Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsComprehensive Problem Land & Building

Comprehensive Problem Land & Building

Uploaded by

Glaizel LarragaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- MCL 450.1243 - 1241 - 702 Resident Agent InfoDocument1 pageMCL 450.1243 - 1241 - 702 Resident Agent Inforicetech100% (2)

- QUIZ - CHAPTER 15 - PPE PART 1 - 2020edDocument3 pagesQUIZ - CHAPTER 15 - PPE PART 1 - 2020edjanna napili100% (1)

- Topic 4 & 5: Land, Building and MachineryDocument11 pagesTopic 4 & 5: Land, Building and MachineryKrissa Mae LongosNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Accounting For Real Estate TransactionDocument52 pagesAccounting For Real Estate TransactionSatish SaripalliNo ratings yet

- Online Quiz 3 Duration Q&ADocument3 pagesOnline Quiz 3 Duration Q&AjonNo ratings yet

- Sample Commericial Real Estate DD ChecklistDocument16 pagesSample Commericial Real Estate DD Checklistjsconrad12No ratings yet

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- PPE ExcelDocument4 pagesPPE ExcelKeana Cassandra TobiasNo ratings yet

- Activity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEDocument2 pagesActivity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEFrankie AsidoNo ratings yet

- Ppe Test BankDocument10 pagesPpe Test BankAna Mae HernandezNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- Problem Set PpeDocument11 pagesProblem Set PpeHdhsiaihagatataNo ratings yet

- ACTIVITIESDocument13 pagesACTIVITIESJanine TupasiNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- Plants, Property and EquipmentDocument21 pagesPlants, Property and EquipmentAna Mae HernandezNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Document5 pagesIA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Ariean Joy DequiñaNo ratings yet

- PPE Initial Recognition. Part 2Document6 pagesPPE Initial Recognition. Part 2sheenacgacitaNo ratings yet

- Quiz Chapter 15 Ppe Part 1 2020ed 1Document3 pagesQuiz Chapter 15 Ppe Part 1 2020ed 1Mark Rafael MacapagalNo ratings yet

- Intermediate Accounting I - Ppe AnswersDocument3 pagesIntermediate Accounting I - Ppe AnswersJoovs Joovho50% (2)

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- Land and Building Exercises - SolutionDocument2 pagesLand and Building Exercises - Solutionjingyuu kimNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Problem 1: InvestmentsDocument7 pagesProblem 1: InvestmentsEsse ValdezNo ratings yet

- Problem No. 1: QuestionsDocument4 pagesProblem No. 1: QuestionsAnna Mae NebresNo ratings yet

- PPE ReviewerDocument13 pagesPPE ReviewerMariel DichosoNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- Minglana, Mitch T. BSA - 301 Quiz 2 Problem 1Document5 pagesMinglana, Mitch T. BSA - 301 Quiz 2 Problem 1Mitch MinglanaNo ratings yet

- Chapter 26 Answer KeyDocument3 pagesChapter 26 Answer KeyShane Tabunggao100% (2)

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Datos Flujo de CajaDocument3 pagesDatos Flujo de CajaManuel DelgadoNo ratings yet

- Ap Ppe Quizzer Q Accounting ReviewerDocument19 pagesAp Ppe Quizzer Q Accounting Reviewercynthia reyesNo ratings yet

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Chapter 5 Audit of Property, Plant and EquipmentDocument26 pagesChapter 5 Audit of Property, Plant and EquipmentDominique Anne BenozaNo ratings yet

- Land, Building and MachineryDocument2 pagesLand, Building and MachineryAlexis KingNo ratings yet

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- Intermediate Accounting I PpeDocument2 pagesIntermediate Accounting I PpeJoovs JoovhoNo ratings yet

- Property Plant and Equipment: Problem 1Document13 pagesProperty Plant and Equipment: Problem 1A.B AmpuanNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Audit of PPE 2 - AssignmentDocument2 pagesAudit of PPE 2 - AssignmentNychi SitchonNo ratings yet

- Assignment PPE PArt 1Document7 pagesAssignment PPE PArt 1JP Mirafuentes100% (1)

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- Audit of PPE AssignmentDocument1 pageAudit of PPE AssignmentAlexis BagongonNo ratings yet

- ACN001 - FinalsDocument15 pagesACN001 - FinalsLeira Ramos DepanteNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- 06 - PpeDocument4 pages06 - PpeLloydNo ratings yet

- 5-1 (Uy Company) : Property, Plant and Equipment ProblemsDocument13 pages5-1 (Uy Company) : Property, Plant and Equipment ProblemsExequielCamisaCrusperoNo ratings yet

- 3 HW On PPEDocument3 pages3 HW On PPENikko Bowie PascualNo ratings yet

- Exercises - Audit of PPEDocument2 pagesExercises - Audit of PPEJason RadamNo ratings yet

- Acccob 2 - 6-1 - 6-10Document27 pagesAcccob 2 - 6-1 - 6-10Ayanna Beyonce CameroNo ratings yet

- Ufrs ActivityDocument4 pagesUfrs ActivityErika TeradoNo ratings yet

- MIDTERM EXAMINATION INTACC2 With AnswersDocument6 pagesMIDTERM EXAMINATION INTACC2 With AnswersMac b IBANEZNo ratings yet

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Ceramic Materials for Energy Applications VIFrom EverandCeramic Materials for Energy Applications VIHua-Tay LinNo ratings yet

- IT Application15. Ann Marie C. GeligDocument15 pagesIT Application15. Ann Marie C. GeligGlaizel LarragaNo ratings yet

- Cost Flow QuizDocument5 pagesCost Flow QuizGlaizel LarragaNo ratings yet

- Liquidation TutorDocument18 pagesLiquidation TutorGlaizel LarragaNo ratings yet

- LAWkeyDocument66 pagesLAWkeyGlaizel LarragaNo ratings yet

- Chapter 10 Merchandising BusinessDocument22 pagesChapter 10 Merchandising BusinessGlaizel LarragaNo ratings yet

- The Four Types of SentenceDocument13 pagesThe Four Types of SentenceGlaizel LarragaNo ratings yet

- Advanced Grammar Composition Autosaved 1Document38 pagesAdvanced Grammar Composition Autosaved 1Glaizel LarragaNo ratings yet

- Sentence Structure and Types of SentencesDocument19 pagesSentence Structure and Types of SentencesGlaizel LarragaNo ratings yet

- PR1ECADocument2 pagesPR1ECAArbaz KhanNo ratings yet

- Print Control PageDocument1 pagePrint Control PageRathnavel SampathNo ratings yet

- SALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsDocument7 pagesSALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsShabeer UppotungalNo ratings yet

- Unit 3 Company IntroductionDocument6 pagesUnit 3 Company IntroductionZaya SapkotaNo ratings yet

- Report Myanmar Financial Sector - A Challenging Environment For Banks Nov2013Document56 pagesReport Myanmar Financial Sector - A Challenging Environment For Banks Nov2013THAN HANNo ratings yet

- Theories of DividendDocument2 pagesTheories of DividendBALRAM SHAHNo ratings yet

- Assignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Document5 pagesAssignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Shafiq UllahNo ratings yet

- NIBL Sahabhagita FundDocument5 pagesNIBL Sahabhagita FundyogendrasthaNo ratings yet

- NPV Vs IRR MethodsDocument4 pagesNPV Vs IRR MethodsRajesh K. PedhaviNo ratings yet

- CFAS Semestral ProjectDocument21 pagesCFAS Semestral ProjectCASSANDRANo ratings yet

- CIR V Aquafresh Seafood IncDocument3 pagesCIR V Aquafresh Seafood IncKat CastilloNo ratings yet

- 111 Test Bank For Cost Management Measuring Monitoring and Motivating Performance 2nd EditionDocument28 pages111 Test Bank For Cost Management Measuring Monitoring and Motivating Performance 2nd EditionEbook free100% (1)

- Topic 1Document30 pagesTopic 1jainsumit_shndNo ratings yet

- InvoiceDocument1 pageInvoiceavikalmanitripathi2023No ratings yet

- Berger Paints Research ReportDocument9 pagesBerger Paints Research ReportAmey LeleNo ratings yet

- Module 1: Introduction: SI-4251 Ekonomi TeknikDocument16 pagesModule 1: Introduction: SI-4251 Ekonomi TeknikJimmael HutagaolNo ratings yet

- Banking Finals ReviewerDocument6 pagesBanking Finals ReviewerFlorence RoseteNo ratings yet

- 2016 PPDocument13 pages2016 PPumeshNo ratings yet

- Neraca Lajur Jaya KartaDocument41 pagesNeraca Lajur Jaya KartaWendelyn ShieNo ratings yet

- College of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2021-2022Document6 pagesCollege of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2021-2022Miles SantosNo ratings yet

- Financing Decisions - Practice QuestionsDocument3 pagesFinancing Decisions - Practice QuestionsAbrarNo ratings yet

- Cost-Benefit Analysis of Urban Fire Stations Management: KANG Canhua, WU Wei Yan XiDocument4 pagesCost-Benefit Analysis of Urban Fire Stations Management: KANG Canhua, WU Wei Yan Xikeydira_irawanNo ratings yet

- DocxDocument26 pagesDocxMary DenizeNo ratings yet

- Chapter5 InflationTaxDocument17 pagesChapter5 InflationTaxadamNo ratings yet

- A Project Report ON: "Income Tax Planning For Income FromDocument6 pagesA Project Report ON: "Income Tax Planning For Income FromRavi SinghNo ratings yet

Comprehensive Problem Land & Building

Comprehensive Problem Land & Building

Uploaded by

Glaizel Larraga0 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesComprehensive Problem Land & Building

Comprehensive Problem Land & Building

Uploaded by

Glaizel LarragaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

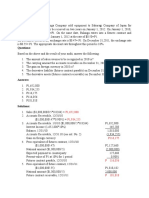

CHAPTER 26: LAND, BUILDING AND MACHINERY

The following costs were incurred by Patrick & Friends Company in connection with

building a new home office:

Land cost 3,000,000

Legal fees 8,000

Settlement of the mortgage on the land

and associated interest payable upon sale 60,000

Settlement of overdue property taxes 15,000

Expense associated with demolishing

the apartment building 40,000

Funds obtained from the sale

of reclaimed materials 6,500

Land site grading and drainage

arrangements 20,000

Architectural fees for a new

construction project 250,000

Compensation for the construction contractor 7,000,000

Interest expenses related to particular loans incurred

during the construction phase 350,000

Settlement of medical expenses for employees accidentally

injured during the inspection of building construction 11,000

Expense associated with paving the driveway and parking area 45,000

Expenditure for trees, shrubs, and additional landscaping elements 65,000

Expense related to the installation of lights in the parking lot 7,000

Expense for a celebratory open house event marking

the opening of the building 50,000

1. What is the cost of the land?

2. What is the cost of building?

3. What is the cost of land improvement?

SOLUTION

Land cost 3,000,000

Legal fees 8,000

Settlement of land mortgage 60,000

Settlement of overdue property taxes 15,000

Grading and drainage 20,000

Total Cost of Land 3,103,000

Net Demolition Cost (40,000 – 6500) 33,500

Architectural fees 250,000

Compensation for contractor 7,000,000

Interest expenses to particular loans incurred 350,000

Total cost of new building 7,633,500

Expense with paving the driveway & parking area 45,000

Expenditure for trees, shrubs, & landscaping elements 65,000

Expense related to the installation of lights 7,000

Total cost of land improvement 117,000

Note : The Settlement of medical expenses for employees accidentally

injured during the inspection of building construction and expense for a

celebratory open house event marking should be treated as outright

expense.

You might also like

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- MCL 450.1243 - 1241 - 702 Resident Agent InfoDocument1 pageMCL 450.1243 - 1241 - 702 Resident Agent Inforicetech100% (2)

- QUIZ - CHAPTER 15 - PPE PART 1 - 2020edDocument3 pagesQUIZ - CHAPTER 15 - PPE PART 1 - 2020edjanna napili100% (1)

- Topic 4 & 5: Land, Building and MachineryDocument11 pagesTopic 4 & 5: Land, Building and MachineryKrissa Mae LongosNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Accounting For Real Estate TransactionDocument52 pagesAccounting For Real Estate TransactionSatish SaripalliNo ratings yet

- Online Quiz 3 Duration Q&ADocument3 pagesOnline Quiz 3 Duration Q&AjonNo ratings yet

- Sample Commericial Real Estate DD ChecklistDocument16 pagesSample Commericial Real Estate DD Checklistjsconrad12No ratings yet

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- PPE ExcelDocument4 pagesPPE ExcelKeana Cassandra TobiasNo ratings yet

- Activity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEDocument2 pagesActivity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEFrankie AsidoNo ratings yet

- Ppe Test BankDocument10 pagesPpe Test BankAna Mae HernandezNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- Problem Set PpeDocument11 pagesProblem Set PpeHdhsiaihagatataNo ratings yet

- ACTIVITIESDocument13 pagesACTIVITIESJanine TupasiNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- Plants, Property and EquipmentDocument21 pagesPlants, Property and EquipmentAna Mae HernandezNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Document5 pagesIA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Ariean Joy DequiñaNo ratings yet

- PPE Initial Recognition. Part 2Document6 pagesPPE Initial Recognition. Part 2sheenacgacitaNo ratings yet

- Quiz Chapter 15 Ppe Part 1 2020ed 1Document3 pagesQuiz Chapter 15 Ppe Part 1 2020ed 1Mark Rafael MacapagalNo ratings yet

- Intermediate Accounting I - Ppe AnswersDocument3 pagesIntermediate Accounting I - Ppe AnswersJoovs Joovho50% (2)

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- Land and Building Exercises - SolutionDocument2 pagesLand and Building Exercises - Solutionjingyuu kimNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Problem 1: InvestmentsDocument7 pagesProblem 1: InvestmentsEsse ValdezNo ratings yet

- Problem No. 1: QuestionsDocument4 pagesProblem No. 1: QuestionsAnna Mae NebresNo ratings yet

- PPE ReviewerDocument13 pagesPPE ReviewerMariel DichosoNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- Minglana, Mitch T. BSA - 301 Quiz 2 Problem 1Document5 pagesMinglana, Mitch T. BSA - 301 Quiz 2 Problem 1Mitch MinglanaNo ratings yet

- Chapter 26 Answer KeyDocument3 pagesChapter 26 Answer KeyShane Tabunggao100% (2)

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Datos Flujo de CajaDocument3 pagesDatos Flujo de CajaManuel DelgadoNo ratings yet

- Ap Ppe Quizzer Q Accounting ReviewerDocument19 pagesAp Ppe Quizzer Q Accounting Reviewercynthia reyesNo ratings yet

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Chapter 5 Audit of Property, Plant and EquipmentDocument26 pagesChapter 5 Audit of Property, Plant and EquipmentDominique Anne BenozaNo ratings yet

- Land, Building and MachineryDocument2 pagesLand, Building and MachineryAlexis KingNo ratings yet

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- Intermediate Accounting I PpeDocument2 pagesIntermediate Accounting I PpeJoovs JoovhoNo ratings yet

- Property Plant and Equipment: Problem 1Document13 pagesProperty Plant and Equipment: Problem 1A.B AmpuanNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Audit of PPE 2 - AssignmentDocument2 pagesAudit of PPE 2 - AssignmentNychi SitchonNo ratings yet

- Assignment PPE PArt 1Document7 pagesAssignment PPE PArt 1JP Mirafuentes100% (1)

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- Audit of PPE AssignmentDocument1 pageAudit of PPE AssignmentAlexis BagongonNo ratings yet

- ACN001 - FinalsDocument15 pagesACN001 - FinalsLeira Ramos DepanteNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- 06 - PpeDocument4 pages06 - PpeLloydNo ratings yet

- 5-1 (Uy Company) : Property, Plant and Equipment ProblemsDocument13 pages5-1 (Uy Company) : Property, Plant and Equipment ProblemsExequielCamisaCrusperoNo ratings yet

- 3 HW On PPEDocument3 pages3 HW On PPENikko Bowie PascualNo ratings yet

- Exercises - Audit of PPEDocument2 pagesExercises - Audit of PPEJason RadamNo ratings yet

- Acccob 2 - 6-1 - 6-10Document27 pagesAcccob 2 - 6-1 - 6-10Ayanna Beyonce CameroNo ratings yet

- Ufrs ActivityDocument4 pagesUfrs ActivityErika TeradoNo ratings yet

- MIDTERM EXAMINATION INTACC2 With AnswersDocument6 pagesMIDTERM EXAMINATION INTACC2 With AnswersMac b IBANEZNo ratings yet

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Ceramic Materials for Energy Applications VIFrom EverandCeramic Materials for Energy Applications VIHua-Tay LinNo ratings yet

- IT Application15. Ann Marie C. GeligDocument15 pagesIT Application15. Ann Marie C. GeligGlaizel LarragaNo ratings yet

- Cost Flow QuizDocument5 pagesCost Flow QuizGlaizel LarragaNo ratings yet

- Liquidation TutorDocument18 pagesLiquidation TutorGlaizel LarragaNo ratings yet

- LAWkeyDocument66 pagesLAWkeyGlaizel LarragaNo ratings yet

- Chapter 10 Merchandising BusinessDocument22 pagesChapter 10 Merchandising BusinessGlaizel LarragaNo ratings yet

- The Four Types of SentenceDocument13 pagesThe Four Types of SentenceGlaizel LarragaNo ratings yet

- Advanced Grammar Composition Autosaved 1Document38 pagesAdvanced Grammar Composition Autosaved 1Glaizel LarragaNo ratings yet

- Sentence Structure and Types of SentencesDocument19 pagesSentence Structure and Types of SentencesGlaizel LarragaNo ratings yet

- PR1ECADocument2 pagesPR1ECAArbaz KhanNo ratings yet

- Print Control PageDocument1 pagePrint Control PageRathnavel SampathNo ratings yet

- SALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsDocument7 pagesSALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsShabeer UppotungalNo ratings yet

- Unit 3 Company IntroductionDocument6 pagesUnit 3 Company IntroductionZaya SapkotaNo ratings yet

- Report Myanmar Financial Sector - A Challenging Environment For Banks Nov2013Document56 pagesReport Myanmar Financial Sector - A Challenging Environment For Banks Nov2013THAN HANNo ratings yet

- Theories of DividendDocument2 pagesTheories of DividendBALRAM SHAHNo ratings yet

- Assignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Document5 pagesAssignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Shafiq UllahNo ratings yet

- NIBL Sahabhagita FundDocument5 pagesNIBL Sahabhagita FundyogendrasthaNo ratings yet

- NPV Vs IRR MethodsDocument4 pagesNPV Vs IRR MethodsRajesh K. PedhaviNo ratings yet

- CFAS Semestral ProjectDocument21 pagesCFAS Semestral ProjectCASSANDRANo ratings yet

- CIR V Aquafresh Seafood IncDocument3 pagesCIR V Aquafresh Seafood IncKat CastilloNo ratings yet

- 111 Test Bank For Cost Management Measuring Monitoring and Motivating Performance 2nd EditionDocument28 pages111 Test Bank For Cost Management Measuring Monitoring and Motivating Performance 2nd EditionEbook free100% (1)

- Topic 1Document30 pagesTopic 1jainsumit_shndNo ratings yet

- InvoiceDocument1 pageInvoiceavikalmanitripathi2023No ratings yet

- Berger Paints Research ReportDocument9 pagesBerger Paints Research ReportAmey LeleNo ratings yet

- Module 1: Introduction: SI-4251 Ekonomi TeknikDocument16 pagesModule 1: Introduction: SI-4251 Ekonomi TeknikJimmael HutagaolNo ratings yet

- Banking Finals ReviewerDocument6 pagesBanking Finals ReviewerFlorence RoseteNo ratings yet

- 2016 PPDocument13 pages2016 PPumeshNo ratings yet

- Neraca Lajur Jaya KartaDocument41 pagesNeraca Lajur Jaya KartaWendelyn ShieNo ratings yet

- College of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2021-2022Document6 pagesCollege of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2021-2022Miles SantosNo ratings yet

- Financing Decisions - Practice QuestionsDocument3 pagesFinancing Decisions - Practice QuestionsAbrarNo ratings yet

- Cost-Benefit Analysis of Urban Fire Stations Management: KANG Canhua, WU Wei Yan XiDocument4 pagesCost-Benefit Analysis of Urban Fire Stations Management: KANG Canhua, WU Wei Yan Xikeydira_irawanNo ratings yet

- DocxDocument26 pagesDocxMary DenizeNo ratings yet

- Chapter5 InflationTaxDocument17 pagesChapter5 InflationTaxadamNo ratings yet

- A Project Report ON: "Income Tax Planning For Income FromDocument6 pagesA Project Report ON: "Income Tax Planning For Income FromRavi SinghNo ratings yet