Professional Documents

Culture Documents

Semi (CM6)

Semi (CM6)

Uploaded by

Pavena Barbacena0 ratings0% found this document useful (0 votes)

0 views2 pagesOriginal Title

SEMI (CM6)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views2 pagesSemi (CM6)

Semi (CM6)

Uploaded by

Pavena BarbacenaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Name: ________________________________________________ Date: ____________

Choose the best answer. No erasure allowed.

1. __________________ he may demand evidence of payment of duties and taxes on imported

goods openly for sale or kept in storage.

a. Commissioner c. customs officers

b. Authorized representatives d. All of the above

2. Presentation of the Proof of Payment of Duties and Taxes within the fifteen (15) day period.

During the said period, the goods shall be placed under Constructive Customs Custody provided

that the same may be released if any of the following documents are presented and verified

except:

a. Proof of payment of correct duties and taxes or proof of exemption from payment of duties

and taxes

b. Proof of local purchase and payment of correct duties and taxes by the original importer or

manufactured

c. Proof that the goods are locally produced or in the event that the interested party fails to

produce such evidence within the said fifteen (15) day period, the goods shall be seized and

subjected to forfeiture proceedings

c. None of the above

3. The shipment shall be deemed abandoned if the owner, importer, or consignee fails to pay in

full the assessed duties, taxes, fees, interests and other charges within fifteen (15) calendar days

from final assessment.

a. The statement is correct c. Either correct or incorrect

b. The statement is incorrect d. None of the choices

4. The owner, importer or consignee of the imported goods may reclaim the impliedly abandoned

imported goods by lodging or filing the corresponding Goods Declaration subject to the

following conditions;

a. The subject goods have not been disposed by the Bureau

b. The goods declaration is filed within thirty 30 calendar days after the lapse of the fifteen 15

calendar days period to file;

c. The duties, taxes and other charges have been paid in full

d. All of the above

5. ___________ shall refer to the notification to the owner, importer, consignee or interested

party to lodge or file, pay, claim, mark, submit clearances and other requirements, or Order of

Release and Lifting the Alert Order.

a. Publication c. Electronic and public notice

b. Due notice d. None of the above

6. If the offense relates only to a part or portion of a shipment, all the part shall be seized or

detained, provided that the District Collector is satisfied that the remainder of the shipment was

not used, directly or indirectly, in the commission of the offense.

a. True c. Either true or false

b. False d. None of the above

7. _________ shall refer to the registration of a Goods Declaration with the Bureau

a. Customs clearance c. Electronic lodgement

b. Lodgement d. Registration

8. For imported goods which have been impliedly abandoned and sold by the Bureau where no

offense has been discovered against the imported goods or the owner, importer, or consignee of

the imported goods, the proceeds of the sale, after deduction of any duty and tax and all other

charges and expenses incurred as provided in Section 1143 of the CMTA, shall be turned over __

a. owner, importer, or consignee c. Bureau of Customs

b. government properties d. All of the above

9. He shall exercise the territorial jurisdiction over the location of the seized goods shall have

the original and exclusive authority to issue the WSD.

a District Collector c. customs officer

b. Commissioner d. Authorize representative

10. If the owner is unknown, with insufficient address, or a foreign entity or individual, service

shall be effected by posting of the WSD by the ESS in the bulletin board of the concerned

collection district office, and by electronic posting through the BOC website, or printed

publication, for thirty (30) days

a. True c. Either true or false

b. False d. None of the above

You might also like

- Tax - Special TopicsDocument28 pagesTax - Special TopicsPrincess Diane VicenteNo ratings yet

- 19Document9 pages19jhouvanNo ratings yet

- GRE Quantitative Reasoning 2014Document16 pagesGRE Quantitative Reasoning 2014perwinsharmaNo ratings yet

- Harvard Financial Accounting Final Exam 3Document11 pagesHarvard Financial Accounting Final Exam 3Bharathi Raju0% (1)

- Taxation Law - DoneDocument6 pagesTaxation Law - DoneJam RockyouonNo ratings yet

- CDP Mastery Test 1.1Document13 pagesCDP Mastery Test 1.1Asnifah AlinorNo ratings yet

- Customs Laws, Rules, Regulations, Ethics CBP Evaluation Examination July 23 2023Document9 pagesCustoms Laws, Rules, Regulations, Ethics CBP Evaluation Examination July 23 2023lito77No ratings yet

- Finals QuizDocument6 pagesFinals QuizAngel MaghuyopNo ratings yet

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Document5 pagesI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- Assessment 3Document9 pagesAssessment 3Celeste Tumbokon IINo ratings yet

- Customs Documentation Evaluation Examination July 23 2023Document12 pagesCustoms Documentation Evaluation Examination July 23 2023lito77No ratings yet

- 2.1.1 Quiz 2 - Answer KeyDocument7 pages2.1.1 Quiz 2 - Answer KeyMark Emil BaritNo ratings yet

- Chapter 29. Powers Authority of The Commissioner of Internal RevenueDocument5 pagesChapter 29. Powers Authority of The Commissioner of Internal RevenuePrincess Edelyn CastorNo ratings yet

- Polytechnic University of The PhilippinesDocument7 pagesPolytechnic University of The PhilippinesTwinie Mendoza100% (1)

- Taxation ExamDocument7 pagesTaxation ExamJean PaladaNo ratings yet

- Midterm WarehousingDocument8 pagesMidterm WarehousingAngelo Ace M. MañalacNo ratings yet

- TAX REMEDIES PART 3 BDocument2 pagesTAX REMEDIES PART 3 BIris BalucanNo ratings yet

- Exercise RemediesDocument9 pagesExercise RemediesJazzd Sy GregorioNo ratings yet

- AbandonmentDocument19 pagesAbandonmentNikko Franchello SantosNo ratings yet

- Abandonment Section 1129-1130Document19 pagesAbandonment Section 1129-1130Arellano AureNo ratings yet

- Tax.103 3 Filing of Returns Income Taxation of PET and Other Admin. MattersDocument13 pagesTax.103 3 Filing of Returns Income Taxation of PET and Other Admin. MattersJoana Lyn GalisimNo ratings yet

- Chap 19 11 13 TaxDocument27 pagesChap 19 11 13 TaxMary DenizeNo ratings yet

- Tax Remedies HandoutssssDocument5 pagesTax Remedies HandoutssssfantasighNo ratings yet

- TaxDocument18 pagesTaxPatrickBeronaNo ratings yet

- Circular 49 2018 CustomsDocument4 pagesCircular 49 2018 CustomsDinesh ChakravartyNo ratings yet

- Answer Sheet F Card 12.02.2023Document15 pagesAnswer Sheet F Card 12.02.2023Import Export ConsultancyNo ratings yet

- Finals Handout TaxDocument3 pagesFinals Handout TaxFlorenz AmbasNo ratings yet

- A. Taxation PDFDocument8 pagesA. Taxation PDFjulie anne mae mendozaNo ratings yet

- Chapter 8Document7 pagesChapter 8yebegashetNo ratings yet

- 1617 1stS FX CLim 1 1Document10 pages1617 1stS FX CLim 1 1ShitzeoNo ratings yet

- TAX - Review Remedies ExDocument6 pagesTAX - Review Remedies Exduguitjinky20.svcNo ratings yet

- Chapter 18 - Tax Remedies: Multiple Choice - Theory 1Document12 pagesChapter 18 - Tax Remedies: Multiple Choice - Theory 1Emmanuel PenullarNo ratings yet

- Income Tax-100 QuestionsDocument5 pagesIncome Tax-100 QuestionsChez Nicole LimpinNo ratings yet

- Taxation Challenge - With Answer KeyDocument9 pagesTaxation Challenge - With Answer Keyariaseg100% (1)

- Finals Exam Tax PDFDocument3 pagesFinals Exam Tax PDFSittieAyeeshaMacapundagDicali100% (1)

- Taxation Material 1Document11 pagesTaxation Material 1Shaira Bugayong100% (1)

- U ST O S A M IN IS Trative Order (Cao)Document8 pagesU ST O S A M IN IS Trative Order (Cao)udaykriciavalleNo ratings yet

- Quizzer: Tariff and Customs CodeDocument22 pagesQuizzer: Tariff and Customs CodeLuming100% (2)

- CPAR B94 TAX Final PB Exam - QuestionsDocument14 pagesCPAR B94 TAX Final PB Exam - QuestionsSilver LilyNo ratings yet

- NOU CBLE 2023 - 1st CL Mock Board Exam Answer Key 1Document21 pagesNOU CBLE 2023 - 1st CL Mock Board Exam Answer Key 1Easter Jane BostonNo ratings yet

- 2010 2015 Tariff and Customs Code PDFDocument6 pages2010 2015 Tariff and Customs Code PDFHassanal AbdurahimNo ratings yet

- Midterm Exam - TaxationDocument5 pagesMidterm Exam - TaxationGANNLAUREN SIMANGANNo ratings yet

- CL MB1Document21 pagesCL MB1Easter Jane BostonNo ratings yet

- A. TaxationDocument8 pagesA. TaxationDarwin Competente LagranNo ratings yet

- Bir LectureDocument4 pagesBir LectureTomoko KatoNo ratings yet

- Final Exam 4th Yr.Document14 pagesFinal Exam 4th Yr.Celeste Tumbokon IINo ratings yet

- Ca 1 Finals A. Commissioner of CustomsDocument4 pagesCa 1 Finals A. Commissioner of CustomsrexNo ratings yet

- CDP LONG QUIZ - With AnswersDocument28 pagesCDP LONG QUIZ - With AnswersElaine Antonette RositaNo ratings yet

- Tax Administration LecturenotesDocument16 pagesTax Administration Lecturenotes엔게르이가키No ratings yet

- Midterm Examination Gen Principles and Tax RemediesDocument3 pagesMidterm Examination Gen Principles and Tax RemediesRameinor Tambuli100% (1)

- LBC Courier Terms and ConditionsDocument3 pagesLBC Courier Terms and ConditionsTomas Diane LizardoNo ratings yet

- PGDTL 50 MCQ Gst-Iv - Q BankDocument6 pagesPGDTL 50 MCQ Gst-Iv - Q BankSoniJhaNo ratings yet

- Meg Stephan L. Cañal Tax 2 FinalsDocument3 pagesMeg Stephan L. Cañal Tax 2 FinalsgirlNo ratings yet

- FAQs in TaxationDocument3 pagesFAQs in TaxationjutesterNo ratings yet

- ReSA B42 TAX Final PB Exam Questions Answers Solutions PDFDocument17 pagesReSA B42 TAX Final PB Exam Questions Answers Solutions PDFNamnam KimNo ratings yet

- ARW Online Long Exam Part 3 PDFDocument12 pagesARW Online Long Exam Part 3 PDFMansour HamjaNo ratings yet

- Taxation1 ReviewerDocument7 pagesTaxation1 Reviewerjane quiambaoNo ratings yet

- Income Taxation (Module 1)Document7 pagesIncome Taxation (Module 1)Joyce Dacian PaloyoNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaFrom EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Man Power Resourcing in Reliance JioDocument56 pagesMan Power Resourcing in Reliance JioSomya Trivedi100% (2)

- G.R. No. L-26379 Reagan V CIR With DigestDocument8 pagesG.R. No. L-26379 Reagan V CIR With DigestRogie ToriagaNo ratings yet

- Tax 1 Cases On Allowable DeductionsDocument45 pagesTax 1 Cases On Allowable DeductionsREJFREEFALLNo ratings yet

- A Permanent Difference Between Taxable Income and Accounting Profits Results When A RevenueDocument4 pagesA Permanent Difference Between Taxable Income and Accounting Profits Results When A Revenuerohanfyaz00No ratings yet

- 101 Reasons To Move To New HampshireDocument46 pages101 Reasons To Move To New Hampshirescotsman33100% (2)

- 2009 Pre-Week Material - TaxationDocument14 pages2009 Pre-Week Material - TaxationellelylNo ratings yet

- The Christian and Government or The Saint and The State Romans 13:1-7Document8 pagesThe Christian and Government or The Saint and The State Romans 13:1-7paul machariaNo ratings yet

- Philippines - Asia Decentralization CasesDocument11 pagesPhilippines - Asia Decentralization Casesaveryl averylNo ratings yet

- MPS 1951020 09106660W 12 2023 112054Document2 pagesMPS 1951020 09106660W 12 2023 112054Ishtiyaq RatherNo ratings yet

- From Public To Private To - . - Mutual? Restructuring Water Supply Governance in England and WalesDocument16 pagesFrom Public To Private To - . - Mutual? Restructuring Water Supply Governance in England and WalesfirlanarahmaniaNo ratings yet

- Joint Circular No. 1 (Dbm-Deped-dilg)Document12 pagesJoint Circular No. 1 (Dbm-Deped-dilg)Deped Tambayan100% (3)

- 2021.11.11 - ADB - LVC Final Report - V 8 - CompletedDocument212 pages2021.11.11 - ADB - LVC Final Report - V 8 - CompletedThelita Pelii100% (1)

- Charese Johnson Complaint - Sovereign Citizens Trust Funds IRS ScamDocument21 pagesCharese Johnson Complaint - Sovereign Citizens Trust Funds IRS ScamBeverly TranNo ratings yet

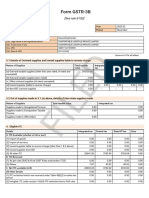

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- Taxation Law NotesDocument3 pagesTaxation Law NotesShivam TiwaryNo ratings yet

- PDF&Rendition Converted SignedDocument71 pagesPDF&Rendition Converted Signedmanwanimuki12No ratings yet

- Price of The Agricultural LandDocument2 pagesPrice of The Agricultural Landcoolest51No ratings yet

- Why Private Prisons Do Not Save Money: Overhead Costs and Executive PayDocument19 pagesWhy Private Prisons Do Not Save Money: Overhead Costs and Executive PayDr Paul LeightonNo ratings yet

- Mudasir Abass SofiDocument5 pagesMudasir Abass Sofilonely mudasirNo ratings yet

- En Banc (G.R. No. L-12353, September 30, 1960) North Camarines Lumber Co., Inc., Petitioner, VS. Collector of Internal Revenue, RespondentDocument3 pagesEn Banc (G.R. No. L-12353, September 30, 1960) North Camarines Lumber Co., Inc., Petitioner, VS. Collector of Internal Revenue, RespondentLex Tamen CoercitorNo ratings yet

- Why CleartaxDocument4 pagesWhy Cleartaxrsood6No ratings yet

- Construction EquipmentDocument19 pagesConstruction EquipmentVikram RaviNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoVivek SamratNo ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- Li Yao vs. CIRDocument4 pagesLi Yao vs. CIRVan John MagallanesNo ratings yet

- Countrywise Withholding Tax Rates Chart As Per DTAADocument8 pagesCountrywise Withholding Tax Rates Chart As Per DTAAajithaNo ratings yet

- The Profit and Loss StatementDocument5 pagesThe Profit and Loss Statementnenaddejanovic100% (1)

- Case Digest TaxDocument36 pagesCase Digest TaxKelsey Olivar Mendoza0% (1)