Professional Documents

Culture Documents

Statement 20211105

Statement 20211105

Uploaded by

jennymccarthy11Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement 20211105

Statement 20211105

Uploaded by

jennymccarthy11Copyright:

Available Formats

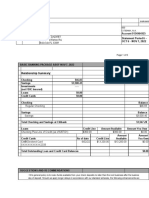

Your Statement

Statement 3 (Page 1 of 2)

Account Number 06 3097 41845428

041

Statement

MRS J MCCARTHY Period 1 Oct 2021 - 5 Nov 2021

4 BROOKTON CT

Closing Balance Nil

HELENSVALE QLD 4212

Enquiries 13 2221

GoalSaver

GoalSaver rewards you with bonus interest for saving regularly, helping you reach your savings goal sooner.

You will earn bonus interest when you grow your savings balance (excluding interest and bank initiated

transactions) each calendar month. You also get 1 fee free assisted withdrawal each month.

Name: JENNY MCCARTHY

Note: Have you checked your statement today? It's easy to find out more information about each of your

transactions by logging on to the CommBank App or NetBank. Should you have any questions on

fees or see an error please contact us on the details above. Cheque proceeds are available when

cleared.

*#* 7059.20787.1.1 ZZ258R3 0303 SL.R3.S931.D309.O V06.00.34

Looks like you haven’t used this account for 6 months now. We figured you didn’t need it anymore so we’ve

closed it for you. If you would like to open another account or want more information about other accounts

which might suit you better, please drop into any of our branches or call 13 2221, 24 hours a day, 7 days a

week. You continue to owe the Commonwealth Bank the outstanding residual debt, if any, indicated on this

account closure statement. Commonwealth Bank reserves all of its rights and entitlements in respect of any

outstanding residual debt.

The date of transactions shown here may be different on your other transaction lists (for example, the transaction list that

appears on the CommBank app).

Date Transaction Debit Credit Balance

01 Oct 2021 OPENING BALANCE Nil

05 Nov 2021 CLOSING BALANCE Nil

Opening balance - Total debits + Total credits = Closing balance

Nil Nil Nil Nil

Your Credit Interest Rate Summary

Date Balance Standard Bonus With

Interest Rate (p.a.) Bonus

Rate (p.a.) Interest

(p.a.)

01 Oct Less than $50,000.00 0.05% 0.25%# 0.30%#

$50,000.00 - $249,999.99 0.05% 0.25%# 0.30%#

$250,000.00 - $999,999.99 0.05% 0.25%# 0.30%#

$1,000,000.00 and over 0.05% 0.25%# 0.30%#

Statement 3 (Page 2 of 2)

Account Number 06 3097 41845428

Your Credit Interest Rate Summary cont.

Date Balance Standard Bonus With

Interest Rate (p.a.) Bonus

Rate (p.a.) Interest

(p.a.)

20 Oct Less than $50,000.00 0.05% 0.20%# 0.25%#

$50,000.00 - $249,999.99 0.05% 0.20%# 0.25%#

$250,000.00 - $999,999.99 0.05% 0.20%# 0.25%#

$1,000,000.00 and over 0.05% 0.20%# 0.25%#

#From 1 May 2017, interest was paid on the portion of the balance that fell within each balance band. From 1 May 2020, one interest rate

applies to your whole balance, the rate depends on your account balance. The standard variable interest rate will apply regardless of the

bonus interest criteria being met or not.

Note. Interest rates are effective as at the date shown but are subject to change.

Transaction Summary during 1st September 2021 to 5th November 2021

Transaction Type 01 Sep 01 Oct 01 Nov Free Chargeable Unit Fee

to to to Price Charged

30 Sep 31 Oct 05 Nov

7059.20787.1.1 ZZ258R3 0303 SL.R3.S931.D309.O V06.00.34

Staff assisted withdrawals+ 0 0 0 0 0 $3.00 $0.00

Account Fee $0.00 $0.00

Paper Statement Fee $2.50 $0.00

+Two additional free staff assisted withdrawals per month if pension paid directly into the account.

Important Information:

We try to get things right the first time – but if we don’t, we’ll do what we can to fix it.

You can fix most problems simply by contacting us.

Write to: CBA Group Customer Relations, Reply Paid 41, Sydney NSW 2001

Tell us online: commbank.com.au/support/compliments-and-complaints.html

Call: 1800 805 605 (free call)

You can also contact the Australian Financial Complaints Authority, AFCA, an independent external dispute

resolution body approved by ASIC - time limits may apply, visit AFCA, afca.org.au, website for more information.

Write to: Australian Financial Complaints Authority, GPO Box 3, Melbourne VIC 3001

Email: info@afca.org.au

Call: 1800 931 678, free call Monday to Friday 9am– 5pm, AEST

You might also like

- Savings (00) : Periodic Account StatementDocument4 pagesSavings (00) : Periodic Account Statementalan100% (1)

- Citi Bank Statement PDFDocument6 pagesCiti Bank Statement PDFblack bird100% (1)

- Chase Statement 28032021Document4 pagesChase Statement 28032021yungler0% (2)

- Australia Commonwealth Bank Statement 2Document1 pageAustralia Commonwealth Bank Statement 2Юлия П100% (4)

- Account Summary Payment InformationDocument4 pagesAccount Summary Payment InformationGenie TooNo ratings yet

- Citibank Bank StatementDocument7 pagesCitibank Bank StatementJOHNNo ratings yet

- Statement Jun, 2021Document4 pagesStatement Jun, 2021S RNo ratings yet

- 000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. Afortha loveof100% (1)

- Captial Bank PDFDocument6 pagesCaptial Bank PDFayaNo ratings yet

- Captial Bank PDFDocument6 pagesCaptial Bank PDFaya100% (1)

- Mar-2021, Apr-2021, May-2021, Jun-2021, Aug-2021Document4 pagesMar-2021, Apr-2021, May-2021, Jun-2021, Aug-2021James Franklin100% (3)

- List PDFDocument2 pagesList PDFFábio Dantas CostaNo ratings yet

- Simply Jordan TD Bank Statement Andrew Jun 2020Document2 pagesSimply Jordan TD Bank Statement Andrew Jun 2020MD Masum0% (1)

- Simply Jordan TD Bank Statement Andrew Oct 2021Document2 pagesSimply Jordan TD Bank Statement Andrew Oct 2021MD MasumNo ratings yet

- Terry D Marshall 16458 Echo Glen DR TYLER, TX 75757Document5 pagesTerry D Marshall 16458 Echo Glen DR TYLER, TX 75757Robert Ott0% (1)

- 000 Citibank Client Services 008 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 008 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AqjianNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument3 pagesStatement of Account: Credit Limit Rs Available Credit Limit Rsarunkumar100% (1)

- Statement 20210225Document2 pagesStatement 20210225Raw HitNo ratings yet

- Your Statement: GoalsaverDocument3 pagesYour Statement: Goalsaveralina.mohini29No ratings yet

- Statement 20210630Document3 pagesStatement 20210630Siobhan76No ratings yet

- Your Statement: Business Transaction AccountDocument7 pagesYour Statement: Business Transaction AccountFine GalleriaNo ratings yet

- Result PDF Watermark Iic7NF6Document4 pagesResult PDF Watermark Iic7NF6mdyafi8084No ratings yet

- Payment Information Summary of Account ActivityDocument8 pagesPayment Information Summary of Account ActivityElizabeth Marie MendelsohnNo ratings yet

- Statement20210331 10Document21 pagesStatement20210331 10jennymccarthy11No ratings yet

- Result PDF Watermark Iic7NF6Document1 pageResult PDF Watermark Iic7NF6mdyafi8084No ratings yet

- Your Statement: Smart AccessDocument8 pagesYour Statement: Smart Accessjesusepu898No ratings yet

- Statement20200930 7Document34 pagesStatement20200930 7jennymccarthy11No ratings yet

- Statement 20211231Document5 pagesStatement 20211231Thai Quoc NguyenNo ratings yet

- Controlled Test GR11 MG 13 April 2021Document6 pagesControlled Test GR11 MG 13 April 2021fatimah WajoodeenNo ratings yet

- Nedbank Investment Statement - 28 Oct 2021Document2 pagesNedbank Investment Statement - 28 Oct 2021Janice MkhizeNo ratings yet

- Statement 2023 08 03Document4 pagesStatement 2023 08 03tylermichael912No ratings yet

- Account Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021Document2 pagesAccount Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021franklin reid rosarioNo ratings yet

- Flerzi Ernani Zitella 10130 Doral BLVD Doral FL 33178-2921Document4 pagesFlerzi Ernani Zitella 10130 Doral BLVD Doral FL 33178-2921Joachim NosikNo ratings yet

- 000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AS RNo ratings yet

- Oct 31, 2022scuTFDocument2 pagesOct 31, 2022scuTFkramergeorgec397No ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- About Our Interest CalculationsDocument7 pagesAbout Our Interest CalculationsMuneebNo ratings yet

- MR Qinjian Jian Yan Jin 1527 Brookhaven DR Mclean Va 22101-4128Document4 pagesMR Qinjian Jian Yan Jin 1527 Brookhaven DR Mclean Va 22101-4128qjian100% (2)

- Stay Home & Buy Your Groceries Online! Avail 30% Discount at Dmart With Silkbank Ready Line Visa Debit Card. For Detail Call On 021-111-100-777Document2 pagesStay Home & Buy Your Groceries Online! Avail 30% Discount at Dmart With Silkbank Ready Line Visa Debit Card. For Detail Call On 021-111-100-777Hamza NajamNo ratings yet

- Relationship Summary:: MR John Doe 2 Post Alley, SEATTLE, WA 98101Document6 pagesRelationship Summary:: MR John Doe 2 Post Alley, SEATTLE, WA 98101Zheng YangNo ratings yet

- Wang H 56180805 444 Alaska Avenue Suite Torrance Ca 90503Document4 pagesWang H 56180805 444 Alaska Avenue Suite Torrance Ca 90503xrayjackdevNo ratings yet

- Gold Account 06 December 2021 To 06 June 2022Document1 pageGold Account 06 December 2021 To 06 June 2022mohamed elmakhzniNo ratings yet

- Relationship Summary:: Page 1 of 7Document7 pagesRelationship Summary:: Page 1 of 7my nameNo ratings yet

- Result PDF Watermark JU3YucaDocument4 pagesResult PDF Watermark JU3Yucamicffj12No ratings yet

- Simply Jordan TD Bank Statement Castillo May 2020Document2 pagesSimply Jordan TD Bank Statement Castillo May 2020MD MasumNo ratings yet

- 48428e0f-b102-4ef0-95e9-bd00ba5e1e8aDocument3 pages48428e0f-b102-4ef0-95e9-bd00ba5e1e8amohd.njahNo ratings yet

- Financial StatementDocument197 pagesFinancial StatementShouvik NagNo ratings yet

- AccountStatement 2020 12 30Document32 pagesAccountStatement 2020 12 30miis.gerelchuluunNo ratings yet

- Annamaria Noel-Clark 421 Marks LN Bardstown Ky 40004: Amount Added Amount Subtracted Balance DateDocument3 pagesAnnamaria Noel-Clark 421 Marks LN Bardstown Ky 40004: Amount Added Amount Subtracted Balance Date419o1No ratings yet

- Equity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Document5 pagesEquity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Test000001No ratings yet

- Банковская выписка TD USADocument2 pagesБанковская выписка TD USAanastasiya DubininaNo ratings yet

- Accounting Reports - Tally ERP9Document27 pagesAccounting Reports - Tally ERP9Backiyalakshmi Venkatraman100% (2)

- 4 - Bank Stament - TD Bank - 2022-02-25Document4 pages4 - Bank Stament - TD Bank - 2022-02-25sulaimon2023No ratings yet

- The Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1From EverandThe Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1No ratings yet

- MM - D Ch-15 Introducing New Market OfferingsDocument33 pagesMM - D Ch-15 Introducing New Market OfferingsAditya KumarNo ratings yet

- Bop Assignment MIPDocument7 pagesBop Assignment MIPMohammad MoosaNo ratings yet

- Model Exit Exam - Advanced Financial Accounting IDocument8 pagesModel Exit Exam - Advanced Financial Accounting IabulemhrNo ratings yet

- Factors Influencing Tourists' Destination Image Formation Process:-A Literature ReviewDocument6 pagesFactors Influencing Tourists' Destination Image Formation Process:-A Literature ReviewMANPREETNo ratings yet

- Company Profile PT IGLDocument10 pagesCompany Profile PT IGLKing AzazirNo ratings yet

- M&A Walmart TakeoverDocument2 pagesM&A Walmart TakeoverPhilip HabersaatNo ratings yet

- Lembar Jawaban Siklus DagangDocument56 pagesLembar Jawaban Siklus DagangSuci Agriani IdrusNo ratings yet

- International Capital BudgetingDocument43 pagesInternational Capital BudgetingRammohanreddy RajidiNo ratings yet

- Application Form For Travel Agency RegistrationDocument1 pageApplication Form For Travel Agency RegistrationFaisal MuhammadNo ratings yet

- Silo - Tips - Taiwan Republic of China 1111Document102 pagesSilo - Tips - Taiwan Republic of China 1111Abhishek AggarwalNo ratings yet

- Case Study #9 - Bruner 31 Debt PoliciesDocument6 pagesCase Study #9 - Bruner 31 Debt PoliciesMarie CuvNo ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- Syllabus Entrepreneurship EssentialsDocument1 pageSyllabus Entrepreneurship EssentialsJanine Ochea GolesNo ratings yet

- Evo PDFDocument25 pagesEvo PDFTinu ThomasNo ratings yet

- Case Study AssignmentDocument3 pagesCase Study AssignmentSalma AlyNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDr. Shoaib MohammedNo ratings yet

- Deu Brochure Petrochemical Services A4 44 WebDocument11 pagesDeu Brochure Petrochemical Services A4 44 Webegy pureNo ratings yet

- WIRC 2023-24 Final DirectoryDocument265 pagesWIRC 2023-24 Final Directorypoojagroup123No ratings yet

- Dtu Thesis TemplateDocument7 pagesDtu Thesis Templatefczeohief100% (1)

- Management Accounting and Controlling Group Assignment: Topic - Cost Analysis of Maruti Suzuki LTDDocument10 pagesManagement Accounting and Controlling Group Assignment: Topic - Cost Analysis of Maruti Suzuki LTDManan LodhaNo ratings yet

- Matt E: Amazon Expert - PPC, Listing Optimization, Seller & Vendor CentralDocument4 pagesMatt E: Amazon Expert - PPC, Listing Optimization, Seller & Vendor Centralzee pointNo ratings yet

- HCL Technologies: PrintDocument2 pagesHCL Technologies: PrintSachin SinghNo ratings yet

- White Blue Collarless CrimeDocument15 pagesWhite Blue Collarless CrimeRAVI VAGHELANo ratings yet

- Ethical BankingDocument3 pagesEthical BankingSadia ChowdhuryNo ratings yet

- Sample Resume For College ApplicationDocument5 pagesSample Resume For College Applicationafdnaqllu100% (1)

- Solution Chapter 11 Afar by Dayag CompressDocument16 pagesSolution Chapter 11 Afar by Dayag Compressholmeshaeley1No ratings yet

- SQTKWB BKG 25975400 20220728023542Document2 pagesSQTKWB BKG 25975400 20220728023542Hoàng LêNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- Marketing Department of Parle: BiscuitsDocument5 pagesMarketing Department of Parle: BiscuitsradhikaNo ratings yet

- Wcms 757878Document15 pagesWcms 757878Anjali jangidNo ratings yet