Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsCFAS Questions

CFAS Questions

Uploaded by

Krisselyn ReigneCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Financial Accounting Volume 1Document29 pagesFinancial Accounting Volume 1Ferjeanie Bernandino100% (1)

- Module 1 Financial Analysis and ReportingDocument22 pagesModule 1 Financial Analysis and ReportingJane Carla Borromeo100% (1)

- 2022 School Operational WorkplanDocument12 pages2022 School Operational WorkplanDorothy Otieno100% (3)

- Topic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaDocument58 pagesTopic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaHazim Badrin100% (1)

- Cfas 2022 Questions and AnswersDocument7 pagesCfas 2022 Questions and AnswersVinz Ray PitargueNo ratings yet

- Chapter 1 - The Accountancy ProfessionDocument4 pagesChapter 1 - The Accountancy Professionforn lettyNo ratings yet

- Ethical ThinkingDocument13 pagesEthical ThinkingZanth Brey CollinsNo ratings yet

- Chapter 1 The Accoutancy ProfessionDocument3 pagesChapter 1 The Accoutancy ProfessionRyleeNo ratings yet

- CFASDocument4 pagesCFASMary Jhel QuiddamNo ratings yet

- C1 The Accounting ProfessionDocument5 pagesC1 The Accounting ProfessionAllaine ElfaNo ratings yet

- Acca102 Chapter 1Document19 pagesAcca102 Chapter 1Khezia Mae U. GarlandoNo ratings yet

- Chapter 1 - 2rev (Students)Document31 pagesChapter 1 - 2rev (Students)NR 7No ratings yet

- Far Reviewer For FinalsDocument38 pagesFar Reviewer For Finalsjessamae gundanNo ratings yet

- Acc 2 ReviewerDocument5 pagesAcc 2 ReviewerAllyza MagtibayNo ratings yet

- Chapter 1Document12 pagesChapter 1Louie Ann CasabarNo ratings yet

- Con-Chap 1Document14 pagesCon-Chap 1Xiency WyneNo ratings yet

- )Document62 pages)Ma. Kristine GarciaNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument9 pagesChapter 1 The Accountancy ProfessionEllen MaskariñoNo ratings yet

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- Conceptual Framework - IntroductionDocument16 pagesConceptual Framework - IntroductionDewdrop Mae RafananNo ratings yet

- Financial Accounting and Reporting ReviewerDocument14 pagesFinancial Accounting and Reporting ReviewerRen Kouen100% (4)

- Midterm ReviewerDocument16 pagesMidterm ReviewerKarren Andrea D. Delos SantosNo ratings yet

- Study MaterialDocument22 pagesStudy MaterialSukrit SunderNo ratings yet

- Accounting Standards Council: Important Points in The Definition ofDocument15 pagesAccounting Standards Council: Important Points in The Definition ofmicolleNo ratings yet

- Fundamentals of Accounting, Business and Management 1Document41 pagesFundamentals of Accounting, Business and Management 1Anne MoralesNo ratings yet

- Week 01 - 01 - Module 01 - Concepts and PrinciplesDocument11 pagesWeek 01 - 01 - Module 01 - Concepts and Principles지마리No ratings yet

- Accounting Midterms ReviewerDocument6 pagesAccounting Midterms Reviewerpatricia culanibanNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument7 pagesChapter 1 The Accountancy ProfessionJoshua Sapphire AmonNo ratings yet

- New and Old Conceptual Framework, Accounting Principles, Accounting Process, PAS 18 - RevenueDocument13 pagesNew and Old Conceptual Framework, Accounting Principles, Accounting Process, PAS 18 - RevenueDennis VelasquezNo ratings yet

- FAR REVIEWER Part 1Document7 pagesFAR REVIEWER Part 1jessamae gundanNo ratings yet

- Fundamentalss of Accountancy and Business ManagementDocument107 pagesFundamentalss of Accountancy and Business ManagementArmina Valdez100% (1)

- Cfas ReviewerDocument193 pagesCfas Reviewerangelafernandez0309No ratings yet

- Lesson 1: Introduction To AccountingDocument4 pagesLesson 1: Introduction To AccountingDante SausaNo ratings yet

- FUNACCODocument28 pagesFUNACCOJondil RotoniNo ratings yet

- Conceptual Framework and Accounting Standard Chapter 1-13 Digest NotesDocument14 pagesConceptual Framework and Accounting Standard Chapter 1-13 Digest Notesangelo subaNo ratings yet

- Fundamental of Financial AccountingDocument26 pagesFundamental of Financial AccountingShirish JhaNo ratings yet

- NEP Class NotesDocument12 pagesNEP Class NotesnsubbuadigaNo ratings yet

- fUNDAMENTALS OF Accounting-I Jimma University Department of Accounting and Finance Fundamentals of Accounting InstructorDocument48 pagesfUNDAMENTALS OF Accounting-I Jimma University Department of Accounting and Finance Fundamentals of Accounting InstructorMany GramNo ratings yet

- Core 1 - Journalize TransactionsDocument14 pagesCore 1 - Journalize TransactionsCharlote MarcellanoNo ratings yet

- Nature and Scope of AccountingDocument19 pagesNature and Scope of AccountingSaffa IbrahimNo ratings yet

- Module in FAR 2021 First Sem BSA-1ADocument99 pagesModule in FAR 2021 First Sem BSA-1AMelody CristobalNo ratings yet

- Accounting-1 Reading Materials#1Document53 pagesAccounting-1 Reading Materials#1Nardsdel RiveraNo ratings yet

- Bookkeeping NC Iii - Module 1Document15 pagesBookkeeping NC Iii - Module 1Abigail AndradeNo ratings yet

- Conversion ProblemsDocument6 pagesConversion ProblemsAce Maynard DiancoNo ratings yet

- Financial Accounting and Reporting 01Document9 pagesFinancial Accounting and Reporting 01Nuah SilvestreNo ratings yet

- AbDocument411 pagesAbMd shahjahanNo ratings yet

- ACC124 - First ExamDocument4 pagesACC124 - First ExamBaby Leonor RazonableNo ratings yet

- Fabm Q1 SlidesDocument261 pagesFabm Q1 Slidesminirifty100% (1)

- Cfasm 11Document4 pagesCfasm 11Marielle JalandoniNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument13 pagesChapter 1 The Accountancy ProfessionLaiza Mae LasutanNo ratings yet

- Accounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Document428 pagesAccounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Ibrahim MuyeNo ratings yet

- Financial Reporting Framework: Accountancy DepartmentDocument14 pagesFinancial Reporting Framework: Accountancy DepartmentJayson ChanNo ratings yet

- Financial and Corporate ReportingDocument257 pagesFinancial and Corporate Reportinganon_636625652100% (1)

- Conceptual Framework & Accounting: College of Business AdministrationDocument10 pagesConceptual Framework & Accounting: College of Business AdministrationRaphael GalitNo ratings yet

- What Is 'Accounting': Definition ofDocument4 pagesWhat Is 'Accounting': Definition ofNica Dacatimbang - LeriosNo ratings yet

- Accounting Lec 1Document28 pagesAccounting Lec 1Swati OzaNo ratings yet

- Financial Accounting Volume 1Document116 pagesFinancial Accounting Volume 1Romuell BanaresNo ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- BESR BuddhismDocument9 pagesBESR BuddhismKrisselyn ReigneNo ratings yet

- BMGT25 - Act3 - MoralesDocument2 pagesBMGT25 - Act3 - MoralesKrisselyn ReigneNo ratings yet

- Econ21 FinalsDocument4 pagesEcon21 FinalsKrisselyn ReigneNo ratings yet

- Intermediate Accounting 3 - Chap 10-12 Answer KeyDocument7 pagesIntermediate Accounting 3 - Chap 10-12 Answer KeyKrisselyn ReigneNo ratings yet

- Proposed Research Titles, Sop, and Obj AbmDocument13 pagesProposed Research Titles, Sop, and Obj AbmKrisselyn ReigneNo ratings yet

- BESR Reviewer ABM 12Document11 pagesBESR Reviewer ABM 12Krisselyn ReigneNo ratings yet

- Letter ITECDocument1 pageLetter ITECKrisselyn ReigneNo ratings yet

- Alphabet IncDocument12 pagesAlphabet IncKrisselyn ReigneNo ratings yet

- Assistant Accountant Cover LetterDocument8 pagesAssistant Accountant Cover Letterafaocsazx100% (2)

- Why BCom AA 2022Document3 pagesWhy BCom AA 2022Shaji SNo ratings yet

- Soc2010version4index05november2015v2 tcm77-181321Document1,761 pagesSoc2010version4index05november2015v2 tcm77-181321Bùi Hắc HảiNo ratings yet

- Creditors Circularization 2008Document15 pagesCreditors Circularization 2008Alice WairimuNo ratings yet

- Udm Auditing Theory 2020Document17 pagesUdm Auditing Theory 2020Ceejay FrillarteNo ratings yet

- DAP 2020 Chapter 1 Appx B INDIGENOUS CONTENT ASPECTSDocument6 pagesDAP 2020 Chapter 1 Appx B INDIGENOUS CONTENT ASPECTSMaj Gen S KhannaNo ratings yet

- Case 1 AccapDocument2 pagesCase 1 AccapRose Medina BarondaNo ratings yet

- 78th BOD Meeting of OFDCDocument28 pages78th BOD Meeting of OFDCritesh MishraNo ratings yet

- Form TR 20 Gaz TAbill 2018 2Document2 pagesForm TR 20 Gaz TAbill 2018 2abc100% (1)

- Classified 2015 04 27 000000Document7 pagesClassified 2015 04 27 000000sasikalaNo ratings yet

- Jubilee Annual Report Final - WebDocument140 pagesJubilee Annual Report Final - WebEdward NjorogeNo ratings yet

- Bridge & Roof Co. (India) LimitedDocument17 pagesBridge & Roof Co. (India) Limitedbhawani27No ratings yet

- Sponsor DocsDocument2 pagesSponsor DocsMaisa SantosNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- The Role of ICMAB Professional AccountantsDocument6 pagesThe Role of ICMAB Professional AccountantsTauhid hassan SakibNo ratings yet

- ExposureDraft-Directive1 01Document109 pagesExposureDraft-Directive1 01JohnNo ratings yet

- New Form 3Document4 pagesNew Form 3seenNo ratings yet

- ZICA CONSITUTION FINAL October 2021Document52 pagesZICA CONSITUTION FINAL October 2021michelo-kandamaNo ratings yet

- DoDocument35 pagesDoRandora LkNo ratings yet

- Transfer PricingDocument235 pagesTransfer PricingRamesh KrishnanNo ratings yet

- Auditing Principle 1 - ch2Document18 pagesAuditing Principle 1 - ch2Sabaa ifNo ratings yet

- Chapter 11 Audit of Insurance CompaniesDocument62 pagesChapter 11 Audit of Insurance CompaniesDiyanaBankovaNo ratings yet

- Acctg 102Document52 pagesAcctg 102Yoonah KimNo ratings yet

- Ra 9298Document14 pagesRa 9298Errah Jenn CajesNo ratings yet

- Chapter One: Cost Management and Strategy: An OverviewDocument30 pagesChapter One: Cost Management and Strategy: An OverviewTran Pham0% (1)

- Vol I of III Web 20170524 210403Document443 pagesVol I of III Web 20170524 210403Ranjan KumarNo ratings yet

- Career Counselling PPT GeneralDocument56 pagesCareer Counselling PPT Generalhardik joshiNo ratings yet

- Gurlal SinghDocument3 pagesGurlal Singhgurpreet kalsiNo ratings yet

- Arb PanelDocument46 pagesArb PanelKarthik VelletiNo ratings yet

CFAS Questions

CFAS Questions

Uploaded by

Krisselyn Reigne0 ratings0% found this document useful (0 votes)

1 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views3 pagesCFAS Questions

CFAS Questions

Uploaded by

Krisselyn ReigneCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

1. Define accounting 6.

Explain recording, classifying and

Accounting is the business language. It is a service summarizing relation to the

activity that aims to give quantitative information, communicating component of

particularly financial information, to aid in accounting.

decision-making. It is the art of recording, Implicit in the communication process is the

classifying, and summarizing financial transactions recording, classifying, and summarizing aspects of

and interpreting the results thereof. It is also a accounting. Recording or journalizing is the

process of identifying, measuring, and process of systematically maintaining a record of

communicating economic information. all economic business transactions after they have

been identified and measured. Classifying is the

2. Explain identifying as a component of sorting or grouping of similar interrelated

accounting. economic transactions into their respective classes.

This is an accounting process whereas recognition It is accomplished by posting to the ledger.

or nonrecognition of business activities as Summarizing is the preparation of financial

“accountable” events happens. An event is statements.

accountable or quantifiable only when it has an

effect on assets, liabilities, and equity. Hence, an 7. What is overall objective of accounting?

activity should be economic to be recognized in The overall objective of accounting is to provide

accounting. Psychological and sociological matters quantitative financial information about a business

are beyond the province of accounting. useful to statement users, particularly owners, and

creditors in making economic decisions.

3. When is a transaction accountable or

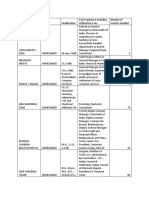

quantifiable? 8. Describe accountancy profession.

An event is accountable or quantifiable when it has An accountant’s primary task is to supply financial

an effect on assets, liabilities, and equity. Only information so that the statement users could make

economic activities, transactions that may be informed judgments and better decisions.

classified as external and internal, can be Accountants are professionals who are in charge of

accountable and recognized in accounting. maintaining and interpreting financial records.

4. Explain measuring as a component of 9. What is R.A. No. 9298?

accounting? Republic Act No. 9298 is the law regulating the

The accounting practice of allocating peso practice of accountancy in the Philippines. This

amounts to accountable economic transactions and Act shall provide for and govern:

events is known as measuring. Accounting

information must be stated in terms of a common (a) The standardization and regulation of

financial denominator in order to be relevant, as accounting education;

failure to do so will result in unclear or (b) The examination for registration of

incomprehensible financial statements. certified public accountants; and

(c) The supervision, control, and

5. Explain communicating as a component regulation of the practice of accountancy

of accounting? in the Philippines.

Communicating is the process of preparing and

distributing accounting reports to potential users of 10. What do you understand by the Board

accounting information. The identifying and of Accountancy?

measuring process of accounting would be The Board of Accountancy is the body empowered

meaningless if it could not be communicated to by law to issue rules and regulations governing the

potential users in some way. Accounting is known practice of accounting in the Philippines. It is in

as the "universal language of business" because of charge of preparing and grading the Philippine

this component. . CPA exam.

11. Explain the limitation of the practice of 21. What is the purpose of the required

public accountancy. CPD credit units?

Single practitioners and partnerships engaged in

the practice of public accounting in the Philippines

must be registered certified public accountants. 22. What is the exemption from the CPD

Furthermore, a certificate of accreditation shall be requirements?

issued to certified public accountants in public

practice only after such registrant has

demonstrated, in accordance with the rules and 23. Distinguish accounting and auditing.

regulations promulgated by the Board of

Accountancy and approved by the Professional

Regulation Commission, that such registrant has 24. Distinguish accounting and

acquired a minimum of three years of meaningful bookkeeping.

experience in any of the areas of public practice,

including taxation. In addition, the SEC shall not 25. Distinguish accounting and

register any corporation organized for the practice accountancy.

of public accounting.

12. 26. Distinguish financial and manageriual

accounting.

13. What are the three main areas in the

practive of the accountancy profession? 27. Explain generally accepted accounting

principles or GAAP.

14. Explain public accounting,

28. What constitutes GAAP in the

Philippines?

15. Explain auditing, taxation, and

management advisory services.

29. Explain the purpose of accounting

standards.

16. Explain private accounting.

17. Explain government accounting. 30. What do you understand about the

Financial Reporoting Standards

Council?

18. What do you understand by the

Continuing Professional Development of

CPAs?

31. What is the composition of FRSC?

19. What is the meaning of CPD credit

units?

32. What do you understand about the

International Accounting Standards

20. How many CPD units are required. Committee?

33. What do you understand by the

International Accounting Standards

Board?

34. What do you understand by the

International Financial Reporting

Standards?

35. What are collectivelyincluded in

Philippine Financial Reporting

Standards?

You might also like

- Financial Accounting Volume 1Document29 pagesFinancial Accounting Volume 1Ferjeanie Bernandino100% (1)

- Module 1 Financial Analysis and ReportingDocument22 pagesModule 1 Financial Analysis and ReportingJane Carla Borromeo100% (1)

- 2022 School Operational WorkplanDocument12 pages2022 School Operational WorkplanDorothy Otieno100% (3)

- Topic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaDocument58 pagesTopic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaHazim Badrin100% (1)

- Cfas 2022 Questions and AnswersDocument7 pagesCfas 2022 Questions and AnswersVinz Ray PitargueNo ratings yet

- Chapter 1 - The Accountancy ProfessionDocument4 pagesChapter 1 - The Accountancy Professionforn lettyNo ratings yet

- Ethical ThinkingDocument13 pagesEthical ThinkingZanth Brey CollinsNo ratings yet

- Chapter 1 The Accoutancy ProfessionDocument3 pagesChapter 1 The Accoutancy ProfessionRyleeNo ratings yet

- CFASDocument4 pagesCFASMary Jhel QuiddamNo ratings yet

- C1 The Accounting ProfessionDocument5 pagesC1 The Accounting ProfessionAllaine ElfaNo ratings yet

- Acca102 Chapter 1Document19 pagesAcca102 Chapter 1Khezia Mae U. GarlandoNo ratings yet

- Chapter 1 - 2rev (Students)Document31 pagesChapter 1 - 2rev (Students)NR 7No ratings yet

- Far Reviewer For FinalsDocument38 pagesFar Reviewer For Finalsjessamae gundanNo ratings yet

- Acc 2 ReviewerDocument5 pagesAcc 2 ReviewerAllyza MagtibayNo ratings yet

- Chapter 1Document12 pagesChapter 1Louie Ann CasabarNo ratings yet

- Con-Chap 1Document14 pagesCon-Chap 1Xiency WyneNo ratings yet

- )Document62 pages)Ma. Kristine GarciaNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument9 pagesChapter 1 The Accountancy ProfessionEllen MaskariñoNo ratings yet

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- Conceptual Framework - IntroductionDocument16 pagesConceptual Framework - IntroductionDewdrop Mae RafananNo ratings yet

- Financial Accounting and Reporting ReviewerDocument14 pagesFinancial Accounting and Reporting ReviewerRen Kouen100% (4)

- Midterm ReviewerDocument16 pagesMidterm ReviewerKarren Andrea D. Delos SantosNo ratings yet

- Study MaterialDocument22 pagesStudy MaterialSukrit SunderNo ratings yet

- Accounting Standards Council: Important Points in The Definition ofDocument15 pagesAccounting Standards Council: Important Points in The Definition ofmicolleNo ratings yet

- Fundamentals of Accounting, Business and Management 1Document41 pagesFundamentals of Accounting, Business and Management 1Anne MoralesNo ratings yet

- Week 01 - 01 - Module 01 - Concepts and PrinciplesDocument11 pagesWeek 01 - 01 - Module 01 - Concepts and Principles지마리No ratings yet

- Accounting Midterms ReviewerDocument6 pagesAccounting Midterms Reviewerpatricia culanibanNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument7 pagesChapter 1 The Accountancy ProfessionJoshua Sapphire AmonNo ratings yet

- New and Old Conceptual Framework, Accounting Principles, Accounting Process, PAS 18 - RevenueDocument13 pagesNew and Old Conceptual Framework, Accounting Principles, Accounting Process, PAS 18 - RevenueDennis VelasquezNo ratings yet

- FAR REVIEWER Part 1Document7 pagesFAR REVIEWER Part 1jessamae gundanNo ratings yet

- Fundamentalss of Accountancy and Business ManagementDocument107 pagesFundamentalss of Accountancy and Business ManagementArmina Valdez100% (1)

- Cfas ReviewerDocument193 pagesCfas Reviewerangelafernandez0309No ratings yet

- Lesson 1: Introduction To AccountingDocument4 pagesLesson 1: Introduction To AccountingDante SausaNo ratings yet

- FUNACCODocument28 pagesFUNACCOJondil RotoniNo ratings yet

- Conceptual Framework and Accounting Standard Chapter 1-13 Digest NotesDocument14 pagesConceptual Framework and Accounting Standard Chapter 1-13 Digest Notesangelo subaNo ratings yet

- Fundamental of Financial AccountingDocument26 pagesFundamental of Financial AccountingShirish JhaNo ratings yet

- NEP Class NotesDocument12 pagesNEP Class NotesnsubbuadigaNo ratings yet

- fUNDAMENTALS OF Accounting-I Jimma University Department of Accounting and Finance Fundamentals of Accounting InstructorDocument48 pagesfUNDAMENTALS OF Accounting-I Jimma University Department of Accounting and Finance Fundamentals of Accounting InstructorMany GramNo ratings yet

- Core 1 - Journalize TransactionsDocument14 pagesCore 1 - Journalize TransactionsCharlote MarcellanoNo ratings yet

- Nature and Scope of AccountingDocument19 pagesNature and Scope of AccountingSaffa IbrahimNo ratings yet

- Module in FAR 2021 First Sem BSA-1ADocument99 pagesModule in FAR 2021 First Sem BSA-1AMelody CristobalNo ratings yet

- Accounting-1 Reading Materials#1Document53 pagesAccounting-1 Reading Materials#1Nardsdel RiveraNo ratings yet

- Bookkeeping NC Iii - Module 1Document15 pagesBookkeeping NC Iii - Module 1Abigail AndradeNo ratings yet

- Conversion ProblemsDocument6 pagesConversion ProblemsAce Maynard DiancoNo ratings yet

- Financial Accounting and Reporting 01Document9 pagesFinancial Accounting and Reporting 01Nuah SilvestreNo ratings yet

- AbDocument411 pagesAbMd shahjahanNo ratings yet

- ACC124 - First ExamDocument4 pagesACC124 - First ExamBaby Leonor RazonableNo ratings yet

- Fabm Q1 SlidesDocument261 pagesFabm Q1 Slidesminirifty100% (1)

- Cfasm 11Document4 pagesCfasm 11Marielle JalandoniNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument13 pagesChapter 1 The Accountancy ProfessionLaiza Mae LasutanNo ratings yet

- Accounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Document428 pagesAccounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Ibrahim MuyeNo ratings yet

- Financial Reporting Framework: Accountancy DepartmentDocument14 pagesFinancial Reporting Framework: Accountancy DepartmentJayson ChanNo ratings yet

- Financial and Corporate ReportingDocument257 pagesFinancial and Corporate Reportinganon_636625652100% (1)

- Conceptual Framework & Accounting: College of Business AdministrationDocument10 pagesConceptual Framework & Accounting: College of Business AdministrationRaphael GalitNo ratings yet

- What Is 'Accounting': Definition ofDocument4 pagesWhat Is 'Accounting': Definition ofNica Dacatimbang - LeriosNo ratings yet

- Accounting Lec 1Document28 pagesAccounting Lec 1Swati OzaNo ratings yet

- Financial Accounting Volume 1Document116 pagesFinancial Accounting Volume 1Romuell BanaresNo ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- BESR BuddhismDocument9 pagesBESR BuddhismKrisselyn ReigneNo ratings yet

- BMGT25 - Act3 - MoralesDocument2 pagesBMGT25 - Act3 - MoralesKrisselyn ReigneNo ratings yet

- Econ21 FinalsDocument4 pagesEcon21 FinalsKrisselyn ReigneNo ratings yet

- Intermediate Accounting 3 - Chap 10-12 Answer KeyDocument7 pagesIntermediate Accounting 3 - Chap 10-12 Answer KeyKrisselyn ReigneNo ratings yet

- Proposed Research Titles, Sop, and Obj AbmDocument13 pagesProposed Research Titles, Sop, and Obj AbmKrisselyn ReigneNo ratings yet

- BESR Reviewer ABM 12Document11 pagesBESR Reviewer ABM 12Krisselyn ReigneNo ratings yet

- Letter ITECDocument1 pageLetter ITECKrisselyn ReigneNo ratings yet

- Alphabet IncDocument12 pagesAlphabet IncKrisselyn ReigneNo ratings yet

- Assistant Accountant Cover LetterDocument8 pagesAssistant Accountant Cover Letterafaocsazx100% (2)

- Why BCom AA 2022Document3 pagesWhy BCom AA 2022Shaji SNo ratings yet

- Soc2010version4index05november2015v2 tcm77-181321Document1,761 pagesSoc2010version4index05november2015v2 tcm77-181321Bùi Hắc HảiNo ratings yet

- Creditors Circularization 2008Document15 pagesCreditors Circularization 2008Alice WairimuNo ratings yet

- Udm Auditing Theory 2020Document17 pagesUdm Auditing Theory 2020Ceejay FrillarteNo ratings yet

- DAP 2020 Chapter 1 Appx B INDIGENOUS CONTENT ASPECTSDocument6 pagesDAP 2020 Chapter 1 Appx B INDIGENOUS CONTENT ASPECTSMaj Gen S KhannaNo ratings yet

- Case 1 AccapDocument2 pagesCase 1 AccapRose Medina BarondaNo ratings yet

- 78th BOD Meeting of OFDCDocument28 pages78th BOD Meeting of OFDCritesh MishraNo ratings yet

- Form TR 20 Gaz TAbill 2018 2Document2 pagesForm TR 20 Gaz TAbill 2018 2abc100% (1)

- Classified 2015 04 27 000000Document7 pagesClassified 2015 04 27 000000sasikalaNo ratings yet

- Jubilee Annual Report Final - WebDocument140 pagesJubilee Annual Report Final - WebEdward NjorogeNo ratings yet

- Bridge & Roof Co. (India) LimitedDocument17 pagesBridge & Roof Co. (India) Limitedbhawani27No ratings yet

- Sponsor DocsDocument2 pagesSponsor DocsMaisa SantosNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- The Role of ICMAB Professional AccountantsDocument6 pagesThe Role of ICMAB Professional AccountantsTauhid hassan SakibNo ratings yet

- ExposureDraft-Directive1 01Document109 pagesExposureDraft-Directive1 01JohnNo ratings yet

- New Form 3Document4 pagesNew Form 3seenNo ratings yet

- ZICA CONSITUTION FINAL October 2021Document52 pagesZICA CONSITUTION FINAL October 2021michelo-kandamaNo ratings yet

- DoDocument35 pagesDoRandora LkNo ratings yet

- Transfer PricingDocument235 pagesTransfer PricingRamesh KrishnanNo ratings yet

- Auditing Principle 1 - ch2Document18 pagesAuditing Principle 1 - ch2Sabaa ifNo ratings yet

- Chapter 11 Audit of Insurance CompaniesDocument62 pagesChapter 11 Audit of Insurance CompaniesDiyanaBankovaNo ratings yet

- Acctg 102Document52 pagesAcctg 102Yoonah KimNo ratings yet

- Ra 9298Document14 pagesRa 9298Errah Jenn CajesNo ratings yet

- Chapter One: Cost Management and Strategy: An OverviewDocument30 pagesChapter One: Cost Management and Strategy: An OverviewTran Pham0% (1)

- Vol I of III Web 20170524 210403Document443 pagesVol I of III Web 20170524 210403Ranjan KumarNo ratings yet

- Career Counselling PPT GeneralDocument56 pagesCareer Counselling PPT Generalhardik joshiNo ratings yet

- Gurlal SinghDocument3 pagesGurlal Singhgurpreet kalsiNo ratings yet

- Arb PanelDocument46 pagesArb PanelKarthik VelletiNo ratings yet