerous when accepted as truth. Thus, firms

may be burdened with inappropriate mental software

Intelligence-gathering when exploring the promises and pitfalls of new

Primary biases in this phase are (1) the tendency investments (Schoemaker, 1990).

towards OVERCONFIDENCE, (2) reliance on flawed Out-of-date heuristics may persist because of

heuristics in estimation and (3) a preference for the third bias mentioned: the failure to search for

confirming over disconfirming evidence. Over- disconfirming evidence. Managers seldom approach

confidence or hubris reflects poor secondary their inference- and hypothesis-testing tasks with a

2 r Palgrave Publishers Ltd

10.1057/9781137294678.0160 - decision-making, Paul J. H. Schoemaker and J. Edward Russo

decision-making

Paul J. H. Schoemaker; J. Edward Russo

DOI: 10.1057/9781137294678.0160 decision-making

Palgrave Macmillan

mindset aimed at disproving received wisdom. flexibility, informality and a tolerance of failure –

Aversion to contrary evidence and institutionalized must largely be suppressed to deliver reliable results

filtering reinforce old beliefs and habits. Often, a new and reduce performance variance. If so, the firm’s

generation of managers or successful start-up com- short-term performance may be optimized at the

petitors are needed before adaptation to changing expense of its long-term survival prospects, due to

circumstances can occur. lack of requisite variety (Ashby, 1956). Balancing

exploitation and exploration (March, 1988) is a major

Choice challenge in most companies.

Of the four phases of decision-making, choice may be Various obstacles plague learning from experience.

on the firmest analytic ground. Net present value They range from rationalization and ego defences to

(NPV) analysis imposes considerable discipline on incomplete or confounded feedback (see Russo and

Copyright material from www.palgraveconnect.com - licensed to Wilmington University - PalgraveConnect - 2015-07-14

calculations that would otherwise overwhelm human Schoemaker, 2002). Since organizations may make only

intuition. Nonetheless, this tool requires unbiased a small number of truly strategic decisions within any

inputs to yield its supposed benefits. Much of finance given management generation, they encounter the

theory addresses how to set the discount rate to problem of infrequent feedback and, probably, a lack of

reflect a project’s cost of capital and systematic risk, independence in the outcomes. This suggests that

but offers little guidance on how to estimate cash outcome feedback will be noisy and limited, and that

flows or the value of downstream options. In addi- the emphasis should shift to process feedback. This

tion, the problem may not be just the valuation of requires examining how the decision was arrived at in

alternatives explicitly considered, but restricting the terms of premises, data sets, choice procedures, incen-

firm unduly to a narrow set of innovation options. tive alignments, implementation and so on. Gulliver

Numerous informal choices are made along the (1987) provides a practical example of the kind of

convoluted path of project idea to formal evaluation, ‘decision auditing’ from which firms can benefit.

both individually and in small groups. Although post-mortems are a great way to learn

One factor especially complicates strategic choices, from mistakes, the ultimate aim is to convert lessons

namely people’s natural aversion to ambiguity. In learned the hard way into pre-mortems (Kahneman

rational models of choice, ambiguity should not and Klein, 2009). Ex ante learning requires a culture

matter. Uncertainty (in the sense of second-order that permits mistakes and diversity. For example,

probability distributions) and even ambiguity (in learning about new technologies may require a new

the sense of ill-defined probability distributions) is organizational unit separate from the mainstream

ignored by integrating over a presumed subjective business or technology. IBM adopted this path, for

probability distribution – defined on the target prob- instance, when developing its PC, as did General

ability. Behaviourally, however, people tend to prefer a Motors (GM) for its Saturn project. Such separation

known probability over an unknown one of equal is one way to resolve the inherent conflict between

mathematical expectation (Ellsberg, 1961; Einhorn the performance and learning cultures in organiza-

and Hogarth, 1986). Thus, projects entailing high tions (Senge, 1990). To optimize performance over

ambiguity – stemming from either technological or the next few periods, the firm should exploit what it

market uncertainties – are likely to be systematically knows best. To maximize its long-term survival, the

undervalued in people’s informal screening of projects. firm must extend its capabilities through exploration.

In addition, the customary insistence of large firms on Long-term success may require short-term sacrifices.

formal, numerical justification of investments, bodes Managing this trade-off well requires an ambidex-

ill for high-ambiguity projects whose risk parameters trous organization (O’Reilly and Tushman, 2004),

– by definition – are hard to estimate objectively. including a strong willingness to challenge the very

mental models that made the firm successful.

Learning PAUL J. H. SCHOEMAKER AND J. EDWARD RUSSO

A strong emphasis on the performing organization –

as is typical in most companies – often occurs at the See also

expense of the learning organization (Senge, 1990). BEHAVIOURAL THEORY OF THE FIRM; INFORMATION AND KNOWLEDGE;

Those characteristics that enabled the firm to find a LEARNING AND ADAPTATION; ORGANIZATIONAL LEARNING; OVERCONFIDENCE;

profitable niche in the first place – such as creativity, RESOURCE ALLOCATION THEORY

r Palgrave Publishers Ltd 3

10.1057/9781137294678.0160 - decision-making, Paul J. H. Schoemaker and J. Edward Russo

decision-making

Paul J. H. Schoemaker; J. Edward Russo

decision-making DOI: 10.1057/9781137294678.0160

Palgrave Macmillan

References you ask. Organizational Behavior and Human Decision

Allison, G. T. 1971. Essence of Decisions: Explaining the Cuban Processes 79, 216–247.

Missile Crisis. Boston, MA: Little, Brown. March, J. G. 1988. Decisions and Organizations. Oxford: Basil

Ashby, W. R. 1956. Introduction to Cybernetics. New York: Blackwell.

Wiley. Mason, R. O. and Mitroff, I. I. 1981. Challenging Strategic

Bower, J. L. 1971. Managing the Resource Allocation Process. Planning Assumptions. Chichester: Wiley-Interscience.

Cambridge, MA: Harvard University Press. O’Reilly, C. A. and Tushman, M. 2004. The ambidextrous

Cohen, M. D., March, J. G. and Olsen, J. P. 1972. A garbage organization. Harvard Business Review 82, 74–83.

can model of organizational choice. Administrative Science Russo, J. E. and Schoemaker, P. J. H. 1992. Managing

Quarterly 17, 1–25. overconfidence. Sloan Management Review 33, 7–17.

Einhorn, H. and Hogarth, R. 1986. Decision making under Russo, J. E. and Schoemaker, P. J. H. 2002. Winning Decisions:

ambiguity. Journal of Business 59, S225–S250. Getting it Right the First Time. New York: Doubleday.

Ellsberg, D. 1961. Risk, ambiguity and the savage axioms. Schoemaker, P. J. H. 1990. Strategy, complexity and economic

Copyright material from www.palgraveconnect.com - licensed to Wilmington University - PalgraveConnect - 2015-07-14

Quarterly Journal of Economics 75, 643–669. rent. Management Science 36, 1178–1192.

Gulliver, F. 1987. Post-project appraisals pay. Harvard Business Schoemaker, P. J. H. 1993. Strategic decisions in organizations.

Review 65, 128–132. Journal of Management Studies 30, 107–129.

Janis, I. 1982. Groupthink. Boston, MA: Houghton Mifflin. Schultze, T., Pfeiffer, F. and Schulz-Hardt, S. 2012. Biased

Kahneman, D. and Klein, G. 2009. Conditions for intuitive information processing in the escalation paradigm. Journal of

expertise: a failure to disagree. American Psychologist 64, Applied Psychology 97, 16–32.

515–526. Senge, P. M. 1990. The leader’s new work: building learning

Kahneman, D. and Tversky, A. 1979. Prospect theory. organizations. Sloan Management Review 19, 7–23.

Econometrica 47, 263–292. Thaler, R. H. 1980. Towards a positive theory of consumer

Kahneman, D., Slovic, P. and Tversky, A. eds. 1982. Judgment choice. Journal of Economic Behavior & Organization 1,

under Uncertainty: Heuristics and Biases. New York: 39–60.

Cambridge University Press. Tversky, A. and Kahneman, D. 1974. Judgment under

Kaplan, R. S. 1986. Must CIM be justified by faith alone? uncertainty: heuristics and biases. Science 185, 1124–1131.

Harvard Business Review 64, 87–95. Tversky, A. and Kahneman, D. 1986. Rational choice and the

Kets de Vries, M. F. R. and Miller, D. 1987. Unstable at the framing of decisions. Journal of Business 59, S251–S284.

Top. New York: NAL Books. Weber, E. U. and Johnson, E. J. 2009. Mindful judgment and

Klayman, J., Soll, J. B., Gonzalez-Vallejo, C. and Barlas, S. decision making. Annual Review of Psychology 60, 53–85.

1999. Overconfidence: it depends on how, what, and whom

4 r Palgrave Publishers Ltd

View publication stats

10.1057/9781137294678.0160 - decision-making, Paul J. H. Schoemaker and J. Edward Russo

You might also like

- 7 Principles of Financial ManagementDocument2 pages7 Principles of Financial ManagementUlfandari Yudianti87% (30)

- Elements of Decision Making Process PDFDocument20 pagesElements of Decision Making Process PDFGeo ManilaNo ratings yet

- Company Name First Name Last NameDocument3 pagesCompany Name First Name Last NameSheel ThakkarNo ratings yet

- Aaaaaaaaa AaaaaaaaaaaaaaaaaaaaaaaaaaDocument8 pagesAaaaaaaaa AaaaaaaaaaaaaaaaaaaaaaaaaaAhmed Mohamud MayorNo ratings yet

- Guler - ASQ 2007 - Throwing Good Money After Bad. Sequential Decision Making in VC (3856)Document39 pagesGuler - ASQ 2007 - Throwing Good Money After Bad. Sequential Decision Making in VC (3856)timhaus85No ratings yet

- A Review of The Relationship Between TMT Shared Co PDFDocument10 pagesA Review of The Relationship Between TMT Shared Co PDFsebastian ariasNo ratings yet

- Laroche, Hervé - From Decision To Action in Organizations - Decision-Making As A Social (1995)Document16 pagesLaroche, Hervé - From Decision To Action in Organizations - Decision-Making As A Social (1995)isabelatitiNo ratings yet

- Bantel 1989Document18 pagesBantel 1989Hellman PriambodoNo ratings yet

- Journal of Business Research: Harriette Bettis-OutlandDocument3 pagesJournal of Business Research: Harriette Bettis-OutlandJacobo EluaniNo ratings yet

- Saaty How To Make A Decision The Analytic Hirearchy ProcessDocument26 pagesSaaty How To Make A Decision The Analytic Hirearchy ProcessBarney LundNo ratings yet

- OC - 8 Decision Making ProcessDocument18 pagesOC - 8 Decision Making ProcessSeemar Babar 512-FSS/MSMC/F22No ratings yet

- The Structure of Unstructured Decision ProcessesDocument31 pagesThe Structure of Unstructured Decision ProcessesMüslüm AkbaşNo ratings yet

- Character Formation With Leadershop, Decision Making, Management and Administration (CFLM 2)Document48 pagesCharacter Formation With Leadershop, Decision Making, Management and Administration (CFLM 2)Eddie Mamusog Awit100% (4)

- Role of Extra Sensory Perception ESP in Managerial PDFDocument7 pagesRole of Extra Sensory Perception ESP in Managerial PDFClarky GueruelaNo ratings yet

- Functional and Dysfuntional ConflictDocument27 pagesFunctional and Dysfuntional ConflictBancy NyawiraNo ratings yet

- Decision MakingDocument43 pagesDecision MakingSuzyNo ratings yet

- Character Formation With Leadershop, Decision Making, Management and Administration (CFLM 2) Prepared By: Jejie M. Awit., LPTDocument22 pagesCharacter Formation With Leadershop, Decision Making, Management and Administration (CFLM 2) Prepared By: Jejie M. Awit., LPTEddie Mamusog Awit100% (3)

- Thomas L. Saaty How To Make A Decision The Analytic Hierarchy ProcDocument31 pagesThomas L. Saaty How To Make A Decision The Analytic Hierarchy ProcroosNo ratings yet

- Pre Print Adam Ledunois Damart GDN Handbook2019Document13 pagesPre Print Adam Ledunois Damart GDN Handbook2019irdhina.harithNo ratings yet

- Decision 1Document1 pageDecision 1lulu mkwananziNo ratings yet

- Salas Rosen Diaz Granados Jom 2009Document32 pagesSalas Rosen Diaz Granados Jom 2009Ana Roisyatul ArifahNo ratings yet

- Organizational Design: A Contingency Approach: Business Horizons February 1973Document20 pagesOrganizational Design: A Contingency Approach: Business Horizons February 1973Arte ZaragozaNo ratings yet

- Lecture 2 LSC-6 Strategic Desisions 22-23Document16 pagesLecture 2 LSC-6 Strategic Desisions 22-23nebyatgeeNo ratings yet

- Evidence-Based Organizational LearningDocument25 pagesEvidence-Based Organizational LearningHazem El BannaNo ratings yet

- Frederickson 1986Document19 pagesFrederickson 1986Nauman AsgharNo ratings yet

- Decision-Making in Organizations: Approaches To More Effective AnalysisDocument12 pagesDecision-Making in Organizations: Approaches To More Effective AnalysischaitanyasamantNo ratings yet

- St4S39-V1 Systems Thinking Assessment Essay 1: by Joseph Wabwire (Id Number: 74108522/)Document19 pagesSt4S39-V1 Systems Thinking Assessment Essay 1: by Joseph Wabwire (Id Number: 74108522/)Joseph Arthur100% (7)

- Strategic Decision MakingDocument22 pagesStrategic Decision MakingpopboymeNo ratings yet

- Effective Strategic Decision Making: Cezar VasilescuDocument6 pagesEffective Strategic Decision Making: Cezar VasilescuukalNo ratings yet

- Academy of Management Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Academy of Management JournalDocument39 pagesAcademy of Management Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Academy of Management Journalsongül ÇALIŞKANNo ratings yet

- McKay and Chia - AMJ 2013Document24 pagesMcKay and Chia - AMJ 2013chickensaregood9No ratings yet

- Strategic Decision-Making Processes: Beyond The Efficiency-Consensus TradeoffDocument50 pagesStrategic Decision-Making Processes: Beyond The Efficiency-Consensus TradeoffamanNo ratings yet

- Sage Publications, Inc. Johnson Graduate School of Management, Cornell UniversityDocument26 pagesSage Publications, Inc. Johnson Graduate School of Management, Cornell UniversityAnyeliz RodriguezNo ratings yet

- Systematic Biases and Culture in Project Failures Barry Shore 2008Document12 pagesSystematic Biases and Culture in Project Failures Barry Shore 2008evanw6666No ratings yet

- Decision Making in Organizations & TechniquesDocument9 pagesDecision Making in Organizations & TechniquesRahul SainiNo ratings yet

- Hart IntegrativeFrameworkStrategyMaking 1992Document26 pagesHart IntegrativeFrameworkStrategyMaking 1992onealnilaNo ratings yet

- Garbage Can ModelDocument26 pagesGarbage Can ModelDominique NunesNo ratings yet

- Michael D. Cohen, James G. March and Johan P. Olsen - Garbage Model PDFDocument26 pagesMichael D. Cohen, James G. March and Johan P. Olsen - Garbage Model PDFJack000123No ratings yet

- Europeana - Eu 2048425 Item - JFIUOSWS7BYUUTTZLRCQYU7B7U4WECTSDocument51 pagesEuropeana - Eu 2048425 Item - JFIUOSWS7BYUUTTZLRCQYU7B7U4WECTSŽeljko BušljetaNo ratings yet

- Economic Crisis and The Centralization ofDocument24 pagesEconomic Crisis and The Centralization ofpedro.carvalhomartinsguedeNo ratings yet

- Cuban Missile Decision MakingDocument23 pagesCuban Missile Decision MakingDavinder SinghNo ratings yet

- Management Science May 1987 33, 5 ABI/INFORM GlobalDocument3 pagesManagement Science May 1987 33, 5 ABI/INFORM GlobalNabeel ChishtiNo ratings yet

- Article On Decision Making PDFDocument15 pagesArticle On Decision Making PDFUmm E Farwa KhanNo ratings yet

- Stanek Theoretical Cer-2013-0007Document20 pagesStanek Theoretical Cer-2013-0007NagabhushanaNo ratings yet

- Lecture 9 - PMS 4001Document84 pagesLecture 9 - PMS 4001wenbaolong9No ratings yet

- Johnson Graduate School of Management, Cornell University Is Collaborating With JSTOR To Digitize, PreserveDocument21 pagesJohnson Graduate School of Management, Cornell University Is Collaborating With JSTOR To Digitize, PreserveJINGO404No ratings yet

- An Overview of Foresight Methodologies 1Document10 pagesAn Overview of Foresight Methodologies 1Anuta CostinelNo ratings yet

- Victor Broom ScientistDocument11 pagesVictor Broom ScientistAnil Kumar SharmaNo ratings yet

- Emergent Learning: A Framework For Whole-System Strategy, Learning, and AdaptationDocument16 pagesEmergent Learning: A Framework For Whole-System Strategy, Learning, and Adaptationrenata.saavedraNo ratings yet

- A Framework For Strategic Decision MakingDocument14 pagesA Framework For Strategic Decision MakingLukemeister99No ratings yet

- Making Decisions Literature ReviewDocument8 pagesMaking Decisions Literature ReviewRenz Carlo CardenasNo ratings yet

- Kathleen M. Eisenhardt and Mark J. Zbaracki 1992Document22 pagesKathleen M. Eisenhardt and Mark J. Zbaracki 1992Nguyệt LưuNo ratings yet

- The University of Chicago Press The Journal of BusinessDocument22 pagesThe University of Chicago Press The Journal of BusinessNélopes SerotraNo ratings yet

- Decision Making and Support Systems - Comparing American, Japanese and Chinese Management - Martinsons2007 PDFDocument17 pagesDecision Making and Support Systems - Comparing American, Japanese and Chinese Management - Martinsons2007 PDFminh duongNo ratings yet

- Decision-Making: Laguna State Polytechnic UniversityDocument6 pagesDecision-Making: Laguna State Polytechnic UniversityCristina GomezNo ratings yet

- Cynefin Statistics and Decision AnalysisDocument16 pagesCynefin Statistics and Decision AnalysisQian ChenNo ratings yet

- Improving The Generation of Decision ObjectivesDocument19 pagesImproving The Generation of Decision ObjectivesLinh PhạmNo ratings yet

- Strategy Formulation Processes Differences in Perceptions of Strength and Weaknesses Indicators and Environmental Uncertainty by Managerial LevelDocument18 pagesStrategy Formulation Processes Differences in Perceptions of Strength and Weaknesses Indicators and Environmental Uncertainty by Managerial LevelamaniNo ratings yet

- 776 - Organizational Behaviour-Pearson Education Limited (2020)Document5 pages776 - Organizational Behaviour-Pearson Education Limited (2020)mozam haqNo ratings yet

- Bab 4 Adoption: From Exploration To Decision-Making: Teknologi Informasi Dan KomunikasiDocument11 pagesBab 4 Adoption: From Exploration To Decision-Making: Teknologi Informasi Dan KomunikasiSyahwa RamadhanNo ratings yet

- Effective Group Problem Solving: How to Broaden Participation, Improve Decision Making, and Increase Commitment to ActionFrom EverandEffective Group Problem Solving: How to Broaden Participation, Improve Decision Making, and Increase Commitment to ActionNo ratings yet

- Post Graduate StudentDocument5 pagesPost Graduate StudentHatem HusseinNo ratings yet

- Calling ScriptDocument4 pagesCalling ScriptNikhil MahajanNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingChris Aruh BorsalinaNo ratings yet

- AAADocument5 pagesAAApatel avaniNo ratings yet

- Procure To Pay (P2P) ProcessDocument8 pagesProcure To Pay (P2P) ProcessLipu MohapatraNo ratings yet

- Suggested CAP II Group I June 2023Document43 pagesSuggested CAP II Group I June 2023pratyushmudbhari340No ratings yet

- Courtesy by MODEC, Inc. Courtesy by MODEC, Inc.: The Yokohama Rubber Co., LTDDocument2 pagesCourtesy by MODEC, Inc. Courtesy by MODEC, Inc.: The Yokohama Rubber Co., LTDlalitNo ratings yet

- Vinayak R. Mithbavkar: & ManagementDocument2 pagesVinayak R. Mithbavkar: & ManagementArnab DasNo ratings yet

- Alnuaimi, A. S., & Mohsin, M. (2013) - Causes of Delay in Completion of Construction Projects in OmanDocument4 pagesAlnuaimi, A. S., & Mohsin, M. (2013) - Causes of Delay in Completion of Construction Projects in OmandimlouNo ratings yet

- CV Chanda DubaiDocument3 pagesCV Chanda Dubaibarkha.tinnani786No ratings yet

- Tourism: The Business of Hospitality and TravelDocument33 pagesTourism: The Business of Hospitality and TravelNajla Nabila AurelliaNo ratings yet

- Report On Total Quality ManagementDocument20 pagesReport On Total Quality Managementfaiza bhattiNo ratings yet

- Nasrullah March23Document11 pagesNasrullah March23Angellin JoiceNo ratings yet

- A037726 Rotor QADocument178 pagesA037726 Rotor QAAndhika PratamaNo ratings yet

- MPR Nh-47 Cbe August-2023Document11 pagesMPR Nh-47 Cbe August-2023s.sureshshanmugavelNo ratings yet

- RFQ COSPR-183642199-A - Qradar Support RenewalDocument2 pagesRFQ COSPR-183642199-A - Qradar Support RenewalAyesha ShahzadNo ratings yet

- Chapter 1 - Fundamentals of Logistics and Supply Chain ManagementDocument29 pagesChapter 1 - Fundamentals of Logistics and Supply Chain ManagementTrần KhangNo ratings yet

- Class 12 Unit 2 Principles of ManagementDocument10 pagesClass 12 Unit 2 Principles of Managementdeepanshu kumarNo ratings yet

- Chapter One Basic Concepts of Supply Chain Management: Customer Supplier ManufacturerDocument80 pagesChapter One Basic Concepts of Supply Chain Management: Customer Supplier ManufacturerYONASNo ratings yet

- Social ManagementDocument36 pagesSocial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- Manali To Srinagar Team Captain FileDocument14 pagesManali To Srinagar Team Captain FileFareed ExtraNo ratings yet

- External Factor EvaluationDocument4 pagesExternal Factor Evaluationhabtamu yilmaNo ratings yet

- OD CIG 024 December 2020Document22 pagesOD CIG 024 December 2020Richard EddingtonNo ratings yet

- Accrual Engine in S4 HANA 1909 - Manual Accrual & How It Is Processed Periodically - Part 1 - SAP BlogsDocument24 pagesAccrual Engine in S4 HANA 1909 - Manual Accrual & How It Is Processed Periodically - Part 1 - SAP Blogssekhar dattaNo ratings yet

- 12 - Consolidated Financial Statement (July 23) 1Document474 pages12 - Consolidated Financial Statement (July 23) 1Shaheryar ShahidNo ratings yet

- Managerial Accounting 3rd Edition Whitecotton Solutions ManualDocument42 pagesManagerial Accounting 3rd Edition Whitecotton Solutions Manualsestetto.vitoe.d4rcv4100% (24)

- Functions of Management-18-27Document10 pagesFunctions of Management-18-27AnggitNo ratings yet

- Primavera Pre Sales 225Document19 pagesPrimavera Pre Sales 225zuka jincharadzeNo ratings yet