Professional Documents

Culture Documents

Wa0000.

Wa0000.

Uploaded by

anpro1299Copyright:

Available Formats

You might also like

- HIPAA PowerPointDocument42 pagesHIPAA PowerPointAlbert Tesoro Silang Jr.No ratings yet

- Equipment Transfer Agreement TemplateDocument3 pagesEquipment Transfer Agreement TemplateNicole Santoalla0% (2)

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1615072023 161901Document2 pagesForm 1615072023 161901Steve BurnsNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Form 1629042024 151129Document2 pagesForm 1629042024 151129UtkarshNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Form 1613062024 094217Document3 pagesForm 1613062024 094217santoshamrute0711No ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1617052024 112840Document3 pagesForm 1617052024 112840sandeep kumarNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Sudhir Jagannath Belose 23-24Document3 pagesSudhir Jagannath Belose 23-24pankajyadav7410No ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

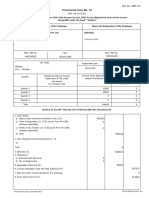

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- CHLPR4183D Partb 2023-24Document4 pagesCHLPR4183D Partb 2023-24JMLNo ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- Datark (1) (2) (2) (2) (1)Document3 pagesDatark (1) (2) (2) (2) (1)Aly BenNo ratings yet

- DIN 976 - Metric Thread Stud BoltsDocument4 pagesDIN 976 - Metric Thread Stud BoltsNajwa NazriNo ratings yet

- PO371 Course Outline 2021 SyllabusDocument5 pagesPO371 Course Outline 2021 SyllabusManjot DhillonNo ratings yet

- The Fathers of The Church. A New Translation. Volume 31.Document408 pagesThe Fathers of The Church. A New Translation. Volume 31.Patrologia Latina, Graeca et Orientalis100% (7)

- Anyone Remember This Email NowDocument106 pagesAnyone Remember This Email NowDavid.Raymond.Amos936No ratings yet

- Llantino v. Co Liong Chong (1990)Document3 pagesLlantino v. Co Liong Chong (1990)Mie TotNo ratings yet

- Appeal Section 374 CRPCDocument11 pagesAppeal Section 374 CRPCHet DoshiNo ratings yet

- The Usual Modes of Avoiding Occurrence of Double Taxation AreDocument8 pagesThe Usual Modes of Avoiding Occurrence of Double Taxation AreGIRLNo ratings yet

- TIL306, TIL307 Numeric Displays With LogicDocument9 pagesTIL306, TIL307 Numeric Displays With LogicNadjNo ratings yet

- SKYLANDERS SWAP Force Xbox One GAME MANUALDocument14 pagesSKYLANDERS SWAP Force Xbox One GAME MANUALsamverbiskyNo ratings yet

- THBT Death Sentences For Terorist and Drug Addicted Should Be ImplementedDocument2 pagesTHBT Death Sentences For Terorist and Drug Addicted Should Be ImplementedMega AyuNo ratings yet

- Ua 103120 PDFDocument105 pagesUa 103120 PDFManuel WilsonNo ratings yet

- Chapter 1Document4 pagesChapter 1WillianfilosofoNo ratings yet

- Sample MCQ Topics 1-5Document12 pagesSample MCQ Topics 1-5horace000715No ratings yet

- Audit of Not For Profit OrganizationsDocument172 pagesAudit of Not For Profit OrganizationsDeepak JainNo ratings yet

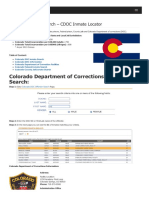

- Colorado Inmate Search Department of Corrections LookupDocument9 pagesColorado Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- Pennar Engineered Building Systems LimitedDocument466 pagesPennar Engineered Building Systems Limitedtuv srinuvasaNo ratings yet

- MSIL VS DR ReddyDocument5 pagesMSIL VS DR ReddyAmbuj PriyadarshiNo ratings yet

- American West and Industrialization Part 2Document13 pagesAmerican West and Industrialization Part 2Christian JonesNo ratings yet

- Constitution With Suggestions From ROSDocument14 pagesConstitution With Suggestions From ROSadrianongliangkiatNo ratings yet

- All Over India IBR Candidate List - CBB AuthorisationDocument6 pagesAll Over India IBR Candidate List - CBB Authorisationsanjay joshiNo ratings yet

- Module 6 - Theo 5Document19 pagesModule 6 - Theo 5Claire G. MagluyanNo ratings yet

- User Manual of HikCentral Professional Web ClientDocument203 pagesUser Manual of HikCentral Professional Web ClientnanoleoNo ratings yet

- Permission To Travel Form: Bentonville High SchoolDocument4 pagesPermission To Travel Form: Bentonville High Schoolapi-199664950No ratings yet

- STW-40th Session PDFDocument78 pagesSTW-40th Session PDFBisratNo ratings yet

- BBCG3103 AkhirDocument5 pagesBBCG3103 AkhirTengku Zulhilmi Al HajNo ratings yet

- People vs. KamadDocument2 pagesPeople vs. KamadGia DimayugaNo ratings yet

- Adam Gurowski Polish Nationalism, Russian Panslavism and American Manifest Destiny Adam Gurowski Polish Nationalism, Russian Panslavism and American Manifest DestinyDocument27 pagesAdam Gurowski Polish Nationalism, Russian Panslavism and American Manifest Destiny Adam Gurowski Polish Nationalism, Russian Panslavism and American Manifest DestinyNikos MisolidisNo ratings yet

Wa0000.

Wa0000.

Uploaded by

anpro1299Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wa0000.

Wa0000.

Uploaded by

anpro1299Copyright:

Available Formats

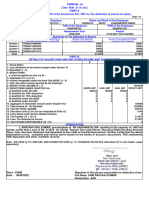

FORM No.

16

[ See Rule 31 (1) (a) ]

PART-A

Certificate under Section 203 of the Income-tax Act, 1961 for Tax deducted at source on salary

Page 1 2

Employer - PAO Code Name and Rank of the Employee

56 MAHENDRA SINGH

PAN of the Deductor TAN of the Deductor PAN of the Employee

DEUPS2278H MRTPO1748F BVXPS0723D

CIT(TDS) Address Assessment Year / Tax Option Period

PAO(ORs) BEG & C 2023-2024/OLD 01/04/2022 TO 31/03/2023

Summary of Tax deducted at Source

Quarter Receipt Numbers of original statements of Amount of tax deducted Amount of tax deducted/remitted

TDS under sub-section(3) of section 200 in respect of the employee in respect of the employee

Quarter 1 770000140249944 13685 13685

Quarter 2 770000146796860 18042 18042

Quarter 3 770000157165960 20844 20844

Quarter 4 770000167804103 13896 13896

Total 66467 66467

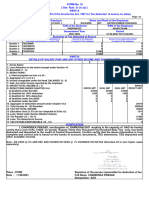

PART-B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

` ` ` `

1. Gross Salary 959447

2. Standard Deduction 50000

3. Less Allowance to the extent exempt under Section 10 2400

4. BALANCE (1 - 2) 907047

5. DEDUCTIONS :

a. Interest payable on loan u/s 24 : 0

6. Aggregate of 5 ( a to b ) 0

7. Income chargeable under the Head 'SALARIES' (3 - 5) 907047

8. Add: Any other income reported by the employee * 0

9. GROSS TOTAL INCOME (6 + 7) 907047

10. DEDUCTIONS UNDER CHAPTER VI-A GROSS AMT QUAL AMT QUAL AMT DEDUCT AMT

a) Qualified under Sec.80C 208620 150000 150000

b) Qualified for 100% deduction 0 0 0

c) Qualified for 50% deduction 0 0 0

d) Qualified under Sec.80DD 0 0 0

e) Qualified under Sec.80U 0 0 0

11. Aggregate of deductible amount under Chapter VI-A 150000

12. Total Income (8 - 10) Rounded 757050

13. TAX ON TOTAL INCOME 63910

14. Health & Education Cess @4% (on tax computed at Sl.No.12) 2557

15. Tax Payable (12 + 13) 66467

16. Less: Relief under Section 89(attach Details) 0

17. Less : Tax Deducted 66467

18. TAX PAYABLE/REFUNDABLE (15 - 16) 0

VERIFICATION

I, KEHAR SINGH, son/daughter of SH SHIB LAL working in the capacity of AAO do hereby certify that

a sum of Rs. 66467 (in words) Rupees Sixty Six Thousand Four Hundred Sixty Seven only. has been deducted

and deposited to the credit of Central Government. I further certify that the above information is true, complete

and correct and is based on the books of account, documents, TDS statements, TDS deposited and other

available records.

Note * : Sl.No.8 above Other Income includes taxable interest accrued on Fund Subscription above 500000 Rupees

Place : ROORKEE Signature of the person responsible for deduction of tax

Date : 26/05/2023 Full Name KEHAR SINGH

Designation AAO

BREAK UP OF TAXABLE EMOLUMENTS FINANCIAL YEARWISE Page 2 2

Employer - PAO Code Name and Rank of the Employee

56 MAHENDRA SINGH

For the financial year from 01/03/2021 to 28/02/2022 = 108667.0

For the financial year from 01/03/2022 to 28/02/2023 = 850780.0

Total taxable emoluments 959447.0

You might also like

- HIPAA PowerPointDocument42 pagesHIPAA PowerPointAlbert Tesoro Silang Jr.No ratings yet

- Equipment Transfer Agreement TemplateDocument3 pagesEquipment Transfer Agreement TemplateNicole Santoalla0% (2)

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1615072023 161901Document2 pagesForm 1615072023 161901Steve BurnsNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Form 1629042024 151129Document2 pagesForm 1629042024 151129UtkarshNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Form 1613062024 094217Document3 pagesForm 1613062024 094217santoshamrute0711No ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1617052024 112840Document3 pagesForm 1617052024 112840sandeep kumarNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Sudhir Jagannath Belose 23-24Document3 pagesSudhir Jagannath Belose 23-24pankajyadav7410No ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- CHLPR4183D Partb 2023-24Document4 pagesCHLPR4183D Partb 2023-24JMLNo ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- Datark (1) (2) (2) (2) (1)Document3 pagesDatark (1) (2) (2) (2) (1)Aly BenNo ratings yet

- DIN 976 - Metric Thread Stud BoltsDocument4 pagesDIN 976 - Metric Thread Stud BoltsNajwa NazriNo ratings yet

- PO371 Course Outline 2021 SyllabusDocument5 pagesPO371 Course Outline 2021 SyllabusManjot DhillonNo ratings yet

- The Fathers of The Church. A New Translation. Volume 31.Document408 pagesThe Fathers of The Church. A New Translation. Volume 31.Patrologia Latina, Graeca et Orientalis100% (7)

- Anyone Remember This Email NowDocument106 pagesAnyone Remember This Email NowDavid.Raymond.Amos936No ratings yet

- Llantino v. Co Liong Chong (1990)Document3 pagesLlantino v. Co Liong Chong (1990)Mie TotNo ratings yet

- Appeal Section 374 CRPCDocument11 pagesAppeal Section 374 CRPCHet DoshiNo ratings yet

- The Usual Modes of Avoiding Occurrence of Double Taxation AreDocument8 pagesThe Usual Modes of Avoiding Occurrence of Double Taxation AreGIRLNo ratings yet

- TIL306, TIL307 Numeric Displays With LogicDocument9 pagesTIL306, TIL307 Numeric Displays With LogicNadjNo ratings yet

- SKYLANDERS SWAP Force Xbox One GAME MANUALDocument14 pagesSKYLANDERS SWAP Force Xbox One GAME MANUALsamverbiskyNo ratings yet

- THBT Death Sentences For Terorist and Drug Addicted Should Be ImplementedDocument2 pagesTHBT Death Sentences For Terorist and Drug Addicted Should Be ImplementedMega AyuNo ratings yet

- Ua 103120 PDFDocument105 pagesUa 103120 PDFManuel WilsonNo ratings yet

- Chapter 1Document4 pagesChapter 1WillianfilosofoNo ratings yet

- Sample MCQ Topics 1-5Document12 pagesSample MCQ Topics 1-5horace000715No ratings yet

- Audit of Not For Profit OrganizationsDocument172 pagesAudit of Not For Profit OrganizationsDeepak JainNo ratings yet

- Colorado Inmate Search Department of Corrections LookupDocument9 pagesColorado Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- Pennar Engineered Building Systems LimitedDocument466 pagesPennar Engineered Building Systems Limitedtuv srinuvasaNo ratings yet

- MSIL VS DR ReddyDocument5 pagesMSIL VS DR ReddyAmbuj PriyadarshiNo ratings yet

- American West and Industrialization Part 2Document13 pagesAmerican West and Industrialization Part 2Christian JonesNo ratings yet

- Constitution With Suggestions From ROSDocument14 pagesConstitution With Suggestions From ROSadrianongliangkiatNo ratings yet

- All Over India IBR Candidate List - CBB AuthorisationDocument6 pagesAll Over India IBR Candidate List - CBB Authorisationsanjay joshiNo ratings yet

- Module 6 - Theo 5Document19 pagesModule 6 - Theo 5Claire G. MagluyanNo ratings yet

- User Manual of HikCentral Professional Web ClientDocument203 pagesUser Manual of HikCentral Professional Web ClientnanoleoNo ratings yet

- Permission To Travel Form: Bentonville High SchoolDocument4 pagesPermission To Travel Form: Bentonville High Schoolapi-199664950No ratings yet

- STW-40th Session PDFDocument78 pagesSTW-40th Session PDFBisratNo ratings yet

- BBCG3103 AkhirDocument5 pagesBBCG3103 AkhirTengku Zulhilmi Al HajNo ratings yet

- People vs. KamadDocument2 pagesPeople vs. KamadGia DimayugaNo ratings yet

- Adam Gurowski Polish Nationalism, Russian Panslavism and American Manifest Destiny Adam Gurowski Polish Nationalism, Russian Panslavism and American Manifest DestinyDocument27 pagesAdam Gurowski Polish Nationalism, Russian Panslavism and American Manifest Destiny Adam Gurowski Polish Nationalism, Russian Panslavism and American Manifest DestinyNikos MisolidisNo ratings yet