Professional Documents

Culture Documents

The 2022 State of The Construction Industry

The 2022 State of The Construction Industry

Uploaded by

Ameli GueveraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The 2022 State of The Construction Industry

The 2022 State of The Construction Industry

Uploaded by

Ameli GueveraCopyright:

Available Formats

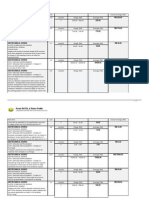

THE 2022 STATE OF THE CONSTRUCTION INDUSTRY

STATE OF THE INDUSTRY

5% increase in engineering and construction spending levels compared to 2021.

$7.28 trillion was what the Construction Market was valued in 2021.

12% increase in total construction across 2021 compared to 2020

GLOBAL CONSTRUCTION DEMANDS ARE GROWING

Industry needs to build 13,000 buildings each day between now and 2050 to support an

expected population of 7 billion people living in cities.

1.55 million new housing units planned annually in the U.S. — up from 583,000 in 2009.

Predicted 35% global growth in next 10 years.

THE RISE OF NEW BUILDING METHODS

58% of owners said they’ve used or plan to use design-build, moving away from traditional

design-bid-build.

Design-build projects are completed 102% faster than traditional design-bid-build projects.

23% of firms report they are taking steps to improve jobsite performance with lean construction

techniques, tools like BIM, and offsite prefabrication.

4.7% compound annual growth (CAGR) in modular construction by 2026 is predicted.

About 90% of firms using prefabrication report improved productivity, improved quality, and

increased schedule certainty compare to traditional stick-built construction.

14% of trades report prefabricating more than 50% of their work in the shop versus field.

13.6% compound annual growth (CAGR) in the construction robot market is predicted between

2021-2026.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

UNDERPERFORMANCE IS AN INDUSTRY WIDE ISSUE

72% of firms say projects have taken longer than anticipated.

46% of firms report a project was postponed in but was rescheduled, but 32% had projects

postponed or canceled and has not been rescheduled.

44% of firms are putting longer completion times into their bids.

Over 50% of engineering and construction professionals report one or more underperforming

projects in the previous year.

69% of owners say poor contractor performance is the single biggest reason for project

underperformance.

68% of general contractors reported experience problems “getting off the job” on at least 25%

of their projects.

66% of general contractors are carrying added costs from overtime/second shifts on at least

three quarters of their projects due to schedule slippage, with 50% of them needing to extend

the project end date.

Just 25% of projects came within 10% of their original deadlines in the past 3 years.

And only 31% of all projects came within 10% of the budget in the past 3 years.

Large projects typically take 20% longer to finish than scheduled and are up to 80% over budget.

98% of megaprojects become delayed or over budget.

77% of megaprojects around the globe are 40% or more behind schedule.

CONSTRUCTION COSTS ARE RISING

6% increase in wage and salaries for construction workers in 2021.

84% of firms report construction costs have been higher than anticipated.

14.1% increase in construction building material November 2021 YTD, tripling the increase of the

prior year.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

REWORK HAS BECOME AN EXPENSIVE STANDARD

14% of all rework in construction globally is caused by bad data.

Up to 70% of total rework experienced in construction and engineering products are a result of

design-induced rework.

52% of rework is caused by poor project data and miscommunication.

Meaning, $31.3 billion in rework was caused by poor project data and miscommunication in the

U.S. alone in 2018.

Roughly 4-6% of total project cost is the median cost of rework—but only taking into

consideration direct cost or reported rework.

9% of total project cost is closer to the actual total cost of rework—considering both direct and

indirect factors combined.

Between 2% and 20% of total costs is the estimated amount of rework, which has a negative

impact on a project schedule.

LABOR SHORTAGE IS AN INDUSTRY WIDE CONCERN

62% of contractors report high levels of difficulty finding skilled workers.

74% of contractors say they are asking skilled workers to do more work.

72% of contractors report a challenge in meeting project schedule requirements.

60% of contractors are putting in higher bids for projects

The number of workers who are either employed or unemployed and looking for work

decreased by just over 2.3 million people since February 2020.

44% of firms indicated labor shortages caused them to lengthen completion time for projects

already underway.

73% of firms report it will be more challenging to fill hourly craft positions.

Percentage of young construction workers declined by 30% from 2005-2016.

40% of construction jobs were lost between 2006-2011 due to the recession.

337,000 unfilled construction positions in December 2021.

21.4% industry wide turnover rate, making it one of the highest rates of all industries.

16-20% of an individual’s base salary is the average cost of a turnover.

29% of firms report investing in technology to supplement worker duties.

29% of firms report they are providing incentives and bonuses to attract craft workers.

92% of contractors report being at least moderately concerned about their workers having

adequate skill levels.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

WORKFORCE AT A GLANCE

12.8% U.S. Construction industry is unionized.

42 years old is the average age of a U.S. construction worker.

Only 11% of the U.S.construction workforce is female.

32.6% of U.S. construction workforce identifies as Hispanic or Latino.

Only 13% of construction firms are women owned.

MEASURING TRUST IN CONSTRUCTION

56% of high trust construction companies report good (low) turnover rates – saving them up to

$750,000 annually.

High trust construction firms are 2X as confident in meeting project deadlines – saving them up

to $4 million annually.

At high trust companies, 4 out of 5 projects are for repeat customers, potentially increasing

gross margins by 2-7%.

High trust construction companies are 2X as likely to be explicit about requests.

51% of high trust construction firms would retain their staff even without confirmed pipeline of

work.

43% of high trust construction companies make collaboration central to how they work.

High trust companies are 2X more likely to have managers that share consistent feedback.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

CHALLENGES IN PRODUCTIVITY

45% of construction professionals report spending more time than expected on non-optimal

activities.

$1.63 trillion could be saved annually from infrastructure productivity changes.

35% of construction professionals’ time is spent (over 14 hours per week) on non-productive

activities including looking for project information, conflict resolution and dealing with mistakes

and rework.

60% of general contractors see problems with coordination and communication between project

team members and issues with the quality of contract documents as the key contributors to

decreased labor productivity.

68% of trades point to poor schedule management as the key contributors to decreased labor

productivity.

50% or more impact on productivity as a result of issues with construction logistics.

10% impact on productivity as a result of late crew build-up.

50% variation in productivity of two groups of workers doing identical jobs on the same site and

at the same time. This gap in productivity was found to vary by 500% at different sites.

30.9% of construction industry professionals say that the top reason for miscommunication is

unresponsiveness to questions/requests.

USAGE AND IMPACT OF CONSTRUCTION TECHNOLOGY

50% of E&C firms (and 33% of project owners) plan to continue building with significant

investment in technologies designed to enhance their delivery of capital programs.

Only 16% of executives surveyed say their organizations have fully integrated systems and tools.

Only 18% of firms reported consistently using mobile apps to access project data and collaborate.

53% of large general contractors are utilizing software to manage safety and/or inspections on at

least half of their projects.

63% of contractors are currently using drones on their projects.

37% of contractors expect to adopt equipment tagging by 2022.

33% of contractors expect to use wearable technology in the next three years.

90.9% of firms report using smartphones on a daily basis for work purposes.

62.4% of companies report using mobile devices on the field for daily reporting.

21.4% of construction firms use 3 or more mobile apps for their projects.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

CHALLENGES TO CONSTRUCTION DIGITIZATION

95% of all data captured in construction and engineering industry goes unused.

19% UK construction firms say that their projects are entirely paper-based.

36% of construction professionals cited the reason technology failed was because of poor fit

with current processes and procedures.

27.8% of contractors do not bid on projects involving BIM.

35.2% of construction firms cite “lack of staff to support the technology” as the primary limiting

factor to adopting new technology.

23.6% say “none” of the software applications they use integrate.

28% of UK construction firms say that lacking the information they need on-site is the single

biggest factor impacting their productivity.

59% of companies state that their workforce doesn’t have the skills needed to work with BIM.

56% of construction firms do not have a dedicated R&D budget.

STATE OF DATA IN CONSTRUCTION

In the last 3 years, the volume of available project data doubled.

75% of respondents stated an increasing need for rapid decision-making in the field.

Only 36% of firms have implemented a process for identifying bad data and repairing it.

14% of all construction rework may have been caused by bad data creating $88.69 billion in

avoidable rework globally.

79% of contractors are using software to capture data and manage information.

60% of contractors rely on one tool.

74% of all the multi-tool contactors stated that they end up relying on one primary toll to track

key processes.

58% of contractors are using standardized inputs on at least half of their projects.

41% of contractors agreed that non-standardized data input leads to inconsistent, inaccurate,

incomplete, and unusable data.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

OPPORTUNITIES FOR SOFTWARE AND TECHNOLOGY

70% of contractors believe that advanced technologies can increase productivity (78%), improve

schedule (75%), and enhance safety (79%).

52% consider the needs of field staff a top consideration for investing in technology.

But only 28% actually receive feedback from field staff before investing in technology.

60% of general contractors and trades feel using software to manage safety and/or inspections

during construction is of high value to improving this process.

Within 10 years, full-scale digitization could lead to savings between $0.7-1.2 trillion (13- 21%) in

the Design & Engineering and Construction phases and $0.3-0.5 trillion (10-17%) in the

Operations phase.

AI has the potential to increase the construction industry’s profits by 71% by 2035.

AI is forecasted to reach $4.51 billion by 2026 in the construction industry.

61% report BIM processes reduced project error.

And 55% report BIM processes reduced the time required for communications.

Additionally, 82% of BIM users report a positive return-on-investment.

47% of construction firms use third-party tools, with around 60% leaning on desktop applications

and 40% using cloud-accessible ones.

32% of owners and contractors use internally developed tools.

Autodesk Blog: https://constructionblog.autodesk.com/construction-industry-statistics/

You might also like

- Building Code PhilippinesDocument59 pagesBuilding Code PhilippinesKitz Batuigas88% (8)

- Design of Screw JackDocument20 pagesDesign of Screw Jackchirag sanghani100% (4)

- Cec 110pDocument20 pagesCec 110pLucia Luciaa100% (8)

- Mobilisation Schedule - Single Officers QuartersDocument1 pageMobilisation Schedule - Single Officers QuartersWoodlock Limited100% (2)

- Hong Kong and Macau ArchitectureDocument10 pagesHong Kong and Macau ArchitectureLyra EspirituNo ratings yet

- Pumping StationDocument54 pagesPumping Stationharipooyam100% (2)

- Construction Hiring Business ReportDocument11 pagesConstruction Hiring Business Reportmundarfathima98No ratings yet

- Pre Fabrication Survey 2013Document32 pagesPre Fabrication Survey 2013Ng Chia ShenNo ratings yet

- 2020 Engineering Construction Industry OutlookDocument10 pages2020 Engineering Construction Industry OutlookiabhiuceNo ratings yet

- Ebook - The Future of Construction - Project - Management - 2023Document14 pagesEbook - The Future of Construction - Project - Management - 2023Alexandru.RosioruNo ratings yet

- MAPR-2560 - Sitemanager - 20201215 - PLANRADARDocument11 pagesMAPR-2560 - Sitemanager - 20201215 - PLANRADARMarco PomaNo ratings yet

- HWBN Report UKIDocument38 pagesHWBN Report UKIhps sgNo ratings yet

- Smart Buildings Fall EditionDocument38 pagesSmart Buildings Fall EditiontejedamarioNo ratings yet

- Construction Technology LandscapeDocument50 pagesConstruction Technology LandscapeVipin SinghalNo ratings yet

- Market Insights TCDRG 2023Document46 pagesMarket Insights TCDRG 2023chilakuri.lokesh6No ratings yet

- Reimagining Construction - ADSK CIOB - Discussion Paper - ReleasedDocument28 pagesReimagining Construction - ADSK CIOB - Discussion Paper - ReleasedWan Yusoff Wan MahmoodNo ratings yet

- (DRAFT) Version 2Document53 pages(DRAFT) Version 2nghitran.31221020434No ratings yet

- Ajme 2Document14 pagesAjme 2sama.hajj.dibNo ratings yet

- Global Semiconductor Industry OutlookDocument26 pagesGlobal Semiconductor Industry OutlookCharls BarneyNo ratings yet

- Donde Las Empresas Estan Encontrando Valor - FMI (01-15)Document15 pagesDonde Las Empresas Estan Encontrando Valor - FMI (01-15)Ninoska VillegasNo ratings yet

- Cfawcom 965317308Document26 pagesCfawcom 965317308ALNo ratings yet

- Accenture Capital Projects Report Metals MiningDocument24 pagesAccenture Capital Projects Report Metals Miningjkj_13874100% (1)

- Navigating The Digital Future The Disruption of Capital Projects PDFDocument12 pagesNavigating The Digital Future The Disruption of Capital Projects PDFGustavo AHNo ratings yet

- Whitepaper - State of Construction TechnologyDocument16 pagesWhitepaper - State of Construction TechnologyRicardo FigueiraNo ratings yet

- Donde Las Empresas Estan Encontrando Valor - FMI (16-35)Document20 pagesDonde Las Empresas Estan Encontrando Valor - FMI (16-35)Ninoska VillegasNo ratings yet

- 2021 State of AI Infrastructure SurveyDocument22 pages2021 State of AI Infrastructure SurveyAayush AgrawalNo ratings yet

- CMPMDocument53 pagesCMPMAllan ArellanoNo ratings yet

- Exploring The Early Impacts of The COVID-19 Pandemic On The Construction Industry in New York StateDocument23 pagesExploring The Early Impacts of The COVID-19 Pandemic On The Construction Industry in New York StateAndreiismNo ratings yet

- Group 8Document23 pagesGroup 8AndreiismNo ratings yet

- ThesisDocument62 pagesThesisAjay MalikNo ratings yet

- Chaos 1994Document14 pagesChaos 1994Khalid ZaffarNo ratings yet

- Al-Jibouri, S. (2002) International Journal of Project Management Vol. 20: 271-277Document13 pagesAl-Jibouri, S. (2002) International Journal of Project Management Vol. 20: 271-277Yasi HanifNo ratings yet

- The Standish Group Report ChaosDocument8 pagesThe Standish Group Report ChaosBodoh SanNo ratings yet

- KPMG 23rd Annual Global Automotive Executive SurveyDocument24 pagesKPMG 23rd Annual Global Automotive Executive SurveyRaúlNo ratings yet

- Global Construction Survey 2016Document32 pagesGlobal Construction Survey 2016Popo AlexanderNo ratings yet

- Us 2022 Manufacturing Industry OutlookDocument11 pagesUs 2022 Manufacturing Industry OutlookLintasnusa Informasi VenturaNo ratings yet

- Exclusive Research - How We Build Now - The Current State of Adoption and Confidence in Digital Transformation by Zineb TeuberDocument11 pagesExclusive Research - How We Build Now - The Current State of Adoption and Confidence in Digital Transformation by Zineb Teuberreb514No ratings yet

- The Next Ten Years of Industry 4.0-ENDocument11 pagesThe Next Ten Years of Industry 4.0-ENBambang WinarsoNo ratings yet

- Accenture Pulse of Change 2024 Index Executive SummaryDocument12 pagesAccenture Pulse of Change 2024 Index Executive Summaryramdhoni.nurbillaNo ratings yet

- McKinsey Report Construction June2016 PDFDocument25 pagesMcKinsey Report Construction June2016 PDFamn8No ratings yet

- 2024 Commercial Real Estate Outlook - DeloitteDocument42 pages2024 Commercial Real Estate Outlook - Deloittevarunjain0392No ratings yet

- Buildings 12 00762 v2Document20 pagesBuildings 12 00762 v2mojback-1No ratings yet

- Literature Review On Trust and Current Construction Industry TrendsDocument8 pagesLiterature Review On Trust and Current Construction Industry TrendsukefbfvkgNo ratings yet

- Integrated Project DeliveryDocument10 pagesIntegrated Project DeliveryNaveen100% (2)

- Forrester - Predictions 2022 NADocument15 pagesForrester - Predictions 2022 NAMarceNo ratings yet

- MIS 1.haftaDocument83 pagesMIS 1.haftaDoğukan ÇorumluNo ratings yet

- IBM Oil and Gas Report 2030Document20 pagesIBM Oil and Gas Report 2030Aya KusumaNo ratings yet

- Tugas 2-MutuDocument7 pagesTugas 2-MutuAlfian ArdhiNo ratings yet

- Article - Digital Promised Much But Half of Employees More Fed Up Than EverDocument7 pagesArticle - Digital Promised Much But Half of Employees More Fed Up Than EverGabriel ANo ratings yet

- A Revolution in Construction - Advancing Our Recovery Through Digital TransformationDocument16 pagesA Revolution in Construction - Advancing Our Recovery Through Digital TransformationHarikrishnan KanakarajNo ratings yet

- Construction Management (Recovered) 2Document10 pagesConstruction Management (Recovered) 2Sithembile DumaNo ratings yet

- Ajce 20221002 11Document12 pagesAjce 20221002 11Amogne GuleleNo ratings yet

- 2021 State of Software Engineering ReportDocument21 pages2021 State of Software Engineering ReportNallely FriasNo ratings yet

- Oracle BIM 4DDocument11 pagesOracle BIM 4DCarlosCerdaRuizNo ratings yet

- MGI Reinventing Construction Executive Summary PDFDocument20 pagesMGI Reinventing Construction Executive Summary PDFtth28288969No ratings yet

- 2.causes and Monitoring of Delays and Cost Overrun in Construction ProjectsDocument14 pages2.causes and Monitoring of Delays and Cost Overrun in Construction Projectsnadir184No ratings yet

- Assignment #01 Final TaimoorDocument5 pagesAssignment #01 Final TaimoorAthar RafiqNo ratings yet

- The Role of Collaboration and Integration in The SDocument14 pagesThe Role of Collaboration and Integration in The SRomie Ziatul FadlanNo ratings yet

- The Strategic Era of Procurement in Construction VFDocument7 pagesThe Strategic Era of Procurement in Construction VFJpbNo ratings yet

- The Construction Productivity ImperativeDocument10 pagesThe Construction Productivity ImperativeNugraha Eka SaputraNo ratings yet

- KPMG Global Construction Survey 2019Document44 pagesKPMG Global Construction Survey 2019Prem JerardNo ratings yet

- Implementation of Prefabrication and Modular Offsite Construction Using BIM and Lean Construction TechniquesDocument8 pagesImplementation of Prefabrication and Modular Offsite Construction Using BIM and Lean Construction Techniquessagasfn94No ratings yet

- The Changing Landscape of Employment A Journey To 2028Document22 pagesThe Changing Landscape of Employment A Journey To 2028jaymursalieNo ratings yet

- Factors Contributing To Project Schedule Delay in Rwanda Case of Horizon Construction LTDDocument19 pagesFactors Contributing To Project Schedule Delay in Rwanda Case of Horizon Construction LTDJean NoelNo ratings yet

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Project Management For Procurement Management ModuleFrom EverandProject Management For Procurement Management ModuleNo ratings yet

- Approval Sheet: Republic of The Philippines Palawan State University College of Engineering, Architecture & TechnologyDocument15 pagesApproval Sheet: Republic of The Philippines Palawan State University College of Engineering, Architecture & TechnologyHarvey Ross MendozaNo ratings yet

- Minutes - FYP Presentation - GTE-HTE - Sem II 2018-19Document5 pagesMinutes - FYP Presentation - GTE-HTE - Sem II 2018-19mulabbi brianNo ratings yet

- Above Ground Storage TankDocument6 pagesAbove Ground Storage TankBasil OguakaNo ratings yet

- Introduction To Counterfort Retaining WallDocument12 pagesIntroduction To Counterfort Retaining WallOmkarNo ratings yet

- FMDS0514Document30 pagesFMDS0514NozibolNo ratings yet

- Research That Shows Insights Into Hong Kong's Construction Industry DevelopmentDocument49 pagesResearch That Shows Insights Into Hong Kong's Construction Industry DevelopmentYaredo MessiNo ratings yet

- Addendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032Document22 pagesAddendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032stretch317No ratings yet

- Beam Cases PDFDocument10 pagesBeam Cases PDFisha maradiaNo ratings yet

- FLS ValveDocument2 pagesFLS Valvegamalyehia13100% (1)

- PFS Unit 1Document23 pagesPFS Unit 1jss_devNo ratings yet

- Estate Late MNS Mtshixa: Structural Appraisal For Fire Damaged PropertyDocument6 pagesEstate Late MNS Mtshixa: Structural Appraisal For Fire Damaged PropertyrendaninNo ratings yet

- En - 7014 12341 2145000Document3 pagesEn - 7014 12341 2145000EverardJuanilloNo ratings yet

- Socket Set ScrewDocument4 pagesSocket Set ScrewimtiyazNo ratings yet

- Masonry Labor Construction Productivity Variation: An Indian Case StudyDocument9 pagesMasonry Labor Construction Productivity Variation: An Indian Case StudyMar John RicamaraNo ratings yet

- Rates 02032015Document7 pagesRates 02032015qoci5koNo ratings yet

- Vetonit Spatter Dash-MC SDM212Document2 pagesVetonit Spatter Dash-MC SDM212toni mujiyono100% (1)

- List of Existing PlantsDocument4 pagesList of Existing PlantsAldrin Lloyd BaalanNo ratings yet

- Skycourt BrochureDocument58 pagesSkycourt BrochureSoumi BanerjeeNo ratings yet

- Buckling of Composite LaminatesDocument6 pagesBuckling of Composite LaminatespdhurveyNo ratings yet

- Bomba de Vacio Part ListDocument2 pagesBomba de Vacio Part ListNayeli Zarate MNo ratings yet

- Dealing With Construction Permits in Malaysia - Doing Business - World Bank GroupDocument3 pagesDealing With Construction Permits in Malaysia - Doing Business - World Bank Groupzul100% (1)

- Reviewer Mechanical EngDocument8 pagesReviewer Mechanical EngLance Darren GalorportNo ratings yet

- Inspection Report: Negros Occidental 1st District Engineering Office Matab-Ang, Talisay City, Negros OccidentalDocument1 pageInspection Report: Negros Occidental 1st District Engineering Office Matab-Ang, Talisay City, Negros OccidentalMae Ann GonzalesNo ratings yet