Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsMidterm Exam 2022 3

Midterm Exam 2022 3

Uploaded by

garohaaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Coursebook Section 2 Practice Question AnswersDocument5 pagesCoursebook Section 2 Practice Question AnswersAhmed Zeeshan100% (9)

- Auditing and Assurance Principles Final ExamDocument10 pagesAuditing and Assurance Principles Final ExamErvin De GuzmanNo ratings yet

- The Quest of Customer Focus.Document5 pagesThe Quest of Customer Focus.Pankaj Kumar Bothra100% (1)

- Ch05 Audit Risk and Materiality 1Document19 pagesCh05 Audit Risk and Materiality 1Mika MolinaNo ratings yet

- Auditing and Assurance ServicesDocument4 pagesAuditing and Assurance ServicesgarohaaiNo ratings yet

- 5-Audit Risk and MaterialityDocument15 pages5-Audit Risk and MaterialitykrizzmaaaayNo ratings yet

- Audit Risk and Materiality Multiple Choice PDF FreeDocument18 pagesAudit Risk and Materiality Multiple Choice PDF Freekathnisse labdetaNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryDocument18 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryFeelingerang MAYoraNo ratings yet

- Prelim With Answer Keys PDFDocument7 pagesPrelim With Answer Keys PDFheyheyNo ratings yet

- Audit Risk and MaterialityDocument5 pagesAudit Risk and Materialitycharmsonin12No ratings yet

- Midterm Exam - AUD002Document6 pagesMidterm Exam - AUD002KathleenNo ratings yet

- AuDocument5 pagesAuJohn Paulo SamonteNo ratings yet

- Review Questions Unit BDocument17 pagesReview Questions Unit BAnna TaylorNo ratings yet

- 60D10731 2Document12 pages60D10731 2Meryl BaytecNo ratings yet

- NAQDOWN - Elimination Auditing TheoryDocument5 pagesNAQDOWN - Elimination Auditing TheoryKarina Barretto AgnesNo ratings yet

- C13Document9 pagesC13Ariana GrandeNo ratings yet

- Professional Responsibilities (AUD THEO)Document5 pagesProfessional Responsibilities (AUD THEO)Francine HollerNo ratings yet

- Audit Risk and MaterialityDocument28 pagesAudit Risk and MaterialityMarian Grace DelapuzNo ratings yet

- N C O B A A: Ational Ollege F Usiness ND RTSDocument9 pagesN C O B A A: Ational Ollege F Usiness ND RTSNico evansNo ratings yet

- Semi FinalsDocument9 pagesSemi FinalsKIM RAGANo ratings yet

- Quiz On Evidence and Documentation Answer KeyDocument5 pagesQuiz On Evidence and Documentation Answer KeyReymark GalasinaoNo ratings yet

- Quiz 11.26.22Document5 pagesQuiz 11.26.22karen perrerasNo ratings yet

- Auditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Document4 pagesAuditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Joana Lyn BuqueronNo ratings yet

- ACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerDocument10 pagesACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerCM MIGUELNo ratings yet

- Auditing CompreDocument10 pagesAuditing CompreHatdogNo ratings yet

- Audcis Quiz 1Document4 pagesAudcis Quiz 1alexissosing.cpaNo ratings yet

- Audit Theory - Booklet 2Document39 pagesAudit Theory - Booklet 2Charis Marie UrgelNo ratings yet

- Ch05 - Audit Risk and MaterialityDocument18 pagesCh05 - Audit Risk and MaterialitySamit Tandukar100% (1)

- Quiz AuditingDocument8 pagesQuiz AuditingWerpa PetmaluNo ratings yet

- T.B - CH09Document17 pagesT.B - CH09MohammadYaqoobNo ratings yet

- Auditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersDocument3 pagesAuditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersJoana Lyn BuqueronNo ratings yet

- Auditing Theory Test BankDocument9 pagesAuditing Theory Test BankTricia Mae FernandezNo ratings yet

- 3 Review RecDocument8 pages3 Review RecJobelle Candace Flores AbreraNo ratings yet

- Multiple-Choice QuestionsDocument17 pagesMultiple-Choice QuestionsathenaNo ratings yet

- Aa 3101Document39 pagesAa 3101Chriz VillasNo ratings yet

- AUD-1stPB 10.22Document14 pagesAUD-1stPB 10.22Harold Dan AcebedoNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- Olytechnic Niversity of The Hilippines College of Accountancy andDocument7 pagesOlytechnic Niversity of The Hilippines College of Accountancy andPrancesNo ratings yet

- Audit EvidenceDocument5 pagesAudit EvidenceAlissa100% (1)

- Bsac303 Final Examination - RoldanDocument16 pagesBsac303 Final Examination - RoldanJheraldinemae RoldanNo ratings yet

- Unit V Audit PlanningDocument23 pagesUnit V Audit PlanningJhuliane RalphNo ratings yet

- AGS CUP 6 Auditing Final RoundDocument19 pagesAGS CUP 6 Auditing Final RoundKenneth RobledoNo ratings yet

- Chapter 09 QuestionsDocument12 pagesChapter 09 QuestionsPhương NguyễnNo ratings yet

- 2 Multiple ChoiceDocument57 pages2 Multiple ChoiceMichael Brian TorresNo ratings yet

- Review Materials LLDocument12 pagesReview Materials LLFake AccountNo ratings yet

- AF304 ExamDocument16 pagesAF304 ExamShikha NandNo ratings yet

- Multiple-Choice QuestionsDocument9 pagesMultiple-Choice QuestionsjhouvanNo ratings yet

- Auditing Theory PRTC PDFDocument35 pagesAuditing Theory PRTC PDFArah OpalecNo ratings yet

- Integrated Review On Auditing & Assurance - DRILL 2: University of Luzon College of Accountancy Cpa Review CenterDocument7 pagesIntegrated Review On Auditing & Assurance - DRILL 2: University of Luzon College of Accountancy Cpa Review CenterWe WNo ratings yet

- 24090953Document8 pages24090953Michael Brian TorresNo ratings yet

- Practice Examination IIIDocument13 pagesPractice Examination IIITwinie MendozaNo ratings yet

- Reckless Disregard Privity of Contract.: C. D. E. F. G. H. I. J. K. L. M. N. O. P. Q. R. S. T. U. VDocument2 pagesReckless Disregard Privity of Contract.: C. D. E. F. G. H. I. J. K. L. M. N. O. P. Q. R. S. T. U. VPaula Mae DacanayNo ratings yet

- Inbound 6206923241467376385Document6 pagesInbound 6206923241467376385Lovely Jean SamaritaNo ratings yet

- Multiple-Choice QuestionsDocument75 pagesMultiple-Choice QuestionsJasmine LimNo ratings yet

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentFrom EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentRating: 2.5 out of 5 stars2.5/5 (4)

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- RAMOS - Diaz Vs PeopleDocument5 pagesRAMOS - Diaz Vs PeopleRovi Kennth RamosNo ratings yet

- O2 Insure Claim Declaration v3 (2363)Document2 pagesO2 Insure Claim Declaration v3 (2363)Rahul KumarNo ratings yet

- List of Approved Etr Manufacturers and Suppliers As at 18 OCTOBER 2021 Summary: 4 ETR Manufacturers & 7 ETR SuppliersDocument2 pagesList of Approved Etr Manufacturers and Suppliers As at 18 OCTOBER 2021 Summary: 4 ETR Manufacturers & 7 ETR SuppliersFidelis MusyokaNo ratings yet

- Factors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Document18 pagesFactors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Sayed Faraz Ali ShahNo ratings yet

- Law QDocument7 pagesLaw Qshakhawat HossainNo ratings yet

- Machinery For Prevention and Settlement of Industrial DisputesDocument3 pagesMachinery For Prevention and Settlement of Industrial Disputesanon_909832531No ratings yet

- Discuss Tools For Tracking Risks Information SecurityDocument3 pagesDiscuss Tools For Tracking Risks Information SecurityNala ManeNo ratings yet

- Principled-Negotiation-Group 3Document17 pagesPrincipled-Negotiation-Group 3Nguyễn Ngọc DuyNo ratings yet

- Problems I: P4-5 Eamirrgr)Document1 pageProblems I: P4-5 Eamirrgr)Amel LiaNo ratings yet

- Lunar Phases and Stock Return: Indian Study: Dr. Kanwal Nayan KapilDocument12 pagesLunar Phases and Stock Return: Indian Study: Dr. Kanwal Nayan KapilHUZEFANo ratings yet

- The Rise and Fall of Pakistan's Textile Industry: An Analytical ViewDocument7 pagesThe Rise and Fall of Pakistan's Textile Industry: An Analytical ViewPIR AIZAZ ALI SHAHNo ratings yet

- Parents Health Insurance - Payment 22-23Document1 pageParents Health Insurance - Payment 22-23nikhil nadakuditi100% (1)

- Invoice For Harbor Real Estate Dubai: CampaignsDocument2 pagesInvoice For Harbor Real Estate Dubai: CampaignsSyed Faseeh Ul HassanNo ratings yet

- GeM Bidding 3164098Document5 pagesGeM Bidding 3164098imtiyazNo ratings yet

- SME ManualDocument19 pagesSME ManualBojackyNo ratings yet

- Staff Working Paper No. 899: The Central Bank Balance Sheet As A Policy Tool: Past, Present and FutureDocument52 pagesStaff Working Paper No. 899: The Central Bank Balance Sheet As A Policy Tool: Past, Present and FutureJohnyMacaroniNo ratings yet

- TEDx ProposalDocument20 pagesTEDx ProposalShubham KenekarNo ratings yet

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- Iso 2901 2016Document9 pagesIso 2901 2016Brandon Vicuña GalánNo ratings yet

- A Project Report On Agri-Input Supply CentreDocument14 pagesA Project Report On Agri-Input Supply CentreSuresh Varma0% (1)

- Topic:-Memorandum of Association & Articles of Association: IndexDocument11 pagesTopic:-Memorandum of Association & Articles of Association: IndexBrajesh SinghNo ratings yet

- RECYBETONDocument4 pagesRECYBETONlijiabinbinNo ratings yet

- Buying Motives and RoleDocument20 pagesBuying Motives and RoleBAHHEP BAHHEPNo ratings yet

- Management and Valuation of Heritage Assets A Comparative Analysis Between Italy and USADocument154 pagesManagement and Valuation of Heritage Assets A Comparative Analysis Between Italy and USALitmanenNo ratings yet

- Project Guidelines IBMRDDocument10 pagesProject Guidelines IBMRDDevendra ChavhanNo ratings yet

- Chapter - 2 Indian Economy Andits ReformsDocument31 pagesChapter - 2 Indian Economy Andits ReformsNickyNo ratings yet

- Dimensions Brand Personality: Jennifer L. AakerDocument16 pagesDimensions Brand Personality: Jennifer L. AakerDahmane OuslimaniNo ratings yet

- PR Algosec + Tech AGRIMDocument1 pagePR Algosec + Tech AGRIMRahul RajNo ratings yet

Midterm Exam 2022 3

Midterm Exam 2022 3

Uploaded by

garohaai0 ratings0% found this document useful (0 votes)

0 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views3 pagesMidterm Exam 2022 3

Midterm Exam 2022 3

Uploaded by

garohaaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

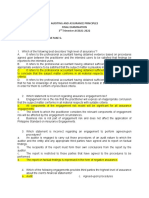

Cairo University Mid-term Exam- 2022-2023 March 2023

Faculty of Commerce Auditing and Assurance Date

Accounting department Georgia Program – Year 3 Page:

Accounting and Auditing Major

MODEL (1)

Choose the appropriate answer from a,b,c and d:

1. Audits with a low acceptable audit risk will normally result in……….

a. limited audit cost b. higher cost of audit c. lower inherent risk d. lower number

of procedures

2. The client business risk measures………………………….

a. the ability of the b. the ability of the c. the ability of the d. All of them

client’s management client’s management client’s management

to generate profit to increase production to meets its objectives

3. The susceptibility of some accounts such as financial leases and pensions to

material misstatements is defined as……………….

a. control risk b. risk of material c. planned detection d. inherent risk

misstatements risk

4. Investigating new clients and re-evaluating existing ones is an essential part of

determining the …………….

a. AAR b. client’s business c. control risk d. inherent risk

risk

5. The CPA firm must have the……….., such as industry knowledge , to accept the

engagement of a new audit.

a. personal judgement b. competency c. scepticism d. professional judgement

6. The predecessor auditor must obtain permission from the client before starting the

communication with the new auditor due to …………………

a. AICPA b. CPA adopted policy c. Engagement letter d. code of

requirements professional conduct

7. ………….. may response by stating that no information will be provided.

a. successor auditor b. the client’s CEO c. predecessor d. the audit

auditor committee

8. For public companies, ………. is responsible for hiring the auditor as required by

the Sarbanes Oxley Act (SOX)

a. the CFO b. the audit committee c. the CEO d. predecessor auditor

9. The restrictions to be imposed on the auditor s work, might be included in ……

a. financial b. Audit plan c. Engagement letter d. Audit report

statements

10. Which of the following transactions involves higher inherent risk?

a. purchases b. sales transactions c. subsidiary and d. capital

transactions with with key customers holding companies’ expenditure

key suppliers mutual transactions transactions

11. The related party transactions lack …………………..

a. the efficiency in b. the independence c. the conflict in d. the effectiveness

operations between parties interests in operations

Model (1) Page 1 of 3

12. Conducting ratio analysis and benchmarking against key competitors, should be

performed after which of the following steps?

a. accepting the b. assessing the c. assessing the preliminary d. Understanding the

new client inherent risk materiality level client s business and

industry.

13. Risks associated with specific industries may affect which of the following?

a. the client’s b. inherent risk c. Acceptable audit risk d. All of them

business risk

14. Which of the following is NOT TRUE?

a. Many inherent risks are common to all clients in certain industries.

b. Key performance indicators (KPIs) that management uses to measure progress toward its

objectives.

c. Materiality is an absolute concept rather than relative .

d. Inherent risk at the financial statements level may increase if the client has set

unreasonable objectives.

15. A tour of the client's facilities provides the auditor an opportunity to………….

a. observe operations b. assess physical c. meet key d. All of them

safeguards over assets. personnel

16. Which of the following is not classified as analytical procedures?

a. reconciling fixed asset dispositions with the fixed asset ledger

b. benchmarking the company's profitability ratios against others in the industry

c. common size analysis

d. dividing income statement account balances by the net sales when the level of sales has

changed from the prior year.

17. Risk of material misstatement at the assertion level.

a. is only relevant to account balances. b. determines the nature, timing, and

extent of further audit procedures.

c. refers to risks that are pervasive to the d. consists of business risk and inherent

financial statements as a whole risk.

18. Risk assessment procedures are performed to identify and assess the risk of

material misstatement which of the following is considered as risk assessment

procedure?

a. Inquiries of management and others b. Observation and inspection

within the entity

c. Analytical procedures d. All of them

19. Which of the following is True?

a. The auditor should assess the audit b. The risk of material misstatement is the

related risks precisely to discover material risk that the financial statements contain a

misstatements. material misstatement due to fraud or error

prior to the audit

c. A significant risk represents an d. Risk of material misstatements refers to

identified and assessed risk of material risk that is related pervasively to the

misstatement due to unintentional errors financial statements as a whole only.

20. Fraud is difficult to uncover because ………………….

a. it has a pervasive effect on the financial b. the auditor lacks the adequate

statements professional skills to discover fraud

c. fraudulent transactions are usually d. Lack of auditing standards that guide

concealed the auditor to uncover fraud.

Model (1) Page 2 of 3

21. Is the risk that audit evidence for a segment will fail to detect misstatements

exceeding performance materiality?

a. Inherent risk b. planned detection c. significant risk d. risk of material

risk misstatements

22. When considering the risk of misstatement due to fraud…….

a. the risk of not detecting a material b. the risk is only made at the financial

misstatement due to fraud is lower than the risk statement level

of not detecting a misstatement due to error.

c. auditing standards outline procedures the d. auditing standards require the auditor

auditor should perform to obtain information to presume that risk of fraud exist in

from management about their consideration of expense transactions.

fraud

23. Which of the following best describes the relationship between PDR and audit

evidence?

a. direct relationship b. inverse c. no relationship d. insignificant

relationship relationship

24. Which transaction cycle has high inherent risk and high control risk?

a. payroll cycle b. Capital acquisition c. Inventory and d. sales collection

cycle warehousing cycle cycle

25. Internal controls are ignored in setting inherent risk because…………

a. they are considered separately in the audit b. they are not affecting each other

risk model as control risk

c. internal controls can not minimize the d. Internal controls are not very important

inherent risk effect

26. The higher the inherent risk, the ………………. to collect.

a. lower evidence b. more evidence c. moderate evidence d. none evidence

27. Why do auditors establish a preliminary judgment about materiality?

a. to help the auditor plan the b. to help the client know what records to make

appropriate evidence to accumulate available to the auditor

c. to finalize the control risk d. to determine the appropriate level of staff to

assessment assign to the audit

28. Which of the following is the primary basis used to decide materiality for a profit-

oriented entity?

a. inventory b. net assets c. net sales d. income before tax and

interest

29. It assesses the effectiveness of internal controls to prevent or detect material

misstatement.

a. significant risk b. planned c. control risk d. fraud risk

detection risk

30. The audit risk model shows the close relationship between ………………………

a. significant risk b. PDR and c. fraud risk and d. inherent and control

and fraud risk AAR client’s business risks

risk

>>>>>>>>>>>>> Good luck <<<<<<<<<<<<<

Model (1) Page 3 of 3

You might also like

- Coursebook Section 2 Practice Question AnswersDocument5 pagesCoursebook Section 2 Practice Question AnswersAhmed Zeeshan100% (9)

- Auditing and Assurance Principles Final ExamDocument10 pagesAuditing and Assurance Principles Final ExamErvin De GuzmanNo ratings yet

- The Quest of Customer Focus.Document5 pagesThe Quest of Customer Focus.Pankaj Kumar Bothra100% (1)

- Ch05 Audit Risk and Materiality 1Document19 pagesCh05 Audit Risk and Materiality 1Mika MolinaNo ratings yet

- Auditing and Assurance ServicesDocument4 pagesAuditing and Assurance ServicesgarohaaiNo ratings yet

- 5-Audit Risk and MaterialityDocument15 pages5-Audit Risk and MaterialitykrizzmaaaayNo ratings yet

- Audit Risk and Materiality Multiple Choice PDF FreeDocument18 pagesAudit Risk and Materiality Multiple Choice PDF Freekathnisse labdetaNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryDocument18 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryFeelingerang MAYoraNo ratings yet

- Prelim With Answer Keys PDFDocument7 pagesPrelim With Answer Keys PDFheyheyNo ratings yet

- Audit Risk and MaterialityDocument5 pagesAudit Risk and Materialitycharmsonin12No ratings yet

- Midterm Exam - AUD002Document6 pagesMidterm Exam - AUD002KathleenNo ratings yet

- AuDocument5 pagesAuJohn Paulo SamonteNo ratings yet

- Review Questions Unit BDocument17 pagesReview Questions Unit BAnna TaylorNo ratings yet

- 60D10731 2Document12 pages60D10731 2Meryl BaytecNo ratings yet

- NAQDOWN - Elimination Auditing TheoryDocument5 pagesNAQDOWN - Elimination Auditing TheoryKarina Barretto AgnesNo ratings yet

- C13Document9 pagesC13Ariana GrandeNo ratings yet

- Professional Responsibilities (AUD THEO)Document5 pagesProfessional Responsibilities (AUD THEO)Francine HollerNo ratings yet

- Audit Risk and MaterialityDocument28 pagesAudit Risk and MaterialityMarian Grace DelapuzNo ratings yet

- N C O B A A: Ational Ollege F Usiness ND RTSDocument9 pagesN C O B A A: Ational Ollege F Usiness ND RTSNico evansNo ratings yet

- Semi FinalsDocument9 pagesSemi FinalsKIM RAGANo ratings yet

- Quiz On Evidence and Documentation Answer KeyDocument5 pagesQuiz On Evidence and Documentation Answer KeyReymark GalasinaoNo ratings yet

- Quiz 11.26.22Document5 pagesQuiz 11.26.22karen perrerasNo ratings yet

- Auditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Document4 pagesAuditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Joana Lyn BuqueronNo ratings yet

- ACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerDocument10 pagesACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerCM MIGUELNo ratings yet

- Auditing CompreDocument10 pagesAuditing CompreHatdogNo ratings yet

- Audcis Quiz 1Document4 pagesAudcis Quiz 1alexissosing.cpaNo ratings yet

- Audit Theory - Booklet 2Document39 pagesAudit Theory - Booklet 2Charis Marie UrgelNo ratings yet

- Ch05 - Audit Risk and MaterialityDocument18 pagesCh05 - Audit Risk and MaterialitySamit Tandukar100% (1)

- Quiz AuditingDocument8 pagesQuiz AuditingWerpa PetmaluNo ratings yet

- T.B - CH09Document17 pagesT.B - CH09MohammadYaqoobNo ratings yet

- Auditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersDocument3 pagesAuditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersJoana Lyn BuqueronNo ratings yet

- Auditing Theory Test BankDocument9 pagesAuditing Theory Test BankTricia Mae FernandezNo ratings yet

- 3 Review RecDocument8 pages3 Review RecJobelle Candace Flores AbreraNo ratings yet

- Multiple-Choice QuestionsDocument17 pagesMultiple-Choice QuestionsathenaNo ratings yet

- Aa 3101Document39 pagesAa 3101Chriz VillasNo ratings yet

- AUD-1stPB 10.22Document14 pagesAUD-1stPB 10.22Harold Dan AcebedoNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- Olytechnic Niversity of The Hilippines College of Accountancy andDocument7 pagesOlytechnic Niversity of The Hilippines College of Accountancy andPrancesNo ratings yet

- Audit EvidenceDocument5 pagesAudit EvidenceAlissa100% (1)

- Bsac303 Final Examination - RoldanDocument16 pagesBsac303 Final Examination - RoldanJheraldinemae RoldanNo ratings yet

- Unit V Audit PlanningDocument23 pagesUnit V Audit PlanningJhuliane RalphNo ratings yet

- AGS CUP 6 Auditing Final RoundDocument19 pagesAGS CUP 6 Auditing Final RoundKenneth RobledoNo ratings yet

- Chapter 09 QuestionsDocument12 pagesChapter 09 QuestionsPhương NguyễnNo ratings yet

- 2 Multiple ChoiceDocument57 pages2 Multiple ChoiceMichael Brian TorresNo ratings yet

- Review Materials LLDocument12 pagesReview Materials LLFake AccountNo ratings yet

- AF304 ExamDocument16 pagesAF304 ExamShikha NandNo ratings yet

- Multiple-Choice QuestionsDocument9 pagesMultiple-Choice QuestionsjhouvanNo ratings yet

- Auditing Theory PRTC PDFDocument35 pagesAuditing Theory PRTC PDFArah OpalecNo ratings yet

- Integrated Review On Auditing & Assurance - DRILL 2: University of Luzon College of Accountancy Cpa Review CenterDocument7 pagesIntegrated Review On Auditing & Assurance - DRILL 2: University of Luzon College of Accountancy Cpa Review CenterWe WNo ratings yet

- 24090953Document8 pages24090953Michael Brian TorresNo ratings yet

- Practice Examination IIIDocument13 pagesPractice Examination IIITwinie MendozaNo ratings yet

- Reckless Disregard Privity of Contract.: C. D. E. F. G. H. I. J. K. L. M. N. O. P. Q. R. S. T. U. VDocument2 pagesReckless Disregard Privity of Contract.: C. D. E. F. G. H. I. J. K. L. M. N. O. P. Q. R. S. T. U. VPaula Mae DacanayNo ratings yet

- Inbound 6206923241467376385Document6 pagesInbound 6206923241467376385Lovely Jean SamaritaNo ratings yet

- Multiple-Choice QuestionsDocument75 pagesMultiple-Choice QuestionsJasmine LimNo ratings yet

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentFrom EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentRating: 2.5 out of 5 stars2.5/5 (4)

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- RAMOS - Diaz Vs PeopleDocument5 pagesRAMOS - Diaz Vs PeopleRovi Kennth RamosNo ratings yet

- O2 Insure Claim Declaration v3 (2363)Document2 pagesO2 Insure Claim Declaration v3 (2363)Rahul KumarNo ratings yet

- List of Approved Etr Manufacturers and Suppliers As at 18 OCTOBER 2021 Summary: 4 ETR Manufacturers & 7 ETR SuppliersDocument2 pagesList of Approved Etr Manufacturers and Suppliers As at 18 OCTOBER 2021 Summary: 4 ETR Manufacturers & 7 ETR SuppliersFidelis MusyokaNo ratings yet

- Factors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Document18 pagesFactors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Sayed Faraz Ali ShahNo ratings yet

- Law QDocument7 pagesLaw Qshakhawat HossainNo ratings yet

- Machinery For Prevention and Settlement of Industrial DisputesDocument3 pagesMachinery For Prevention and Settlement of Industrial Disputesanon_909832531No ratings yet

- Discuss Tools For Tracking Risks Information SecurityDocument3 pagesDiscuss Tools For Tracking Risks Information SecurityNala ManeNo ratings yet

- Principled-Negotiation-Group 3Document17 pagesPrincipled-Negotiation-Group 3Nguyễn Ngọc DuyNo ratings yet

- Problems I: P4-5 Eamirrgr)Document1 pageProblems I: P4-5 Eamirrgr)Amel LiaNo ratings yet

- Lunar Phases and Stock Return: Indian Study: Dr. Kanwal Nayan KapilDocument12 pagesLunar Phases and Stock Return: Indian Study: Dr. Kanwal Nayan KapilHUZEFANo ratings yet

- The Rise and Fall of Pakistan's Textile Industry: An Analytical ViewDocument7 pagesThe Rise and Fall of Pakistan's Textile Industry: An Analytical ViewPIR AIZAZ ALI SHAHNo ratings yet

- Parents Health Insurance - Payment 22-23Document1 pageParents Health Insurance - Payment 22-23nikhil nadakuditi100% (1)

- Invoice For Harbor Real Estate Dubai: CampaignsDocument2 pagesInvoice For Harbor Real Estate Dubai: CampaignsSyed Faseeh Ul HassanNo ratings yet

- GeM Bidding 3164098Document5 pagesGeM Bidding 3164098imtiyazNo ratings yet

- SME ManualDocument19 pagesSME ManualBojackyNo ratings yet

- Staff Working Paper No. 899: The Central Bank Balance Sheet As A Policy Tool: Past, Present and FutureDocument52 pagesStaff Working Paper No. 899: The Central Bank Balance Sheet As A Policy Tool: Past, Present and FutureJohnyMacaroniNo ratings yet

- TEDx ProposalDocument20 pagesTEDx ProposalShubham KenekarNo ratings yet

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- Iso 2901 2016Document9 pagesIso 2901 2016Brandon Vicuña GalánNo ratings yet

- A Project Report On Agri-Input Supply CentreDocument14 pagesA Project Report On Agri-Input Supply CentreSuresh Varma0% (1)

- Topic:-Memorandum of Association & Articles of Association: IndexDocument11 pagesTopic:-Memorandum of Association & Articles of Association: IndexBrajesh SinghNo ratings yet

- RECYBETONDocument4 pagesRECYBETONlijiabinbinNo ratings yet

- Buying Motives and RoleDocument20 pagesBuying Motives and RoleBAHHEP BAHHEPNo ratings yet

- Management and Valuation of Heritage Assets A Comparative Analysis Between Italy and USADocument154 pagesManagement and Valuation of Heritage Assets A Comparative Analysis Between Italy and USALitmanenNo ratings yet

- Project Guidelines IBMRDDocument10 pagesProject Guidelines IBMRDDevendra ChavhanNo ratings yet

- Chapter - 2 Indian Economy Andits ReformsDocument31 pagesChapter - 2 Indian Economy Andits ReformsNickyNo ratings yet

- Dimensions Brand Personality: Jennifer L. AakerDocument16 pagesDimensions Brand Personality: Jennifer L. AakerDahmane OuslimaniNo ratings yet

- PR Algosec + Tech AGRIMDocument1 pagePR Algosec + Tech AGRIMRahul RajNo ratings yet