Professional Documents

Culture Documents

Fintech Regulations

Fintech Regulations

Uploaded by

BHUVANESWARI CHITHIRALACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fintech Regulations

Fintech Regulations

Uploaded by

BHUVANESWARI CHITHIRALACopyright:

Available Formats

Fintech research contributes to making the world a better place in several impactful ways:

Financial Inclusion:

Fintech innovations have helped bring banking and financial services to underserved

populations worldwide. For instance, mobile banking platforms and digital payment systems

have empowered people in remote areas to access financial services without relying on

traditional banks. M-Pesa in Kenya is a prime example, enabling millions to conduct financial

transactions via mobile phones, fostering economic growth and financial inclusion.

Efficiency and Accessibility:

Fintech research has streamlined financial processes, making them more efficient and

accessible. Robo-advisors, for instance, use algorithms to provide investment advice,

making financial planning affordable and available to a broader range of individuals.

Companies like Betterment and Wealthfront have revolutionized investment management,

offering low-cost solutions to investors.

Innovation in Lending:

Fintech research has led to alternative lending models beyond traditional banks.

Peer-to-peer lending platforms like Prosper and LendingClub directly connect borrowers with

investors, often providing better rates and terms compared to traditional lending institutions.

These platforms open up financing options for small businesses and individuals who may

have been overlooked by banks.

Fraud Prevention and Security:

Research in fintech continually improves security measures, such as biometric

authentication, encryption, and AI-based fraud detection systems. These advancements

enhance the safety of financial transactions, reducing the risk of fraudulent activities and

ensuring the protection of individuals' financial assets.

Sustainable Finance:

Fintech research increasingly focuses on sustainable finance solutions, fostering

investments in environmentally friendly projects. Platforms like Swell Investing and

Aspiration prioritize socially responsible investments, allowing individuals to support

companies that align with their ethical and environmental values.

Access to Capital for Small Businesses:

Fintech research has facilitated easier access to capital for small businesses. Companies

like Kiva enable individuals to lend small amounts of money to entrepreneurs worldwide,

supporting local economies and fostering entrepreneurship in developing regions.

In summary, fintech research has significantly contributed to making financial services more

inclusive, efficient, secure, and aligned with ethical and sustainable principles. These

advancements have positively impacted individuals, businesses, and economies globally,

promoting financial stability and growth while empowering underserved communities.

You might also like

- U of I Credit UnionDocument4 pagesU of I Credit UnionMani JoraNo ratings yet

- Stock Watson 4E Exercisesolutions Chapter3 InstructorsDocument25 pagesStock Watson 4E Exercisesolutions Chapter3 InstructorsRodrigo PassosNo ratings yet

- CAT G3500 Gas Engine Maintenance ScheduleDocument3 pagesCAT G3500 Gas Engine Maintenance ScheduleQaiser Iqbal67% (6)

- Fintech: Ecosystem, Business Models, Investment Decisions, and ChallengesDocument12 pagesFintech: Ecosystem, Business Models, Investment Decisions, and ChallengesRicard Diago SambuagaNo ratings yet

- Research ProposalDocument14 pagesResearch ProposalFerdyana LieNo ratings yet

- Co5 FebDocument9 pagesCo5 Febsaritasinha0207No ratings yet

- What Is Financial InclusionDocument4 pagesWhat Is Financial Inclusionitsv0317No ratings yet

- Digital Finance and Its Impact On Financial InclusDocument51 pagesDigital Finance and Its Impact On Financial InclusHAFSA ASHRAF50% (2)

- Team 05Document78 pagesTeam 05GAMER GAMENo ratings yet

- Fintech and Financial Services - Delivering For DevelopmentDocument5 pagesFintech and Financial Services - Delivering For Developmentsharafernando2No ratings yet

- Nikunj Sharma CTIF Assignment 1Document14 pagesNikunj Sharma CTIF Assignment 1nikunj sharmaNo ratings yet

- Assignment1_Introduction_to_FintechDocument5 pagesAssignment1_Introduction_to_Fintechshreyanshjaiswal1998No ratings yet

- The Rise of FintechDocument1 pageThe Rise of Fintechsuneel66229No ratings yet

- Chapter Two (1B)Document16 pagesChapter Two (1B)Robb CarlosNo ratings yet

- Digitalization in Banking and Factors That Makes It More CompellingDocument18 pagesDigitalization in Banking and Factors That Makes It More CompellingJaljala NirmanNo ratings yet

- Essay 1Document4 pagesEssay 12027dpatel.studentNo ratings yet

- Digitalization in BankingDocument18 pagesDigitalization in Bankingप्रवीण घिमिरेNo ratings yet

- FintechDocument3 pagesFintechKash MonNo ratings yet

- MCQ BankingDocument37 pagesMCQ BankingKripa Vijay100% (1)

- F1Document2 pagesF1Ra BaNo ratings yet

- 6 2 25 431 PDFDocument4 pages6 2 25 431 PDFVikash DudiNo ratings yet

- Lee 2018Document12 pagesLee 2018Yusuf Fidi UcupNo ratings yet

- Fintech IntroDocument2 pagesFintech IntroTushar NegiNo ratings yet

- Digital Finance-Fintech and It's Impact On Financial Inclusion in IndiaDocument10 pagesDigital Finance-Fintech and It's Impact On Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fintech RevolutionDocument2 pagesFintech Revolution2032500130No ratings yet

- Financial Technology (Fintech) Is Used To Describe New Tech That Seeks To Improve and Automate TheDocument4 pagesFinancial Technology (Fintech) Is Used To Describe New Tech That Seeks To Improve and Automate ThePreah GulatiNo ratings yet

- NEC EssayDocument6 pagesNEC EssayflorayolandezhengNo ratings yet

- FintechDocument2 pagesFintechhunnain zahidNo ratings yet

- UNIT 2 FintechDocument20 pagesUNIT 2 Fintechneha1No ratings yet

- Review of Literature OldDocument52 pagesReview of Literature OldRohit GowdaNo ratings yet

- Research PaperDocument19 pagesResearch Paperhimanshu bhattNo ratings yet

- Paradigm Shift in BankingDocument3 pagesParadigm Shift in BankingAbdullah AssilNo ratings yet

- Technological Advances in Recent Years Have Led To A Growing Number of FastDocument4 pagesTechnological Advances in Recent Years Have Led To A Growing Number of Fastnabila tasanNo ratings yet

- 671-Article Text-2007-1-10-20211229Document15 pages671-Article Text-2007-1-10-20211229Jonre LouisNo ratings yet

- Development of FintechDocument15 pagesDevelopment of FintechEvangelist Stephen NziokaNo ratings yet

- Financial Services For The Poor - Digital Infrastructure - Bill & Melinda Gates FoundationDocument11 pagesFinancial Services For The Poor - Digital Infrastructure - Bill & Melinda Gates FoundationkelvinkinergyNo ratings yet

- Notes For The ClassDocument25 pagesNotes For The ClassgopiNo ratings yet

- Introduction To Fintech333Document1 pageIntroduction To Fintech333David PimeislNo ratings yet

- Understanding The Disrupting The Financial Industry (What and Why)Document20 pagesUnderstanding The Disrupting The Financial Industry (What and Why)himanshu bhattNo ratings yet

- Business Research FinalDocument13 pagesBusiness Research FinalMuhammad FaizanNo ratings yet

- ფინტექიDocument14 pagesფინტექიnanuka nanukaNo ratings yet

- The Evolution of Financial ServicesDocument4 pagesThe Evolution of Financial ServicesMizanul amalNo ratings yet

- Fin TechDocument6 pagesFin TechgopiNo ratings yet

- Financial Services.: Presented By: Badal SharmaDocument13 pagesFinancial Services.: Presented By: Badal Sharmachirag aggarwalNo ratings yet

- 8 (T) How Fintech Promotes Financial InclusionDocument4 pages8 (T) How Fintech Promotes Financial InclusionKanika MaheshwariNo ratings yet

- Digital Financial InclusionDocument14 pagesDigital Financial InclusionANONYMOUS PeopleNo ratings yet

- Final Sip Report On FintechDocument43 pagesFinal Sip Report On FintechsujitNo ratings yet

- Fin TechDocument7 pagesFin TechHarsh ChaudharyNo ratings yet

- Enactment and Recent Advancement of mfs-1Document7 pagesEnactment and Recent Advancement of mfs-1Anusha.RNo ratings yet

- FINTECH (Zirak Zaidan)Document5 pagesFINTECH (Zirak Zaidan)zirak.zidan466No ratings yet

- MBA Global Trends Lecture 1 - Intro To Financial TechnologyDocument20 pagesMBA Global Trends Lecture 1 - Intro To Financial Technologyemanz21No ratings yet

- FinTech and The Younger GeneraDocument19 pagesFinTech and The Younger GeneraĐinh HạnhNo ratings yet

- Financial Technology (Fintech) - Its Uses and Impact On Our LivesDocument10 pagesFinancial Technology (Fintech) - Its Uses and Impact On Our Livessharafernando2No ratings yet

- Challenges and Opportunities of Digital Financial Services For Low-Income PopulationsDocument8 pagesChallenges and Opportunities of Digital Financial Services For Low-Income PopulationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Transformatioin FinanceDocument15 pagesDigital Transformatioin FinancesuhitaNo ratings yet

- FintechDocument2 pagesFintechNitanshu ChavdaNo ratings yet

- Fin TechDocument2 pagesFin TechMcatandaNo ratings yet

- FinTech Paper - RevisedDocument11 pagesFinTech Paper - Revisedsrinivasa rao arigelaNo ratings yet

- UntitledDocument6 pagesUntitledAnuj TanwarNo ratings yet

- Fint TechDocument13 pagesFint TechLaxmi SadhukhanNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- Comandos de ScilabDocument11 pagesComandos de ScilabAlejandro Galindo Vega0% (1)

- Eugene Life DirectoryDocument84 pagesEugene Life DirectoryEugene Area Chamber of Commerce Communications100% (1)

- Curriculum Vitae: Pramod - Junior CAM EngineerDocument4 pagesCurriculum Vitae: Pramod - Junior CAM EngineerpramodNo ratings yet

- Testes Avaliação Inglês 6º AnoDocument43 pagesTestes Avaliação Inglês 6º AnoRui PauloNo ratings yet

- Kindergarten Writing Lesson PlanDocument7 pagesKindergarten Writing Lesson Planapi-332051194No ratings yet

- Ferrari On FroomeDocument2 pagesFerrari On FroomeRaceRadioNo ratings yet

- 4.contour Flow Conditioner PDFDocument14 pages4.contour Flow Conditioner PDFFIRMANSYAHNo ratings yet

- Production of Germ Cell Spermatozoa From The Testis During Coitus Production of Male Sex Hormone Testosterone From The TestisDocument3 pagesProduction of Germ Cell Spermatozoa From The Testis During Coitus Production of Male Sex Hormone Testosterone From The Testisamelia niitaNo ratings yet

- Riemann Mapping Theorem PDFDocument10 pagesRiemann Mapping Theorem PDFjayroldparcedeNo ratings yet

- Cash Out With WhatsappDocument22 pagesCash Out With WhatsappIDRIS JAMIUNo ratings yet

- OLD 2900 Downflow Manual PDFDocument32 pagesOLD 2900 Downflow Manual PDFintermountainwaterNo ratings yet

- Sealwell-Pump Mechanical SealsDocument8 pagesSealwell-Pump Mechanical SealsVaibhav JainNo ratings yet

- Adv RDBDocument7 pagesAdv RDBKunal ChaudhariNo ratings yet

- Kreativitas Dan Inovasi Berpengaruh Terhadap Kewirausahaan Usaha KecilDocument17 pagesKreativitas Dan Inovasi Berpengaruh Terhadap Kewirausahaan Usaha Kecilapsari hasanNo ratings yet

- Guide-4 StepsDocument8 pagesGuide-4 StepsAurelio Vázquez AlejoNo ratings yet

- Jody Howard Director, Social Responsibility Caterpillar, IncDocument17 pagesJody Howard Director, Social Responsibility Caterpillar, IncJanak ValakiNo ratings yet

- CirclesDocument54 pagesCirclestrishaNo ratings yet

- Module 2Document40 pagesModule 2surya989030No ratings yet

- Analog Communication Model ExamDocument20 pagesAnalog Communication Model ExamwalternampimadomNo ratings yet

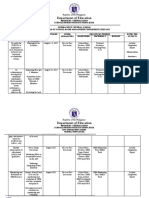

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesRussel RapisoraNo ratings yet

- Historiography On The Origins of The Cold WarDocument4 pagesHistoriography On The Origins of The Cold Warapi-297872327100% (2)

- CirclesDocument15 pagesCirclesJustine ReanNo ratings yet

- P PotassiumDocument12 pagesP PotassiumHeleneSmithNo ratings yet

- Pdvsa: Engineering Design ManualDocument2 pagesPdvsa: Engineering Design ManualElvina Sara Sucre BuenoNo ratings yet

- Part B Unit 3 DBMSDocument4 pagesPart B Unit 3 DBMSkaran.1888kNo ratings yet

- PROVISIONDocument18 pagesPROVISIONKirena XavieryNo ratings yet

- Coping Mechanisms of ScienceDocument26 pagesCoping Mechanisms of ScienceYouth ChoirNo ratings yet

- Fluency ReflectionDocument7 pagesFluency Reflectionapi-316375440No ratings yet