Professional Documents

Culture Documents

Tue, 4 Jun 2024: Global Indices

Tue, 4 Jun 2024: Global Indices

Uploaded by

Ketan ShahCopyright:

Available Formats

You might also like

- Zara Market AnalysisDocument30 pagesZara Market Analysisdedjana lopaNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- K 1 M 04 Z 0 W 7 e 3 K 1 J 0Document4 pagesK 1 M 04 Z 0 W 7 e 3 K 1 J 0RamCharyNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- Nifty 50 - Google SearchDocument1 pageNifty 50 - Google Searchvqsykdb8mvNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Newsletter Feb2Document10 pagesDaily Newsletter Feb2amjadyusuf118No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-221305449No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Updates - March 28Document2 pagesDaily Updates - March 28rksapsecgrc010No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Derivative Premium Daily Journal-25th Oct 2017, WednesdayDocument13 pagesDerivative Premium Daily Journal-25th Oct 2017, WednesdaySiddharth PatelNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Weekly Equity Market Report of Indian MarketDocument5 pagesWeekly Equity Market Report of Indian MarketRahul SolankiNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Investing in Markets and Stockmarket by CapitalHeight.Document4 pagesInvesting in Markets and Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Market Prediction - EquityPanditDocument1 pageMarket Prediction - EquityPanditYathiraj C GowdaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Equity Research Lab: Derivative ReportDocument6 pagesEquity Research Lab: Derivative ReportAru MehraNo ratings yet

- Sharekhan Pre Market Presentation 6th July 2020 Monday FinalDocument25 pagesSharekhan Pre Market Presentation 6th July 2020 Monday FinalOqtec Engg Acerris TeksolNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- FourDocument43 pagesFourHiralal patilNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- DailymarketOutlook 1january2013Document3 pagesDailymarketOutlook 1january2013Darshan MaldeNo ratings yet

- 7Document15 pages7Ketan ShahNo ratings yet

- 13Document8 pages13Ketan ShahNo ratings yet

- Flash Flash: DHOOM.......... DHAMAKA.........Document36 pagesFlash Flash: DHOOM.......... DHAMAKA.........Ketan ShahNo ratings yet

- 2Document14 pages2Ketan ShahNo ratings yet

- 9Document11 pages9Ketan ShahNo ratings yet

- 6Document10 pages6Ketan ShahNo ratings yet

- 10Document16 pages10Ketan ShahNo ratings yet

- 15Document7 pages15Ketan ShahNo ratings yet

- 5Document8 pages5Ketan ShahNo ratings yet

- 13Document12 pages13Ketan ShahNo ratings yet

- 17-03-2024Document12 pages17-03-2024Ketan ShahNo ratings yet

- 1Document16 pages1Ketan ShahNo ratings yet

- 15Document26 pages15Ketan ShahNo ratings yet

- Sr. No. Part No. Item QTY Unit PriceDocument1 pageSr. No. Part No. Item QTY Unit PriceKetan ShahNo ratings yet

- વડોદરા ગુજરાત સમાચારDocument18 pagesવડોદરા ગુજરાત સમાચારKetan ShahNo ratings yet

- 15Document18 pages15Ketan ShahNo ratings yet

- ૩૦- સંદેશ ભાવનગરDocument14 pages૩૦- સંદેશ ભાવનગરKetan ShahNo ratings yet

- 04 - Chapter 1Document20 pages04 - Chapter 1Ketan ShahNo ratings yet

- TANABE H-64 ManualDocument2 pagesTANABE H-64 ManualKetan ShahNo ratings yet

- ET Mumbai 17-03-2024Document10 pagesET Mumbai 17-03-2024Ketan ShahNo ratings yet

- Final DraftDocument67 pagesFinal DraftKetan ShahNo ratings yet

- 1Document25 pages1Ketan ShahNo ratings yet

- Chapter 1Document22 pagesChapter 1Ketan ShahNo ratings yet

- 1Document14 pages1Ketan ShahNo ratings yet

- Man B&W 5L60 Mce SparesDocument1 pageMan B&W 5L60 Mce SparesKetan ShahNo ratings yet

- Foundation Course-Semester-IIDocument4 pagesFoundation Course-Semester-IIKetan ShahNo ratings yet

- HatlapaDocument88 pagesHatlapaKetan ShahNo ratings yet

- Corporate Finance ProjectDocument6 pagesCorporate Finance ProjectInsha GhafoorNo ratings yet

- Demerger of Ultra Tech Cement by L&T andDocument46 pagesDemerger of Ultra Tech Cement by L&T andDeepika KapoorNo ratings yet

- Urc DiscussionDocument3 pagesUrc DiscussionME ValleserNo ratings yet

- Paranginan Partners Tax Law FirmDocument5 pagesParanginan Partners Tax Law FirmBram SostenesNo ratings yet

- Sample Project. MGT314Document48 pagesSample Project. MGT314Tahmid Ismail 1831665642No ratings yet

- Market Never Ending Cycle: ChannelDocument1 pageMarket Never Ending Cycle: ChannelfizzNo ratings yet

- Your Vi Bill: Rs 299.00 Rs 310.00 Rs 0.00 Rs 299.00 Rs 338.00Document2 pagesYour Vi Bill: Rs 299.00 Rs 310.00 Rs 0.00 Rs 299.00 Rs 338.00Rahul KumarNo ratings yet

- "A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDDocument2 pages"A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDPrashant Bansod100% (1)

- May 21Document253 pagesMay 21sachin kumarNo ratings yet

- Total Experience:-6 Years (5 Years in Die Casting.) : Deepak A Jagzap Diploma IN Mechanical EnggDocument3 pagesTotal Experience:-6 Years (5 Years in Die Casting.) : Deepak A Jagzap Diploma IN Mechanical EnggSmart TradingNo ratings yet

- Forecasting and PurchasingDocument25 pagesForecasting and PurchasingPartha Pratim SenguptaNo ratings yet

- Mycroft TMFDocument11 pagesMycroft TMFdarwin12100% (1)

- HACCP Plan Template Checklist - SafetyCultureDocument7 pagesHACCP Plan Template Checklist - SafetyCulturepattysaborio520No ratings yet

- Logistics Strategy (FIFO, FEFO or LSFO) Decision Support System For Perishable Food ProductsDocument6 pagesLogistics Strategy (FIFO, FEFO or LSFO) Decision Support System For Perishable Food ProductsRamkumarArumugapandiNo ratings yet

- Sim CBM 122 Lesson 2Document7 pagesSim CBM 122 Lesson 2Andrew Sy ScottNo ratings yet

- ProjectDocument69 pagesProjectChandan YadavNo ratings yet

- Business Concept:: Key Success FactorsDocument5 pagesBusiness Concept:: Key Success FactorsRoxan AssemienNo ratings yet

- Non Home BR Revised CirDocument17 pagesNon Home BR Revised CirNitesh VazekarNo ratings yet

- How To Be A Canteen ConcessionaireDocument2 pagesHow To Be A Canteen ConcessionairePersonal MailNo ratings yet

- Eco-244 Course-Outline Spring2012Document2 pagesEco-244 Course-Outline Spring2012Madiha Kabir ChowdhuryNo ratings yet

- Exercise 5-8Document8 pagesExercise 5-8Kaye MagbirayNo ratings yet

- Addressing Competition and Driving GrowthDocument12 pagesAddressing Competition and Driving GrowthHiba N IkhmyesNo ratings yet

- Increase Organizational Effectiveness Through Customer Relationship and Business Process ManagementDocument8 pagesIncrease Organizational Effectiveness Through Customer Relationship and Business Process ManagementHai Duc NguyenNo ratings yet

- Week 4Document43 pagesWeek 4CHUA WEI JINNo ratings yet

- Cif Palm Kernel ShellDocument14 pagesCif Palm Kernel ShellPanwascam PurwoharjoNo ratings yet

- Graham Packaging Company 2022Document68 pagesGraham Packaging Company 2022woonjunyangNo ratings yet

- Hair Color Consumer BehaviourDocument28 pagesHair Color Consumer Behaviourhitesh100% (2)

- A Study On Perception of Consumer Towards Digital Payment DoneDocument71 pagesA Study On Perception of Consumer Towards Digital Payment DoneMayur MoreNo ratings yet

- SynopsisAdv Reena B. LokhandeDocument7 pagesSynopsisAdv Reena B. LokhandeGirish V ThoratNo ratings yet

Tue, 4 Jun 2024: Global Indices

Tue, 4 Jun 2024: Global Indices

Uploaded by

Ketan ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tue, 4 Jun 2024: Global Indices

Tue, 4 Jun 2024: Global Indices

Uploaded by

Ketan ShahCopyright:

Available Formats

www.premarketpulse.

com

Tue, 4 Jun 2024

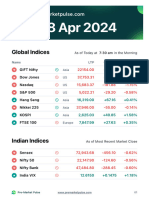

Global Indices As of Today at 7:31 am in the Morning

Name LTP Change Change %

GIFT Nifty Asia 23,574.0 +107.0 +0.46%

Dow Jones US 38,571.03 -115.29 -0.30%

Nasdaq US 16,828.63 +93.62 +0.56%

S&P 500 US 5,283.40 +5.89 +0.11%

Hang Seng Asia 18,462.00 +58.96 +0.32%

Nikkei 225 Asia 38,711.50 -229.00 -0.59%

KOSPI Asia 2,670.08 -12.44 -0.46%

FTSE 100 Europe 8,262.75 -12.63 -0.15%

Indian Indices As of Most Recent Market Close

Sensex 76,468.78 +2507.47 +3.39%

Nifty 50 23,263.90 +733.20 +3.25%

Nifty Bank 50,979.95 +1996.00 +4.07%

India VIX 20.9375 -3.6650 -14.90%

Pre-Market Pulse www.premarketpulse.com 01

Market Bulletin

Sensex and Nifty expected to open higher on June 4

Indian stock market hit record highs, with Sensex and Nifty 50

surging over 3% each after exit polls indicated a BJP-led

alliance win

Asian markets traded lower; US markets ended mixed due to

weak manufacturing data, raising hopes for a Fed rate cut

Wall Street saw mixed results, with Nvidia shares rallying and a

technical glitch affecting NYSE trading

US Treasury yields and the dollar fell following weak PMI data

India VIX dropped over 15%, indicating reduced market

volatility ahead of election results

FII were heavy buyers, and analysts suggest potential for

further FII inflows if NDA is re-elected

Analysts advise caution and profit booking due to potential

market volatility following the election results

BSE-listed companies' market cap increased by ₹14 lakh crore,

with major contributions from Reliance Industries, SBI, and

ICICI Bank hitting record highs

PSU stocks, especially in the Nifty PSE and PSU bank indices,

saw significant gains, with REC, PFC, and Power Grid leading

the surge

Oil prices remained near four-month lows due to OPEC's plans

to increase supply.

Pre-Market Pulse www.premarketpulse.com 02

Technical Analysis

50

Nifty

Closing Level: Nifty 50 closed above 23,250 for the first time,

gaining 733 points

Support Levels: Immediate support at 23,000; pivot point

supports at 23,116, 23,051, and 22,945

Resistance Levels: Expected to surpass 23,500; pivot point

resistances at 23,327, 23,392, and 23,498

Special Formation: Higher high-higher low formation, trading

above key moving averages, positive RSI crossover on daily

and weekly charts.

Bank Nifty

Support Levels: Pivot point supports at 50,338, 50,092, and

49,695; Fibonacci retracement supports at 50,152 and 49,542

Resistance Levels: Pivot point resistances at 51,133, 51,378,

and 51,776; Fibonacci retracement resistances at 51,825 and

54,819

Special Formation: Higher high-higher low formation, positive

bias in RSI and MACD, robust trading volumes.

Pre-Market Pulse www.premarketpulse.com 03

Nifty Call Options Data

Maximum Open Interest: 24,000 strike (98.45 lakh contracts)

Significant Strikes: 23,500 strike (71.07 lakh contracts);

24,500 strike (67.42 lakh contracts)

Maximum Call Writing: 24,000 strike (35.4 lakh contracts).

Nifty Put Options Data

Maximum Open Interest: 22,500 strike (39.46 lakh contracts)

Significant Strikes: 22,000 strike (38.39 lakh contracts); 23,000

strike (26.42 lakh contracts)

Maximum Put Writing: 23,200 strike (16.12 lakh contracts).

Technical Analysis Source:

https://www.moneycontrol.com/news/business/markets/trade-setup-for-

tuesday-15-things-to-know-before-opening-bell-34-12739691.html

Pre-Market Pulse www.premarketpulse.com 04

Key Stocks to Watch

Zee Entertainment: Board meeting on June 6 to consider equity

share fund raise

Kalyan Jewellers: Acquires 15% equity from Rupesh Jain; Enovate

becomes a 100% subsidiary. Acquisition in three tranches by Nov

30, 2024, for ₹42 crore

Sapphire Foods: Board meeting on June 19 to consider stock split

MOIL: Sales hit 2.15 lakh tonnes in May, surpassing Dec 2019

record; sales up 41% YoY. April-May production up 7%

Biocon: USFDA approval for Micafungin, an antifungal injectable

drug

Mahindra & Mahindra Financial Services: May disbursement at

₹4,430 crore, up 7% YoY. YTD disbursement at ₹8,360 crore, up

6%. Collection efficiency at 96%

RVNL: Letter of Acceptance from South Central Railway for ₹440

crore order

Veranda Learnings: Subsidiary Tapasya Educational announces

growth strategy to expand managed college network and course

offerings

Sanofi India: Record date for demerged company shareholders set

for June 13, 2024

Capacite Infra: Board meet to consider ₹100 crore NCD fund raise

delayed for modifications.

Pre-Market Pulse www.premarketpulse.com 05

FII were net buyers with total sales amounting to

FII

Rs 6850.8 Cr on 3, Jun 2024

DII were net buyers with total sales amounting to

DII

Rs 1914 Cr on 3, Jun 2024

Weekly PCR of Indices

Indices PCR Change

Nifty 0.89 +0.13

Bank Nifty 0.68 -0.08

Fin Nifty 0.6 +0.09

A PCR above 1 indicates that the put volume has exceeded the call

volume. It indicates an increase in the bearish sentiment.

A PCR below 1 indicates that the call volume exceeds the put volume.

It signifies a bullish market ahead.

Pre-Market Pulse www.premarketpulse.com 06

Feedback

Do you have any feedback or suggestions? We'd love

to hear from you. Please feel free to send an email to

premarketpulse@gmail.com.

Contact Us

envelope premarketpulse@gmail.com

whatsapp +91 8618318166

globe www.premarketpulse.com

Privacy:

Disclaimer:

Terms & Conditions:

Source:

Pre-Market Pulse

You might also like

- Zara Market AnalysisDocument30 pagesZara Market Analysisdedjana lopaNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- K 1 M 04 Z 0 W 7 e 3 K 1 J 0Document4 pagesK 1 M 04 Z 0 W 7 e 3 K 1 J 0RamCharyNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- Nifty 50 - Google SearchDocument1 pageNifty 50 - Google Searchvqsykdb8mvNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Newsletter Feb2Document10 pagesDaily Newsletter Feb2amjadyusuf118No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-221305449No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Updates - March 28Document2 pagesDaily Updates - March 28rksapsecgrc010No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Derivative Premium Daily Journal-25th Oct 2017, WednesdayDocument13 pagesDerivative Premium Daily Journal-25th Oct 2017, WednesdaySiddharth PatelNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Weekly Equity Market Report of Indian MarketDocument5 pagesWeekly Equity Market Report of Indian MarketRahul SolankiNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Investing in Markets and Stockmarket by CapitalHeight.Document4 pagesInvesting in Markets and Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Market Prediction - EquityPanditDocument1 pageMarket Prediction - EquityPanditYathiraj C GowdaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Equity Research Lab: Derivative ReportDocument6 pagesEquity Research Lab: Derivative ReportAru MehraNo ratings yet

- Sharekhan Pre Market Presentation 6th July 2020 Monday FinalDocument25 pagesSharekhan Pre Market Presentation 6th July 2020 Monday FinalOqtec Engg Acerris TeksolNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- FourDocument43 pagesFourHiralal patilNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- DailymarketOutlook 1january2013Document3 pagesDailymarketOutlook 1january2013Darshan MaldeNo ratings yet

- 7Document15 pages7Ketan ShahNo ratings yet

- 13Document8 pages13Ketan ShahNo ratings yet

- Flash Flash: DHOOM.......... DHAMAKA.........Document36 pagesFlash Flash: DHOOM.......... DHAMAKA.........Ketan ShahNo ratings yet

- 2Document14 pages2Ketan ShahNo ratings yet

- 9Document11 pages9Ketan ShahNo ratings yet

- 6Document10 pages6Ketan ShahNo ratings yet

- 10Document16 pages10Ketan ShahNo ratings yet

- 15Document7 pages15Ketan ShahNo ratings yet

- 5Document8 pages5Ketan ShahNo ratings yet

- 13Document12 pages13Ketan ShahNo ratings yet

- 17-03-2024Document12 pages17-03-2024Ketan ShahNo ratings yet

- 1Document16 pages1Ketan ShahNo ratings yet

- 15Document26 pages15Ketan ShahNo ratings yet

- Sr. No. Part No. Item QTY Unit PriceDocument1 pageSr. No. Part No. Item QTY Unit PriceKetan ShahNo ratings yet

- વડોદરા ગુજરાત સમાચારDocument18 pagesવડોદરા ગુજરાત સમાચારKetan ShahNo ratings yet

- 15Document18 pages15Ketan ShahNo ratings yet

- ૩૦- સંદેશ ભાવનગરDocument14 pages૩૦- સંદેશ ભાવનગરKetan ShahNo ratings yet

- 04 - Chapter 1Document20 pages04 - Chapter 1Ketan ShahNo ratings yet

- TANABE H-64 ManualDocument2 pagesTANABE H-64 ManualKetan ShahNo ratings yet

- ET Mumbai 17-03-2024Document10 pagesET Mumbai 17-03-2024Ketan ShahNo ratings yet

- Final DraftDocument67 pagesFinal DraftKetan ShahNo ratings yet

- 1Document25 pages1Ketan ShahNo ratings yet

- Chapter 1Document22 pagesChapter 1Ketan ShahNo ratings yet

- 1Document14 pages1Ketan ShahNo ratings yet

- Man B&W 5L60 Mce SparesDocument1 pageMan B&W 5L60 Mce SparesKetan ShahNo ratings yet

- Foundation Course-Semester-IIDocument4 pagesFoundation Course-Semester-IIKetan ShahNo ratings yet

- HatlapaDocument88 pagesHatlapaKetan ShahNo ratings yet

- Corporate Finance ProjectDocument6 pagesCorporate Finance ProjectInsha GhafoorNo ratings yet

- Demerger of Ultra Tech Cement by L&T andDocument46 pagesDemerger of Ultra Tech Cement by L&T andDeepika KapoorNo ratings yet

- Urc DiscussionDocument3 pagesUrc DiscussionME ValleserNo ratings yet

- Paranginan Partners Tax Law FirmDocument5 pagesParanginan Partners Tax Law FirmBram SostenesNo ratings yet

- Sample Project. MGT314Document48 pagesSample Project. MGT314Tahmid Ismail 1831665642No ratings yet

- Market Never Ending Cycle: ChannelDocument1 pageMarket Never Ending Cycle: ChannelfizzNo ratings yet

- Your Vi Bill: Rs 299.00 Rs 310.00 Rs 0.00 Rs 299.00 Rs 338.00Document2 pagesYour Vi Bill: Rs 299.00 Rs 310.00 Rs 0.00 Rs 299.00 Rs 338.00Rahul KumarNo ratings yet

- "A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDDocument2 pages"A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDPrashant Bansod100% (1)

- May 21Document253 pagesMay 21sachin kumarNo ratings yet

- Total Experience:-6 Years (5 Years in Die Casting.) : Deepak A Jagzap Diploma IN Mechanical EnggDocument3 pagesTotal Experience:-6 Years (5 Years in Die Casting.) : Deepak A Jagzap Diploma IN Mechanical EnggSmart TradingNo ratings yet

- Forecasting and PurchasingDocument25 pagesForecasting and PurchasingPartha Pratim SenguptaNo ratings yet

- Mycroft TMFDocument11 pagesMycroft TMFdarwin12100% (1)

- HACCP Plan Template Checklist - SafetyCultureDocument7 pagesHACCP Plan Template Checklist - SafetyCulturepattysaborio520No ratings yet

- Logistics Strategy (FIFO, FEFO or LSFO) Decision Support System For Perishable Food ProductsDocument6 pagesLogistics Strategy (FIFO, FEFO or LSFO) Decision Support System For Perishable Food ProductsRamkumarArumugapandiNo ratings yet

- Sim CBM 122 Lesson 2Document7 pagesSim CBM 122 Lesson 2Andrew Sy ScottNo ratings yet

- ProjectDocument69 pagesProjectChandan YadavNo ratings yet

- Business Concept:: Key Success FactorsDocument5 pagesBusiness Concept:: Key Success FactorsRoxan AssemienNo ratings yet

- Non Home BR Revised CirDocument17 pagesNon Home BR Revised CirNitesh VazekarNo ratings yet

- How To Be A Canteen ConcessionaireDocument2 pagesHow To Be A Canteen ConcessionairePersonal MailNo ratings yet

- Eco-244 Course-Outline Spring2012Document2 pagesEco-244 Course-Outline Spring2012Madiha Kabir ChowdhuryNo ratings yet

- Exercise 5-8Document8 pagesExercise 5-8Kaye MagbirayNo ratings yet

- Addressing Competition and Driving GrowthDocument12 pagesAddressing Competition and Driving GrowthHiba N IkhmyesNo ratings yet

- Increase Organizational Effectiveness Through Customer Relationship and Business Process ManagementDocument8 pagesIncrease Organizational Effectiveness Through Customer Relationship and Business Process ManagementHai Duc NguyenNo ratings yet

- Week 4Document43 pagesWeek 4CHUA WEI JINNo ratings yet

- Cif Palm Kernel ShellDocument14 pagesCif Palm Kernel ShellPanwascam PurwoharjoNo ratings yet

- Graham Packaging Company 2022Document68 pagesGraham Packaging Company 2022woonjunyangNo ratings yet

- Hair Color Consumer BehaviourDocument28 pagesHair Color Consumer Behaviourhitesh100% (2)

- A Study On Perception of Consumer Towards Digital Payment DoneDocument71 pagesA Study On Perception of Consumer Towards Digital Payment DoneMayur MoreNo ratings yet

- SynopsisAdv Reena B. LokhandeDocument7 pagesSynopsisAdv Reena B. LokhandeGirish V ThoratNo ratings yet