Professional Documents

Culture Documents

B. AOP Test 7 2023

B. AOP Test 7 2023

Uploaded by

Nishtha Garg0 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

B. AOP test 7 2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageB. AOP Test 7 2023

B. AOP Test 7 2023

Uploaded by

Nishtha GargCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

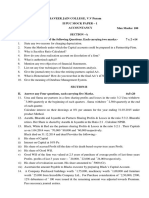

DEEPAK GUPTA 8800929191

Your Accountancy Coach

Admission of Partner (Test)

Time allowed:1 hour] [Maximum marks:16

1. Atal and Madan were partners in a firm sharing profits in the ratio of 5 : 3. on 31.3.2022

they admitted Mehra as a new partner for 1/5th share in the profit. The new profit sharing

ratio was 5 : 3 : 2. On Mehra’s admission the Balance Sheet of the firm was as follows:(8)

Liabilities Amount Assets Amount

(Rs.) (Rs.)

Capitals: Land and Building 1,50,000

Atal Rs. 1,50,000 Machinery 40,000

Madan Rs. 90,000 2,40,000 Patents 5,000

Stock 27,000

20,000 Debtors 47,000

Creditors

32,000 - Provision for D/d 1200 45800

Workmen Compensation Fund

Cash 4,200

Profits & Loss Account 20,000

2,92,000 2,92,000

On Mehra’s admission it was agreed that:

1. Mehra will bring Rs. 40,000 as his capital and Rs. 16,000 for his share of goodwill

premium.

2. A provision of 21⁄2% for bad and doubtful debts was to be created:

3. Included in the sundry creditors was an item of Rs. 2,500 which was not be paid;

4. A provision was to be made for an outstanding bill for electricity Rs. 3,000;

5. A claim of Rs. 325 for damages against the firm was likely to be admitted. Provision

for the same was to be made.

6. After the above adjustments, the capitals of Atal and Madan were to be adjusted on

the basis of Mehra’s capital. Actual cash was to be brought in or to be paid off to Atal

and Madan as the case may be.

Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of

the new firm.

2. A and B were partners in a firm sharing profits in the ratio of 11 : 4. C was admitted as a

new partner for 1/5th share in the profits on 1.3.2010. the Balance sheet of A and B on 1

April 2022 was as follows: (8)

Liabilities Amount (Rs.) Assets Amount (Rs.)

Creditors 15,000 Bank 17,000

Bills Payables 30,000 Stock 29,000

Employees Provident Fund 20,000 Debtors Rs. 30,000

Workmen Compensation Fund 1,60,000

Less: Provision for Bad debts 1,000

Capitals: 29,000

Plant

A Rs.20,00,000 3,00,000

Land

25,50,000, 10,00,000

B Rs. 5,50,000 Building

14,00,000

27,75,000 27,75,000

It was agreed that

1. C to bring in capital to be extent of 1/5th of the total capital of the firm and Rs. 1,50,000

for his share of goodwill, half of which was withdrawn by A and B.

2. Building and Plant were to be depreciated by 20%.

3. Provision for bad debts was to be increased by Rs. 200.

4. Claim on account of workmen compensation is Rs. 10,000.

Prepare Revaluation Account, Partners Capital Account and Balance Sheet of the new firm.

Available at:-

Meritorious Education Centre (Rohini Sec – 22), Success Study Circle (Jain Nagar), Study Point (Budh Vihar)

You might also like

- Ebook PDF Corporate Finance 12th Edition by Stephen Ross PDFDocument42 pagesEbook PDF Corporate Finance 12th Edition by Stephen Ross PDFjennifer.browne34593% (45)

- DCF ModelDocument7 pagesDCF ModelSai Dinesh BilleNo ratings yet

- BBA II Chapter 2 Sale of Partnership ProblemsDocument14 pagesBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarNo ratings yet

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- REVISION TEST Admission of A PartnerDocument2 pagesREVISION TEST Admission of A PartnerOshvi Shrivastava100% (1)

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- 1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Document3 pages1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Arthur ShelbyNo ratings yet

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926No ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Cbse Questions Adm RetirementDocument19 pagesCbse Questions Adm RetirementDeepanshu kaushikNo ratings yet

- Screenshot 2022-10-06 at 9.42.46 AMDocument20 pagesScreenshot 2022-10-06 at 9.42.46 AMUzer BagwanNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Retirement of Partners Cbse Question BankDocument6 pagesRetirement of Partners Cbse Question Bankabhayku1689No ratings yet

- TP 4 Pa 18 JuneDocument2 pagesTP 4 Pa 18 JuneAditya srivastavaNo ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- C. Retirement & Death Assingment UpdateDocument7 pagesC. Retirement & Death Assingment UpdateNishtha GargNo ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- Accounts DPP Retirement of A PartnerDocument15 pagesAccounts DPP Retirement of A PartnerPreeti SharmaNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Partnership Final AccountDocument1 pagePartnership Final Accountsujan Bhandari100% (1)

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- PQ - Covnersion Partnership To CompanyDocument8 pagesPQ - Covnersion Partnership To CompanyAnshul BiyaniNo ratings yet

- Accounts Dissolution Test 3rd SemesterDocument6 pagesAccounts Dissolution Test 3rd SemesterNeha agarwalNo ratings yet

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolDocument3 pagesRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpNo ratings yet

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocument11 pagesTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaNo ratings yet

- Adobe Scan 29 Aug 2022Document9 pagesAdobe Scan 29 Aug 2022kumardeepak5242No ratings yet

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- Day 2 Accounts (1)Document1 pageDay 2 Accounts (1)kawaljeetsingh121666No ratings yet

- Accountancy: Pre-Board Examinations 2078Document3 pagesAccountancy: Pre-Board Examinations 2078Herman PecassaNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- 12 Podar International School QPDocument2 pages12 Podar International School QPAkshat KhetanNo ratings yet

- AdmissionDocument3 pagesAdmissionaashishNo ratings yet

- II Puc Accountancy Mock Paper IIDocument5 pagesII Puc Accountancy Mock Paper IISAI KISHORENo ratings yet

- Retire Death Dissolution SheetDocument6 pagesRetire Death Dissolution SheetTanvi SisodiaNo ratings yet

- 12 Com....Document5 pages12 Com....Advanced AcademyNo ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- 12 Accountancy Lyp 2008 Set1Document9 pages12 Accountancy Lyp 2008 Set1Yash VagrechaNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- FINANCIAL - 22UCOS304 - Corrected - 23N528Document5 pagesFINANCIAL - 22UCOS304 - Corrected - 23N528aswathvignessNo ratings yet

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- Dissolution of FirmDocument4 pagesDissolution of FirmAMIN BUHARI ABDUL KHADERNo ratings yet

- Chapter 5 Amalgamtion of Companies HandoutsDocument7 pagesChapter 5 Amalgamtion of Companies Handoutsvikax90927No ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- Retirement and Dissolution of Firm Class TestDocument2 pagesRetirement and Dissolution of Firm Class TestHarish RajputNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- 2017-08-03 Bobulinski Email To CEFCDocument21 pages2017-08-03 Bobulinski Email To CEFCChuck Ross100% (2)

- Dummy - SIP Enrollment PDFDocument1 pageDummy - SIP Enrollment PDFKiranmayi UppalaNo ratings yet

- Dbfs ProfileDocument5 pagesDbfs ProfileMaza StreetNo ratings yet

- Registered ValueDocument9 pagesRegistered ValueSangram PandaNo ratings yet

- Practical Accounting II - 2nd PreboardDocument9 pagesPractical Accounting II - 2nd PreboardKim Cristian Maaño0% (1)

- Mini MBA B10 - 01 Financial Management - Day 01Document41 pagesMini MBA B10 - 01 Financial Management - Day 01Reza MonoarfaNo ratings yet

- Corporate Venture CapitalDocument33 pagesCorporate Venture CapitalAntares OrionNo ratings yet

- PPE Lecture NotesDocument54 pagesPPE Lecture Notesmacmac29No ratings yet

- Ass#1 Bus. MathDocument3 pagesAss#1 Bus. MathHannah Rodelynn GaliciaNo ratings yet

- Lyceum of Alabang: Review Materials in PFRS 3, Business CombinationsDocument12 pagesLyceum of Alabang: Review Materials in PFRS 3, Business CombinationsThom Santos Crebillo100% (1)

- 3 Sec 185 Loan To DirectorDocument6 pages3 Sec 185 Loan To DirectorKumar SwamyNo ratings yet

- Slide AccaDocument463 pagesSlide AccaNile NguyenNo ratings yet

- MODULE 1 Summative Business FinanceDocument2 pagesMODULE 1 Summative Business Financerandy magbudhiNo ratings yet

- Satyam Scandal: Initial Confession and ChargesDocument5 pagesSatyam Scandal: Initial Confession and ChargesSarvanRajNo ratings yet

- Intraperiod Tax AllocationDocument2 pagesIntraperiod Tax AllocationAllen KateNo ratings yet

- Emp Archi ConsulDocument81 pagesEmp Archi ConsulVikramNo ratings yet

- Notice - Final ExamDocument13 pagesNotice - Final ExamNicoleNo ratings yet

- FRM AssignmentDocument5 pagesFRM AssignmentAfaq AhmadNo ratings yet

- Financial Report DraftDocument28 pagesFinancial Report Draftjayar medicoNo ratings yet

- Eefm PresentationDocument11 pagesEefm Presentationkarthik100% (1)

- Chap 5 - Relative ValuationDocument58 pagesChap 5 - Relative Valuationrafat.jalladNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingAnonymous LC5kFdtcNo ratings yet

- Latihan Soal Analysis of Financial StatementDocument7 pagesLatihan Soal Analysis of Financial StatementCaroline H24No ratings yet

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaNo ratings yet

- Official List: 4647 Trading SessionDocument12 pagesOfficial List: 4647 Trading SessionEric Selase EdiforNo ratings yet

- "A" Level Accounting: DepreciationDocument7 pages"A" Level Accounting: DepreciationTARMAK MC LYONNo ratings yet

- Towers Watson Tail Risk Management Strategies Oct2015Document14 pagesTowers Watson Tail Risk Management Strategies Oct2015Gennady NeymanNo ratings yet