Professional Documents

Culture Documents

Chapter Three-Setting Up General Ledger

Chapter Three-Setting Up General Ledger

Uploaded by

risingsun9723Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter Three-Setting Up General Ledger

Chapter Three-Setting Up General Ledger

Uploaded by

risingsun9723Copyright:

Available Formats

Chapter 3

Setting up General Ledger

Lesson Outcomes

At the end of this Chapter, you should be able to.

LO 1 Explain how to restore a backup file or open a company file.

LO 2 Explain the meaning of the general ledger and its interactions with other sections

in the system.

LO 3 Describe the principles relating to accounts numbering/ coding.

LO 4 Explain different account types available in Sage 50.

LO 5 Explain how to create, modify, and delete a chart of accounts; and

LO 6 Explain how to set default information relating to the general ledger.

3.1Restoring Backup Files (LO 1)

Before discussing the general ledger, let's see how to restore the latest backup file.

Steps:

Select File in the menu bar - Select Restore – Select Browse – Select Drive – Select Folder –

Select the Backup File – Click Open – Click Next – Tick New Company – Click Next – Click

Finish.

Or

Select the System navigation bar – select Restore Now - Click Browse – Select Drive – Select

Folder – Select the Backup File – Click Open – Click Next – Tick New Company – Click

Next – Click Finish.

Once you have restored the backup File, you are ready to work. However, if you are working on

the same computer, you can open the company file using the following steps (as shown in Figure

3.1).

Steps:

Select Open Existing Company Button – Select your company name from the List – Click

OK.

ACC2344: Computer Based Accounting 1|Page

Figure 3.1: Sage Starting Window

3.2General Ledger: (LO 2)

The General Ledger stores information relating to all financial activities of your company. All

business transactions are eventually posted to the accounts that make up General Ledger. This set

of accounts is called the Chart of Accounts (COA). General Ledger helps us to create the

financial statements of the company. We need to set the chart of accounts properly to cover all

the necessary accounts to develop the business's financial statements.

The chart of accounts consists of all the Assets, Liabilities, Equity, Income, and Expenses

accounts of the organization. The journals are updated when transactions are posted in Accounts

Receivable, Accounts Payable, Inventory, and Payroll. The journals, in turn, update General

Ledger. Entries made to the General Journal also update General Ledger. The interaction

between General Ledger and the other sections in Sage 50 is illustrated in Figure 3.2.

ACC2344: Computer Based Accounting 2|Page

Figure 3.2: Interaction between General Ledger and the Other Sections in Sage 50

Accounts Payroll

Accounts Inventory

Payable

Receivable

Journals

General General

Ledger Journal

As we are not using a sample chart of accounts, we need to create the chart of accounts before

any other activities.

3.2.1 Account Numbering/ Coding: (LO 3)

Sage 50 allows using numbers and characters in an account numbering/ coding system.

However, an account numbering system should be established understandably. When developing

a numbering system requires following generally accepted rules. Table 3.1 shows the starting

number of different account types. Further, you must decide the number of digits of an account

code. The number of digits depends on the existing and future requirements of the accounting

system.

Table 3.1: Starting Number of Different Account Types

ACC2344: Computer Based Accounting 3|Page

Account Code Account Types

1 XXX Assets (PPE, Cash, Accounts Receivable, etc.)

2 XXX Liabilities (Accounts Payable, Borrowings, etc.)

3 XXX Equity (Stated Capital, Retained Earnings, etc.)

4 XXX Income (Sales, Rent Income Etc.)

5 XXX Cost of Sales

6 XXX – 9 XXX Expenses (Salaries, Electricity, etc.)

Sage 50's sample companies use numbering schemes similar to those in the table above. As we

choose not to use a sample chart of accounts, a few other rules and guidelines should be

followed when an account numbering system is established.

1. Up to 15 alphanumeric characters can be used in an account ID.

2. Asterisks (*), question marks (?), and plus signs (+) cannot be used in an account ID.

3. Leading or trailing spaces are not permitted in an account ID. However, spaces

between characters are allowed.

4. Account numbers are sorted alphabetically, with numbers in the account ID sorted

before letters. For example, account ID "2" lists after account ID "1000" and before

an account ID starting with "AR." Account numbers are not case sensitive; therefore,

CASH and Cash are the same account ID.

5. There can only be one account assigned an account type of Equity--Retained

Earnings.

3.2.2 Account Types (LO 4)

Account types are used to group similar accounts. They also determine where the accounts will

appear on financial statements and whether the account typically carries a debit or credit balance.

Sage 50 has a wide variety of account types available.

At the end of the fiscal year, the balances of the Income, Expense, Cost of Sales, and Equity -

Gets Closed account types become zero. The net difference of these accounts is added to the

Equity-Retained Earnings account. Balances of other account types, i.e., Assets, Liabilities, and

Equity Don't Close, are carried forward to the next financial period. Table 3.2 shows the account

types available in Sage with examples.

Table 3.2: Available Accounts Types in Sage

ACC2344: Computer Based Accounting 4|Page

Account Type Example/s

Accounts Payable Creditors control

Accounts Receivable Debtors control

Accumulated Depreciation Accumulated depreciation - Furniture

Cash Cash in hand, Cash at banks

Cost of Sales Cost of sales

Equity - Doesn’t Close Capital, Stated Capital

Equity - Gets Closed Drawings, Dividends

Equity - Retained Earnings Retained Earnings

Expenses Salaries, Rent

Fixed Assets Buildings, Furniture

Income Sales, Other Income

Inventory Inventory

Long Term Liabilities Bank loans, Debentures

Other Assets Goodwill, Brand name

Other Current Assets Prepayments, Other receivables

Other Current Liabilities Accruals, Other payables

Each account type is described in the following section.

a) Accounts Payable:

AP represents balances owed to vendors for goods, supplies, and services purchased on an open

account. Accounts payable balances are used in accrual-based accounting, are generally due in

30 or 60 days and do not bear interest. Select this account type if you set up open vendor

accounts or credit card (purchase) accounts.

b) Accounts Receivable:

AR represents amounts owed by customers for items or services sold to them when Cash is not

received at the time of sale. Typically, accounts receivable balances are recorded on sales

invoices that include payment terms. Accounts receivable are used in accrual-based accounting.

Select this account type if you are setting up accrued income that customers owe.

c) Accumulated Depreciation:

AD is a contra asset account for depreciable (fixed) assets such as buildings, machinery, and

equipment. Depreciable basis (expense) is the difference between an asset's cost and estimated

salvage value. Recording depreciation is a way to indicate that assets have declined in service

potential. Accumulated depreciation represents the total depreciation taken to date on the assets.

Select this account type if you set up depreciation accounts for known fixed assets.

d) Cash:

ACC2344: Computer Based Accounting 5|Page

It represents deposits in banks available for current operations, plus cash on hand consisting of

currency, undeposited checks, drafts, and money orders. Select this account type if you set up

bank checking accounts, petty cash accounts, money market accounts, and certificates of deposit

(CDs).

e) Cost of Sales:

COS represents the general cost to your business for items or services when sold to customers.

The cost of sales (also known as cost of goods sold) for inventory items is computed based on

the inventory costing method (FIFO, LIFO, or Average Cost ). Select this account type if you set

up cost-of-goods-sold accounts to be used when selling inventory items.

f) Equity - Doesn't Close (Corporations):

It represents equity from year to year (like Ordinary shares). Equity is the owner's claim against

the assets or interest in the entity. These accounts are typically found in corporation-type

businesses. Select this account type if you are a corporation and want to record Ordinary shares

or other equity intended as owner investment.

g) Equity - Gets Closed (Proprietorship):

It represents equity zeroed out at the end of the fiscal year, with their amounts moved to the

retained earnings account. Equity, also known as capital or net worth, is owners' (partners' or

stockholders') claims against assets they contributed to the business. Select this account type if

your business is a proprietorship and you want to record dividends paid to partners or if you

are a corporation and want to record dividends paid to stockholders.

h) Equity - Retained Earnings:

It represents the earned capital of the enterprise. Its balance is the cumulative, lifetime earnings

of the company that have not been distributed to owners. You can have only one retained

earnings account in Sage 50.

i) Expenses:

These represent the costs and liabilities incurred to produce revenues. The assets surrendered or

consumed when serving customers indicate company expenses. If income exceeds expenses, net

income will result. The business is said to be operating at a net loss if expenses exceed income.

Select this account type if you are setting up accounts such as operation, supplies, salary, wages,

travel, or charity expenses.

j) Fixed Assets:

ACC2344: Computer Based Accounting 6|Page

These represent property, plant, or equipment assets acquired to be used in a business rather than

for resale. They are called fixed assets because they are used for long periods. Select this account

type if you are setting up any of the following fixed assets:

Land: property, storage space, or parking lots.

Buildings: structures in which the business is carried out.

Machinery: heavy equipment used to carry out business operations. For example, you

may want to set up any of the following: store equipment or fixtures, factory equipment

of fixtures, office equipment or fixtures (including computers and furniture), and delivery

equipment (including autos, trucks, and vans used primarily in making deliveries to

customers).

k) Income:

Income (also known as revenue) represents the inflow of assets from selling products and

services to customers. If income exceeds expenses, net income will result. The business is said to

be operating at a net loss if expenses exceed income. Select this account type if you are setting

up sales revenue accounts. It is common practice to create different income accounts for each

category of revenue that you want to track (for example, retail income, service income, interest

income, and so on).

l) Inventory:

It represents the quantity (value) of goods on hand and available for sale at any time. Inventory is

considered to be an asset that is purchased, manufactured (or assembled), and sold to customers

for revenue. Select this account type if you are setting up assets intended for resale. It is common

practice to create different accounts for each category of inventory you want to track (for

example, retail, raw materials, work in progress, finished goods, and so on).

m) Long Term Liabilities:

It represents those debts that are not due for a relatively long period, usually more than one year.

Portions of unpaid long-term loans and notes payable with a maturity date of at least one year or

more beyond the current balance sheet date are considered long-term liabilities. Select this

account type if you set up long-term liabilities (for example, long-term loans and noncurrent

notes payable).

ACC2344: Computer Based Accounting 7|Page

n) Other Assets:

It represents those assets considered nonworking capital and are not due for a relatively long

period, usually more than one year. Notes receivable with maturity dates at least one year or

more beyond the current balance sheet date are considered "noncurrent" assets. Select this

account type if you are setting up assets such as deposits, organization costs, amortization

expenses, noncurrent notes receivable, etc.

o) Other Current Assets:

It represents those assets considered nonworking capital and are due within a short period,

usually less than a year. Prepaid expenses, employee advances, and notes receivable with

maturity dates of less than one year of the current balance sheet date are considered to be

"current" assets. Select this account type if you set up assets such as prepaid expenses, employee

advances, current notes receivable, etc.

p) Other Current Liabilities:

It represents those debts that are due within a short period, usually less than a year. The payment

of these debts usually requires the use of current assets. Select this account type if you are setting

up accrued expenses from a vendor, extended lines of credit, short-term loans, sales tax payables,

payroll tax payables, client escrow accounts, suspense (clearing) accounts, and so on.

3.2.3 Set up the Chart of Accounts for the First Time

If you are currently using a manual system for your accounting, there are several things you need

to know when you set up a chart of accounts:

Determine a conversion date, and gather balances as of that date. You use this information

for your beginning balances.

If you are setting up a new chart of accounts (instead of copying from one of Sage 50's

sample businesses), you must have all your account numbers and names written down.

Have all of your transactions after the conversion date ready to enter to bring your accounts

up to date.

Opening Chart of Accounts (LO 5)

The chart of Accounts window can be opened using one of the following ways. Figure 3.3 shows

the Chart of Accounts window.

ACC2344: Computer Based Accounting 8|Page

Steps:

Select Maintain from the Menu - Select Chart of Account.

Or

Select List from the Menu - Select Chart of Account – Click New

Figure 3.3: Maintain Chart of Accounts Window

The Maintain Chart of Accounts window is used to enter new accounts, edit existing accounts,

and enter account beginning balances. Fields of interest are described below:

• Account ID: Identifies the account in the chart of accounts, lookup lists, transactions, and

reports. The ID can be up to 15 characters.

• Description: Enter an explanation for the account. This description prints on reports and

financial statements.

ACC2344: Computer Based Accounting 9|Page

• Inactive: Select this check box to make the ID inactive. Inactive records are deleted

when the purge utility is run if they have not been used in any transactions in an open

fiscal year. Inactive records can be used in transactions, but a message appears,

reminding you of the inactive status.

• Account Type: Select a type from the drop-down List (Refer to the 3.2.2 section of the

Chapter). Accounts are grouped by account type on financial statements.

a) Create Ledger Accounts

When you create new ledger accounts, the following steps can be used.

Steps:

Open Maintain Chart of Accounts Window - Enter the Account ID - Enter the Description -

Select the Account Type - Click Save.

Class Activity 3.1 (ILO 1,2,3,4 & 5)

Create the following ledger accounts for AFMA 2022 (Pvt) Ltd.

Account ID Description Account Type

1000-CL Lands

1010-CL Buildings

1015-CL Provision for depreciation - buildings

1020-CL Motor vehicles

1025-CL Accumulated depreciation – motor vehicles

1026-CL Patent Right

1050-CL Inventory

1100-CL Trade Receivables

1150-CL Other Receivables

1160-TR Other Receivables

1200-CL Cash in Hand

1250-CL BOC

1260-CL HNB

1270-TR HNB

2000-CL Trade Payables

2050-CL Other Payables

2100-TR Other Payables

2200-CL Bank Loan - HNB

3000-CL Stated Capital

3100-CL Retained Earnings

3200-CL General Reserve

ACC2344: Computer Based Accounting 10 | P a g e

4000-CL Sales

4050-TR Training Income

4100-CL Interest Income

4150-CL Other Income

5000-CL Cost of Sales

6000-CL Salaries

6010-TR Salaries

6020-CL Electricity

6030-CL Water

6040-CL Training Materials

6050-CL Telephone & Internet

6060-CL Depreciation - Buildings

6070-CL Internet Expenses

7000-CL Distribution Costs

7010-CL Advertising

7020-TR Advertising

7030-CL Depreciation – Motor vehicles

8000-CL Interest Expenses

8010-CL Other Expenses

8020-TR Other Expenses

8030-CL Damage Inventory

b) Modifying Ledger Accounts: (LO 5)

In the Maintain Chart of Accounts window, you can edit existing accounts or delete accounts

that have no activity. You can also enter beginning balances for the accounts. However, the

beginning balances section will be covered in Chapter 4.

i. Changing Account Descriptions

Use one of the following ways to change the descriptions of accounts:

Select List from the menu bar – Select Chart of Accounts – Select the required account

– Click the Open button – Change the Description - Click the Save button.

Or

Select Maintain from the menu bar – Select Chart of Accounts - Enter or select account

code/ number in the Account ID lookup list - Change the Description - Click the Save

button.

ACC2344: Computer Based Accounting 11 | P a g e

Class Activity 3.2 (ILO 5)

Change the description of the following ledger accounts of AFMA 2022 (Pvt)Ltd.

Account ID New Description

1015-CL Accumulated depreciation - buildings

7020-TR Business Promotion

8020-TR Other Expenses - Training

ii. Changing Account ID

Use one of the following ways to change the descriptions of accounts:

Select List from the menu bar – Select Chart of Accounts – Select the required account

– Click Open button –Change ID tool button – Enter the New ID Number –Click OK.

Or

Select Maintain from the menu bar – Select Chart of Accounts - Enter or select account

code/ number in the Account ID lookup list - Click the Change ID tool button – Enter

the New ID Number –Click OK.

Class Activity 3.3 (ILO 5)

Change Account IDs of the following ledger accounts of the AFMA 2022 (Pvt)Ltd.

Account ID New Account ID

1026-CL 1030-CL

6040-CL 6040-TR

iii. Deleting Accounts

Some accounts are not needed so they can be deleted. Use one of the following ways to

change the descriptions of accounts:

Select List from the menu bar – Select Chart of Accounts – Select the required account

– Click Open button – Click Delete tool button –Click YES.

Or

Select Maintain from the menu bar – Select Chart of Accounts - Enter or select account

code/ number in the Account ID lookup list - Click Delete tool button –Click YES.

ACC2344: Computer Based Accounting 12 | P a g e

Class Activity 3.4 (ILO 5)

Delete the following ledger accounts of AFMA 2022 (Pvt)Ltd.

Account ID Description

6070-CL Internet Expenses

8030-CL Damage Inventory

How to see the Changes on the Chart of Accounts?

3.3 Use one of the following ways to see the Chart of Accounts.

Select List from the menu bar – Select Chart of Accounts

Or

Click the Reports icon in the toolbar of the Maintain Chart of Accounts window and-

from the drop-down list, select Chart of Accounts. This will open the report on your

screen.

3.3.1 General Ledger Defaults: (LO 6)

Here we need to set the defaults related to rounding any odd amounts on financial statements. Set

up the Rounding Account. The following steps can be used.

Steps:

Select the Maintain menu, Default Information, and General Ledger from the submenu.

ACC2344: Computer Based Accounting 13 | P a g e

General ledger default information consists of two tabs: Rounding Account Tab and the Account

Segments Tab.

a) Rounding Account Tab:

The Rounding Account is an account in your General Ledger used by Sage 50 to store rounding

differences on Financial Statements. This account can be either a balance sheet or an income

statement. Typically, the Retained Earnings account is used as the rounding account. Figure 3.4

shows the Rounding Account tab.

Figure 3.4: Rounding Account Tab

Class Activity 3.5 (ILO 6)

Set 3100-CL: Retained Earning as a rounding account for AFMA 2022 (Pvt)Ltd.

ACC2344: Computer Based Accounting 14 | P a g e

b) Account Segments Tab:

On the Account Segments tab, you can create or change segments for your chart of accounts ID.

It will allow you to take full advantage of the masking and filtering features of Sage 50 when you

print reports and financial statements.

You can use this feature to print reports filtered by department, division, account ID, or any other

segment you create. When you initially create your company in New Company Setup, Sage 50

allows you to divide your Account ID into segments, but you can also do it here.

If your chart of accounts is already set up and you change the segment structure, Sage 50 will

scan your chart of accounts and inform you if any accounts do not fit the new segment structure.

You can then print your Chart of Accounts report to identify those accounts. You can segment

your chart of accounts ID by creating descriptions, lengths, and separators for up to five

segments. Figure 3.5 shows the Account Segment tab.

Figure 3.5: Account Segment Tab

Backup your Company

ACC2344: Computer Based Accounting 15 | P a g e

You might also like

- Case 68 Sweet DreamsDocument12 pagesCase 68 Sweet Dreams3happy3No ratings yet

- Tutorial 7 Trade Receivables (Q)Document3 pagesTutorial 7 Trade Receivables (Q)lious liiNo ratings yet

- Statement of Financial Position: Problem 1: True or FalseDocument13 pagesStatement of Financial Position: Problem 1: True or FalsePaula Bautista0% (1)

- Cost Systems and Cost AccumulationDocument27 pagesCost Systems and Cost AccumulationYonathan Widya NugrahaNo ratings yet

- Session 2-Setting - Up - General - LedgerDocument10 pagesSession 2-Setting - Up - General - LedgerTharushi NavodyaNo ratings yet

- Acb3 01Document41 pagesAcb3 01lidetu100% (3)

- Five Major Types of AccountsDocument17 pagesFive Major Types of AccountsCharmie Flor CuetoNo ratings yet

- Co Chapter 2 Accounting Cycle RevisedDocument19 pagesCo Chapter 2 Accounting Cycle RevisedmikeNo ratings yet

- LedgerDocument6 pagesLedgerclean makeNo ratings yet

- Wiley Notes Chapter 2Document7 pagesWiley Notes Chapter 2hasanNo ratings yet

- Entrep12 Q2 Mod10 Bookkeeping-ReviewerDocument61 pagesEntrep12 Q2 Mod10 Bookkeeping-ReviewerKairi UlrichNo ratings yet

- Fund AccountingDocument26 pagesFund AccountingFethi ADUSS100% (1)

- Lecture 1 - 2-Basics of AccountingDocument29 pagesLecture 1 - 2-Basics of AccountingRavi KumarNo ratings yet

- Chapter 3: Implementing Oracle General Ledger - Designing A Chart of AccountsDocument25 pagesChapter 3: Implementing Oracle General Ledger - Designing A Chart of Accountssridhar_ee100% (1)

- Entrepreneurship: Quarter 2: Module 7 & 8Document15 pagesEntrepreneurship: Quarter 2: Module 7 & 8Winston MurphyNo ratings yet

- Basics Accounting ConceptsDocument25 pagesBasics Accounting ConceptsMamun Enamul HasanNo ratings yet

- Lecture 3 DoubleentrysystemDocument47 pagesLecture 3 Doubleentrysystem叶祖儿No ratings yet

- First Chapter TwoDocument18 pagesFirst Chapter TwoAbdiraxman MaxamedNo ratings yet

- Bilal Raja: Information 4 EveryoneDocument6 pagesBilal Raja: Information 4 EveryoneBilal RajaNo ratings yet

- Chapter IVDocument54 pagesChapter IVVeena GowdaNo ratings yet

- Chart of AccountsDocument35 pagesChart of AccountsbatowiiseNo ratings yet

- Preview of Summary Financial Accounting 1 - Part 1 MidtermDocument11 pagesPreview of Summary Financial Accounting 1 - Part 1 Midtermaebel1574No ratings yet

- BAF3ME Unit 3 - Activity 7 - Summative Assessment Quiz NotesDocument9 pagesBAF3ME Unit 3 - Activity 7 - Summative Assessment Quiz NotesHibbah OwaisNo ratings yet

- Processing Transactions: by Prof Sameer LakhaniDocument83 pagesProcessing Transactions: by Prof Sameer LakhaniBhagyashree JadhavNo ratings yet

- Accounting Equation (Abm)Document43 pagesAccounting Equation (Abm)EasyGaming100% (1)

- CH 2 Recording ProcessDocument7 pagesCH 2 Recording ProcessFarhanAnsariNo ratings yet

- CH 5-6 AccDocument25 pagesCH 5-6 AccKaashifNo ratings yet

- Acc Chapter 2 LSCMDocument80 pagesAcc Chapter 2 LSCMwoleliemekieNo ratings yet

- Class NotesDocument45 pagesClass NotesNaveed Whatsapp Status100% (1)

- Accounts (1) FinalDocument28 pagesAccounts (1) FinalManan MullickNo ratings yet

- FCA Notes 01Document8 pagesFCA Notes 01US10No ratings yet

- Accounting Basics: The Accounting ProcessDocument21 pagesAccounting Basics: The Accounting ProcessZahur AhmedNo ratings yet

- SAP FICO Interview QuestionsDocument4 pagesSAP FICO Interview Questionsnagasuresh nNo ratings yet

- Lesson 2 Notes Understand Myob EnvironmentDocument26 pagesLesson 2 Notes Understand Myob EnvironmentBarry HolmesNo ratings yet

- Accounting Cycle For ServiceDocument12 pagesAccounting Cycle For ServiceNo MoreNo ratings yet

- 4 Chart of AccountsDocument115 pages4 Chart of Accountsresti rahmawatiNo ratings yet

- Chapter 2Document31 pagesChapter 2abenezer nardiyasNo ratings yet

- How To Prepare Balance SheetDocument29 pagesHow To Prepare Balance SheetRamiro Magbanua FelicianoNo ratings yet

- ACCT Accounting Chapter 2Document5 pagesACCT Accounting Chapter 2Lemopi Emelda MandiNo ratings yet

- Fatimatus Zehroh - SUMMARY ACCOUNTING SYSTEM INFORMATION Unit 5&6Document8 pagesFatimatus Zehroh - SUMMARY ACCOUNTING SYSTEM INFORMATION Unit 5&6Fatimatus ZehrohNo ratings yet

- FA-I (Lecture Note Ch-2)Document51 pagesFA-I (Lecture Note Ch-2)samioro746No ratings yet

- Chapter 2 Accounting CycleDocument17 pagesChapter 2 Accounting CycleEzy playboyNo ratings yet

- Entrepreneurship Na BusfinDocument7 pagesEntrepreneurship Na BusfinkiawaNo ratings yet

- EntrepreneurshipHandout Week 5Document6 pagesEntrepreneurshipHandout Week 5Pio GuiretNo ratings yet

- Tally 9 NotesDocument17 pagesTally 9 NotesAnjali HemadeNo ratings yet

- SAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasyDocument20 pagesSAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasykhaledNo ratings yet

- Accountancy ProjectDocument14 pagesAccountancy ProjectKshitize NigamNo ratings yet

- Accounting in BanksDocument27 pagesAccounting in BankssaktipadhiNo ratings yet

- Fundamentals Accounting IDocument42 pagesFundamentals Accounting IKhalid Muhammad100% (1)

- Chapter 2 Fundamental 1Document28 pagesChapter 2 Fundamental 1samita2721No ratings yet

- Chapter Two Part of The Accounting System: An Account Is ADocument48 pagesChapter Two Part of The Accounting System: An Account Is Akidest mesfinNo ratings yet

- Business Accounting - BBA-IT 2Document8 pagesBusiness Accounting - BBA-IT 2Ishika SrivastavaNo ratings yet

- Act07 - Lfca133e022 - Lique GinoDocument4 pagesAct07 - Lfca133e022 - Lique GinoGino LiqueNo ratings yet

- Chapter Five: Setting Up General Ledger: Session 5 2/14/16Document10 pagesChapter Five: Setting Up General Ledger: Session 5 2/14/16barber bobNo ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- The Chart of Accounts: AssetsDocument8 pagesThe Chart of Accounts: AssetsSrinivasarao BendalamNo ratings yet

- Account TitlesDocument4 pagesAccount TitlesErin Jane FerreriaNo ratings yet

- Chart of Accounts: BackgroundDocument10 pagesChart of Accounts: Backgroundjohn irsyamNo ratings yet

- Account TitlesDocument10 pagesAccount TitlesNelcie BatanNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Chapter Two The Accountig CycleDocument20 pagesChapter Two The Accountig Cyclehayelom50% (4)

- Lesson 10Document12 pagesLesson 10Noralyn DimnatangNo ratings yet

- JournalizationDocument36 pagesJournalizationDavid Guerrero Terrado100% (1)

- CFAS4 - PAS 1 - Presentation of Financial StatementsDocument17 pagesCFAS4 - PAS 1 - Presentation of Financial Statementspamelajanmea2018No ratings yet

- 2009-08-04 172654 Happy 2Document6 pages2009-08-04 172654 Happy 2gazer beamNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Business Combination Final ExamDocument9 pagesBusiness Combination Final Examcharlene lizardoNo ratings yet

- Class Test 3: SFX Greenherald Int'L School As Level Accounting (9706)Document4 pagesClass Test 3: SFX Greenherald Int'L School As Level Accounting (9706)Abid AhmedNo ratings yet

- Acctng1 Lesson 1-4Document28 pagesAcctng1 Lesson 1-4Icel EstoqueNo ratings yet

- General JournalDocument11 pagesGeneral Journaltri yuliNo ratings yet

- MFRS 112 042015 PDFDocument44 pagesMFRS 112 042015 PDFAisyah JaafarNo ratings yet

- BTM452Document4 pagesBTM4522023817012No ratings yet

- Chapter 18 Short Term Finance and PlanningDocument25 pagesChapter 18 Short Term Finance and Planningtheovester natanNo ratings yet

- Carrefour 2022 Half-Year Financial ReportDocument71 pagesCarrefour 2022 Half-Year Financial Reportgarcia.heberNo ratings yet

- 01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 FormationDocument5 pages01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 Formationjohn francisNo ratings yet

- Mba104mb0041 - Financial and Management AccountingDocument59 pagesMba104mb0041 - Financial and Management AccountinghsWSNo ratings yet

- Chapter 1: Introduction To Accounting (FAR By: Millan)Document91 pagesChapter 1: Introduction To Accounting (FAR By: Millan)Lovely LimNo ratings yet

- Lecture Sheet PracticeDocument2 pagesLecture Sheet PracticeUpal MahmudNo ratings yet

- Mefa ProblemsDocument39 pagesMefa Problemssravan kumarNo ratings yet

- Partnership Liquidation Question#4Document2 pagesPartnership Liquidation Question#4Ivy BautistaNo ratings yet

- Afar Drill 3Document7 pagesAfar Drill 3ROMAR A. PIGANo ratings yet

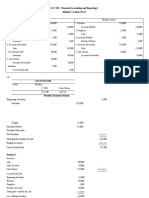

- ACC 101 - Financial Accounting and Reporting 1Document14 pagesACC 101 - Financial Accounting and Reporting 1Rc RocafortNo ratings yet

- Acct2 Financial Asia Pacific 2nd Edition Tyler Test BankDocument32 pagesAcct2 Financial Asia Pacific 2nd Edition Tyler Test BankAlanHolmesgnbdp100% (12)

- Inventory Depreciation Expense RecognitionDocument9 pagesInventory Depreciation Expense RecognitionZulu MasukuNo ratings yet

- Case StudyDocument18 pagesCase StudyalbertNo ratings yet

- Absorption and Variable CostingDocument8 pagesAbsorption and Variable CostingGerard Beltran ArcaNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceMikhaNo ratings yet

- CH 5 Practice Questions SolutionsDocument24 pagesCH 5 Practice Questions SolutionsChloe IbrahimNo ratings yet

- Chamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesDocument30 pagesChamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesUmarNo ratings yet