Professional Documents

Culture Documents

IDirect Pharma SectorUpdate Jun22

IDirect Pharma SectorUpdate Jun22

Uploaded by

durjoythermaxCopyright:

Available Formats

You might also like

- Noco v. Autogen Tech. - ComplaintDocument87 pagesNoco v. Autogen Tech. - ComplaintSarah BursteinNo ratings yet

- Pharma Industry AnalysisDocument59 pagesPharma Industry AnalysissamathagondiNo ratings yet

- ChemicalsDocument50 pagesChemicalssamathagondiNo ratings yet

- PL ChemicalsDocument8 pagesPL Chemicalsg.alekhya111No ratings yet

- SWOT ExampleDocument2 pagesSWOT Examplefrank1704No ratings yet

- Divis-Laboratories 24022020Document6 pagesDivis-Laboratories 24022020anjugaduNo ratings yet

- Consumer - Outlook 2021Document24 pagesConsumer - Outlook 2021Deepak SharmaNo ratings yet

- Strong Momentum Across Verticals Maintain BUY: Dr. Reddy's Laboratories LTDDocument9 pagesStrong Momentum Across Verticals Maintain BUY: Dr. Reddy's Laboratories LTDPratik DiyoraNo ratings yet

- Major Discontinuities in The Global Chemicals Market: Operational Excellence: Leadership PerspectivesDocument3 pagesMajor Discontinuities in The Global Chemicals Market: Operational Excellence: Leadership PerspectivesmittleNo ratings yet

- Investment Idea: DIVI'S Laboratories 2021-09-13Document5 pagesInvestment Idea: DIVI'S Laboratories 2021-09-13vikalp123123No ratings yet

- Jubilant Pharmova 07 06 2021 IciciDocument6 pagesJubilant Pharmova 07 06 2021 IciciBhagwat RautelaNo ratings yet

- Achieving Operational Excellence Five ElDocument20 pagesAchieving Operational Excellence Five ElJack HuseynliNo ratings yet

- Nse:Dabur Stock Pitch: Team Cap-It-All - Xlri JamshedpurDocument15 pagesNse:Dabur Stock Pitch: Team Cap-It-All - Xlri JamshedpurSimran JainNo ratings yet

- Report - Divis LabDocument7 pagesReport - Divis LabAnonymous y3hYf50mTNo ratings yet

- Specialty Chemicals Industry India PDFDocument32 pagesSpecialty Chemicals Industry India PDFSachin VermaNo ratings yet

- IcisDocument118 pagesIcismarketing7No ratings yet

- Balmoral Newsletter Chemicals 2019 Q2Document9 pagesBalmoral Newsletter Chemicals 2019 Q2CDI Global IndiaNo ratings yet

- Best 4 Specialty Chemicals Stocks To Buy NowDocument60 pagesBest 4 Specialty Chemicals Stocks To Buy Nowmasta kalandarNo ratings yet

- Heranba Industries IPO Note ICICI DirectDocument12 pagesHeranba Industries IPO Note ICICI DirectVasim MerchantNo ratings yet

- Cornell EMI Case - Campus RoundDocument20 pagesCornell EMI Case - Campus Roundkunal patilNo ratings yet

- Outsourced Pharmaceutical Manufacturing 2020 White Paper - Results HealthcareDocument24 pagesOutsourced Pharmaceutical Manufacturing 2020 White Paper - Results HealthcareStevin GeorgeNo ratings yet

- Amber - Enterprises - IC - 17mar21 - JMFLDocument29 pagesAmber - Enterprises - IC - 17mar21 - JMFLAshish KudalNo ratings yet

- Vinati Organics - Initiating Coverage - 12 Jun 24Document40 pagesVinati Organics - Initiating Coverage - 12 Jun 24amarjeetNo ratings yet

- Quarterly Update Report Laurus Labs Q1 FY24Document8 pagesQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDANo ratings yet

- Rossari Biotech LTD: SubscribeDocument9 pagesRossari Biotech LTD: SubscribeDavid BassNo ratings yet

- 02 External EnvironmentDocument38 pages02 External Environment然No ratings yet

- Speciality Chemicals Sector Thematic Jun24Document50 pagesSpeciality Chemicals Sector Thematic Jun24mayankabra29No ratings yet

- FMCG & Alco Bev: 1QFY21 PreviewDocument8 pagesFMCG & Alco Bev: 1QFY21 PreviewSanket SharmaNo ratings yet

- Thematic - Indian Pharma Sector - Centrum 09122022Document58 pagesThematic - Indian Pharma Sector - Centrum 09122022NikhilKapoor29No ratings yet

- HEALTHCARE MOSL Sep23Document60 pagesHEALTHCARE MOSL Sep23Sriram RanganathanNo ratings yet

- Post Holdings Buying WeetabixDocument16 pagesPost Holdings Buying WeetabixKing KosherNo ratings yet

- 02.22 EY CGPA Capacity Study - FINAL 1Document47 pages02.22 EY CGPA Capacity Study - FINAL 1Prasoon MishraNo ratings yet

- Piramal Enterprises: Building Scalable Differentiated Pharma BusinessDocument14 pagesPiramal Enterprises: Building Scalable Differentiated Pharma BusinessEcho WackoNo ratings yet

- Zantac (A) Case AnalysisDocument4 pagesZantac (A) Case AnalysisshakhilNo ratings yet

- Pidilite Industries: Robust Recovery Margin Pressure AheadDocument15 pagesPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7No ratings yet

- Rossari Biotech IC Mar21Document42 pagesRossari Biotech IC Mar21Vipul Braj Bhartia100% (1)

- Business Communication: Individual Case Assignment - 1 Written Analysis OnDocument10 pagesBusiness Communication: Individual Case Assignment - 1 Written Analysis OnParidhi JainNo ratings yet

- PC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344Document70 pagesPC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344PriyankaNo ratings yet

- Indian Pharma Industry To Surpass USD 60 Billion in Two YearsDocument3 pagesIndian Pharma Industry To Surpass USD 60 Billion in Two YearsKiran KudtarkarNo ratings yet

- Viral Vectors, Non-Viral Vectors and Gene Therapy Manufacturing Market (3rd Edition), 2019-2030Document39 pagesViral Vectors, Non-Viral Vectors and Gene Therapy Manufacturing Market (3rd Edition), 2019-2030Roots Analysis100% (1)

- J&J Supply Chain Strategy - OdpDocument10 pagesJ&J Supply Chain Strategy - OdpChanaka PradeepNo ratings yet

- GMM Ic June20Document43 pagesGMM Ic June20Melissa PerryNo ratings yet

- Division Presentation - Care ChemicalsDocument18 pagesDivision Presentation - Care ChemicalsChris SongNo ratings yet

- The Outlook: UV BombardmentDocument8 pagesThe Outlook: UV BombardmentBAlmohsinNo ratings yet

- New Supply Chains of Global Companies After COVID-19: - Focusing On The Changed Production StrategyDocument2 pagesNew Supply Chains of Global Companies After COVID-19: - Focusing On The Changed Production Strategyparkseoyeon623No ratings yet

- Strategic Management - Chapter 4Document13 pagesStrategic Management - Chapter 4Hòa Nguyễn KhánhNo ratings yet

- Industry Analysis 4Document48 pagesIndustry Analysis 4ZainNo ratings yet

- Valiant Organics LTD.: Eureka in The LabDocument11 pagesValiant Organics LTD.: Eureka in The LabAJNo ratings yet

- Supply Chain EfficiencyDocument4 pagesSupply Chain EfficiencySaurabhNo ratings yet

- The Searle Company (SEARL) - Reinstating With A BuyDocument17 pagesThe Searle Company (SEARL) - Reinstating With A BuySHAHZAIB -No ratings yet

- Q1 2024 Medtech Public Comp Sheet and Valuation Guide PreviewDocument8 pagesQ1 2024 Medtech Public Comp Sheet and Valuation Guide PreviewKumud GoelNo ratings yet

- In-Line Q1FY22 Stabilising Underlying Trends: Company CMP (Inr) RecoDocument17 pagesIn-Line Q1FY22 Stabilising Underlying Trends: Company CMP (Inr) RecoGowtamdNo ratings yet

- Market Specialtychemicals Edelweiss 26.06.19 PDFDocument198 pagesMarket Specialtychemicals Edelweiss 26.06.19 PDFakhileshguptamnreNo ratings yet

- Journey From Globalisation To GlocalisationDocument16 pagesJourney From Globalisation To GlocalisationItzKenMC INo ratings yet

- Orient Electric IC Jun22Document44 pagesOrient Electric IC Jun22nishantNo ratings yet

- Ey Pharma Supply Chains of The Future FinalDocument19 pagesEy Pharma Supply Chains of The Future FinalPedro HerycNo ratings yet

- The Impact of COVID 19 On Capital Markets One Year in PDFDocument8 pagesThe Impact of COVID 19 On Capital Markets One Year in PDFRhenyAANo ratings yet

- The Race to Manufacture COVID-19 Vaccines: Emerging Vaccine TechnologiesFrom EverandThe Race to Manufacture COVID-19 Vaccines: Emerging Vaccine TechnologiesNo ratings yet

- Reshaping Global Value Chains in Light of COVID-19: Implications for Trade and Poverty Reduction in Developing CountriesFrom EverandReshaping Global Value Chains in Light of COVID-19: Implications for Trade and Poverty Reduction in Developing CountriesNo ratings yet

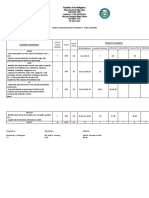

- Q1 Mapeh - TosDocument2 pagesQ1 Mapeh - TosKenneth Roy MatuguinaNo ratings yet

- DepedDocument25 pagesDepedCharles Allen TanglaoNo ratings yet

- Wipro Case StudyDocument8 pagesWipro Case Studysumaya parveenNo ratings yet

- An Overview of Financial Statement AnalysisDocument37 pagesAn Overview of Financial Statement AnalysisShynara MuzapbarovaNo ratings yet

- ICTAD Specifications For WorksDocument12 pagesICTAD Specifications For Workssanojani50% (8)

- InterviewDocument3 pagesInterviewThiya NalluNo ratings yet

- Halfling Rogue BackstoryDocument2 pagesHalfling Rogue BackstoryalexNo ratings yet

- Update Data Karyawan - ShareDocument4 pagesUpdate Data Karyawan - SharedanangNo ratings yet

- Dayao v. ComelecDocument15 pagesDayao v. ComelecRichelle CartinNo ratings yet

- 9 Crime Media Culture 83Document19 pages9 Crime Media Culture 83MariaNo ratings yet

- Unit 10 - Market Leader AdvancedDocument4 pagesUnit 10 - Market Leader AdvancedIa GioshviliNo ratings yet

- Glan People V IAC Case DigestDocument2 pagesGlan People V IAC Case Digesthistab100% (1)

- SOM 664 Arrow Electronics, Inc: by Group 1Document18 pagesSOM 664 Arrow Electronics, Inc: by Group 1Aakanksha Gulabdhar MishraNo ratings yet

- Rajkot N-Equity QuotationDocument3 pagesRajkot N-Equity QuotationanilravraniNo ratings yet

- 4 Lives, New IntroductionDocument10 pages4 Lives, New IntroductionSaraNo ratings yet

- Pages From Model Financial Statements 2018 - Final - Pg. 3Document1 pagePages From Model Financial Statements 2018 - Final - Pg. 3Ahsan TariqNo ratings yet

- Maharashtra State Board of Secondary & Higher Secondary Education, PuneDocument14 pagesMaharashtra State Board of Secondary & Higher Secondary Education, PuneAjinkya DahivadeNo ratings yet

- 21 ChapterDocument30 pages21 Chapteribrahim javedNo ratings yet

- 07 - Chapter 1Document51 pages07 - Chapter 1Yash JaiswalNo ratings yet

- Competitive Profile MatrixDocument4 pagesCompetitive Profile MatrixDikshit KothariNo ratings yet

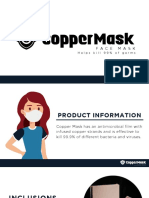

- COPPERMASK - FAQsDocument28 pagesCOPPERMASK - FAQsvernalbelasonNo ratings yet

- Annual Financial Results 2015Document92 pagesAnnual Financial Results 2015Muhammad JavedNo ratings yet

- Bharat Forge - Balance SheetDocument2 pagesBharat Forge - Balance SheetAnkit SinghNo ratings yet

- Shell Place Opens Its Doors: Discover Online Making History For Shell Deep Water Conserving GreenspaceDocument16 pagesShell Place Opens Its Doors: Discover Online Making History For Shell Deep Water Conserving GreenspaceJNo ratings yet

- (A Model) : A Policy of The (AGENCY) On Equal Opportunity Principle in The Four (4) Core Areas of PRIME-HRMDocument12 pages(A Model) : A Policy of The (AGENCY) On Equal Opportunity Principle in The Four (4) Core Areas of PRIME-HRMClarissa BustardeNo ratings yet

- Melting Pot or Salad Bowl? Cultural DiversityDocument9 pagesMelting Pot or Salad Bowl? Cultural DiversityRingle JobNo ratings yet

- Report On Human RightsDocument5 pagesReport On Human RightsQuinnee VallejosNo ratings yet

- Revista Martor 26 2021Document185 pagesRevista Martor 26 2021Orasul lui BucurNo ratings yet

- Memorandum MODDocument21 pagesMemorandum MODrajeshd006100% (2)

IDirect Pharma SectorUpdate Jun22

IDirect Pharma SectorUpdate Jun22

Uploaded by

durjoythermaxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect Pharma SectorUpdate Jun22

IDirect Pharma SectorUpdate Jun22

Uploaded by

durjoythermaxCopyright:

Available Formats

Pharmaceuticals

Auto

June 27, 2022

Narrative favours CRAMS, branded domestic; Sector View: Positive

calculated approach for US…

After a buoyant FY21 (Covid induced), the pharmaceutical sector witnessed a mixed

Top Picks

Sector Update

FY22 amid three overarching themes- 1) contraction of Covid led opportunities, 2)

industry specific structural issues such as, a) US price erosion, b) significant CMP Target Upside

Company Rating

(|/share) (|/share) (%)

inventory de-stocking, and 3) adverse global macro deflators like, a) higher input,

freight and power cost and b) supply chain challenges due to Covid and geo-political Cipla 940 1095 16% BUY

issues from H2FY22. Structural stories in pharmaceutical space like CRAMS and Divi's Lab 3670 4655 27% BUY

branded domestic formulations continue to deliver on their earning potential. We

Laurus

also draw comfort from companies with a diversified geographical presence in the 470 690 47% BUY

Labs

branded space and select players in the US with portfolios of complex nature Sun

845 1070 27% BUY

(specialty, biosimilars, injectable and complex generics with limited competition). Pharma

Key risks to our call

The pharma CRAMs story continued to unfold on capex-driven opportunities in FY22 Higher-than-expected competition

while the pandemic driven windfall gains further added to the already strong prints and continued US high price erosion

of most CRAMs players. Aggressive capex drives based on ‘’China-plus One’’ theme

is now coming to the fore as the post-Covid scenario further strengthens the High input cost for APIs and slower

argument in favour of outsourcing with incremental order wins and client additions. demand revival for generic APIs

Aggregated financial performances of the I-direct pharma CRAMs universe reflect

the improved trajectory, which is likely to persist as companies prepare for the next Negative outcomes from USFDA

ICICI Securities – Retail Equity Research

capex cycle. increased visits for plant inspection

Supply chain issues limiting

US oral solid dosages (OSD) Generics witnessed intense price erosion in FY22, execution capabilities amid robust

affecting both revenues and margins of pharma companies with higher mix for US order-book for CRAMS

generics. Nonetheless, we expect better prospects for the US as a whole from

H2FY23 onwards due to 1) moderation in OSD pricing pressure on back of exits due Research Analysts

to product unviability 2) optical focus on more complex products (injectables,

Siddhant Khandekar

oncology, respiratory, biosimilars), which may shift bargaining power towards siddhant.khandekar@icicisecurities.com

manufacturers and 3) decongestion of pending approvals pipeline as the USFDA and

Raunak Thakur

product inspection momentum which can go back to pre-pandemic level. raunak.thakur@icicisecurities.com

Kush Mehta

kush.mehta@icicisecurities.com

Domestic formulations business continues to remain main lever for growth during

both tough as well as normal times. During lockdowns and limited MR

activities/patients footfalls in clinics, most companies shifted focus to Covid related

opportunities. As the situation started to normalise, the focus was back on normal

activities via digital drives, new products introduction, etc. Many companies,

including market leader Sun, have augmented MR recruitment drive to focus on

untapped therapy areas.

Considering structural advantage for CRAMS, steady growth rate of domestic

branded generics besides calibrated US approach, we have earmarked top picks –

Divi’s Lab (BUY rating; target price: | 4,655), Laurus Labs (BUY rating; target price:

| 690), Sun Pharma (BUY rating; target price: | 1,070) and Cipla (BUY rating; target

price: | 1,095).

Sector Update | Pharmaceutical ICICI Direct Research

Top bets in Pharmaceutical Coverage Universe Price Chart

Divi’s Lab 10000 20000

Divi’s is engaged in manufacturing generic APIs and intermediates, custom synthesis 5000 10000

of active ingredients and advanced intermediates. The company has been building

capacities in a few more niche APIs as per the evolving demand scenario in the 0 0

Dec-19

Dec-20

Dec-21

Jun-21

Jun-19

Jun-20

Jun-22

backdrop of ‘China plus one’ opportunities and upcoming opportunity size of

~US$20 billion in molecules going off-patent over FY23-25. Divi’s has identified

Divis Labs(L.H.S)

execution strategy for growth areas of 1) Established generics, 2) Existing generics, NSE500 (R.H.S)

3) New generics, 4) Sartan APIs, 5) Contrast Media and 6) CS. We take comfort from

the company’s plant level fungibility, which offers flexibility to the company to Particulars

capture opportunities emerging in either of generics or custom synthesis segment. Particular Amount

We retain BUY rating and value Divi’s at | 4655 i.e. 38x on FY24E EPS of | 122.5. Market Capitalisation | 97427 crore

Debt (FY22) | 4 crore

Cash & equivalents (FY22) | 2891 crore

EV | 94540 crore

52 week H/L 5425/3790

Equity capital | 53.1 crore

Face value |2

Exhibit 1: Financial Summary

Key Financials (| crore) FY20 FY21 FY22 5 year CAGR (FY17-22) FY23E FY24E 2 year CAGR (FY22-24E)

Revenues 5394.4 6969.4 8959.8 17.1 9031.4 10348.8 7.5

EBITDA 1816.1 2859.9 3881.9 21.8 3938.1 4554.1 8.3

EBITDA margins (%) 33.7 41.0 43.3 43.6 44.0

Adj. Net Profit 1376.5 1984.3 2960.5 22.8 2805.3 3252.4 4.8

Adjusted EPS (|) 51.9 74.7 111.5 105.7 122.5

PE (x) 70.8 49.1 32.9 34.7 30.0

RoNW (%) 18.8 21.3 25.2 20.3 20.0

RoCE (%) 23.9 27.6 30.2 25.8 25.5

Source: Company, ICICI Direct Research

Laurus Labs Price Chart

1000 20000

Laurus Labs operates in the segment of generic APIs & FDFs (formulations), custom

synthesis and biotechnology. In the near to medium term, Laurus plans to 1) diversify 500 10000

into Non-ARV APIs and formulations, 2) scale up synthesis business and 3) leverage

Richore acquisition to tap into new area of biologics. Laurus has multiple planned 0 0

Dec-19

Dec-20

Dec-21

Jun-20

Jun-22

Jun-19

Jun-21

capacity expansions in portfolio based on complexity and scale and has set an

aspirational target of US$1 billion revenues in FY23. We retain BUY rating and value

Laurus(L.H.S)

Laurus at | 690 i.e. 26x P/E on FY24E EPS of | 26.5.

NSE500 (R.H.S)

Particulars

Particular Amount

Market Capitalisation | 25256 crore

Debt (FY22) | 1915 crore

Cash & Equivalents (FY22) | 76 crore

EV (| Cr) | 27095 crore

52 week H/L (|) 724/433

Equity capital | 107.5 crore

Face value |2

Exhibit 2: Financial Summary

Key Financials (| Crore) FY20 FY21 FY22 5 year CAGR (FY17-22) FY23E FY24E 3 year CAGR (FY22-24E)

Net Sales 2831.7 4813.5 4935.7 21.0 6439.4 7750.4 25.3

EBITDA 561.0 1550.7 1422.4 30.7 1846.2 2327.4 27.9

EBITDA Margins (%) 19.8 32.2 28.8 28.7 30.0

Adj. Profit 255.3 983.6 827.5 39.7 1107.7 1426.0 31.3

Adj. EPS (|) 4.8 18.3 15.4 20.6 26.5

PE (x) 98.9 25.7 30.5 22.8 17.7

RoE (%) 14.4 37.9 24.7 25.5 25.3

RoCE (%) 13.0 31.7 21.3 22.6 24.7

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 2

Sector Update | Pharmaceutical ICICI Direct Research

Sun Pharma Price Chart

1000 20000

Sun Pharma’s portfolio mix is changing with increased higher contribution from

global specialty and strong branded franchise for more remunerative businesses. In 500 10000

the US, Sun is diversifying into specialty products like Ilumya, Levulan, BromSite,

0 0

Cequa, Xelpros, Odomzo, Yonsa, Winlevi, etc. Global specialty business contribution

Dec-19

Dec-20

Dec-21

Jun-20

Jun-22

Jun-19

Jun-21

has inched up from 7% in FY18 to 13% in FY22 and sales grew 39% in FY22 to

US$674 million. Sun Pharma continues to maintain launch momentum in India and Sun Pharma (L.H.S)

plans for field expansion in FY23. We retain BUY rating and value Sun Pharma at NSE500 (R.H.S)

| 1070 i.e. 28x P/E on FY24E EPS of | 38.3.

Particulars

Particular Amount

Market Capitalisation | 202744 crore

Debt (FY22) | 1290 crore

Cash & Equivalents (FY22) | 5033 crore

EV (| Cr) | 199001 crore

52 week H/L (|) 967/653

Equity capital | 239.9 crore

Face value |1

Exhibit 3: Financial Summary

Key Financials (| Crore) FY20 FY21 FY22 5 year CAGR (FY17-22) FY23E FY24E 2 year CAGR (FY22-24E)

Net Sales 32837.5 33498.1 38654.5 4.1 42606.9 46710.0 9.9

EBITDA 6989.8 8491.4 10397.7 0.6 11500.2 13195.6 12.7

EBITDA Margins (%) 21.3 25.3 26.9 27.0 28.3

Adj. Profit 4025.6 7210.0 7667.1 1.9 7822.9 9189.1 9.5

Adj. EPS (|) 16.8 30.0 32.0 32.6 38.3

PE (x) 53.9 69.8 61.9 25.9 22.1

RoE (%) 8.9 15.5 16.0 14.3 14.7

RoCE (%) 10.0 14.2 18.2 17.7 18.2

Source: Company, ICICI Direct Research

Cipla

Price Chart

Cipla has a long-drawn strategy of targeting four verticals viz. One India, South Africa

2000 20000

& EMs, US generics & specialty and lung leadership. In the US, significant momentum

is likely from H2FY23 onwards on the back of peptide portfolio unlocking and 1000 10000

possible approvals, launches of gRevlimid, gAdvair and gAbraxane besides gains

from Albuterol portfolio. In branded prescription portfolio therapy mix reflects strong 0 0

Dec-19

Dec-20

Dec-21

Jun-20

Jun-22

Jun-19

Jun-21

fundamentals across chronic and acute segments while company is focussed on

board transformation from tenderised model to private model in exports market. We

retain BUY rating and value Cipla at | 1095 i.e. 25x P/E on FY24E EPS of | 42.5 + Cipla(L.H.S) NSE500 (R.H.S)

| 32 NPV for gRevlimid.

Particulars

Particular Amount

Market Capitalisation | 75841 crore

Debt (FY22) | 824 crore

Cash (FY22) | 1928 crore

EV | 74736 crore

52 week H/L (|) 1083/850

Equity capital | 161.4 crore

Face value |2

Exhibit 4: Financial Summary

Key Financials (| crore) FY20 FY21 FY22 5 year CAGR (FY17-22) FY23E FY24E 2 year CAGR (FY22-24E)

Revenues 17132.0 19159.6 21763.3 8.3 23507.7 25798.7 8.9

EBITDA 3206.0 4252.4 4552.8 13.0 4967.9 5675.7 11.7

EBITDA margins (%) 18.7 22.2 20.9 21.1 22.0

Adjusted PAT 1546.5 2404.9 2650.2 21.4 2915.5 3422.8 13.6

Adj. EPS (|) 19.2 29.9 32.9 36.2 42.5

PE (x) 48.9 31.5 30.1 26.0 22.1

RoNW (%) 9.8 13.1 12.7 12.6 13.3

RoCE (%) 12.0 16.3 16.7 16.7 17.7

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 3

Sector Update | Pharmaceutical ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorises them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as

the analysts' valuation for a stock

Buy: >15%;

Hold: -5% to 15%;

Reduce: -5% to -15%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 4

Sector Update | Pharmaceutical ICICI Direct Research

ANALYST CERTIFICATION

I/We, Siddhant Khandekar, Inter CA, Raunak Thakur, PGDM, Kush Mehta, CA, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect

our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that

above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies

mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture

capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial

interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past

twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or actual/ beneficial ownership of one percent or more or other material

conflict of interest various companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 5

You might also like

- Noco v. Autogen Tech. - ComplaintDocument87 pagesNoco v. Autogen Tech. - ComplaintSarah BursteinNo ratings yet

- Pharma Industry AnalysisDocument59 pagesPharma Industry AnalysissamathagondiNo ratings yet

- ChemicalsDocument50 pagesChemicalssamathagondiNo ratings yet

- PL ChemicalsDocument8 pagesPL Chemicalsg.alekhya111No ratings yet

- SWOT ExampleDocument2 pagesSWOT Examplefrank1704No ratings yet

- Divis-Laboratories 24022020Document6 pagesDivis-Laboratories 24022020anjugaduNo ratings yet

- Consumer - Outlook 2021Document24 pagesConsumer - Outlook 2021Deepak SharmaNo ratings yet

- Strong Momentum Across Verticals Maintain BUY: Dr. Reddy's Laboratories LTDDocument9 pagesStrong Momentum Across Verticals Maintain BUY: Dr. Reddy's Laboratories LTDPratik DiyoraNo ratings yet

- Major Discontinuities in The Global Chemicals Market: Operational Excellence: Leadership PerspectivesDocument3 pagesMajor Discontinuities in The Global Chemicals Market: Operational Excellence: Leadership PerspectivesmittleNo ratings yet

- Investment Idea: DIVI'S Laboratories 2021-09-13Document5 pagesInvestment Idea: DIVI'S Laboratories 2021-09-13vikalp123123No ratings yet

- Jubilant Pharmova 07 06 2021 IciciDocument6 pagesJubilant Pharmova 07 06 2021 IciciBhagwat RautelaNo ratings yet

- Achieving Operational Excellence Five ElDocument20 pagesAchieving Operational Excellence Five ElJack HuseynliNo ratings yet

- Nse:Dabur Stock Pitch: Team Cap-It-All - Xlri JamshedpurDocument15 pagesNse:Dabur Stock Pitch: Team Cap-It-All - Xlri JamshedpurSimran JainNo ratings yet

- Report - Divis LabDocument7 pagesReport - Divis LabAnonymous y3hYf50mTNo ratings yet

- Specialty Chemicals Industry India PDFDocument32 pagesSpecialty Chemicals Industry India PDFSachin VermaNo ratings yet

- IcisDocument118 pagesIcismarketing7No ratings yet

- Balmoral Newsletter Chemicals 2019 Q2Document9 pagesBalmoral Newsletter Chemicals 2019 Q2CDI Global IndiaNo ratings yet

- Best 4 Specialty Chemicals Stocks To Buy NowDocument60 pagesBest 4 Specialty Chemicals Stocks To Buy Nowmasta kalandarNo ratings yet

- Heranba Industries IPO Note ICICI DirectDocument12 pagesHeranba Industries IPO Note ICICI DirectVasim MerchantNo ratings yet

- Cornell EMI Case - Campus RoundDocument20 pagesCornell EMI Case - Campus Roundkunal patilNo ratings yet

- Outsourced Pharmaceutical Manufacturing 2020 White Paper - Results HealthcareDocument24 pagesOutsourced Pharmaceutical Manufacturing 2020 White Paper - Results HealthcareStevin GeorgeNo ratings yet

- Amber - Enterprises - IC - 17mar21 - JMFLDocument29 pagesAmber - Enterprises - IC - 17mar21 - JMFLAshish KudalNo ratings yet

- Vinati Organics - Initiating Coverage - 12 Jun 24Document40 pagesVinati Organics - Initiating Coverage - 12 Jun 24amarjeetNo ratings yet

- Quarterly Update Report Laurus Labs Q1 FY24Document8 pagesQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDANo ratings yet

- Rossari Biotech LTD: SubscribeDocument9 pagesRossari Biotech LTD: SubscribeDavid BassNo ratings yet

- 02 External EnvironmentDocument38 pages02 External Environment然No ratings yet

- Speciality Chemicals Sector Thematic Jun24Document50 pagesSpeciality Chemicals Sector Thematic Jun24mayankabra29No ratings yet

- FMCG & Alco Bev: 1QFY21 PreviewDocument8 pagesFMCG & Alco Bev: 1QFY21 PreviewSanket SharmaNo ratings yet

- Thematic - Indian Pharma Sector - Centrum 09122022Document58 pagesThematic - Indian Pharma Sector - Centrum 09122022NikhilKapoor29No ratings yet

- HEALTHCARE MOSL Sep23Document60 pagesHEALTHCARE MOSL Sep23Sriram RanganathanNo ratings yet

- Post Holdings Buying WeetabixDocument16 pagesPost Holdings Buying WeetabixKing KosherNo ratings yet

- 02.22 EY CGPA Capacity Study - FINAL 1Document47 pages02.22 EY CGPA Capacity Study - FINAL 1Prasoon MishraNo ratings yet

- Piramal Enterprises: Building Scalable Differentiated Pharma BusinessDocument14 pagesPiramal Enterprises: Building Scalable Differentiated Pharma BusinessEcho WackoNo ratings yet

- Zantac (A) Case AnalysisDocument4 pagesZantac (A) Case AnalysisshakhilNo ratings yet

- Pidilite Industries: Robust Recovery Margin Pressure AheadDocument15 pagesPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7No ratings yet

- Rossari Biotech IC Mar21Document42 pagesRossari Biotech IC Mar21Vipul Braj Bhartia100% (1)

- Business Communication: Individual Case Assignment - 1 Written Analysis OnDocument10 pagesBusiness Communication: Individual Case Assignment - 1 Written Analysis OnParidhi JainNo ratings yet

- PC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344Document70 pagesPC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344PriyankaNo ratings yet

- Indian Pharma Industry To Surpass USD 60 Billion in Two YearsDocument3 pagesIndian Pharma Industry To Surpass USD 60 Billion in Two YearsKiran KudtarkarNo ratings yet

- Viral Vectors, Non-Viral Vectors and Gene Therapy Manufacturing Market (3rd Edition), 2019-2030Document39 pagesViral Vectors, Non-Viral Vectors and Gene Therapy Manufacturing Market (3rd Edition), 2019-2030Roots Analysis100% (1)

- J&J Supply Chain Strategy - OdpDocument10 pagesJ&J Supply Chain Strategy - OdpChanaka PradeepNo ratings yet

- GMM Ic June20Document43 pagesGMM Ic June20Melissa PerryNo ratings yet

- Division Presentation - Care ChemicalsDocument18 pagesDivision Presentation - Care ChemicalsChris SongNo ratings yet

- The Outlook: UV BombardmentDocument8 pagesThe Outlook: UV BombardmentBAlmohsinNo ratings yet

- New Supply Chains of Global Companies After COVID-19: - Focusing On The Changed Production StrategyDocument2 pagesNew Supply Chains of Global Companies After COVID-19: - Focusing On The Changed Production Strategyparkseoyeon623No ratings yet

- Strategic Management - Chapter 4Document13 pagesStrategic Management - Chapter 4Hòa Nguyễn KhánhNo ratings yet

- Industry Analysis 4Document48 pagesIndustry Analysis 4ZainNo ratings yet

- Valiant Organics LTD.: Eureka in The LabDocument11 pagesValiant Organics LTD.: Eureka in The LabAJNo ratings yet

- Supply Chain EfficiencyDocument4 pagesSupply Chain EfficiencySaurabhNo ratings yet

- The Searle Company (SEARL) - Reinstating With A BuyDocument17 pagesThe Searle Company (SEARL) - Reinstating With A BuySHAHZAIB -No ratings yet

- Q1 2024 Medtech Public Comp Sheet and Valuation Guide PreviewDocument8 pagesQ1 2024 Medtech Public Comp Sheet and Valuation Guide PreviewKumud GoelNo ratings yet

- In-Line Q1FY22 Stabilising Underlying Trends: Company CMP (Inr) RecoDocument17 pagesIn-Line Q1FY22 Stabilising Underlying Trends: Company CMP (Inr) RecoGowtamdNo ratings yet

- Market Specialtychemicals Edelweiss 26.06.19 PDFDocument198 pagesMarket Specialtychemicals Edelweiss 26.06.19 PDFakhileshguptamnreNo ratings yet

- Journey From Globalisation To GlocalisationDocument16 pagesJourney From Globalisation To GlocalisationItzKenMC INo ratings yet

- Orient Electric IC Jun22Document44 pagesOrient Electric IC Jun22nishantNo ratings yet

- Ey Pharma Supply Chains of The Future FinalDocument19 pagesEy Pharma Supply Chains of The Future FinalPedro HerycNo ratings yet

- The Impact of COVID 19 On Capital Markets One Year in PDFDocument8 pagesThe Impact of COVID 19 On Capital Markets One Year in PDFRhenyAANo ratings yet

- The Race to Manufacture COVID-19 Vaccines: Emerging Vaccine TechnologiesFrom EverandThe Race to Manufacture COVID-19 Vaccines: Emerging Vaccine TechnologiesNo ratings yet

- Reshaping Global Value Chains in Light of COVID-19: Implications for Trade and Poverty Reduction in Developing CountriesFrom EverandReshaping Global Value Chains in Light of COVID-19: Implications for Trade and Poverty Reduction in Developing CountriesNo ratings yet

- Q1 Mapeh - TosDocument2 pagesQ1 Mapeh - TosKenneth Roy MatuguinaNo ratings yet

- DepedDocument25 pagesDepedCharles Allen TanglaoNo ratings yet

- Wipro Case StudyDocument8 pagesWipro Case Studysumaya parveenNo ratings yet

- An Overview of Financial Statement AnalysisDocument37 pagesAn Overview of Financial Statement AnalysisShynara MuzapbarovaNo ratings yet

- ICTAD Specifications For WorksDocument12 pagesICTAD Specifications For Workssanojani50% (8)

- InterviewDocument3 pagesInterviewThiya NalluNo ratings yet

- Halfling Rogue BackstoryDocument2 pagesHalfling Rogue BackstoryalexNo ratings yet

- Update Data Karyawan - ShareDocument4 pagesUpdate Data Karyawan - SharedanangNo ratings yet

- Dayao v. ComelecDocument15 pagesDayao v. ComelecRichelle CartinNo ratings yet

- 9 Crime Media Culture 83Document19 pages9 Crime Media Culture 83MariaNo ratings yet

- Unit 10 - Market Leader AdvancedDocument4 pagesUnit 10 - Market Leader AdvancedIa GioshviliNo ratings yet

- Glan People V IAC Case DigestDocument2 pagesGlan People V IAC Case Digesthistab100% (1)

- SOM 664 Arrow Electronics, Inc: by Group 1Document18 pagesSOM 664 Arrow Electronics, Inc: by Group 1Aakanksha Gulabdhar MishraNo ratings yet

- Rajkot N-Equity QuotationDocument3 pagesRajkot N-Equity QuotationanilravraniNo ratings yet

- 4 Lives, New IntroductionDocument10 pages4 Lives, New IntroductionSaraNo ratings yet

- Pages From Model Financial Statements 2018 - Final - Pg. 3Document1 pagePages From Model Financial Statements 2018 - Final - Pg. 3Ahsan TariqNo ratings yet

- Maharashtra State Board of Secondary & Higher Secondary Education, PuneDocument14 pagesMaharashtra State Board of Secondary & Higher Secondary Education, PuneAjinkya DahivadeNo ratings yet

- 21 ChapterDocument30 pages21 Chapteribrahim javedNo ratings yet

- 07 - Chapter 1Document51 pages07 - Chapter 1Yash JaiswalNo ratings yet

- Competitive Profile MatrixDocument4 pagesCompetitive Profile MatrixDikshit KothariNo ratings yet

- COPPERMASK - FAQsDocument28 pagesCOPPERMASK - FAQsvernalbelasonNo ratings yet

- Annual Financial Results 2015Document92 pagesAnnual Financial Results 2015Muhammad JavedNo ratings yet

- Bharat Forge - Balance SheetDocument2 pagesBharat Forge - Balance SheetAnkit SinghNo ratings yet

- Shell Place Opens Its Doors: Discover Online Making History For Shell Deep Water Conserving GreenspaceDocument16 pagesShell Place Opens Its Doors: Discover Online Making History For Shell Deep Water Conserving GreenspaceJNo ratings yet

- (A Model) : A Policy of The (AGENCY) On Equal Opportunity Principle in The Four (4) Core Areas of PRIME-HRMDocument12 pages(A Model) : A Policy of The (AGENCY) On Equal Opportunity Principle in The Four (4) Core Areas of PRIME-HRMClarissa BustardeNo ratings yet

- Melting Pot or Salad Bowl? Cultural DiversityDocument9 pagesMelting Pot or Salad Bowl? Cultural DiversityRingle JobNo ratings yet

- Report On Human RightsDocument5 pagesReport On Human RightsQuinnee VallejosNo ratings yet

- Revista Martor 26 2021Document185 pagesRevista Martor 26 2021Orasul lui BucurNo ratings yet

- Memorandum MODDocument21 pagesMemorandum MODrajeshd006100% (2)