Professional Documents

Culture Documents

Capital Account, Current Account, Appropriation Statement

Capital Account, Current Account, Appropriation Statement

Uploaded by

baekmiyuiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Account, Current Account, Appropriation Statement

Capital Account, Current Account, Appropriation Statement

Uploaded by

baekmiyuiCopyright:

Available Formats

PART B

1.0 PARTNERSHIP AGREEMENT

+ Additional Partnership Business Information

Accounting year end : 30 November 2022

Net Profit or Loss (does not include depreciation charges) : RM 330,000

Additional Capital contributed by Partner B via online banking on 2 February

2022 : RM 30,000

Interest on capital (Basis) : Calculated on the basis of ending capital

Drawing made by Partner C : RM700 was made on the first week of the third month

of the accounting period7

Salary to partner : As at the end of the accounting period, salaries were paid to all

partners RM8,000 each.

Sharing of Profit or Loss Ratio : 2:1:1

Partner C is guaranteed with a minimum profit : RM 90,000

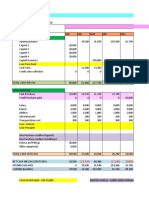

Capital account

Partner Partner Partner Partner Partner Partner

A B C A B C

RM RM RM RM RM RM

Bal b/d 100000 50000 60000

Bal c/d 100000 80000 60000 Cash - 30000 -

(additional)

100000 80000 60000 100000 80000 60000

Current Account

Partner Partner Partner Partner Partner Partner

A B C A B C

RM RM RM RM RM RM

Bal b/d 8000 7000 Bal b/d 5000

Drawings 700 Interest 8000 5800 4800

on

capital

Interest 26 Interest 2750

on on loan

drawing

Bal c/d Salaries 4000 4000 4000

Profit

shared

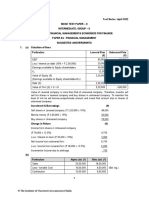

Appropriation Statement for the year ended 30 April 2022

RM RM

Net profit b/d 300,000

(-) Interest on Loan (50,000* 6% * 4/12) (1000)

(-) Depreciation n machinery ( 10% * 70,000) (7000)

Adjusted Net Profit 292,000

Add: Interest on drawings

Partner C (5% * 800 *3/12) 10

Less: Salaries

Partner A 12,000

Partner B 12,000

Partner C 12,000 (36,000)

Less: Interest on capital

Partner A (100,000 * 8%) 8000

Partner B (50,000* 8%) + (30,000*8%*3/12) 4600

Partner C (60,000*8%) 4800 (17,400)

Net Profit for Appropriation 238,610

Profit shared

Partner A (1/3*238,610) (79536.67 – 231.67) 79,305

Partner B (1/3*238,610) (79536.67 – 231. 67) 79,305

Partner C (1/3*246840) (79536.67 + 231.67 +231.67) 80,000

238,610

You might also like

- Far160 - Question 5 Tutorial Chapter 1Document2 pagesFar160 - Question 5 Tutorial Chapter 1Syaza AisyahNo ratings yet

- Assignment 2 Taxation AtxDocument17 pagesAssignment 2 Taxation Atxiknowu250No ratings yet

- AutomationDocument36 pagesAutomationParvez AlamNo ratings yet

- JJJJJDocument3 pagesJJJJJMursid mohammedNo ratings yet

- Example - Tax ComputationDocument10 pagesExample - Tax ComputationAminul Islam RubelNo ratings yet

- Tutorial 6 Q1 2 and 4 Excel AnswersDocument23 pagesTutorial 6 Q1 2 and 4 Excel AnswersMurali RasamahNo ratings yet

- FM 2019 SolutionsDocument6 pagesFM 2019 Solutionsaditikotere92No ratings yet

- Chapter 2 Capital Account SumsDocument9 pagesChapter 2 Capital Account SumsAparna PNo ratings yet

- Ut Sample Paper Ak G 12 AccDocument4 pagesUt Sample Paper Ak G 12 Accblackpink771170No ratings yet

- Answer For Tutorial 4Document2 pagesAnswer For Tutorial 4Ellie QarinaNo ratings yet

- ACC407-section BDocument3 pagesACC407-section Banissyafiqahh17No ratings yet

- Ak 2024-1Document7 pagesAk 2024-1kingaliisgreat.07860No ratings yet

- Multi A SDN BHDDocument15 pagesMulti A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- Partnership Operations - AssignmentDocument6 pagesPartnership Operations - AssignmentRosmar AbanerraNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1Sharmaine JoyceNo ratings yet

- Example 2 - Tax ComputationDocument19 pagesExample 2 - Tax ComputationAminul Islam RubelNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFDocument3 pagesLagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFSarah Nicole S. LagrimasNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Answer Question 6.6Document3 pagesAnswer Question 6.6Lee Li HengNo ratings yet

- Lecture 8Document7 pagesLecture 8ahmed qazzafiNo ratings yet

- ACC 206 Test 2 2023Document8 pagesACC 206 Test 2 2023tawanaishe shoniwaNo ratings yet

- ACC 206 Test 2 2023Document9 pagesACC 206 Test 2 2023tawanaishe shoniwaNo ratings yet

- 9.2018_FA.3_Asg 2 Q+ADocument4 pages9.2018_FA.3_Asg 2 Q+ATS YONGNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Marr Calculation and ExamplesDocument4 pagesMarr Calculation and ExamplesAi manNo ratings yet

- Example 21.19 Text BookDocument4 pagesExample 21.19 Text BookNUR DARWISYAH KAMARUDINNo ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- Test Bank of Advanced Accounting by Guerrero Peralta Chapter 10Document19 pagesTest Bank of Advanced Accounting by Guerrero Peralta Chapter 10Bianca AcoymoNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- 12 Acc Accoun Partner Firm Fundamentals Im6 PDFDocument12 pages12 Acc Accoun Partner Firm Fundamentals Im6 PDFDID You KNOWNo ratings yet

- Chapter 1 Partnership Account 1Document21 pagesChapter 1 Partnership Account 1Akmal MalikNo ratings yet

- Designlabproject 1517400951Document27 pagesDesignlabproject 1517400951Pritam ThapaNo ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Assignment 9/17/2020: Use The Following Information For The Next Two QuestionsDocument6 pagesAssignment 9/17/2020: Use The Following Information For The Next Two QuestionsRosmar AbanerraNo ratings yet

- Bachelor of Management With Honours (Bim)Document11 pagesBachelor of Management With Honours (Bim)Aizat Ahmad100% (3)

- Test Bank of Advanced Accounting by Guerrero Peralta Chapter 10Document16 pagesTest Bank of Advanced Accounting by Guerrero Peralta Chapter 10Aldrin ZolinaNo ratings yet

- March16 Q4Document1 pageMarch16 Q4SITI NUR DIANA SELAMATNo ratings yet

- Discussions Updated 24.03Document28 pagesDiscussions Updated 24.03rajawatswadheentaNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Caunit 4Document23 pagesCaunit 4Sathya DineshNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- Book 1Document2 pagesBook 1GIROLYDIA EDDYNo ratings yet

- Accounting and Financial Management-ProjectDocument8 pagesAccounting and Financial Management-ProjectMelokuhle MhlongoNo ratings yet

- FBF Final Project Report (Financial Plan)Document6 pagesFBF Final Project Report (Financial Plan)Afaq BhuttaNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- Tutorial 7 Answer Q1 2 3Document12 pagesTutorial 7 Answer Q1 2 3Chuah Chong AnnNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Departmental Accounting IllustrationsDocument13 pagesDepartmental Accounting IllustrationsHarsha BabyNo ratings yet

- SS RPCDocument6 pagesSS RPCALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- Module 3 DepreciationDocument4 pagesModule 3 DepreciationLouie Jay JadraqueNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Example Accounting Ledgers ACC406Document5 pagesExample Accounting Ledgers ACC406AinaAteerahNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- MS Xii Accountancy Set 1Document10 pagesMS Xii Accountancy Set 1arikoff07No ratings yet

- Xii Ca Model KeyDocument3 pagesXii Ca Model Keyapmmontage112No ratings yet

- Problem 1:: Current Liabilities Long-Term LiabilitiesDocument4 pagesProblem 1:: Current Liabilities Long-Term LiabilitiesaidarinNo ratings yet

- Assingment 3-2Document4 pagesAssingment 3-2Shira HaizanNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CAN For Vehicles HugoProvencher 2Document67 pagesCAN For Vehicles HugoProvencher 2Skyline DvNo ratings yet

- Op AmpDocument36 pagesOp AmpLord Nafaryus100% (1)

- Anime and MangaDocument14 pagesAnime and Mangapuspo agungNo ratings yet

- Navodaya Vidyalaya Samiti Navodaya Vidyalaya Samiti Navodaya Vidyalaya SamitiDocument31 pagesNavodaya Vidyalaya Samiti Navodaya Vidyalaya Samiti Navodaya Vidyalaya Samiticat manNo ratings yet

- Sustainability 12 04099Document14 pagesSustainability 12 04099Dorothy Joy Sayson FonacierNo ratings yet

- The MoonDocument6 pagesThe MoonjaudreytuyNo ratings yet

- The Masculoskeletal SystemDocument6 pagesThe Masculoskeletal Systemapi-296199660No ratings yet

- Int Org 2Document60 pagesInt Org 2Alara MelnichenkoNo ratings yet

- Auxiliary StructuresDocument19 pagesAuxiliary StructuresdarwinNo ratings yet

- Passive Voice PPT 1Document30 pagesPassive Voice PPT 1Muhammad Rafif FadillahNo ratings yet

- CV Bhineka 21 Hari FS 4.5Document1 pageCV Bhineka 21 Hari FS 4.5ppg.desyaalfatih82No ratings yet

- 02 Surface Production Material Movement V70Document49 pages02 Surface Production Material Movement V70Jobs Mathan100% (1)

- Special EducationDocument13 pagesSpecial EducationJanelle CandidatoNo ratings yet

- A Detailed Lesson Plan in English 9: (Using Adverbs in Narration)Document8 pagesA Detailed Lesson Plan in English 9: (Using Adverbs in Narration)Faith Malinao100% (1)

- Distortion in Music ProductionDocument306 pagesDistortion in Music ProductionjansolostarNo ratings yet

- Mechanism On Scissor Lift Operation Report PDFDocument4 pagesMechanism On Scissor Lift Operation Report PDFAMY SHAKYLLA BINTI ADEHAM / UPMNo ratings yet

- Short Keys f1-f12Document2 pagesShort Keys f1-f12Farhan Khan NiaZiNo ratings yet

- UAV - NPTEL - IIT RoorkeeDocument14 pagesUAV - NPTEL - IIT Roorkeesankalp chopkarNo ratings yet

- Service Manual: DSC-F505VDocument34 pagesService Manual: DSC-F505VAnonymous Lfgk6vygNo ratings yet

- Astronomy 480 Characterizing A CCD: ObjectivesDocument9 pagesAstronomy 480 Characterizing A CCD: Objectivesddidomenico12345No ratings yet

- 2exam LogisticsDocument6 pages2exam LogisticsJessica LaguatanNo ratings yet

- Monash UniversityDocument17 pagesMonash Universityimmanuel nauk elokpereNo ratings yet

- ANAPHY Lec Session #4 - SASDocument10 pagesANAPHY Lec Session #4 - SASFherry Mae UsmanNo ratings yet

- Aviation HistoryDocument15 pagesAviation HistoryAchmad FauzanNo ratings yet

- Chapter 2 Part 2Document83 pagesChapter 2 Part 2Amanuel Q. Mulugeta80% (5)

- 93admit Card Semester-V 011 12-01-2022 16-51-1Document37 pages93admit Card Semester-V 011 12-01-2022 16-51-1Spotify premiumNo ratings yet

- A Primer On Governance of The Family Enterprise: Industry AgendaDocument32 pagesA Primer On Governance of The Family Enterprise: Industry AgendaMALLI ROYALNo ratings yet

- All About Zookeeper and ClickHouse KeeperDocument45 pagesAll About Zookeeper and ClickHouse KeeperomyeudaihiepNo ratings yet

- UL Listed Class 2 TransformersDocument3 pagesUL Listed Class 2 TransformersHerm HarrisonNo ratings yet