Professional Documents

Culture Documents

Notes About Section 85 Tax2

Notes About Section 85 Tax2

Uploaded by

Farnaz CharandabiCopyright:

Available Formats

You might also like

- Housing Delivery System in The PhilippinesDocument64 pagesHousing Delivery System in The PhilippinesJoshua Buctuan33% (3)

- Group 06 Farm ElectronicsDocument7 pagesGroup 06 Farm ElectronicsRohan ShankpalNo ratings yet

- Jurisprudence On Liberality of RulesDocument2 pagesJurisprudence On Liberality of RulesLaurice PocaisNo ratings yet

- Notes About Section 86 Tax2Document1 pageNotes About Section 86 Tax2Farnaz CharandabiNo ratings yet

- QA MATRIX SHEET - RadiatorDocument4 pagesQA MATRIX SHEET - RadiatorBaljeet SinghNo ratings yet

- 2 MasterCapTable 2021 06 28Document1 page2 MasterCapTable 2021 06 28MD.SHAHNEWAZ MazumderNo ratings yet

- Notes About Section 87 Tax2Document1 pageNotes About Section 87 Tax2Farnaz CharandabiNo ratings yet

- Adobe Scan 07-Jun-2023Document1 pageAdobe Scan 07-Jun-2023Hardik JindalNo ratings yet

- Bharat Sanchar Nigam Limited: Office of The General Manager, TiruvallaDocument3 pagesBharat Sanchar Nigam Limited: Office of The General Manager, TiruvallaSDE BSS KollamNo ratings yet

- Company Accounts Accounting For Bonus Issue and Right Issue Unit4Document7 pagesCompany Accounts Accounting For Bonus Issue and Right Issue Unit4bhawanar3950No ratings yet

- Predictive Maintenance Chart - 07052009Document9 pagesPredictive Maintenance Chart - 07052009sudarshanksNo ratings yet

- SCL SHP 31 12 2022Document8 pagesSCL SHP 31 12 2022indraseenayya chilakalaNo ratings yet

- Example Ship SheetDocument2 pagesExample Ship SheetmatthaeusbmNo ratings yet

- AirCon 465 A0 PDFDocument1 pageAirCon 465 A0 PDFLasmian SitumorangNo ratings yet

- Chapter-2 Amalgamation of Companies (As-14) SolutionsDocument64 pagesChapter-2 Amalgamation of Companies (As-14) SolutionsRaja DasNo ratings yet

- INTERNAL CONTROLS - Section 3 Example of Documentation: FlowchartDocument8 pagesINTERNAL CONTROLS - Section 3 Example of Documentation: Flowchartحسين عبدالرحمنNo ratings yet

- Choice Broking BrouchreDocument2 pagesChoice Broking BrouchreVanitha BNo ratings yet

- Tablero ORDocument1 pageTablero ORvanessa alcantaraNo ratings yet

- 2017 - 18 Procurement Standards Graphs 2Document1 page2017 - 18 Procurement Standards Graphs 2ReCyoNo ratings yet

- Capacity Expansion - ScreenerDocument1 pageCapacity Expansion - ScreenerCarl del RioNo ratings yet

- Notes About Section 88 Tax2Document1 pageNotes About Section 88 Tax2Farnaz CharandabiNo ratings yet

- Purpose:: Monthly Theme Based ActivityDocument6 pagesPurpose:: Monthly Theme Based Activitybabuhsr5096100% (2)

- ACE-9 - VSWR Meter Scrapping BSS Sub Div KLMDocument3 pagesACE-9 - VSWR Meter Scrapping BSS Sub Div KLMSDE BSS KollamNo ratings yet

- Fifa 23 Squad Builder Futbin 2Document1 pageFifa 23 Squad Builder Futbin 2Uray Paradas RuizNo ratings yet

- Ubi 3Document1 pageUbi 3boomtechNo ratings yet

- EC 9875 0003 03 Workbook TSI-WAG 2019Document38 pagesEC 9875 0003 03 Workbook TSI-WAG 2019İsmail OktemNo ratings yet

- Underwriting of Shares and Debentures - PROBLEMSDocument4 pagesUnderwriting of Shares and Debentures - PROBLEMSSiddharth DhanrajNo ratings yet

- 11 Daily BM NOVEMBER BRNADocument37 pages11 Daily BM NOVEMBER BRNAMas TeguhNo ratings yet

- Wal-Mart Activity System MapDocument1 pageWal-Mart Activity System MapWan Wan HushNo ratings yet

- SAP S4 HANA SD CertificationDocument1 pageSAP S4 HANA SD CertificationYong Benedict80% (5)

- SAP S4 HANA SD 1709 Overview (Mindmap Edition) Final PDFDocument1 pageSAP S4 HANA SD 1709 Overview (Mindmap Edition) Final PDFAsterx Le Gaulois100% (1)

- Notes Ni MaegandaDocument20 pagesNotes Ni MaegandablueredashbirdsNo ratings yet

- Orgunit / Concepts / Processes: MaterialDocument1 pageOrgunit / Concepts / Processes: MaterialPrakash Praky100% (1)

- Reassessment of LeaseDocument29 pagesReassessment of Leaseabdullah.bawany7No ratings yet

- FAR 1 1st Quarter CurrentDocument3 pagesFAR 1 1st Quarter CurrentvisayasstateuNo ratings yet

- AGTL Visual - Dhaka PartDocument5 pagesAGTL Visual - Dhaka PartshakibNo ratings yet

- Fuel SystemDocument16 pagesFuel SystemGONZALEZ MOLINA ANGEL ABDIASNo ratings yet

- IBR Valves Schedule: Thermax LTD., PuneDocument3 pagesIBR Valves Schedule: Thermax LTD., PuneGuitarist Ratan DebnathNo ratings yet

- Dailycoal1 2021 08 30Document3 pagesDailycoal1 2021 08 30Sanjay SatyajitNo ratings yet

- Form-G: (See Sub - Rule (2) of Rule 5)Document3 pagesForm-G: (See Sub - Rule (2) of Rule 5)Sathavahana ElectricalNo ratings yet

- Atellica Solution CH Analyzer Assay Chart, 11484427 Rev 04, EN DXDCM 09017fe9807b250b-1676056852193Document26 pagesAtellica Solution CH Analyzer Assay Chart, 11484427 Rev 04, EN DXDCM 09017fe9807b250b-1676056852193chinuswami100% (3)

- Screenshot 2024-02-05 at 2.18.25 PMDocument1 pageScreenshot 2024-02-05 at 2.18.25 PMtaykaimingisaacNo ratings yet

- ESN 598909 HPTACC Broken Brackets Report Rev 3Document12 pagesESN 598909 HPTACC Broken Brackets Report Rev 3Chente Flores PanezNo ratings yet

- SCL SHP 30092022 1Document8 pagesSCL SHP 30092022 1indraseenayya chilakalaNo ratings yet

- Comparison Sheet For HVAC AccessoriesDocument3 pagesComparison Sheet For HVAC AccessoriesEslam ElsayedNo ratings yet

- SI Auto Transm BPT 06 18 Rev2Document1 pageSI Auto Transm BPT 06 18 Rev2deepak.sNo ratings yet

- Adobe Scan 08-May-2024Document1 pageAdobe Scan 08-May-2024shreya7501No ratings yet

- OPCR Form (ISO Aligned) PDFDocument1 pageOPCR Form (ISO Aligned) PDFRovie Christal Pascual RoseteNo ratings yet

- Catalogue LG 2017latestDocument46 pagesCatalogue LG 2017latestOmar Ardila100% (1)

- Sample - Lubrication ScheduleDocument1 pageSample - Lubrication Schedulemangesh chidrawarNo ratings yet

- Periodic Replacement PartsDocument2 pagesPeriodic Replacement PartsJesuz GrüberNo ratings yet

- 700r4 Accumulator Valve TrainDocument2 pages700r4 Accumulator Valve Traindaniel carpenterNo ratings yet

- Personal Finance Unit 2 B.Com 3rd YearDocument23 pagesPersonal Finance Unit 2 B.Com 3rd YearHarshika SaxenaNo ratings yet

- RM NotesDocument14 pagesRM Notesjohnwick20012004No ratings yet

- SHP WebsiteDocument5 pagesSHP WebsiteAditya SinghNo ratings yet

- Ea FC 24 Squad Builder FutbinDocument1 pageEa FC 24 Squad Builder FutbinSanti LopezNo ratings yet

- ENQUIRIES, WORK ORDERS AND INVOICE TRACKING REGISTER .Xls (Recovered) PDFDocument53 pagesENQUIRIES, WORK ORDERS AND INVOICE TRACKING REGISTER .Xls (Recovered) PDFSai Sashank100% (1)

- Ynerg : ACO Water Management: +Document15 pagesYnerg : ACO Water Management: +codefinder100% (1)

- Stock Transtank PE Desember 2021Document18 pagesStock Transtank PE Desember 2021Risali AddiniNo ratings yet

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- Practic in Class Solution Ex 13.18Document2 pagesPractic in Class Solution Ex 13.18Farnaz CharandabiNo ratings yet

- Practic in Class Solution Ex 13.21Document1 pagePractic in Class Solution Ex 13.21Farnaz CharandabiNo ratings yet

- Chapter 7 Flexiable Budget FormulaDocument1 pageChapter 7 Flexiable Budget FormulaFarnaz CharandabiNo ratings yet

- Practic in Class Solution Ex 13.10Document1 pagePractic in Class Solution Ex 13.10Farnaz CharandabiNo ratings yet

- Chapter 4 Over (Under) AllocatedDocument1 pageChapter 4 Over (Under) AllocatedFarnaz CharandabiNo ratings yet

- CRG 650: Chapter 1 Understanding Business EthicsDocument18 pagesCRG 650: Chapter 1 Understanding Business EthicsMJ HashmiNo ratings yet

- Heir of Ramon Arce v. DARDocument2 pagesHeir of Ramon Arce v. DARSandy Marie DavidNo ratings yet

- PBB Application For Employment Form 072017Document5 pagesPBB Application For Employment Form 072017Wise MiseNo ratings yet

- Mumbai Finance DatabaseDocument8 pagesMumbai Finance DatabaseVikram0% (1)

- Pugadlawin Balintawak or Bahay Toro AutosavedDocument44 pagesPugadlawin Balintawak or Bahay Toro AutosavedMarlon BenaventeNo ratings yet

- Ecorp Annual Report 2018Document129 pagesEcorp Annual Report 2018Adeel JavaidNo ratings yet

- Credit Card ProcessingDocument21 pagesCredit Card Processingtushar20010% (1)

- PL 9101354537Document12 pagesPL 9101354537manammadhuNo ratings yet

- Osmobsc Vty ReferenceDocument272 pagesOsmobsc Vty Referencelong leeNo ratings yet

- Level:3ASL December 2019: English Exam First TermDocument4 pagesLevel:3ASL December 2019: English Exam First TermAmira FatahNo ratings yet

- East Side Regional Hob Nob Straw Poll ResultsDocument44 pagesEast Side Regional Hob Nob Straw Poll ResultsJacob EngelsNo ratings yet

- Cost Analysis Sheet - Option 2.Document2 pagesCost Analysis Sheet - Option 2.AB Rakib AhmedNo ratings yet

- Essay On Freedom Fighter: (Maulana Abul Kalam Azad)Document6 pagesEssay On Freedom Fighter: (Maulana Abul Kalam Azad)drmadankumarbnysNo ratings yet

- Marketiniac - Round 1 - Case PDFDocument6 pagesMarketiniac - Round 1 - Case PDFTahiratul ElmaNo ratings yet

- Investigative Statement No 4-RedactedDocument4 pagesInvestigative Statement No 4-RedactedNewsTeam20No ratings yet

- Law Commission Report-Land RegistrationDocument308 pagesLaw Commission Report-Land RegistrationIngrid TarlageanuNo ratings yet

- EowDocument3 pagesEowravi_bhateja_2No ratings yet

- Business Ethics and Social ResponsibilityDocument13 pagesBusiness Ethics and Social ResponsibilitymarkNo ratings yet

- Doctrine of ElectionDocument4 pagesDoctrine of ElectionAbir Al Mahmud KhanNo ratings yet

- Challan Form PDFDocument1 pageChallan Form PDFJauhar JauharabadNo ratings yet

- Buber (Buberian)Document5 pagesBuber (Buberian)Jay Michael CorderoNo ratings yet

- APA 8-9 Ball Game RulesDocument11 pagesAPA 8-9 Ball Game RulesbarajirNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- PNCC VS CaDocument1 pagePNCC VS Casamdelacruz1030No ratings yet

- Worldcom Scandal 2002 Case Study Business Accountancy: - Jaspreet - Krish - Raghav - Lakhshit - NagaDocument15 pagesWorldcom Scandal 2002 Case Study Business Accountancy: - Jaspreet - Krish - Raghav - Lakhshit - NagaIsfh 67No ratings yet

- KIA Booking DocketDocument7 pagesKIA Booking Docketshantibhushan.saleNo ratings yet

- 2023 Training MatRIX Campus Journalism VlogDocument2 pages2023 Training MatRIX Campus Journalism VlogPrecious Rhoilyn Dublado BascugNo ratings yet

- Liaison Office Guidelines PDFDocument3 pagesLiaison Office Guidelines PDFawellNo ratings yet

Notes About Section 85 Tax2

Notes About Section 85 Tax2

Uploaded by

Farnaz CharandabiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes About Section 85 Tax2

Notes About Section 85 Tax2

Uploaded by

Farnaz CharandabiCopyright:

Available Formats

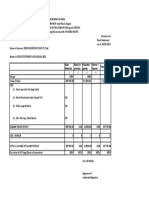

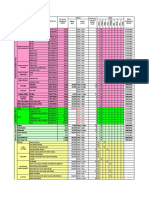

No Section 85.1 Section 85.

1 - Share for Share Exchange

Acquiror Co Shares

Checklist

Must be singles class of new share

No NSC or "boot"

Checklist

Dealing at Arms's Length

No Section 85 elections on exchanged shares

Acquiror Corp

(Purchaser)

Target Co

Shareholders

Target Corp Shares Assumptions

FMV 1,970,000

Checklist ACB -

1.) Taxable Canadian Corporatiom PUC 542,143

- Resident in Canada Yes Checklist

1.) Must not control

purchaser after the

exchange or own shares

with over 50% of the FMV

of the purchasing corps

Assumptions on Target Co Shares - Incorporated in Canada Yes oustanding shares

FMV 10,000 - Not exempt from Part 1 Tax Yes

PUC 5,000

ACB 5,000

Acquiror Corp. (Purchaser) Target Co Shareholder

Acquiror Corp Target Co Shareholder Section 85.1 Automatic No election!

FMV 10,000 POD = ACB -

ACB -5,000 Lesser of ACB -

5,000 - FMV immediately before the exchange 1,970,000 Capital Gain to Target Co Shareholders -

Capital Gain inclusion 50% - PUC immediately before exchange 542,143 Capital Gain inclusion 50%

Taxable Capital Gain 2,500 Taxable Capital Gain -

ACB 10,000 Choice 542,143

New Acquiror Corp Shares

ACB -

PUC

Legal Captial 1,970,000

PUC reduction (1,427,857)

542,143

You might also like

- Housing Delivery System in The PhilippinesDocument64 pagesHousing Delivery System in The PhilippinesJoshua Buctuan33% (3)

- Group 06 Farm ElectronicsDocument7 pagesGroup 06 Farm ElectronicsRohan ShankpalNo ratings yet

- Jurisprudence On Liberality of RulesDocument2 pagesJurisprudence On Liberality of RulesLaurice PocaisNo ratings yet

- Notes About Section 86 Tax2Document1 pageNotes About Section 86 Tax2Farnaz CharandabiNo ratings yet

- QA MATRIX SHEET - RadiatorDocument4 pagesQA MATRIX SHEET - RadiatorBaljeet SinghNo ratings yet

- 2 MasterCapTable 2021 06 28Document1 page2 MasterCapTable 2021 06 28MD.SHAHNEWAZ MazumderNo ratings yet

- Notes About Section 87 Tax2Document1 pageNotes About Section 87 Tax2Farnaz CharandabiNo ratings yet

- Adobe Scan 07-Jun-2023Document1 pageAdobe Scan 07-Jun-2023Hardik JindalNo ratings yet

- Bharat Sanchar Nigam Limited: Office of The General Manager, TiruvallaDocument3 pagesBharat Sanchar Nigam Limited: Office of The General Manager, TiruvallaSDE BSS KollamNo ratings yet

- Company Accounts Accounting For Bonus Issue and Right Issue Unit4Document7 pagesCompany Accounts Accounting For Bonus Issue and Right Issue Unit4bhawanar3950No ratings yet

- Predictive Maintenance Chart - 07052009Document9 pagesPredictive Maintenance Chart - 07052009sudarshanksNo ratings yet

- SCL SHP 31 12 2022Document8 pagesSCL SHP 31 12 2022indraseenayya chilakalaNo ratings yet

- Example Ship SheetDocument2 pagesExample Ship SheetmatthaeusbmNo ratings yet

- AirCon 465 A0 PDFDocument1 pageAirCon 465 A0 PDFLasmian SitumorangNo ratings yet

- Chapter-2 Amalgamation of Companies (As-14) SolutionsDocument64 pagesChapter-2 Amalgamation of Companies (As-14) SolutionsRaja DasNo ratings yet

- INTERNAL CONTROLS - Section 3 Example of Documentation: FlowchartDocument8 pagesINTERNAL CONTROLS - Section 3 Example of Documentation: Flowchartحسين عبدالرحمنNo ratings yet

- Choice Broking BrouchreDocument2 pagesChoice Broking BrouchreVanitha BNo ratings yet

- Tablero ORDocument1 pageTablero ORvanessa alcantaraNo ratings yet

- 2017 - 18 Procurement Standards Graphs 2Document1 page2017 - 18 Procurement Standards Graphs 2ReCyoNo ratings yet

- Capacity Expansion - ScreenerDocument1 pageCapacity Expansion - ScreenerCarl del RioNo ratings yet

- Notes About Section 88 Tax2Document1 pageNotes About Section 88 Tax2Farnaz CharandabiNo ratings yet

- Purpose:: Monthly Theme Based ActivityDocument6 pagesPurpose:: Monthly Theme Based Activitybabuhsr5096100% (2)

- ACE-9 - VSWR Meter Scrapping BSS Sub Div KLMDocument3 pagesACE-9 - VSWR Meter Scrapping BSS Sub Div KLMSDE BSS KollamNo ratings yet

- Fifa 23 Squad Builder Futbin 2Document1 pageFifa 23 Squad Builder Futbin 2Uray Paradas RuizNo ratings yet

- Ubi 3Document1 pageUbi 3boomtechNo ratings yet

- EC 9875 0003 03 Workbook TSI-WAG 2019Document38 pagesEC 9875 0003 03 Workbook TSI-WAG 2019İsmail OktemNo ratings yet

- Underwriting of Shares and Debentures - PROBLEMSDocument4 pagesUnderwriting of Shares and Debentures - PROBLEMSSiddharth DhanrajNo ratings yet

- 11 Daily BM NOVEMBER BRNADocument37 pages11 Daily BM NOVEMBER BRNAMas TeguhNo ratings yet

- Wal-Mart Activity System MapDocument1 pageWal-Mart Activity System MapWan Wan HushNo ratings yet

- SAP S4 HANA SD CertificationDocument1 pageSAP S4 HANA SD CertificationYong Benedict80% (5)

- SAP S4 HANA SD 1709 Overview (Mindmap Edition) Final PDFDocument1 pageSAP S4 HANA SD 1709 Overview (Mindmap Edition) Final PDFAsterx Le Gaulois100% (1)

- Notes Ni MaegandaDocument20 pagesNotes Ni MaegandablueredashbirdsNo ratings yet

- Orgunit / Concepts / Processes: MaterialDocument1 pageOrgunit / Concepts / Processes: MaterialPrakash Praky100% (1)

- Reassessment of LeaseDocument29 pagesReassessment of Leaseabdullah.bawany7No ratings yet

- FAR 1 1st Quarter CurrentDocument3 pagesFAR 1 1st Quarter CurrentvisayasstateuNo ratings yet

- AGTL Visual - Dhaka PartDocument5 pagesAGTL Visual - Dhaka PartshakibNo ratings yet

- Fuel SystemDocument16 pagesFuel SystemGONZALEZ MOLINA ANGEL ABDIASNo ratings yet

- IBR Valves Schedule: Thermax LTD., PuneDocument3 pagesIBR Valves Schedule: Thermax LTD., PuneGuitarist Ratan DebnathNo ratings yet

- Dailycoal1 2021 08 30Document3 pagesDailycoal1 2021 08 30Sanjay SatyajitNo ratings yet

- Form-G: (See Sub - Rule (2) of Rule 5)Document3 pagesForm-G: (See Sub - Rule (2) of Rule 5)Sathavahana ElectricalNo ratings yet

- Atellica Solution CH Analyzer Assay Chart, 11484427 Rev 04, EN DXDCM 09017fe9807b250b-1676056852193Document26 pagesAtellica Solution CH Analyzer Assay Chart, 11484427 Rev 04, EN DXDCM 09017fe9807b250b-1676056852193chinuswami100% (3)

- Screenshot 2024-02-05 at 2.18.25 PMDocument1 pageScreenshot 2024-02-05 at 2.18.25 PMtaykaimingisaacNo ratings yet

- ESN 598909 HPTACC Broken Brackets Report Rev 3Document12 pagesESN 598909 HPTACC Broken Brackets Report Rev 3Chente Flores PanezNo ratings yet

- SCL SHP 30092022 1Document8 pagesSCL SHP 30092022 1indraseenayya chilakalaNo ratings yet

- Comparison Sheet For HVAC AccessoriesDocument3 pagesComparison Sheet For HVAC AccessoriesEslam ElsayedNo ratings yet

- SI Auto Transm BPT 06 18 Rev2Document1 pageSI Auto Transm BPT 06 18 Rev2deepak.sNo ratings yet

- Adobe Scan 08-May-2024Document1 pageAdobe Scan 08-May-2024shreya7501No ratings yet

- OPCR Form (ISO Aligned) PDFDocument1 pageOPCR Form (ISO Aligned) PDFRovie Christal Pascual RoseteNo ratings yet

- Catalogue LG 2017latestDocument46 pagesCatalogue LG 2017latestOmar Ardila100% (1)

- Sample - Lubrication ScheduleDocument1 pageSample - Lubrication Schedulemangesh chidrawarNo ratings yet

- Periodic Replacement PartsDocument2 pagesPeriodic Replacement PartsJesuz GrüberNo ratings yet

- 700r4 Accumulator Valve TrainDocument2 pages700r4 Accumulator Valve Traindaniel carpenterNo ratings yet

- Personal Finance Unit 2 B.Com 3rd YearDocument23 pagesPersonal Finance Unit 2 B.Com 3rd YearHarshika SaxenaNo ratings yet

- RM NotesDocument14 pagesRM Notesjohnwick20012004No ratings yet

- SHP WebsiteDocument5 pagesSHP WebsiteAditya SinghNo ratings yet

- Ea FC 24 Squad Builder FutbinDocument1 pageEa FC 24 Squad Builder FutbinSanti LopezNo ratings yet

- ENQUIRIES, WORK ORDERS AND INVOICE TRACKING REGISTER .Xls (Recovered) PDFDocument53 pagesENQUIRIES, WORK ORDERS AND INVOICE TRACKING REGISTER .Xls (Recovered) PDFSai Sashank100% (1)

- Ynerg : ACO Water Management: +Document15 pagesYnerg : ACO Water Management: +codefinder100% (1)

- Stock Transtank PE Desember 2021Document18 pagesStock Transtank PE Desember 2021Risali AddiniNo ratings yet

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- Practic in Class Solution Ex 13.18Document2 pagesPractic in Class Solution Ex 13.18Farnaz CharandabiNo ratings yet

- Practic in Class Solution Ex 13.21Document1 pagePractic in Class Solution Ex 13.21Farnaz CharandabiNo ratings yet

- Chapter 7 Flexiable Budget FormulaDocument1 pageChapter 7 Flexiable Budget FormulaFarnaz CharandabiNo ratings yet

- Practic in Class Solution Ex 13.10Document1 pagePractic in Class Solution Ex 13.10Farnaz CharandabiNo ratings yet

- Chapter 4 Over (Under) AllocatedDocument1 pageChapter 4 Over (Under) AllocatedFarnaz CharandabiNo ratings yet

- CRG 650: Chapter 1 Understanding Business EthicsDocument18 pagesCRG 650: Chapter 1 Understanding Business EthicsMJ HashmiNo ratings yet

- Heir of Ramon Arce v. DARDocument2 pagesHeir of Ramon Arce v. DARSandy Marie DavidNo ratings yet

- PBB Application For Employment Form 072017Document5 pagesPBB Application For Employment Form 072017Wise MiseNo ratings yet

- Mumbai Finance DatabaseDocument8 pagesMumbai Finance DatabaseVikram0% (1)

- Pugadlawin Balintawak or Bahay Toro AutosavedDocument44 pagesPugadlawin Balintawak or Bahay Toro AutosavedMarlon BenaventeNo ratings yet

- Ecorp Annual Report 2018Document129 pagesEcorp Annual Report 2018Adeel JavaidNo ratings yet

- Credit Card ProcessingDocument21 pagesCredit Card Processingtushar20010% (1)

- PL 9101354537Document12 pagesPL 9101354537manammadhuNo ratings yet

- Osmobsc Vty ReferenceDocument272 pagesOsmobsc Vty Referencelong leeNo ratings yet

- Level:3ASL December 2019: English Exam First TermDocument4 pagesLevel:3ASL December 2019: English Exam First TermAmira FatahNo ratings yet

- East Side Regional Hob Nob Straw Poll ResultsDocument44 pagesEast Side Regional Hob Nob Straw Poll ResultsJacob EngelsNo ratings yet

- Cost Analysis Sheet - Option 2.Document2 pagesCost Analysis Sheet - Option 2.AB Rakib AhmedNo ratings yet

- Essay On Freedom Fighter: (Maulana Abul Kalam Azad)Document6 pagesEssay On Freedom Fighter: (Maulana Abul Kalam Azad)drmadankumarbnysNo ratings yet

- Marketiniac - Round 1 - Case PDFDocument6 pagesMarketiniac - Round 1 - Case PDFTahiratul ElmaNo ratings yet

- Investigative Statement No 4-RedactedDocument4 pagesInvestigative Statement No 4-RedactedNewsTeam20No ratings yet

- Law Commission Report-Land RegistrationDocument308 pagesLaw Commission Report-Land RegistrationIngrid TarlageanuNo ratings yet

- EowDocument3 pagesEowravi_bhateja_2No ratings yet

- Business Ethics and Social ResponsibilityDocument13 pagesBusiness Ethics and Social ResponsibilitymarkNo ratings yet

- Doctrine of ElectionDocument4 pagesDoctrine of ElectionAbir Al Mahmud KhanNo ratings yet

- Challan Form PDFDocument1 pageChallan Form PDFJauhar JauharabadNo ratings yet

- Buber (Buberian)Document5 pagesBuber (Buberian)Jay Michael CorderoNo ratings yet

- APA 8-9 Ball Game RulesDocument11 pagesAPA 8-9 Ball Game RulesbarajirNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- PNCC VS CaDocument1 pagePNCC VS Casamdelacruz1030No ratings yet

- Worldcom Scandal 2002 Case Study Business Accountancy: - Jaspreet - Krish - Raghav - Lakhshit - NagaDocument15 pagesWorldcom Scandal 2002 Case Study Business Accountancy: - Jaspreet - Krish - Raghav - Lakhshit - NagaIsfh 67No ratings yet

- KIA Booking DocketDocument7 pagesKIA Booking Docketshantibhushan.saleNo ratings yet

- 2023 Training MatRIX Campus Journalism VlogDocument2 pages2023 Training MatRIX Campus Journalism VlogPrecious Rhoilyn Dublado BascugNo ratings yet

- Liaison Office Guidelines PDFDocument3 pagesLiaison Office Guidelines PDFawellNo ratings yet