Professional Documents

Culture Documents

Nssa Skills

Nssa Skills

Uploaded by

marvadomarvellous67Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nssa Skills

Nssa Skills

Uploaded by

marvadomarvellous67Copyright:

Available Formats

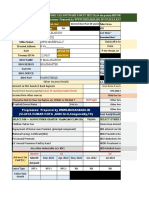

WCIF= Basic Salary × WCIF Percentage

NPS= (Employee's NPS contribution Rate 0.045×Basic Salary)+(Employer's contribution Rate 0.045×Basic Salary)

If the Basic Salary is over the maximum insurable earnings we using the NSSA maximum insurable earnings contribution which is 2 414 896

Employee No Name Basic Salary NPS 4.5%= 0.0045 WCIF 1.63%= 0.0163

MP001 Matsike A 3000000 (0.045×2414896)+(0.045×2414896)=217340.64 3000000×0.0163= 48900

MP002 Zindaba W 2500000 (0.045×2414896)+(0.045×2414896)=217340.64 2500000×0.0163=40750

MP003 Tariro C 1800000 (0.045×1800000)+(0.045×1800000)=162000 1800000×0.0163=29340

MP004 Ncube C 6500000 (0.045×2414896)+(0.045×2414896)=217340.50 6500000×0.0163=105950

MP005 Ndhlovu A 6800000 (0.045×2414896)+(0.045×2414896)=217340.64 6800000×0.0163=110840

MP006 Kagura G 500000 (0.045×500000)+(0.045×500000)=45000 500000×0.0163=8150

MP007 Valeri R 1980000 (0.045×1980000)+(0.045×1980000)=178200 1980000×0.0163=32274

MP008 Ngwenya T 1200000 (0.045×1200000)+(0.045×1200000)=108000 1200000×0.0163=19560

MP009 Munetsi T 1795000 (0.045×1795000)+(0.045×1795000)=161550 1795000×0.0163=29258.50

MP010 Thabo M 3000000 (0.045×2414896)+(0.045×2414896)=217340.64 3000000×0.0163=48900

MP011 Pretty F 3200000 (0.045×2414896)+(0.045×2414896)=217340.64 3200000×0.0163=52160

MP012 Faith G 4500000 (0.045×2414896)+(0.045×2414896)=217340.64 4500000×0.0163=73350

MP013 Mbasera P 2600000 (0.045×2414896)+(0.045×2414896)=217340.64 2600000×0.0163=42380

MP014 Maduyu P 1100000 (0.045×1100000)+(0.045×1100000)=99000 1100000×0.0163=17930

MP015 Musungwa M 9500000 (0.045×2414896)+(0.045×2414896)=217340.64 9500000×0.0163=154850

TOTAL 2709815.76 808742.50

2) Total amount to be remitted to the National Pension Scheme and Workers Compensation Insurance Fund:

Total NPS: 2709815.76

Total WCIF: 808,742.5

Total amount to be remitted is the sum of the total NPS and total WCIF, which is $2 709 815.76 + $808 742.50 = $3 518 558.26

You might also like

- Compensation Management TATA Motors 2Document86 pagesCompensation Management TATA Motors 2deepak Gupta75% (4)

- Case Hardhat LTD.: 30 Per UnitDocument6 pagesCase Hardhat LTD.: 30 Per UnitRajeshkumar NayakNo ratings yet

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Recruitment Practices and Compensation Policies at Nestle PDFDocument12 pagesRecruitment Practices and Compensation Policies at Nestle PDFAbhishek Mukherjee100% (1)

- Tasa de Dependencia y TBNDocument4 pagesTasa de Dependencia y TBNMARTIN EMILIO VAZQUEZ SARMIENTONo ratings yet

- CVP ANALYSIS (Solutions)Document24 pagesCVP ANALYSIS (Solutions)Mohammad UmairNo ratings yet

- Finanzas Corporativas UltimaDocument5 pagesFinanzas Corporativas UltimaKenia MantuanoNo ratings yet

- Bond Valuation Version 1.XlsbDocument14 pagesBond Valuation Version 1.XlsbAlie Dys100% (1)

- Susti 2011-ADocument10 pagesSusti 2011-AJAIME ANTONIO VALVERDE RAMOSNo ratings yet

- Commission and InterestsDocument48 pagesCommission and InterestsAlyssa ManrizaNo ratings yet

- Bond Valuation Version 1.xlsbDocument14 pagesBond Valuation Version 1.xlsbJessie jorgeNo ratings yet

- Libro 1Document6 pagesLibro 1Chester DavidNo ratings yet

- Wee K (I) Expected Number of Failures N N 0 1 2 3 4 5Document2 pagesWee K (I) Expected Number of Failures N N 0 1 2 3 4 5mohamed hishamNo ratings yet

- Hasil: SD 0,00445396 % KV 4,4%Document1 pageHasil: SD 0,00445396 % KV 4,4%machiiNo ratings yet

- Sample CalculationDocument2 pagesSample CalculationMohammed AlmoriseyNo ratings yet

- Calculo Del Factor Camión Por Aashto de Diferentes VehiculosDocument57 pagesCalculo Del Factor Camión Por Aashto de Diferentes VehiculosUriarte Vallejos EinsteinNo ratings yet

- Pelaburan WongDocument2 pagesPelaburan WongEma ZulkiffliNo ratings yet

- Marking SchemeDocument5 pagesMarking SchemeEric BYIRINGIRONo ratings yet

- Income From Salary Solution ZDocument3 pagesIncome From Salary Solution ZMuhammad FaisalNo ratings yet

- Return (Annual) 36.0118889 Return (Annual) Return (Monthly) 3.00099074Document5 pagesReturn (Annual) 36.0118889 Return (Annual) Return (Monthly) 3.00099074Muhammad AtifNo ratings yet

- Tensile Test Lab Report: Strength of MaterialDocument5 pagesTensile Test Lab Report: Strength of Materialirfan bashirNo ratings yet

- Saifurs Math - Partnership SolutionDocument8 pagesSaifurs Math - Partnership SolutionShaikat D. AjaxNo ratings yet

- Tyler, Barnes and Solace Formed A Partnership On Jan 1 2019 Each Contributed 120000 Salaries Were To Be Allocated As FollowsDocument2 pagesTyler, Barnes and Solace Formed A Partnership On Jan 1 2019 Each Contributed 120000 Salaries Were To Be Allocated As FollowsMosesNo ratings yet

- 02 - Motafawik.com - كتاب الأستاذ في مادة المحاسبة (3 ثالثة ثانوي)Document65 pages02 - Motafawik.com - كتاب الأستاذ في مادة المحاسبة (3 ثالثة ثانوي)arands 1No ratings yet

- 19.2 818,142,400 VND 268,372,720 VND: Taxable Value of Excise DutyDocument2 pages19.2 818,142,400 VND 268,372,720 VND: Taxable Value of Excise Dutyacademic purpose Its forNo ratings yet

- Book Pro Comptabilite 3ASDocument65 pagesBook Pro Comptabilite 3ASمحمد زرواطيNo ratings yet

- Coordinates of Point A: Angle D Cos TP 1 E Tp1 Ip 1Document8 pagesCoordinates of Point A: Angle D Cos TP 1 E Tp1 Ip 1bernie3sanders-1No ratings yet

- Chapter-9-Worked-Solutions Year 11 Standard Maths Cambridge NSWDocument15 pagesChapter-9-Worked-Solutions Year 11 Standard Maths Cambridge NSWallthehalls666No ratings yet

- Imtiaz Ali 70110394 BDocument6 pagesImtiaz Ali 70110394 BImtiaz RahiNo ratings yet

- The Progressive Tax On Employment Between The President of Nepal and His/her Secretary Will Compared Through The Tax CalculationDocument3 pagesThe Progressive Tax On Employment Between The President of Nepal and His/her Secretary Will Compared Through The Tax CalculationAdolf HittlerNo ratings yet

- Bahasan Aritmatika2Document6 pagesBahasan Aritmatika2Noni DwisariNo ratings yet

- All Inds Min Wage - 1.1.21 - 30.6.21Document5 pagesAll Inds Min Wage - 1.1.21 - 30.6.21shubham savantNo ratings yet

- FIN 081 - P2 Quiz2Document55 pagesFIN 081 - P2 Quiz2Grazielle DiazNo ratings yet

- Yohanes Sihdanardi 201712037 Tugas Analisis LeverageDocument10 pagesYohanes Sihdanardi 201712037 Tugas Analisis LeverageFebri Jkw 1No ratings yet

- Ley de HookeDocument6 pagesLey de Hookeyeimy hernandezNo ratings yet

- MTH 601 BC 190400351Document1 pageMTH 601 BC 190400351Iqra IqraNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- Acc Final 2Document15 pagesAcc Final 2Tanvir OnifNo ratings yet

- Solution Partnership OperationsDocument3 pagesSolution Partnership OperationsStella SabaoanNo ratings yet

- Brosur Al Maliki ReloadDocument2 pagesBrosur Al Maliki ReloadIct Smk Darul MuqomahNo ratings yet

- Calculo de Areas VariosDocument106 pagesCalculo de Areas Variosjuan cordovaNo ratings yet

- COST BEHAVIOR (Solution)Document5 pagesCOST BEHAVIOR (Solution)Mustafa ArshadNo ratings yet

- Trabajo Nº1-Ing. Ccallo Cusi, Ruben German - Analisis Estructural 2Document27 pagesTrabajo Nº1-Ing. Ccallo Cusi, Ruben German - Analisis Estructural 2educacion universitarioNo ratings yet

- Note 1Document2 pagesNote 1gantulgahaliun3No ratings yet

- Paper Bags Price ListDocument1 pagePaper Bags Price ListHari AchuNo ratings yet

- AN Tema 3 01 C Integracion Numerica TrapecioDocument13 pagesAN Tema 3 01 C Integracion Numerica TrapecioAndrés AvílaNo ratings yet

- Manual de Soluciones Capítulo 7 Ejercicios 7.2 2. 32,000 R (1 + 0.1336/52)Document36 pagesManual de Soluciones Capítulo 7 Ejercicios 7.2 2. 32,000 R (1 + 0.1336/52)StevenNo ratings yet

- CFM Take-home Exercise 8(1)Document6 pagesCFM Take-home Exercise 8(1)camlansuc09999No ratings yet

- Assignment-2 18MVD0071Document9 pagesAssignment-2 18MVD0071Akshay PatharkarNo ratings yet

- IntegraciontrapecioDocument13 pagesIntegraciontrapecioO Galã SecretoNo ratings yet

- Ujian Tengah Semester Mata Kuliah Statistika Dan ProbabilitasDocument4 pagesUjian Tengah Semester Mata Kuliah Statistika Dan ProbabilitasMHS MIRZA ALFARIZNo ratings yet

- Ep E G X+a X: Calculation Elevation Points Along Vertical CurvesDocument6 pagesEp E G X+a X: Calculation Elevation Points Along Vertical Curvesbernie3sanders-1No ratings yet

- Lampiran FluidisasiDocument24 pagesLampiran FluidisasihossiNo ratings yet

- Aral Pan 9 EquationDocument5 pagesAral Pan 9 EquationRashiel Jane Paronia CelizNo ratings yet

- Robotics Worksheet 2Document5 pagesRobotics Worksheet 2Khanh Phạm HoàngNo ratings yet

- Finanzas 2 - Calculo Van - Tir - BCDocument52 pagesFinanzas 2 - Calculo Van - Tir - BCFotos VacacionesNo ratings yet

- Diagrama 4Document6 pagesDiagrama 4Hara NanaNo ratings yet

- Solved Financial Planning ExerciseDocument8 pagesSolved Financial Planning ExerciseScribdTranslationsNo ratings yet

- Steel Beam Compression Member by KDocument70 pagesSteel Beam Compression Member by KKhandaker Khairul AlamNo ratings yet

- PuntirDocument3 pagesPuntirjacobchristopher17No ratings yet

- ST STDocument4 pagesST STAar AeyNo ratings yet

- Tugas 2Document8 pagesTugas 2ISRENNA RATU REZKY SUCINo ratings yet

- Mai Moyo Company Law Theory 2Document14 pagesMai Moyo Company Law Theory 2marvadomarvellous67No ratings yet

- Mai Moyo InvoicesDocument6 pagesMai Moyo Invoicesmarvadomarvellous67No ratings yet

- Mai Moyo Fin Man Theory 1Document4 pagesMai Moyo Fin Man Theory 1marvadomarvellous67No ratings yet

- Mai Moyo Managerial Ecos Theory 2Document9 pagesMai Moyo Managerial Ecos Theory 2marvadomarvellous67No ratings yet

- Mai Moyo Prac 1 Managerial EconomicsDocument8 pagesMai Moyo Prac 1 Managerial Economicsmarvadomarvellous67No ratings yet

- Mai Moyo Prac 2 Company LawDocument7 pagesMai Moyo Prac 2 Company Lawmarvadomarvellous67No ratings yet

- Advantages of ResearchDocument6 pagesAdvantages of Researchmarvadomarvellous67No ratings yet

- Mai Moyo Taxation Theory 1 Gross IncomeDocument4 pagesMai Moyo Taxation Theory 1 Gross Incomemarvadomarvellous67No ratings yet

- Mai Moyo Zse Closing PricesDocument2 pagesMai Moyo Zse Closing Pricesmarvadomarvellous67No ratings yet

- Essay 1712604824275Document2 pagesEssay 1712604824275marvadomarvellous67No ratings yet

- Essay 1712603966996Document2 pagesEssay 1712603966996marvadomarvellous67No ratings yet

- Managerial Economics As An Integral Course (Last)Document6 pagesManagerial Economics As An Integral Course (Last)marvadomarvellous67No ratings yet

- Essay 1712604065561Document1 pageEssay 1712604065561marvadomarvellous67No ratings yet

- Essay 1712604623904Document3 pagesEssay 1712604623904marvadomarvellous67No ratings yet

- Essay 1712604253073Document1 pageEssay 1712604253073marvadomarvellous67No ratings yet

- Essay 1712604448277Document1 pageEssay 1712604448277marvadomarvellous67No ratings yet

- Essay 1712604015638Document1 pageEssay 1712604015638marvadomarvellous67No ratings yet

- Economics Question and AnswersDocument144 pagesEconomics Question and Answersmarvadomarvellous67No ratings yet

- My Canons of TaxationDocument3 pagesMy Canons of Taxationmarvadomarvellous67No ratings yet

- English Speaking Seminar TopicsDocument7 pagesEnglish Speaking Seminar TopicsVigneyard Mizu0% (1)

- BMGT28 Income and Taxation Syllabus 2022 23 PDFDocument9 pagesBMGT28 Income and Taxation Syllabus 2022 23 PDFFRANCO, Monique P.No ratings yet

- 2022 Abrigo - v. - Commissioner - On - Audit Commission20230206 11 1nr30viDocument18 pages2022 Abrigo - v. - Commissioner - On - Audit Commission20230206 11 1nr30viAizaLizaNo ratings yet

- AP IT FY 2022-23 Income Tax Software 23.01.2023Document14 pagesAP IT FY 2022-23 Income Tax Software 23.01.2023Nitesh SreeNo ratings yet

- How To Conduct Job Analysis EffectivelyDocument9 pagesHow To Conduct Job Analysis EffectivelyReader100% (1)

- Taxable Salary IncomeDocument253 pagesTaxable Salary IncomedjbbuzzzNo ratings yet

- Employee Benefits and ServicesDocument22 pagesEmployee Benefits and ServicesMD.Rakibul HasanNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- IT Compensation NotesDocument33 pagesIT Compensation NotesWinnie GiveraNo ratings yet

- Mekari FlexDocument8 pagesMekari FlexSoebHan MauLanaNo ratings yet

- Leonardo, Kylene Edelle L. - ASSESSMENTSDocument27 pagesLeonardo, Kylene Edelle L. - ASSESSMENTSKylene Edelle LeonardoNo ratings yet

- IELTS Band 9 Vocab Secrets-1Document74 pagesIELTS Band 9 Vocab Secrets-1Shehzad Sohail ChNo ratings yet

- Salary Survey 2006-Macdonald & Company Middle East Salary and Benefits SurveyDocument56 pagesSalary Survey 2006-Macdonald & Company Middle East Salary and Benefits SurveysanjeevNo ratings yet

- Topic TwoDocument67 pagesTopic TwoMerediths KrisKringleNo ratings yet

- 2011 Employee Job Satisfaction and Engagement: Gratification and Commitment at Work in A Sluggish EconomyDocument72 pages2011 Employee Job Satisfaction and Engagement: Gratification and Commitment at Work in A Sluggish Economysoltoianu_irinaNo ratings yet

- Retention Questionnaire 12Document8 pagesRetention Questionnaire 12nikki_ceNo ratings yet

- Faqs Withholding TaxDocument50 pagesFaqs Withholding TaxHarryNo ratings yet

- 10october2017 by AuditDocument76 pages10october2017 by AuditJoemar JacabaNo ratings yet

- Lmia FormDocument25 pagesLmia Formsonumonu23No ratings yet

- Salary Formula: Gross Salary Received and The Net Salary ReceivedDocument9 pagesSalary Formula: Gross Salary Received and The Net Salary ReceivedFarhang PrintingNo ratings yet

- Recruitment by Icici Prudential 1Document79 pagesRecruitment by Icici Prudential 1Suyash ThokeNo ratings yet

- Notes On Employee BenefitsDocument26 pagesNotes On Employee BenefitsSarannyaRajendraNo ratings yet

- Guide Health Sector Categories in IrelandDocument69 pagesGuide Health Sector Categories in IrelandprotoginaNo ratings yet

- 1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019Document10 pages1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019sossmsNo ratings yet

- SSS LAwDocument14 pagesSSS LAwbebs CachoNo ratings yet

- The Awesome Notes Tax On RC, NRC, RaDocument8 pagesThe Awesome Notes Tax On RC, NRC, RaMay Anne NangleganNo ratings yet

- 2009 Compensation & Benefits Survey QuestionnaireDocument18 pages2009 Compensation & Benefits Survey QuestionnaireearendilvorondoNo ratings yet