Professional Documents

Culture Documents

Final Test - A

Final Test - A

Uploaded by

s21710021Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Test - A

Final Test - A

Uploaded by

s21710021Copyright:

Available Formats

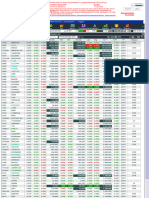

PORTFOLIO & INVESTMENT FINAL TEST Name:

April 29th, 2024

A

Return Data

Month KLBF BMRI ICBP SMGR R Market Step 1 Calculate the Expected Return for each stock KLBF BMRI ICBP SMGR

1 -0.042453 -0.024155 0.106383 -0.02521 -0.040842 25% 25% 25% 25% 100%

2 0.0281956 0.029703 -0.032051 0.093234 0.004314 Expected Return -0.010613 -0.006039 0.026596 -0.006303 0.003641

3 -0.065854 0.1009615 -0.011038 0.148148 0.040451 KLBF -0.0299 0.007049 0.007426 -0.008013 0.023309 0.02977

4 -0.052219 0.0524017 0.016768 -0.02509 0.00316 BMRI 0.0292 -0.016463 0.02524 -0.002759 0.037037 0.043055

5 -0.033058 0 -0.011161 -0.055147 -0.001923 ICBP 0.0104 -0.013055 0.0131 0.004192 -0.006272 -0.002035

6 -0.037037 -0.058091 -0.065463 -0.050584 -0.027044 SMGR 0.0062 -0.008264 0 -0.00279 -0.013787 -0.024841

7 -0.044379 0.030837 0.115942 0.065574 0.048655 -0.009259 -0.014523 -0.016366 -0.012646 -0.052794

8 -0.003096 0.034188 -0.084416 -0.015385 0.027124 Step 2 Calculate the Risk for each stock -0.011095 0.007709 0.028986 0.016393 0.041994

9 -0.062112 0.0991736 0.113475 -0.03125 -0.008918 -0.000774 0.008547 -0.021104 -0.003846 -0.017177

10 -0.013245 0.0526316 -0.019108 -0.016129 0.015007 Risk -0.015528 0.024793 0.028369 -0.007813 0.029822

11 -0.003356 0.0035714 -0.015152 -0.020492 -0.009384 KLBF 0.0289 -0.003311 0.013158 -0.004777 -0.004032 0.001037

BMRI 0.0481

ICBP 0.0707

SMGR 0.0658

Step 3 Calculate the Risk and the expected return of portfolio with the SAME PROPORTION for each stock

Risk 0.031332

Expected Return 0.005247

Step 4 Calculate the Risk, the expected return, and the weight of portfolio using solver with 0.015 (1.5%) targeted return

Risk 0.03353

Expected Return 0.015

KLBF BMRI ICBP SMGR

-0.0059 0.0194 0.0014 0.0000

Step 5 Create 7 combinations of stock that will Step 6 Draw the efficient frontier based on the combinations Make sure to change back the stock proportion into equal proportions

result to different risk and return of step 5 after you're done using the solver

Risk Return

1 0.025

2 0.023

3 0.021

4 0.019

5 0.017

6 0.015

7 0.013

Step 7 Calculate the Beta for each stock with the Step 8 Evaluate the portfolio using RVAR and RVOL

SAME PROPORTION for each stock using the SAME PROPORTION for each stock

BETA Weight Risk Free monthly 0.006

KLBF 25%

BMRI 25% RVAR

ICBP 25% RVOL

SMGR 25%

Beta Portfolio

You might also like

- Fin 460-HW 4 Adianto JoelDocument7 pagesFin 460-HW 4 Adianto JoelAdianto TjandraNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Summary of Five-Year Eurobond Terms Available To R.J. ReynoldsDocument8 pagesSummary of Five-Year Eurobond Terms Available To R.J. ReynoldsRyan Putera Pratama ManafeNo ratings yet

- FM Textbook Solutions Chapter 2 Second Edition PDFDocument11 pagesFM Textbook Solutions Chapter 2 Second Edition PDFlibredescarga100% (1)

- LAB2 - Rizki Yogatama - MKL5Document6 pagesLAB2 - Rizki Yogatama - MKL5rizkiyoga21No ratings yet

- HDFC by IshanDocument14 pagesHDFC by IshanIshan MalikNo ratings yet

- Donalbain SlidesCarnivalDocument27 pagesDonalbain SlidesCarnivalJerin TasnimNo ratings yet

- Risk, Price and Valuations of Jet Airways (India) LTDDocument1 pageRisk, Price and Valuations of Jet Airways (India) LTDShubhamSoodNo ratings yet

- Answer For Q4 Case Study 1 ExcelDocument5 pagesAnswer For Q4 Case Study 1 ExcelKyounosuke YuiNo ratings yet

- TABLE: Auto Seismic - IS 1893:2002 Load Pattern Type Direction Period Method CT Top Story Bottom Story Z TypeDocument3 pagesTABLE: Auto Seismic - IS 1893:2002 Load Pattern Type Direction Period Method CT Top Story Bottom Story Z TypeAmren ShahNo ratings yet

- Blk-2 Modal Participation Analysis ResultDocument3 pagesBlk-2 Modal Participation Analysis ResultmonishNo ratings yet

- Censo de Carga: Estudiante: Victor Rafael Palmett ArizaDocument10 pagesCenso de Carga: Estudiante: Victor Rafael Palmett ArizaVictor PalmettNo ratings yet

- Column 1 Column 2Document6 pagesColumn 1 Column 2Mifta Dian PratiwiNo ratings yet

- FSAV Part 2Document47 pagesFSAV Part 2yesrat sharmin polyNo ratings yet

- ILab Portfolio Variance TemplatesDocument10 pagesILab Portfolio Variance Templatesnibaba1No ratings yet

- Stock Selling and LiquidatingDocument210 pagesStock Selling and LiquidatingImran TanoliNo ratings yet

- Forecasting - CocaColaSalesDocument6 pagesForecasting - CocaColaSalesRavinderpal S WasuNo ratings yet

- Wapic Smart LifeSavers PlanDocument8 pagesWapic Smart LifeSavers PlanSalifu AbdulNo ratings yet

- Final FM Assignment - Group 7Document479 pagesFinal FM Assignment - Group 7Godi SreemitraNo ratings yet

- AnsDocument8 pagesAnskvj111111No ratings yet

- Final Mock CalculationsDocument5 pagesFinal Mock CalculationsfadsNo ratings yet

- Case Study LBODocument4 pagesCase Study LBOadarshraj100% (3)

- RollPower Calculator - V2.2Document29 pagesRollPower Calculator - V2.2Crypto FriendlyNo ratings yet

- ICICI Prudential Life InsuranceDocument3 pagesICICI Prudential Life InsuranceArjun BhatnagarNo ratings yet

- Cgs-Cimb ItradeDocument1 pageCgs-Cimb ItradeNorsyaliza Abd RazakNo ratings yet

- ملف التانيDocument3 pagesملف التانيmondialismepubNo ratings yet

- Management Account PPT Vandit Bathla and Shivam JhaDocument4 pagesManagement Account PPT Vandit Bathla and Shivam JhaVandit BatlaNo ratings yet

- MMult Function and Demo of ROIDocument6 pagesMMult Function and Demo of ROIJITESHNo ratings yet

- Tugas 4 Mip Elsa Rezino Tiyafani (0120077301)Document5 pagesTugas 4 Mip Elsa Rezino Tiyafani (0120077301)9wyz9k9mptNo ratings yet

- Problema 22Document4 pagesProblema 22zimbolixNo ratings yet

- Libro 1Document4 pagesLibro 1Roy AlfaroNo ratings yet

- Excl - JK TLKM - JK Isat - JK Jkse Bi RateDocument5 pagesExcl - JK TLKM - JK Isat - JK Jkse Bi RateAgung ApriansyahNo ratings yet

- OA Landed CalculationDocument36 pagesOA Landed CalculationAnonymous D8oxvPegNo ratings yet

- Lampiran ReturnDocument12 pagesLampiran ReturnGus Suma Arta SevenmanNo ratings yet

- Balanced - Dataset - Comparison: P-ValueDocument21 pagesBalanced - Dataset - Comparison: P-ValueChinniah DevarNo ratings yet

- Table: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz Sumux Sumuy SumuzDocument4 pagesTable: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz Sumux Sumuy SumuzJuan David HernandezNo ratings yet

- PortfolioDocument1 pagePortfolioShakhawat RahmanNo ratings yet

- Latihan spss1Document4 pagesLatihan spss1fadila amalisNo ratings yet

- BBSW 20171214Document3 pagesBBSW 20171214NDNo ratings yet

- MassDocument5 pagesMassLenjerTVNo ratings yet

- Assignment 6Document14 pagesAssignment 6Utkarsh ChoudharyNo ratings yet

- A Sismico-433Document474 pagesA Sismico-433Roly ValenzuelaNo ratings yet

- Im MT 021Document6 pagesIm MT 021Emy SumartiniNo ratings yet

- Sir Afraz Port FolioDocument7 pagesSir Afraz Port FolioHafeez KhanNo ratings yet

- Jn91ao4yltxa4dcoqvqv7w17bivz6b 1Document2 pagesJn91ao4yltxa4dcoqvqv7w17bivz6b 1Vinay AgarwalNo ratings yet

- Problem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Document4 pagesProblem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Bona Christanto SiahaanNo ratings yet

- BCS-CRM 204 - 6 Sep2017Document4 pagesBCS-CRM 204 - 6 Sep2017Ishmael WoolooNo ratings yet

- Financial Management-1 Project ReportDocument6 pagesFinancial Management-1 Project ReportNakulesh VijayvargiyaNo ratings yet

- Wednesday, 6 September 2023Document1 pageWednesday, 6 September 2023DOST IX RSTLNo ratings yet

- FRM INS 4001 Calibration Record Form Square RootDocument3 pagesFRM INS 4001 Calibration Record Form Square Rootismail BCMNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- AnnexDocument10 pagesAnnexmelkamuNo ratings yet

- Summary of Capital Gains 01/04 To 15/06 16/06 To 15/09: Capital Gain / Loss StatementDocument10 pagesSummary of Capital Gains 01/04 To 15/06 16/06 To 15/09: Capital Gain / Loss Statement9nv4tt9zjqNo ratings yet

- Blue Bus485 FinalDocument13 pagesBlue Bus485 FinalTamzid Ahmed AnikNo ratings yet

- Arch Garch AssignmentDocument5 pagesArch Garch AssignmentSurbhiVijhaniNo ratings yet

- New PlcuxDocument19 pagesNew PlcuxyesawovNo ratings yet

- 250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Document9 pages250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Kai ZhaoNo ratings yet

- Book 1Document4 pagesBook 1AkhileshNo ratings yet

- LT1 - LyxorDocument3 pagesLT1 - LyxorMark Paolo Navata100% (1)

- Python For FinanceDocument9 pagesPython For FinancePiyush PurohitNo ratings yet

- Bobi CDocument4 pagesBobi Cwishy1516No ratings yet

- B60518100203NDocument3 pagesB60518100203N祥智孟No ratings yet

- Project ABCDocument2 pagesProject ABClorrynorryNo ratings yet

- Materi 5.1-Inference in Simple Linear RegressionDocument15 pagesMateri 5.1-Inference in Simple Linear RegressionarismansyahNo ratings yet

- Mathematics of Investment FormulasDocument4 pagesMathematics of Investment FormulasaileeNo ratings yet

- Pratik Pranay ResumeDocument1 pagePratik Pranay ResumePratik PranayNo ratings yet

- Session 2 Portfolio AnalysisDocument33 pagesSession 2 Portfolio Analysispvkoganti1No ratings yet

- Chapter 5 Problems The Time Value of MoneyDocument46 pagesChapter 5 Problems The Time Value of MoneyShahid KhanNo ratings yet

- Marathon 1 - Time Value of MoneyDocument116 pagesMarathon 1 - Time Value of Moneypriyanshusingh.inboxNo ratings yet

- Sabr SLVDocument21 pagesSabr SLVArturo ZamudioNo ratings yet

- Bahan Investasi Tambang PT Lagadar AbadiDocument8 pagesBahan Investasi Tambang PT Lagadar AbadiBintangNo ratings yet

- Penentuan Kelayakan Finansial Usaha Produksi Pupuk Abc Pada CV - Xyz Dusun Sebotu Kabupaten SanggauDocument8 pagesPenentuan Kelayakan Finansial Usaha Produksi Pupuk Abc Pada CV - Xyz Dusun Sebotu Kabupaten SanggauArif SetiajayaNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneySouvik NandiNo ratings yet

- 2007 IAA Education Syllabus: 1. Financial MathematicsDocument5 pages2007 IAA Education Syllabus: 1. Financial Mathematicsarcanum78No ratings yet

- Time Value Formula and TricksDocument7 pagesTime Value Formula and Tricksrbansak234No ratings yet

- SS9 FMDocument2 pagesSS9 FMNguyễn Hồng HạnhNo ratings yet

- White and Blue Modern Professional Enterprise Risk Management PresentationDocument3 pagesWhite and Blue Modern Professional Enterprise Risk Management PresentationMarjorie BricenioNo ratings yet

- Datacamp Python 4Document37 pagesDatacamp Python 4Luca FarinaNo ratings yet

- Principles of Investments 1St Edition Bodie Test Bank Full Chapter PDFDocument63 pagesPrinciples of Investments 1St Edition Bodie Test Bank Full Chapter PDFDawnCrawforddoeq100% (10)

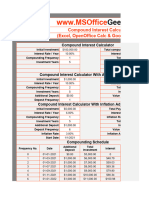

- Compound Interest CalculatorDocument14 pagesCompound Interest CalculatorSiyabongaNo ratings yet

- Tentative Program QFW2024Document6 pagesTentative Program QFW2024Ahmadi AliNo ratings yet

- AFRM-Advanced Financial Risk Management - Programme by IIM Bangalore OverviewDocument22 pagesAFRM-Advanced Financial Risk Management - Programme by IIM Bangalore OverviewjavidfinanceNo ratings yet

- Corporate FInance 101 EDX IIMBX Course PracticeDocument2 pagesCorporate FInance 101 EDX IIMBX Course PracticeDipesh dipsNo ratings yet

- Bullock Gold Mining: Corporate Finance Case StudyDocument28 pagesBullock Gold Mining: Corporate Finance Case StudyVivek TripathyNo ratings yet

- Business Management ReportDocument15 pagesBusiness Management ReportFenith Morandarte ManulongNo ratings yet

- Present and Future Value TablesDocument6 pagesPresent and Future Value TablesRakyNo ratings yet

- Pyetje Shumefishe BFDocument5 pagesPyetje Shumefishe BFAnisa HoxhaNo ratings yet

- (University of London, Jacquier) Volatility Seminar - Some Notes On Variance Swaps and Volatility DerivativesDocument12 pages(University of London, Jacquier) Volatility Seminar - Some Notes On Variance Swaps and Volatility DerivativesanuragNo ratings yet

- Aiternatif Risk Transfer: Solusi Pembiayaan Risiko: Moeninggar S. Salusra Satria Gomos B. SilitongaDocument13 pagesAiternatif Risk Transfer: Solusi Pembiayaan Risiko: Moeninggar S. Salusra Satria Gomos B. Silitongadindathap28No ratings yet