Professional Documents

Culture Documents

Imo LTD Q3

Imo LTD Q3

Uploaded by

Rajendran KajananthanCopyright:

Available Formats

You might also like

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Q 1Document3 pagesQ 1Rajendran KajananthanNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- A LTD - Investment AppraisalDocument1 pageA LTD - Investment AppraisalmamitjasNo ratings yet

- Assignment Bba 4th SemDocument3 pagesAssignment Bba 4th SemShadaab MalikNo ratings yet

- HandouDocument4 pagesHandouAbhishek ParmarNo ratings yet

- CAPITAL BUDGETING AssignmentDocument4 pagesCAPITAL BUDGETING Assignmentqurban baloch100% (1)

- Cash Flow Analysis - Delta Co Problems - Docx + RepcoDocument2 pagesCash Flow Analysis - Delta Co Problems - Docx + RepcoAnjali ChopraNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- LAB 4 Capital Budgeting 2024Document3 pagesLAB 4 Capital Budgeting 2024asthapatel.akpNo ratings yet

- Capital Budgeting Sample QuestionsDocument2 pagesCapital Budgeting Sample QuestionsNCTNo ratings yet

- Unit IiDocument15 pagesUnit IiSamuNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Unit 2 Problem SheetDocument9 pagesUnit 2 Problem SheetTejas ArgulewarNo ratings yet

- 22 - Mtest - Management Accounting Morning 1st HalfDocument4 pages22 - Mtest - Management Accounting Morning 1st HalfZohaib NasirNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingEdmon ManalotoNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingShaji Kutty0% (1)

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- CAF 8 CMA Autumn 2019 PDFDocument4 pagesCAF 8 CMA Autumn 2019 PDFbinuNo ratings yet

- Adv Issues in CapBud - Gr2 9-02 WipDocument24 pagesAdv Issues in CapBud - Gr2 9-02 WipHimanshu GuptaNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- NPV SumsDocument2 pagesNPV SumsSunitha RamNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- CVP AnalysisDocument4 pagesCVP AnalysisLalit SapkaleNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Question Bank - Economics For EngineersDocument3 pagesQuestion Bank - Economics For EngineersAnurag AnandNo ratings yet

- MARGINAL COSTIN1 Auto SavedDocument6 pagesMARGINAL COSTIN1 Auto SavedVedant RaneNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar50% (2)

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Chapter No.2 Capital Budgeting: Tybaf Financial Management Sem VDocument8 pagesChapter No.2 Capital Budgeting: Tybaf Financial Management Sem VAyushi PachoriNo ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Acn 3Document5 pagesAcn 3Navidul IslamNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan S100% (1)

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Interpretation of StatutesDocument2 pagesInterpretation of StatutesAnchit JassalNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Chapter 4 - Annual WorthDocument15 pagesChapter 4 - Annual WorthUpendra ReddyNo ratings yet

- (B) Alaska LTD., Wants To Buy A New Item of Equipment. Two Models of Equipment Are Available, OneDocument1 page(B) Alaska LTD., Wants To Buy A New Item of Equipment. Two Models of Equipment Are Available, OneDinesh LalwaniNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even AnalysisRachit DixitNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsDocument4 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- From Bots to Billions: Unlocking Explosive Growth with AI AutomationFrom EverandFrom Bots to Billions: Unlocking Explosive Growth with AI AutomationNo ratings yet

- Numerical Illustrations On Determining Cash Flows For Investment AnalysisDocument2 pagesNumerical Illustrations On Determining Cash Flows For Investment AnalysisRajendran KajananthanNo ratings yet

- Cash Flows For Investment Analysi1Document2 pagesCash Flows For Investment Analysi1Rajendran KajananthanNo ratings yet

- Process CostingDocument13 pagesProcess CostingRajendran KajananthanNo ratings yet

- Tariff New RatesDocument3 pagesTariff New RatesRajendran KajananthanNo ratings yet

- Nehtk Gu 2020 Gupl Irfs : Nraw GHL L KL LK (Operational Level) Kfhikf FZF FPLDocument13 pagesNehtk Gu 2020 Gupl Irfs : Nraw GHL L KL LK (Operational Level) Kfhikf FZF FPLRajendran KajananthanNo ratings yet

- Extreme Jobs - FinalDocument14 pagesExtreme Jobs - FinalRajendran KajananthanNo ratings yet

- IJARPED - Time Management and Teaching PerformanceDocument20 pagesIJARPED - Time Management and Teaching PerformanceRajendran Kajananthan100% (1)

- Start For ResearchDocument8 pagesStart For ResearchRajendran KajananthanNo ratings yet

- InnofCourts RoleForensicAccountingLitigationDocument78 pagesInnofCourts RoleForensicAccountingLitigationRajendran KajananthanNo ratings yet

- Employee Job Satisfaction: Please Take A Few Minutes To Tell Us About Your Job and How The Organization Assists YouDocument2 pagesEmployee Job Satisfaction: Please Take A Few Minutes To Tell Us About Your Job and How The Organization Assists YouRajendran KajananthanNo ratings yet

- 981 1370516495Document262 pages981 1370516495Rajendran KajananthanNo ratings yet

- Producing and Utilizing The Dairy Based Products in Northern ProvinceDocument2 pagesProducing and Utilizing The Dairy Based Products in Northern ProvinceRajendran KajananthanNo ratings yet

- Calculators: Management Information System Management Information SystemDocument8 pagesCalculators: Management Information System Management Information SystemRajendran KajananthanNo ratings yet

- Work Family Conflict and Its Impact On Career and Relation To GenderDocument20 pagesWork Family Conflict and Its Impact On Career and Relation To GenderRajendran KajananthanNo ratings yet

- Walter PresentationDocument18 pagesWalter PresentationRajendran KajananthanNo ratings yet

Imo LTD Q3

Imo LTD Q3

Uploaded by

Rajendran KajananthanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Imo LTD Q3

Imo LTD Q3

Uploaded by

Rajendran KajananthanCopyright:

Available Formats

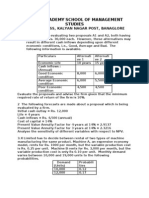

Imo Ltd.

is considering investing in a new project which involves developing and selling of

an innovative gadget targeting youth below 25 years. For this, the company expects to

invest Rs.125 million for a special machinery and Rs.3 million for working capital

requirement.

For the next 5 years, sales and advertising costs will be expected to be as follows:

Year Production/Sales Selling Price per Advertising Cost per

(Units) Unit (Rs) Annum (Rs)

1 7000 11000 8,000,000

2 11000 10500 23,000,000

3 18000 9500 15,000,000

4 20000 9000 15,000,000

5 15000 8500 4,000,000

The machinery has a lifetime of 5 years and the company depreciates its’ machineries

under the straight-line basis at cost. The company is eligible to claim capital allowance at

the rate of 25% per annum on the machinery.

The variable production cost other than advertising cost is expected to be Rs.4,000/- per

unit and the fixed overhead cost including depreciation on machinery is expected to be

Rs.37 million per annum. Working capital can be recovered at the end of the 5th year.

The company pays income tax at the rate of 24% per annum and it should be paid in the

same year. Imo Ltd.’s cost of capital is 10% per annum.

You are required to:

(a) Calculate the Net Present Value (NPV) of the new project.

(b) Assess the viability of the above project based on NPV.

You might also like

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Q 1Document3 pagesQ 1Rajendran KajananthanNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- A LTD - Investment AppraisalDocument1 pageA LTD - Investment AppraisalmamitjasNo ratings yet

- Assignment Bba 4th SemDocument3 pagesAssignment Bba 4th SemShadaab MalikNo ratings yet

- HandouDocument4 pagesHandouAbhishek ParmarNo ratings yet

- CAPITAL BUDGETING AssignmentDocument4 pagesCAPITAL BUDGETING Assignmentqurban baloch100% (1)

- Cash Flow Analysis - Delta Co Problems - Docx + RepcoDocument2 pagesCash Flow Analysis - Delta Co Problems - Docx + RepcoAnjali ChopraNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- LAB 4 Capital Budgeting 2024Document3 pagesLAB 4 Capital Budgeting 2024asthapatel.akpNo ratings yet

- Capital Budgeting Sample QuestionsDocument2 pagesCapital Budgeting Sample QuestionsNCTNo ratings yet

- Unit IiDocument15 pagesUnit IiSamuNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Unit 2 Problem SheetDocument9 pagesUnit 2 Problem SheetTejas ArgulewarNo ratings yet

- 22 - Mtest - Management Accounting Morning 1st HalfDocument4 pages22 - Mtest - Management Accounting Morning 1st HalfZohaib NasirNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingEdmon ManalotoNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingShaji Kutty0% (1)

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- CAF 8 CMA Autumn 2019 PDFDocument4 pagesCAF 8 CMA Autumn 2019 PDFbinuNo ratings yet

- Adv Issues in CapBud - Gr2 9-02 WipDocument24 pagesAdv Issues in CapBud - Gr2 9-02 WipHimanshu GuptaNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- NPV SumsDocument2 pagesNPV SumsSunitha RamNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- CVP AnalysisDocument4 pagesCVP AnalysisLalit SapkaleNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Question Bank - Economics For EngineersDocument3 pagesQuestion Bank - Economics For EngineersAnurag AnandNo ratings yet

- MARGINAL COSTIN1 Auto SavedDocument6 pagesMARGINAL COSTIN1 Auto SavedVedant RaneNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar50% (2)

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Chapter No.2 Capital Budgeting: Tybaf Financial Management Sem VDocument8 pagesChapter No.2 Capital Budgeting: Tybaf Financial Management Sem VAyushi PachoriNo ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Acn 3Document5 pagesAcn 3Navidul IslamNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan S100% (1)

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Interpretation of StatutesDocument2 pagesInterpretation of StatutesAnchit JassalNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Chapter 4 - Annual WorthDocument15 pagesChapter 4 - Annual WorthUpendra ReddyNo ratings yet

- (B) Alaska LTD., Wants To Buy A New Item of Equipment. Two Models of Equipment Are Available, OneDocument1 page(B) Alaska LTD., Wants To Buy A New Item of Equipment. Two Models of Equipment Are Available, OneDinesh LalwaniNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even AnalysisRachit DixitNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsDocument4 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- From Bots to Billions: Unlocking Explosive Growth with AI AutomationFrom EverandFrom Bots to Billions: Unlocking Explosive Growth with AI AutomationNo ratings yet

- Numerical Illustrations On Determining Cash Flows For Investment AnalysisDocument2 pagesNumerical Illustrations On Determining Cash Flows For Investment AnalysisRajendran KajananthanNo ratings yet

- Cash Flows For Investment Analysi1Document2 pagesCash Flows For Investment Analysi1Rajendran KajananthanNo ratings yet

- Process CostingDocument13 pagesProcess CostingRajendran KajananthanNo ratings yet

- Tariff New RatesDocument3 pagesTariff New RatesRajendran KajananthanNo ratings yet

- Nehtk Gu 2020 Gupl Irfs : Nraw GHL L KL LK (Operational Level) Kfhikf FZF FPLDocument13 pagesNehtk Gu 2020 Gupl Irfs : Nraw GHL L KL LK (Operational Level) Kfhikf FZF FPLRajendran KajananthanNo ratings yet

- Extreme Jobs - FinalDocument14 pagesExtreme Jobs - FinalRajendran KajananthanNo ratings yet

- IJARPED - Time Management and Teaching PerformanceDocument20 pagesIJARPED - Time Management and Teaching PerformanceRajendran Kajananthan100% (1)

- Start For ResearchDocument8 pagesStart For ResearchRajendran KajananthanNo ratings yet

- InnofCourts RoleForensicAccountingLitigationDocument78 pagesInnofCourts RoleForensicAccountingLitigationRajendran KajananthanNo ratings yet

- Employee Job Satisfaction: Please Take A Few Minutes To Tell Us About Your Job and How The Organization Assists YouDocument2 pagesEmployee Job Satisfaction: Please Take A Few Minutes To Tell Us About Your Job and How The Organization Assists YouRajendran KajananthanNo ratings yet

- 981 1370516495Document262 pages981 1370516495Rajendran KajananthanNo ratings yet

- Producing and Utilizing The Dairy Based Products in Northern ProvinceDocument2 pagesProducing and Utilizing The Dairy Based Products in Northern ProvinceRajendran KajananthanNo ratings yet

- Calculators: Management Information System Management Information SystemDocument8 pagesCalculators: Management Information System Management Information SystemRajendran KajananthanNo ratings yet

- Work Family Conflict and Its Impact On Career and Relation To GenderDocument20 pagesWork Family Conflict and Its Impact On Career and Relation To GenderRajendran KajananthanNo ratings yet

- Walter PresentationDocument18 pagesWalter PresentationRajendran KajananthanNo ratings yet