Professional Documents

Culture Documents

Accounting - Goldberg PLC

Accounting - Goldberg PLC

Uploaded by

Anh PhamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting - Goldberg PLC

Accounting - Goldberg PLC

Uploaded by

Anh PhamCopyright:

Available Formats

Thông tin :

Tên :

Email

Di động

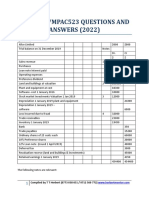

6 Goldberg plc

The following trial balance was extracted from the nominal ledger of Goldberg plc on

31 December 20X1:

£ £

Sales 2,284,900

Inventories at 1 January 20X1 71,000

Purchases 1,052,100

Distribution costs 172,100

Administrative expenses 437,000

Irrecoverable debts expense 29,000

Loan interest paid 4,500

Land and buildings cost 800,000

Plant and equipment cost 224,000

Motor vehicles cost 48,800

Land and buildings accumulated depreciation at 1 January 20X1 33,000

Plant and equipment accumulated depreciation at 1 January 20X1 44,800

Motor vehicles accumulated depreciation at 1 January 20X1 24,400

Trade receivables 226,900

Cash at bank 12,600

Ordinary share capital (£1 shares) 150,000

Share premium 125,000

Irredeemable 5% preference shares 100,000

Bank loan 150,000

Retained earnings 101,800

Dividends paid 25,000

Trade payables 89,100

3,103,000 3,103,000

The following adjustments have yet to be accounted for:

(1) The company depreciates all its non-current assets on a straight-line basis with zero residual

values. Land included in non-current assets cost £250,000 and buildings are depreciated

over 50 years.

Plant and equipment is depreciated over 5 years and Motor vehicles are depreciated over

four years.

Depreciation is charged as follows:

Depreciation on: Charged to:

Buildings Administrative expenses

Motor vehicles Distribution expenses

Plant and equipment Cost of sales

(2) Goldberg plc sells three products (Product Z1, Product Z2 and Product Z3). Inventory

at 31 December 20X1 is made up of the following:

Item Z1 Z2 Z3

Units 1,100 2,000 1,200

Cost per unit (£) 25 15 18

70 Accounting: Electronic Question Bank ICAEW 2024

100 of the units of Z3 sustained minor damage when being moved from one inventory area to

another. As a result these will only be sold for half of their normal selling price of £30 per unit.

70 Accounting: Electronic Question Bank ICAEW 2024

(3) Goldberg plc rents offices at a cost of £48,000 per year and pays quarterly in arrears. The

last rental payment made during 20X1 covered the quarter ending 31 October 20X1. The

invoice for the following quarter to 31 January 20X2 is yet to be received. Rent is charged to

administrative expenses.

(4) Trade receivables at 31 December 20X1 include a balance of £2,300 in relation to a

customer having severe financial difficulties. Goldberg considers it very unlikely this amount

will ever be recovered and have decided to write the debt off as irrecoverable. The

Irrecoverable debts expense is included in other operating expenses.

(5) The company received the bank loan on 1 February 20X1. The loan is repayable in full on

31 July 20X9. Interest is charged at a fixed rate of 6% per annum.

(6) A company employee dismissed during the year initiated a legal action against Goldberg in

November 20X1. The likely outcome is an out of court settlement for £20,000. Provisions

are charged to administrative expenses.

(7) Income tax for the year ended 31 December 20X1 is yet to be provided for. It is estimated that

£140,000 of income tax will be payable.

(8) The dividends paid represents £5,000 paid in respect of irredeemable preference shares and

£20,000 paid in respect of ordinary shares.

Requirement

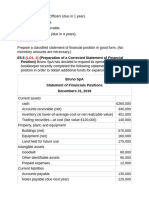

Prepare the statement of profit or loss for Goldberg plc for the year ended 31 December 20X1 and

the statement of financial position at that date.

Statement of profit or loss for the year ended 31 December 20X1

£

Revenue Cost of

sales Gross profit

Distribution costs

Administrative expenses

Other operating

expenses Operating

profit / (loss) Finance

costs

Profit / (loss) before tax

Income tax expense

Profit / (loss) for year

ICAEW 2024 Question bank 71

You might also like

- Group 4. FultexDocument3 pagesGroup 4. FultexMichelle Mora0% (1)

- CFAB - Accounting - QB - Chapter 12Document13 pagesCFAB - Accounting - QB - Chapter 12Huy NguyenNo ratings yet

- Voucher System, Special Journals, and Subsidiary LedgersDocument9 pagesVoucher System, Special Journals, and Subsidiary LedgersCatherine Calero50% (2)

- Accounting Final Mock 1 2023Document13 pagesAccounting Final Mock 1 2023diya pNo ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- Group Assignment On FSDocument4 pagesGroup Assignment On FSHuyền TrangNo ratings yet

- Chapter 12 3 Bài DàiDocument6 pagesChapter 12 3 Bài DàiMai Lâm LêNo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- Bản inDocument23 pagesBản inTrang VũNo ratings yet

- Accounting: The Institute of Chartered Accountants in England and WalesDocument26 pagesAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhNo ratings yet

- Prepare Statements of FinancialDocument5 pagesPrepare Statements of FinancialNguyễn Ngọc HàNo ratings yet

- AC101 Quiz 1Document2 pagesAC101 Quiz 1irene TogaraNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- ICAEW QB2024 Accounting Scenario DangKhoaDocument21 pagesICAEW QB2024 Accounting Scenario DangKhoaminhphuc0177No ratings yet

- CL9BD LTD., Company Financial StatementsDocument2 pagesCL9BD LTD., Company Financial Statementsrumelrashid_seuNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Accounting Mock Exam 3Document3 pagesAccounting Mock Exam 3Hâ HiiNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- ICAEW-Accounting-QB-2023-chapter 12Document3 pagesICAEW-Accounting-QB-2023-chapter 12daolengan03No ratings yet

- Aurora LTD QuestionDocument2 pagesAurora LTD Questionyohan.mathew132No ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Jimmy Lim - Perbaikan UAS ICAEWDocument9 pagesJimmy Lim - Perbaikan UAS ICAEWJimmy LimNo ratings yet

- Lcci - Higher - 2023 - QPDocument18 pagesLcci - Higher - 2023 - QPMUSTHARI KHANNo ratings yet

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- Worked Example Chap12Document8 pagesWorked Example Chap12Giang Thái HươngNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- 1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 EpsDocument3 pages1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 Epsarmaan ryanNo ratings yet

- Total Mark: 32.5Document5 pagesTotal Mark: 32.5phithuhang2909No ratings yet

- Accounts Revision QuestionDocument1 pageAccounts Revision QuestionZaara AshfaqNo ratings yet

- Past ExamDocument9 pagesPast ExamHaziNo ratings yet

- Activtiy Balance SheetDocument5 pagesActivtiy Balance SheetMa. Jhoan DailyNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- Companies Accounting Class Execises - Williams LTDDocument2 pagesCompanies Accounting Class Execises - Williams LTDndilimotuwilika001No ratings yet

- 2023AcF100EXAM1JUNEFINAL AccountingandFSADocument11 pages2023AcF100EXAM1JUNEFINAL AccountingandFSAnikoleta demosthenousNo ratings yet

- QuestionDocument2 pagesQuestionKamoheloNo ratings yet

- CourseworkDocument9 pagesCourseworkAbhishek DebNo ratings yet

- Is and BS For FinalsDocument5 pagesIs and BS For FinalsRehan FarhatNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- 2022 Sem 1 ACC10007 Lecture IllustrationsDocument8 pages2022 Sem 1 ACC10007 Lecture IllustrationsJordanNo ratings yet

- 1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramDocument3 pages1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramLê Minh TríNo ratings yet

- Bs 320 - 30th AprilDocument2 pagesBs 320 - 30th AprilPrince Daniels TutorNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Required: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"Document2 pagesRequired: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"АннаNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Practice Question Taxable Income of A CompanyDocument3 pagesPractice Question Taxable Income of A CompanyNokubongaNo ratings yet

- Accounting Principles Question Paper, Answers and Examiners CommentsDocument24 pagesAccounting Principles Question Paper, Answers and Examiners CommentsRyanNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- Osa Jan24 s1 Adbm Business Finance FinalDocument13 pagesOsa Jan24 s1 Adbm Business Finance FinalpzrgftctbxNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Exercise Chap 5Document9 pagesExercise Chap 5JF FNo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- ADBM - FA - Questions CRADocument5 pagesADBM - FA - Questions CRAMahima SheromiNo ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Final ExamDocument16 pagesFinal ExamAtif KhosoNo ratings yet

- @ProCA - Inter Adv Accounts (New) Must Do List Dec21Document109 pages@ProCA - Inter Adv Accounts (New) Must Do List Dec21Sonu SharmaNo ratings yet

- Partnership and Corporation Part 2Document41 pagesPartnership and Corporation Part 2Jeraldine DejanNo ratings yet

- FY24 Q1 Consolidated Financial StatementsDocument3 pagesFY24 Q1 Consolidated Financial StatementsDhanaRajNo ratings yet

- ACT NO. 2031 (Negotiable Instruments Law) 566 of The Code of Commerce Checks Are Still in Force BecauseDocument9 pagesACT NO. 2031 (Negotiable Instruments Law) 566 of The Code of Commerce Checks Are Still in Force BecauseReina Almira CuyahonNo ratings yet

- OverviewDocument6 pagesOverviewDia rielNo ratings yet

- OECD Outlook 2060Document45 pagesOECD Outlook 2060Sergiu MitrescuNo ratings yet

- Sovereign Debt Crisis in Sri-Lanka Anatomy and Policy OptionsDocument12 pagesSovereign Debt Crisis in Sri-Lanka Anatomy and Policy OptionsHamdy ElshazlyNo ratings yet

- Conceptual FrameworkDocument7 pagesConceptual Frameworkais.jnu.13No ratings yet

- Yojna Vihar Distress PropertyDocument8 pagesYojna Vihar Distress PropertySanjana SharmaNo ratings yet

- Forms of Business OrgansiationDocument64 pagesForms of Business OrgansiationShaji ViswambharanNo ratings yet

- 4202 Basic Interview Questions Financial Statement Analysis 14thDocument45 pages4202 Basic Interview Questions Financial Statement Analysis 14thSarkar SahebNo ratings yet

- In The United States Bankruptcy Court Southern District of Texas Houston DivisionDocument175 pagesIn The United States Bankruptcy Court Southern District of Texas Houston DivisionEmadNo ratings yet

- Theory FA1Document27 pagesTheory FA1talha ShakeelNo ratings yet

- Expenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Document6 pagesExpenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Srijan SaxenaNo ratings yet

- Why Our Course: Banking Important Terms Part 5Document17 pagesWhy Our Course: Banking Important Terms Part 5Vaishali SinghNo ratings yet

- Notes On Internal ReconstructionDocument7 pagesNotes On Internal ReconstructionAli NadafNo ratings yet

- Chapter 2 - Analyzing TransactionDocument100 pagesChapter 2 - Analyzing TransactionAzriel100% (1)

- Models For PD LGD EadDocument38 pagesModels For PD LGD Eadshanks de rouxeNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument8 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionnatashaNo ratings yet

- Chapter 1Document12 pagesChapter 1Kyllar HizonNo ratings yet

- Review Handouts and Materials: Semester Auditing Problems INTEGR 2-004 Agriculture and LiabilitiesDocument8 pagesReview Handouts and Materials: Semester Auditing Problems INTEGR 2-004 Agriculture and LiabilitiesKarlayaanNo ratings yet

- BER310 Practice Sem Test MemorandumDocument3 pagesBER310 Practice Sem Test MemorandumCailin Van RoooyenNo ratings yet

- Citizenship & Immigration Laws ProjectDocument10 pagesCitizenship & Immigration Laws ProjectAnand Hitesh SharmaNo ratings yet

- Indigo PaperDocument75 pagesIndigo Papernxoxoxrx xxxNo ratings yet

- Your Payment ReceiptDocument1 pageYour Payment ReceiptXDCVXNo ratings yet

- English 2 ProjectDocument8 pagesEnglish 2 ProjectSoumil BoradiaNo ratings yet

- MOJAKOE AK1 UTS 2010 GasalDocument10 pagesMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNo ratings yet