Professional Documents

Culture Documents

ACTIVITY 2 Internal-Controls

ACTIVITY 2 Internal-Controls

Uploaded by

Donna Kaye Lu0 ratings0% found this document useful (0 votes)

1 views7 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views7 pagesACTIVITY 2 Internal-Controls

ACTIVITY 2 Internal-Controls

Uploaded by

Donna Kaye LuCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

FINANCIAL CONTROLLERSHIP

NAME: DONNA KAYE LU DATE: FEBRUARY 16, 2024

COURSE: BSBA FM-3 BLOCK 1 SUBJECT: FINANCIAL CONTROLLERSHIP

TOPIC: INTERNAL CONTROLS

Research and review the following outlined topics:

1. Described and explain what is Financial Control System.

A Financial Control System (FCS) is a set of policies, procedures, and tools used

by organizations to manage their financial resources effectively and efficiently.

It's like a safety net and compass for an organization's finances, ensuring they stay

on track and achieve their financial goals.

2. Discuss what is controls

Controls are the foundation of any effective financial control system. They are the

policies, procedures, and activities that help organizations safeguard their assets,

ensure accurate financial reporting, comply with regulations, and achieve their

financial goals.

3. The internal control structure of an entity is divided in two parts:

Explain the following and give example.

a. Control environment- This refers to the overall attitude, awareness, and actions of

management and employees regarding the importance of controls and integrity in the

organization. It sets the tone for the organization's control consciousness and

influences the effectiveness of other control components. Example: A company with

a strong control environment may have clear policies and procedures in place, regular

training on ethical conduct, and a culture of accountability and transparency among

its employees.

b. Accounting System- This includes the methods and procedures used to record,

classify, summarize, and report financial transactions of an entity. It encompasses

both manual and computerized processes for maintaining financial records. Example:

An accounting system may include software for bookkeeping, chart of accounts for

organizing transactions, and procedures for reconciling bank statements.

4. Explain the following that a controller should be aware of the various types of controls

that must be interlinked to create a control system that adequately safeguards the

company assets:

a. Accounting controls- These are procedures designed to ensure the accuracy,

completeness, and reliability of accounting records and financial reports. Example:

Implementing segregation of duties between employees responsible for recording

transactions, reviewing financial statements for errors or inconsistencies, and

conducting regular internal audits to detect fraud or errors.

b. Administrative controls- These are policies and procedures established by

management to ensure the effective and efficient operation of the organization.

Example: Establishing clear delegation of authority, implementing budgetary controls

to monitor expenses, and conducting performance evaluations to assess employee

productivity and adherence to policies.

c. Primary operational controls- These are controls specific to the operational

processes of the organization, aimed at achieving operational objectives and

minimizing risks. Example: Implementing inventory controls to track stock levels and

prevent theft or losses, establishing quality control measures to ensure product

consistency, and implementing safety protocols to protect employees from workplace

hazards.

5. The following are some of the following different controls that a controller see to it that

all are in place.

Kindly explain and give at least three (3) examples per controls:

a. Segregation of duties- This control involves dividing responsibilities among

different individuals or departments to prevent errors, fraud, or misuse of resources.

Examples: Having one employee responsible for approving purchases, another for

receiving goods, and a different employee for recording transactions in the accounting

system.

b. Authorization and Approval procedures- These controls require proper

authorization and approval before certain actions or transactions can take place.

Examples: Requiring management approval for significant expenditures, obtaining

authorization before granting access to sensitive information, and obtaining approval

before releasing payments to vendors.

c. Reconciliation process- This control involves comparing two sets of records to

ensure they are in agreement and any differences are identified and resolved.

Examples: Reconciling bank statements with cash records, matching inventory counts

with accounting records, and comparing sales invoices with customer payments.

d. Financial reporting controls- These controls ensure the accuracy and reliability of

financial reporting processes and disclosures. Examples: Implementing internal

controls over financial reporting (ICFR) to ensure compliance with accounting

standards, conducting periodic reviews of financial statements by management, and

providing training to employees on proper accounting procedures.

e. Internal Audit- This control involves an independent review of the organization's

operations, financial records, and internal controls by internal auditors. Examples:

Conducting regular audits of financial transactions and controls, investigating

suspected fraud or irregularities, and providing recommendations for improving

internal controls and operational efficiency.

f. Physical controls- These controls involve safeguarding physical assets and resources

from theft, loss, or damage. Examples: Installing security cameras and alarms in

sensitive areas, restricting access to inventory storage areas, and implementing key

card access systems for restricted areas.

g. IT controls- These controls involve measures to ensure the security, confidentiality,

and integrity of information technology systems and data. Examples: Implementing

firewalls and antivirus software to protect against cyber threats, regularly updating

software and patches to address vulnerabilities, and providing user training on IT

security best practices.

h. Compliance controls- These controls ensure that the organization complies with

relevant laws, regulations, and internal policies. Examples: Conducting regular

compliance audits to assess adherence to legal and regulatory requirements, providing

training to employees on compliance policies and procedures, and establishing a

whistleblower hotline for reporting.

6. Explain and give example of the following control segments that represent a

collective effort under the 'Control the Environment' category

a. Management philosophy and operating cycle- This refers to the beliefs, values, and

principles that guide management's decision-making and actions, as well as the

processes involved in carrying out the organization's activities. Example: A company

that prioritizes customer satisfaction and continuous improvement as part of its

management philosophy may have a focus on delivering high-quality products and

services and regularly reviewing and refining its operational processes.

b. Organization structure- This encompasses the arrangement of roles, responsibilities,

and reporting relationships within the organization. Example: A hierarchical

organization structure may have clear lines of authority and communication, with

employees reporting to supervisors, who report to managers, and so on, facilitating

efficient decision-making and coordination of activities.

c. Functioning of the Board of Directors and the Board committees- This involves

the oversight and governance provided by the Board of Directors and its committees

in setting strategic direction, monitoring performance, and ensuring compliance with

laws and regulations. Example: A company's Audit Committee may review financial

statements and internal controls to ensure accuracy and transparency, while the

Governance Committee may oversee board composition and effectiveness.

d. Methods of assigning authority and responsibility- This refers to how decision-

making authority and accountability are allocated within the organization. Example:

Implementing a clear delegation of authority policy that outlines who has the

authority to make decisions and take action on behalf of the organization, based on

their roles and responsibilities.

e. Management control methods- These are the processes and procedures

implemented by management to monitor and control the organization's activities and

achieve its objectives. Example: Implementing budgetary controls to track expenses

and revenues, setting performance targets and key performance indicators (KPIs) to

measure progress, and conducting regular performance reviews to assess employee

performance and provide feedback.

f. The existence and effectiveness of an internal audit function- This involves the

establishment of an internal audit department responsible for independently

evaluating the adequacy and effectiveness of internal controls, risk management

processes, and compliance with policies and procedures. Example: A company's

internal audit function may conduct periodic audits of financial transactions,

operational processes, and compliance with regulatory requirements, providing

recommendations for improvement to management and the Board of Directors.

g. Personnel policies and procedures- These are the rules and guidelines governing the

recruitment, selection, training, performance management, and termination of

employees within the organization. Example: Implementing fair and transparent

hiring practices, providing ongoing training and development opportunities for

employees, and establishing clear performance expectations and evaluation criteria.

h. Influence of external factors- This includes considering the impact of external

factors such as economic conditions, industry trends, technological advancements,

regulatory changes, and competitive pressures on the organization's control

environment. Example: A company operating in a highly regulated industry may need

to adapt its control environment to comply with new laws or industry standards, while

a company facing increased competition may need to focus on innovation and cost

control measures to remain competitive.

7. Discuss what is Accounting System.

An accounting system is a structured set of procedures and methods used by an

organization to record, classify, summarize, and report financial transactions and

information. It encompasses both manual and computerized processes, including

the use of accounting software, to ensure accurate and reliable financial reporting.

8. An effective accounting system encompasses different principles, methods, and

procedures.

In line with this and give at least five (5) examples

Double-entry bookkeeping: Recording each financial transaction with both a

debit and a credit entry.

Accrual accounting: Recognizing revenues and expenses when they are earned

or incurred, regardless of when cash is received or paid.

Internal controls: Implementing procedures to safeguard assets, prevent fraud,

and ensure the accuracy of financial records.

Cost accounting: Allocating costs to products or services to determine their

profitability.

Financial reporting: Preparing financial statements such as the balance sheet,

income statement, and cash flow statement to communicate the company's

financial performance and position.

9. One way to identify a company’s principal activities and control objectives is to

separate the

typical company into four basic operating components.

Discuss and explain the following basic components:

a. Sales controls objectives- These focus on ensuring accurate and timely recording of

sales transactions, proper authorization of sales orders, and effective credit

management to minimize bad debts.

b. Production or service control objectives- These involve maintaining quality

standards, optimizing production efficiency, managing inventory levels, and ensuring

timely delivery of products or services to customers.

c. Finance control objectives- These include managing cash flow effectively,

maintaining accurate records of financial transactions, and ensuring compliance with

financial regulations and reporting requirements.

d. Administrative control objectives- These relate to managing administrative

functions such as human resources, procurement, and facilities management

efficiently and cost-effectively.

10. Understanding Control Systems, Accounting transactions should be clearly

flowcharted, so that they can be studied for possible weaknesses by the controller’s

staff. This review involves a businessperson’s perspective of what should be done, a

consideration of things that can go wrong, and a recognition of the accounts that

would be affected. Any issues concerning the control of those transactions should be

documented.

When reviewing the flowcharts for control weaknesses, there are five general control

objectives that should be kept in mind:

Explain the following five general control objectives and give each example.

a. Authorization- Ensuring that all transactions are approved by authorized personnel

before they are executed. Example: Requiring manager approval for large purchases

or expenditures.

b. Recording- Ensuring that all transactions are accurately recorded in the accounting

records in a timely manner. Example: Posting sales invoices and receipts promptly to

the general ledger.

c. Safeguarding- Implementing measures to protect assets from theft, loss, or misuse.

Example: Storing cash and valuable assets in a secure location with limited access.

d. Reconciliation- Comparing different sets of records or accounts to ensure they are

consistent and accurate. Example: Reconciling bank statements with cash records to

identify discrepancies and errors.

11. The following are the basic transactions that take place in the usual operation of

business which a

controller shall oversee the end to end transaction.

With the following transaction, enumerate at least three internal controls that should have

in place for you to say that indeed such role of controller really done his/her in overseeing

such operation.

1. Investments transactions/operations

Requiring approval from senior management or an investment committee

before making any investment decisions.

Implementing segregation of duties between individuals responsible for

initiating investments, approving transactions, and reconciling investment

accounts.

Regularly monitoring and evaluating the performance of investments against

established benchmarks or criteria.

2. Receivables transaction/operations

Implementing credit policies and procedures to assess the creditworthiness of

customers and establish credit limits.

Performing regular reconciliations between receivables records and customer

statements to identify and address discrepancies.

Conducting periodic aging analyses of accounts receivable to identify overdue

accounts and follow-up on collection efforts.

3. Inventory valuation

Implementing periodic physical inventory counts to verify the accuracy of

inventory records and identify any discrepancies.

Establishing internal controls over inventory movements, such as segregation

of duties between individuals responsible for receiving, storing, and issuing

inventory.

Performing regular inventory reconciliations between physical counts and

inventory records to ensure accurate valuation and reporting.

4. Fixed Assets

Establishing controls over the acquisition, disposal, and depreciation of fixed

assets, including approval processes and documentation requirements.

Conducting periodic physical inspections and reconciliations of fixed assets to

verify their existence and condition.

Maintaining detailed records of fixed asset acquisitions, disposals, and

depreciation adjustments for accurate financial reporting.

5. Revenue recognition

Implementing policies and procedures for recognizing revenue in accordance

with applicable accounting standards and company policies.

Performing regular reviews and approvals of sales contracts and agreements to

ensure they meet revenue recognition criteria.

Conducting periodic reconciliations between recorded revenue and supporting

documentation, such as sales invoices and customer contracts, to verify

accuracy and completeness.

12. The following are the basics elements of Internal Accounting Control

That are necessary to meet the broad objectives of good internal accounting control—

objectives that include safeguarding the assets against loss arising from intentional

(fraud) or unintentional errors and producing reliable financial records for internal use

and for external reporting purposes.

Explain the following and give each example.

a. Competent and trustworthy personnel, with clearly defined lines of authority

and responsibility- Hiring qualified individuals and clearly outlining their roles

and responsibilities to ensure accountability and effectiveness. Example:

Designating specific individuals responsible for approving transactions, recording

financial data, and reconciling accounts.

b. Adequate separation of duties- Assigning different tasks and responsibilities to

different individuals to prevent errors and fraud. Example: Having one person

responsible for approving purchases, another for receiving goods, and a third for

recording transactions in the accounting system.

c. Proper procedures for authorization of transactions- Establishing protocols

for approving transactions to ensure they are legitimate and comply with company

policies. Example: Requiring manager approval for significant expenditures

before they are incurred.

d. Adequate records and documents- Maintaining accurate and complete records

and documents to support financial transactions and ensure transparency and

accountability. Example: Keeping detailed records of all financial transactions,

including invoices, receipts, and bank statements.

e. Proper physical control over both assets and records- Implementing measures

to safeguard physical assets and records from loss, theft, or damage. Example:

Securing cash and valuable assets in locked safes or cabinets and restricting

access to sensitive financial records.

f. Proper procedures for adequate record keeping- Establishing protocols for

recording and maintaining financial data to ensure accuracy, reliability, and

accessibility. Example: Implementing standardized accounting procedures and

documentation requirements for recording transactions and preparing financial

reports.

g. A staff that can provide independent verifications- Having personnel or teams

responsible for conducting independent reviews and verifications of financial

transactions and controls. Example: Assigning internal auditors to periodically

review and assess the effectiveness of internal controls and compliance with

policies and procedures.

13. Auditing for fraud, especially for small-scale fraud, is like looking for the proverbial

needle in the haystack.

Explain the following reasons why it is so difficult to find:

a. Too many transactions- With a large volume of transactions, auditors may

struggle to thoroughly examine each one, making it easier for fraudulent activities

to go unnoticed amidst the sheer volume of data.

b. Ineffective use of audit time- Auditors may not allocate sufficient time and

resources to thoroughly investigate potential fraud indicators, leading to oversight

or inadequate detection of fraudulent activities.

c. Audits have time limits- Auditors are typically constrained by deadlines and

time limits for completing audits, which may prevent them from conducting

comprehensive investigations into potential fraud schemes.

d. Trend analysis is not sufficient- While trend analysis can help identify

anomalies or irregularities in financial data, it may not always be effective in

detecting sophisticated or subtle fraud schemes that are designed to evade

detection.

e. Perpetrators know the procedures- Fraudsters may have insider knowledge of

the company's internal control procedures and audit processes, allowing them to

manipulate or circumvent controls to conceal fraudulent activities and avoid

detection.

f. Fraud is hard to recognize- Fraudulent activities may be disguised as legitimate

transactions or concealed through complex schemes, making them difficult for

auditors to detect without sufficient evidence or specific indicators of fraud.

Additionally, auditors may face challenges in distinguishing between errors,

irregularities, and intentional misstatements.

Prepared by:

_____________________

Signature Over Printed Name

Date and time Submitted: _________________

Please review our topic for discussion and graded recitation

Link will also be provided to you through Google forms.

Please be guided accordingly. rrm

You might also like

- Jean Set Off & RecoupmentDocument2 pagesJean Set Off & RecoupmentKonan Snowden98% (106)

- Crime Scene QuizDocument24 pagesCrime Scene Quizjjpietra100% (1)

- Official Document TulsaDocument200 pagesOfficial Document Tulsaapi-439913416100% (2)

- The Baptist FaithDocument3 pagesThe Baptist FaithJeanelle Denosta100% (1)

- Overview of Internal Control and Fraud and ErrorDocument6 pagesOverview of Internal Control and Fraud and ErrorbabyNo ratings yet

- Chapter-Four Internal Control SystemsDocument12 pagesChapter-Four Internal Control SystemsmulunehNo ratings yet

- AUD 0 Finals MergedDocument41 pagesAUD 0 Finals MergedBea MallariNo ratings yet

- Consideration of Internal ControlDocument7 pagesConsideration of Internal Controlemc2_mcv100% (1)

- CONSIDERATIONS OF ENTITY'S INTERNAL CONTROL Red Sirug Lecture NoteDocument7 pagesCONSIDERATIONS OF ENTITY'S INTERNAL CONTROL Red Sirug Lecture NoteMikaNo ratings yet

- Audit Note TOPIC 4Document47 pagesAudit Note TOPIC 4Tusiime Wa Kachope SamsonNo ratings yet

- Chapter 4audDocument10 pagesChapter 4audMoti BekeleNo ratings yet

- Chapter 6 Internal Control ProcessesDocument8 pagesChapter 6 Internal Control ProcessesKim VisperasNo ratings yet

- Chapter 5 Internal Auditing (Autosaved)Document107 pagesChapter 5 Internal Auditing (Autosaved)Reian ParamaNo ratings yet

- Consideration of Internal ControlDocument14 pagesConsideration of Internal ControlCarlito B. BancilNo ratings yet

- ACTIVITY 4 Internal Audit FunctionDocument6 pagesACTIVITY 4 Internal Audit FunctionDonna Kaye LuNo ratings yet

- CHAPTER III Internal Control (IC)Document13 pagesCHAPTER III Internal Control (IC)mulu melakNo ratings yet

- Internal Control Accountability and Value For Money AuditDocument17 pagesInternal Control Accountability and Value For Money AuditAbdulrahaman ShettimaNo ratings yet

- Internal Control ComponentsDocument6 pagesInternal Control ComponentsFretchie SenielNo ratings yet

- Gbermic Internal Control CabreraDocument5 pagesGbermic Internal Control CabreraÌÐølJåyskëiUvNo ratings yet

- 1 Nature and Objectives of Operational Audit EngagementDocument32 pages1 Nature and Objectives of Operational Audit EngagementMay Angelica TenezaNo ratings yet

- Acctg 023B Mod. 4 (Control, Governance, Risk Management)Document8 pagesAcctg 023B Mod. 4 (Control, Governance, Risk Management)0101No ratings yet

- CHapter 5 Internal ControlDocument11 pagesCHapter 5 Internal ControlYitera SisayNo ratings yet

- Characteristics of Management ControlDocument7 pagesCharacteristics of Management ControlKaran SinghNo ratings yet

- Lesson 7 - Accounting System and Related Internal ControlsDocument24 pagesLesson 7 - Accounting System and Related Internal Controlskipngetich392No ratings yet

- Audit UNIT 4Document14 pagesAudit UNIT 4Nigussie BerhanuNo ratings yet

- Internal Control PSA315Document8 pagesInternal Control PSA315John Lexter Macalber100% (1)

- 13 Developing Internal Control SystemDocument10 pages13 Developing Internal Control SystemJerson AgsiNo ratings yet

- PSA Discussion and Question From Sir JRMDocument60 pagesPSA Discussion and Question From Sir JRMGarcia Alizsandra L.No ratings yet

- Introduction To Internal Control SystemDocument35 pagesIntroduction To Internal Control SystemStoryKingNo ratings yet

- GROUP-5-Internal-Control-Written-ReportDocument28 pagesGROUP-5-Internal-Control-Written-ReportKezNo ratings yet

- COSO Framework: A. Physical Control ActivityDocument1 pageCOSO Framework: A. Physical Control ActivityManu aggarwalNo ratings yet

- Auditing Principle 1 - ch4Document11 pagesAuditing Principle 1 - ch4DEREJENo ratings yet

- Auditing Lesson 4Document11 pagesAuditing Lesson 4Ruth KanaizaNo ratings yet

- Lecture #8 Q and A On Internal Control and Managing RisksDocument11 pagesLecture #8 Q and A On Internal Control and Managing RisksJr CialanaNo ratings yet

- Auditing I Chapter FourDocument10 pagesAuditing I Chapter FourDere GurandaNo ratings yet

- Auditing Theory - Risk AssessmentDocument10 pagesAuditing Theory - Risk AssessmentYenelyn Apistar CambarijanNo ratings yet

- Audit I-CH 4-INTERNAL CONTROL SYSTEMS-1Document13 pagesAudit I-CH 4-INTERNAL CONTROL SYSTEMS-1bikilahussenNo ratings yet

- CH04 1Document5 pagesCH04 1Tilahun TesemaNo ratings yet

- Summary ISA 315Document3 pagesSummary ISA 315IQBAL MAHMUDNo ratings yet

- CHAPTER FOUR-Auditing IDocument10 pagesCHAPTER FOUR-Auditing ITesfaye DiribaNo ratings yet

- PSA Discussion and Question From Sir JRM 1Document55 pagesPSA Discussion and Question From Sir JRM 1Jev CastroverdeNo ratings yet

- Big Picture D Week 8-9Document8 pagesBig Picture D Week 8-9leovanne andre romaNo ratings yet

- Controlling Control in OrganizationsDocument5 pagesControlling Control in OrganizationsJulius MwambiNo ratings yet

- Internal ControlDocument9 pagesInternal Controlahmi lalaNo ratings yet

- MGT 209 - CH 13 NotesDocument6 pagesMGT 209 - CH 13 NotesAmiel Christian MendozaNo ratings yet

- Audit QNSDocument51 pagesAudit QNSkiddyhimsselfNo ratings yet

- The Auditor'S Consideration AND Understanding of The Entity'S Internal ControlDocument66 pagesThe Auditor'S Consideration AND Understanding of The Entity'S Internal ControlbrepoyoNo ratings yet

- Unit Four 4.1 Meaning of Internal ControlDocument11 pagesUnit Four 4.1 Meaning of Internal Controlmekibib fisihaNo ratings yet

- 10 Control and Quality ManagementDocument6 pages10 Control and Quality ManagementPrince BudhaNo ratings yet

- At Module 5B Internal Control T2AY2324Document5 pagesAt Module 5B Internal Control T2AY2324JEFFERSON CUTENo ratings yet

- Internal ControlDocument8 pagesInternal ControlRasha RabbaniNo ratings yet

- Definition and Purposes of Internal ControlDocument18 pagesDefinition and Purposes of Internal Controlnur_haryantoNo ratings yet

- ISA 315. ACCA p7 Technical ArticleDocument5 pagesISA 315. ACCA p7 Technical ArticleNikie5No ratings yet

- Lecture 8 Q and A On Internal Control and Managing RisksDocument11 pagesLecture 8 Q and A On Internal Control and Managing RisksMairene CastroNo ratings yet

- Auditing I Ch.4Document14 pagesAuditing I Ch.4Abrha636No ratings yet

- Module 8 Internal Control LPUDocument11 pagesModule 8 Internal Control LPUJoana Lyn BuqueronNo ratings yet

- Answer Audting IIDocument9 pagesAnswer Audting IIkiduseNo ratings yet

- Business Ethics (Chapt 13-17)Document30 pagesBusiness Ethics (Chapt 13-17)Hads LunaNo ratings yet

- UNDERSTANDING-AND-EVALUATION-OF-INTERNAL-CONTROLSDocument7 pagesUNDERSTANDING-AND-EVALUATION-OF-INTERNAL-CONTROLSPeachy CamNo ratings yet

- Assessment of Internal Control WordDocument8 pagesAssessment of Internal Control WordGiddel Ann Kristine VelasquezNo ratings yet

- Internal Control: Auditing TheoryDocument7 pagesInternal Control: Auditing Theoryrandom17341No ratings yet

- CHAPTER 4 Audit IDocument24 pagesCHAPTER 4 Audit IDanisaraNo ratings yet

- Essay - Internal ControlsDocument4 pagesEssay - Internal Controlslorie anne valleNo ratings yet

- Amicus Curiae Brief NCLA 22-3179Document19 pagesAmicus Curiae Brief NCLA 22-3179LeferianNo ratings yet

- The Usual Modes of Avoiding Occurrence of Double Taxation AreDocument8 pagesThe Usual Modes of Avoiding Occurrence of Double Taxation AreGIRLNo ratings yet

- IbDocument2 pagesIbSrinivasa Reddy KarriNo ratings yet

- Unit 1 Bearer PlantsDocument2 pagesUnit 1 Bearer PlantsEmzNo ratings yet

- Architect Acts 2016 PDFDocument92 pagesArchitect Acts 2016 PDFKelingwgongNo ratings yet

- NotesDocument10 pagesNotesHannah Pauleen G. LabasaNo ratings yet

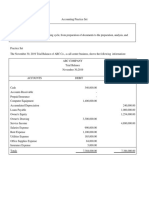

- ABC CompanyDocument11 pagesABC CompanyA DiolataNo ratings yet

- Enus212 004Document20 pagesEnus212 004Gilbert Torres GalvezNo ratings yet

- Chapter Summary: Lesson 1: The First MissionsDocument2 pagesChapter Summary: Lesson 1: The First MissionsevankyleNo ratings yet

- MSIL VS DR ReddyDocument5 pagesMSIL VS DR ReddyAmbuj PriyadarshiNo ratings yet

- 420 SCRA 438 Tolentino v. ComelecDocument16 pages420 SCRA 438 Tolentino v. ComelecPeter Paul RecaboNo ratings yet

- Accolite Inc Private Company ProfileDocument3 pagesAccolite Inc Private Company Profilehitesh guptaNo ratings yet

- Indian National CongressDocument22 pagesIndian National CongressSwaroopa KhangarotNo ratings yet

- Syquia vs. LopezDocument2 pagesSyquia vs. LopezAra KimNo ratings yet

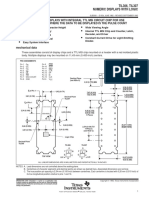

- TIL306, TIL307 Numeric Displays With LogicDocument9 pagesTIL306, TIL307 Numeric Displays With LogicNadjNo ratings yet

- WS - QHSE - S23 - G05 - Cement Head - 3313701 - 07Document17 pagesWS - QHSE - S23 - G05 - Cement Head - 3313701 - 07CiprianHnNo ratings yet

- Political & Legal Enviroment Facing BusinessDocument15 pagesPolitical & Legal Enviroment Facing BusinessNaim H. FaisalNo ratings yet

- 803E Incoterms 2020 Wallchart A4Document1 page803E Incoterms 2020 Wallchart A4bd6999No ratings yet

- Bill TodayDocument3 pagesBill Todaymansoorsain42No ratings yet

- CCC419 Advance Notice AGM2009Document2 pagesCCC419 Advance Notice AGM2009gallerycourtNo ratings yet

- Anyone Remember This Email NowDocument106 pagesAnyone Remember This Email NowDavid.Raymond.Amos936No ratings yet

- Paper-1 (Business Organisation & Management)Document24 pagesPaper-1 (Business Organisation & Management)dinbhatt100% (1)

- Outline in Persons & Family RelationsDocument24 pagesOutline in Persons & Family RelationsLeizl A. VillapandoNo ratings yet

- Informative Essay On Prison CisDocument4 pagesInformative Essay On Prison Cisapi-302642512No ratings yet

- The Paradox of Being A Probationer Tales of Joy and SorrowDocument10 pagesThe Paradox of Being A Probationer Tales of Joy and SorrowInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Creative Styles Candle Business Final DocsDocument112 pagesCreative Styles Candle Business Final DocsTatine AvelinoNo ratings yet