Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsMktcaprisk

Mktcaprisk

Uploaded by

Juan M. Flores M.Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- DCF Method (Instrict Value of A Stock) by Adam KhooDocument7 pagesDCF Method (Instrict Value of A Stock) by Adam KhooErvin Kërluku33% (3)

- Statement Standarter 1523Document1 pageStatement Standarter 1523SW Project100% (1)

- Lifefuels Risk FinanceDocument6 pagesLifefuels Risk FinanceAdmir MeskovicNo ratings yet

- BankingDocument5 pagesBankingFahim MkfNo ratings yet

- 077 - UBAID DHANSAY Financial Accounting AasgnDocument15 pages077 - UBAID DHANSAY Financial Accounting Aasgniffu rautNo ratings yet

- NadiDocument7 pagesNadisamikriteshNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Broadcom Financial AnalysisDocument68 pagesBroadcom Financial AnalysisKipley_Pereles_5949No ratings yet

- Book 1Document8 pagesBook 1Swetal SwetalNo ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- Betas de DamodaranDocument3 pagesBetas de DamodaranDIEGO ALONSO PARI CORDOVANo ratings yet

- Asignación Portafolio FEDocument1 pageAsignación Portafolio FEAndrea Torres EchevarríaNo ratings yet

- Kingfisher School of Business and Finance: Lucao District, Dagupan City, PangasinanDocument8 pagesKingfisher School of Business and Finance: Lucao District, Dagupan City, Pangasinansecret 12No ratings yet

- EXHIBITDocument5 pagesEXHIBITmelisaNo ratings yet

- Bank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetDocument2 pagesBank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetMartha Gracia ManurungNo ratings yet

- Betas (Utility Water)Document1 pageBetas (Utility Water)hfredianNo ratings yet

- DCF SBI TemplateDocument7 pagesDCF SBI Templatekeya.bitsembryoNo ratings yet

- 93 Optimal Risky PortfolioDocument6 pages93 Optimal Risky Portfoliomridul tiwariNo ratings yet

- Banks RatiosDocument4 pagesBanks RatiosYAKUBU ISSAHAKU SAIDNo ratings yet

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- Instruction To Use This Worksheet: WWW - Screener.inDocument18 pagesInstruction To Use This Worksheet: WWW - Screener.inRasulNo ratings yet

- CRISILDocument19 pagesCRISILBcomE ANo ratings yet

- Cla 2Document22 pagesCla 2Ranjan KoiralaNo ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- Bob Turner Polling Data 10.10.10Document1 pageBob Turner Polling Data 10.10.10Celeste KatzNo ratings yet

- CRE99Document31 pagesCRE99wissalriyaniNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Análisis de Datos para PortafolioDocument8 pagesAnálisis de Datos para PortafolioAlberto Elías Gómez PalacioNo ratings yet

- Data Neraca Perdagangan - EditDocument8 pagesData Neraca Perdagangan - EditMega SenoputriNo ratings yet

- Tasas de Rendimiento 30 Asfi-ValoresDocument4 pagesTasas de Rendimiento 30 Asfi-ValoresRoger David Camargo CondeNo ratings yet

- TrabajoDocument3 pagesTrabajoveronica delfinNo ratings yet

- PER SizeShare 20190906Document4 pagesPER SizeShare 20190906felipearanzazugNo ratings yet

- Narration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseDocument30 pagesNarration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseXicaveNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- Narayana Hrudayalaya RatiosDocument10 pagesNarayana Hrudayalaya RatiosMovie MasterNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- Hindustan Aeronautics LTDDocument6 pagesHindustan Aeronautics LTDVIPIN NAIRNo ratings yet

- Session 3 Security - Market - IndicesDocument14 pagesSession 3 Security - Market - Indicessiddhant hingoraniNo ratings yet

- Final Excel FileDocument14 pagesFinal Excel FileArif RahmanNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Laurus LabsDocument33 pagesLaurus Labsnidhul07No ratings yet

- Industry AveragesDocument5 pagesIndustry AveragesNuwani ManasingheNo ratings yet

- AMFEIX - Monthly Report (October 2019)Document15 pagesAMFEIX - Monthly Report (October 2019)PoolBTCNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- DuPont Financial Analysis Nestle 1709006894Document4 pagesDuPont Financial Analysis Nestle 170900689482rnkgr7p4No ratings yet

- Ratio 3Document42 pagesRatio 3Komal KapilNo ratings yet

- Vertoz AdvertisDocument33 pagesVertoz AdvertismivomNo ratings yet

- C 4 - Discrete Probability CalculatorsDocument23 pagesC 4 - Discrete Probability CalculatorsGautam DugarNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- Cherat Cement AnalysisDocument16 pagesCherat Cement Analysismustafafaysal03No ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- Narration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CaseDocument30 pagesNarration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CasenhariNo ratings yet

- Finance Beta - IndiaDocument4 pagesFinance Beta - Indiag9573407No ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- DOA SBLC FreshCut 55% - PHendraDocument13 pagesDOA SBLC FreshCut 55% - PHendraSultan Cikupa100% (2)

- Agg Innov - Business PlanDocument16 pagesAgg Innov - Business Planshankarjmc7407No ratings yet

- Abbey Secondary School Study Guides Final History PDFDocument16 pagesAbbey Secondary School Study Guides Final History PDFPeter LwandaNo ratings yet

- BNP Paribas Sfrrrr.Document132 pagesBNP Paribas Sfrrrr.mariejoe.market1No ratings yet

- Madura Chapter 2 PDFDocument31 pagesMadura Chapter 2 PDFMahmoud AbdullahNo ratings yet

- The Role of Normative Marketing EthicsDocument15 pagesThe Role of Normative Marketing EthicsPrameswari ZahidaNo ratings yet

- PEOS CertDocument1 pagePEOS CertRonald VergaraNo ratings yet

- BCG Matrix For Corning IncDocument8 pagesBCG Matrix For Corning IncBrynAmaaiaNo ratings yet

- Role of Social Media in CooperativesDocument30 pagesRole of Social Media in Cooperativessaniya darbariNo ratings yet

- Kebebe Gerawork - 1Document73 pagesKebebe Gerawork - 1Bereket TsehayNo ratings yet

- Tutorial Week 4: Short Answer QuestionsDocument6 pagesTutorial Week 4: Short Answer QuestionssimranNo ratings yet

- Module 1a - Sagss Presentation 2016 FinalDocument64 pagesModule 1a - Sagss Presentation 2016 Finalsamueljosh.sanchez.engNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document48 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Kristine Joy EbradoNo ratings yet

- South Africa's Just Energy Transition Investment PlanDocument216 pagesSouth Africa's Just Energy Transition Investment PlanSundayTimesZANo ratings yet

- Cloud ComputingDocument9 pagesCloud ComputingManal FaluojiNo ratings yet

- Beckett's Essential Guide To Funko Pop 2016Document50 pagesBeckett's Essential Guide To Funko Pop 2016AlenaMC19No ratings yet

- Business and Professional Communication Keys For Workplace Excellence 3Rd Edition Quintanilla Test Bank Full Chapter PDFDocument35 pagesBusiness and Professional Communication Keys For Workplace Excellence 3Rd Edition Quintanilla Test Bank Full Chapter PDFtarascottyskiajfzbq93% (14)

- Microeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions ManualDocument16 pagesMicroeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions Manualhauesperanzad0ybz100% (39)

- Alice Blue Financial Service PVT LTD: Client Registration FormDocument26 pagesAlice Blue Financial Service PVT LTD: Client Registration FormAzhar ShaikhNo ratings yet

- Master in Business Administration (Mba) (Supply Chain and Logistics) 2021/2022Document6 pagesMaster in Business Administration (Mba) (Supply Chain and Logistics) 2021/2022AvinaNo ratings yet

- ARDIENTE-Research QuestionnaireDocument6 pagesARDIENTE-Research QuestionnaireHennessy Shania Gallera ArdienteNo ratings yet

- Integrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemDocument8 pagesIntegrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemMarko KojicNo ratings yet

- Business Ehics Lec 3Document30 pagesBusiness Ehics Lec 3nailaNo ratings yet

- PCAOB Proposal To Increase Auditor Vigilance Against Fraud and Other Forms of Noncompliance With Laws and RegulationsDocument146 pagesPCAOB Proposal To Increase Auditor Vigilance Against Fraud and Other Forms of Noncompliance With Laws and RegulationsAdrienne GonzalezNo ratings yet

- Letter of Inquiry Fajar Agung of Book and School Equipment Pasar Minggu Block 3 Number 6 Jakarta 46429Document6 pagesLetter of Inquiry Fajar Agung of Book and School Equipment Pasar Minggu Block 3 Number 6 Jakarta 46429siti KhadijahNo ratings yet

- Reading 39 PDFDocument38 pagesReading 39 PDFKaramjeet SinghNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- SEVEN Big Wins Penresa PDFDocument28 pagesSEVEN Big Wins Penresa PDFAF Dowell MirinNo ratings yet

- CRPF Form 2023Document4 pagesCRPF Form 2023Ganesh DaphaleNo ratings yet

Mktcaprisk

Mktcaprisk

Uploaded by

Juan M. Flores M.0 ratings0% found this document useful (0 votes)

0 views6 pagesOriginal Title

mktcaprisk

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views6 pagesMktcaprisk

Mktcaprisk

Uploaded by

Juan M. Flores M.Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

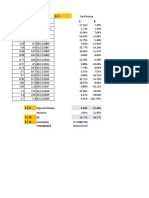

Date updated: 1/5/2024\

Created by: Aswath Damodaran, adamodar@stern.nyu.edu

What is this data? Risk & Liquidity Measures by Market Cap Decile (firms with market cap >$10 mi

Home Page: http://www.damodaran.com

Data website: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Companies in each industry: https://pages.stern.nyu.edu/~adamodar/pc/datasets/indname.xls

Variable definitions: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/variable.ht

Market Cap in millions of US$ Number of firms Aggregate Market Cap

Bottom decile 490 $8,162.10

2nd decile 492 $18,369.50

3rd decile 495 $37,122.70

4th decile 492 $70,953.00

5th decile 493 $147,563.80

6th decile 492 $318,407.30

7th decile 492 $699,599.10

8th decile 493 $1,525,874.10

9th decile 492 $3,736,071.20

Top decile 493 $42,590,578.90

Market 4,924 $49,152,701.70

du

ile (firms with market cap >$10 million)

w_Home_Page/data.html

datasets/indname.xls

w_Home_Page/datafile/variable.htm

Cash/Firm Value Annual trading volume/Shrs outstanding

5.12% 0.42

8.28% 0.42

7.41% 0.42

8.43% 0.42

8.97% 0.42

7.74% 0.42

6.12% 0.42

4.66% 0.42

3.46% 0.42

2.75% 0.42

3.99% 0.42

US

Market Debt to capital ratio (median) Median Beta

6.41% 0.64

9.91% 0.54

6.50% 0.39

10.99% 0.61

19.24% 0.91

23.31% 1.05

25.38% 1.17

21.29% 1.14

22.80% 1.15

16.80% 1.05

14.57% 0.95

Correlation with market (median) Standard deviation in stock price (median)

13.04% 58.50%

15.81% 44.12%

15.49% 34.59%

20.25% 34.83%

32.86% 36.37%

38.73% 32.50%

45.61% 29.62%

50.00% 26.47%

54.50% 23.21%

59.67% 19.96%

27.75% 32.83%

Total Beta HiL0 Risk Measure (Hi- lo)/ (Hi+Lo) (median)

4.95 0.6226

3.43 0.4815

2.54 0.3021

3.03 0.3654

2.76 0.3680

2.72 0.3363

2.55 0.3061

2.27 0.2712

2.12 0.2406

1.76 0.1939

3.41 0.3977

Interest Coverage Ratio

NA

NA

NA

NA

NA

NA

0.27

1.63

2.78

9.32

6.35

You might also like

- DCF Method (Instrict Value of A Stock) by Adam KhooDocument7 pagesDCF Method (Instrict Value of A Stock) by Adam KhooErvin Kërluku33% (3)

- Statement Standarter 1523Document1 pageStatement Standarter 1523SW Project100% (1)

- Lifefuels Risk FinanceDocument6 pagesLifefuels Risk FinanceAdmir MeskovicNo ratings yet

- BankingDocument5 pagesBankingFahim MkfNo ratings yet

- 077 - UBAID DHANSAY Financial Accounting AasgnDocument15 pages077 - UBAID DHANSAY Financial Accounting Aasgniffu rautNo ratings yet

- NadiDocument7 pagesNadisamikriteshNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Broadcom Financial AnalysisDocument68 pagesBroadcom Financial AnalysisKipley_Pereles_5949No ratings yet

- Book 1Document8 pagesBook 1Swetal SwetalNo ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- Betas de DamodaranDocument3 pagesBetas de DamodaranDIEGO ALONSO PARI CORDOVANo ratings yet

- Asignación Portafolio FEDocument1 pageAsignación Portafolio FEAndrea Torres EchevarríaNo ratings yet

- Kingfisher School of Business and Finance: Lucao District, Dagupan City, PangasinanDocument8 pagesKingfisher School of Business and Finance: Lucao District, Dagupan City, Pangasinansecret 12No ratings yet

- EXHIBITDocument5 pagesEXHIBITmelisaNo ratings yet

- Bank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetDocument2 pagesBank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetMartha Gracia ManurungNo ratings yet

- Betas (Utility Water)Document1 pageBetas (Utility Water)hfredianNo ratings yet

- DCF SBI TemplateDocument7 pagesDCF SBI Templatekeya.bitsembryoNo ratings yet

- 93 Optimal Risky PortfolioDocument6 pages93 Optimal Risky Portfoliomridul tiwariNo ratings yet

- Banks RatiosDocument4 pagesBanks RatiosYAKUBU ISSAHAKU SAIDNo ratings yet

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- Instruction To Use This Worksheet: WWW - Screener.inDocument18 pagesInstruction To Use This Worksheet: WWW - Screener.inRasulNo ratings yet

- CRISILDocument19 pagesCRISILBcomE ANo ratings yet

- Cla 2Document22 pagesCla 2Ranjan KoiralaNo ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- Bob Turner Polling Data 10.10.10Document1 pageBob Turner Polling Data 10.10.10Celeste KatzNo ratings yet

- CRE99Document31 pagesCRE99wissalriyaniNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Análisis de Datos para PortafolioDocument8 pagesAnálisis de Datos para PortafolioAlberto Elías Gómez PalacioNo ratings yet

- Data Neraca Perdagangan - EditDocument8 pagesData Neraca Perdagangan - EditMega SenoputriNo ratings yet

- Tasas de Rendimiento 30 Asfi-ValoresDocument4 pagesTasas de Rendimiento 30 Asfi-ValoresRoger David Camargo CondeNo ratings yet

- TrabajoDocument3 pagesTrabajoveronica delfinNo ratings yet

- PER SizeShare 20190906Document4 pagesPER SizeShare 20190906felipearanzazugNo ratings yet

- Narration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseDocument30 pagesNarration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseXicaveNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- Narayana Hrudayalaya RatiosDocument10 pagesNarayana Hrudayalaya RatiosMovie MasterNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- Hindustan Aeronautics LTDDocument6 pagesHindustan Aeronautics LTDVIPIN NAIRNo ratings yet

- Session 3 Security - Market - IndicesDocument14 pagesSession 3 Security - Market - Indicessiddhant hingoraniNo ratings yet

- Final Excel FileDocument14 pagesFinal Excel FileArif RahmanNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Laurus LabsDocument33 pagesLaurus Labsnidhul07No ratings yet

- Industry AveragesDocument5 pagesIndustry AveragesNuwani ManasingheNo ratings yet

- AMFEIX - Monthly Report (October 2019)Document15 pagesAMFEIX - Monthly Report (October 2019)PoolBTCNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- DuPont Financial Analysis Nestle 1709006894Document4 pagesDuPont Financial Analysis Nestle 170900689482rnkgr7p4No ratings yet

- Ratio 3Document42 pagesRatio 3Komal KapilNo ratings yet

- Vertoz AdvertisDocument33 pagesVertoz AdvertismivomNo ratings yet

- C 4 - Discrete Probability CalculatorsDocument23 pagesC 4 - Discrete Probability CalculatorsGautam DugarNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- Cherat Cement AnalysisDocument16 pagesCherat Cement Analysismustafafaysal03No ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- Narration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CaseDocument30 pagesNarration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CasenhariNo ratings yet

- Finance Beta - IndiaDocument4 pagesFinance Beta - Indiag9573407No ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- DOA SBLC FreshCut 55% - PHendraDocument13 pagesDOA SBLC FreshCut 55% - PHendraSultan Cikupa100% (2)

- Agg Innov - Business PlanDocument16 pagesAgg Innov - Business Planshankarjmc7407No ratings yet

- Abbey Secondary School Study Guides Final History PDFDocument16 pagesAbbey Secondary School Study Guides Final History PDFPeter LwandaNo ratings yet

- BNP Paribas Sfrrrr.Document132 pagesBNP Paribas Sfrrrr.mariejoe.market1No ratings yet

- Madura Chapter 2 PDFDocument31 pagesMadura Chapter 2 PDFMahmoud AbdullahNo ratings yet

- The Role of Normative Marketing EthicsDocument15 pagesThe Role of Normative Marketing EthicsPrameswari ZahidaNo ratings yet

- PEOS CertDocument1 pagePEOS CertRonald VergaraNo ratings yet

- BCG Matrix For Corning IncDocument8 pagesBCG Matrix For Corning IncBrynAmaaiaNo ratings yet

- Role of Social Media in CooperativesDocument30 pagesRole of Social Media in Cooperativessaniya darbariNo ratings yet

- Kebebe Gerawork - 1Document73 pagesKebebe Gerawork - 1Bereket TsehayNo ratings yet

- Tutorial Week 4: Short Answer QuestionsDocument6 pagesTutorial Week 4: Short Answer QuestionssimranNo ratings yet

- Module 1a - Sagss Presentation 2016 FinalDocument64 pagesModule 1a - Sagss Presentation 2016 Finalsamueljosh.sanchez.engNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document48 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Kristine Joy EbradoNo ratings yet

- South Africa's Just Energy Transition Investment PlanDocument216 pagesSouth Africa's Just Energy Transition Investment PlanSundayTimesZANo ratings yet

- Cloud ComputingDocument9 pagesCloud ComputingManal FaluojiNo ratings yet

- Beckett's Essential Guide To Funko Pop 2016Document50 pagesBeckett's Essential Guide To Funko Pop 2016AlenaMC19No ratings yet

- Business and Professional Communication Keys For Workplace Excellence 3Rd Edition Quintanilla Test Bank Full Chapter PDFDocument35 pagesBusiness and Professional Communication Keys For Workplace Excellence 3Rd Edition Quintanilla Test Bank Full Chapter PDFtarascottyskiajfzbq93% (14)

- Microeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions ManualDocument16 pagesMicroeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions Manualhauesperanzad0ybz100% (39)

- Alice Blue Financial Service PVT LTD: Client Registration FormDocument26 pagesAlice Blue Financial Service PVT LTD: Client Registration FormAzhar ShaikhNo ratings yet

- Master in Business Administration (Mba) (Supply Chain and Logistics) 2021/2022Document6 pagesMaster in Business Administration (Mba) (Supply Chain and Logistics) 2021/2022AvinaNo ratings yet

- ARDIENTE-Research QuestionnaireDocument6 pagesARDIENTE-Research QuestionnaireHennessy Shania Gallera ArdienteNo ratings yet

- Integrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemDocument8 pagesIntegrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemMarko KojicNo ratings yet

- Business Ehics Lec 3Document30 pagesBusiness Ehics Lec 3nailaNo ratings yet

- PCAOB Proposal To Increase Auditor Vigilance Against Fraud and Other Forms of Noncompliance With Laws and RegulationsDocument146 pagesPCAOB Proposal To Increase Auditor Vigilance Against Fraud and Other Forms of Noncompliance With Laws and RegulationsAdrienne GonzalezNo ratings yet

- Letter of Inquiry Fajar Agung of Book and School Equipment Pasar Minggu Block 3 Number 6 Jakarta 46429Document6 pagesLetter of Inquiry Fajar Agung of Book and School Equipment Pasar Minggu Block 3 Number 6 Jakarta 46429siti KhadijahNo ratings yet

- Reading 39 PDFDocument38 pagesReading 39 PDFKaramjeet SinghNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- SEVEN Big Wins Penresa PDFDocument28 pagesSEVEN Big Wins Penresa PDFAF Dowell MirinNo ratings yet

- CRPF Form 2023Document4 pagesCRPF Form 2023Ganesh DaphaleNo ratings yet