Professional Documents

Culture Documents

En NLD Country Brief Apr2019

En NLD Country Brief Apr2019

Uploaded by

Rik van OijenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

En NLD Country Brief Apr2019

En NLD Country Brief Apr2019

Uploaded by

Rik van OijenCopyright:

Available Formats

April 2019

The Netherlands

The OECD Inventory of Support Measures for Fossil Fuels identifies, documents and estimates direct

budgetary support and tax expenditures supporting the production or consumption of fossil fuels in OECD

countries and eight partner economies (Argentina, Brazil, the People’s Republic of China, Colombia, India,

Indonesia, the Russian Federation, and South Africa).

Energy resources and market structure Total Primary Energy Supply* in 2017

The Netherlands has been a major

producer and exporter of natural gas since Natural gas,

the 1960s, when the massive Groningen 42%

field was developed. Though its share has Nuclear, 1%

been decreasing for several years in profits

of renewable energy, natural gas still Geothermal,

solar & wind,

covered 40% of the total energy supply in 2%

2016. These resources are nearing

exhaustion and, with smaller fields Biofuels & Coal, 12%

reaching maturity, domestic gas production waste, 5% Oil, 38%

has been declining in the Netherlands. In

2016, domestic production still largely *excluding net electricity import

Source: IEA

covered the demand for gas.

The country is a major hub in European oil trade with oil refineries and storage located in its big

international ports such as Rotterdam. It has also become a producer with the discovery of the oilfields

near Schoonebeek in 1943. This production has been declining (-50% between 2002 and 2012), partly

due to some technical difficulties to extract the remaining reserves.

The Dutch energy industry is mostly private, but the state, the provinces, and municipalities retain a

structural role and ownership in the natural gas and electricity sectors. The upstream oil and gas sector

is entirely private and liberalised. NAM (Nederlandse Aardolie Maatschappij), jointly owned by Royal

Dutch Shell and Exxon Mobil, operates Groningen and hence is the largest producer of natural gas.

Smaller onshore and offshore fields are operated by a variety of private oil and natural gas companies.

All the refineries and distribution and retailing networks are privately owned.

State-owned Gasunie, through its affiliate Gasunie Transport Services (GTS), owns and operates the

natural gas transmission network. GasTerra, a trading and supply company which is owned by 50% by

the state, sells domestically produced gas in the Netherlands. The other half is owned in equal parts by

Shell and Exxon and is the dominant player in the wholesale market with a share exceeding 70%. Three

large supply companies – Eneco, RWE-Essent, and Vattenfall-Nuon – dominate the retail market. Under a

2006 law mandating ownership unbundling of distribution companies, distribution assets must be fully

separated from supply activity, and cannot be sold to private companies or investors. Competition in the

retail natural-gas market is thus well developed. Unlike in most other EU countries, a relatively large

proportion of small consumers have hence switched away from the incumbent suppliers.

Electricity-generating assets are partly privately owned and partly owned by provincial or municipal

governments. However, foreign energy companies have overtaken a few major players over the last

years. The country’s transmission system operator, TenneT, is fully owned by the state.

www.oecd.org/site/tadffss ffs.contact@oecd.org @OECDtrade

Energy prices and taxes

The prices of fuel and energy services in the Netherlands are entirely set by the market. Retail electricity

and natural gas tariffs, however, are subject to regulation so as to provide a safety net to consumers.

The national regulator, the Office of Energy Regulation (Energiekamer) within the Authority for

Consumers and Markets (ACM), is responsible for approving all tariffs and for ensuring that prices

charged to consumers are reasonable. In addition to VAT, excise taxes and a special compulsory storage

fee (COVA) are levied on the sale of petroleum products, and an energy tax is levied on the supply of

electricity and natural gas (with tax rates decreasing with the level of consumption).

Total support by for fossil fuels in Netherlands by support indicator (left) and fuel type (right)

Note: CSE=Consumer Support Estimate; PSE=Producer Support Estimate; GSSE=General Services Support Estimate

Recent developments and trends in support

The Netherlands successfully phased-out a large part of their supports to fossil fuels in recent years as

part of an Energy Agreement designed with key stakeholders. Until 2013, the taxation rate on diesel

highly depended on its end use. Diesel attracted a higher tax rate when used as transport fuel while

diesel used in non-transport activities, such as heating and off-road machinery, was taxed at a lower

rate. The differentiated rate on tax fuel cost the government EUR 228 million in 2012. On 1 January

2013, tax breaks relative to diesel and heating were phased-out because of their negative impact on the

environment and public finance. This explains the large fall in consumer support in 2013. Netherlands

currently only provides consumption tax concessions for natural gas and electricity used in heating the

buildings of non-profit organisations.

Examples of measures

Energy-Tax Rebate for Religious Institutions Residents of buildings that are primarily used for public

(2000-) religious services or for philosophical reflection can apply for a

50% energy-tax rebate for both natural gas and electricity.

Energy-Tax Rebate for Non-Profit Natural gas and electricity used in heating the buildings of non-

Organisations profit organisations in the Netherlands receive a 50% energy-

(2000-) tax rebate. Since 2006, community buildings used by non-profit

organisations for over 70% of the time can also apply for the

rebate.

www.oecd.org/site/tadffss ffs.contact@oecd.org @OECDtrade

You might also like

- Oracle Cloud Project Management Assessment-5Document31 pagesOracle Cloud Project Management Assessment-5Romman Md. Ashad50% (4)

- Accenture Performance AppraisalDocument30 pagesAccenture Performance AppraisalChanpreet Singh Grover25% (4)

- Philips C Pap SettlementDocument274 pagesPhilips C Pap SettlementKhristopher Brooks0% (1)

- Hydro Case Study MSTM 6032Document17 pagesHydro Case Study MSTM 6032butler_jonathancyahoNo ratings yet

- The Growth Hacker's Guide To The Galaxy For BetakitDocument33 pagesThe Growth Hacker's Guide To The Galaxy For BetakitGrowthHackerGuide.com78% (9)

- Vocabulary Words in Araling Panlipunan Grade 7Document3 pagesVocabulary Words in Araling Panlipunan Grade 7Sonia50% (2)

- EN SWE Country Brief Apr2019 PDFDocument2 pagesEN SWE Country Brief Apr2019 PDFFrancisco Javier Ari QuintanaNo ratings yet

- Iceland 1Document2 pagesIceland 1Daniela ArandaNo ratings yet

- EN FRA Country Brief Jun2020Document2 pagesEN FRA Country Brief Jun2020MaraNo ratings yet

- Background Note - Carbon TaxDocument4 pagesBackground Note - Carbon TaxSrividhya SNo ratings yet

- En IDN Country Brief Jun2020Document2 pagesEn IDN Country Brief Jun2020yedasompark3No ratings yet

- Hydrogen Could Help Decarbonise The Global EconomyDocument9 pagesHydrogen Could Help Decarbonise The Global EconomyIlimaiechoNo ratings yet

- The Green Electrcity Market in Denmark: Quotas, Certificates and International TradeDocument9 pagesThe Green Electrcity Market in Denmark: Quotas, Certificates and International TradepeixeNo ratings yet

- F GSL SpeechDocument2 pagesF GSL SpeechMaitreyi GuptaNo ratings yet

- Annual Market Update 2020 0Document63 pagesAnnual Market Update 2020 0jlskdfjNo ratings yet

- Sustainability 13 01346Document14 pagesSustainability 13 01346Gary Test1No ratings yet

- McKinsey Accelerating The Energy Transition Cost or Opportunity PDFDocument48 pagesMcKinsey Accelerating The Energy Transition Cost or Opportunity PDFVladimir MarinkovicNo ratings yet

- An Energy Neutral Kortrijk Region in 2050.: Towards A Regional Energy StrategyDocument14 pagesAn Energy Neutral Kortrijk Region in 2050.: Towards A Regional Energy Strategyriki187No ratings yet

- Defining Features of The Renewable Energy Act (EEG) 2014 Feed-In TariffsDocument6 pagesDefining Features of The Renewable Energy Act (EEG) 2014 Feed-In TariffsDiana GavrilovaNo ratings yet

- Renewable Energy: Policy Analysis of Major ConsumersDocument8 pagesRenewable Energy: Policy Analysis of Major ConsumersAwaneesh ShuklaNo ratings yet

- Winning With WindDocument32 pagesWinning With WindAnderson NieswaldNo ratings yet

- United Kingdom 2012Document19 pagesUnited Kingdom 2012rodrigo_andsNo ratings yet

- Neoen Equity ReportDocument11 pagesNeoen Equity ReportTiffany SandjongNo ratings yet

- Infographic Dutch Energy SectorDocument1 pageInfographic Dutch Energy SectorSergio Rivero AcháNo ratings yet

- Philibert Hydrogen Strategy 2020Document42 pagesPhilibert Hydrogen Strategy 2020Alex AbakumovNo ratings yet

- Aluminium EU ETSDocument45 pagesAluminium EU ETSDouglas Uemura NunesNo ratings yet

- Hydrogen Strategy PDFDocument24 pagesHydrogen Strategy PDFAlper KzNo ratings yet

- EN EN: European CommissionDocument24 pagesEN EN: European Commissionandrea bottazziNo ratings yet

- Case Story DK - Green Methanol - Web 1Document4 pagesCase Story DK - Green Methanol - Web 1Pao M. MorenoNo ratings yet

- Industrial-Pellets-Report PellCert 2012 SecuredDocument30 pagesIndustrial-Pellets-Report PellCert 2012 SecuredmilosgojicNo ratings yet

- FRANCE-A Case Study: Energy Consumption & Emission Patterns, Climate Policy, Action PlanDocument17 pagesFRANCE-A Case Study: Energy Consumption & Emission Patterns, Climate Policy, Action PlanVishvesh TextbooknoteNo ratings yet

- Situation Report All 7-8-2012!0!1Document242 pagesSituation Report All 7-8-2012!0!1Christos MyriounisNo ratings yet

- Luxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-FuelsDocument3 pagesLuxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-Fuelssagetarius92No ratings yet

- Energy Report Transition To Sustainable EnergyDocument12 pagesEnergy Report Transition To Sustainable EnergyEduardo QuintanaNo ratings yet

- Energy Today in EstoniaDocument9 pagesEnergy Today in EstoniaTiinaKoolNo ratings yet

- Trabajo Con AlvaroDocument3 pagesTrabajo Con AlvaroNicolas MariéNo ratings yet

- Energy Taxation in Europe, Japan and The United StatesDocument16 pagesEnergy Taxation in Europe, Japan and The United StatesPham Minh CongNo ratings yet

- Invest in Denmark CleanTech Factsheet March 2021Document8 pagesInvest in Denmark CleanTech Factsheet March 2021Christian JonstrupNo ratings yet

- Mark Diesen Dorf Renewable EnergyDocument13 pagesMark Diesen Dorf Renewable EnergymaronnamNo ratings yet

- GeoDH Report 2014 WebDocument62 pagesGeoDH Report 2014 WebΜπάμπης ΧρυσοχοΐδηςNo ratings yet

- Research: Committee On Industry, Research and Energy (ITRE)Document5 pagesResearch: Committee On Industry, Research and Energy (ITRE)GeorgiaStefanNo ratings yet

- Position Paper Port of Rotterdam Green DealDocument5 pagesPosition Paper Port of Rotterdam Green DealJCANo ratings yet

- 2009 - Italian Biogas (Economics)Document9 pages2009 - Italian Biogas (Economics)ilariofabbianNo ratings yet

- EU China Energy Magazine 2021 Autumn Issue: 2021, #3From EverandEU China Energy Magazine 2021 Autumn Issue: 2021, #3No ratings yet

- s10668 024 04872 3Document39 pagess10668 024 04872 3omkargaikwad5577No ratings yet

- Energy Efficiency in The Industry - Complement For Renewable Energies - Maria Holopainen VTTDocument33 pagesEnergy Efficiency in The Industry - Complement For Renewable Energies - Maria Holopainen VTTCentro de Innovación UC Anacleto AngeliniNo ratings yet

- Study Id51447 HydrogenDocument44 pagesStudy Id51447 HydrogenhjuzqxbwNo ratings yet

- MM EngDocument7 pagesMM EngMuhamed IbrahimNo ratings yet

- CBS Environmental Accounts of The NetherlandsDocument184 pagesCBS Environmental Accounts of The NetherlandsEnergiemediaNo ratings yet

- Brochure4 - Cogeneration Various Power Gen TechDocument20 pagesBrochure4 - Cogeneration Various Power Gen TechShridhar MuthuNo ratings yet

- Green Is The Color of Money: The EU ETS Failure As A Model For The "Green Economy"Document23 pagesGreen Is The Color of Money: The EU ETS Failure As A Model For The "Green Economy"dr_kandimbaNo ratings yet

- REPowerEU - A PlanDocument5 pagesREPowerEU - A PlansamNo ratings yet

- 1 IreDocument6 pages1 Ireldunphy900No ratings yet

- RECIPES Country Info SenegalDocument5 pagesRECIPES Country Info SenegalAna OrriolsNo ratings yet

- The Hydrogen Solution?: FeatureDocument3 pagesThe Hydrogen Solution?: Featuresoti.richard.tataNo ratings yet

- War and Subsidies Have Turbocharged The Green TransitionDocument7 pagesWar and Subsidies Have Turbocharged The Green TransitionH ProductionNo ratings yet

- Hot Cool 3 2012Document32 pagesHot Cool 3 2012thermosol5416No ratings yet

- Redução Da Dependência de Energia Russa Na EuropaDocument4 pagesRedução Da Dependência de Energia Russa Na EuropaDev DrudiNo ratings yet

- EE PresentationDocument8 pagesEE PresentationAlissa SafonovaNo ratings yet

- Factsheet Ets enDocument6 pagesFactsheet Ets enHjkkkkNo ratings yet

- Alternative Vehicle Fuels: Research PaperDocument66 pagesAlternative Vehicle Fuels: Research PaperSivashankar DhanarajNo ratings yet

- Renewables Se enDocument3 pagesRenewables Se enAmir FauwazNo ratings yet

- Energies: Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine EmissionsDocument31 pagesEnergies: Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine EmissionsHuy ĐoànNo ratings yet

- Demand Response, Decentralisation and Energy Communities - Federico PierucciDocument11 pagesDemand Response, Decentralisation and Energy Communities - Federico Pieruccipierucci93No ratings yet

- SynergyDocument3 pagesSynergyJunior VeigaNo ratings yet

- FinMan 4 Group 2 - 20240220 - 222159 - 0000Document44 pagesFinMan 4 Group 2 - 20240220 - 222159 - 0000SILVESTRE, NelsonNo ratings yet

- Lecture7-8 - 18527 - URBANIZATION AND SOCIAL CHANGEDocument8 pagesLecture7-8 - 18527 - URBANIZATION AND SOCIAL CHANGEMidhun ChowdaryNo ratings yet

- OG200C Rev 3 TG5Document2 pagesOG200C Rev 3 TG5ИгорьNo ratings yet

- 2017 Official Ffa ManualDocument104 pages2017 Official Ffa Manualapi-223674252No ratings yet

- Index: Construction Quantity Surveying: A Practical Guide For The Contractor's QS, Second Edition. Donald ToweyDocument8 pagesIndex: Construction Quantity Surveying: A Practical Guide For The Contractor's QS, Second Edition. Donald ToweyBee Dan Budhachettri100% (1)

- 401 (K) Planner: Growth of InvestmentDocument1 page401 (K) Planner: Growth of Investmentanon-13887100% (1)

- IELTS Speaking Part 2 & 3: A House or Apartment You Would Like To Live inDocument7 pagesIELTS Speaking Part 2 & 3: A House or Apartment You Would Like To Live inKenyNo ratings yet

- Target Costing SumsDocument4 pagesTarget Costing Sumspankaj baviskarNo ratings yet

- Final Legal NoticeDocument4 pagesFinal Legal NoticeNISHANTH RAO KARRE NARSING RAONo ratings yet

- Bajaj Allianz General Insurance Company LimitedDocument7 pagesBajaj Allianz General Insurance Company LimitedRavi GoyalNo ratings yet

- Oil Free Scroll Compressors 2 30 KW Brochure NADocument8 pagesOil Free Scroll Compressors 2 30 KW Brochure NAKervin CoronadoNo ratings yet

- Installation of New ChlorinatorDocument4 pagesInstallation of New ChlorinatorRL SanNo ratings yet

- Legal Notice Format of Credit CardDocument2 pagesLegal Notice Format of Credit CardLionKingNo ratings yet

- Pre-Final Case StudyDocument4 pagesPre-Final Case StudyMatt TejadaNo ratings yet

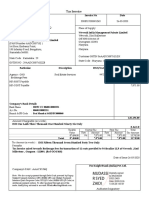

- Tax Invoice: Mudassi R Syed ZaidiDocument2 pagesTax Invoice: Mudassi R Syed ZaidiManoj KumarNo ratings yet

- Dimensional ModelingDocument40 pagesDimensional ModelingAhmad ShahNo ratings yet

- KIOCL Annual Report - Website MailDocument136 pagesKIOCL Annual Report - Website MailJyotiradityya BanikNo ratings yet

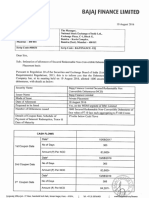

- Intimation of Allotment of Secured Redeemable Non-Convertible Debentures On Private Placement Basis (Company Update)Document3 pagesIntimation of Allotment of Secured Redeemable Non-Convertible Debentures On Private Placement Basis (Company Update)Shyam SunderNo ratings yet

- Cantor - Company Update - First Mining June 11, 2020Document6 pagesCantor - Company Update - First Mining June 11, 2020TFMetalsNo ratings yet

- Acca Mys Paper F4: Corporate & Business LawDocument2 pagesAcca Mys Paper F4: Corporate & Business LawDavid ChauNo ratings yet

- Chapter 2 Assignment Cost AccountingDocument1 pageChapter 2 Assignment Cost AccountingSydnei HaywoodNo ratings yet

- Employee Turnover and Retention StrategiDocument51 pagesEmployee Turnover and Retention StrategiPreeti JadhavNo ratings yet

- Fort Bonifacio Development Corp Vs FongDocument3 pagesFort Bonifacio Development Corp Vs FongssNo ratings yet

- Documents You Need To Make A Valid Claim of InsuranceDocument5 pagesDocuments You Need To Make A Valid Claim of InsuranceEkta singhNo ratings yet