Professional Documents

Culture Documents

Accounting

Accounting

Uploaded by

hb44yd5yqfCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting

Accounting

Uploaded by

hb44yd5yqfCopyright:

Available Formats

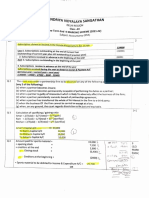

A ,

B ,

C has a partnership , capital accounts of A ,

B & C are as follows

,

A : E 50

, 000

B :

240

, 000

C : f 30

, 000

Over the years ,

the partnership has

generated goodwill amounting to 260

, 000

for 2 : 1

profit-sharing

The ratio A ,

B & C was 3 :

After some time C has decided to leave the partnership & the new

profit sharing ratio for A & B is 2 /

:

,

Since PSR Goodwill has to be recalculated

,

there was a

change in ,

Goodwill is not included in capital normally ,

so when

recalculating goodwill is first added back ,

in

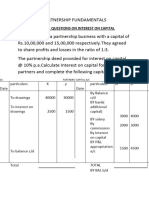

Dr Goodwill 60 , 000

Cr Capital all , 000

60

Capital

A B C A B C

bid , 00040, 000

50 So,, 00 0

10 000

Goodwill 30

, 000 20

, 000 ,

c)& ,00040

, 000 60

80 , 000

↑ Partnership will when he leaves

pay C40 , 000

After is then taken out not included

adding Goodwill

,

again as it is in Capital normally

Dr Capital all 60

, 000

Cr Goodwill 60, 000

-

Capital

A B A B

b/d 80

, 000

60, 000

Goodwill 40

, 000 20

, ooo

40

, 00040

, 000

Cld

C goodwill of ,

000

originally

10

: has

now this

goodwill has been "bought" by A

using As capital

so -10, 000 has been reduced from As capital as it has been

converted into goodwill

You might also like

- Adp Pay Stub TemplateDocument1 pageAdp Pay Stub Templateluis gonzalez0% (1)

- Partnership Formation: Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Formation: Name: Date: Professor: Section: Score: QuizWenjun100% (3)

- Illustrations Partnership OperationsDocument23 pagesIllustrations Partnership OperationsMary Joy AlbandiaNo ratings yet

- Division of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsDocument7 pagesDivision of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsJuliana Cheng100% (3)

- Sarah Finance Project 6th SemesterDocument24 pagesSarah Finance Project 6th Semestersarah IsharatNo ratings yet

- CBSE Class 12 Accountancy Important FormulasDocument3 pagesCBSE Class 12 Accountancy Important Formulasrio_harcan100% (2)

- Afar ParcorDocument271 pagesAfar Parcorawesome bloggers50% (2)

- Solutions To Chapter 13 Problems 1Document3 pagesSolutions To Chapter 13 Problems 1Hira ParachaNo ratings yet

- Accounting Crossword Puzzle Answer KeyDocument1 pageAccounting Crossword Puzzle Answer KeyFru RyNo ratings yet

- Change Management at TescoDocument15 pagesChange Management at TescobahilashNo ratings yet

- Tutorial Solution CH - 03Document3 pagesTutorial Solution CH - 03RavineahNo ratings yet

- MCQs Partnership(Solved)Document5 pagesMCQs Partnership(Solved)Himanshu ShuklaNo ratings yet

- Admission of PartnerDocument6 pagesAdmission of PartnerYutika DoshiNo ratings yet

- Double Entry Book Keeping Ts Grewal Vol. I 2019 For Class 12 Commerce Accountancy Chapter 5 - Admission of A PartnerDocument1 pageDouble Entry Book Keeping Ts Grewal Vol. I 2019 For Class 12 Commerce Accountancy Chapter 5 - Admission of A PartnerTishaNo ratings yet

- Double Entry Book Keeping Ts Grewal Vol. I 2019 For Class 12 Commerce Accountancy Chapter 5 - Admission of A Partner 2Document1 pageDouble Entry Book Keeping Ts Grewal Vol. I 2019 For Class 12 Commerce Accountancy Chapter 5 - Admission of A Partner 2TishaNo ratings yet

- Int On Drawings 2Document10 pagesInt On Drawings 2JanaNo ratings yet

- Guarantee of Profits: Profit & Loss Appropriation A/cDocument4 pagesGuarantee of Profits: Profit & Loss Appropriation A/cVarun RaghunathanNo ratings yet

- AdmissionDocument3 pagesAdmissionaashishNo ratings yet

- Give The Necessary Journal Entries For The Following Transactions On Dissolution of The Firm of Aman and Rajat On 31 ST MarchDocument3 pagesGive The Necessary Journal Entries For The Following Transactions On Dissolution of The Firm of Aman and Rajat On 31 ST Marchvaishnavi coolNo ratings yet

- Partners Old Share - New Share Share Sacrificed Share GainedDocument2 pagesPartners Old Share - New Share Share Sacrificed Share GainedImran KhanNo ratings yet

- ILLUSTRATIVE PROBLEMS - Partnership Dissolution (Change in Ownership Structure)Document5 pagesILLUSTRATIVE PROBLEMS - Partnership Dissolution (Change in Ownership Structure)Mathew LumapasNo ratings yet

- Partnership Dissolution - 2Document27 pagesPartnership Dissolution - 2Trisha GarciaNo ratings yet

- Acct3161 Asm 3Document3 pagesAcct3161 Asm 3cprs6cw6vmNo ratings yet

- Adobe Scan May 28, 2022Document4 pagesAdobe Scan May 28, 2022nishthadudeja21No ratings yet

- 2accountancy-Ms (4) - 230329 - 173510Document11 pages2accountancy-Ms (4) - 230329 - 173510jiya.mehra.2306No ratings yet

- Partnership Dissolution 4Document6 pagesPartnership Dissolution 4Karl Wilson GonzalesNo ratings yet

- Chapter-3 Additional and Missing Value QuestionsDocument6 pagesChapter-3 Additional and Missing Value Questionsgoelr1802No ratings yet

- Advance Class Exerciseriver Sept 15Document2 pagesAdvance Class Exerciseriver Sept 15SANDY MARILOU RAMIREZNo ratings yet

- Set. 2. Test No.1 Answer KeyDocument5 pagesSet. 2. Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Partnership Operations - AssignmentDocument6 pagesPartnership Operations - AssignmentRosmar AbanerraNo ratings yet

- Adobe Scan 29 Aug 2022Document9 pagesAdobe Scan 29 Aug 2022kumardeepak5242No ratings yet

- AST Outcome 1 ResitDocument3 pagesAST Outcome 1 Resit6p86m84qb2No ratings yet

- PARTNERSHIP FUNDAMENTALS - INT On CapitalDocument12 pagesPARTNERSHIP FUNDAMENTALS - INT On Capitalmollysamuels.0019No ratings yet

- M S Accy Pre-Board 1Document7 pagesM S Accy Pre-Board 1Krishna SinghNo ratings yet

- Assignment 3 Partnership DissolutionDocument5 pagesAssignment 3 Partnership DissolutionJohn Kennedy CristobalNo ratings yet

- DIY LiquidationDocument27 pagesDIY LiquidationJOYCE C ANDADORNo ratings yet

- Assignment 9/17/2020: Use The Following Information For The Next Two QuestionsDocument6 pagesAssignment 9/17/2020: Use The Following Information For The Next Two QuestionsRosmar AbanerraNo ratings yet

- Larong Aihzel G. Ast Long Quiz 1Document5 pagesLarong Aihzel G. Ast Long Quiz 1Mitch Tokong MinglanaNo ratings yet

- Paper - 1: Advanced Accounting: Answer All QuestionsDocument22 pagesPaper - 1: Advanced Accounting: Answer All Questionsmakarand8july78100% (1)

- C. Retirement & Death Assingment UpdateDocument7 pagesC. Retirement & Death Assingment UpdateNishtha GargNo ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- Capital AdjustmentDocument13 pagesCapital Adjustmentsvasti2780No ratings yet

- Partnership Dissolution Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Dissolution Name: Date: Professor: Section: Score: QuizNahwi KimpaNo ratings yet

- Acc Vol 1 Chap 4 SolDocument78 pagesAcc Vol 1 Chap 4 Solkhushichandak07No ratings yet

- V Ek Cvu 2 Iesaa PP YKP5 C CDocument51 pagesV Ek Cvu 2 Iesaa PP YKP5 C CNakul GoyalNo ratings yet

- Assessment of Partnership Firms: Illustration 01Document8 pagesAssessment of Partnership Firms: Illustration 01kreshmith2No ratings yet

- 001 - Partnership Formation - Summary NotesDocument3 pages001 - Partnership Formation - Summary NotesJñelle Faith Herrera SaludaresNo ratings yet

- Cash FlowsDocument18 pagesCash Flowsm.slug1212No ratings yet

- Partnership OperationDocument8 pagesPartnership OperationJasmine PeraltaNo ratings yet

- AC +2Document12 pagesAC +2amulrakejaNo ratings yet

- Bizcom Problem 3-3Document1 pageBizcom Problem 3-3kate trishaNo ratings yet

- Suggested - Answer - CAP - II - June - 2016 6Document75 pagesSuggested - Answer - CAP - II - June - 2016 6Dipen AdhikariNo ratings yet

- IAS 12 Income TaxDocument15 pagesIAS 12 Income TaxdanishsajwaniNo ratings yet

- E - Book - Death of A Partner (Questions With Solutions) - Accountancy - Class 12th - Itika Ma'am - SohelDocument31 pagesE - Book - Death of A Partner (Questions With Solutions) - Accountancy - Class 12th - Itika Ma'am - Sohelitika.chaudharyNo ratings yet

- Solution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyDocument10 pagesSolution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyPratik PrakashNo ratings yet

- Assignment 1 (Date 10.8.23)Document3 pagesAssignment 1 (Date 10.8.23)Biswajit BNo ratings yet

- Accounts 2Document25 pagesAccounts 2Kartik PanwarNo ratings yet

- Sir Win Lectures 2Document6 pagesSir Win Lectures 2blueredashbirdsNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- 1goalfreeeducation Wordpress Com 2018-05-17 D K Goel VolumeDocument122 pages1goalfreeeducation Wordpress Com 2018-05-17 D K Goel VolumeGourab GoraiNo ratings yet

- Joint Venture Account PracticalDocument15 pagesJoint Venture Account Practicalasmita23840No ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionYam SondayNo ratings yet

- CH C Assignment.Document1 pageCH C Assignment.Canice ChiuNo ratings yet

- SolutionsDocument24 pagesSolutionsa86476007No ratings yet

- Act1108 - Intro To FinmanDocument14 pagesAct1108 - Intro To FinmanAnna WilliamsNo ratings yet

- Cash and Accrual Basis: Topic OverviewDocument20 pagesCash and Accrual Basis: Topic OverviewAngelieNo ratings yet

- Activity 2 - Transaction Analysis (FLORES)Document4 pagesActivity 2 - Transaction Analysis (FLORES)angela floresNo ratings yet

- Annex B 2118-EA v2 PDFDocument2 pagesAnnex B 2118-EA v2 PDFjencastroNo ratings yet

- (Kotak) Vedanta, October 02, 2023Document9 pages(Kotak) Vedanta, October 02, 2023PrakashNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Covered Ratio SpreadDocument2 pagesCovered Ratio SpreadpkkothariNo ratings yet

- Lesson 5 Capital Structure and The Cost of CapitalDocument57 pagesLesson 5 Capital Structure and The Cost of CapitalNombulelo NdlovuNo ratings yet

- Material Ledgers BlogDocument25 pagesMaterial Ledgers BlogMukesh PoddarNo ratings yet

- Ch3 - Batch - Exercises and SolutionDocument9 pagesCh3 - Batch - Exercises and Solution黃群睿No ratings yet

- Spe - Audit of PR Financials 20-18-19Document43 pagesSpe - Audit of PR Financials 20-18-19Abc DefNo ratings yet

- Uncovering Toshiba's Fraudulent Financial Statements: An Audit PerspectiveDocument19 pagesUncovering Toshiba's Fraudulent Financial Statements: An Audit PerspectiveAyu Rosiana DewiNo ratings yet

- Features of Equity SharesDocument4 pagesFeatures of Equity SharesAnkita Modi100% (1)

- Impact of Corporate Taxation On Dividend Policy of Quoted Firms in NigeriaDocument12 pagesImpact of Corporate Taxation On Dividend Policy of Quoted Firms in NigeriaMayaz AhmedNo ratings yet

- Solusi Assignment 24-21 Dan 24-23Document2 pagesSolusi Assignment 24-21 Dan 24-23Badrud TamamNo ratings yet

- Sales Force: IntegrationDocument7 pagesSales Force: IntegrationEina GuptaNo ratings yet

- Financial Strategies Creating Values in Global EraDocument4 pagesFinancial Strategies Creating Values in Global Erabhullar_pritpalNo ratings yet

- Lecture 15 LevarageDocument50 pagesLecture 15 LevarageDevyansh GuptaNo ratings yet

- Present Worth Method of Comparison: Revenue-Dominated Cash Flow DiagramDocument12 pagesPresent Worth Method of Comparison: Revenue-Dominated Cash Flow DiagramRaja Sanjay KrishnaNo ratings yet

- Fundamental of Business 1st Assignment 2018Document21 pagesFundamental of Business 1st Assignment 2018Irfan MeharNo ratings yet

- Himanshu Sharma PDFDocument1 pageHimanshu Sharma PDFHimanshu SharmaNo ratings yet

- Commissioner of Internal Revenue V. Lancaster Philippines, Inc. FactsDocument11 pagesCommissioner of Internal Revenue V. Lancaster Philippines, Inc. FactsJun Bill CercadoNo ratings yet

- Accrual AccountingDocument44 pagesAccrual AccountingSophia LynchNo ratings yet