Professional Documents

Culture Documents

Taxation Assignment

Taxation Assignment

Uploaded by

sadforhappy08Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Assignment

Taxation Assignment

Uploaded by

sadforhappy08Copyright:

Available Formats

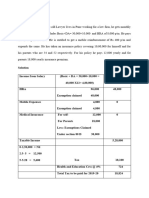

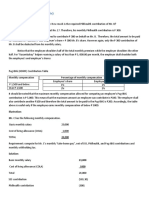

To calculate Mr.

B's taxable income and tax liability, we need to consider all sources of

income and the deductions available under the Indian Income Tax Act.

Income Sources:

1. Business Income: ₹75,00,000

2. Gift from Ex-Wife: ₹6,00,000 (Note: Gifts from specified relatives are not taxable,

hence this is not considered taxable income.)

3. Lottery Winnings: ₹19,00,000 (Taxable at a special rate)

4. Matured Life Insurance Policy: ₹32,00,000 (Subject to certain conditions for tax

exemption)

Expenditures and Investments:

1. Family Trip Expense: ₹15,00,000 (Not deductible)

2. Gift to Wife: ₹4,50,000 (Not deductible)

3. Life Insurance Premium: ₹50,000 annually (Eligible for deduction under Section 80C)

4. Tuition Fee for Daughter: ₹50,000 (Eligible for deduction under Section 80C)

5. PPF Investment: ₹80,000 (Eligible for deduction under Section 80C)

6. Medical Test: ₹6,000 (Not deductible)

7. Health Insurance Premium: ₹27,000 (Eligible for deduction under Section 80D)

Working Notes:

1. Calculate Gross Total Income

a. Business Income: ₹75,00,000

b. Lottery Winnings: ₹19,00,000 (Taxed at 30% flat rate, no deductions allowed)

c. Matured Life Insurance Policy: ₹32,00,000 (Assumed exempt if it qualifies

under Section 10(10D))

Total Gross Income (excluding non-taxable items):-

₹75,00,000 (Business Income) + ₹19,00,000 (Lottery Winnings) = ₹94,00,000

2. Deductions under Section 80C

Life Insurance Premium: ₹50,000

Tuition Fees: ₹50,000

PPF Investment: ₹80,000

Total 80C Deductions:-

₹50,000 + ₹50,000 + ₹80,000 = ₹1,80,000

Note: Maximum allowable deduction under Section 80C is ₹1,50,000.

3. Deductions under Section 80D

Health Insurance Premium: ₹27,000

4. Calculate Net Taxable Income

a. Income excluding Lottery Winnings:

₹75,00,000 (Business Income)

b. Deductions:

Section 80C: ₹1,50,000 (Max allowed)

Section 80D: ₹27,000

Total Deductions:-

₹1,50,000 + ₹27,000 = ₹1,77,000

Net Taxable Income excluding Lottery Winnings:-

₹75,00,000 - ₹1,77,000 = ₹73,23,000

c. Taxable Income including Lottery Winnings:-

₹73,23,000 + ₹19,00,000 (Lottery Winnings) = ₹92,23,000

5. Calculate Tax Liability

a. Tax on Regular Income: ₹73,23,000

Income up to ₹2,50,000: Nil

₹2,50,001 to ₹5,00,000: 5% of ₹2,50,000 = ₹12,500

₹5,00,001 to ₹10,00,000: 20% of ₹5,00,000 = ₹1,00,000

Above ₹10,00,000: 30% of ₹63,23,000 = ₹18,96,900

Total Tax on Regular Income:-

₹12,500 + ₹1,00,000 + ₹18,96,900 = ₹20,09,400

b. Tax on Lottery Winnings: ₹19,00,000

30% of ₹19,00,000 = ₹5,70,000

Plus 4% Health and Education Cess on lottery tax: ₹5,70,000 4% =

₹22,800

Total Tax on Lottery Winnings:-

₹5,70,000 + ₹22,800 = ₹5,92,800

c. Total Tax Liability:-

₹20,09,400 (Regular Income Tax) + ₹5,92,800 (Lottery Tax) = ₹26,02,200

d. Add Health and Education Cess on Regular Income Tax:-

4% of ₹20,09,400 = ₹80,376

Final Total Tax Liability:

₹26,02,200 + ₹80,376 = ₹26,82,576

Conclusion

Mr. B's total taxable income is ₹92,23,000 and

his total tax liability is ₹26,82,576.

You might also like

- VSA Lite Tradingview Guide To VSA Lite Alerts V1 0 2Document28 pagesVSA Lite Tradingview Guide To VSA Lite Alerts V1 0 2Jonathan Pereira0% (1)

- Business and SocietyDocument53 pagesBusiness and Societybijay83% (6)

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Kotak InsuraceDocument1 pageKotak InsuraceRemo RomeoNo ratings yet

- Taxation Assignment 2Document1 pageTaxation Assignment 2biju.mahapatra23No ratings yet

- Assignment 19 3Document2 pagesAssignment 19 3sahibsinghthapar1No ratings yet

- To Calculate TaxtationDocument2 pagesTo Calculate Taxtationmannu10091No ratings yet

- Assignment On TaxationDocument3 pagesAssignment On TaxationJasmeetKaurNo ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Income Tax Must Do Questions by Vinit Mishra SirDocument109 pagesIncome Tax Must Do Questions by Vinit Mishra SirHenil DharodNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- New Course Solutions May 2019Document18 pagesNew Course Solutions May 2019Kali KhannaNo ratings yet

- Basic Concepts - QuestionsDocument6 pagesBasic Concepts - QuestionsbadalNo ratings yet

- Sec. 24 NircDocument17 pagesSec. 24 NircCharie Mae YdNo ratings yet

- Tax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaDocument28 pagesTax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaEddie Mar JagunapNo ratings yet

- Taxation Review June2017Document9 pagesTaxation Review June2017Shaiful Alam FCANo ratings yet

- TRAIN Part 1 - Income TaxDocument53 pagesTRAIN Part 1 - Income TaxGianna CantoriaNo ratings yet

- ATax - 03Document29 pagesATax - 03Haseeb Ahmed ShaikhNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Computation of Total Income & Tax LiabilityDocument24 pagesComputation of Total Income & Tax LiabilityKartikNo ratings yet

- Computation of Total IncomeDocument15 pagesComputation of Total Incomekhushi shahNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

- Solution 15 To 21Document9 pagesSolution 15 To 21pratham kannanNo ratings yet

- Illustration 1 and 2 Salary - 21-22 Nov 2023Document5 pagesIllustration 1 and 2 Salary - 21-22 Nov 2023Chinmay HarshNo ratings yet

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- 2021 T2 TPLA601 Final Exam STUDENT v1Document16 pages2021 T2 TPLA601 Final Exam STUDENT v1Anas HassanNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- DT Must Do List!! (Apr - 2023) - 230228 - 125036Document129 pagesDT Must Do List!! (Apr - 2023) - 230228 - 125036Ameen AhmadNo ratings yet

- Chapter 1 Basic Concepts - General Tax RatesDocument4 pagesChapter 1 Basic Concepts - General Tax RatesYashNo ratings yet

- ASSIGNMENT Taxable IncomeDocument4 pagesASSIGNMENT Taxable Incomes.adhishriNo ratings yet

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDocument6 pagesTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173No ratings yet

- Capii Income Tax and Vat July2015Document15 pagesCapii Income Tax and Vat July2015casarokarNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Taxable IncomeDocument2 pagesTaxable IncomeNavdeep SinghNo ratings yet

- Exercise 1Document6 pagesExercise 1lihubruhNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Suggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Document13 pagesSuggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Parasuram IyerNo ratings yet

- Chapter 17 & 18 SolutionsDocument4 pagesChapter 17 & 18 SolutionsSheena CarrouthersNo ratings yet

- $110,000 2%) $1,375 ($110,000) 1.25% (Tier 2 ($105,001 - $140,000) )Document3 pages$110,000 2%) $1,375 ($110,000) 1.25% (Tier 2 ($105,001 - $140,000) )Umair RaheemNo ratings yet

- Taxation Review Dec2017Document7 pagesTaxation Review Dec2017Shaiful Alam FCANo ratings yet

- Chapter - 4 TDS NotesDocument7 pagesChapter - 4 TDS Notesmbfake12No ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Identify and Discuss Direct TaxDocument7 pagesIdentify and Discuss Direct Taxsamuel asefaNo ratings yet

- Discussions Updated 24.03Document28 pagesDiscussions Updated 24.03rajawatswadheentaNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- 01 Revision Salary IncomeDocument24 pages01 Revision Salary IncomeUmer ArabiNo ratings yet

- Reales Tax Rev Computation ExerciseDocument4 pagesReales Tax Rev Computation ExerciseJethroret RealesNo ratings yet

- Rebate Details W.R.T. Inspector Manoj Kumar (Pis NO. 16960170) FOR THE FINANCIAL YEAR 2015-16Document3 pagesRebate Details W.R.T. Inspector Manoj Kumar (Pis NO. 16960170) FOR THE FINANCIAL YEAR 2015-16Vinay PrabhakarNo ratings yet

- Tax Planning and Form of BusinessDocument11 pagesTax Planning and Form of Businessabdulraqeeb alareqiNo ratings yet

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Ca Inter Full Book 2Document32 pagesCa Inter Full Book 2Amar SharmaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Audit of Intangible AssetDocument14 pagesAudit of Intangible AssetJoseph SalidoNo ratings yet

- Economic Policy 1991Document20 pagesEconomic Policy 1991Anusha Palakurthy100% (1)

- 3 Design Challenge ClassDocument27 pages3 Design Challenge ClassNithish Devaraj ManiNo ratings yet

- Database Management System PDFDocument51 pagesDatabase Management System PDFEmente EmenteNo ratings yet

- Recent Trends in Public Sector BanksDocument79 pagesRecent Trends in Public Sector Banksnitesh01cool67% (3)

- Marketing - Section ADocument15 pagesMarketing - Section AArchana NeppolianNo ratings yet

- Entrepreneurship - Business Plan FormatDocument4 pagesEntrepreneurship - Business Plan FormatDranreb Janry LoinaNo ratings yet

- Estee Lauder Strategic AuditDocument17 pagesEstee Lauder Strategic Auditamit29birth100% (1)

- SummaryDocument31 pagesSummaryuyiNo ratings yet

- Worthiness of Technologies and Innovation Intensiveness As An Entrepreneurship Strategy On Business Effectiveness and Newness in Malolos, BulacanDocument6 pagesWorthiness of Technologies and Innovation Intensiveness As An Entrepreneurship Strategy On Business Effectiveness and Newness in Malolos, BulacanAngela TalastasNo ratings yet

- Task 1 ModelDocument5 pagesTask 1 ModelBichngoc PhamNo ratings yet

- Greg McKinnon Resume With ReferencesDocument6 pagesGreg McKinnon Resume With ReferencesGreg McKinnonNo ratings yet

- Entrep-Q1-M2 ReviewDocument2 pagesEntrep-Q1-M2 ReviewBUNTA, NASRAIDANo ratings yet

- Asset and Liability Management: A Multiple Case Study in Brazilian Financial InstitutionsDocument13 pagesAsset and Liability Management: A Multiple Case Study in Brazilian Financial InstitutionsJohn MichaelNo ratings yet

- Muyiwa Bakery ConsultancyDocument2 pagesMuyiwa Bakery ConsultancyMuyiwa AdeniyiNo ratings yet

- tFYzwDhiQd PDFDocument64 pagestFYzwDhiQd PDFchinmay dalviNo ratings yet

- Labor Laws - Consequences of Termination (Separation Pay and Backwages)Document15 pagesLabor Laws - Consequences of Termination (Separation Pay and Backwages)Jeff Sarabusing100% (1)

- Operation Management Heizer Solution Module FDocument5 pagesOperation Management Heizer Solution Module FHuyền Lê Thị Thanh0% (1)

- Answer Key For The Live Leak IBPS SO Mains Model Question Paper For MarketingDocument18 pagesAnswer Key For The Live Leak IBPS SO Mains Model Question Paper For MarketingHiten Bansal100% (1)

- Compass Point Board Model PDFDocument1 pageCompass Point Board Model PDFapi-340041361No ratings yet

- Ethics Case StudiesDocument15 pagesEthics Case StudiesSivakumar KandasamyNo ratings yet

- C6-Intercompany Inventory Transactions PDFDocument43 pagesC6-Intercompany Inventory Transactions PDFVico JulendiNo ratings yet

- Consumer Behaviour For Financial ServicesDocument19 pagesConsumer Behaviour For Financial Servicessonia.raniNo ratings yet

- Bestpractice Pos AnalyticsDocument32 pagesBestpractice Pos Analyticsnataliperalta188100% (1)

- Case Study-3 (Malacca Conundrum)Document26 pagesCase Study-3 (Malacca Conundrum)hari menonNo ratings yet

- Dinakar Vempati: ObjectiveDocument2 pagesDinakar Vempati: Objectiveelearning123No ratings yet